Professional Documents

Culture Documents

Forms of Business Ownership

Uploaded by

Ajay KaundalOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Forms of Business Ownership

Uploaded by

Ajay KaundalCopyright:

Available Formats

ESSENTIALS OF ENTREPRENEURSHIP AND SMALL BUSINESS MANAGEMENT 6E

Chapter 5: Forms of Business Organization

CHAPTER

Choosing a Form of Ownership

Forms of

Business Ownership

Copyright

2011 Pearson Education, Inc. Publishing as Prentice Hall

Ch, 5: Forms of Business Ownership

Copyright

Copyright

5-3

2011 Pearson Education, Inc. Publishing as Prentice Hall

2011 Pearson Education, Inc. Publishing as Prentice Hall

The best form of ownership depends on

an entrepreneurs particular situation.

Key: Understanding the characteristics of

each form of ownership and how well they

match an entrepreneurs business and

personal circumstances.

Copyright

5-2

2011 Pearson Education, Inc. Publishing as Prentice Hall

Major Forms of Ownership

Tax considerations

Liability exposure

Start-up and future capital requirements

Control

Managerial ability

Business goals

Management succession plans

Cost of formation

Ch, 5: Forms of Business Ownership

There is no one best form of ownership.

Ch, 5: Forms of Business Ownership

Factors Affecting the Choice

Sole Proprietorship

Partnership

Corporation

S Corporation

Limited Liability Company

Joint Venture

Ch, 5: Forms of Business Ownership

Copyright

5-4

2011 Pearson Education, Inc. Publishing as Prentice Hall

FIGURE 5.1 (A)

FIGURE 5.1 (B)

Forms of Business

Ownership

Percentage of Business

Forms of Business

Ownership Percentage of Sales

5-5

Ch, 5: Forms of Business Ownership

Copyright

2011 Pearson Education, Inc. Publishing as Prentice Hall

5-6

ESSENTIALS OF ENTREPRENEURSHIP AND SMALL BUSINESS MANAGEMENT 6E

Chapter 5: Forms of Business Organization

Advantages of the

Sole Proprietorship

Ch, 5: Forms of Business Ownership

Copyright

Simple to create

Least costly form to begin

Profit incentive

Total decision making authority

FIGURE 5.1 (C)

No special legal restrictions

Forms of Business

Ownership Percentage of Sales

Easy to discontinue

2011 Pearson Education, Inc. Publishing as Prentice Hall

5-7

Ch, 5: Forms of Business Ownership

Disadvantages of the

Sole Proprietorship

Copyright

2011 Pearson Education, Inc. Publishing as Prentice Hall

5-8

Liability Features of the Basic

Forms of Ownership

Sole Proprietorship

Unlimited personal liability

Claims of Sole Proprietors Creditors

Sole Proprietors Personal Assets

Ch, 5: Forms of Business Ownership

Copyright

2011 Pearson Education, Inc. Publishing as Prentice Hall

5-9

Ch, 5: Forms of Business Ownership

Disadvantages of the

Sole Proprietorship

Unlimited personal liability

Limited skills and capabilities

Feelings of isolation

Limited access to capital

Lack of continuity of the business

Ch, 5: Forms of Business Ownership

Copyright

2011 Pearson Education, Inc. Publishing as Prentice Hall

Copyright

2011 Pearson Education, Inc. Publishing as Prentice Hall

5 - 10

Partnership

5 - 11

An association of two or more people

who co-own a business for the

purpose of making a profit.

Always wise to create a partnership

agreement.

The best partnerships are

built on trust and respect.

Ch, 5: Forms of Business Ownership

Copyright

2011 Pearson Education, Inc. Publishing as Prentice Hall

5 - 12

ESSENTIALS OF ENTREPRENEURSHIP AND SMALL BUSINESS MANAGEMENT 6E

Chapter 5: Forms of Business Organization

Types of Partners

Advantages of the Partnership

General partners

Easy to establish

Complementary skills of partners

Division of profits

Larger pool of capital

Ability to attract limited partners

Ch, 5: Forms of Business Ownership

Copyright

Take an active role in managing a business.

Have unlimited liability for the partnerships

debts.

Every partnership must have at least one

general partner.

Cannot participate in the day-to-day

management of a company.

Have limited liability for the partnerships

debts.

5 - 13

2011 Pearson Education, Inc. Publishing as Prentice Hall

Limited partners

Ch, 5: Forms of Business Ownership

Easy to establish

Complementary skills of partners

Division of profits

Larger pool of capital

Ability to attract limited partners

Minimal government regulation

Flexibility

Taxation

Ch, 5: Forms of Business Ownership

Copyright

5 - 15

2011 Pearson Education, Inc. Publishing as Prentice Hall

Claims of Partnerships Creditors

Ch, 5: Forms of Business Ownership

Copyright

2011 Pearson Education, Inc. Publishing as Prentice Hall

Copyright

2011 Pearson Education, Inc. Publishing as Prentice Hall

5 - 16

Disadvantages of the

Partnership

Partnership

Partnerships Assets

5 - 14

Unlimited liability of at least one

partner

Ch, 5: Forms of Business Ownership

Liability Features of the Basic

Forms of Ownership

General

Partners

Personal

Assets

2011 Pearson Education, Inc. Publishing as Prentice Hall

Disadvantages of the

Partnership

Advantages of the Partnership

Copyright

General

Partners

Personal

Assets

5 - 17

Unlimited liability of at least one partner

Capital accumulation

Difficulty in disposing of partnership

interest without dissolving the partnership

Lack of continuity

Potential for personality and authority

conflicts

Partners bound by law of agency

Ch, 5: Forms of Business Ownership

Copyright

2011 Pearson Education, Inc. Publishing as Prentice Hall

5 - 18

ESSENTIALS OF ENTREPRENEURSHIP AND SMALL BUSINESS MANAGEMENT 6E

Chapter 5: Forms of Business Organization

Corporation

Limited Partnership

A partnership composed of at least

one general partner and one or more

limited partners.

A general partner in this partnership

is treated exactly as in a general

partnership.

A limited partner has limited

liability and is treated as an

investor in the business.

Ch, 5: Forms of Business Ownership

Copyright

2011 Pearson Education, Inc. Publishing as Prentice Hall

A separate legal entity from its owners.

Types of corporations:

Domestic a corporation doing business

in the state in which it is incorporated.

Foreign a corporation doing business in

a state other than the state in which it is

incorporated.

Alien a corporation formed in another

country but doing business in the United

States.

5 - 19

Corporation

Ch, 5: Forms of Business Ownership

Copyright

2011 Pearson Education, Inc. Publishing as Prentice Hall

5 - 20

Advantages of the Corporation

Types of corporations:

Publicly held a corporation that has

a large number of shareholders and

whose stock usually is traded on one

of the large stock exchanges.

Closely held a corporation in which

shares are controlled by a relatively

small number of people, often family

members, relatives, or friends.

Ch, 5: Forms of Business Ownership

Copyright

2011 Pearson Education, Inc. Publishing as Prentice Hall

5 - 21

Liability Features of the Basic

Forms of Ownership

Ch, 5: Forms of Business Ownership

Claims of Corporations Creditors

Corporations Assets

Ch, 5: Forms of Business Ownership

Copyright

Copyright

2011 Pearson Education, Inc. Publishing as Prentice Hall

5 - 22

Advantages of the Corporation

Corporation

Shareholders

Personal Assets

Limited liability of stockholders

Limited liability of stockholders

Ability to attract capital

Ability to continue indefinitely

Transferable ownership

Shareholders

Personal Assets

2011 Pearson Education, Inc. Publishing as Prentice Hall

5 - 23

Ch, 5: Forms of Business Ownership

Copyright

2011 Pearson Education, Inc. Publishing as Prentice Hall

5 - 24

ESSENTIALS OF ENTREPRENEURSHIP AND SMALL BUSINESS MANAGEMENT 6E

Chapter 5: Forms of Business Organization

Disadvantages of the

Corporation

Cost and time of incorporation process

Double taxation

Potential for diminished managerial

incentives

Legal requirements and regulatory red

tape

Potential loss of control by founder(s)

Ch, 5: Forms of Business Ownership

Copyright

2011 Pearson Education, Inc. Publishing as Prentice Hall

S Corporation

5 - 25

No different from any other corporation

from a legal perspective.

An S corporation is taxed like a partnership,

passing all of its profits (or losses) through

to individual shareholders.

To elect S status, all shareholders must

consent, and the corporation must file with

the IRS within the first 75 days of its tax

year.

Ch, 5: Forms of Business Ownership

S-Corporation

Claims of S-Corporations Creditors

S-Corporations Assets

Ch, 5: Forms of Business Ownership

Copyright

2011 Pearson Education, Inc. Publishing as Prentice Hall

5 - 26

Limited Liability Company

(LLC)

Liability Features of the Basic

Forms of Ownership

Shareholders

Personal Assets

Copyright

Resembles an S Corporation but is

not subject to the same restrictions.

Two documents required:

Articles of organization

Operating agreement

Shareholders

Personal Assets

2011 Pearson Education, Inc. Publishing as Prentice Hall

5 - 27

Ch, 5: Forms of Business Ownership

Copyright

2011 Pearson Education, Inc. Publishing as Prentice Hall

Limited Liability Company

(LLC)

Liability Features of the Basic

Forms of Ownership

An LLC cannot have more than two of

Limited Liability Company - LLC

these four corporate characteristics:

Claims of LLCs Creditors

5 - 28

1. Limited liability

2. Continuity of life

LLCs Assets

3. Free transferability of interest

4. Centralized management

Ch, 5: Forms of Business Ownership

Copyright

2011 Pearson Education, Inc. Publishing as Prentice Hall

Members

Personal Assets

5 - 29

Ch, 5: Forms of Business Ownership

Copyright

Members

Personal Assets

2011 Pearson Education, Inc. Publishing as Prentice Hall

5 - 30

ESSENTIALS OF ENTREPRENEURSHIP AND SMALL BUSINESS MANAGEMENT 6E

Chapter 5: Forms of Business Organization

The Professional Corporation

The Joint Venture

Designed for professions lawyers,

doctors, dentists, accountants and other

professionals

Much like a partnership, but it:

Is formed for a specific purpose

Created in the same manner as a

corporation

Has a beginning and an end

Identified by the abbreviations:

P.C. Professional Corporation

P.A. Professional Association

S.C. Service Corporation

Ch, 5: Forms of Business Ownership

Copyright

2011 Pearson Education, Inc. Publishing as Prentice Hall

5 - 31

Ch, 5: Forms of Business Ownership

Copyright

2011 Pearson Education, Inc. Publishing as Prentice Hall

5 - 32

Conclusion

The right choice of the form of

ownership is unique to every

entrepreneur and their business.

Each form has advantages and

disadvantages.

The entrepreneur must be thoughtful

All rights reserved. No part of this publication may be

reproduced, stored in a retrieval system, or transmitted, in any

form or by any means, electronic, mechanical, photocopying,

recording, or otherwise, without the prior written permission of

the publisher. Printed in the United States of America.

and strategic about this important

decision.

Ch, 5: Forms of Business Ownership

Copyright

2011 Pearson Education, Inc. Publishing as Prentice Hall

5 - 33

Ch, 5: Forms of Business Ownership

Copyright

2011 Pearson Education, Inc. Publishing as Prentice Hall

5 - 34

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Republic vs. Santos IIIDocument24 pagesRepublic vs. Santos IIIMirzi Olga Breech SilangNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- Land Laws 4Document23 pagesLand Laws 4Krishna KishoreNo ratings yet

- Property OutlineDocument198 pagesProperty Outlinedollyccruz100% (1)

- Project ManagementDocument16 pagesProject ManagementAjay KaundalNo ratings yet

- Design Build AgreementDocument7 pagesDesign Build AgreementJaseTanNo ratings yet

- Balus Vs Balus Case DigestDocument3 pagesBalus Vs Balus Case DigestHanna TevesNo ratings yet

- Article 1459 SalesDocument2 pagesArticle 1459 SalesLeoj Anule0% (1)

- Balus Vs BalusDocument6 pagesBalus Vs BalusSachuzen23No ratings yet

- Sec 104-106 Certificate of Land TransferDocument6 pagesSec 104-106 Certificate of Land TransferEi Ar TaradjiNo ratings yet

- 1.1.1. Cheng V Genato - DigestDocument3 pages1.1.1. Cheng V Genato - DigestKate GaroNo ratings yet

- Certificate: Ref: - DateDocument4 pagesCertificate: Ref: - DateAjay KaundalNo ratings yet

- Project Report: The Comparative Study of Public Sector and Private Sector Insurance Company (L.i.c and HDFC SLIC)Document1 pageProject Report: The Comparative Study of Public Sector and Private Sector Insurance Company (L.i.c and HDFC SLIC)Ajay KaundalNo ratings yet

- Laureate Institute of Management and Info. Tech., Kathog Laureate Institute of Management and Info. Tech., KathogDocument5 pagesLaureate Institute of Management and Info. Tech., Kathog Laureate Institute of Management and Info. Tech., KathogAjay KaundalNo ratings yet

- Online Project Management System: Six Month Training SynopsisDocument2 pagesOnline Project Management System: Six Month Training SynopsisAjay KaundalNo ratings yet

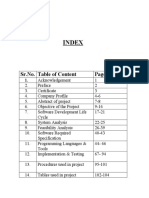

- Index: 1. Introduction To Project 1Document1 pageIndex: 1. Introduction To Project 1Ajay KaundalNo ratings yet

- AcknowledgementDocument3 pagesAcknowledgementAjay KaundalNo ratings yet

- Introduction To The ProjectDocument24 pagesIntroduction To The ProjectAjay KaundalNo ratings yet

- Factors in Plant Location SelectionDocument80 pagesFactors in Plant Location SelectionAjay KaundalNo ratings yet

- Project Report: Financial Analysis and Projection of Working Capital Requirements of Indswift Laboratories LTDDocument1 pageProject Report: Financial Analysis and Projection of Working Capital Requirements of Indswift Laboratories LTDAjay KaundalNo ratings yet

- Index: SR - No. Table of Content Page NoDocument2 pagesIndex: SR - No. Table of Content Page NoAjay KaundalNo ratings yet

- Table of ContentsDocument1 pageTable of ContentsAjay KaundalNo ratings yet

- International Trade: Economics and PolicyDocument24 pagesInternational Trade: Economics and PolicyAjay KaundalNo ratings yet

- 2012 Lecture Notes International Trade Policy 2010 - 129817278416252500 PDFDocument45 pages2012 Lecture Notes International Trade Policy 2010 - 129817278416252500 PDFAjay KaundalNo ratings yet

- Curriculum Vitae: Arun Kumar JaswalDocument2 pagesCurriculum Vitae: Arun Kumar JaswalAjay KaundalNo ratings yet

- Entrepreneurial Development: NotesDocument2 pagesEntrepreneurial Development: NotesAjay KaundalNo ratings yet

- Curriculum Vitae: Abhinav SharmaDocument2 pagesCurriculum Vitae: Abhinav SharmaAjay KaundalNo ratings yet

- 2012 Lecture Notes International Trade Policy 2010 - 129817278416252500 PDFDocument45 pages2012 Lecture Notes International Trade Policy 2010 - 129817278416252500 PDFAjay KaundalNo ratings yet

- Glossary of Key Terms: International EconomicsDocument21 pagesGlossary of Key Terms: International EconomicsAjay KaundalNo ratings yet

- Iii. International Trade: A. Gains From Trade - A History of Thought ApproachDocument11 pagesIii. International Trade: A. Gains From Trade - A History of Thought ApproachAjay KaundalNo ratings yet

- Company Profile: The Kangra Cooperative Bank Ltd. Started in A Very Humble Way As A Small Thrift/Credit SocietyDocument47 pagesCompany Profile: The Kangra Cooperative Bank Ltd. Started in A Very Humble Way As A Small Thrift/Credit SocietyAjay KaundalNo ratings yet

- Clyde Pumps India Private LimitedDocument4 pagesClyde Pumps India Private LimitedAjay KaundalNo ratings yet

- Eco MCQDocument2 pagesEco MCQAjay KaundalNo ratings yet

- Income From House PropertyDocument6 pagesIncome From House PropertyKamini PawarNo ratings yet

- Lilian Capitle V de GabanDocument2 pagesLilian Capitle V de GabanJohn YeungNo ratings yet

- Lecture Notes 1&2Document19 pagesLecture Notes 1&2VanillaheroineNo ratings yet

- Mar Yuson Vs Atty. Jeremias R. Vitan A.C. No. 6955, July 27, 2006 FactsDocument5 pagesMar Yuson Vs Atty. Jeremias R. Vitan A.C. No. 6955, July 27, 2006 Factsnicole coNo ratings yet

- Community Land Trusts: A Radical or Reformist Response To The Housing Question Today?Document26 pagesCommunity Land Trusts: A Radical or Reformist Response To The Housing Question Today?AlanNo ratings yet

- ASC Focus Proliferation of Private Equity Investment in ASCsDocument4 pagesASC Focus Proliferation of Private Equity Investment in ASCsRonit MirchandaniNo ratings yet

- Código Civil CaliforniaDocument10 pagesCódigo Civil CaliforniaCarla PieriniNo ratings yet

- Retrospective Operation of Statutes Relating To Succession and Transfer.Document3 pagesRetrospective Operation of Statutes Relating To Succession and Transfer.ramanjeet singhNo ratings yet

- Midway Maritime and Technological Foundation vs. CastroDocument5 pagesMidway Maritime and Technological Foundation vs. CastroSangguniang Kabataan Distrito TresNo ratings yet

- Form of BussinessDocument73 pagesForm of BussinessmousumiinderNo ratings yet

- Transcribed Notes 1Document11 pagesTranscribed Notes 1Benedict Lim RosarioNo ratings yet

- JMA Vs Land BankDocument10 pagesJMA Vs Land BankFacio BoniNo ratings yet

- Property Law ProjectDocument15 pagesProperty Law ProjectAnkit Nande100% (1)

- HFL PortfolioDocument5 pagesHFL PortfolioZahira Shaik OmarNo ratings yet

- 2nd AssignmentDocument3 pages2nd AssignmentFriekis Tan-ganNo ratings yet

- Corpo Odd Number Digest NaDocument20 pagesCorpo Odd Number Digest NaYsabelleNo ratings yet

- 3 Carino V Insular Government G.R. No. 2869Document2 pages3 Carino V Insular Government G.R. No. 2869April Eloise M. Borja0% (1)

- Pichel V AlonzoDocument2 pagesPichel V AlonzoTerence Mark Arthur FerrerNo ratings yet

- Subject: Transfer of Property Topic: Restriction Regarding Enjoyment With Special Refference ToDocument2 pagesSubject: Transfer of Property Topic: Restriction Regarding Enjoyment With Special Refference ToanushaNo ratings yet

- Petreport 2411218Document371 pagesPetreport 2411218plantree venturesNo ratings yet

- GEMS - Notifications Tutorial - v005 - L4 - Master PDFDocument21 pagesGEMS - Notifications Tutorial - v005 - L4 - Master PDFDenis GrienenbergerNo ratings yet