Professional Documents

Culture Documents

Does FBT Apply?: Div 13 Exclusions

Uploaded by

oddsey0713Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Does FBT Apply?: Div 13 Exclusions

Uploaded by

oddsey0713Copyright:

Available Formats

1.

9 FBT

Does FBT apply?

Exclusions

1) Specific s136(1) salary,ETP,deemed div, compo for personal injury of capital

nature, employee share schemes, employer superfund contributions

2) Specific Div 13

3) Div 14 reductions s62 allows $500 reduction for all in-house benefits and airline

FB; s63A allows taxable value for entertainment FB where not provided to employee

Div 13 exclusions

> Section 58A employment interviews and selection tests

> Section 58B relocation: removals and storage of household effects

> Section 58C incidental costs on sale or acquisition of a dwelling

> Section 58D relocation: connection or reconnection of certain utilities

> Section 58E leasing of household goods while living away from home

> Section 58F relocation transport

> Section 58H newspapers and periodicals used for business purposes

> Section 58J compensable work-related trauma

> Section 58K in-house health care

> Section 58M work-related medical exp, counselling, migrant training

> Section 58P minor benefits < A$100

> Section 58X provision of certain work-related items:

mobile or car phone (s58X(2) exemption if primarily for business use s58X(3))

notebook or laptop computer (exemption s58X(2) and only for the first laptop

provided in the FBT year s58X(4))

protective clothing required by employer

briefcase

calculator

tools of trade

computer software for business use

electronic diary

personal digital assistants and portable printers for laptops

> Section 58Y membership and subscription fees for:

trade or professional journals

entitlement to use a corporate credit card

entitlement to use an airport lounge membership

> Section 58Z taxi travel between home and work is exempt from FBT (if taken

in a single trip that begins or ends at work)

Car FBT

Car is held available for private use

Not exempt:

1) Taxi, panel van, utility truck (<1tonne) with

private use limited to a) employee work-related

travel, b) minor, infrequent and irregular use

2) Unregistered car principally for business

Statutory formula vs

Operating Cost

*if car is >4yrs old at beginning

of FBT, take 2/3 of the value

Debt Waiver s15

TV = amt of pmt or

re-pmt waived

LAFHA s30

TV=total amt

reasonable compo for

accomo reasonable

compo for increased

food expenditure s31

Select method

yielding lower

FBT s10(5)

FBT interaction with income tax & GST

Loan FB s16 (7.3%)

TV = Interest accrued +

diff btwn stat interest

*subject to s19 otherwise

deductible rule (only for

once off deduction)

Meal entertainment Div 9A

If NO election

per head basis where

employee proportion is FBT s32-30

1) 50/50 method s37BA, 2) 12

Election

week register method (valid for nxt 4 yrs, unless

actual expense is 20% higher than register yr

*same method applied to income tax

Other info

- Salary packaging

effective

when providing exempt FB

-s23L excludes fringe benefits

from ITAA, and s26(e) has the

same effect.

- FBT deductible under s8-1

*Otherwise deductible rule

DOES NOT apply to associates

Gross-up

Type I

2.0647

Type II

1.8692

Expense payment FB s20

1) Employee pays first & gets reimbursement

-s51AH denies deduction to employees for

reimbursed amts

2) Employer pays 3rd party directly

TV = FV (generally, depends on inhouse v

external)

- subject to s24 otherwise deductible rule

(only for once off deduction)

Entertainment facility leasing s152B

TV=50% total expenses

-incl corporate box, boats, planes, other

premises

-does NOT incl food and drink, advertising

Residual FB s45

TV determined by table below if in-house

FB, external is arms length cost (s50-51)

- In-house subject to $500 reduction (s62)

- reduced by recipients contribution; s52

otherwise deductible rule (only for once

off deduction)

Reportable fringe benefits

-if FB >$1000 for an employee,

grossed up at 1.8692

- incl in payment summary, not

taxed, but used to determine

entitlements such as family

allowance, surcharges etc

Property FB s40

Employer provides property free or discount, s136 def incl

tangible & intangible goods, real property, choses in action

(shares, bonds etc)

TV determined by table below if in-house FB, external is arms

length cost (s43)

- In-house subject to $500 reduction (s62)

- TV reduced by recipients contribution;

-s44 otherwise deductible rule (only for once off deduction)

-exemption applies to property provided on working days at

employers premises s41

Manufacturer

Retailer

Ken Choi 2007

You might also like

- Restrictions on franking creditsDocument1 pageRestrictions on franking creditsoddsey0713No ratings yet

- 2-3 Capital AllowancesDocument1 page2-3 Capital Allowancesoddsey0713No ratings yet

- 1-8 GST - GST Payable or ITC AvalDocument2 pages1-8 GST - GST Payable or ITC Avaloddsey0713No ratings yet

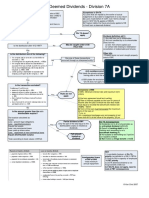

- 3-3 Div 7A Deemed Divs - VLDocument1 page3-3 Div 7A Deemed Divs - VLoddsey0713No ratings yet

- 4-3 Part IVA General AntiAvoidanceDocument1 page4-3 Part IVA General AntiAvoidanceoddsey0713No ratings yet

- ADJUSTMENTS AT FINANCIAL PERIOD ENDDocument18 pagesADJUSTMENTS AT FINANCIAL PERIOD ENDTevabless Suoived SpotlightbabeNo ratings yet

- Module 2Document12 pagesModule 2zoyaNo ratings yet

- TAX ADMINISTRATION GUIDEDocument4 pagesTAX ADMINISTRATION GUIDEwumel01No ratings yet

- GST On Property Transactions - 99 Page Research ReportDocument99 pagesGST On Property Transactions - 99 Page Research ReporttestnationNo ratings yet

- Capital Budgeting Decision - SBSDocument43 pagesCapital Budgeting Decision - SBSSahil SherasiyaNo ratings yet

- Tax Book 2016-17 - Version 1.0a USB PDFDocument372 pagesTax Book 2016-17 - Version 1.0a USB PDFemc2_mcv100% (1)

- Understanding Income TaxDocument43 pagesUnderstanding Income TaxMerediths KrisKringleNo ratings yet

- Income Taxes (IAS 12)Document15 pagesIncome Taxes (IAS 12)Mahir RahmanNo ratings yet

- Code of Ethics Part C Professional Accountants in Business 1 Jan 2011Document11 pagesCode of Ethics Part C Professional Accountants in Business 1 Jan 2011James De Torres CarilloNo ratings yet

- Smieliauskas 6e - Solutions Manual - Chapter 02Document14 pagesSmieliauskas 6e - Solutions Manual - Chapter 02scribdteaNo ratings yet

- Balance Sheet: For Year Ending June 30, 2008Document3 pagesBalance Sheet: For Year Ending June 30, 2008arazeqNo ratings yet

- CMA Handbook: Your Guide To Information and Requirements For CMA CertificationDocument13 pagesCMA Handbook: Your Guide To Information and Requirements For CMA CertificationBupe ChaliNo ratings yet

- CPA TestDocument22 pagesCPA Testdani13_335942No ratings yet

- TABL2751 2016-2 Tutorial Program FinalDocument25 pagesTABL2751 2016-2 Tutorial Program FinalAnna ChenNo ratings yet

- LifeInsRetirementValuation M15 AppraisalValues 181205Document46 pagesLifeInsRetirementValuation M15 AppraisalValues 181205Jeff JonesNo ratings yet

- VIVA Answers (Mock-2)Document12 pagesVIVA Answers (Mock-2)isuri abeykoon100% (1)

- When To Hire A Tax ProfessionalDocument7 pagesWhen To Hire A Tax ProfessionalMaimai Durano100% (1)

- SwotDocument3 pagesSwotShahebazNo ratings yet

- Start Your BusinessDocument8 pagesStart Your BusinessIqbal MOUSSANo ratings yet

- Cma Final Law Hand Written Notes - 1608742860Document2 pagesCma Final Law Hand Written Notes - 1608742860Dharshini AravamudhanNo ratings yet

- Ipcc Tax Practice Manual PDFDocument651 pagesIpcc Tax Practice Manual PDFshakshi gupta100% (1)

- Accounting Dissertations - IfRSDocument30 pagesAccounting Dissertations - IfRSgappu002No ratings yet

- Benifit Pension ObligationDocument20 pagesBenifit Pension ObligationTouseefNo ratings yet

- Assignment 2: Tracy Van Rensburg STUDENT NUMBER 59548525Document8 pagesAssignment 2: Tracy Van Rensburg STUDENT NUMBER 59548525Chris NdlovuNo ratings yet

- Taxation (Bs211)Document348 pagesTaxation (Bs211)RewardMaturureNo ratings yet

- 51 List of CA Final Law SectionsDocument35 pages51 List of CA Final Law SectionsAishwarya TiwariNo ratings yet

- 401K PlannerDocument3 pages401K Plannertf2025No ratings yet

- Fin701 Module3Document22 pagesFin701 Module3Krista CataldoNo ratings yet

- AUD Notes Chapter 2Document20 pagesAUD Notes Chapter 2janell184100% (1)

- SMA QuizDocument76 pagesSMA QuizQuỳnh ChâuNo ratings yet

- MBA104 - Almario - Parco - Chapter 1 Part 2 Individual Assignment Online Presentation 3Document25 pagesMBA104 - Almario - Parco - Chapter 1 Part 2 Individual Assignment Online Presentation 3Jesse Rielle CarasNo ratings yet

- Audit Practices ManualDocument354 pagesAudit Practices ManualRaif QelaNo ratings yet

- Section A: Multiple Choice Questions - Single Option: This Section Has 70 Questions Worth 1 Mark Each (Total of 70 Marks)Document24 pagesSection A: Multiple Choice Questions - Single Option: This Section Has 70 Questions Worth 1 Mark Each (Total of 70 Marks)Kenny HoNo ratings yet

- SBR Study Support Guide: Plan Prepare PassDocument27 pagesSBR Study Support Guide: Plan Prepare PassNitesh RawatNo ratings yet

- F7 Technical ArticlesDocument121 pagesF7 Technical ArticlesNicquain0% (1)

- BEC Study Guide 4-19-2013Document220 pagesBEC Study Guide 4-19-2013Valerie Readhimer100% (1)

- Exp Fia-Ffm NotesDocument51 pagesExp Fia-Ffm Notesati19100% (1)

- Additional Deferred Tax Examples.2Document3 pagesAdditional Deferred Tax Examples.2milton1986100% (1)

- Aud NotesDocument75 pagesAud NotesClaire O'BrienNo ratings yet

- Auditors' responsibilities and ethicsDocument12 pagesAuditors' responsibilities and ethicsscribdtea100% (1)

- Part 3 - Understanding Financial Statements and ReportsDocument7 pagesPart 3 - Understanding Financial Statements and ReportsJeanrey AlcantaraNo ratings yet

- Acca SBR 691 698 PDFDocument8 pagesAcca SBR 691 698 PDFYudheesh P 1822082No ratings yet

- MBA104 - Almario - Parco - Chapter 1 Part 2 Individual Assignment Online Presentation 1Document23 pagesMBA104 - Almario - Parco - Chapter 1 Part 2 Individual Assignment Online Presentation 1Jesse Rielle CarasNo ratings yet

- US CMA MCQ QuestionsDocument5 pagesUS CMA MCQ QuestionsSachin Kandloor0% (1)

- What Is The Indirect MethodDocument3 pagesWhat Is The Indirect MethodHsin Wua ChiNo ratings yet

- William WongDocument3 pagesWilliam WongKashif Mehmood0% (1)

- Lsbf-Mock Answer f8Document15 pagesLsbf-Mock Answer f8emmadavisonsNo ratings yet

- 04 Working Capital Management and Corporate GovernanceDocument26 pages04 Working Capital Management and Corporate GovernanceKrutika NandanNo ratings yet

- Income TaxDocument109 pagesIncome TaxDaksh KohliNo ratings yet

- Cma TemplateDocument25 pagesCma TemplateSavoir PenNo ratings yet

- CFA Investment Foundations - Module 1 (CFA Institute) (Z-Library)Document39 pagesCFA Investment Foundations - Module 1 (CFA Institute) (Z-Library)gmofneweraNo ratings yet

- Fringe Benefit Tax (FBT)Document35 pagesFringe Benefit Tax (FBT)SanjayNo ratings yet

- ACCT604 Week 7 Lecture SlidesDocument29 pagesACCT604 Week 7 Lecture SlidesBuddika PrasannaNo ratings yet

- CIR v. SOJ & PAGCOR: Final Withholding Tax on Fringe BenefitsDocument4 pagesCIR v. SOJ & PAGCOR: Final Withholding Tax on Fringe BenefitsIan Villafuerte100% (1)

- 1-4 Deductions FlowchartDocument2 pages1-4 Deductions Flowchartoddsey0713No ratings yet

- 3-3 Company LossesDocument1 page3-3 Company Lossesoddsey0713No ratings yet

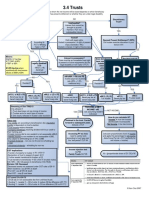

- 3-4 TrustsDocument1 page3-4 Trustsoddsey0713No ratings yet

- 1-3 Assessable IncomeDocument2 pages1-3 Assessable Incomeoddsey0713No ratings yet

- 3 5 PartnershipsDocument1 page3 5 Partnershipsoddsey0713No ratings yet

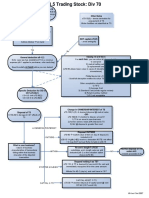

- 1-5 Trading StockDocument1 page1-5 Trading Stockoddsey0713No ratings yet

- 2-4,5 Capital WorksDocument1 page2-4,5 Capital Worksoddsey0713No ratings yet

- Creating Effective Ads PPT 4 MGMTDocument22 pagesCreating Effective Ads PPT 4 MGMToddsey0713No ratings yet

- Executing-The-Creative Design Elements and Layout Styles With ADS As ExamplesDocument47 pagesExecuting-The-Creative Design Elements and Layout Styles With ADS As Examplesoddsey0713No ratings yet

- T5 Chapters 4 and 8 Solutions To The Essential ActivitiesDocument18 pagesT5 Chapters 4 and 8 Solutions To The Essential Activitiesoddsey0713No ratings yet

- Case Summaries 1 193Document54 pagesCase Summaries 1 193oddsey0713100% (1)

- T7 Chapter 6 Solutions To The Essential ActivitiesDocument26 pagesT7 Chapter 6 Solutions To The Essential Activitiesoddsey0713No ratings yet

- T6 Chapter 5 Solutions To The Essential ActivitiesDocument12 pagesT6 Chapter 5 Solutions To The Essential Activitiesoddsey0713No ratings yet

- T8 Chapters 9 and 7 Solutions To The Essential ActivitiesDocument12 pagesT8 Chapters 9 and 7 Solutions To The Essential Activitiesoddsey0713No ratings yet

- 2006 Planning EvalDocument33 pages2006 Planning EvalSanjay SahooNo ratings yet

- Summer Training Report On Talent AcquisitionDocument56 pagesSummer Training Report On Talent AcquisitionFun2ushhNo ratings yet

- Axial DCF Business Valuation Calculator GuideDocument4 pagesAxial DCF Business Valuation Calculator GuideUdit AgrawalNo ratings yet

- Form A2: AnnexDocument8 pagesForm A2: Annexi dint knowNo ratings yet

- Order in The Matter of Pancard Clubs LimitedDocument84 pagesOrder in The Matter of Pancard Clubs LimitedShyam SunderNo ratings yet

- Beyond Vertical Integration The Rise of The Value-Adding PartnershipDocument17 pagesBeyond Vertical Integration The Rise of The Value-Adding Partnershipsumeet_goelNo ratings yet

- MoneyDocument2 pagesMoney09-Nguyễn Hữu Phú BìnhNo ratings yet

- 2022 Logistics 05 Chap 08 PlanningRes CapaMgmt Part 1Document37 pages2022 Logistics 05 Chap 08 PlanningRes CapaMgmt Part 1Chíi KiệttNo ratings yet

- Introduction and Company Profile: Retail in IndiaDocument60 pagesIntroduction and Company Profile: Retail in IndiaAbhinav Bansal0% (1)

- Assignment 1: NPV and IRR, Mutually Exclusive Projects: Net Present Value 1,930,110.40 2,251,795.46Document3 pagesAssignment 1: NPV and IRR, Mutually Exclusive Projects: Net Present Value 1,930,110.40 2,251,795.46Giselle MartinezNo ratings yet

- Working Capital Management of Nepal TelecomDocument135 pagesWorking Capital Management of Nepal TelecomGehendraSubedi70% (10)

- Accounting for Legal FirmsDocument23 pagesAccounting for Legal FirmsARVIN RAJNo ratings yet

- Market SegmentationDocument21 pagesMarket SegmentationMian Mujeeb RehmanNo ratings yet

- 20 Accounting Changes and Error CorrectionsDocument17 pages20 Accounting Changes and Error CorrectionsKyll MarcosNo ratings yet

- Fire in A Bangladesh Garment FactoryDocument6 pagesFire in A Bangladesh Garment FactoryRaquelNo ratings yet

- Regulatory Framework For Hospitality Industry in Nigeria 3Document35 pagesRegulatory Framework For Hospitality Industry in Nigeria 3munzali67% (3)

- Download ebook Economics For Business Pdf full chapter pdfDocument60 pagesDownload ebook Economics For Business Pdf full chapter pdfcurtis.williams851100% (21)

- Weeks 3 & 4Document46 pagesWeeks 3 & 4NursultanNo ratings yet

- Niti Aayog PDFDocument4 pagesNiti Aayog PDFUppamjot Singh100% (1)

- Managing Organizational Change at Campbell and Bailyn's Boston OfficeDocument12 pagesManaging Organizational Change at Campbell and Bailyn's Boston OfficeBorne KillereNo ratings yet

- Executive Master in Health AdministrationDocument3 pagesExecutive Master in Health Administrationapi-87967494No ratings yet

- Fundamentals of AccountingDocument56 pagesFundamentals of AccountingFiza IrfanNo ratings yet

- Traders CodeDocument7 pagesTraders CodeHarshal Kumar ShahNo ratings yet

- Clutch Auto PDFDocument52 pagesClutch Auto PDFHarshvardhan KothariNo ratings yet

- Oswal Woolen MillsDocument76 pagesOswal Woolen MillsMohit kolliNo ratings yet

- 22 Immutable Laws of Marketing SummaryDocument2 pages22 Immutable Laws of Marketing SummaryWahid T. YahyahNo ratings yet

- Using APV: Advantages Over WACCDocument2 pagesUsing APV: Advantages Over WACCMortal_AqNo ratings yet

- Department of Labor: DekalbDocument58 pagesDepartment of Labor: DekalbUSA_DepartmentOfLabor50% (2)

- Jio Fiber Tax Invoice TemplateDocument5 pagesJio Fiber Tax Invoice TemplatehhhhNo ratings yet

- How Businesses Have Adapted Their Corporate Social Responsibility Amidst the PandemicDocument7 pagesHow Businesses Have Adapted Their Corporate Social Responsibility Amidst the PandemicJapsay Francisco GranadaNo ratings yet

- Difference Between Delegation and DecentralizationDocument4 pagesDifference Between Delegation and Decentralizationjatinder99No ratings yet