Professional Documents

Culture Documents

Mrunal SBI Pahala Kadam, Pahali Udaan, Features Minor Bank Accounts

Uploaded by

Chaitanya SharmaCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Mrunal SBI Pahala Kadam, Pahali Udaan, Features Minor Bank Accounts

Uploaded by

Chaitanya SharmaCopyright:

Available Formats

9/27/2014

Mrunal SBI Pahala Kadam, Pahali Udaan, features Minor bank accounts

- Mrunal - http://mrunal.org -

[Banking] Minor Bank Accounts, SBIs Pahali Udaan,

Pahala Kadam, Kotak My Junior Account

1. Banking rights for Bachchaa Party

1. Pro arguments: Minor Bank accounts

2. Anti-Argumens: Minor Bank accounts

2. SBI: Pahali Udaan, Pahala kadam

3. Kotak My Junior Account

Banking rights for Bachchaa Party

Man arrested for stealing Miley Cy rus blow-up doll (BWNToday )

Topic was in news during May 2014. Again resurfaced in Sep 2014, when SBI launched

new products. Therefore Im combining the two topics for quicker revision.

System, until now:

Children below 18 are minor

Minor cannot have separate account

They can open joint account with adults. Father natural guardian. Later RBI also

authorized mothers. (But doesnt apply to Muslim minors)

If guardian dies, minor will GET MONEY from account only after attaining

majority. (Bollywood movies exploit this premise by introducing an evil uncle).

Minor should be literate

Two minors cannot open joint account

Minors can sign cheque.

RBI reform May 2014

All minors can open bank accounts via parents/ legal guardian.

BUT Minors above 10 years can open bank account without adult supervision

AND they can open only three type of Bank accounts:

http://mrunal.org/2014/09/minor-bank-accounts-sbi-pahali-udaan-pahala-kadam-kotak-junior.html/print/

1/3

9/27/2014

Mrunal SBI Pahala Kadam, Pahali Udaan, features Minor bank accounts

1. savings account

2. fixed deposit account

3. recurring deposit account.

In other words, they cannot open Current account, meant for businessmen.

Can get ATM card, cheque books, netbanking facilities

Safeguards for minor accounts

Bank cannot charge penalty if minimum balance not maintained. (this applies to

all minor and major accounts, after 1st April 2014.)

But bank should ensure that such accounts remain in credit. Meaning children

should not be allowed to totally empty his balance.

Bank can put restriction of money withdrawal e.g. not more than 500 in 24

hours.

Bank can decide minimum documents.

Now lets see pro and anti-arguments for group discussion / interview:

Pro arguments

This will bring uniformity in the bankaccounts. Some banks already offering

separate minor accounts e.g. Kotak Mahindras My Junior account.

Financial awareness, financial literacy: children learn about savings habit and

banking system.

Financial discipline: They understand the value of money and difference between

needs vs wants.

Financial inclusion: e.g. child-laborers in tea-stalls can save money.

Government directly sends scholarship money to such account.

Social change: many urban teenagers have broken family theyre pretty much

living on their own.

Anti-Argument

Children more Gullible, and likely to be victims of identity theft, hacking,

phishing.

They can become victim of miselling by private banks via Bancassurance, mutual

funds and hidden charges on credit card.

Therefore, RBI shouldnt have allowed the children to open accounts without

adult supervision.

Interview Question: Are you in favor of RBIs latest move of allowing Children to

open bank accounts without adult supervision? Yes / No / why?

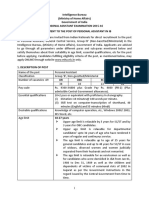

SBI: Pahali Udaan, Pahala kadam

http://mrunal.org/2014/09/minor-bank-accounts-sbi-pahali-udaan-pahala-kadam-kotak-junior.html/print/

2/3

9/27/2014

Mrunal SBI Pahala Kadam, Pahali Udaan, features Minor bank accounts

Sep 2014: SBI has launched two products, after RBI guidelines on minor-accounts.

Pehli Udaan

Pehla Kadam

Age: 10 years and above

any age

Singly operated savings bank account Jointly with his/her parent or guardian

Transaction limits

Netbanking

Rs.5000

Mobile banking Rs.2000

What are the benefits offered?

Specially branded passbook, cheque book,

Personalized photo ATMcumDebit card.

Internet banking with limited transaction facilities like bill payment, opening of

fixed deposit, recurring deposits, etc.

Auto-sweep facility also available- meaning, part of the savings account money

will be transferred to fixed deposit account-, thus kid can earn more interest.

Kotak My Junior Account

Savings account for kids, Launched in 2013, June.

Child alone cannot operate it without guardian.

Child is given a membership card- to purchase kid products from variety of

online and retail stores, at discount.

Only kids aged 10 years and above, can get debit card. But with withdrawal limit

of Rs.5000/- per month.

6% interest on savings account per year only if balance above 1 lakh rupees.

This rate doesnt apply to NRI kids accounts.

Parents can also make recurring deposits (RD) to this account and earn 8%. In

this case, Kotak provides free movie tickets and book vouchers.

Penalty charges apply, if minimum balance (Rs.5000) not maintained. This rule

doesnt apply if parents are making recurring deposits (RD)

Published on 23/09/2014 @ 4:00 pm under Category: Economy

URL to article: http://mrunal.org/2014/09/minor-bank-accounts-sbi-pahali-udaanpahala-kadam-kotak-junior.html

http://mrunal.org/2014/09/minor-bank-accounts-sbi-pahali-udaan-pahala-kadam-kotak-junior.html/print/

3/3

You might also like

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Upper Part of Satluj Basin & Spiti Valley (Satluj Basin)Document9 pagesUpper Part of Satluj Basin & Spiti Valley (Satluj Basin)Chaitanya SharmaNo ratings yet

- Job Description For Intelligence Bureau Assistant Central Intelligence OfficerDocument14 pagesJob Description For Intelligence Bureau Assistant Central Intelligence OfficerChaitanya SharmaNo ratings yet

- SAS Compliance Solutions: Overview: Course NotesDocument164 pagesSAS Compliance Solutions: Overview: Course NotesChaitanya SharmaNo ratings yet

- Jkti ) Fgekpy Izns'k Jkti ) Fgekpy Izns'k Jkti ) Fgekpy Izns'k Jkti ) Fgekpy Izns'k Jkti ) Fgekpy Izns'kDocument186 pagesJkti ) Fgekpy Izns'k Jkti ) Fgekpy Izns'k Jkti ) Fgekpy Izns'k Jkti ) Fgekpy Izns'k Jkti ) Fgekpy Izns'kChaitanya SharmaNo ratings yet

- Detailedadvertisement 2015Document9 pagesDetailedadvertisement 2015Chaitanya SharmaNo ratings yet

- Particulars: REGISTERED OFFICE: #139-141 Abercromby Street, Port of SpainDocument3 pagesParticulars: REGISTERED OFFICE: #139-141 Abercromby Street, Port of SpainChaitanya SharmaNo ratings yet

- Current Affairs of April 14Document8 pagesCurrent Affairs of April 14Chaitanya SharmaNo ratings yet

- Enterdigital: Print CloseDocument2 pagesEnterdigital: Print CloseChaitanya SharmaNo ratings yet

- 15 Killer Tips To Crack SSB Interview in 2014 - SSB Interview Tips & Coaching - SSBCrackDocument5 pages15 Killer Tips To Crack SSB Interview in 2014 - SSB Interview Tips & Coaching - SSBCrackChaitanya SharmaNo ratings yet

- SSB SRT Pratiyogita Darpan - Google SearchDocument2 pagesSSB SRT Pratiyogita Darpan - Google SearchChaitanya SharmaNo ratings yet

- Https Exploringgeography - Wikispaces.com File View Chapter+5+Mineral+and+power+resource+ (New) PDFDocument8 pagesHttps Exploringgeography - Wikispaces.com File View Chapter+5+Mineral+and+power+resource+ (New) PDFChaitanya SharmaNo ratings yet

- About DOEACC Courses PDFDocument3 pagesAbout DOEACC Courses PDFChaitanya SharmaNo ratings yet

- Vidwaan Academy: General KnowledgeDocument8 pagesVidwaan Academy: General KnowledgeChaitanya SharmaNo ratings yet

- Indian State and Its Folk Dances: Sl. No. Name of The States List of Dances 1 2Document2 pagesIndian State and Its Folk Dances: Sl. No. Name of The States List of Dances 1 2Chaitanya SharmaNo ratings yet

- Jabs0208-013cv VBBBBBBBBBBBBBBBBBBBBBBBBGBBBBBBBBBBBDocument2 pagesJabs0208-013cv VBBBBBBBBBBBBBBBBBBBBBBBBGBBBBBBBBBBBChaitanya SharmaNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Drilling and Blasting Activities at Senakin Mine ProjectDocument18 pagesDrilling and Blasting Activities at Senakin Mine ProjectSlamet SetyowibowoNo ratings yet

- 8531Document9 pages8531Mudassar SaqiNo ratings yet

- PROVA DE INGLÊS Anpad 2009 JunDocument6 pagesPROVA DE INGLÊS Anpad 2009 JunDavi Zorkot100% (1)

- Addendum To Real Estate Purchase and Sale AgreementDocument2 pagesAddendum To Real Estate Purchase and Sale AgreementJC MagsNo ratings yet

- Garage Locator PDFDocument134 pagesGarage Locator PDFMCS SBINo ratings yet

- Chapter 4 - TaxesDocument28 pagesChapter 4 - TaxesabandcNo ratings yet

- IB Economics SL8 - Overall Economic ActivityDocument6 pagesIB Economics SL8 - Overall Economic ActivityTerran100% (1)

- Democracy in Pakistan Hopes and HurdlesDocument3 pagesDemocracy in Pakistan Hopes and HurdlesAftab Ahmed100% (1)

- Registration of PropertyDocument13 pagesRegistration of PropertyambonulanNo ratings yet

- The Importance of Public TransportDocument1 pageThe Importance of Public TransportBen RossNo ratings yet

- Brian Ghilliotti: BES 218: Entrepreneurial Studies: Week 3Document3 pagesBrian Ghilliotti: BES 218: Entrepreneurial Studies: Week 3Brian GhilliottiNo ratings yet

- Double Taxation Relief: Tax SupplementDocument5 pagesDouble Taxation Relief: Tax SupplementlalitbhatiNo ratings yet

- Howe India Company ProfileDocument62 pagesHowe India Company ProfileowngauravNo ratings yet

- Tax Invoice GJ1181910 AK79503Document3 pagesTax Invoice GJ1181910 AK79503AnkitNo ratings yet

- S.B. No. 824: First Regular SessionDocument5 pagesS.B. No. 824: First Regular SessionKevin TayagNo ratings yet

- Ethiopia Profile Enhanced Final 7th October 2021Document6 pagesEthiopia Profile Enhanced Final 7th October 2021sarra TPINo ratings yet

- The Role of Philanthropy or The Social ResponsibilityDocument8 pagesThe Role of Philanthropy or The Social ResponsibilityShikha Trehan100% (1)

- Role of Financial Markets and InstitutionsDocument15 pagesRole of Financial Markets and Institutionsনাহিদ উকিল জুয়েলNo ratings yet

- Education and Social DevelopmentDocument30 pagesEducation and Social DevelopmentMichelleAlejandroNo ratings yet

- Economic System and BusinessDocument51 pagesEconomic System and BusinessJoseph SathyanNo ratings yet

- ENG - (Press Release) PermataBank and Kredivo Team Up For Rp1 Trillion Credit LineDocument2 pagesENG - (Press Release) PermataBank and Kredivo Team Up For Rp1 Trillion Credit LineTubagus Aditya NugrahaNo ratings yet

- Assignment - Engro CorpDocument18 pagesAssignment - Engro CorpUmar ButtNo ratings yet

- 7 Costs of ProductionDocument24 pages7 Costs of Productionakshat guptaNo ratings yet

- Outward Remittance Form PDFDocument2 pagesOutward Remittance Form PDFAbhishek GuptaNo ratings yet

- Indian MFTrackerDocument1,597 pagesIndian MFTrackerAnkur Mittal100% (1)

- Court of Tax Appeals First Division: Republic of The Philippines Quezon CityDocument2 pagesCourt of Tax Appeals First Division: Republic of The Philippines Quezon CityPaulNo ratings yet

- Tender Waiver Form 2015Document6 pagesTender Waiver Form 2015ahtin618No ratings yet

- Lecture 3 Profit Maximisation and Competitive SupplyDocument36 pagesLecture 3 Profit Maximisation and Competitive SupplycubanninjaNo ratings yet

- Five Year PlanDocument5 pagesFive Year PlanrakshaksinghaiNo ratings yet

- Tata Vistara - Agency PitchDocument27 pagesTata Vistara - Agency PitchNishant Prakash0% (1)