Professional Documents

Culture Documents

Investor Expectations On Return' and Trust' On Ipo Grading: An Empirical Analysis

Uploaded by

IAEME PublicationOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Investor Expectations On Return' and Trust' On Ipo Grading: An Empirical Analysis

Uploaded by

IAEME PublicationCopyright:

Available Formats

International Journal of Management (IJM)

Volume 7, Issue 3, March-April 2016, pp. 172184, Article ID: IJM_07_03_016

Available online at

http://www.iaeme.com/IJM/issues.asp?JType=IJM&VType=7&IType=3

Journal Impact Factor (2016): 8.1920 (Calculated by GISI) www.jifactor.com

ISSN Print: 0976-6502 and ISSN Online: 0976-6510

IAEME Publication

INVESTOR EXPECTATIONS ON RETURN

AND TRUST ON IPO GRADING: AN

EMPIRICAL ANALYSIS

Biju Thomas Muttath

HeadFinance (Star Group),

Research Scholar, R&D Centre,

Bharathiar University, Coimbatore46, T.N, India

Dr. Assissi Menachery

Professor, Loyola Institute of Technology & Science,

K.K Dist, T.N, India

ABSTRACT

Oversubscription during IPO is the result of demand over supply due to

investors keen interest and expectation to subscribe new shares. Grading

agencies play a major role in attracting investors to subscribe shares during

IPO. This is due to the trust that investors have on the grading agency,

regarding its capability to perform research on the key fundamental

indicators. Informed and knowledgeable investors act vigorously to get

maximum shares during the initial public offer. Book building pricing method

plays vital role in attracting the investors who anticipate efficient price

discovery. The study attempts to provide insights to investors on how

significantly efficient the listing prices of oversubscribed shares between 1 to

5 grades by approved rating agencies are; as well as the profitability in

investing oversubscribed IPOs with respect to the 1) Close price of the listing

day 2) Short term and 3) Long term returns in both manufacturing and service

sector.

Key words: Book building, Grading, Hot Issue Market, IPO, Under-pricing)

Cite this Article: Biju Thomas Muttath and Dr. Assissi Menachery, Investor

Expectations on Return and Trust on IPO Grading: An Empirical Analysis.

International Journal of Management, 7(3), 2016, pp. 172184.

http://www.iaeme.com/IJM/issues.asp?JType=IJM&VType=7&IType=3

1. INTRODUCTION

Companies opt for Initial Public Offerings (IPOs) and approach potential investors for

capital, to raise funds for their various strategic plans. However, for an investor it is

questionable as to whether it makes sense to subscribe to the deluge offerings or not.

http://www.iaeme.com/IJM/index.asp

172

editor@iaeme.com

Investor Expectations on Return and Trust on IPO Grading: An Empirical

Analysis

Investors do not pursue value strategies because they may not be aware of the data, or

that much of evidence is refuted by the conclusions offered by the consultants [1].

Attracting and persuading the investor is the tactic of the investment banker and other

intermediaries. Investors are less informed about the fate of the issuers but glitters the

charms of the shares where insanity works among the investors [2]. In Indian IPO

market, book building mechanism was introduced in 1999 and since then gained

popularity particularly in respect of large IPOs. In this paper, researchers attempts to

study on how significantly efficient the listing prices of oversubscribed graded and

non-graded IPOs with respect to 1) Close price of the first day 2) Short term return

and 3) Long term returns among manufacturing and service sectors.

Oversubscription of the IPO shares is the combined outcome of various

perceptions of the investors. Bull markets and irrational behavior of the investors

create a hot issue market where demand for new issues became very high [3]. In bull

market, when investors are greedy for buying stocks such IPOs, they find their way to

the hot issue market [4]. During this time, investors become irrational and their greed

to make money become prominent by investing in anything [5]. But such things

cannot happen in market especially in bull market, as the intention of issuers is to

raise maximum resources [6]. The expectations of the investors define whether the

shares are under priced or not [7]. Under-pricing of IPOs brought to the market by

reputable underwriters is lower than those brought by non reputable underwriters [8,

9]. While an IPO enhances a firms legitimacy, significant uncertainties remain about

its capabilities [10]. This study reveals the reality of oversubscribed IPO shares during

the period, 2006 to 2010, based on the investors perception on hot issue and under

pricing phenomenon.

IPO grading is a service that provides an assessment of fundamentals regarding

quality of equity shares offered to aid comparative assessment which would be a

useful information and investment tool to investors [11]. This way, the investor, by

trusting on the IPO grading can decide whether the particular offer has potential to

bring returns or not. IPO grading methodology examines the key variables such as: i)

Business and Competitive position, ii) New projects- risks and Prospects, iii)

Financial position and Prospects, iv) Management Quality, v) Corporate governance

practices and vi) Compliance and litigation history.

ICRA and CARE have the following 5 point scale grading IPO fundamentals.

Grade 5 Strong Fundamentals, Grade 4 Above average Fundamentals, Grade 3

Average Fundamentals, Grade 2 Below average Fundamentals, Grade 1 Poor

Fundamentals. During 1990 2000 many IPOs in India have vanished looting

millions of public funds. The regulator of Indian Stock Market, The Security

Exchange Board of India (SEBI) made grading of IPOs by all companies mandatory

from May 1, 2007 to help investors make informed decision and grading to be done

by the SEBI- registered crediting rating agencies. The rationale for such move, as per

SEBI, is to protect the retail investors from fly-by- night entrepreneurs. After six

years, SEBI scraped the mandatory policy of grading on December 24, 2013 making

the grading norms as voluntary.

Grading is resulting in an analysis of fundamentals and the grades should be

conveyed the same information to the uninformed investors, what the costly research

would be conveying to the institutional investors [12]. Investors incur a lower cost of

information accumulation if an IPO has some backing that signals better quality [13].

IPO grading decreases underpricing and positively influences the demand of retail

investors. In emerging markets, regulators role to signal the quality of an IPO

http://www.iaeme.com/IJM/index.asp

173

editor@iaeme.com

Biju Thomas Muttath and Dr. Assissi Menachery

contributes towards the market welfare [11]. Studies also reveal that IPO grading has

limited influence on the IPO demand. It is not evident in Indian IPO market that IPO

pricing improves due to the introduction of IPO grading [14]. Shares which do not

have grading have higher short term return than graded [15]. Study on IPO grading on

under-pricing [16], reveals no significant influence between IPO grades and

subsequent market performance. Thus these analyses reveal the contrary results

between IPO grading and their performance. This research aims to examine the

similarities or differences among IPO grading and non-grading with respect to its

returns in manufacturing and service sectors during different investment durations.

Even though various studies on IPOs performance have been carried out in

different periods, the researchers intend to analyse the bull and bear phases of market,

IPO offerings in terms of total numbers of IPOs and influence of grading in

performance of the shares. This is because, values and IPOs are the reflections of bear

and bull markets respectively. Hence, researchers have taken up the time period that

integrate both bull and bear run to ensure homogeneity. 2006-2010 is the period both

bull and bear phases are apparent (Fig.1). Hence IPOs performance of these periods

had been taken into consideration to get a complete picture.

Figure 1

(NSE INDEX- NIFTY) Bull and Bear Rally during 2006 2010

7000

6000

Bear Rally-1

5000

4000

3000

2000

1000

Bull Rally-1

0

2-Jan-06 2-Jan-07

Bull Rally-2

2-Jan-08

2-Jan-09

2-Jan-10

Moreover, special focus on manufacturing and service sectors with respect to IPO

performance in these periods has given preference in the present study. Other studies

with comparative analysis on manufacturing and service sector found to be scarce.

Hence, comparative analysis of the manufacturing and service sectors on the:

1. Listing day(first day) return

2. Short term return, and

3. Long term return would give insight to the investors regarding the right time for

investment in hot issue shares.

2. OBJECTIVES OF THE STUDY

1. To analyze and study the returns obtained while investing in graded IPOs on various

time periods such as a) First day of trade b) Short term basis and c) Long term basis

2. To analyze and study the returns obtained while investing in graded IPOs belonging

to manufacturing sector on various time periods such as a) First day of trade b) Short

term basis and c) Long term basis

http://www.iaeme.com/IJM/index.asp

174

editor@iaeme.com

Investor Expectations on Return and Trust on IPO Grading: An Empirical

Analysis

3. To analyze and study the returns obtained while investing in graded IPOs belonging

to service sector on various time periods such as a) First day of trade b) Short term

basis and c) Long term basis.

4. To analyze and study the returns obtained while investing in hot issue shares

(oversubscribed IPOs) on various time periods such as a) First day of trade b) Short

term basis and c) Long term basis.

5. To analyze and study the returns obtained while investing in hot issue shares

(oversubscribed IPOs) belonging to manufacturing sector on various time periods

such as a) First day of trade, b) Short term basis and c) Long term basis.

6. To analyze and study the returns obtained while investing in hot issue shares

(oversubscribed IPOs) belonging to service sector on various time periods such as a)

First day of trade b) Short term basis and c) Long term basis.

2.1. Hypotheses

1. There is no significant relationship between the average rates of returns obtained

while investing in hot issue shares (oversubscribed IPOs) and the time periods such as

a) First day of trade b) Short term and c) Long term.

2. There is no significant relationship between the average rates of returns obtained

while investing in hot issue shares (oversubscribed IPOs) in manufacturing sector and

the time periods such as a) First day of trade b) Short term and c) Long term.

3. There is no significant relationship between the average rates of returns obtained

while investing in hot issue shares (oversubscribed IPOs) in service sector and the

time periods such as a) First day of trade b) Short term and c) Long term.

4. There is no significant relationship between the average rates of returns obtained

while investing in hot issue shares (oversubscribed IPOs) and the time periods such as

a) First day of trade b) Short term and c) Long term.

5. There is no significant relationship between the average rates of returns obtained

while investing in hot issue shares (over subscribed) in manufacturing sector and the

time periods such as a) First day of trade b) Short term and c) Long term.

6. There is no significant relationship between the average rates of returns obtained

while investing in hot issue shares (over subscribed) in service sector and the time

periods such as a) First day of trade, b) Short term and c) Long term.

2.2. Methodology

2.2.1. Sample

Sample containing 220 from 321 companies came out with IPO, during the period

2006- 2010 have been considered in the study (Table 1). Out of 220 companies 94

were graded by registered agencies (Table 2). The information is drawn from the

SEBI, NSE and ICRA.

Table 1

Year wise IPOs & Sampling Frame

Year

2006

2007

2008

2009

2010

Total

Number

Population

91

107

38

21

64

321

of IPOs

Sample

70

69

18

14

49

220

http://www.iaeme.com/IJM/index.asp

175

editor@iaeme.com

Biju Thomas Muttath and Dr. Assissi Menachery

Table 2

Grading Sector Wise

Sector

Service

Manufacturing

Total

High (4 and 5)

18

7

25

Grades

Medium (3)

28

13

41

Low (1 and 2)

14

14

28

Total

60

34

94

2.2.2. Sampling frame and Characteristics

It has been observed that all shares were oversubscribed by investors. The sample

consists of 220 companies are drawn on the criteria of availability of information on

IPO regarding book building price, issue date, issue price, listing date, listing day,

close price, short term price and long term price.

Book building price, Return on first day, Short term return and Long term

return have been considered for the analysis.

Return on first day is the return on the closing hours of the listing day.

Short term return is considered as the return after the first year of listing and

Long term return is considered as return on 30 th October 2015. Long term is

considered as more than five years.

These returns are again classified as positive and negative returns. The shares

have categorized into two sectors such as manufacturing and service. The graded

shares are grouped into three categories such as High, Medium and Low. Shares

with 4 and 5 grades are categorized as high grade, shares with 3 grade are

categorized as medium grade and shares with 1 and 2 grades are categorized as low

grade.

2.2.3. Technique

Cross sectional analysis is carried out to explore the significance or difference with

respect to returns generated in various time periods. Data collected were analyzed

using various statistical tools and the results are presented. Null hypotheses

formulated for the purpose of present investigation are put together using inferential

statistical tools. Chi-Square test is used to find out the significant association between

sectors, grading and returns. During discussion, attention has to been given in arriving

at a conclusive perspective on the analysis, hypotheses testing and interpretation of

data related to the variables. The results are discussed in detail.

2.3. Analysis Results and Discussion

2.3.1. Analysis: Grading and Listing day return

It is clear from the Table 3 that out of the total 94 shares that have been graded, 37

(39.4%) shares have given negative return and 57 (60.6%) shares have given positive

return. While considering the shares that have graded high, out of 25 shares, 4 (16%)

shares have given negative return and 21 (84%) shares have given positive returns.

Among the shares that have been graded as medium, out of 41 shares, 19 (46.3%)

shares have given negative return and 22 (53.7%) shares gave positive returns. When

low graded shares are considered, out of 28 shares 14 (50%) shares gave negative

return and 14 (50%) shares have given positive returns on first day of listing.

http://www.iaeme.com/IJM/index.asp

176

editor@iaeme.com

Investor Expectations on Return and Trust on IPO Grading: An Empirical

Analysis

Table 3

Grading and Listing day return

Classification of

Grading

High

Medium

Low

Total

Return

Negative

4 (16%)

19 (46.3%)

14 (50%)

37 (39.4%)

Positive

21 (84%)

22 (53.7%)

14 (50%)

57 (60.6%)

Total

25(100%)

41(100%)

28(100%)

94(100%)

From Table 4 it is observed that the grading influences listing day returns whether

positive or negative. Further, the results of Chi-square provide the first indication that

the hypotheses is not supported, grading has an influence on listing day returns

whether positive or negative. Hence we reject the null hypotheses that there is

significant relationship between grading and listing day returns (positive or negative).

It is inferred from table 4 that there is relationship between grading and listing day

returns.

Table 4

Chi Square Listing day return

Pearson Chi-Square

Likelihood Ratio

Linear-by-Linear As

N of Valid Cases

Value

7.881

8.606

6.094

94

df

2

2

1

Asymp. Sig. (2-sided)

.019

.014

.014

**Significant at 0.05 significance level

It is found that 60.6% of the graded IPOs have provided positive return on the

listing day. Among this, while considering higher grades 84% has provided positive

return on the listing day, whereas in medium grade 53.7% have got positive return and

in low grade 50% have got positive return. From this it can be concluded that

investing in higher graded IPOs are advisable, provided the shares are sold on the

first day of the listing. Another possibility is that to short sell such shares on the

listing day. The study supports the findings of previous studies [2,17,18,19] where

they establish the presence of underpricing during the initial book building process

and creating artificial demand for retail investors during the initial hike of share price

on the first day. This is reported to be the advantage of information edge, which

financial institutions have over retail investors.

2.3.2. Analysis and Discussion: Grading and Short term return

It is clear from Table 5 that among the total 94 shares that have been graded, 74

(78.7%) shares have given negative return and 20 (21.3%) shares have given positive

return. While considering the shares that have graded high, among the 25 shares, 18

(72%) shares have given negative return and 7 (28%) shares gave positive returns. In

the category of medium graded shares, among the 41 shares, 30 (73.2%) shares have

given negative return and 11(26.8%) shares gave positive returns. Where as in low

graded shares out of 28 shares 26 (92.9%) shares have given negative return and 2

(7.1%) shares gave positive returns in short term.

http://www.iaeme.com/IJM/index.asp

177

editor@iaeme.com

Biju Thomas Muttath and Dr. Assissi Menachery

Table 5

Grading and Short term return

Classification of

Grading

High

Medium

Low

Total

Return

Negative

18 (72%)

30 (73.2%)

26 (92.9%)

74 (78.7%)

Positive

7 (28%)

11(23.8%)

2 (7.1%)

20(21.3%)

Total

25 (100%)

41 (100%)

28 (100%)

94 (100%)

From Table 6 it is observed that grading does not influence short term returns

whether positive or negative. Further the results of Chi-square provide the first

indication that the hypotheses should support grading of IPOs does not have any

relationship at 0.05 confidence level on short term returns whether positive or

negative. However it shows statistically significant at 0.01 confidence level. Hence

we accept the null hypotheses that there is no significant relationship between grading

and short term returns (positive or negative) at 0.05 confidence level. It is inferred

from the above table that there is no relationship between grading and short term

returns (positive or negative).

Table 6 Chi Square Short term return

Pearson Chi-Square

Likelihood Ratio

Linear-by-Linear As

N of Valid Cases

Value

4.769

5.564

3.549

94

Df

2

2

1

Asymp. Sig. (2-sided)

.092

.062

.060

*Not Significant at 0.05 and 0.01 significance level

It is clear from the Table 7 that out of the total 94 shares that have been graded, 70

(74.5%) shares have given negative return and 24 (25.5%) shares have given positive

return. While considering the shares that have graded high, out of 25 shares 16 (64%)

shares have given negative return and 9 (36%) shares have given positive returns. In

medium grade category, out of 41 shares 31 (75.6%) shares have given negative

return and 10 (24.4%) shares have given positive returns. Where as in low graded

shares out of 28 shares 23 (82.1%) shares have given negative return and 5(17.9%)

shares have given positive returns in long term.

Table 7

Grading and Long term return

Classification of

Grading

High

Medium

Low

Total

Return

Negative

16(64%)

31(75.6%)

23(82.1%)

70(74.5%)

http://www.iaeme.com/IJM/index.asp

Positive

9 (36%)

10(24.4%)

5(17.9%)

24(25.5%)

178

Total

25(100%)

41(100%)

28(100%)

94(100%)

editor@iaeme.com

Investor Expectations on Return and Trust on IPO Grading: An Empirical

Analysis

From the Table 8 (Appendix) it is observed that the grading does not influence

long return whether positive or negative. Further the results of Chi-square provide the

first indication that our hypotheses should support that grading of IPOs does not have

any relationship on long term returns whether positive or negative. Hence we accept

the null hypotheses that there is no relationship between grading and long term

returns.

Table 8

Chi Square Long term return

Pearson Chi-Square

Likelihood Ratio

Linear-by-Linear As

No of Valid Cases

Value

Df

2.336

2.302

2.234

94

2

2

1

Asymp.

Sig. (2-sided)

.311

.316

.135

*Not Significant at 0.05 and 0.01 significance level

2.3.3. Analysis and Discussion: Manufacturing and Service Sector

It is clear from the Table 9 that among the total sample of 220 shares, 77 (35%) shares

have given negative return and 143 (65 %) shares gave positive return. While

considering the shares belong to service sector, among the 133 shares, 46 (34.6%)

shares have given negative return and 87 (65.4%) shares have given positive returns.

In manufacturing sector, among the 87 shares, 31 (35.6%) shares have given negative

return and 56 (64.4%) shares have given positive returns on the listing day. It can be

inferred that on listing day most of the shares generate positive return.

Table 9

Sectors and Listing day Return

Sectors

Service

Manufacturing

Total

Return

Negative

46 (34.6%)

31 (35.6%)

77 (35%)

Positive

87(65.4%)

56 (64.4%)

143 (65 %)

Total

133(100%)

87 (100%)

220 (100%)

It is clear from Table 10 that the sectors do not influence listing day returns

whether positive or negative. Further the results of Chi-square provide the first

indication that our hypotheses should be supported that sectors does not have an

influence on listing day returns whether positive or negative. Hence we accept the null

hypotheses that, there is no significant relationship between manufacturing and

service sectors and the listing day return (positive or negative).

http://www.iaeme.com/IJM/index.asp

179

editor@iaeme.com

Biju Thomas Muttath and Dr. Assissi Menachery

Table 10

Chi Square Listing day

Value

Df

Asymp.Sig.

(2-sided)

.874

.988

.874

PearsonChi-Square

.025

1

Continuity correction

.000

1

Likelihood Ratio

.025

1

Fishers Exact Test

Linear-by-Linear As

.025

1

.874

N of Valid Cases

220

*Not Significant at 0.05 and 0.01 significance level

Exact Sig

(2 sided)

.886

Exact Sig (1

sided)

.493

It is also clear from the study that among the total 220 oversubscribed IPOs

belonging to service and manufacturing sectors, 65% of the total shares generated

positive return on listing day. Among this, while considering the service sector, 65.4%

has provided positive return and 64.4% of manufacturing sector provided positive

return on the listing day. It can be inferred from the analysis that both service and

manufacturing sectors are indifferent in providing return on listing day in between 64

to 66%. The study supports the findings of various studies [11,16,18,20,21] on the

underperformance of IPOs in Indian and foreign stock markets and substantiate the

prevalent under pricing phenomena.

It is clear from the Table 11 that among the total sample of 220 shares,

151(68.6%) shares have given negative return and 69 (31.4%) shares have given

positive return. While considering the shares belonging to service sector, among the

133 shares 94 (70.7%) shares have given negative return and 39 (29.3%) shares have

given positive returns. In manufacturing sector, among the 87 shares, 57 (65.5%)

shares have given negative return and 30 (34.5%) shares gave positive returns in short

term.

Table 11

Sectors and Short Term Return

Sectors

Service

Manufacturing

Total

Return

Negative

94 (70.7%)

57 (65.5%)

151(68.6%)

Positive

39 (29.3%)

30 (34.5%)

69 (31.4%)

Total

133(100%)

87 (100%)

220 (100%)

It is clear from Table 12 that the sectors does not influence short term returns

whether positive or negative. Further the results of Chi-square provide the first

indication that our hypotheses should support that sectors do not have any influence

on short term whether positive or negative. Hence we accept the null hypotheses that

there is no significant relationship between manufacturing and service sectors and

short term returns (positive or negative).

http://www.iaeme.com/IJM/index.asp

180

editor@iaeme.com

Investor Expectations on Return and Trust on IPO Grading: An Empirical

Analysis

Table 12

Chi Square Short term return

Pearson Chi-Square

Continuity correction

Likelihood Ratio

Fishers Exact Test

N of Valid Cases

Value

Df

.650

.433

.647

1

1

1

Asymp. Sig.

(2-sided)

.420

.511

.421

Exact Sig

(2 sided)

Exact Sig (1

sided)

.459

.255

220

*Not Significant at 0.05 and 0.01 significance level

It is clear from the Table 13 that among the total sample of 220 shares, 162

(73.6%) shares have given negative return and 58 (26.4 %) shares have given positive

return. While considering the shares which belong to service sector, out of 133 shares,

99 (74.4%) shares have given negative return and 34 (25.6%) shares have given

positive returns. In manufacturing sector, among the 87 shares, 63 (72.4%) shares

have given negative return and 24 (27.6%) shares gave positive returns in the long

term.

Table 13

Sectors and Long Term Return

Sectors

Service

Manufacturing

Total

Return

Negative

99 (74.4%)

63 (72.4%)

162 (73.6%)

Total

Positive

34 (25.6%)

24 (27.6%)

58 (26.4 %)

133(100%)

87 (100%)

220 (100%)

From Table 14 (Appendix), it is observed that the sectors do not influence long

term returns whether positive or negative. Further the results of Chi-square provide

the first indication that our hypotheses should support that sectors do not have any

influence on long term whether positive or negative. Hence we accept the null

hypotheses that there is no significant relationship between manufacturing and service

sectors and long term returns (positive or negative).

Table 14

Chi Square Long term return

Pearson Chi-Square

Continuity correction

Likelihood Ratio

Fishers Exact Test

N of Valid Cases

Value

df

.111

.031

.110

1

1

1

Asymp.

Sig.(2-sided)

.739

.860

.740

Exact Sig

(2 sided)

Exact Sig

(1 sided)

.756

.428

220

*Not Significant at 0.05 and 0.01 significance level

http://www.iaeme.com/IJM/index.asp

181

editor@iaeme.com

Biju Thomas Muttath and Dr. Assissi Menachery

2.4. Discussion

The study intends to find out the relevance of IPO grading on the day of listing, as

well as on short term and long term returns. Moreover, the study also brings out the

relevance of investing in oversubscribed IPOs on listing day, short term and long

term time periods.

From the study it is revealed that grading is not an indicator to get profits on short

term and long term basis. Only 20.3% and 25.5% of graded shares generated positive

return in short term and long term respectively. It is also clear from the study that total

of 220 overs subscribed IPOs belong to service and manufacturing sectors has not

performing as expected by the investors in short term and long term periods. The

study also reveals that shares of medium grade is generating more profit in all three

periods, this supports the previous study [22]. The study recommends the investors to

invest in service sectors with high grade in order to generate positive return on listing

day of the IPOs. In spite of the information asymmetry prevailing in the stock market,

retail investors are consciously burning their fingers. Credit rating and grading are the

supportive indicators that can be considered for investing but not for a trusted value

investing. Probably, focusing on these persistent hot issues and underpricing

phenomena, the regulator took lenient step on the mandatory grading.

In order to generate return from investment, individuals ought to look into two

important qualitative aspects viz, quality of the management and sustainability of the

business in the present and future economic scenario. Risk analysis is another

important tool by which companies ensure sustainability in future so that investors

will be in a position to gain return from the investment. Negative returns in short term

and long term periods are evident in the stock market which emphasizes under

valuation of shares in the book building process. Moreover it becomes a relevant

question that whether companies are conducting adequate risk analysis that involves,

risk identification, assessment and mitigation. It is an alarming situation to note that

among the total 321 oversubscribed IPOs, only 20.3% and 25.5% of graded shares

generated positive return in short term and long term respectively. This calls for

immediate action from the SEBI, RBI and relevant statutory and regulatory authorities

to take appropriate corrective actions to bring out the governance of Indian companies

back into action.

Summary

1. There is a significant relationship between grading and listing day returns (positive or

negative) at 0.05 significant level.

2. There is no significant relationship between grading and short term returns (positive

or negative).

3. There is no significant relationship between grading and long term returns (positive

or negative).

4. There is no significant relationship between Manufacturing and Service sectors and

listing day returns (positive or negative).

5. There is no significant relationship between manufacturing and service sectors and

short term returns (positive or negative).

6. There is no significant relationship between manufacturing and service sectors and

long term returns (positive or negative)

http://www.iaeme.com/IJM/index.asp

182

editor@iaeme.com

Investor Expectations on Return and Trust on IPO Grading: An Empirical

Analysis

3. FUTURE RESEARCH DIRECTIONS

Initial Public Offerings are characterized by phenomena such as hot issue market,

under pricing and long term under performance. Researchers considered grading,

oversubscribed IPOs and sectors as the variables to explore its influence on return of

IPO shares on listing day, shot term and long term returns. Investor heuristic,

economic indicators, political, national and international scenarios are few of the

other factors which determining the bull and bear rally in the stock market. Influence

of these factors on IPO prices, grading and its return at different time periods can also

be considered for detailed analysis to explore the philosophy of IPO returns.

4. CONCLUSION & RECOMMENDATIONS

The main reason behind companies decision to go public is to raise money and

spread the risk of ownership among a large group of shareholders. Reducing debt

component in the source fund is another major motive behind IPOs. While going for

investing in IPO, informed investors are rich with the information on fundamental

aspects of the issuing company. In order to reduce the impact of information

asymmetric, SEBI introduced grading mechanism. The Cross tabulation, Chi square

and Correlation study reveals that grading is not an indicator to get profits on short

term and long term basis. Only 20.3% and 25.5% of graded shares generated positive

return in short term and long term respectively. However it is found that 60.6% of the

graded IPOs have provided positive return on the listing day. Among this, while

considering higher grades 84% has provided positive return on the listing day,

whereas in medium grade 53.7% has got positive return and in low grade 50% has got

positive return. From this it can be concluded that investing in higher graded IPO is

advisable, provided the shares are sold on the first day of the listing. Further the study

emphasis the pervasiveness of under-pricing phenomena in book building process of

Indian IPO market. We strongly advocate that an investor goes for an IPO offer will

be in a position to generate a positive return, if he/ she off load the shares on the first

day of listing. The role of grading agencies in awarding various grades is also

questionable as the strips graded 3, 4 and 5 failed to meet the expectations of the

investors. Trust on grading agencies in awarding 4 and 5 graded shares are also

skeptical. We conclude that IPO is a speculation opportunity to make expected return

on listing day and grading is not the only parameter investors should rely upon.

REFERENCES

[1]

[2]

[3]

[4]

[5]

Josef, Lakonishok, Andrei, Shleifer, Robert, W. Vishney. (1994). Contrarian

investment, Extrapolation and Risk, The Journal of Finance, Volume 49, Issue

5,Dec., 1994, 1541-1578.

Rock, Kevin. (1986). Why new issues are underpriced, Journal of Financial

Economics 15:187-212.

Darrien, Francois and Kent, Womack. (2003). Auctions vs. book building and

the control of underpricing in hot IPO markets, Review of Financial Studies 16,

31-61.

Goyal, Vidhan and Lewis & H. K. Tam. (2009). Investor characteristics,

relationships, and IPO allocations, HKUST Working Paper.

Jitendra, Gala. (2010). Investment strategies for IPOs, Buzzing Stock Publishing

House, Mumbai.

http://www.iaeme.com/IJM/index.asp

183

editor@iaeme.com

Biju Thomas Muttath and Dr. Assissi Menachery

[6]

[7]

[8]

[9]

[10]

[11]

[12]

[13]

[14]

[15]

[16]

[17]

[18]

[19]

[20]

[21]

[22]

[23]

[24]

Carter, Richard B., Frederick, H. Dark, and Ajai K. Singh. (1998).Underwriter

reputation, initial returns, and the long-run performance of IPO stocks, Journal

of Finance 53, 285-311.

Allen, F. & Faulhaber, G.R. (1989). Signaling by Underpricing in the IPO

Market.Journal of Financial Economics, 23,303-323.

Beatty, R.P., Ritter, J. (1986). Investment banking, reputation and the

underpricing of initial public offerings, Journal of Financial Economics, Vol.15,

pp.213-232.

Sherman, A. E, & Titman, S (2002). Building the IPO order book: underpricing

and participation limits with costly information, Journal of financial economics

65(1), 3.

Fischer, H. M. and Pollock, T.G. (2004). Effects of Social Capital and Power on

Surviving Transformational Change: The Case of Initial Public Offerings,

Academy of Management Journal, Vol. 47, pp.463-81.

Deb, S. S. and Marisetty, V. B. (2010). Information content of IPO grading.

Journal of Banking & Finance, 34(9):2294 -2305.

Arif, Khurshed, Stefano Paleari, Alok Pande, Silvio Vismara. (2011). IPO

certification: The role of grading and transparent books, 31 March 2011 WP

Thomas, J. Chemmanur, Paolo, Fulghieri. (1999). A Theory of the Going-Public

Decision, The Review of Financial Studies, Vol. 12, No. 2,Summer, 1999, pp.

249-279

Joshy, Jacob & Sobesh, Kumar, Agarwalla. (2012). Mandatory IPO Grading:

Does It Help Pricing Efficiency? W.P.No.2012- 12-07, IIM-Ahmedabad,

December.

Bhanumurthy, K V., and Amit Kumar Singh. (2012). "IPO Pricing : Who Does

IPO Grading Help?" paper presented at the World Finance & Banking

Symposium - 2012, held at Shanghai, China, December 17 -18, 2012.

Sanjay, Poudyal. (2008). "Grading Initial Public Offerings (IPOs) in India's

Capital Markets A Globally Unique Concept" W.P. No.2008-12-08

Benveniste, L.M., and Paul,.A Spindt, How investment Banker Determine the

Offer Price and Allocation of New Issues, Journal of Financial and Economics

24(1989), 343-361.

Loughran, T., Ritter J.R. (2004). Why has IPO underpricing increased over

time? Financial Management, 33(3), 5-37.

Krishnamurti, C. (2002).The Initial Listing Performance of Indian IPOs.

Managerial Finance, 28 (2), 39-51.

Seal, J. K., & Matharu, J. S. (2012). Long Run Performance of Initial Public

Offerings and Seasoned Equity Offerings in India. Indian Institute of Foreign

Trade.

Garima, Baluja. (2013). Comparative Analysis of Listing Price Performance

between Different Graded IPOs in India Volume 6, Issue 5, November 2013

Bhuvaneswari.Gowthaman, Rau.S.S, Trust In Relationship Marketing.

International Journal of Management, 1(2), 2010, pp. 1419.

Dr. K.K.Ramachandran and Dayanasajjanan, Study of Awareness, Perception

and Satisfaction Level of Gold Bullion Investors. International Journal of

Management, 5(5), 2014, pp. 1424.

Shiva Prasad, H. N, Kallanagouda. (2013). IPO Performance and IPO Grading in

Indian Markets: An Empirical Study (2008-2012), Nitte Management Review,

Vol 7, Issue 1, 48-58.

http://www.iaeme.com/IJM/index.asp

184

editor@iaeme.com

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Broad Unexposed Skills of Transgender EntrepreneursDocument8 pagesBroad Unexposed Skills of Transgender EntrepreneursIAEME PublicationNo ratings yet

- Determinants Affecting The User's Intention To Use Mobile Banking ApplicationsDocument8 pagesDeterminants Affecting The User's Intention To Use Mobile Banking ApplicationsIAEME PublicationNo ratings yet

- A Study On The Reasons For Transgender To Become EntrepreneursDocument7 pagesA Study On The Reasons For Transgender To Become EntrepreneursIAEME PublicationNo ratings yet

- Analyse The User Predilection On Gpay and Phonepe For Digital TransactionsDocument7 pagesAnalyse The User Predilection On Gpay and Phonepe For Digital TransactionsIAEME PublicationNo ratings yet

- Impact of Emotional Intelligence On Human Resource Management Practices Among The Remote Working It EmployeesDocument10 pagesImpact of Emotional Intelligence On Human Resource Management Practices Among The Remote Working It EmployeesIAEME PublicationNo ratings yet

- Voice Based Atm For Visually Impaired Using ArduinoDocument7 pagesVoice Based Atm For Visually Impaired Using ArduinoIAEME PublicationNo ratings yet

- Modeling and Analysis of Surface Roughness and White Later Thickness in Wire-Electric Discharge Turning Process Through Response Surface MethodologyDocument14 pagesModeling and Analysis of Surface Roughness and White Later Thickness in Wire-Electric Discharge Turning Process Through Response Surface MethodologyIAEME PublicationNo ratings yet

- Attrition in The It Industry During Covid-19 Pandemic: Linking Emotional Intelligence and Talent Management ProcessesDocument15 pagesAttrition in The It Industry During Covid-19 Pandemic: Linking Emotional Intelligence and Talent Management ProcessesIAEME PublicationNo ratings yet

- A Proficient Minimum-Routine Reliable Recovery Line Accumulation Scheme For Non-Deterministic Mobile Distributed FrameworksDocument10 pagesA Proficient Minimum-Routine Reliable Recovery Line Accumulation Scheme For Non-Deterministic Mobile Distributed FrameworksIAEME PublicationNo ratings yet

- Gandhi On Non-Violent PoliceDocument8 pagesGandhi On Non-Violent PoliceIAEME PublicationNo ratings yet

- Influence of Talent Management Practices On Organizational Performance A Study With Reference To It Sector in ChennaiDocument16 pagesInfluence of Talent Management Practices On Organizational Performance A Study With Reference To It Sector in ChennaiIAEME PublicationNo ratings yet

- A Study On The Impact of Organizational Culture On The Effectiveness of Performance Management Systems in Healthcare Organizations at ThanjavurDocument7 pagesA Study On The Impact of Organizational Culture On The Effectiveness of Performance Management Systems in Healthcare Organizations at ThanjavurIAEME PublicationNo ratings yet

- Visualising Aging Parents & Their Close Carers Life Journey in Aging EconomyDocument4 pagesVisualising Aging Parents & Their Close Carers Life Journey in Aging EconomyIAEME PublicationNo ratings yet

- A Study On Talent Management and Its Impact On Employee Retention in Selected It Organizations in ChennaiDocument16 pagesA Study On Talent Management and Its Impact On Employee Retention in Selected It Organizations in ChennaiIAEME PublicationNo ratings yet

- A Study of Various Types of Loans of Selected Public and Private Sector Banks With Reference To Npa in State HaryanaDocument9 pagesA Study of Various Types of Loans of Selected Public and Private Sector Banks With Reference To Npa in State HaryanaIAEME PublicationNo ratings yet

- EXPERIMENTAL STUDY OF MECHANICAL AND TRIBOLOGICAL RELATION OF NYLON/BaSO4 POLYMER COMPOSITESDocument9 pagesEXPERIMENTAL STUDY OF MECHANICAL AND TRIBOLOGICAL RELATION OF NYLON/BaSO4 POLYMER COMPOSITESIAEME PublicationNo ratings yet

- Role of Social Entrepreneurship in Rural Development of India - Problems and ChallengesDocument18 pagesRole of Social Entrepreneurship in Rural Development of India - Problems and ChallengesIAEME PublicationNo ratings yet

- Application of Frugal Approach For Productivity Improvement - A Case Study of Mahindra and Mahindra LTDDocument19 pagesApplication of Frugal Approach For Productivity Improvement - A Case Study of Mahindra and Mahindra LTDIAEME PublicationNo ratings yet

- A Multiple - Channel Queuing Models On Fuzzy EnvironmentDocument13 pagesA Multiple - Channel Queuing Models On Fuzzy EnvironmentIAEME PublicationNo ratings yet

- Analysis of Fuzzy Inference System Based Interline Power Flow Controller For Power System With Wind Energy Conversion System During Faulted ConditionsDocument13 pagesAnalysis of Fuzzy Inference System Based Interline Power Flow Controller For Power System With Wind Energy Conversion System During Faulted ConditionsIAEME PublicationNo ratings yet

- Optimal Reconfiguration of Power Distribution Radial Network Using Hybrid Meta-Heuristic AlgorithmsDocument13 pagesOptimal Reconfiguration of Power Distribution Radial Network Using Hybrid Meta-Heuristic AlgorithmsIAEME PublicationNo ratings yet

- Various Fuzzy Numbers and Their Various Ranking ApproachesDocument10 pagesVarious Fuzzy Numbers and Their Various Ranking ApproachesIAEME PublicationNo ratings yet

- Dealing With Recurrent Terminates in Orchestrated Reliable Recovery Line Accumulation Algorithms For Faulttolerant Mobile Distributed SystemsDocument8 pagesDealing With Recurrent Terminates in Orchestrated Reliable Recovery Line Accumulation Algorithms For Faulttolerant Mobile Distributed SystemsIAEME PublicationNo ratings yet

- Prediction of Average Total Project Duration Using Artificial Neural Networks, Fuzzy Logic, and Regression ModelsDocument13 pagesPrediction of Average Total Project Duration Using Artificial Neural Networks, Fuzzy Logic, and Regression ModelsIAEME PublicationNo ratings yet

- A Review of Particle Swarm Optimization (Pso) AlgorithmDocument26 pagesA Review of Particle Swarm Optimization (Pso) AlgorithmIAEME PublicationNo ratings yet

- Financial Literacy On Investment Performance: The Mediating Effect of Big-Five Personality Traits ModelDocument9 pagesFinancial Literacy On Investment Performance: The Mediating Effect of Big-Five Personality Traits ModelIAEME PublicationNo ratings yet

- Knowledge Self-Efficacy and Research Collaboration Towards Knowledge Sharing: The Moderating Effect of Employee CommitmentDocument8 pagesKnowledge Self-Efficacy and Research Collaboration Towards Knowledge Sharing: The Moderating Effect of Employee CommitmentIAEME PublicationNo ratings yet

- Moderating Effect of Job Satisfaction On Turnover Intention and Stress Burnout Among Employees in The Information Technology SectorDocument7 pagesModerating Effect of Job Satisfaction On Turnover Intention and Stress Burnout Among Employees in The Information Technology SectorIAEME PublicationNo ratings yet

- Quality of Work-Life On Employee Retention and Job Satisfaction: The Moderating Role of Job PerformanceDocument7 pagesQuality of Work-Life On Employee Retention and Job Satisfaction: The Moderating Role of Job PerformanceIAEME PublicationNo ratings yet

- Analysis On Machine Cell Recognition and Detaching From Neural SystemsDocument9 pagesAnalysis On Machine Cell Recognition and Detaching From Neural SystemsIAEME PublicationNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Business Management LatestDocument16 pagesBusiness Management LatestNathaniel T. GuanzonNo ratings yet

- 1.1. Problems On VAT (With Answers and Solutions) - PDF - Value Added Tax - Invoice PDFDocument60 pages1.1. Problems On VAT (With Answers and Solutions) - PDF - Value Added Tax - Invoice PDFMarjorie Joyce BarituaNo ratings yet

- SK Illustrative Problems - For All SessionsDocument6 pagesSK Illustrative Problems - For All SessionsLea Mae JenNo ratings yet

- 124.J & P Services Pty Limited ABNDocument2 pages124.J & P Services Pty Limited ABNFlinders TrusteesNo ratings yet

- Search Report New FormatDocument9 pagesSearch Report New FormatSiddharth Pratap Singh Chauhan100% (1)

- Chapter 9 The Analysis of Competitive MarketsDocument16 pagesChapter 9 The Analysis of Competitive MarketsRitesh RajNo ratings yet

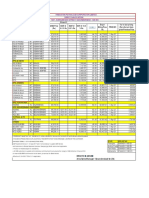

- MTP 2 AccountsDocument8 pagesMTP 2 AccountssuzalaggarwalllNo ratings yet

- Requirement: Determine The Financial Liabilities To Be Disclosed in The NotesDocument4 pagesRequirement: Determine The Financial Liabilities To Be Disclosed in The NotesInvisible CionNo ratings yet

- Itr 2018-19 PDFDocument1 pageItr 2018-19 PDFMalik MuzafferNo ratings yet

- Chapter 3 Recognizing Assessing and Exploiting Opportunities Autosaved AutosavedDocument37 pagesChapter 3 Recognizing Assessing and Exploiting Opportunities Autosaved Autosavedyametehhhh9No ratings yet

- Finals PPT Notes - Economic DevelopmentDocument6 pagesFinals PPT Notes - Economic DevelopmentGRACELINE JOY TOMENo ratings yet

- Subject: Globalisation Law and Justice Assignment in Lieu of AttendanceDocument3 pagesSubject: Globalisation Law and Justice Assignment in Lieu of AttendanceSHUBHANGI SINGH 21123107No ratings yet

- Group 2: Wilkins, A Zurn Company: Aggregate Production PlanningDocument10 pagesGroup 2: Wilkins, A Zurn Company: Aggregate Production PlanningSiddhant SinghNo ratings yet

- Rule On Guardianship of MinorsDocument9 pagesRule On Guardianship of MinorsZen ArinesNo ratings yet

- Global Industry Forecast - Engineering and Metal Goods Q4 2022Document18 pagesGlobal Industry Forecast - Engineering and Metal Goods Q4 2022nguyen minhanhNo ratings yet

- Alternative Model For Land ProcurementDocument55 pagesAlternative Model For Land ProcurementKudlappa DesaiNo ratings yet

- DocubDocument24 pagesDocubGayli Cortiguerra100% (1)

- Unifoam Cost Project PDF FreeDocument21 pagesUnifoam Cost Project PDF Freekh.srm.ukNo ratings yet

- Equity Analysis of Vodafone PLCDocument11 pagesEquity Analysis of Vodafone PLCBethelNo ratings yet

- Wolfx Signals ®Document9 pagesWolfx Signals ®Fale MensNo ratings yet

- 1Q21 Profit in Line With Estimates: SM Investments CorporationDocument8 pages1Q21 Profit in Line With Estimates: SM Investments CorporationJajahinaNo ratings yet

- Armstrong Product GuideDocument101 pagesArmstrong Product GuideKenji TanNo ratings yet

- MSTC Limited - DRHP - Final - 20190205122416Document338 pagesMSTC Limited - DRHP - Final - 20190205122416SubscriptionNo ratings yet

- 3.earnings Per ShareDocument13 pages3.earnings Per ShareTsekeNo ratings yet

- Dates Fresh and Dried Sector 2021Document13 pagesDates Fresh and Dried Sector 2021FileuploaderNo ratings yet

- Birla Sun Life Mutual FundDocument84 pagesBirla Sun Life Mutual FundRoushan RajNo ratings yet

- Assignment 1:: Secutrities Analysis & Portfolio ManagementDocument37 pagesAssignment 1:: Secutrities Analysis & Portfolio ManagementsnehaaggarwalNo ratings yet

- HPCL - PRICE - LIST - EFF-1st April 2021Document1 pageHPCL - PRICE - LIST - EFF-1st April 2021aee lweNo ratings yet

- Kina Bank Fees Charges ScheduleDocument15 pagesKina Bank Fees Charges SchedulemarcialitovivaresNo ratings yet

- Life Insurance Premium ReceiptDocument1 pageLife Insurance Premium ReceiptChandPari AkulNo ratings yet