Professional Documents

Culture Documents

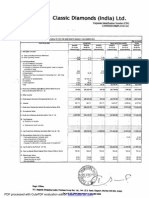

Financial Results For Sept 30, 2014 (Standalone) (Result)

Uploaded by

Shyam SunderOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Financial Results For Sept 30, 2014 (Standalone) (Result)

Uploaded by

Shyam SunderCopyright:

Available Formats

G

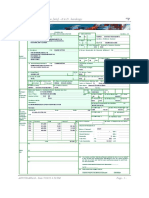

GLODYNE TECHNOSERVE LIMITED

Standalone Unaudited Financial Results for the Quarter ended 30th Sept, 2014

Particulars

Particulars

Unaudited

30th Sep, 2014

Income

1. Net Sales/Income from Operations

Quarter Ended

Unaudited

30th June, 2014

Half Year Ended

Unaudited

Unaudited

30th Sep, 2014

30th Sep, 2013

Unaudited

30th Sep, 2013

(Rs. In Lakhs)

Year ended

Audited

31st Mar, 2014

163.62

318.73

3,111.57

482.35

12,278.99

13,755.28

Total

163.62

318.73

3,111.57

482.35

12,278.99

13,755.28

Total

5,443.39

8.10

443.13

5,894.62

1,064.73

7.93

440.72

1,513.38

9,372.41

238.86

1,799.47

11,410.74

6,508.12

16.03

883.85

7,408.00

23,120.13

1,005.43

3,555.50

27,681.06

83,115.95

1,104.85

6,576.39

90,797.19

(5,731.00)

(1,194.65)

(8,299.17)

(6,925.65)

(15,402.07)

(77,041.91)

177.99

366.17

2,480.72

544.16

4,854.57

6,470.03

(5,553.01)

(828.48)

(5,818.45)

(6,381.49)

(10,547.50)

(70,571.88)

2. Expenses

a. Operating Expenses

b. Employee Benefit Expenses

c. Depreciation and Amortization

3. Profit from Operations before Other Income,

Interest and Exceptional Items

4. Other Income

5. Profit / (Loss) from ordinary activities before finance

costs and exceptional items (3 + 4)

6. Finance Cost

7.Profit / (Loss) from ordinary activities after finance

costs but before exceptional items (5 - 6)

2,224.91

1,712.78

2,079.02

3,937.69

3,511.15

7,040.85

(7,777.92)

(2,541.26)

(7,897.47)

(10,319.18)

(14,058.65)

(77,612.73)

8. Exceptional items

9. Profit / Loss from Ordinary Activities before tax

(7,777.92)

10. Tax expense

11. Net Profit / Loss from Ordinary Activities after

taxes

(7,777.92)

12. Prior Period Items

13. Net Profit/ Loss for the period

(2,541.26)

(2,541.26)

-

(7,777.92)

(2,541.26)

(7,897.47)

(10,319.18)

(7,897.47)

(77,612.73)

(10,319.18)

(7,897.47)

(14,058.65)

(14,058.65)

-

(10,319.18)

(14,058.65)

(77,612.73)

(77,612.73)

14. Share of profit / (loss) of associates

15. Minority interest

16.Net Profit / (Loss) after taxes, minority interest and

share of profit / (loss) of associates (13 - 14 - 15)

(7,777.92)

(2,541.26)

(7,897.47)

(10,319.18)

(14,058.65)

(77,612.73)

2,709.07

2,709.07

2,709.07

2,709.07

2,709.07

2,709.07

19. Earnings Per Share (EPS)

a) Basic EPS before Extraordinary items

b) Diluted EPS before Extraordinary items

(17.23)

(17.23)

(5.63)

(5.63)

(17.49)

(17.49)

(22.85)

(22.85)

(31.14)

(31.14)

(171.90)

(171.90)

c) Basic EPS after Extraordinary items

d) Diluted EPS after Extraordinary items

(17.23)

(17.23)

(5.63)

(5.63)

(17.49)

(17.49)

(22.85)

(22.85)

(31.14)

(31.14)

(171.90)

(171.90)

17. Paid-up equity share capital

(Face Value of Rs. 6 each.)

18. Reserve excluding Revaluation Reserves as per

balance sheet of previous accounting year

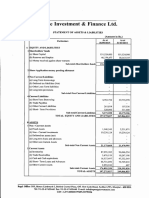

Standalone Statement of Assets and Liabilites as at 30th Sept'2014

Rs. in Lakhs

Particulars

A. EQUITY AND LIABILITIES

1 . Shareholders' Funds

(a) Share Capital

(b) Reserves and Surplus

Sub total - Sharesholders' Funds

Half Year Ended

Unaudited

30th Sept,2014

Year Ended

Audited

31st Mar,2014

2,709.07

(28,332.03)

2,709.07

(18,012.85)

(25,622.96)

(15,303.78)

2. Share application money Pending allotment

3. Minority Interest

4. Non-Current Liabilites

(a) Long Term Borrowings

(b) Long Term Provision

22.00

21.50

22.00

21.50

25,817.10

10,847.85

41,962.70

4,634.73

25,815.46

9,646.93

38,270.65

4,640.52

83,262.38

78,373.56

57,661.42

63,091.28

1 . Non-Currrent Assets

(a) Fixed Assets

(b) Non-Current Investment

(c) Long-term loans and advnaces

2,929.49

50,250.62

3,823.11

18,005.05

32,904.46

Sub total - Non-current assets

53,180.11

54,732.62

2. Currrent Assets

(a) Inventories

(b) Trade receivables

(c) Cash and Bank Balances

(d) Short-term Loans and Advances

(e) Other current Assets

0.05

240.29

62.37

4,177.51

1.09

0.82

3,975.54

44.69

4,337.47

0.14

4,481.31

8,358.66

57,661.42

63,091.28

Sub total - Non-current libilities

5. Current Liabilites

(a) Short Term Borrowings

(b) Trade Payable

(c) Other Current Libilities

(d) Short Term Provision

Sub total -Current libilities

TOTAL - EQUITY AND LIABILITIES

B. ASSETS

Sub total - Currrent Assets

TOTAL - ASSETS

(0.00)

Particulars

A

1

PARTICULARS OF

SHAREHOLDING

Public shareholding

- Number of shares

- Percentage of

shareholding

Quarter

Ended

Quarter

Ended

30 Sept,

2014*

Unaudited

30 June,

2014

Unaudited

Quarter

Ended In

Previous

year

30 Sept,

2013

Audited

357,43,149

357,43,149

3,48,69,645

357,43,149

357,43,149

79.16%

79.16%

77.23%

79.16%

79.16%

8538145

8538145

94,11,649

8538145

8538145

90.75%

90.75%

91.54%

90.75%

90.75%

18.91%

18.91%

20.84%

18.91%

18.91%

869,800

869,800

8,69,800

869,800

869,800

9.25%

9.25%

8.46%

9.25%

9.25%

1.93%

1.93%

1.93%

1.93%

1.93%

Promoters and Promoter

Group Shareholding **

a) Pledged /

Encumbered

- Number of shares

- Percentage of shares

(as a % of the total

shareholding of

promoter and promoter

group)

- Percentage of shares

(as a % of the total

share capital of the

company)

b) Non - encumbered

- Number of shares

- Percentage of shares

(as a % of the total

shareholding of the

Promoter and

Promoter group)

- Percentage of shares

(as a % of the total

share capital of the

company)

Year To

Date Period

Ended

Previous year

ended

30 Sept,

2014*

Unaudited

31 March,

2014

Audited

* - The beneficiary data from the depositories was not available to the company as on 30.09.2014,

therefore the exact position could not be ascertained. There have been no intimation to the

promoter about any change of pledge status due to invocation / release. Hence the data for the

previous quarter has been taken as base and shown in the current quarter as well. The same may

or may not exactly match with depositories data.

Particulars

B

3 months ended

Sept 30, 2014

INVESTOR COMPLAINTS

Pending at the beginning of the quarter

Received during the quarter

Disposed of during the quarter

Remaining unresolved at the end of the quarter

0

3

3

0

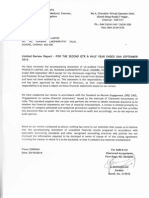

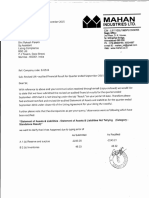

GLODYNE TECHNOSERVE LIMITED

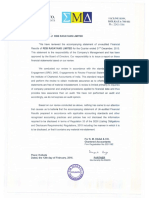

Notes:

1.

The financial results of the Company for the quarter ended September 30, 2014 were reviewed by the

th

th

Audit Committee and adopted by the Board of Directors at their meeting held on 14 and 15 November 2014 and

the auditors of the Company has carried out Limited Review of the same.

2.

The accounts have been prepared in accordance with the accepted Accounting standards as notified by

Companies (Accounting Standard) Rules, 2006.

3.

Operating Expenses of Rs. 5443.49 Lakhs includes amounts written off / provisions in respect of the bad

debt/assets. In view of some of the repayment defaults in respect of certain bank borrowings / interest and

restructuring of borrowings in certain cases, as well certain legal disputes about the same, have given rise to

differences in the amount of debt /interest as may be charged by the Banks, and amounts estimated by the

Company and recorded in the books and therefore such balances are subject to reconciliation.

4. In view of legal disputes with some of the creditors, the creditors have filed winding up petitions against the

company, some which has been admitted by the Court. The Company has presently filed appeal against such order

and taking possible steps to try and safeguard the company from the same.

5. The Companys advances to some of its wholly owned subsidiaries have been outstanding with the subsidiaries.

In view of the long term nature of the same, the said advances have been classified as equity and resultant

notional interest income has been discarded from the current financial year.

6. During the quarter, 3 complaints were received from investors which were resolved, one complaint was pending

at the beginning and no complaint was pending at the end of the quarter.

7. Figures for the previous periods / year are re-grouped / re-arranged / re-classified, wherever considered

necessary, to confirm to the figures of the current period.

Place: Mumbai

For Glodyne Technoserve Limited

Date: November 15, 2014

Annand Sarnaaik

Chairman & Managing Director

You might also like

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Sept 30, 2014 (Result)Document13 pagesFinancial Results & Limited Review For Sept 30, 2014 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For June 30, 2014 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For June 30, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Document2 pagesFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Unaudited Financial Results For The Quarter/Half Year Ended 30th September, 2014Document4 pagesUnaudited Financial Results For The Quarter/Half Year Ended 30th September, 2014Dhruba DebnathNo ratings yet

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Document6 pagesFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Revised Financial Results For Sept 30, 2015 (Result)Document3 pagesRevised Financial Results For Sept 30, 2015 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- 28 Consolidated Financial Statements 2013Document47 pages28 Consolidated Financial Statements 2013Amrit TejaniNo ratings yet

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Document5 pagesFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Announces Q2 Results, Limited Review Report & Results Press Release For The Quarter Ended September 30, 2015 (Result)Document5 pagesAnnounces Q2 Results, Limited Review Report & Results Press Release For The Quarter Ended September 30, 2015 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Afm PDFDocument5 pagesAfm PDFBhavani Singh RathoreNo ratings yet

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Ho Beefs Announcement 3 Q 2014Document10 pagesHo Beefs Announcement 3 Q 2014mmccNo ratings yet

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Document2 pagesFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document3 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Reckitt Benckiser (India) Limited: Standalone Balance Sheet For Period 01/04/2013 To 31/03/2014Document112 pagesReckitt Benckiser (India) Limited: Standalone Balance Sheet For Period 01/04/2013 To 31/03/2014junkyNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- 2023 Con Quarter03 AllDocument59 pages2023 Con Quarter03 AllDivyal GhodeNo ratings yet

- (A) Fixed AssetsDocument14 pages(A) Fixed AssetsPriya GoyalNo ratings yet

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- 03-LBP2015 Executive Summary PDFDocument7 pages03-LBP2015 Executive Summary PDFFrens PanlarocheNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document3 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Apl 2013Document45 pagesApl 2013Wasif Pervaiz DarNo ratings yet

- FAREASTLIF-Annual Report - 2014Document67 pagesFAREASTLIF-Annual Report - 2014Saram ShahNo ratings yet

- Payu Payments Private Limited: Standalone Balance Sheet For Period 01/04/2013 To 31/03/2014Document74 pagesPayu Payments Private Limited: Standalone Balance Sheet For Period 01/04/2013 To 31/03/2014junkyNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For December 31, 2014 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review For December 31, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Document2 pagesFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Annual Report 13 14Document38 pagesAnnual Report 13 14sana ahmadNo ratings yet

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Document2 pagesFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Letter To Shareholders and Financial Results September 2012Document5 pagesLetter To Shareholders and Financial Results September 2012SwamiNo ratings yet

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Bestway Cement Annual 15 AccountsDocument49 pagesBestway Cement Annual 15 AccountsM Umar FarooqNo ratings yet

- Macrohon Executive Summary 2013Document7 pagesMacrohon Executive Summary 2013rominadulfo4bNo ratings yet

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Company Update)Document5 pagesFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Company Update)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Annual Report 2010Document52 pagesAnnual Report 2010Shazib AliNo ratings yet

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Document2 pagesFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Document5 pagesFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Revised Statement of Assets & Liabilities As On September 30, 2015 (Result)Document4 pagesRevised Statement of Assets & Liabilities As On September 30, 2015 (Result)Shyam SunderNo ratings yet

- KFA - Published Unaudited Results - Sep 30, 2011Document3 pagesKFA - Published Unaudited Results - Sep 30, 2011Chintan VyasNo ratings yet

- Settlement Order in Respect of Bikaner Wooltex Pvt. Limited in The Matter of Sangam Advisors LimitedDocument2 pagesSettlement Order in Respect of Bikaner Wooltex Pvt. Limited in The Matter of Sangam Advisors LimitedShyam SunderNo ratings yet

- Mutual Fund Holdings in DHFLDocument7 pagesMutual Fund Holdings in DHFLShyam SunderNo ratings yet

- Order of Hon'ble Supreme Court in The Matter of The SaharasDocument6 pagesOrder of Hon'ble Supreme Court in The Matter of The SaharasShyam SunderNo ratings yet

- HINDUNILVR: Hindustan Unilever LimitedDocument1 pageHINDUNILVR: Hindustan Unilever LimitedShyam SunderNo ratings yet

- PR - Exit Order in Respect of Spice & Oilseeds Exchange Limited (Soel)Document1 pagePR - Exit Order in Respect of Spice & Oilseeds Exchange Limited (Soel)Shyam SunderNo ratings yet

- JUSTDIAL Mutual Fund HoldingsDocument2 pagesJUSTDIAL Mutual Fund HoldingsShyam SunderNo ratings yet

- Financial Results For June 30, 2014 (Audited) (Result)Document3 pagesFinancial Results For June 30, 2014 (Audited) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Auditors Report For March 31, 2016 (Result)Document5 pagesStandalone Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Exit Order in Respect of The Spice and Oilseeds Exchange Limited, SangliDocument5 pagesExit Order in Respect of The Spice and Oilseeds Exchange Limited, SangliShyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document4 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Settlement Order in Respect of R.R. Corporate Securities LimitedDocument2 pagesSettlement Order in Respect of R.R. Corporate Securities LimitedShyam SunderNo ratings yet

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results For March 31, 2016 (Result)Document11 pagesStandalone Financial Results For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results For Dec 31, 2013 (Result)Document4 pagesFinancial Results For Dec 31, 2013 (Result)Shyam Sunder0% (1)

- Financial Results For Mar 31, 2014 (Result)Document2 pagesFinancial Results For Mar 31, 2014 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results For September 30, 2016 (Result)Document3 pagesStandalone Financial Results For September 30, 2016 (Result)Shyam SunderNo ratings yet

- PDF Processed With Cutepdf Evaluation EditionDocument3 pagesPDF Processed With Cutepdf Evaluation EditionShyam SunderNo ratings yet

- Financial Results For June 30, 2013 (Audited) (Result)Document2 pagesFinancial Results For June 30, 2013 (Audited) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results For September 30, 2013 (Result)Document2 pagesFinancial Results For September 30, 2013 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results For June 30, 2016 (Result)Document2 pagesStandalone Financial Results For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Transcript of The Investors / Analysts Con Call (Company Update)Document15 pagesTranscript of The Investors / Analysts Con Call (Company Update)Shyam SunderNo ratings yet

- Investor Presentation For December 31, 2016 (Company Update)Document27 pagesInvestor Presentation For December 31, 2016 (Company Update)Shyam SunderNo ratings yet

- Master The Stock Market: Certified Equity Market AnalystDocument8 pagesMaster The Stock Market: Certified Equity Market AnalystsunnyNo ratings yet

- Fabm2121 Week 11 19Document40 pagesFabm2121 Week 11 19Mikhaela CoronelNo ratings yet

- Financial Policy at Apple-NiveDocument19 pagesFinancial Policy at Apple-NiveUtsavNo ratings yet

- Namkeen Farsan Manufacturing SchemeDocument2 pagesNamkeen Farsan Manufacturing SchemeYogesh ShivannaNo ratings yet

- Canning The Eastern Question PDFDocument285 pagesCanning The Eastern Question PDFhamza.firatNo ratings yet

- Dutch Bangla Bank Online BankingDocument9 pagesDutch Bangla Bank Online BankingNazmulHasanNo ratings yet

- Agreed Upn Procedures Report 3 PDFDocument4 pagesAgreed Upn Procedures Report 3 PDFirfanNo ratings yet

- BaupostDocument20 pagesBaupostapi-26094277No ratings yet

- 26-Assurant Settlement Agreement FL ExecutedDocument50 pages26-Assurant Settlement Agreement FL ExecutedMark MehnerNo ratings yet

- Greek CrisisDocument7 pagesGreek CrisisFilip NikolicNo ratings yet

- Product Costing Material Ledger1Document31 pagesProduct Costing Material Ledger1Anand NcaNo ratings yet

- 7th NFC Award 2010Document4 pages7th NFC Award 2010humayun313No ratings yet

- Crown Valley Financial Plaza 100% Leased!Document2 pagesCrown Valley Financial Plaza 100% Leased!Scott W JohnstoneNo ratings yet

- BP2313 Audit With Answers)Document44 pagesBP2313 Audit With Answers)hodgl1976100% (4)

- Questionnaire Revised 2Document7 pagesQuestionnaire Revised 2Anish MarwahNo ratings yet

- Financial Markets and Institutions Course Outline - SINDHUDocument4 pagesFinancial Markets and Institutions Course Outline - SINDHUNajia SiddiquiNo ratings yet

- Summative Test in Math (Part Ii) Quarter 1Document1 pageSummative Test in Math (Part Ii) Quarter 1JAY MIRANDANo ratings yet

- MIDTERMDocument23 pagesMIDTERMJanine LerumNo ratings yet

- Econ & Ss 2011Document187 pagesEcon & Ss 2011Amal ChinthakaNo ratings yet

- Content Problem Sets 4. Review Test Submission: Problem Set 08Document8 pagesContent Problem Sets 4. Review Test Submission: Problem Set 08gggNo ratings yet

- IFRS 9 Training Slides For MLDC - DAY 1Document43 pagesIFRS 9 Training Slides For MLDC - DAY 1Onche Abraham100% (1)

- L6M5 Tutor Notes 1.0 AUG19Document22 pagesL6M5 Tutor Notes 1.0 AUG19Timothy Manyungwa IsraelNo ratings yet

- 201120020118700048000000Document3 pages201120020118700048000000shubhamNo ratings yet

- Investment Theory Body Kane MarcusDocument5 pagesInvestment Theory Body Kane MarcusPrince ShovonNo ratings yet

- Afcqm QB 2013 PDFDocument99 pagesAfcqm QB 2013 PDFHaumzaNo ratings yet

- IFRNPO FullReport FinalDocument140 pagesIFRNPO FullReport FinalRatnawatyNo ratings yet

- Final Project Report of Summer Internship (VK)Document56 pagesFinal Project Report of Summer Internship (VK)Vikas Kumar PatelNo ratings yet

- UNI DRFT - Duty - Apsara - 31.07.2023Document1 pageUNI DRFT - Duty - Apsara - 31.07.2023praneeth jayeshaNo ratings yet

- JE InFINeeti Nemani Sri Harsha 28KADocument2 pagesJE InFINeeti Nemani Sri Harsha 28KAMehulNo ratings yet

- Adjudication Order in Respect of M/s Arihant Thermoware Limited in The Matter of M/s Arihant Thermoware LimitedDocument11 pagesAdjudication Order in Respect of M/s Arihant Thermoware Limited in The Matter of M/s Arihant Thermoware LimitedShyam SunderNo ratings yet