Professional Documents

Culture Documents

CASE DIGEST Mindanao Bus Company

Uploaded by

Erica Dela Cruz0 ratings0% found this document useful (0 votes)

99 views1 pageProperty Law Case Digest

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentProperty Law Case Digest

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

99 views1 pageCASE DIGEST Mindanao Bus Company

Uploaded by

Erica Dela CruzProperty Law Case Digest

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

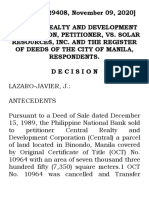

CASE #2

MINDANAO BUS CITY COMPANY vs CITY ASSESSOR AND TREASURER

PROMULGATED: September 6, 1962

PONENTE: J. LABRADOR

This is a petition for the review of the decision of the Court of Tax Appeals holding

petitioner, Mindanao Bus Company, liable to the payment of realty tax on its maintenance and

repair equipment.

Petitioner, Mindanao Bus Company, Inc., is a public utility solely engaged in transporting

passengers and cargoes by motor trucks, over its authorized lines in the island of Mindanao. The

equipment subjected to tax are the following: (a) Hobart Electric Welder machine; (b) Storm

Boring Machine; (c) Lathe machine with motor; (d) Black and Decker grinder; (e) PEMCO

Hydraulic Press; (f) battery charger; and (g) D-Engine Waukesha-M-Fuel. These machineries are

sitting on cement or wooden platforms. Petitioner is the owner of the land where it maintains

and operates its garage. Respondent, City Assessor of Cagayan De Oro City, assessed petitioners

equipment at P 4,400. Petitioner appealed the assessment to the Board of Tax Appeals on the

ground that the equipment is not realty. The Board and the Court of Tax Appeals sustained the

assessment made by respondent.

Petitioner contends that the tools, equipment or machineries are not immovable taxable

real properties. On the other hand, respondents contend that said equipment, though movable,

are immobilized by destination, in accordance with Article 415 (5), NCC.

WHETHER THE EQUIPMENT MENTIONED ARE CONSIDERED IMMOVABLE

PROPERTIES UNDER ARTICLE 415 (5) OF THE NCC, AND ARE THEREFORE TAXABLE?

No. In B.H. Berkenkotter vs Cu Unjieng, the Supreme Court stated that the movable

equipment to be immobilized in contemplation of law must first be essential and principal

elements of an industry or works without which such industry or work would be unable to

function or carry on the industrial purpose for which it was established. It is important to

distinguish that: Movables that become immobilized by destination, are essential and principal

elements in the industry, while those which may not be so considered immobilized are because

they are merely incidental, and are therefore not essential and principal.

In the case at bar, the tools and equipment in question are by their nature, not essential

and principal elements of petitioners business of transporting passengers and cargoes by motor

trucks. They are merely incidentals and acquired as movables and used only for expediency to

facilitate and/or improve its service.

Aside from the element of essentiality the above-quoted provision also requires that the

industry or works be carried on in a building or on a piece of land. The equipment in question

are destined only to repair or service the transportation business, which is not carried on in a

building or permanently on a piece of land, as demanded by law.

The decision is set aside and the equipment in question is declared not subject to

assessment of real estate for the purposes of the real estate tax.

You might also like

- Land Titles and Deeds Case DigestDocument6 pagesLand Titles and Deeds Case DigestZeawea100% (1)

- Securities and Exchange Commission Revokes Rappler Inc.'s RegistrationDocument29 pagesSecurities and Exchange Commission Revokes Rappler Inc.'s RegistrationSunStar Philippine NewsNo ratings yet

- CASE DIGEST Laurel Vs GarciaDocument2 pagesCASE DIGEST Laurel Vs GarciaErica Dela CruzNo ratings yet

- The Father of Torrens System in The PhilippinesDocument15 pagesThe Father of Torrens System in The PhilippinesRomeo A. Garing Sr.92% (12)

- Real EstateDocument53 pagesReal Estateitzmsmichelle100% (3)

- Equatorial Realty Development Inc Petitioner Vs Mayfair TheaterDocument4 pagesEquatorial Realty Development Inc Petitioner Vs Mayfair TheaterJose Marie JambonganaNo ratings yet

- 7 Tabasondra v. Spouses ConstantinoDocument2 pages7 Tabasondra v. Spouses Constantinot7uyuytuNo ratings yet

- Bachrach v. TalisayDocument2 pagesBachrach v. TalisayNoemi Mejia0% (1)

- Transpo Cases and NotesDocument579 pagesTranspo Cases and NotesPaul Christopher PinedaNo ratings yet

- Sales CodalDocument13 pagesSales CodalEl-el RedNo ratings yet

- Leung Yee vs. Strong Machinery 37 Phil 644Document9 pagesLeung Yee vs. Strong Machinery 37 Phil 644Jayzell Mae FloresNo ratings yet

- Berkenkotter V. Cu Unjieng FactsDocument3 pagesBerkenkotter V. Cu Unjieng FactsLady MAy SabanalNo ratings yet

- Domicile of A CorporationDocument3 pagesDomicile of A CorporationmaggiNo ratings yet

- Court Determines Who Has Better Right To PropertyDocument2 pagesCourt Determines Who Has Better Right To Propertyyurets929No ratings yet

- P.P V. Taneo FactsDocument2 pagesP.P V. Taneo FactsMyrna B RoqueNo ratings yet

- Case Digest NatresDocument3 pagesCase Digest NatresoihahNo ratings yet

- 3 - Francisco I. Chavez v. Public Estates Authority - HauloDocument15 pages3 - Francisco I. Chavez v. Public Estates Authority - Hauloanorith88No ratings yet

- Province of Camarines Sur v. CA GR No. 103125 May 17 1993Document1 pageProvince of Camarines Sur v. CA GR No. 103125 May 17 1993Christopher AdvinculaNo ratings yet

- Facts:: REPUBLIC v. REV. CLAUDIO R. CORTEZ, GR No. 197472, 2015-09-07Document4 pagesFacts:: REPUBLIC v. REV. CLAUDIO R. CORTEZ, GR No. 197472, 2015-09-07Sean Pamela BalaisNo ratings yet

- Land Titles Case DigestsDocument4 pagesLand Titles Case DigestsNino Kim AyubanNo ratings yet

- Delfin vs. ValdezDocument5 pagesDelfin vs. ValdezPaolo M. SegubreNo ratings yet

- 6.piansay v. DavidDocument1 page6.piansay v. DavidNanz JermaeNo ratings yet

- Davao Sawmill Co Vs CastilloDocument1 pageDavao Sawmill Co Vs CastilloCariss MagallonesNo ratings yet

- 1 Sarmiento Vs ECCDocument10 pages1 Sarmiento Vs ECCMa. Christian RamosNo ratings yet

- San Lorenzo Development Corp vs. CADocument5 pagesSan Lorenzo Development Corp vs. CABea CapeNo ratings yet

- 53) Asian Cathay Finance and Leasing Corporation vs. Gravador, 623 SCRA 517 (2010)Document1 page53) Asian Cathay Finance and Leasing Corporation vs. Gravador, 623 SCRA 517 (2010)Zyrene CabaldoNo ratings yet

- Property - 493 de Guia VS Ca PDFDocument5 pagesProperty - 493 de Guia VS Ca PDFXing Keet LuNo ratings yet

- Salas V JarencioDocument3 pagesSalas V JarencioABNo ratings yet

- CIR V Castaneda DigestDocument1 pageCIR V Castaneda DigestKTNo ratings yet

- ATP My DigestsDocument65 pagesATP My DigestsGui EshNo ratings yet

- 6 Eastern Telecom vs. ICC Case DigestDocument3 pages6 Eastern Telecom vs. ICC Case DigestJaja GkNo ratings yet

- Layug vs. SandiganbayanDocument5 pagesLayug vs. SandiganbayanMarion JossetteNo ratings yet

- Medina V CIRDocument1 pageMedina V CIRJoshua PielagoNo ratings yet

- Light Rail Transit Authority v. NavidadDocument2 pagesLight Rail Transit Authority v. NavidadReyes, Ann Margareth A.No ratings yet

- Philippine Journalists, Inc. vs. Thoenen 477 Scra 482 (2005)Document1 pagePhilippine Journalists, Inc. vs. Thoenen 477 Scra 482 (2005)Syed Almendras IINo ratings yet

- Lecture Notes I Agrarian Law and Social LegislationDocument3 pagesLecture Notes I Agrarian Law and Social LegislationAra LimNo ratings yet

- Froilan v. Pan Oriental Shipping Co.Document22 pagesFroilan v. Pan Oriental Shipping Co.enan_intonNo ratings yet

- Cantiller Vs Potenciano-DetailedDocument3 pagesCantiller Vs Potenciano-DetailedMa Gabriellen Quijada-TabuñagNo ratings yet

- LTD Case DigestDocument10 pagesLTD Case DigestBeya AmaroNo ratings yet

- PCGG V SandiganbayanDocument2 pagesPCGG V SandiganbayanNelia Mae S. VillenaNo ratings yet

- Retro" Over A 50,000-Square Meter Portion of Lot No. 1213Document43 pagesRetro" Over A 50,000-Square Meter Portion of Lot No. 1213Anonymous 6i1wUgzNo ratings yet

- Pichel vs. ALonzoDocument1 pagePichel vs. ALonzoJosine ProtasioNo ratings yet

- BUREAU OF FORESTRY vs. CA PDFDocument2 pagesBUREAU OF FORESTRY vs. CA PDFWILLY C. DUMPITNo ratings yet

- Padilla Vs CADocument14 pagesPadilla Vs CAKarina Katerin BertesNo ratings yet

- Recio Vs Heirs of Sps Aguedo and Maria Altamarino - IpilDocument1 pageRecio Vs Heirs of Sps Aguedo and Maria Altamarino - IpilCareyssa MaeNo ratings yet

- Sales CasesDocument4 pagesSales CasesAnonymous GEPAhin6NjNo ratings yet

- Tupas VDocument2 pagesTupas VCentSeringNo ratings yet

- (Tax 1) Midterms ReviewerDocument46 pages(Tax 1) Midterms ReviewerAiken Alagban LadinesNo ratings yet

- Phil. Banking Corp. Vs CIRDocument2 pagesPhil. Banking Corp. Vs CIRKatherine EvangelistaNo ratings yet

- Sales AssignmentDocument3 pagesSales AssignmentDANICA FLORESNo ratings yet

- Credit Transaction Cases - 2020Document12 pagesCredit Transaction Cases - 2020SamKris Guerrero MalasagaNo ratings yet

- SalesDocument7 pagesSalesEileen Eika Dela Cruz-LeeNo ratings yet

- Feliciano Vs ZaldivarDocument5 pagesFeliciano Vs ZaldivarZeus Karlo A. EspuertaNo ratings yet

- 2017 Bar Exams Questions in Taxation LawDocument7 pages2017 Bar Exams Questions in Taxation LawJade Marlu DelaTorre100% (1)

- LTD Midterm Exams by Dickbrown and CoDocument3 pagesLTD Midterm Exams by Dickbrown and CoBrandon BeradNo ratings yet

- Republic Planters Bank Vs CA (1992)Document3 pagesRepublic Planters Bank Vs CA (1992)Francis MasiglatNo ratings yet

- Enviro Law Case DigestDocument13 pagesEnviro Law Case Digest1925habeascorpusNo ratings yet

- Labor Cases SCRADocument240 pagesLabor Cases SCRAKrizNo ratings yet

- Calimlim-Canullas vs. FortunDocument2 pagesCalimlim-Canullas vs. Fortungen1No ratings yet

- Mindanao Bus Co. v. City Assessor and TreasurerDocument1 pageMindanao Bus Co. v. City Assessor and TreasurerDomski Fatima CandolitaNo ratings yet

- Mindanao Bus Co Vs City Assesor and TreasurerDocument6 pagesMindanao Bus Co Vs City Assesor and TreasurerLau NunezNo ratings yet

- 6 Property - MindanaoBusCo - V - City-Assessor - DolinogDocument1 page6 Property - MindanaoBusCo - V - City-Assessor - DolinogHANNAH GRACE TEODOSIONo ratings yet

- Mindanao Bus Co. vs. City AssessorDocument6 pagesMindanao Bus Co. vs. City Assessorred gynNo ratings yet

- Mindanao Bus Co. V City AssessorDocument4 pagesMindanao Bus Co. V City AssessorRenceNo ratings yet

- Property Law Cases Art 414 - 418Document138 pagesProperty Law Cases Art 414 - 418Albert Navaja SadiliNo ratings yet

- Book ListDocument2 pagesBook ListErica Dela CruzNo ratings yet

- CASE DIGEST Iniego Vs Honorable PurgananDocument2 pagesCASE DIGEST Iniego Vs Honorable PurgananErica Dela CruzNo ratings yet

- SYLLABUS Criminal Law I 2015Document14 pagesSYLLABUS Criminal Law I 2015Erica Dela CruzNo ratings yet

- CASE DIGEST Gan Vs CA and PeopleDocument1 pageCASE DIGEST Gan Vs CA and PeopleErica Dela CruzNo ratings yet

- CASE DIGEST People's Broadcasting, Inc. (Bombo Radyo) Vs Secretary of DOLEDocument2 pagesCASE DIGEST People's Broadcasting, Inc. (Bombo Radyo) Vs Secretary of DOLEErica Dela Cruz100% (2)

- CASE LIST Negotiable Instruments Law Under Dean Jose R. SundiangDocument2 pagesCASE LIST Negotiable Instruments Law Under Dean Jose R. SundiangErica Dela CruzNo ratings yet

- SYLLABUS Public Corporations Atty. Randolph PascasioDocument5 pagesSYLLABUS Public Corporations Atty. Randolph PascasioErica Dela Cruz100% (1)

- Catechism For Filipino Catholics BookDocument513 pagesCatechism For Filipino Catholics BookPaul Pineda93% (14)

- SYLLABUS Administrative Law Under Atty. Randolph PascasioDocument3 pagesSYLLABUS Administrative Law Under Atty. Randolph PascasioErica Dela CruzNo ratings yet

- SYLLABUS Election Law Under Atty. Randolph PascasioDocument5 pagesSYLLABUS Election Law Under Atty. Randolph PascasioErica Dela CruzNo ratings yet

- CASE DIGEST Garcia Vs Court of AppealsDocument2 pagesCASE DIGEST Garcia Vs Court of AppealsErica Dela CruzNo ratings yet

- CASE DIGESTS Selected Cases in Pub. Corp. Dela Cruz Vs Paras To Miaa Vs CADocument10 pagesCASE DIGESTS Selected Cases in Pub. Corp. Dela Cruz Vs Paras To Miaa Vs CAErica Dela Cruz100% (1)

- CASE LIST Sales and Lease Under Atty. Carlo BusmenteDocument3 pagesCASE LIST Sales and Lease Under Atty. Carlo BusmenteErica Dela CruzNo ratings yet

- CASE LIST Agency, Trusts and Partnership Under Atty. Dante O. Dela CruzDocument2 pagesCASE LIST Agency, Trusts and Partnership Under Atty. Dante O. Dela CruzErica Dela Cruz100% (1)

- CASE DIGEST Filipinas Colleges Inc Vs TimbangDocument2 pagesCASE DIGEST Filipinas Colleges Inc Vs TimbangErica Dela Cruz50% (2)

- CASE DIGEST Green Acres Holding, Inc. Vs Victoria CabralDocument2 pagesCASE DIGEST Green Acres Holding, Inc. Vs Victoria CabralErica Dela CruzNo ratings yet

- SYLLABUS Transportation Law Atty. Reinier Yebra 2015Document6 pagesSYLLABUS Transportation Law Atty. Reinier Yebra 2015Erica Dela CruzNo ratings yet

- LAW NIPAS Act of 1992Document9 pagesLAW NIPAS Act of 1992Erica Dela CruzNo ratings yet

- CASE DIGEST Daclison Vs BaytionDocument2 pagesCASE DIGEST Daclison Vs BaytionErica Dela Cruz0% (1)

- CASE LIST Insurance Law Under Dean Jose R. SundiangDocument5 pagesCASE LIST Insurance Law Under Dean Jose R. SundiangErica Dela CruzNo ratings yet

- CASE DIGESTS Selected Cases in Labor StandardsDocument36 pagesCASE DIGESTS Selected Cases in Labor StandardsErica Dela CruzNo ratings yet

- CASE DIGEST Isaguirre Vs de LaraDocument2 pagesCASE DIGEST Isaguirre Vs de LaraErica Dela CruzNo ratings yet

- CASE DIGEST Ignao Vs IacDocument1 pageCASE DIGEST Ignao Vs IacErica Dela CruzNo ratings yet

- Trust Codal - Review AidDocument2 pagesTrust Codal - Review Aidc@rpe_diemNo ratings yet

- CASE DIGEST Alolino V FloresDocument2 pagesCASE DIGEST Alolino V FloresErica Dela CruzNo ratings yet

- CASE DIGEST Javier Vs Veridiano IIDocument1 pageCASE DIGEST Javier Vs Veridiano IIErica Dela CruzNo ratings yet

- CASE DIGEST Capitol WirelessDocument2 pagesCASE DIGEST Capitol WirelessErica Dela Cruz100% (3)

- CASE DIGEST Heirs of Malabanan Vs RepublicDocument3 pagesCASE DIGEST Heirs of Malabanan Vs RepublicErica Dela CruzNo ratings yet

- Act 3077Document2 pagesAct 3077Jay Arnold PanganibanNo ratings yet

- Public and Patrimonial Property CasesDocument7 pagesPublic and Patrimonial Property CasesShammah Rey MahinayNo ratings yet

- Blanco vs. QuashaDocument1 pageBlanco vs. QuashaSeffirion69No ratings yet

- Closing of Real Estate Sale Transactions and Transfer of TitleDocument6 pagesClosing of Real Estate Sale Transactions and Transfer of TitleescaNo ratings yet

- Research Report Pooja MishraDocument75 pagesResearch Report Pooja MishraPooja MishraNo ratings yet

- The International Comparative Legal Guide To - Real Estate 2015Document13 pagesThe International Comparative Legal Guide To - Real Estate 2015Panos KolNo ratings yet

- Ackman Realty Income ShortDocument35 pagesAckman Realty Income Shortmarketfolly.com100% (1)

- 6 Property - MindanaoBusCo - V - City-Assessor - DolinogDocument1 page6 Property - MindanaoBusCo - V - City-Assessor - DolinogHANNAH GRACE TEODOSIONo ratings yet

- Dir of Lands v. IAC and EspartinezDocument3 pagesDir of Lands v. IAC and EspartinezKerriganJamesRoiMaulitNo ratings yet

- Effects of Possession (Arts. 539-545)Document16 pagesEffects of Possession (Arts. 539-545)Jeon Won WooNo ratings yet

- Module 2 ExamDocument12 pagesModule 2 ExamRoger ChivasNo ratings yet

- Ra 7279 PropertyDocument10 pagesRa 7279 PropertyMariaHannahKristenRamirezNo ratings yet

- Dionisio C. Ladignon, Petitioner, vs. Court of AppealsDocument17 pagesDionisio C. Ladignon, Petitioner, vs. Court of AppealsTheHoneybhieNo ratings yet

- Pedro P. Pecson V. Court of Appeals, Sps. Nuguid: FactsDocument15 pagesPedro P. Pecson V. Court of Appeals, Sps. Nuguid: FactsGabriel UyNo ratings yet

- PECSON v. CADocument8 pagesPECSON v. CAValerie PinoteNo ratings yet

- Indiana Property Tax Benefits: (This Form Must Be Printed On Gold or Yellow Paper)Document2 pagesIndiana Property Tax Benefits: (This Form Must Be Printed On Gold or Yellow Paper)abramsdcNo ratings yet

- Adverse Claim - GRN 229408 CRDC PDFDocument68 pagesAdverse Claim - GRN 229408 CRDC PDFJoAnneGallowayNo ratings yet

- Adverse Claim For Transferred Rights Over Real PropertyDocument2 pagesAdverse Claim For Transferred Rights Over Real PropertyFeEdithOronicoNo ratings yet

- Consti2 Case DigestDocument156 pagesConsti2 Case DigestPeanutButter 'n JellyNo ratings yet

- CRuz Vs CaDocument5 pagesCRuz Vs CaIm reineNo ratings yet

- Leveriza-vs-IAC Digest 1Document3 pagesLeveriza-vs-IAC Digest 1Elias IbarraNo ratings yet

- Concept of Gift Under Muslim Law - AcademikeDocument16 pagesConcept of Gift Under Muslim Law - AcademikeAbdul Wahab KhanNo ratings yet

- Private International LawConflict of LawsDocument6 pagesPrivate International LawConflict of LawsSasmit PatilNo ratings yet

- Frequently Asked QuestionsDocument15 pagesFrequently Asked QuestionsJunelyn T. EllaNo ratings yet

- RA 4726 (Condo Act)Document6 pagesRA 4726 (Condo Act)Bianca Margaret TolentinoNo ratings yet

- Due Diligence of Property AcquisitionDocument6 pagesDue Diligence of Property AcquisitionDon VillegasNo ratings yet

- Reserva TroncalDocument5 pagesReserva TroncalRenz AmonNo ratings yet