Professional Documents

Culture Documents

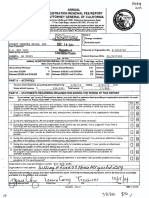

Caa RRF 2004

Uploaded by

L. A. PatersonOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Caa RRF 2004

Uploaded by

L. A. PatersonCopyright:

Available Formats

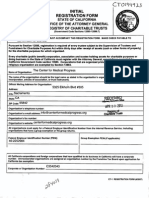

CSZ

REGISTRATION/RENEWAL FEE REPORT

IN

MAIL TO:

Registiy of Charitable Trusts

P.O. Box 903447

Sacramento, CA 94203-4470

Telephone: (916) 445-2021

TO ATTORNEY GENERAL OF CALIFORNIA

Sections 12586 and 12587, California Government Code

11 CCR Sections 311 and 312

Failure to submit this report annually no later than four months and fifteen days after the

end of the organization's accounting period may result in the loss of tax exemption and

the assessment of a minimum tax of >800, plus interest, and/or fines or filing penalties

as defined in Government Code Section 12586.1.

WEBSITE ADDRESS:

http://ag.ca:gov/charities/

IRS FORM 930 EXTENSIONS WILL BE HONORED. PLEASE SUBMIT WITH RRF-1 ALL

IRS EXTENSION REQUESTS AND, WHERE APPLICABLE. IRS EXTENSION APPROVALS.

Check if:

State Charity Registration Number

005666

CARMEL ART ASSOCIATION-

" '

Change of address

Amended report

Name of Organization

PO BOX 2271

^

"T-'^

oV"

..

Corporate or Organization No.

D-0157265

Address (Number and Street)

CARMEL, CA-93921 - City or Town

.. .

'

' '

State-

ZIP Code

Federal Employer ID No.

:

' .

94-1012517

'

' "" " *

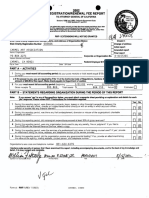

PART A - ACTIVITIES

1

During your most recent full accountina period did your aross receipts or total assets equal $100,000 or more?

Note:

No

|xl

If the answer is yes, you are required by Title 11 of the California Code of Regulations, Sections 311 and 312, to attach a check in

the amount of $25.00 to this report. Make check payable to Department of Justice.

1/01/04

2 'For your most recent full accounting period (beginning

i

Yes

Gross receipts $

r-

940, 63.7.

. . Total assets

12/31/04

1,001, 1 0 6 .

ending

) list:

PART B - STATEMENTS REGARDING ORGANIZATION DURING THE PERIOD OF THIS REPORT

Note:

If you answer 'yes' to any of the questions below, you must attach a separate sheet providing an explanation and details for each

'yes' response. Please review RRF-I instructions for information required.

Yes

During this reporting period, were there any contracts, loans, leases or other.financial transactions between the

organization and any officer, director or trustee thereof either directly or with an entity in which any such officer,

director or trustee had any financial interest?

During this reporting period, was there any theft, embezzlement, diversion or misuse of the organization's charitable

property or funds?

Durina this reporting period, did non-program expenditures exceed 50% of gross revenues?

During this reporting period, were any organization funds used to pay any penalty, fine or judgment? If you filed a

Form 4720 with the Internal Revenue Service, attach a copy.

During this reporting period, were the services of a professional fundraiser or fundraising counsel used? If 'yes,' provide

an attachment listing the name, address, and telephone number of the service provider.

During this reporting period, did the organization receive any governmental funding? If so, provide an attachment listing

the name of tne agency, mailing address, contact person, and telephone number.

During this reporting period, did the organization hold a raffle for charitable purposes? If 'yes,' provide an attachment

indicating the number of raffles and the date(s) they occurred.

Does the organization conduct a vehicle donation program? If 'yes,' provide an attachment indicating whether the program is

operated by the charity or whether the organization contracts with a commercial fundraiser.

Organization's area code and telephone number

(831)

No

n [Xl

n |x|

n (Xl

n m

n |xl

n m

n fxl

n [xl

624-6176

Organization's e-mail address

I declare under penalty oLffeijury that I have examined this report, including accompanying documents, and to the best of my knowledge

and belietfit is true, cZrrect and'complete.

Printed

ed Name

CAVA9801L

01/18/05

Title

"

DECEIVED

MAY 1 7 2005

Attorney General's

You might also like

- General Post OfficeDocument12 pagesGeneral Post Office11223300616598% (46)

- Dispute To Creditor For Charge OffDocument4 pagesDispute To Creditor For Charge Offrodney75% (20)

- FCI Employees in Alabama and ArkansasDocument62 pagesFCI Employees in Alabama and ArkansasPaul Cortez BlancarteNo ratings yet

- Center For Medical Progress California RegistrationDocument10 pagesCenter For Medical Progress California RegistrationelicliftonNo ratings yet

- Oakland Community Land Trust - Founding Documents 1999Document75 pagesOakland Community Land Trust - Founding Documents 1999auweia1No ratings yet

- IRS Complaint Against NH District Corporation 11-18-19Document26 pagesIRS Complaint Against NH District Corporation 11-18-19Roberto RoldanNo ratings yet

- ATO Rollover FormDocument3 pagesATO Rollover FormKowsik AhmedNo ratings yet

- 10000005335Document166 pages10000005335Chapter 11 Dockets50% (2)

- USA Directory Idc1-023759Document153 pagesUSA Directory Idc1-023759sonukarma321No ratings yet

- Engagement letter for business bookkeeping and tax preparationDocument2 pagesEngagement letter for business bookkeeping and tax preparationPinky Daisies100% (1)

- Discover QatarDocument41 pagesDiscover Qatarheru2910No ratings yet

- PA Notary Application and InstructionsDocument2 pagesPA Notary Application and InstructionsThe Pennsylvania NotaryNo ratings yet

- Data Collection ListDocument32 pagesData Collection ListAmjad ShareefNo ratings yet

- Caa RRF 2001Document2 pagesCaa RRF 2001L. A. PatersonNo ratings yet

- FTG RRF 2001Document2 pagesFTG RRF 2001L. A. PatersonNo ratings yet

- FTG RRF 2012Document1 pageFTG RRF 2012L. A. PatersonNo ratings yet

- Pac Rep RRF 2002Document2 pagesPac Rep RRF 2002L. A. PatersonNo ratings yet

- Istration/Renewal Fee Retort: JEL EL JEL JEL JEL JEL JEL JELDocument1 pageIstration/Renewal Fee Retort: JEL EL JEL JEL JEL JEL JEL JELL. A. PatersonNo ratings yet

- C SBTT (: Annual Registration Renewal Fee Report To Attorney General of CaliforniaDocument1 pageC SBTT (: Annual Registration Renewal Fee Report To Attorney General of CaliforniaL. A. PatersonNo ratings yet

- FTG RRF 2003Document2 pagesFTG RRF 2003L. A. PatersonNo ratings yet

- Pac Rep RRF 2003Document2 pagesPac Rep RRF 2003L. A. PatersonNo ratings yet

- Pac Rep RRF 2005Document2 pagesPac Rep RRF 2005L. A. PatersonNo ratings yet

- Caa RRF 2010Document1 pageCaa RRF 2010L. A. PatersonNo ratings yet

- FTG RRF 2009Document1 pageFTG RRF 2009L. A. PatersonNo ratings yet

- FTG RRF 2002Document2 pagesFTG RRF 2002L. A. PatersonNo ratings yet

- Pacrep RRF 2014Document1 pagePacrep RRF 2014L. A. PatersonNo ratings yet

- Caa RRF 2012Document1 pageCaa RRF 2012L. A. PatersonNo ratings yet

- FTG RRF 2004Document2 pagesFTG RRF 2004L. A. PatersonNo ratings yet

- FTG RRF 2005Document2 pagesFTG RRF 2005L. A. PatersonNo ratings yet

- SCC RRF 2010Document2 pagesSCC RRF 2010L. A. PatersonNo ratings yet

- FTG RRF 2007Document1 pageFTG RRF 2007L. A. PatersonNo ratings yet

- Carmel Art Association PO BOX 2271 CARMEL, CA 93 921: Registration/Renewal Fee ReportDocument1 pageCarmel Art Association PO BOX 2271 CARMEL, CA 93 921: Registration/Renewal Fee ReportL. A. PatersonNo ratings yet

- SCC RRF 2005Document3 pagesSCC RRF 2005L. A. PatersonNo ratings yet

- SCC RRF 2011Document2 pagesSCC RRF 2011L. A. PatersonNo ratings yet

- FTG RRF 2006Document1 pageFTG RRF 2006L. A. PatersonNo ratings yet

- SCC RRF 2004Document3 pagesSCC RRF 2004L. A. PatersonNo ratings yet

- Pac Rep RRF 2007Document1 pagePac Rep RRF 2007L. A. PatersonNo ratings yet

- Pac Rep RRF 2009Document2 pagesPac Rep RRF 2009L. A. PatersonNo ratings yet

- CA Charity Annual Report FormDocument1 pageCA Charity Annual Report FormagbufzbfNo ratings yet

- FTG RRF 2013Document1 pageFTG RRF 2013L. A. PatersonNo ratings yet

- Pac Rep RRF 2006Document1 pagePac Rep RRF 2006L. A. PatersonNo ratings yet

- Fomtnp RRF 2013Document2 pagesFomtnp RRF 2013L. A. PatersonNo ratings yet

- SCC RRF 2009Document2 pagesSCC RRF 2009L. A. PatersonNo ratings yet

- Caa RRF 2014Document1 pageCaa RRF 2014L. A. PatersonNo ratings yet

- Fomtnp RRF 2015Document2 pagesFomtnp RRF 2015L. A. PatersonNo ratings yet

- FTG RRF 2000Document1 pageFTG RRF 2000L. A. PatersonNo ratings yet

- 2014 2015 Annual Registration Renewal Form RRF 1Document2 pages2014 2015 Annual Registration Renewal Form RRF 1Nyi Lwin HtetNo ratings yet

- Pac Rep RRF 2004Document4 pagesPac Rep RRF 2004L. A. PatersonNo ratings yet

- Breast Cancer Survivors FoundationDocument48 pagesBreast Cancer Survivors FoundationthereadingshelfNo ratings yet

- CWCS Founding DocumentsDocument98 pagesCWCS Founding DocumentsWilliamsburg GreenpointNo ratings yet

- Clinton Foundation Revised Filing 2013Document108 pagesClinton Foundation Revised Filing 2013Daily Caller News FoundationNo ratings yet

- CWCS AG RegistrationDocument2 pagesCWCS AG RegistrationWilliamsburg GreenpointNo ratings yet

- Request For Copy of Personal Income or Fiduciary Tax ReturnDocument2 pagesRequest For Copy of Personal Income or Fiduciary Tax ReturnAsjsjsjsNo ratings yet

- Ir524 PDFDocument2 pagesIr524 PDFTiffany Morris0% (1)

- Pa Rev-72Document12 pagesPa Rev-72Nick Rosati0% (1)

- Ag990 AnnualreportDocument2 pagesAg990 AnnualreportDaniel_Johnson_1322No ratings yet

- FYI 406 Your Rights Under The Tax LawDocument2 pagesFYI 406 Your Rights Under The Tax LawFuji guruNo ratings yet

- ST Ending:: CincinnatiDocument3 pagesST Ending:: CincinnatiMassiNo ratings yet

- NHCT 2a ReportDocument11 pagesNHCT 2a Reportapi-364422685No ratings yet

- Engagement Letter For Business Bookkeeping and TaxDocument2 pagesEngagement Letter For Business Bookkeeping and TaxLois Yanzeigh Habbiling BalachaweNo ratings yet

- Request For Transcript of Tax ReturnDocument2 pagesRequest For Transcript of Tax Returnapi-268415505No ratings yet

- BUSLIC Business Licence FormDocument10 pagesBUSLIC Business Licence Formcrew242No ratings yet

- IRS e-file Acknowledgement for Tax Year 2016Document2 pagesIRS e-file Acknowledgement for Tax Year 2016anandrapakaNo ratings yet

- Reporting Requirements For Charities and Not For Profit OrganizationsDocument15 pagesReporting Requirements For Charities and Not For Profit OrganizationsRay Brooks100% (1)

- 2013 Partnership Eng Letter WebsiteDocument6 pages2013 Partnership Eng Letter WebsiteClarisse30No ratings yet

- Councilmember Announcements 12-03-18Document1 pageCouncilmember Announcements 12-03-18L. A. PatersonNo ratings yet

- City of Carmel-By-The-Sea City Council AgendaDocument2 pagesCity of Carmel-By-The-Sea City Council AgendaL. A. PatersonNo ratings yet

- City of Carmel-By-The-Sea City Council AgendaDocument2 pagesCity of Carmel-By-The-Sea City Council AgendaL. A. PatersonNo ratings yet

- Agenda City Council Special Meeting 12-03-18Document3 pagesAgenda City Council Special Meeting 12-03-18L. A. PatersonNo ratings yet

- MPRWA Agenda Packet 11-08-18Document18 pagesMPRWA Agenda Packet 11-08-18L. A. PatersonNo ratings yet

- Appointments FORA 12-03-18Document2 pagesAppointments FORA 12-03-18L. A. PatersonNo ratings yet

- City of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved byDocument2 pagesCity of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved byL. A. PatersonNo ratings yet

- City of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved byDocument5 pagesCity of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved byL. A. PatersonNo ratings yet

- Adopting City Council Meeting Dates For 2019 12-03-18Document3 pagesAdopting City Council Meeting Dates For 2019 12-03-18L. A. PatersonNo ratings yet

- Minutes 12-03-18Document7 pagesMinutes 12-03-18L. A. PatersonNo ratings yet

- City of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved byDocument2 pagesCity of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved byL. A. PatersonNo ratings yet

- Mprwa Minutes October 25, 2018Document2 pagesMprwa Minutes October 25, 2018L. A. PatersonNo ratings yet

- Appointments Monterey-Salinas Transit Board 12-03-18Document2 pagesAppointments Monterey-Salinas Transit Board 12-03-18L. A. PatersonNo ratings yet

- Holiday Closure 12-03-18Document3 pagesHoliday Closure 12-03-18L. A. PatersonNo ratings yet

- Minutes City Council Special Meeting November 5, 2018 12-03-18Document1 pageMinutes City Council Special Meeting November 5, 2018 12-03-18L. A. PatersonNo ratings yet

- Minutes City Council Regular Meeting November 6, 2018 12-03-18Document5 pagesMinutes City Council Regular Meeting November 6, 2018 12-03-18L. A. PatersonNo ratings yet

- City of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved By: SubjectDocument2 pagesCity of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved By: SubjectL. A. PatersonNo ratings yet

- City of Carmel-By-The-Sea City Council AgendaDocument5 pagesCity of Carmel-By-The-Sea City Council AgendaL. A. PatersonNo ratings yet

- City of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved byDocument5 pagesCity of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved byL. A. PatersonNo ratings yet

- City of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved byDocument3 pagesCity of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved byL. A. PatersonNo ratings yet

- Agenda City Council 03-21-18Document2 pagesAgenda City Council 03-21-18L. A. PatersonNo ratings yet

- Mprwa Minutes April 26, 2016Document2 pagesMprwa Minutes April 26, 2016L. A. PatersonNo ratings yet

- Proclamation Celebrating AMBAG' Fiftieth Anniversary 11-06-18Document2 pagesProclamation Celebrating AMBAG' Fiftieth Anniversary 11-06-18L. A. PatersonNo ratings yet

- City of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved byDocument4 pagesCity of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved byL. A. PatersonNo ratings yet

- Monthly Reports September 2018 11-05-18Document55 pagesMonthly Reports September 2018 11-05-18L. A. PatersonNo ratings yet

- Agenda City Council 03-21-18Document2 pagesAgenda City Council 03-21-18L. A. PatersonNo ratings yet

- City of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved By: SubjectDocument8 pagesCity of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved By: SubjectL. A. PatersonNo ratings yet

- Destruction of Certain Records 11-05-18Document41 pagesDestruction of Certain Records 11-05-18L. A. PatersonNo ratings yet

- City of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved byDocument4 pagesCity of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved byL. A. PatersonNo ratings yet

- City of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved By: SubjectDocument4 pagesCity of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved By: SubjectL. A. PatersonNo ratings yet

- 10000002226Document67 pages10000002226Chapter 11 DocketsNo ratings yet

- Certificate of Eligibility CaliforniaDocument3 pagesCertificate of Eligibility CaliforniaJojo Aboyme CorcillesNo ratings yet

- Import / Export Permit Application Form: or FAX To: 9637 8475Document2 pagesImport / Export Permit Application Form: or FAX To: 9637 8475buddyhello1No ratings yet

- Cargo Manifest AnnabaDocument8 pagesCargo Manifest AnnabaMohamed ChelfatNo ratings yet

- FBC - Outgoing Exchange FormDocument1 pageFBC - Outgoing Exchange FormScott Dauenhauer, CFP, MSFP, AIFNo ratings yet

- Peace Corps Tanzania Welcome Book - July 2008Document107 pagesPeace Corps Tanzania Welcome Book - July 2008Accessible Journal Media: Peace Corps Documents100% (1)

- Redemption FormDocument2 pagesRedemption FormMaskered SantanderNo ratings yet

- Form 176 MDB Ecfmg2Document10 pagesForm 176 MDB Ecfmg2Swati TyagiNo ratings yet

- Construction Orange BookDocument17 pagesConstruction Orange Bookastra0007No ratings yet

- January 2011Document64 pagesJanuary 2011sake1978No ratings yet

- Application FormDocument2 pagesApplication FormbernardleloNo ratings yet

- Global Process Systems InvoiceDocument16 pagesGlobal Process Systems InvoiceValiNo ratings yet

- Pollard-Ravenscroft Chevrolet Dealer in Van NuysDocument7 pagesPollard-Ravenscroft Chevrolet Dealer in Van NuysSFValleyblogNo ratings yet

- Australia Post Address Presentation StandardDocument40 pagesAustralia Post Address Presentation StandardparasiticideNo ratings yet

- QI Macros Quick Start Card PDFDocument2 pagesQI Macros Quick Start Card PDFthuronNo ratings yet

- Republican State Leadership Cmte: July ActivityDocument39 pagesRepublican State Leadership Cmte: July ActivitySally Jo SorensenNo ratings yet

- Michelle Burgess OhioDocument27 pagesMichelle Burgess Ohiorob pennNo ratings yet

- CA Statement of Information - Corp Form LLC-12Document2 pagesCA Statement of Information - Corp Form LLC-12nextcaseNo ratings yet

- List of Plants Approved To Handle Immediate Slaughter AnimalsDocument24 pagesList of Plants Approved To Handle Immediate Slaughter AnimalsLotushomecookingNo ratings yet

- Codeco D95BDocument45 pagesCodeco D95BOscar Enrique Urdaneta SaezNo ratings yet

- Berkley Fireline RebateDocument2 pagesBerkley Fireline RebateKristin LerdahlNo ratings yet

- Curriculum Order FormDocument2 pagesCurriculum Order FormElizabeth BennettNo ratings yet

- Corp Npdiss PDFDocument10 pagesCorp Npdiss PDFSpiritually GiftedNo ratings yet

- Trump Legal Expense Fund DisclosuresDocument6 pagesTrump Legal Expense Fund DisclosuresLachlan MarkayNo ratings yet