Professional Documents

Culture Documents

Birla Sun Life Frontline Equity Fund: Investment Objective

Uploaded by

hnarwalOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Birla Sun Life Frontline Equity Fund: Investment Objective

Uploaded by

hnarwalCopyright:

Available Formats

h

alt n

We atio s

n

e

Cr lutio

So

Birla Sun Life Frontline Equity Fund

As on September 30, 2009

Investment Style Box

Investment Objective

Investment Style

Value

Blend

Growth

Size

An open-ended growth scheme with the objective of long term growth of capital, through a portfolio with a target allocation of 100% equity by

aiming at being as diversified across various industries and or sectors as its chosen benchmark index, BSE 200.

Large

Investment Performance

Mid

Small

50

44.39

40

Key Features

Default option

Plan A

Fresh Purchase

Additional Purchase

Plan B

Fresh Purchase

Additional Purchase

Redemption Cheques

issued

Systematic Investment

Plan (SIP)

Systematic Withdrawal

Plan (SWP)

Systematic Transfer

Plan (STP)

:

:

:

:

:

Mr. Mahesh Patil

October 01,2006

20 years

August 30, 2002

An Open-ended Growth Scheme

Plan A/Dividend Reinvestment

:

:

Rs. 5000/Rs. 1000/-

:

:

:

Rs. 2,00,000/Rs. 1000/Within 10 working days

Available

Available

Available

Plans / Options & NAV (As on September 30, 2009)

Plan A

Dividend

:

22.07

20

11.56

10

0

3 Years

1 Year

Birla Sun Life Frontline Equity Fund Plan A - Growth

5 Years

Since Inception

Past performance may or may not be sustained in future. Returns are in % and

absolute returns for period less than 1 year & CAGR for period 1 year or more.

BSE 200

Systematic Investment Plan (SIP)

SIP is a powerful tool that can help you create wealth over time. If you had invested in Birla Sun Life Frontline Equity Fund...

Value (Rs.) of SIP in

Total Investment

(Rs.)

BSE 200

Since Inception

84000

Last 5 years

60000

Investment Period

Returns (%)*

Birla Sun Life

Frontline Equity Fund

BSE 200

Birla Sun Life

Frontline Equity Fund

194774

245516

23.62

30.19

94878

111729

18.39

25.15

Last 3 years

36000

45819

49648

16.32

22.05

Last 1 year

12000

18590

18469

116.00

113.66

11.28

Date of First Installment : October 01, 2002

The data assumes the investment of Rs.1,000/- on 1st day of every month or the subsequent working day. Load and Taxes are not considered for computation of

returns. Past performance may or may not be sustained in future.

*CAGR Returns are computed after accounting for the cash flow by using the XIRR method (investment internal rate of return)

(Payout, Reinvestment & Sweep)

Growth

17.95

74.65

(With/without Trigger Facility)

Plan B

Dividend

27.33

22.95

(Payout, Reinvestment & Sweep)

Growth

32.78

30

% Returns

Fund Manager

Managing Fund Since

Total Experience

Date of inception

Nature of the scheme

34.66

29.89

Fund Details

11.28

:

:

BSE 200

Rs. 1,219.03 Crores

(With/without Trigger Facility)

Benchmark

Average AUM

Load Structure (Incl for SIP)

Entry Load

:

Exit Load**

Other Parameter

Standard Deviation

Sharpe Ratio##

Beta

:

:

:

Portfolio & Asset Allocation

Issuer

% to Net

Assets

Nil

1% if redeemed / switched out

within 365 days from the date of

allotment

**Exit / Entry Load is NIL for units

issued in Bonus & Dividend

Reinvestment.

33.71%

0.45

0.85

Note:

Standard Deviation, Sharpe Ratio & Beta are calculated on Annualised basis using

3 years history of monthly returns, source: MFI Explorer

##Risk-free rate assumed to be 3.42%(91 day T-bill yield as on September 29, 2009)

Banks

ICICI Bank Ltd.

Axis Bank Ltd.

State Bank of India

HDFC Bank Ltd.

Bank of Baroda

ING Vysya Bank Ltd.

Kotak Mahindra Bank Ltd.

13.85

2.90

2.51

2.06

1.95

1.57

1.48

1.39

Issuer

% to Net

Assets

Issuer

Reliance Communications Ltd.

2.00

Cipla Ltd.

1.22

Construction Project

Punj Lloyd Ltd.

Larsen & Toubro Ltd.

LANCO Infratech Ltd.

Nagarjuna Construction Company Ltd.

5.85

1.67

1.59

1.56

1.03

Non - Ferrous Metals

Sterlite Industries (India) Ltd.

1.72

1.72

Minerals/Mining

Sesa Goa Ltd.

1.38

1.38

Oil

Oil & Natural Gas Corporation Ltd.

Cairn India Ltd.

Oil India Ltd

5.22

3.61

1.36

0.25

Industrial Products

Cummins India Ltd.

1.37

1.37

Auto

Tata Motors Ltd.

Mahindra & Mahindra Ltd.

Bajaj Auto Ltd.

5.12

2.01

1.95

1.16

Consumer Non Durables

ITC Ltd.

United Spirits Ltd.

Balrampur Chini Mills Ltd.

5.09

2.84

1.22

1.04

Finance

Rural Electrification Corporation Ltd.

LIC Housing Finance Ltd.

HDFC Ltd.

Power Finance Corporation Ltd

3.95

1.18

1.14

0.89

0.75

Diversified

Hindustan Unilever Ltd.

Software

Infosys Technologies Ltd.

Tata Consultancy Services Ltd.

Mphasis Ltd.

Wipro Ltd.

9.77

4.24

2.89

1.73

0.91

Petroleum Products

Reliance Industries Ltd.

Indian Oil Corporation Ltd.

Hindustan Petroleum Corporation Ltd.

7.33

5.10

1.57

0.66

Power

Reliance Infrastructure Ltd.

CESC Ltd.

Torrent Power Ltd.

Tata Power Company Ltd.

NTPC Ltd.

PTC India Ltd

7.22

1.29

1.28

1.24

1.18

1.13

1.10

Industrial Capital Goods

Bharat Heavy Electricals Ltd.

BEML Ltd.

Crompton Greaves Ltd.

Siemens Ltd.

Alstom Projects India Ltd.

Bharat Electronics Ltd.

7.17

1.78

1.33

1.29

1.06

1.03

0.67

Cement

Jaiprakash Associates Ltd.

Grasim Industries Ltd.

3.49

1.77

1.72

Future and Options

Cipla Ltd Fut Oct 2009

CNX Nifty Futures Oct 2009

Construction

Housing Development & Infrastructure Ltd

IVRCL Infrastructures & Projects Ltd.

2.64

1.99

0.65

Cash & Cash Equivalents

2.73

Net receivables / payables

4.45

Telecom-Services

Bharti Airtel Ltd.

5.87

3.87

Pharmaceuticals

Dr.Reddys Laboratories Ltd.

2.62

1.40

Total Net Assets

Media & Entertainment

Zee Entertainment Enterprises Ltd.

1.18

1.18

Gas

GAIL India Ltd.

1.16

1.16

United Kingdom

Tata Steel Ltd GDR

1.09

1.09

Hotels

Indian Hotels Company Limited

1.04

1.04

Ferrous Metals

Tata Steel Limited

0.86

0.86

0.79

0.79

-2.97

0.17

-3.14

100.00

Value Research Rating#

CRISIL~CPR 1^^

Birla Sun Life Frontline Equity Fund

Birla Sun Life Frontline Equity Fund

Diversified Equity Scheme (72 Schemes), 2 Yrs ended 30-Jun-09

Equity: Diversified (148 Schemes), for 3 & 5 Years periods ending 30-Sep-09

5-Star Award by ICRA

Birla Sun Life Frontline Equity Fund

Open Ended Diversified Equity - Defensive (55 Schemes), 3 year ended 31-Dec-08

5-Star Award by ICRA

Birla Sun Life Frontline Equity Fund

Open Ended Diversified Equity - Defensive (62 Schemes), 1 year ended 31-Dec-08

(Past performance is no guarantee of future results.) for ranking methodology please refer page 53

26

% to Net

Assets

You might also like

- Live Project: Financial Planning For Hawkers GROUP 4 (PG SEC-B 2011-2012)Document15 pagesLive Project: Financial Planning For Hawkers GROUP 4 (PG SEC-B 2011-2012)Shakthi ShankaranNo ratings yet

- Combined Factsheet Nov11Document17 pagesCombined Factsheet Nov11friendrocks20079017No ratings yet

- Sector Allocation: Reliance Vision Fund Vs BSE 100Document2 pagesSector Allocation: Reliance Vision Fund Vs BSE 100Rijo PhilipsNo ratings yet

- HDFC Top 200 Fund LeafletDocument4 pagesHDFC Top 200 Fund LeafletNandakumar GanesamoorthyNo ratings yet

- Future DRDocument34 pagesFuture DRarpitimsrNo ratings yet

- Factsheet August 2012 V10Document13 pagesFactsheet August 2012 V10Roshni BhatiaNo ratings yet

- Axis Factsheet February 2015Document20 pagesAxis Factsheet February 2015Sumit GuptaNo ratings yet

- Franklin India Taxshield FIT: PortfolioDocument1 pageFranklin India Taxshield FIT: PortfolioShekhar KapoorNo ratings yet

- Stock-Tracker Investor Policy Statement: & Portfolio AnalysisDocument8 pagesStock-Tracker Investor Policy Statement: & Portfolio AnalysisTanmay YadavNo ratings yet

- PRESENTATION ON FINANCIAL MANAGEMENT - Copy124524Document34 pagesPRESENTATION ON FINANCIAL MANAGEMENT - Copy1245249824534642No ratings yet

- SBI Securities Morning Update - 27-10-2022Document5 pagesSBI Securities Morning Update - 27-10-2022deepaksinghbishtNo ratings yet

- Daily Equity Report 2 February 2015Document4 pagesDaily Equity Report 2 February 2015NehaSharmaNo ratings yet

- L&T Tax Saver Fund Application FormDocument32 pagesL&T Tax Saver Fund Application FormPrajna CapitalNo ratings yet

- One From Everyone NEWDocument14 pagesOne From Everyone NEWPratik KathuriaNo ratings yet

- UTI Fund Guide: Investment Options from India's Largest Mutual FundDocument17 pagesUTI Fund Guide: Investment Options from India's Largest Mutual FundRaj KumarNo ratings yet

- India Bulls Securities LTDDocument13 pagesIndia Bulls Securities LTDTiny TwixNo ratings yet

- State Bank of IndiaDocument30 pagesState Bank of IndiaSahil ChhibberNo ratings yet

- Ashok Ley LandDocument105 pagesAshok Ley LandAmit NagarNo ratings yet

- SBI Emerging Businesses1Document4 pagesSBI Emerging Businesses1Ram AgarwalNo ratings yet

- SBI Securities Morning Update - 21-10-2022Document5 pagesSBI Securities Morning Update - 21-10-2022deepaksinghbishtNo ratings yet

- SBI Mutual Funds PresentationDocument21 pagesSBI Mutual Funds Presentationtoff1410No ratings yet

- HSTL Annual-Report 2021Document72 pagesHSTL Annual-Report 2021ums 3vikramNo ratings yet

- Research: Sintex Industries LimitedDocument4 pagesResearch: Sintex Industries LimitedMohd KaifNo ratings yet

- Coal India Limited FinalDocument30 pagesCoal India Limited FinaladihonNo ratings yet

- SBI Securities Morning Update - 06-10-2022Document5 pagesSBI Securities Morning Update - 06-10-2022deepaksinghbishtNo ratings yet

- Reliance A Debt Free CompanyDocument13 pagesReliance A Debt Free Companypulimi manojNo ratings yet

- SBI Securities Morning Update - 18-01-2023Document7 pagesSBI Securities Morning Update - 18-01-2023deepaksinghbishtNo ratings yet

- Entrepreneurship ManagementDocument33 pagesEntrepreneurship ManagementhinalviraNo ratings yet

- Annual Report 07 08Document142 pagesAnnual Report 07 08jagat_sabatNo ratings yet

- PTC India Financial Services: IPO Fact SheetDocument4 pagesPTC India Financial Services: IPO Fact SheetVicky ShahNo ratings yet

- Financial Reporting & Analysis Session Provides InsightsDocument41 pagesFinancial Reporting & Analysis Session Provides InsightspremoshinNo ratings yet

- Boost savings and returns with Axis Long Term Equity FundDocument2 pagesBoost savings and returns with Axis Long Term Equity FundAmandeep SharmaNo ratings yet

- Bajaj Finserv LimitedDocument31 pagesBajaj Finserv LimitedDinesh Gehi DGNo ratings yet

- Bajaj Finance LTD PresentationDocument31 pagesBajaj Finance LTD Presentationanon_395825960100% (2)

- Capital Budgeting of ITC Company LimitedDocument12 pagesCapital Budgeting of ITC Company LimitedRama Sardesai50% (2)

- Kotak Mahindra Mutual FundDocument30 pagesKotak Mahindra Mutual FundSandeep KhatwaniNo ratings yet

- Mirae Asset Funds Speak April 2014Document15 pagesMirae Asset Funds Speak April 2014Prasad JadhavNo ratings yet

- HDFC Mutual Fund ListDocument60 pagesHDFC Mutual Fund Listhshah21No ratings yet

- SID ABSL Equity Hybrid 95 Fund 010620Document82 pagesSID ABSL Equity Hybrid 95 Fund 010620Sujeet YadavNo ratings yet

- S&A KS - MSME Stimulus - UpdateV7Document5 pagesS&A KS - MSME Stimulus - UpdateV7Shatir LaundaNo ratings yet

- CAP II Group II June 2022Document97 pagesCAP II Group II June 2022aneupane465No ratings yet

- Sundaram Select MidcapDocument2 pagesSundaram Select Midcapredchillies7No ratings yet

- Accounts Manual - Part 1Document28 pagesAccounts Manual - Part 1Kiran KothariNo ratings yet

- Sunrise Fund Pitchbook 1110v1Document16 pagesSunrise Fund Pitchbook 1110v1Kj NaveenNo ratings yet

- Outcome of Board Meeting - Scheme of Arrangement (Board Meeting)Document3 pagesOutcome of Board Meeting - Scheme of Arrangement (Board Meeting)Shyam SunderNo ratings yet

- Shriram Transport Finance Company LTD.: Investor PresentationDocument44 pagesShriram Transport Finance Company LTD.: Investor PresentationAbhishek AgarwalNo ratings yet

- Cebbco Spa 030412Document3 pagesCebbco Spa 030412RavenrageNo ratings yet

- SFM 5 PDFDocument4 pagesSFM 5 PDFketulNo ratings yet

- Institute of Cost and Management Accountants of Pakistan Spring (Summer) 2010 ExaminationsDocument4 pagesInstitute of Cost and Management Accountants of Pakistan Spring (Summer) 2010 ExaminationsIrfanNo ratings yet

- Bajaj Auto LTD: Presented By: Hitesh RameshDocument15 pagesBajaj Auto LTD: Presented By: Hitesh RameshnancyagarwalNo ratings yet

- Reliance Power Limited: IPO SnapshotDocument6 pagesReliance Power Limited: IPO SnapshotSandhya RanaNo ratings yet

- QR Sept10Document1 pageQR Sept10Sagar PatilNo ratings yet

- Dividend PolicyDocument8 pagesDividend PolicySumit PandeyNo ratings yet

- ICICI Prudential Mutual Fund's Performance AnalysisDocument27 pagesICICI Prudential Mutual Fund's Performance AnalysisBrojo MondalNo ratings yet

- Policies to Support the Development of Indonesia’s Manufacturing Sector during 2020–2024: A Joint ADB–BAPPENAS ReportFrom EverandPolicies to Support the Development of Indonesia’s Manufacturing Sector during 2020–2024: A Joint ADB–BAPPENAS ReportNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: 2020 EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: 2020 EditionNo ratings yet

- Credit Union Revenues World Summary: Market Values & Financials by CountryFrom EverandCredit Union Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Guidebook for Demand Aggregation: Way Forward for Rooftop Solar in IndiaFrom EverandGuidebook for Demand Aggregation: Way Forward for Rooftop Solar in IndiaNo ratings yet

- List of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosFrom EverandList of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosNo ratings yet

- Brezza Brand BrochureDocument12 pagesBrezza Brand BrochurehnarwalNo ratings yet

- The Option School - Option Strategies by IIM AlumnusDocument6 pagesThe Option School - Option Strategies by IIM Alumnushnarwal14% (7)

- High Turnover Companies ListDocument2 pagesHigh Turnover Companies ListhnarwalNo ratings yet

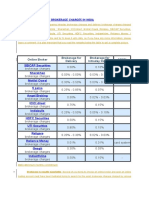

- Comparison Table of Brokerage Charges in IndiaDocument2 pagesComparison Table of Brokerage Charges in IndiahnarwalNo ratings yet

- Reliance Tax Saver (ELSS) Fund09 PDFDocument40 pagesReliance Tax Saver (ELSS) Fund09 PDFhnarwalNo ratings yet

- Discipline, Mental Skills, Psychology of Trading - LakhaniDocument4 pagesDiscipline, Mental Skills, Psychology of Trading - Lakhaniapurva100% (3)

- F&O MarginDocument7 pagesF&O MarginhnarwalNo ratings yet

- Andrews PitchforkDocument2 pagesAndrews PitchforkForex Fisher100% (1)

- Top 25 Interview Q&A for Big Data and AnalyticsDocument27 pagesTop 25 Interview Q&A for Big Data and AnalyticsSenthil KumarNo ratings yet

- AFP Invest PDFDocument3 pagesAFP Invest PDFhnarwalNo ratings yet

- Article 4Document31 pagesArticle 4Abdul OGNo ratings yet

- CMTD42M FDocument3 pagesCMTD42M FagengfirstyanNo ratings yet

- HealthFlex Dave BauzonDocument10 pagesHealthFlex Dave BauzonNino Dave Bauzon100% (1)

- 2011 Mid America - WebDocument156 pages2011 Mid America - WebFaronNo ratings yet

- BC Specialty Foods DirectoryDocument249 pagesBC Specialty Foods Directoryjcl_da_costa6894No ratings yet

- Ultrasonic Inspection Standards for Wrought MetalsDocument44 pagesUltrasonic Inspection Standards for Wrought Metalsdomsoneng100% (1)

- Broschuere Unternehmen Screen PDFDocument16 pagesBroschuere Unternehmen Screen PDFAnonymous rAFSAGDAEJNo ratings yet

- PDF Reply Position Paper For ComplainantDocument4 pagesPDF Reply Position Paper For ComplainantSheron Biase100% (1)

- DAP FullTextIntroductionByStuartLichtman PDFDocument21 pagesDAP FullTextIntroductionByStuartLichtman PDFAlejandro CordobaNo ratings yet

- Amended ComplaintDocument38 pagesAmended ComplaintDeadspinNo ratings yet

- Troubleshooting Edge Quality: Mild SteelDocument14 pagesTroubleshooting Edge Quality: Mild SteelAnonymous U6yVe8YYCNo ratings yet

- Sierra Wireless AirPrimeDocument2 pagesSierra Wireless AirPrimeAminullah -No ratings yet

- Management Reporter Integration Guide For Microsoft Dynamics® SLDocument22 pagesManagement Reporter Integration Guide For Microsoft Dynamics® SLobad2011No ratings yet

- City Gas Distribution ReportDocument22 pagesCity Gas Distribution Reportdimple1101100% (9)

- Department of Education: Republic of The PhilippinesDocument3 pagesDepartment of Education: Republic of The PhilippinesAdonis BesaNo ratings yet

- How To: Create A Clickable Table of Contents (TOC)Document10 pagesHow To: Create A Clickable Table of Contents (TOC)Xuan Mai Nguyen ThiNo ratings yet

- Road Safety GOs & CircularsDocument39 pagesRoad Safety GOs & CircularsVizag Roads100% (1)

- Anomaly Sell Out Remap December 2019 S SUMATRA & JAMBIDocument143 pagesAnomaly Sell Out Remap December 2019 S SUMATRA & JAMBITeteh Nha' DwieNo ratings yet

- Sample Contract Rates MerchantDocument2 pagesSample Contract Rates MerchantAlan BimantaraNo ratings yet

- Company Profi Le: IHC HytopDocument13 pagesCompany Profi Le: IHC HytopHanzil HakeemNo ratings yet

- ASM Architecture ASM Disk Group AdministrationDocument135 pagesASM Architecture ASM Disk Group AdministrationVamsi ChowdaryNo ratings yet

- Exam Venue For Monday Sep 25, 2023 - 12-00 To 01-00Document7 pagesExam Venue For Monday Sep 25, 2023 - 12-00 To 01-00naveed hassanNo ratings yet

- StrutsDocument7 pagesStrutsBatrisyialya RusliNo ratings yet

- Hilti X-HVB SpecsDocument4 pagesHilti X-HVB SpecsvjekosimNo ratings yet

- Top Machine Learning ToolsDocument9 pagesTop Machine Learning ToolsMaria LavanyaNo ratings yet

- Intermediate Accounting Testbank 2Document419 pagesIntermediate Accounting Testbank 2SOPHIA97% (30)

- Nucleic Acid Isolation System: MolecularDocument6 pagesNucleic Acid Isolation System: MolecularWarung Sehat Sukahati100% (1)

- UNIT: 01 Housekeeping SupervisionDocument91 pagesUNIT: 01 Housekeeping SupervisionRamkumar RamkumarNo ratings yet

- Data SheetDocument14 pagesData SheetAnonymous R8ZXABkNo ratings yet

- ViscosimetroDocument7 pagesViscosimetroAndres FernándezNo ratings yet