Professional Documents

Culture Documents

07 - Petty Cash Fund and Bank Reconciliation

Uploaded by

Cy Miolata100%(2)100% found this document useful (2 votes)

1K views2 pagesNOTES

Original Title

07 -- Petty Cash Fund and Bank Reconciliation

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentNOTES

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

100%(2)100% found this document useful (2 votes)

1K views2 pages07 - Petty Cash Fund and Bank Reconciliation

Uploaded by

Cy MiolataNOTES

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 2

Review Class for ACT111-0 and ACT112-0

E.T Yuchengco School of Business and Management

MODULE 7

PETTY CASH FUND AND BANK RECONCILIATION

Petty Cash Fund

A petty cash fund is a cash fund used to pay relatively small amounts.

a. The operation of the fund, often called an imprest system, involves three steps: (1) establishing the

fund, (2) making payments from the fund and (3) replenishing the fund.

b. Accounting entries are required when (1) the fund is established, (2) the fund is replenished and (3)

the amount of the fund is changed.

Use of a Bank Account

The use of a bank account minimizes the amount of currency that must be kept on hand and therefore

contributes significantly to good internal control over cash.

A check is a written order signed by the depositor directing the bank to pay a specified sum of money to

a designated recipient. The three parties to a check are as follows:

a. The drawer who issues the check.

b. The bank (or payer) on which the check is drawn.

c. The payee to whom the check is payable.

A bank statement shows (a) checks paid and other debits and transfers that reduce the balance in the

account, (b) deposits and other credits and transfers that increase the balance in the account and (c) the

account balance after each day's transactions.

A bank statement memoranda is usually included to explain debits made by the bank against the

depositor's account such as a bank service charge, cost of printing checks, issuing traveller's checks,

when a previously deposited customer's check "bounces" because of insufficient funds (NSF check), and

the transfers of funds to other locations.

The bank statement memoranda also explain the credits made by the bank to the depositors account

such as the collection of a note receivable for the depositor by the bank, and the transfers of funds into

the account from other locations.

Reconciling the Bank Account

A reconciliation of a bank account is necessary because the balance per bank and balance per books

are seldom in agreement. The lack of agreement may be the result of time lags and errors.

To obtain the maximum benefit from reconciling the bank account, the reconciliation should be prepared

by an employee who has no other responsibilities pertaining to cash.

In reconciling the bank statement, it is customary to reconcile the balance per books and balance per

bank to their adjusted (correct) cash balances. The reconciliation schedule consists of two sections. The

steps in preparing a bank reconciliation are: (a) Determine outstanding deposits. (b) Determine

unpresented checks. (c) Note any errors discovered. (d) Note all direct debits and credits.

Each reconciling item used in determining the adjusted cash balance per books should be recorded by

the depositor.

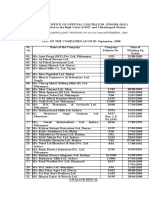

Proforma bank reconciliation:

Name of the Company

Bank Reconciliation

Date

Balance per bank statement

Add:

Deposit in transit

Less:

Outstanding check

Add/Less: Bank errors

Adjusted balance

xx

xx

(xx)

xx

xx

Balance per books (or per ledger)

Add: Note collected and interest

Wire transfers (deposits)

Less: NSF checks

Bank service charge

Wire transfers (withdrawals)

Add/Less: Book errors

Adjusted balance

xx

xx

xx

(xx)

(xx)

(xx)

xx

xx

Review Class for ACT111-0 and ACT112-0

E.T Yuchengco School of Business and Management

Sample Theory Questions

1. The entry to replenish a petty cash fund includes a

A. Debit to Cash and a credit to Petty Cash.

B. Debit to Petty Cash Fund and a credit to Cash.

C. Debits to various expense accounts and a credit to Petty Cash Fund.

D. Debits to various expense accounts and a credit to Cash.

2. Which of the following items is subtracted from the unadjusted bank balance to determine the

company's true cash balance?

A. Deposits in transit.

B. Outstanding checks.

C. Debit memo for the monthly bank service charge.

D. Credit memo for the collection of the company's accounts receivable by the bank.

3. The proper treatment on the bank reconciliation of an NSF check of a customer that is returned with

the bank statement is to show it as a(an)

A. Addition per book balance of cash.

C. Addition per bank statement balance.

B. Deduction per book balance of cash.

D. Deduction per bank statement balance.

4. If a check written by a firm is not canceled by the bank and returned with the month's bank statement,

the firm should

A. Adjust the balance in the firm's checkbook to reflect the data that appears in the bank's records.

B. Immediately notify the bank requesting that it correct its records.

C. Consider this check as outstanding when preparing the bank reconciliation.

D. Consider this check to be lost and issue a replacement check.

5. The following items appear on the company's bank reconciliation: a deposit in transit, outstanding

checks, an NSF check from a customer, and a bank service charge. The items that must be recorded

by the company in journal entries include the

A. Deposit in transit, the outstanding checks, the NSF check, and the bank service charge.

B. Deposit in transit, the NSF check, and the bank service charge.

C. Outstanding checks and the bank service charge.

D. NSF check and the bank service charge.

Computational Drills

1. On March 31, 2014, Nick Company had a cash balance per books of P6,781.50. The bank statement

from State Bank on that date showed a balance of P6,804.60. A comparison of the statement with

the cash account revealed the following facts.

a. The statement included a debit memo of P40 for the printing of additional company checks.

b. Cash sales of P836.15 on March 12 were deposited in the bank. The cash receipt journal entry

and the deposit slip were incorrectly made for P886.15. The bank credited Nick Company for the

correct amount.

c. Outstanding checks at March 31 totaled P276.25. Deposits in transit were P1,916.15.

d. On March 20, the company issued check No. 121 for P685 to Lim Company, on account. The

check, which cleared the bank in May, was incorrectly journalized and posted by Nick Company

for P658.

e. A P3,000 note receivable was collected by the bank for Nick Company on March 31 plus P80

interest. The bank charged a collection fee of P20. No interest has been accrued on the note.

f. Included with the cancelled check was a check issued by Stone Store to Sand Company for P600

that was incorrectly charged to Nick Company by the bank.

g. On March 31, the bank statement showed NSF charge of P680 for a check issued by Linda, a

customer to Nick Company on account.

Required: Prepare a bank reconciliation.

2. Provided below is a bank reconciliation prepared by Santa Fe, Inc.

Balance per bank statement

P11,800

Add: Deposit in transit

1,200

Less: Outstanding checks

200

Less: Bank error-wrong deposit

amount recorded

100

Adjusted bank balance, May 31

?

Balance per books, May 1

Add: Interest earned

Less: Customer's NSF check

Adjusted book balance, May 31

?

40

300

_______

?

Required: Complete the bank reconciliation and answer the following questions:

b. How much should Santa Fe report on its balance sheet as Cash at May 31?

c. How much is the amount of Santa Fes net adjustment to the cash account? Indicate whether

this amount is a decrease or increase.

You might also like

- CHAPTER SIX - Doc Internal Control Over CashDocument7 pagesCHAPTER SIX - Doc Internal Control Over CashYared DemissieNo ratings yet

- C6Document20 pagesC6AkkamaNo ratings yet

- Final Chapter 6Document6 pagesFinal Chapter 6Hussen AbdulkadirNo ratings yet

- Cash Management ProceduresDocument9 pagesCash Management ProceduresNigussie BerhanuNo ratings yet

- Fundamentas of Accounting I CH 5Document24 pagesFundamentas of Accounting I CH 5israelbedasa3100% (1)

- Bank ReconciliationDocument12 pagesBank ReconciliationJenny Pearl Dominguez CalizarNo ratings yet

- Accounting Cash Internal ControlsDocument14 pagesAccounting Cash Internal ControlsDave A ValcarcelNo ratings yet

- Cash Chapter 5Document8 pagesCash Chapter 5Abdii DhufeeraNo ratings yet

- Chapter 5Document5 pagesChapter 5Abrha636No ratings yet

- Unit 7. Cash 6.0 Aims & ObjectivesDocument10 pagesUnit 7. Cash 6.0 Aims & ObjectivesKaleab TesfayeNo ratings yet

- How To Prepare A Bank ReconciliationDocument6 pagesHow To Prepare A Bank ReconciliationMk Fisiha100% (1)

- Accounting For CashDocument6 pagesAccounting For CashAsnake YohanisNo ratings yet

- Final Chapter 6Document12 pagesFinal Chapter 6Nigussie BerhanuNo ratings yet

- PRI II Note CH 1-7Document78 pagesPRI II Note CH 1-7AbelNo ratings yet

- Module 1 CashDocument13 pagesModule 1 Cashtite ko'y malakeNo ratings yet

- Cash Chapter 5Document9 pagesCash Chapter 5yoantanNo ratings yet

- Final Chapter 6Document14 pagesFinal Chapter 6zynab123No ratings yet

- Module 1 CashDocument13 pagesModule 1 CashKim JisooNo ratings yet

- Bank Reconciliation StatementsDocument6 pagesBank Reconciliation StatementsTawanda Tatenda Herbert0% (1)

- Chapter 12 - Bank ReconciliationDocument29 pagesChapter 12 - Bank Reconciliationshemida100% (7)

- Chapter 10: Cash and Financial InvestmentsDocument13 pagesChapter 10: Cash and Financial Investmentsdes arellanoNo ratings yet

- Bank Reconciliation Statement - Definition, Explanation, Example and Causes of Difference - Accounting For ManagementDocument5 pagesBank Reconciliation Statement - Definition, Explanation, Example and Causes of Difference - Accounting For Managementpeter tichiNo ratings yet

- Module 1 5 AnswersDocument111 pagesModule 1 5 AnswersryanNo ratings yet

- Chapter - 6Document12 pagesChapter - 6Mehamed NureNo ratings yet

- Managing Cash Through Bank Accounts and ReconciliationDocument7 pagesManaging Cash Through Bank Accounts and ReconciliationNigussie BerhanuNo ratings yet

- Bank Reconciliation GuideDocument6 pagesBank Reconciliation GuideAdan EveNo ratings yet

- Verify Cash BalancesDocument16 pagesVerify Cash Balancesirene_pabello100% (1)

- Audit of Cash and Cash Equivalents: Problem No. 20Document6 pagesAudit of Cash and Cash Equivalents: Problem No. 20Robel MurilloNo ratings yet

- Bank ReconciliationDocument18 pagesBank ReconciliationJanaica MacaraegNo ratings yet

- Bank Recon Review 1Document13 pagesBank Recon Review 1CYCY CyraNo ratings yet

- Bank ReconcilationDocument9 pagesBank ReconcilationJohnpaul FloranzaNo ratings yet

- Bank ReconciliationDocument5 pagesBank ReconciliationaizaNo ratings yet

- Step BankDocument4 pagesStep BankSamrawit MewaNo ratings yet

- Quiz 2 Cash To ARDocument4 pagesQuiz 2 Cash To ARGraziela MercadoNo ratings yet

- BRS Full ChapterDocument16 pagesBRS Full ChapterMumtazAhmad100% (1)

- Cash and RecievablesDocument60 pagesCash and Recievablesአንተነህ የእናቱ100% (1)

- Bank Reconciliation Theory & ProblemsDocument9 pagesBank Reconciliation Theory & ProblemsSalvador DapatNo ratings yet

- Chapter Eight Bank Reconciliation-2Document67 pagesChapter Eight Bank Reconciliation-2Kingsley MweembaNo ratings yet

- E-Handout On Audit of Cash and Cash EquivalentsDocument12 pagesE-Handout On Audit of Cash and Cash EquivalentsAsnifah AlinorNo ratings yet

- Module 8Document3 pagesModule 8Rainielle Sy DulatreNo ratings yet

- Optimize Cash ControlsDocument18 pagesOptimize Cash ControlsAhmed RawyNo ratings yet

- Lesson 10 Bank Reconciliation StatementDocument22 pagesLesson 10 Bank Reconciliation StatementGelai Batad100% (1)

- Fabm2 QTR.2 Las 7.1Document10 pagesFabm2 QTR.2 Las 7.1Trunks KunNo ratings yet

- Chapter 2 Bank Reconciliation (Gatdc)Document20 pagesChapter 2 Bank Reconciliation (Gatdc)Joan LeonorNo ratings yet

- Bank Reconciliation Statement GuideDocument5 pagesBank Reconciliation Statement GuideEng Abdulkadir MahamedNo ratings yet

- CashDocument7 pagesCashhellohello100% (1)

- Chap 4 Principle AccountingDocument49 pagesChap 4 Principle Accountingissack mohamedNo ratings yet

- PAC - Bank Reconciliations and Accounting Concepts TestDocument5 pagesPAC - Bank Reconciliations and Accounting Concepts TestNadir MuhammadNo ratings yet

- AP - Audit of CashDocument4 pagesAP - Audit of CashRose CastilloNo ratings yet

- FABM2 Q4 Module 2Document23 pagesFABM2 Q4 Module 2Jet Planes100% (1)

- BRS, IASB FRMWKDocument4 pagesBRS, IASB FRMWKNadir MuhammadNo ratings yet

- MODULE 3 - Part 3 Bank ReconciliationDocument16 pagesMODULE 3 - Part 3 Bank ReconciliationShaena Mae50% (2)

- Ch.4 - Cash and Receivables - MHDocument75 pagesCh.4 - Cash and Receivables - MHSamZhaoNo ratings yet

- Bank ReconciliationDocument6 pagesBank ReconciliationDenishNo ratings yet

- Bank Reconciliation StatementDocument39 pagesBank Reconciliation StatementinnovativiesNo ratings yet

- PE 6-3. Petty Cash Fund: PE 6-1. Classifying Major Business ActivitiesDocument58 pagesPE 6-3. Petty Cash Fund: PE 6-1. Classifying Major Business ActivitiesJamil Macabanding100% (1)

- Reviewer - Cash & Cash EquivalentsDocument5 pagesReviewer - Cash & Cash EquivalentsMaria Kathreena Andrea Adeva100% (1)

- CH05 PaiDocument12 pagesCH05 PaiKanbiro OrkaidoNo ratings yet

- Bookkeeping for Nonprofits: A Step-by-Step Guide to Nonprofit AccountingFrom EverandBookkeeping for Nonprofits: A Step-by-Step Guide to Nonprofit AccountingRating: 4 out of 5 stars4/5 (2)

- What Is PFRSDocument1 pageWhat Is PFRSCy MiolataNo ratings yet

- Dog EatersDocument5 pagesDog EatersCy MiolataNo ratings yet

- Agricultural RevolutionDocument23 pagesAgricultural RevolutionCy MiolataNo ratings yet

- Oligopolistic Competition and Public PolicyDocument16 pagesOligopolistic Competition and Public PolicyCy MiolataNo ratings yet

- Theories of PersonalityDocument12 pagesTheories of PersonalityCy MiolataNo ratings yet

- RizalDocument8 pagesRizalCy MiolataNo ratings yet

- CH 13Document31 pagesCH 13Natasha GraciaNo ratings yet

- 09 - Plant AssetsDocument3 pages09 - Plant AssetsCy MiolataNo ratings yet

- 06 InventoriesDocument3 pages06 InventoriesCy MiolataNo ratings yet

- 09 - Plant AssetsDocument3 pages09 - Plant AssetsCy MiolataNo ratings yet

- Multiple Choice Questions ReviewDocument46 pagesMultiple Choice Questions ReviewJ Camille Mangundaya Lacsamana77% (30)

- Wiley AdvaccDocument31 pagesWiley AdvaccCy MiolataNo ratings yet

- 01 - Introduction To Accounting (Notes)Document4 pages01 - Introduction To Accounting (Notes)Cy MiolataNo ratings yet

- Boiler Check ListDocument4 pagesBoiler Check ListFrancis VinoNo ratings yet

- Victron MultiPlus 48 1200-13-16 Datasheet enDocument1 pageVictron MultiPlus 48 1200-13-16 Datasheet enBAHJARI AMINENo ratings yet

- Material Safety Data Sheet Lime Kiln Dust: Rev. Date:5/1/2008Document6 pagesMaterial Safety Data Sheet Lime Kiln Dust: Rev. Date:5/1/2008suckrindjink100% (1)

- Colour Ring Labels for Wireless BTS IdentificationDocument3 pagesColour Ring Labels for Wireless BTS Identificationehab-engNo ratings yet

- 00 CCSA TestDocument276 pages00 CCSA TestPedro CubillaNo ratings yet

- Statement of Compulsory Winding Up As On 30 SEPTEMBER, 2008Document4 pagesStatement of Compulsory Winding Up As On 30 SEPTEMBER, 2008abchavhan20No ratings yet

- Finance at Iim Kashipur: Group 9Document8 pagesFinance at Iim Kashipur: Group 9Rajat SinghNo ratings yet

- Philips DVD Player SpecificationsDocument2 pagesPhilips DVD Player Specificationsbhau_20No ratings yet

- Radio Theory: Frequency or AmplitudeDocument11 pagesRadio Theory: Frequency or AmplitudeMoslem GrimaldiNo ratings yet

- Lesson 2 Mathematics Curriculum in The Intermediate GradesDocument15 pagesLesson 2 Mathematics Curriculum in The Intermediate GradesRose Angel Manaog100% (1)

- Micropolar Fluid Flow Near The Stagnation On A Vertical Plate With Prescribed Wall Heat Flux in Presence of Magnetic FieldDocument8 pagesMicropolar Fluid Flow Near The Stagnation On A Vertical Plate With Prescribed Wall Heat Flux in Presence of Magnetic FieldIJBSS,ISSN:2319-2968No ratings yet

- Programming Language Foundations PDFDocument338 pagesProgramming Language Foundations PDFTOURE100% (2)

- Doe v. Myspace, Inc. Et Al - Document No. 37Document2 pagesDoe v. Myspace, Inc. Et Al - Document No. 37Justia.comNo ratings yet

- APC Smart-UPS 1500VA LCD 230V: Part Number: SMT1500IDocument3 pagesAPC Smart-UPS 1500VA LCD 230V: Part Number: SMT1500IDesigan SannasyNo ratings yet

- GIS Arrester PDFDocument0 pagesGIS Arrester PDFMrC03No ratings yet

- Programming Manual Magic 308/616-CLI Quick ReferenceDocument16 pagesProgramming Manual Magic 308/616-CLI Quick ReferencekrishnamarajublrNo ratings yet

- Electrosteel Castings Limited (ECL) - Technology That CaresDocument4 pagesElectrosteel Castings Limited (ECL) - Technology That CaresUjjawal PrakashNo ratings yet

- Amana PLE8317W2 Service ManualDocument113 pagesAmana PLE8317W2 Service ManualSchneksNo ratings yet

- NPV Irr ArrDocument16 pagesNPV Irr ArrAnjaliNo ratings yet

- Neuropathology of Epilepsy: Epilepsy-Related Deaths and SUDEPDocument11 pagesNeuropathology of Epilepsy: Epilepsy-Related Deaths and SUDEPTeuku AvicennaNo ratings yet

- Your Inquiry EPALISPM Euro PalletsDocument3 pagesYour Inquiry EPALISPM Euro PalletsChristopher EvansNo ratings yet

- Restructuring Egypt's Railways - Augst 05 PDFDocument28 pagesRestructuring Egypt's Railways - Augst 05 PDFMahmoud Abo-hashemNo ratings yet

- Russian Tea Market Growth and Brand PreferenceDocument6 pagesRussian Tea Market Growth and Brand PreferenceKing KhanNo ratings yet

- Ana White - PLANS - A Murphy Bed YOU Can Build, and Afford To Build - 2011-03-03Document20 pagesAna White - PLANS - A Murphy Bed YOU Can Build, and Afford To Build - 2011-03-03Ahmad KamilNo ratings yet

- Modern Indian HistoryDocument146 pagesModern Indian HistoryJohn BoscoNo ratings yet

- Hawk Technology Systems v. NCLDocument6 pagesHawk Technology Systems v. NCLPriorSmartNo ratings yet

- Machine Learning: Bilal KhanDocument26 pagesMachine Learning: Bilal KhanBilal KhanNo ratings yet

- ROM Flashing Tutorial For MTK Chipset PhonesDocument5 pagesROM Flashing Tutorial For MTK Chipset PhonesAriel RodriguezNo ratings yet

- A General Guide To Camera Trapping Large Mammals in Tropical Rainforests With Particula PDFDocument37 pagesA General Guide To Camera Trapping Large Mammals in Tropical Rainforests With Particula PDFDiego JesusNo ratings yet

- Introduction To OpmDocument30 pagesIntroduction To OpmNaeem Ul HassanNo ratings yet