Professional Documents

Culture Documents

Harold A. Serr, Director Alcohol and Tobacco Tax Division Internal Revenue Service v. Juleus J. Sullivan, Jr., Hiram Walker Incorporated, (Respondent-Intervenor in d.c.). Harold A. Serr, Director Alcohol and Tobacco Tax Division Internal Revenue Service v. Francis Deimeyer, Hiram Walker Incorporated, (Respondent-Intervenor in d.c.). Harold A. Serr, Director Alcohol and Tobacco Tax Division Internal Revenue Service v. James F. Curran, Hiram Walker Incorporated, (Respondent-Intervenor in d.c.). Harold A. Serr, Director Alcohol and Tobacco Tax Division Internal Revenue Service v. Joseph Letizia, Hiram Walker Incorporated, (Respondent-Intervenor in d.c.). Harold A. Serr, Director Alcohol and Tobacco Tax Division Internal Revenue Service v. James J. Wheatley, Jr., Hiram Walker Incorporated, (Respondent-Intervenor in d.c.). Harold A. Serr, Director Alcohol and Tobacco Tax Division Internal Revenue Service v. Nicholas Dewilde, Hiram Walker Incorporated, (Respondent-Intervenor in d.c.). Harold

Uploaded by

Scribd Government DocsCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Harold A. Serr, Director Alcohol and Tobacco Tax Division Internal Revenue Service v. Juleus J. Sullivan, Jr., Hiram Walker Incorporated, (Respondent-Intervenor in d.c.). Harold A. Serr, Director Alcohol and Tobacco Tax Division Internal Revenue Service v. Francis Deimeyer, Hiram Walker Incorporated, (Respondent-Intervenor in d.c.). Harold A. Serr, Director Alcohol and Tobacco Tax Division Internal Revenue Service v. James F. Curran, Hiram Walker Incorporated, (Respondent-Intervenor in d.c.). Harold A. Serr, Director Alcohol and Tobacco Tax Division Internal Revenue Service v. Joseph Letizia, Hiram Walker Incorporated, (Respondent-Intervenor in d.c.). Harold A. Serr, Director Alcohol and Tobacco Tax Division Internal Revenue Service v. James J. Wheatley, Jr., Hiram Walker Incorporated, (Respondent-Intervenor in d.c.). Harold A. Serr, Director Alcohol and Tobacco Tax Division Internal Revenue Service v. Nicholas Dewilde, Hiram Walker Incorporated, (Respondent-Intervenor in d.c.). Harold

Uploaded by

Scribd Government DocsCopyright:

Available Formats

390 F.

2d 619

Harold A. SERR, Director Alcohol and Tobacco Tax Division

Internal Revenue Service, Appellant,

v.

Juleus J. SULLIVAN, Jr., Hiram Walker Incorporated,

(Respondent-Intervenor in D.C.).

Harold A. SERR, Director Alcohol and Tobacco Tax Division

Internal Revenue Service, Appellant,

v.

Francis DEIMEYER, Hiram Walker Incorporated,

(Respondent-Intervenor in D.C.).

Harold A. SERR, Director Alcohol and Tobacco Tax Division

Internal Revenue Service, Appellant,

v.

James F. CURRAN, Hiram Walker Incorporated,

(Respondent-Intervenor in D.C.).

Harold A. SERR, Director Alcohol and Tobacco Tax Division

Internal Revenue Service, Appellant,

v.

Joseph LETIZIA, Hiram Walker Incorporated,

(Respondent-Intervenor in D.C.).

Harold A. SERR, Director Alcohol and Tobacco Tax Division

Internal Revenue Service, Appellant,

v.

James J. WHEATLEY, Jr., Hiram Walker Incorporated,

(Respondent-Intervenor in D.C.).

Harold A. SERR, Director Alcohol and Tobacco Tax Division

Internal Revenue Service, Appellant,

v.

Nicholas DeWILDE, Hiram Walker Incorporated,

(Respondent-Intervenor in D.C.).

Harold A. SERR, Director Alcohol and Tobacco Tax Division

Internal Revenue Service, Appellant,

v.

Gustav MORTENSEN, Hiram Walker Incorporated,

(Respondent-Intervenor in D.C.).

Nos. 16908-16914.

United States Court of Appeals Third Circuit.

Argued Feb. 20, 1968.

Decided March 1, 1968.

Philip Wilens, Head, Statutory Enforcement Unit, Criminal Division,

Dept. of Justice, Washington, D.C., Drew J. T. O'Keefe, U.S. Atty.,

Philadelphia, Pa., for appellant. Charles Ruff, Robert Gary, Attys., Dept.

of Justice, John W. Coggins, Director, Alcohol and Tobacco Tax Legal

Division, Office of Chief Counsel, Internal Revenue Service, Washington,

D.C., of counsel.

James H. McGlothlin, Washington, D.C.

Pepper, Hamilton & Scheetz, Philadelphia, Pa., Richard A. Brady,

William A. Dobrovir, Covington & Burling, Washington, D.C., Philip H.

Strubing, Philadelphia, Pa., for appellee Hiram Walker Incorporated.

H. Francis DeLone, Richard G. Schneider, Philadelphia, Pa., for appelleewitnesses: Sullivan, Deimeyer, Curran, Letizia, Wheatley, DeWilde.

Russell E. Ellis, Norristown, Pa., for Appellee-witness: Mortensen.

Before KALODNER, FREEDMAN and VAN DUSEN, Circuit Judges.

OPINION OF THE COURT

PER CURIAM.

Is the Director of the Alcohol and Tobacco Tax Division, Internal Revenue

Service, empowered by the Federal Alcohol Administration Act, 27 U.S.C.A.

201 et seq., to conduct a special investigation the power to compel witnesses to

appear the power to compel witnesses to appear and testify?

The District Court answered the question in the negative in the instant case in

denying the Director's petitions for enforcement of his subpoenas duces tecum

directed to the appellees in the course of his investigation of the Division's

permittee, Hiram Walker Incorporated.

3

We are of the view that the District Court did not err in holding that the Federal

Alcohol Administration Act did not in 2(g), or any other section, expressly or

impliedly empower the Director of the Alcohol and Tobacco Division to

conduct special investigation of the Division's permittees and to issue

subpoenas duces tecum pursuant thereto.

The District Court's Order denying the petitions to enforce the Director's

subpoenas will be affirmed for the reasons so well stated in Judge John W.

Lord's excellent opinion reported at 270 F.Supp. 544 (E.D.Pa.1967).

You might also like

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Coyle v. Jackson, 10th Cir. (2017)Document7 pagesCoyle v. Jackson, 10th Cir. (2017)Scribd Government Docs100% (1)

- Consolidation Coal Company v. OWCP, 10th Cir. (2017)Document22 pagesConsolidation Coal Company v. OWCP, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- Payn v. Kelley, 10th Cir. (2017)Document8 pagesPayn v. Kelley, 10th Cir. (2017)Scribd Government Docs50% (2)

- United States v. Garcia-Damian, 10th Cir. (2017)Document9 pagesUnited States v. Garcia-Damian, 10th Cir. (2017)Scribd Government Docs100% (1)

- United States v. Kieffer, 10th Cir. (2017)Document20 pagesUnited States v. Kieffer, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- United States v. Olden, 10th Cir. (2017)Document4 pagesUnited States v. Olden, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- Greene v. Tennessee Board, 10th Cir. (2017)Document2 pagesGreene v. Tennessee Board, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- Brown v. Shoe, 10th Cir. (2017)Document6 pagesBrown v. Shoe, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- Wilson v. Dowling, 10th Cir. (2017)Document5 pagesWilson v. Dowling, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- City of Albuquerque v. Soto Enterprises, 10th Cir. (2017)Document21 pagesCity of Albuquerque v. Soto Enterprises, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- Harte v. Board Comm'rs Cnty of Johnson, 10th Cir. (2017)Document100 pagesHarte v. Board Comm'rs Cnty of Johnson, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- United States v. Kearn, 10th Cir. (2017)Document25 pagesUnited States v. Kearn, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- Publish United States Court of Appeals For The Tenth CircuitDocument10 pagesPublish United States Court of Appeals For The Tenth CircuitScribd Government DocsNo ratings yet

- Publish United States Court of Appeals For The Tenth CircuitDocument24 pagesPublish United States Court of Appeals For The Tenth CircuitScribd Government DocsNo ratings yet

- Publish United States Court of Appeals For The Tenth CircuitDocument14 pagesPublish United States Court of Appeals For The Tenth CircuitScribd Government Docs100% (1)

- Pecha v. Lake, 10th Cir. (2017)Document25 pagesPecha v. Lake, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- Apodaca v. Raemisch, 10th Cir. (2017)Document15 pagesApodaca v. Raemisch, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- United States v. Voog, 10th Cir. (2017)Document5 pagesUnited States v. Voog, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- United States v. Roberson, 10th Cir. (2017)Document50 pagesUnited States v. Roberson, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- Northglenn Gunther Toody's v. HQ8-10410-10450, 10th Cir. (2017)Document10 pagesNorthglenn Gunther Toody's v. HQ8-10410-10450, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- United States v. Windom, 10th Cir. (2017)Document25 pagesUnited States v. Windom, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- Webb v. Allbaugh, 10th Cir. (2017)Document18 pagesWebb v. Allbaugh, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- NM Off-Hwy Vehicle Alliance v. U.S. Forest Service, 10th Cir. (2017)Document9 pagesNM Off-Hwy Vehicle Alliance v. U.S. Forest Service, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- United States v. Muhtorov, 10th Cir. (2017)Document15 pagesUnited States v. Muhtorov, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- United States v. Magnan, 10th Cir. (2017)Document27 pagesUnited States v. Magnan, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- United States v. Henderson, 10th Cir. (2017)Document2 pagesUnited States v. Henderson, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- Pledger v. Russell, 10th Cir. (2017)Document5 pagesPledger v. Russell, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- Publish United States Court of Appeals For The Tenth CircuitDocument17 pagesPublish United States Court of Appeals For The Tenth CircuitScribd Government DocsNo ratings yet

- United States v. Magnan, 10th Cir. (2017)Document4 pagesUnited States v. Magnan, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- United States v. Kundo, 10th Cir. (2017)Document7 pagesUnited States v. Kundo, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- AITAS 8th Doctor SourcebookDocument192 pagesAITAS 8th Doctor SourcebookClaudio Caceres100% (13)

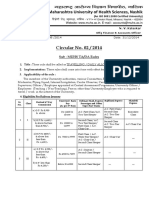

- Circular No 02 2014 TA DA 010115 PDFDocument10 pagesCircular No 02 2014 TA DA 010115 PDFsachin sonawane100% (1)

- Ikramul (Electrical)Document3 pagesIkramul (Electrical)Ikramu HaqueNo ratings yet

- Introduction To Emerging TechnologiesDocument145 pagesIntroduction To Emerging TechnologiesKirubel KefyalewNo ratings yet

- Aqualab ClinicDocument12 pagesAqualab ClinichonyarnamiqNo ratings yet

- Game Theory Presentation: Big BrotherDocument11 pagesGame Theory Presentation: Big BrotherNitinNo ratings yet

- TrematodesDocument95 pagesTrematodesFarlogy100% (3)

- You Are The Reason PDFDocument1 pageYou Are The Reason PDFLachlan CourtNo ratings yet

- Answer Key For 1st QaurterDocument5 pagesAnswer Key For 1st QaurterSteffi89% (9)

- UXBenchmarking 101Document42 pagesUXBenchmarking 101Rodrigo BucketbranchNo ratings yet

- Iii. The Impact of Information Technology: Successful Communication - Key Points To RememberDocument7 pagesIii. The Impact of Information Technology: Successful Communication - Key Points To Remembermariami bubuNo ratings yet

- Amt 3103 - Prelim - Module 1Document17 pagesAmt 3103 - Prelim - Module 1kim shinNo ratings yet

- The Skylane Pilot's CompanionDocument221 pagesThe Skylane Pilot's CompanionItayefrat100% (6)

- BSBHRM405 Support Recruitment, Selection and Induction of Staff KM2Document17 pagesBSBHRM405 Support Recruitment, Selection and Induction of Staff KM2cplerkNo ratings yet

- Lesson 17 Be MoneySmart Module 1 Student WorkbookDocument14 pagesLesson 17 Be MoneySmart Module 1 Student WorkbookAry “Icky”100% (1)

- Annual Report Aneka Tambang Antam 2015Document670 pagesAnnual Report Aneka Tambang Antam 2015Yustiar GunawanNo ratings yet

- Weird Tales v14 n03 1929Document148 pagesWeird Tales v14 n03 1929HenryOlivr50% (2)

- The Nature of Mathematics: "Nature's Great Books Is Written in Mathematics" Galileo GalileiDocument9 pagesThe Nature of Mathematics: "Nature's Great Books Is Written in Mathematics" Galileo GalileiLei-Angelika TungpalanNo ratings yet

- Phylogenetic Tree: GlossaryDocument7 pagesPhylogenetic Tree: GlossarySab ka bada FanNo ratings yet

- Parts Catalog: TJ053E-AS50Document14 pagesParts Catalog: TJ053E-AS50Andre FilipeNo ratings yet

- Linkedin Job Invite MessageDocument4 pagesLinkedin Job Invite MessageAxiom IntNo ratings yet

- Food Combining PDFDocument16 pagesFood Combining PDFJudas FK TadeoNo ratings yet

- Human Development IndexDocument17 pagesHuman Development IndexriyaNo ratings yet

- MELC5 - First ObservationDocument4 pagesMELC5 - First ObservationMayca Solomon GatdulaNo ratings yet

- Panlilio vs. Regional Trial Court, Branch 51, City of ManilaDocument10 pagesPanlilio vs. Regional Trial Court, Branch 51, City of ManilaMaria Nicole VaneeteeNo ratings yet

- 978-1119504306 Financial Accounting - 4thDocument4 pages978-1119504306 Financial Accounting - 4thtaupaypayNo ratings yet

- Basics of An Model United Competition, Aippm, All India Political Parties' Meet, Mun Hrishkesh JaiswalDocument7 pagesBasics of An Model United Competition, Aippm, All India Political Parties' Meet, Mun Hrishkesh JaiswalHRISHIKESH PRAKASH JAISWAL100% (1)

- FCAPSDocument5 pagesFCAPSPablo ParreñoNo ratings yet

- ACSRDocument3 pagesACSRWeber HahnNo ratings yet

- Repair and Field Service BrochureDocument4 pagesRepair and Field Service Brochurecorsini999No ratings yet