Professional Documents

Culture Documents

Tutorial 02 Questions

Uploaded by

Aamir ShaikCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Tutorial 02 Questions

Uploaded by

Aamir ShaikCopyright:

Available Formats

FIN3CFI - CORPORATE FINANCE

Tutorial 2 Questions

Be prepared to discuss these questions in your tutorial classes in Week 3, starting from

10 August 2015

1. Explain the following with examples

a. Opportunity cost

b. Sunk Cost

c. Salvage Value

d. Nominal Vs real cash flow

2. Question 2, page 131 of your text book

The Best Manufacturing Company is considering a new investment. Financial

projections for the investment are tabulated here. The corporate tax rate is 34 percent.

Assume all sales revenue is received in cash, all operating costs and income taxes are

paid in cash, and all cash flows occur at the end of the year. All net working capital is

recovered at the end of the project.

Year 0

Year 1 Year 2 Year 3

Year 4

Investment

$24,000

Sales revenue

$12,500 $13,000 $13,500 $10,500

Operating costs

2,700

2,800

2,900

2,100

Depreciation

6,000

6,000

6,000

6,000

Net working capital spending

300

350

400

300

?

a. Compute the incremental net income of the investment for each year.

b. Compute the incremental cash flows of the investment each year.

c. Suppose the appropriate discount rate is 12 percent. What is the NPV of the

project?

3. Question 15, page 133 of your text book

Consider the following cash flows on two mutually exclusive projects:

Annual cash flows

Year 0

1

2

3

Real Cash Flows

Project A ($)

(50,000)

30,000

25,000

20,000

Nominal Cash Flows

Project B ($)

(65,000)

29,000

38,000

41,000

The cash flows of project A are expressed in real terms, whereas those of project B

are expressed in nominal terms. The appropriate nominal discount rate is 13 percent

and the inflation rate is 4 percent. Which project should you choose?

4. Question 25, page 135 of your text book

Pilot Plus Pens is deciding when to replace its old machine. The machines current

salvage value is $2.2 million. Its current book value is $1.4 million. If not sold, the

old machine will require maintenance costs of $845,000 at the end of the year for next

five years. Depreciation on the old machine is $280,000 per year. At the end of five

years, it will have a salvage value of $120,000 and a book value of $0. A replacement

machine costs $4.3 million now and requires maintenance costs of $330,000 at the

end of year during its economic life of 5 years. At the end of five years, the new

machine will have a salvage value of 800,000. It will be fully depreciated by the

straight-line method. In five years a replacement machine will cost $3,200,000. Pilot

will need to purchase this machine regardless of what choice it makes today. The

corporate tax rate is 40 percent and the appropriate discount rate is 8 percent. The

company is assumed to earn sufficient revenues to generate tax shields from

depreciation. Should Pilot Plus Pens replace the old machine now or at the end of five

years?

5. Question 33, page 137 of your text book

Suppose we are thinking of replacing an old computer with a new one. The old one

cost us $450,000; the new one will cost $580,000. The new machine will be

depreciated straight-line to zero over its five-year life. It will probably be worth about

$130,000 after five years.

The old computer is being depreciated at a rate of $90,000 per year. It will be

completely written off in three years. If we dont replace it now, we will have to

replace it in two years. We can sell it now for $230,000; in two years it will probably

be worth $60,000. The new machine will save us $85,000 per year in operating costs.

The tax rate is 38 percent, and the discount rate is 14 percent.

a. Suppose we recognize that if we dont replace the computer now, we will be

replacing it in two years. Should we replace it now or should we wait? (Hint: What

we effectively have here is a decision either to invest in the old computer by not

selling it - or to invest in the new one. Notice that two investments have unequal

lives).

b. Suppose we consider only whether we should replace the old computer now

without worrying about whats going to happen in two years. What are the relevant

cash flows? Should we replace it or not? (Hint: Consider the net change in the firms

after-tax cash flows if we do the replacement).

Text book:

Balachandran, B. (2015).

Education

FIN3CFI Corporate Finance.

Australia: McGraw-Hill

You might also like

- Converting Units of Measure PDFDocument23 pagesConverting Units of Measure PDFM Faisal ChNo ratings yet

- Corporate Finance Assignment PDFDocument13 pagesCorporate Finance Assignment PDFسنا عبداللهNo ratings yet

- Market-Based Valuation: Price MultiplesDocument28 pagesMarket-Based Valuation: Price MultiplesShaikh Saifullah KhalidNo ratings yet

- Cost & Managerial Accounting II EssentialsFrom EverandCost & Managerial Accounting II EssentialsRating: 4 out of 5 stars4/5 (1)

- Corporate Valuation, Value-Based Management and Corporate GovernanceDocument56 pagesCorporate Valuation, Value-Based Management and Corporate GovernanceDavut AbdullahNo ratings yet

- High Intermediate Analogies 9Document2 pagesHigh Intermediate Analogies 9Usman KhalidNo ratings yet

- Making Investment Decisions With The Net Present Value Rule: Principles of Corporate FinanceDocument25 pagesMaking Investment Decisions With The Net Present Value Rule: Principles of Corporate FinanceSalehEdelbiNo ratings yet

- Dravyaguna VijaDocument1,095 pagesDravyaguna VijaSilas Chagas100% (1)

- Dryer User ManualDocument118 pagesDryer User ManualAyman Alhassny100% (1)

- Capital Budgeting: Dr. Akshita Arora IBS-GurgaonDocument24 pagesCapital Budgeting: Dr. Akshita Arora IBS-GurgaonhitanshuNo ratings yet

- George F Kennan and The Birth of Containment The Greek Test CaseDocument17 pagesGeorge F Kennan and The Birth of Containment The Greek Test CaseEllinikos Emfilios100% (1)

- Assignment 3Document7 pagesAssignment 3Abdullah ghauriNo ratings yet

- Product Life Cycle Costing / Whole Life Cycle Costing /life Cycle CostingDocument23 pagesProduct Life Cycle Costing / Whole Life Cycle Costing /life Cycle CostingTapiwa Tbone MadamombeNo ratings yet

- Expected Questions of FIN 515Document8 pagesExpected Questions of FIN 515Mian SbNo ratings yet

- Risk and Return AnswersDocument11 pagesRisk and Return AnswersmasterchocoNo ratings yet

- Duration GAP analysis: Measuring interest rate riskDocument5 pagesDuration GAP analysis: Measuring interest rate riskShubhash ShresthaNo ratings yet

- Sons and Lovers AuthorDocument9 pagesSons and Lovers AuthorArmen NeziriNo ratings yet

- Chicago Valve TemplateDocument5 pagesChicago Valve TemplatelittlemissjaceyNo ratings yet

- KOCH6Document63 pagesKOCH6Swati SoniNo ratings yet

- The Discrimination ModelDocument16 pagesThe Discrimination ModelSiti MuslihaNo ratings yet

- AnovaDocument26 pagesAnovaMuhammad NasimNo ratings yet

- Quiz Chapter 18Document5 pagesQuiz Chapter 18Steve Smith FinanceNo ratings yet

- Solutions to Chapter 5 Bond Valuation ProblemsDocument8 pagesSolutions to Chapter 5 Bond Valuation ProblemsCandace WagnerNo ratings yet

- Case 11Document10 pagesCase 11Trương Quốc VũNo ratings yet

- FNCE 30001 Week 12 Portfolio Performance EvaluationDocument83 pagesFNCE 30001 Week 12 Portfolio Performance EvaluationVrtpy Ciurban100% (1)

- Finec 2Document11 pagesFinec 2nurulnatasha sinclairaquariusNo ratings yet

- Chapter 12Document25 pagesChapter 12Muhammad Umair KhalidNo ratings yet

- Assignment 5 - CH 10 - The Cost of Capital PDFDocument6 pagesAssignment 5 - CH 10 - The Cost of Capital PDFAhmedFawzy0% (1)

- QMB Exam 2 ReviewDocument7 pagesQMB Exam 2 ReviewShatara BryantNo ratings yet

- Hillier Model 3Document19 pagesHillier Model 3kavyaambekarNo ratings yet

- FIN323 Exam 2 SolutionsDocument7 pagesFIN323 Exam 2 SolutionskatieNo ratings yet

- The Cost of Capital: HKD 100,000,000 HKD 250,000,000 HKD 150,000,000 HKD 250,000,000Document24 pagesThe Cost of Capital: HKD 100,000,000 HKD 250,000,000 HKD 150,000,000 HKD 250,000,000chandel08No ratings yet

- Cost of Capital Questions 2Document3 pagesCost of Capital Questions 2Andrya VioNo ratings yet

- AirTran Airways PresentationDocument54 pagesAirTran Airways PresentationSarah GhummanNo ratings yet

- Types and Costs of Financial Capital: True-False QuestionsDocument8 pagesTypes and Costs of Financial Capital: True-False Questionsbia070386No ratings yet

- Capital Budgeting Techniques Capital Budgeting TechniquesDocument58 pagesCapital Budgeting Techniques Capital Budgeting TechniquesMuhammad ZeeshanNo ratings yet

- Capital Budgeting - 01Document23 pagesCapital Budgeting - 01ru4angelNo ratings yet

- 5.1 Questions: Chapter 5 Relevant Information For Decision Making With A Focus On Pricing DecisionsDocument37 pages5.1 Questions: Chapter 5 Relevant Information For Decision Making With A Focus On Pricing DecisionsLiyana ChuaNo ratings yet

- 5 - Capital Budgeting - Risk & UncertaintyDocument22 pages5 - Capital Budgeting - Risk & UncertaintySymron KheraNo ratings yet

- BD3 SM17Document3 pagesBD3 SM17Nguyễn Bành100% (1)

- Exercises Unit 14 Qam A1Document7 pagesExercises Unit 14 Qam A1Luis QuinonesNo ratings yet

- The Marketing EnvironmentDocument21 pagesThe Marketing EnvironmentIMRAN ALAM100% (1)

- Chapter - 5 Long Term FinancingDocument6 pagesChapter - 5 Long Term FinancingmuzgunniNo ratings yet

- Chapter 6 Discounted Cash Flow ValuationDocument27 pagesChapter 6 Discounted Cash Flow ValuationAhmed Fathelbab100% (1)

- Mark XDocument10 pagesMark XJennifer Ayers0% (2)

- Finance Management-Week 10Document4 pagesFinance Management-Week 10arwa_mukadam03No ratings yet

- Solution For HW 1Document15 pagesSolution For HW 1Ashtar Ali Bangash0% (1)

- The Utease CorporationDocument8 pagesThe Utease CorporationFajar Hari Utomo0% (1)

- Costs of Production AnalysisDocument8 pagesCosts of Production AnalysisdevrajkinjalNo ratings yet

- Compoun Interest New - 412310955Document21 pagesCompoun Interest New - 412310955Kathryn Santos50% (2)

- BKM 10e Chap003 SM SelectedDocument6 pagesBKM 10e Chap003 SM SelectedahmedNo ratings yet

- Wallace Garden SupplyDocument4 pagesWallace Garden SupplyestoniloannNo ratings yet

- Answers To Chapter 7 - Interest Rates and Bond ValuationDocument8 pagesAnswers To Chapter 7 - Interest Rates and Bond ValuationbuwaleedNo ratings yet

- Appendix B Solutions To Concept ChecksDocument31 pagesAppendix B Solutions To Concept Checkshellochinp100% (1)

- Understanding Keynesian Cross Model and Fiscal Policy MultipliersDocument30 pagesUnderstanding Keynesian Cross Model and Fiscal Policy MultiplierswaysNo ratings yet

- Report On Foreign Exchange Practice of ICB Islamic BankDocument122 pagesReport On Foreign Exchange Practice of ICB Islamic BankMahadi HasanNo ratings yet

- Au Mod - 1Document8 pagesAu Mod - 1Keyur PopatNo ratings yet

- Making Capital Investment Decisions for Goodtime Rubber Co's New Tire ModelDocument3 pagesMaking Capital Investment Decisions for Goodtime Rubber Co's New Tire ModelMuhammad abdul azizNo ratings yet

- Did United Technologies Overpay For Rockwell CollinsDocument2 pagesDid United Technologies Overpay For Rockwell CollinsRadNo ratings yet

- Chapter-1 Introduction To Cost and Management AccountingDocument14 pagesChapter-1 Introduction To Cost and Management AccountingJatin DhingraNo ratings yet

- Chap009 MaDocument57 pagesChap009 MamaglennaNo ratings yet

- Tutorial Questions Chap. 13a (Topic 5 - Leverage & Capital Structure)Document2 pagesTutorial Questions Chap. 13a (Topic 5 - Leverage & Capital Structure)hengNo ratings yet

- TB Special - PDF 15 & 16Document12 pagesTB Special - PDF 15 & 16Rabie HarounNo ratings yet

- Assignment 1Document2 pagesAssignment 1Elston DsouzaNo ratings yet

- S 12Document15 pagesS 12AbhishekKumar0% (3)

- 3 - 0607 - Making Capital Investment Decisions. Risk Analysis, Real OptionsDocument3 pages3 - 0607 - Making Capital Investment Decisions. Risk Analysis, Real OptionsPham Ngoc VanNo ratings yet

- HW1 NPVDocument4 pagesHW1 NPVLalit GuptaNo ratings yet

- Practice Problems - Making Capital Investment DecisionsDocument2 pagesPractice Problems - Making Capital Investment DecisionsHello KittyNo ratings yet

- Cultural Practices and Academic Performance of Blaan Pupils in Sinapulan Elementary SchoolDocument15 pagesCultural Practices and Academic Performance of Blaan Pupils in Sinapulan Elementary SchoolLorNo ratings yet

- HandoverDocument23 pagesHandoveryekoyesewNo ratings yet

- Sigafoose Robert Diane 1984 SingaporeDocument5 pagesSigafoose Robert Diane 1984 Singaporethe missions networkNo ratings yet

- ATS - Contextual Theology SyllabusDocument4 pagesATS - Contextual Theology SyllabusAts ConnectNo ratings yet

- Miranda V AgDocument3 pagesMiranda V AgCARLO JOSE BACTOLNo ratings yet

- Family Health Nursing Process Part 2Document23 pagesFamily Health Nursing Process Part 2Fatima Ysabelle Marie RuizNo ratings yet

- Chapter 2Document26 pagesChapter 2Dinindu Siriwardene100% (1)

- IS-LM Model Analysis of Monetary and Fiscal PolicyDocument23 pagesIS-LM Model Analysis of Monetary and Fiscal PolicyFatima mirzaNo ratings yet

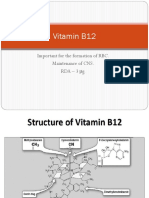

- Vitamin B12: Essential for RBC Formation and CNS MaintenanceDocument19 pagesVitamin B12: Essential for RBC Formation and CNS MaintenanceHari PrasathNo ratings yet

- Aviation Case StudyDocument6 pagesAviation Case Studynabil sayedNo ratings yet

- Academic Transcript Of:: Issued To StudentDocument3 pagesAcademic Transcript Of:: Issued To Studentjrex209No ratings yet

- 202002Document32 pages202002Shyam SundarNo ratings yet

- Rak Single DentureDocument48 pagesRak Single Denturerakes0No ratings yet

- Physics 401 Assignment # Retarded Potentials Solutions:: Wed. 15 Mar. 2006 - Finish by Wed. 22 MarDocument3 pagesPhysics 401 Assignment # Retarded Potentials Solutions:: Wed. 15 Mar. 2006 - Finish by Wed. 22 MarSruti SatyasmitaNo ratings yet

- Score:: A. Double - Napped Circular ConeDocument3 pagesScore:: A. Double - Napped Circular ConeCarmilleah FreyjahNo ratings yet

- Critters Table MannersDocument3 pagesCritters Table Mannersapi-248006371No ratings yet

- 1402 2046Document11 pages1402 2046Luca PilottiNo ratings yet

- Problem Set 12Document5 pagesProblem Set 12Francis Philippe Cruzana CariñoNo ratings yet

- Larry Dossey - HealingBeyondtheBodyDocument2 pagesLarry Dossey - HealingBeyondtheBodypaulxeNo ratings yet

- Araminta Spook My Haunted House ExtractDocument14 pagesAraminta Spook My Haunted House Extractsenuthmi dihansaNo ratings yet

- Theories of ProfitDocument39 pagesTheories of Profitradhaindia100% (1)

- Econometrics IntroductionDocument41 pagesEconometrics IntroductionRay Vega LugoNo ratings yet