Professional Documents

Culture Documents

AIR - Donor's Tax

Uploaded by

Raz JisrylOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

AIR - Donor's Tax

Uploaded by

Raz JisrylCopyright:

Available Formats

DONORS TAX

1.

2.

3.

4.

For donors tax purposes, who among the following

is/are stranger(s) to you?

I.

The grandson of the daughter of your grandson

II.

The grandfather of the mother of your

grandmother

III.

The brother of the father of your grandfather

IV.

The grandson of the sister of your mother

a. I and II

c. III only

b. III and IV

d. IV only

Statement 1: The gift is perfected from the moment of

the donor effects the delivery either actually or

constructively of the property donated.

Statement 2: Donors tax is a property tax imposed on

the property transferred by way of gift inter vivos.

a. True, True

c. False, True

b. True, False

d. False, False

Statement 1: For purpose of the donors tax, second

degree cousins are strangers to each other

Statement 2: Encumbrance on the property donated, if

assumed by the donor is deductible for donors tax

purposes.

a. True, True

c. False, True

b. True, False

d. False, False

Statement 1: Where real property is transferred during

lifetime for less than adequate and full consideration in

money or moneys worth, the amount by which the value

of the property exceeded the value of the consideration

shall for the purpose made of the donors tax, be

deemed a gift.

Statement 2: Gifts of conjugal property made by both

spouse shall be considered as having been made onehalf by the husband and the other half by the wife and is

taxable to each donor spouse.

a. True, True

c. False, True

b. True, False

d. False, False

a.

b.

True, True

True, False

c. False, True

d. False, False

8.

All of the following are exempt from gift tax under special

laws, except one:

a. Donation to the Integrated Bar of the Philippines

b. Donation to the Development Academy of the

Philippines

c. Donation to Philippine Institute of Certified Public

Accountants

d. Donation to International Rice Research Institute

9.

One of the following statements is false:

a. Contracts of donation between husband and wife

are void in all cases.

b. The donation by Chavit to President Aquino in view

of his public office is void.

c. Donations between persons guilty of adultery or

concubinage are void.

d. Donations to conceived or unborn children are valid.

10.

During the current year, Mr. and Mrs. Reyes,

nonresident citizen, donated the following:

September 25 To Bea, a legitimate child, on account of

marriage last month a conjugal property located in the

Philippines, FMV P400,000.

October 9 To Gale, a legitimate child, conjugal property

in the Philippines, FMV P100,000.

The gift tax payable on September 25 gift of the husband

is:

a. P 7,600

c. P 1,800

b. P 2,600

d. P 3,353

11. Using the data in number, 3, the gift tax payable on the

October 9 gift of the husband is:

a. P 9,600

c. P 1,800

b. P 5,907

d. P 3,600

5.

Using the preceding number, the acceptance of the done

may be made

a. In the same deed of donation

b. In a separate document

c. Either A or B

d. Neither A or B

6.

Statement 1: Dowries or gifts made on account of family

celebration, on or before its celebration, or within one

year thereafter, by parents to each of their legitimate,

recognized natural or adopted children, to the extent of

the first P 10,000 shall be exempt from donors tax.

Statement 2: Donations in favor of an educational

and/or charitable, religious, cultural or social welfare

corporation, institutions, accredited non-government

organization, trust or philanthropic organization or

research institution or organization provided that no

amount of said gifts shall be used by the done for

administration purposes shall be exempt from donors

tax.

a. True, True

c. False, True

b. True, False

d. False, False

12. The following property transfers/gifts were given by a

resident donor in 2009 at the given fair valuation:

A vehicle gifted to the Ramon Magsaysay

Foundation, P160,000

A dowry, made in cash, to her legally adopted child

who is to be married, P90,000

Baptismal presents to his godson, P15,000

A Toyota car, acquired for P175,000 with a book

value of P120,000, but fairly valued at P150,000

given to her sister for a consideration of P20,000

Mountain bike gifted to his nephew, P25,000

Cash gift to his step daughter in account of her

marriage, P45,000

Jewelrys gifted to his mother but subject to

revocation, P100,000

Old clothes donated to the victims of fire, P15,000

Old furniture sold for P50,000 to his neighbor, FMV

is P85,000

The taxable net gift to stranger is

a. P245,000

c. P235,000

b. P110,000

d. P155,000

7.

Statement 1: As a rule, donation between husband and

wife during the marriage is void.

Statement 2: Donation can be made to conceived or

unborn children.

13. Using the preceding information, the taxable net gift to

relatives is

a. P160,000

c. P235,000

b. P110,000

d. P155,000

Page 1 of 5

DONORS TAX

14. The husband and the wife gave the following gift of

conjugal property, January 20, 2010 Land valued at

P180,000. Donee is a brother of the wife and the gift is

on account of marriage of the brother held on January

10, 2008. The total donors tax due on the gift is

a. P 1,600

c. P28,600

b. P 27,000

d. P54,000

15. Donations of properties, with fair market values:

Land in Indonesia

P 1,000,000

Land and Building in the Philippines

1,500,000

Shares of stock of a domestic corporation

500,000

Shares of stock of a foreign corporation

400,000

Receivable from a friend (residing in the same

country as that of donor)

50,000

There was a transfer inter vivos (to take

Effect during the lifetime of the

transferor) of property in the country of

the transferor. Consideration received

P 90,000; Fair Market Value of the

property at the time of transfer was

200,000

Cancellation of indebtedness of a resident

of the country where the transferor

resides, as an act of liberality

20,000

Gross gift if the donor was a citizen or resident of the

Philippines?

a. P2,080,000

c. P3,580,000

b. P2,580,000

d. P3,510,000

16. Estate tax as distinguished from donors tax

a. Payment is made as the return is filed.

b. Notice is not needed.

c. There is optional valuation date.

d. Exemption per tax table is P200,000

17. Exempt from donors taxation are gifts made

a. For the use of the barangay

b. In consideration of marriage

c. To a school which is a stock corporation

d. To a for-profit government corporation

18. Which is not true about donation between spouses?

a. Husband and wife cannot donate any conjugal or

community property without the consent of the other

b. Husband and wife may make a joint donation of

conjugal or community property

c. In a joint donation of conjugal or community

property, each spouse shall be considered a

separate donor of his or her interest in the property

d. When a spouse makes moderate donations for

charity or on occasions of family rejoicing or family

distress, the consent of the other spouse is needed.

19. Statement 1: In order that the donation of an immovable

property may be valid, it must be made in public

instrument specifying therein the property donated.

Statement 2: General renunciation of the heir, including

the surviving spouse, of his or her share in the hereditary

estate left by the decedent is not subject to donors tax.

a. Both statements are false

b. 1st statement is false while 2nd statement is true

c. 1st statement is true while 2nd statement is false

d. Both statements are true

20. The following donations were made to a legitimate child

of a citizen donor:

Property in the Philippines

P210,000

Property outside the Philippines on

Account of marriage

300,000

Donors tax paid in foreign country

7,500

The donors tax due after tax credit for foreign donors tax

paid is

a. P14,000

c. P7,500

b. P 8,120

d. P6,500

21. Three of the following are declared exempt or excluded

from the donors tax. Which is the exception?

a. P150,000 given by a parent at the marriage

celebration of an illegitimate child

b. Donation to a Filipino by a British national of a

condominium in Hong Kong

c. P15,000 donation to a non-stock and non-profit

school, 25% of the said amount is used for

administrative purposes.

d. Donation by a resident American of P10,000 cash

to his daughter upon her marriage to a Filipino.

22. Donors tax shall be filed

a. Within 30 days after the gift is made

b. Within 6 months after the gift is made

c. Within 20 days after the gift is made

d. Within 30 days after the month when the gift is

made

23. Candy gave the following donations to her legitimate son

on account of marriage on December 31, 2011

Date

Property

Amount

1/30/2011

Cash

P 7,500

3/7/2011

Personal Property

25,000

5/25/2011

Cash

80,000

The amount of deduction on account of marriage on

March 7, 2011

a. None

c. P 7,500

b. P 2,500

d. P10,000

24. Using the preceding given, the donors tax due on the

May 25, 2011 donation

a. P2,050

c. P 50

b. P 250

d. Exempt

25. Gienneth Lou wrote to James on December 31, 2011

donating his car worth P850,000. The letter was received

by the latter on January 7, 2012 who accepted the

donation. The letter of acceptance was sent by James on

January 15, 2012 and was received by Gieneth Lou on

January 20, 2012. The donors was not paid until May

22, 2012. For donors tax purposes, the gross gift should

be based on the value of the property on

a. December 31, 2011

c. January 15, 2012

b. January 7, 2012

d. January 20, 2012

For items number 26-28, refer to the following

information:

Mr. and Mrs. Crisante gave the following donations in 2011:

Date

Donor

Property

Amount

Donee

1/5/11

Mr. Crisante Separate

P150,000

Lito,

legitimate son

on account of

marriage on

June 1, 2011

Page 2 of 5

DONORS TAX

4/6/11

Mr. Crisante

Separate

175,000

Gemma,

his mother

5/7/11

Mr. and Mrs. Conjugal

500,000 Timmy,

daughter,

on

account

of

marriage

on

June 1, 2010

9/9/11 Mrs. Crisante

Separate 200,000 Timmy,

daughter, on

account of

Marriage

26. The donors tax and payable due on the January 5, 2011

donation is

a. Exempt

c. P45,000

b. P 1,000

d. P 800

27. The donors tax due and payable of Mr. Crisante on May

7, 2011

a. P 10,700

c. P26, 500

b. P 3,600

d. P 25,700

28. The September 9, 2011 donations donors tax due is

a. P 2,000

c. P11,600

b. P 8,000

d. Exempt

29. At the testimonial dinner for new CPAs, Christian was

requested to sing the theme song of the movie Ghost.

Mae was so delighted that she feels she is falling in love

with Christian, so she decided to cancel Christians

indebtedness to her. As a result,

a. Christian

realized

a

taxable

income

as

compensation for services.

b. If Christian accepts the cancellation, he will pay

donors tax.

c. Christian received a gift from Mae and therefore not

part of his taxable income.

d. The amount of indebtedness cancelled is partly

taxable, and partly exempt.

30. For donors tax purposes, who of the following is not

considered as a stranger?

a. Son of a first cousin

b. Wife of the brother

c. First cousin

d. Father of the wife

31. Mr. Earl Montera, single, a Filipino citizen and a religious

leader, is a cancer patient with remaining 3 months to

live during the calendar year. His only asset is composed

of cash amounting to P 5,000,000. Prior to his death, he

asks you whether he would transfer his property through

donation (donors tax) or fact of death (estate tax) to his

brother.

You presented to him the donors tax rate applicable for

P 5,000,000 is 12% and the estate tax rate applicable for

P 5,000,000 is 15%. Accordingly, he noted that his

preference is to pay the tax through donation because it

has lesser transfer taxes. Is Mr. Montera correct?

a. Yes, because the tax savings would be P 150,000.

b. No, because whether donors tax or estate tax is to

be paid, the amount of related transfer tax is the

same.

c. Yes, because he is still alive.

d. No, because the estate tax is cheaper by P 49,000.

32. 1st Statement: Dowries made on account of family

celebration, on or before its celebration, or within one

year thereafter, by parent to each of their legitimate,

recognized natural or adopted children, to the extent of

the first P 10,000 shall be exempt from donors tax.

2nd Statement: Donation in favor of an educational

and/or charitable, religious, cultural or social welfare

corporation, institution, accredited non-government

organization, trust or philanthropic organization or

research institution or organization provided no amount

of said gifts shall be used by the donee for administration

purposes shall be exempt from donors tax.

a. True, True

c. False, True

b. True, False

d. False, False

33. 1st statement: Dowries made by non-resident alien

parents to their children before marriage are exempt

from gift tax up to P 10,000.

2nd statement: Donors can always claim a tax credit for

donors taxes paid to a foreign country.

a.

True, True

c. False, True

b.

False, False

d. True, False

For items 28 31, refer to the following information:

On February 25, 2012, Mr. and Mrs. Bayabas donated their

conjugal land worth P500, 000 to their three sons, but on

account of marriage to one of them who got married 5

months ago. On June 9, 2012, they also donated to the child

of Mrs. Bayabas by first marriage, jewelry worth P75, 000 on

account of marriage more than a month after the donation.

Finally on December 25, 2012, they donated to the nephew

of Mr. Bayabas a building worth P750, 000, 40% of which

was co- owned by their Kumpare who agreed to the donation

and executed the necessary documents donating his share.

34. The donors taxes due on the February 25, 2012

donation should be:

a.

P 14, 000 for Mr. & Mrs.

b.

P 3, 600 each for Mr. & Mrs.

c.

P 4, 000 each for Mr. & Mrs.

d.

P 5, 750 each for Mr. & Mrs.

35. The donors tax due on the June 9, 2012 donation is:

a.

Mr. 0; Mrs. P1, 875

b.

Mr. 11, 250; Mrs. P4, 700

c.

Mr. 11, 250; Mrs. P1, 100

d.

Mr. 11, 250; Mrs. P1, 875

36. The donors tax due on the December 25, 2012 for Mr. &

Mrs. are:

a.

Mr. 9, 875; Mrs. P13, 500

b.

Mr. 67, 500; Mrs. P67, 500

c.

Mr. 9, 000; Mrs. P13, 500

d.

Mr. 9, 000; Mrs. P67, 500

Page 3 of 5

DONORS TAX

37. The donors tax due on the December 25, 2012 for their

Kumpare is:

a.

P 90, 000

c. P 0

b.

P 6, 000

d. P 30, 000

38. A donor gave the following donations in year 2012:

January 24 -Land located in the Philippines valued at P

2,000,000 to her uncle subject to the condition that

her uncle will pay the donors tax due and to

assume the mortgage to which he agreed to pay the

mortgage amounting to P 500,000.

November 30- Building in US valued at P 4,500,000 to

her

sister. Donors tax paid in US was P 400,000.

43. The donation of a movable property may be made

a. Orally

c. Either A or B

b. In writing

d. Neither A or B

44. Using the preceding number, the donation and

acceptance should be in writing if the value of the

property donated is

a. Less than P 5,000 c. P 5,000 or more

b. P 5,000 or less d. More than P 5,000

45. A donation which takes effect upon the death of the

donor.

a. Donation mortis causa

b. Partakes of the nature of a testamentary disposition

c. Shall be governed by the law on succession

d. All of the above.

The donors tax due on January 24 was

a. P 84,000

c. P 92,000

b. P 450,000

c. P 480,000

46. The donation of an immovable property shall be made

a. In writing

c. Either A or B

b. In public instrument d. Orally

39. The donors tax due and payable on the November 30

donation in number 11 amounted to

a. P 131,000

c. P 524,00

b. P 47,000

d. P 124,000

47. A donor gave the following donations in year 2012 Jan.

24- Land located in the Philippines valued at P2,000,000

to her uncle subject to the condition that uncle will pay

the donors tax due and mortgage to which she agreed

to pay the mortgage amounting to P500,000. Nov.30Building in US valued at P4,500,000 to her sister.

Donors tax paid in US was P400,000. The donors tax

on the gift on Jan. 24 is:

40. The spouses Helena and Frederico wanted to donate a

parcel of Land to their son Gerrick who is getting married

in December, 2011. The parcel of land has a zonal

valuation of P 420,000. What is the most efficient mode

of donating the property?

a. The spouses should first donate in 2011 a portion of

the property valued at P 20,000 then spread the P

400,000 equally for 2012, 2013, 2014 and 2015.

b. Spread the donation over a period of 5 years by the

spouses donating P 100,000 each year from 2011 to

2015.

c. The spouses should each donate a P 110,000

portion of the value of the property in 2011 then

each should donate P 100,000 in 2012.

d. The spouses should each donate P 100,000 portion

value of the property in 2011, and another P

100,000 each in 2012. Then, in 2013, Helena should

donate the remaining P 20,000

41. Matubo Corp. donated P 100,000 for the purpose of

cementing a barangay road where its factory is located.

Statement 1: The donation is exempt from donors tax.

Statement 2: The corporation may claim a full deduction

for income tax purposes.

a. Both statements are incorrect.

b. Both statements are correct.

c. Only Statement 1 is correct.

d. Only Statement 2 is correct.

42. Statement 1: If the value of the movable property

donated is P 5,000 or more the donation and the

acceptance shall be made in writing, otherwise, the

donation shall be void.

Statement 2: Regardless of the value of the immovable

property donated, the donation and acceptance shall be

made in writing, otherwise, the donation shall be void.

a. True, True

c. False, True

b. True, False

d. False, False

a.

P 84,000

b.

P 92,000

c. P 450,000

d. P 480,000

48. The donors tax due on the Nov. 30 donation is:

a.

P 131,000

c. P47,000

b.

P 524,000

d. P124,000

PROBLEMS

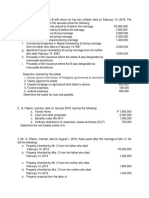

Problem1. During the calendar year, Mr. Masagana paid a

total donors tax amounting to P38,000 to his legitimate

children on account of marriage. On his first donation during

the year, he paid a donors tax amounting to P13,600.

a. The amount of gross gift made on the first donation

_________________

b. The amount of gross gift made on the second donation

_________________

Problem 2. Mr. Haiko Kuri, a Malaysian residing in Cebu,

made the following gifts for the year:

Property located in Malaysia donated to a Filipino

relative, P1,000,000

Property located in the Philippines donated to Nigerian

friend, P2,000,000

Compute the donors tax due and payable to Philippine

government if the amount of donors tax paid to Malaysian

government is P 70,000. ____________________

Problem 3. Mikaela made a donation of property with a FMV

of P1,000,000 to his legitimate daughter, Gina and Jano on

Page 4 of 5

DONORS TAX

December 25, 2010 on account of Ginas marriage to Jano to

be celebrated on February 14, 2012. Mikaela filed the donors

tax return on February 28, 2011.

a. The donors tax due for gift made to Gina.

________________

b. The donors tax due for gift made to Jano

________________

c. The total donors tax due and payable on February 28,

2011. _________________

Problem 4. S, made the following donations in 2014:

a. February 26: To T, a legitimate son on account of Ts

graduation, P 150,000.

b.

April 26:

To U, an acknowledged natural

child on account of Us forthcoming marriage on January

14, 2015, P 7,000.

c. May 26:

To V, a legitimate daughter on

account of Vs marriage celebrated on June 14, 2013, P

8,000.

d. July 26:

To T, on account of Ts graduation

on January 14, 2014, P 100,000.

e. October 26:

To U, additional gift on account of

Us marriage on January 14, 2015, P 93,000.

f. December 26:

To V, additional gift on account of

Vs marriage on June 14, 2013, P 92,000.

Determine the donors tax due on each donation.

Page 5 of 5

You might also like

- Question #1: Taxation - Donors Tax (Average)Document8 pagesQuestion #1: Taxation - Donors Tax (Average)Rey PerosaNo ratings yet

- DONOR S Tax Multiple Choice Question 1Document13 pagesDONOR S Tax Multiple Choice Question 1Kj Banal80% (5)

- Donor's Tax Multiple Choice QuestionsDocument13 pagesDonor's Tax Multiple Choice QuestionsRen A Eleponio100% (2)

- Deductions From Gross Income 2 1Document42 pagesDeductions From Gross Income 2 1Katherine EderosasNo ratings yet

- TAX - Final Pre-Board With Answer Key Batch Exodus - EncryptedDocument16 pagesTAX - Final Pre-Board With Answer Key Batch Exodus - EncryptedSophia PerezNo ratings yet

- Arturo Died Leaving The Following PropertiesDocument1 pageArturo Died Leaving The Following PropertiesCristine Salvacion PamatianNo ratings yet

- Taxbook PDFDocument151 pagesTaxbook PDFMARIA100% (1)

- Exercises - Percentage TaxesDocument2 pagesExercises - Percentage TaxesMaristella GatonNo ratings yet

- ICPA Final Pre-Board - TaxationDocument31 pagesICPA Final Pre-Board - TaxationAlexis SosingNo ratings yet

- 1Document9 pages1James Diaz100% (2)

- Estate TaxDocument21 pagesEstate TaxPatrick ArazoNo ratings yet

- A Citizen and Resident of The Philippines Died Leaving The Following Properties and RightsDocument1 pageA Citizen and Resident of The Philippines Died Leaving The Following Properties and RightsAmie Jane MirandaNo ratings yet

- TAX Preweek Lecture (B42)Document24 pagesTAX Preweek Lecture (B42)Bernadette Panican100% (1)

- Calculating Philippine Estate, VAT and Income TaxesDocument17 pagesCalculating Philippine Estate, VAT and Income TaxesJohayra AbbasNo ratings yet

- Police Power vs Taxation QuizDocument7 pagesPolice Power vs Taxation QuizBesha Sorigano50% (2)

- CPAR - TAX7411 - Estate Tax With Answer PDFDocument6 pagesCPAR - TAX7411 - Estate Tax With Answer PDFAngelo Villadores92% (12)

- FX AC 13 Transfer and Business Taxes - INTRUZO ANSWERDocument6 pagesFX AC 13 Transfer and Business Taxes - INTRUZO ANSWERPam IntruzoNo ratings yet

- CPA tax review questionsDocument10 pagesCPA tax review questionsRalph SantosNo ratings yet

- MCQ Property Regime ExamDocument4 pagesMCQ Property Regime ExamMeresa HernandezNo ratings yet

- Taxation Atty. Macmod, C.P.A. Estate TaxDocument7 pagesTaxation Atty. Macmod, C.P.A. Estate TaxJohn Brian D. SorianoNo ratings yet

- Answer: The Company Remitted P 22,400 VAT To The BIR. SolutionDocument3 pagesAnswer: The Company Remitted P 22,400 VAT To The BIR. SolutionGreyzon AbdonNo ratings yet

- Income TaxDocument20 pagesIncome Taxjuliaysabellepepitoaguilar100% (1)

- Acco 4133 - Taxation: College of Accountancy and FinanceDocument10 pagesAcco 4133 - Taxation: College of Accountancy and FinanceNadi Hood100% (1)

- COMEX1 TAX REVIEW Canvas-1Document18 pagesCOMEX1 TAX REVIEW Canvas-1LhowellaAquinoNo ratings yet

- Stock Valuation Activity - Compare Share Types & Calculate PricesDocument3 pagesStock Valuation Activity - Compare Share Types & Calculate PricesKyla de SilvaNo ratings yet

- Estate Tax101Document14 pagesEstate Tax101Alexandra Garcia100% (3)

- PrefinalDocument7 pagesPrefinalLeisleiRagoNo ratings yet

- VatDocument7 pagesVatCharla SuanNo ratings yet

- Estate Tax Deductions and ExclusionsDocument18 pagesEstate Tax Deductions and ExclusionsLindbergh Sy67% (3)

- Individual Income TaxDocument13 pagesIndividual Income TaxDaniel Dialino100% (1)

- EeeDocument9 pagesEeeNico evansNo ratings yet

- Ch28 Test Bank 4-5-10Document9 pagesCh28 Test Bank 4-5-10bluephoe100% (1)

- Deductions from Gross Estate for Funeral ExpensesDocument93 pagesDeductions from Gross Estate for Funeral ExpensesMARIA50% (2)

- Chapter 1 Succession and Transfer Taxes Part 1Document2 pagesChapter 1 Succession and Transfer Taxes Part 1AngieNo ratings yet

- Drill Discussion on Gross Income Inclusions and ExclusionsDocument32 pagesDrill Discussion on Gross Income Inclusions and ExclusionsJao FloresNo ratings yet

- Individual Taxpayers Classified and Taxed DifferentlyDocument95 pagesIndividual Taxpayers Classified and Taxed DifferentlyRoronoa Zoro67% (3)

- Solutions To Quiz 2 - VAT PAYABLEDocument4 pagesSolutions To Quiz 2 - VAT PAYABLEMark Emil BaritNo ratings yet

- University of Batangas Estate Tax: Multiple Choice ExercisesDocument5 pagesUniversity of Batangas Estate Tax: Multiple Choice ExercisesEdnel Loterte100% (1)

- Practice Set 1Document4 pagesPractice Set 1Shiela Mae BautistaNo ratings yet

- Taxation Deduction QuestionnaireDocument5 pagesTaxation Deduction QuestionnaireJanaela100% (1)

- Test Bank Sales, Agency and PledgeDocument34 pagesTest Bank Sales, Agency and PledgeEssa JardsNo ratings yet

- Principles of TaxationDocument32 pagesPrinciples of TaxationTyra Joyce Revadavia100% (1)

- Filipino Estate Tax Calculation for Married IndividualDocument3 pagesFilipino Estate Tax Calculation for Married IndividualSharjaaah100% (2)

- Chapter 03 Gross EstateDocument16 pagesChapter 03 Gross EstateNikki Bucatcat0% (1)

- Quiz Week 2 No AnswerDocument10 pagesQuiz Week 2 No AnswerKatherine EderosasNo ratings yet

- Quiz 8 - BTX 113Document3 pagesQuiz 8 - BTX 113Rae Vincent Revilla100% (1)

- Deal or No Deal Tax 2 Quiz BeeDocument13 pagesDeal or No Deal Tax 2 Quiz BeeRebecca SisonNo ratings yet

- Chapter 04 Deductions From Gross EstateDocument19 pagesChapter 04 Deductions From Gross EstateNikki Bucatcat0% (1)

- TRANSFER TAXATION- ESTATE TAXES KEY POINTSDocument4 pagesTRANSFER TAXATION- ESTATE TAXES KEY POINTSCharles100% (1)

- Income TaxationDocument28 pagesIncome TaxationJessa Gay Cartagena TorresNo ratings yet

- 1Document6 pages1Marinel FelipeNo ratings yet

- DONOR'S TAX QUIZDocument5 pagesDONOR'S TAX QUIZMarinel FelipeNo ratings yet

- Tax 86-12Document5 pagesTax 86-12Marinel FelipeNo ratings yet

- CPA Review: Donor's Tax Rules in the PhilippinesDocument4 pagesCPA Review: Donor's Tax Rules in the PhilippinesEl Gene Lois MontesNo ratings yet

- Evaluate 2 - Donor's TaxDocument5 pagesEvaluate 2 - Donor's TaxNicolas AlonsoNo ratings yet

- Donors Tax QADocument3 pagesDonors Tax QADan Di0% (2)

- Donors TaxDocument4 pagesDonors TaxIsrael MarquezNo ratings yet

- For Donations Made On or After January 1, 2018, The Donor's Tax Return Shall Be Filed WithinDocument10 pagesFor Donations Made On or After January 1, 2018, The Donor's Tax Return Shall Be Filed Withinishinoya keishiNo ratings yet

- Bam 208 Sas 12Document11 pagesBam 208 Sas 12Sherina Mae GonzalesNo ratings yet

- Donor's Tax SeatworkDocument12 pagesDonor's Tax SeatworkVirginia PalisukNo ratings yet

- Pre MaterialsDocument1 pagePre MaterialsRaz JisrylNo ratings yet

- Revenue Regulation No. 16-2005Document0 pagesRevenue Regulation No. 16-2005Kaye MendozaNo ratings yet

- Lecture - Estate TaxationDocument11 pagesLecture - Estate TaxationRaz Jisryl0% (1)

- Lecture 2b - Fringe BenefitsDocument2 pagesLecture 2b - Fringe BenefitsCPANo ratings yet

- AIR - CorporateDocument5 pagesAIR - CorporateRaz JisrylNo ratings yet

- Who Are Relatives?Document4 pagesWho Are Relatives?Jean CabigaoNo ratings yet

- Lecture 2b - Fringe BenefitsDocument2 pagesLecture 2b - Fringe BenefitsCPANo ratings yet

- A. National Internal Revenue Code: Topical Quizzer: Community TaxDocument2 pagesA. National Internal Revenue Code: Topical Quizzer: Community TaxRaz JisrylNo ratings yet

- A. National Internal Revenue Code: Topical Quizzer: Community TaxDocument2 pagesA. National Internal Revenue Code: Topical Quizzer: Community TaxRaz JisrylNo ratings yet

- A. National Internal Revenue Code: Topical Quizzer: Community TaxDocument2 pagesA. National Internal Revenue Code: Topical Quizzer: Community TaxRaz JisrylNo ratings yet

- Taxation Review LectureDocument600 pagesTaxation Review LectureRaz Jisryl79% (52)

- Partnership Formation and Operations Exercises and Problems1,670,000518,0001,152,0001,792,000256,000160,000198,000(16,000)(120,000)2,270,000Document21 pagesPartnership Formation and Operations Exercises and Problems1,670,000518,0001,152,0001,792,000256,000160,000198,000(16,000)(120,000)2,270,000Jayson Villena Malimata100% (2)

- Venezuela Vs PeopleDocument22 pagesVenezuela Vs PeopleajdgafjsdgaNo ratings yet

- Referat EnglezaDocument3 pagesReferat EnglezaIonutGheorghiuNo ratings yet

- Malvika's GPC ProjectDocument23 pagesMalvika's GPC ProjectMalvika BishtNo ratings yet

- (B29) LAW 104 - Amedo v. Rio (No. L-6870)Document3 pages(B29) LAW 104 - Amedo v. Rio (No. L-6870)m100% (1)

- Case of DOTC vs. AbecinaDocument6 pagesCase of DOTC vs. AbecinaMaica MagbitangNo ratings yet

- Cuba v. CuencoDocument2 pagesCuba v. CuencoKing BadongNo ratings yet

- Pilinas Shell Petroleum Vs Coc - GR No. 176380 June 18, 2009Document1 pagePilinas Shell Petroleum Vs Coc - GR No. 176380 June 18, 2009Ray John Uy-Maldecer AgregadoNo ratings yet

- Succession JY Notes Pre-Mid (Mod 1-4)Document25 pagesSuccession JY Notes Pre-Mid (Mod 1-4)Jandi YangNo ratings yet

- Civil Law - Special Forms of PaymentDocument1 pageCivil Law - Special Forms of PaymentJeff SarabusingNo ratings yet

- Bank of The Philippine Islands and Fgu Insurance Corporation (Presently Known As Bpi/Ms Insurance CORPORATION), Petitioners, Vs - YOLANDA LAINGODocument56 pagesBank of The Philippine Islands and Fgu Insurance Corporation (Presently Known As Bpi/Ms Insurance CORPORATION), Petitioners, Vs - YOLANDA LAINGOKatherine GutierrezNo ratings yet

- Cagang vs. SandiganbayanDocument1 pageCagang vs. SandiganbayanLance Christian Zoleta100% (1)

- Woolmington V DPPDocument12 pagesWoolmington V DPPTravis Anthony Benain67% (3)

- Caunca V SalazarDocument9 pagesCaunca V SalazarCJ VillaluzNo ratings yet

- Business Law AssignmentDocument3 pagesBusiness Law AssignmentjsinNo ratings yet

- Investigation Report WritingDocument23 pagesInvestigation Report WritingMarco PagariganNo ratings yet

- Equality and Diversity PolicyDocument3 pagesEquality and Diversity PolicyalwoodleytennisclubNo ratings yet

- Retirement Benefits DisputeDocument3 pagesRetirement Benefits DisputeDiane HigidaNo ratings yet

- En Banc (G.R. No. L-8964. July 31, 1956.) JUAN EDADES, Plaintiff-Appellant, vs. SEVERINO EDADES, ET AL., Defendants-AppelleesDocument21 pagesEn Banc (G.R. No. L-8964. July 31, 1956.) JUAN EDADES, Plaintiff-Appellant, vs. SEVERINO EDADES, ET AL., Defendants-AppelleesTetris BattleNo ratings yet

- Case Digests in Civil LawDocument55 pagesCase Digests in Civil LawPaula GasparNo ratings yet

- Motion For Temporary Restraining Order, Preliminary InjunctionDocument69 pagesMotion For Temporary Restraining Order, Preliminary InjunctionKellyNo ratings yet

- Child SupportDocument16 pagesChild SupportDeneb DoydoraNo ratings yet

- Del Monte v. Sunshine- Trademark InfringementDocument5 pagesDel Monte v. Sunshine- Trademark InfringementAdmin DivisionNo ratings yet

- Amanquiton V People Digest UpdatedDocument2 pagesAmanquiton V People Digest Updatedjustine bayosNo ratings yet

- Partnership Dissolution DisputeDocument6 pagesPartnership Dissolution DisputeAnakataNo ratings yet

- MALAD DecDocument22 pagesMALAD DecAngelika CalingasanNo ratings yet

- UNITED STATES of America Ex Rel. Herman RUCKER, Appellant, v. David N. MYERS, Warden, State Correctional Institution, Graterford, PennsylvaniaDocument8 pagesUNITED STATES of America Ex Rel. Herman RUCKER, Appellant, v. David N. MYERS, Warden, State Correctional Institution, Graterford, PennsylvaniaScribd Government DocsNo ratings yet

- Petitioners Vs Vs Respondents: First DivisionDocument16 pagesPetitioners Vs Vs Respondents: First DivisionPio MathayNo ratings yet

- NORMA A. DEL SOCORRO For and in Behalf of Her Minor Child RODERIGO Norjo Van Wilsem V. Ernst Johan Brinkman Van WilsemDocument2 pagesNORMA A. DEL SOCORRO For and in Behalf of Her Minor Child RODERIGO Norjo Van Wilsem V. Ernst Johan Brinkman Van Wilsemanne6louise6panagaNo ratings yet

- Quiz On Limited PartnershipDocument9 pagesQuiz On Limited PartnershipKuya KimNo ratings yet

- Land Titles: A C B O 2007 Civil LawDocument28 pagesLand Titles: A C B O 2007 Civil LawMiGay Tan-Pelaez86% (14)