Professional Documents

Culture Documents

8

Uploaded by

asyrafmuhddCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

8

Uploaded by

asyrafmuhddCopyright:

Available Formats

International Journal of Manpower

Skill Shortages in the Construction Sector

Geoffrey Briscoe

Article information:

To cite this document:

Geoffrey Briscoe, (1990),"Skill Shortages in the Construction Sector", International Journal of Manpower, Vol. 11 Iss 2 pp. 23

- 28

Permanent link to this document:

http://dx.doi.org/10.1108/01437729010135791

Downloaded on: 24 November 2015, At: 01:56 (PT)

References: this document contains references to 0 other documents.

To copy this document: permissions@emeraldinsight.com

The fulltext of this document has been downloaded 397 times since 2006*

Downloaded by Universiti Teknologi MARA At 01:56 24 November 2015 (PT)

Users who downloaded this article also downloaded:

Andrew R.J. Dainty, Stephen G. Ison, David S. Root, (2004),"Bridging the skills gap: a regionally driven strategy for resolving

the construction labour market crisis", Engineering, Construction and Architectural Management, Vol. 11 Iss 4 pp. 275-283

http://dx.doi.org/10.1108/09699980410547621

Yadeed B. Lobo, Suzanne Wilkinson, (2008),"New approaches to solving the skills shortages in the New Zealand

construction industry", Engineering, Construction and Architectural Management, Vol. 15 Iss 1 pp. 42-53 http://

dx.doi.org/10.1108/09699980810842052

Mohamed S. Abdel-Wahab, Andrew R.J. Dainty, Stephen G. Ison, Patrick Bowen, Guy Hazlehurst, (2008),"Trends of skills

and productivity in the UK construction industry", Engineering, Construction and Architectural Management, Vol. 15 Iss 4 pp.

372-382 http://dx.doi.org/10.1108/09699980810886865

Access to this document was granted through an Emerald subscription provided by emerald-srm:434496 []

For Authors

If you would like to write for this, or any other Emerald publication, then please use our Emerald for Authors service

information about how to choose which publication to write for and submission guidelines are available for all. Please visit

www.emeraldinsight.com/authors for more information.

About Emerald www.emeraldinsight.com

Emerald is a global publisher linking research and practice to the benefit of society. The company manages a portfolio of

more than 290 journals and over 2,350 books and book series volumes, as well as providing an extensive range of online

products and additional customer resources and services.

Emerald is both COUNTER 4 and TRANSFER compliant. The organization is a partner of the Committee on Publication

Ethics (COPE) and also works with Portico and the LOCKSS initiative for digital archive preservation.

*Related content and download information correct at time of download.

SKILL SHORTAGES IN THE CONSTRUCTION SECTOR

Downloaded by Universiti Teknologi MARA At 01:56 24 November 2015 (PT)

he nature of skill shortages in the UK

construction sector is examined.

Skill

Shortages

in the

Construction

Sector

Geoffrey Briscoe

industry. A Commons Select Committee took evidence

on skill shortages in the construction sector. The CITB's

Annual Report for 1986-87 acknowledged the problem of

skill shortages especially in London and the South-East

and in the particular trades of carpentry, bricklaying,

plastering and painting and decorating. It concluded that

whilst there was unlikely to be a serious shortage of labour

nationally, some contractors would face problems in

meeting their specific requirements in local labour

markets[3]. During 1987 and continuing into 1988, demand

for construction output has grown strongly, especially in

the South-Eastern region, and these problems of skill

shortage have been intensified.

Survey Reports

Whilst a good deal of the evidence of construction skill

shortage remains anecdotal, a number of surveys provide

more tangible proof. The Building Employers'

Confederation (BEC) conducts a quarterly survey amongst

its 600 member firms and the results are weighted to

reflect the size of firm. Some of the results reported in

the Spring 1988 survey are reproduced in Table I. Part

A of this table shows how skill shortages have significantly

increased over the last two years. Of the selected skills

examined, shortages of bricklayers and carpenters appear

to be more severe than those for plasterers. Part B of

Table I provides a breakdown by region. It is apparent

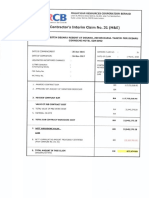

Table I. BEC Survey Evidence of Skill Shortages

Bricklayers

The Evidence

In the decade after 1973 overall construction output

declined by a quarter and this produced associated

reductions in the size of the industry's workforce and,

in particular, in the number of construction trainees.

During the late 1970s and the early 1980s the concern was

with large-scale unemployment amongst construction

operatives and there were very few mentions of skill

shortages. Indeed, the Building Economic Development

Committee's (EDC) Skilled Manpower Steering Group,

reporting in 1984, found that generalised shortages of

operative skills were unlikely to be a problem in the near

future [1]. Other commentators on construction manpower

shared this view. By late 1986, although output in the

industry had only grown relatively slowly in the intervening

years, widespread concern was being expressed over

construction skill shortages.

Early in 1987 the building press ran a number of articles

on skill shortages; the magazine Building wrote of the

missing thousands of tradesmen[2]. The Minister for

Housing advised the Construction Industry Training Board

(CITB) urgently to introduce extra trainees into the

Carpenters

Plasterers

IA: Percentage of Firms

Nationally Reporting Difficulty

in Recruiting Specific Skills

(first quarter of each year)

Date:

1984

40

48

1986

80

1988

38

35

77

24

25

64

IB: Percentage of Firms with

Skill Shortages, by Region

(first quarter, 1988)

Region:

London

97

Southern

86

South-West

85

Eastern

83

Scotland

43

Northern

47

Yorkshire

70

Midland

85

77

84

88

84

56

51

66

85

75

71

72

66

1

47

59

80

Source: Building Employers' Confederation State of the Trade Enquiry

(Spring 1988)

24 SKILL SHORTAGES IN THE 1990s

Downloaded by Universiti Teknologi MARA At 01:56 24 November 2015 (PT)

that skill shortages are more pronounced in London and

the Southern regions than in Scotland and the North.

However, contractors in both the Midlands and Yorkshire

were also experiencing significant shortages at the start

of 1988. Of course, the severity of these reported

shortages is open to question, but the BEC survey

confirms that some 11 per cent of all firms considered

their manpower problems to be contributing to serious

contract delays. This percentage was as high as 52 per

cent in the London region, but it was appreciably less

elsewhere.

A second important source of evidence is afforded by the

September 1987 survey of the Federation of Master

Builders (FMB). This employers' federation represents

mainly smaller contracting firms, but the results are

generally consistent with those found for the larger

member firms of the BEC. Table IIA confirms the regional

disparities in skill shortages, whilst Table IIB indicates

how the shortage problem is most pronounced amongst

bricklayers, carpenters and plasterers.

The evidence provided in these two surveys is also

mirrored by other research organisations in the

construction sector, such as the trade unions and the

Table II. FMB Survey Results on Construction Skill

Shortages (September 1987)

IIA: Percentage of Firms with Skill Shortages, by Region

Region

London

Southern

Eastern

South-West

Midland

Northern

Yorkshire

North-West

English Total

Percentage of All Firms

79

64

63

57

53

47

36

32

55

IIB: Percentage of Skills Involved, Based on the Firms

Reporting a Shortage

Trade

Carpenters

Bricklayers

Plasterers

General Operatives

Painters

Mechanical Engineers

Roofers

Percentage of Cases

75

66

22

20

19

12

12

Source: Federation of Master Builders Manpower and Training Survey

(December 1987)

London Research Centre. The Association of

Metropolitan Authorities revealed in 1987 how 72 per

cent of its Direct Labour Organisations (DLOs) had

difficulty recruiting skilled labour. Moreover, it would

appear that the problem is not simply confined to

operative skills, but it also extends to professional and

supervisory staff. A recent report in Building magazine

highlighted a shortfall of graduates in the construction

sector[4] and certainly the salary offers currently being

made to this year's graduates underlines this shortage.

In the first half of 1988 the construction press has been

overladen with job advertisements for every kind of skill,

whilst the same magazines have continued to report on

crisis meetings over skill shortages, especially in the

London and South-Eastern area markets.

Patterns of Demand for Skills

The demand for construction skills is governed by both

the geographical location of the activity and by the exact

nature of the product which is demanded. Unlike most

manufactured products, construction goods and services

are produced at the point of demand and there is little

opportunity for centralised production and subsequent

distribution. In the 1980s, demand has tended to

concentrate in the Southern regions of the country and

this is a major contributory factor to skill shortages in

labour markets in and around London.

Construction activity embraces a wide diversity of

different products and services, and demand for these

has been changing quite significantly in recent years.

Often there are very different labour skill implications

between the different types of work. So, as the Building

EDC makes clear, whilst 1,000 contract value (measured

in 1970 prices) of new housebuilding work uses some nine

site-person days of a bricklayer's employment, the same

contract value in a commercial building uses only 3.3

bricklayer site-person days and on a civil engineering

contract, such as roadbuilding, this falls to 0.2 days.

Regional Aspects

Data provided in Table III show how the overall

construction workload has shifted in favour of London and

the Southern regions of Great Britain during the 1980s.

In 1981, London, the South-East and the South-West

between them shared some 44 per cent of the total

industry output; by 1986 this figure had moved up to 48

per cent. Measured in terms of new work only, the gains

were even greater, so that by 1986 these Southern areas

were responsible for half of all new output in Great

Britain. When new commercial work is looked at in

isolation, it can be seen how, by 1986, these same regions

generated 63 per cent of the national total. This

concentration of demand in one part of the country puts

pressure on the existing skilled labour force and, in the

absence of matching supply responses, contributes to skill

shortages.

SKILL SHORTAGES IN THE CONSTRUCTION SECTOR 25

Table III. Construction Sector Constractors' Output Statistics

MA: Regional Percentage Shares

Downloaded by Universiti Teknologi MARA At 01:56 24 November 2015 (PT)

Region

London

(Rest of) South-East

South-West

East Midlands

East Anglia

West Midlands

North-West

North

Yorkshire

Wales

Scotland

Great Britain

All

work

1981

New

work

Commercial

work

All

work

1986

New

work

Commercial

work

16.0

20.9

7.4

6.5

4.3

7.5

.9.7

5.0

8.2

4.9

9.6

15.9

20.8

7.2

6.5

4.4

6.9

9.4

5.5

7.8

5.5

10.1

35.6

19.5

7.3

3.6

2.8

5.4

6.7

3.1

5.5

3.1

7.4

15.8

23.7

8.4

6.1

4.3

8.3

9.1

4.7

7.3

3.4

8.9

16.8

25.0

8.0

5.8

4.4

7.8

8.7

5.2

6.3

3.2

8.8

33.1

24.1

6.0

4.7

2.6

6.2

6.3

5.4

4.1

2.1

5.4

100%

100%

100%

100%

100%

100%

IIIB: Percentage Type of Work Done

1976

1981

1986

New Public Housing

New Private Housing

New Public Non-housing

New Industrial

New Commercial

Housing R&M

Non-housing R&M

14.6

17.3

22.6

11.9

11.8

11.6

10.2

6.0

13.4

17.9

13.3

14.8

19.0

15.6

3.1

15.9

15.7

11.5

18.6

20.0

15.2

Total

100%

100%

100%

Type of Work

Source: Housing and Construction Statistics (HMSO, 1987)

During the 1980s, many major construction schemes have

been initiated in the South-Eastern region. Prominent

amongst these projects have been London Docklands and

Canary Wharf, the Broadgate development, airport

terminals at Heathrow, as well as Gatwick and Stanstead,

commercial developments in the City of London in the

wake of "Big Bang", the M25 motorway and the Dartford

Crossing. In the late 1980s, construction began on the

Channel Tunnel and its associated infrastructure, major

new developments are in prospect at Kings Cross-St

Pancras and electricity power stations are due for

significant upgrading in the region. At the same time, the

region remains highly favoured for house building and

developers continue to formulate plans for new housing

initiatives, as well as for major refurbishments of the

existing stock.

Frain[5], writing on the labour implications of the Channel

Tunnel, has shown how the project already employs some

2,000 construction workers and this is expected to

increase to a peak of 5,000 in the early 1990s. Skill

shortages appear inevitable, as Kent has never been

noted as an area of construction specialism. There is a

high likelihood that skilled labour will be displaced from

existing local employers and there will be an impact on

other regional labour markets as Trans-Marche Link

(TML), the tunnelling contractors, attempt to recruit

skills from elsewhere. Initially, the tunnel will require civil

engineering skills, such as tunnellers and earthmovers,

but later the demand for bricklayers, plumbers and

plasterers will increase as the tunnelling phase is

completed. TML are already experiencing difficulties

recruiting suitably qualified professional engineers.

Outside the South-Eastern region there is growing

evidence of increasing construction activity in other

regions which, in the first half of the 1980s, have

experienced comparatively low demand. The West

Midlands is enjoying much higher construction output

levels in 1988, as private sector initiatives are targeted

on Birmingham the International Convention Centre,

the Bull Ring redevelopment, and the Heartlands urban

Downloaded by Universiti Teknologi MARA At 01:56 24 November 2015 (PT)

26 SKILL SHORTAGES IN THE 1990s

development proposals. The completion of the M40

motorway is increasing public sector demand in this region

too. The most recent skill shortage survey in Table I

suggests that the Midlands region as a whole is already

short of key skilled operatives. In Sheffield, a 1 billion

renewal programme has just begun and a recent report

on that city has highlighted the difficulties which

contractors and the local authorities are likely to

experience in recruiting suitable labour skills[6]. Other

areas are also experiencing significantly higher

construction demand. Scotland, in particular, is reported

in the building press as enjoying a belated upsurge in

commercial building demand. Previously, skilled operatives

have moved from regions such as Scotland and Yorkshire

and thereby helped to relieve the skills shortage in the

South-East, but perhaps this pattern will change with

higher demand levels in the Northern regions.

The Changing Work Mix

The bottom half of Table III indicates how the balance in

the type of construction work done has shifted significantly

over the most recent decade. By 1986, there was a marked

reduction in all types of public sector work compared to

the position in 1976. New housing in total was much less

important, whilst repair and maintenance activity,

especially in housing, had increased very markedly. The

other notable change was in the growth of new commercial

building which by 1986 had become the single most

important new work category. These observed trends are

likely to continue into the future, according to the scenario

developed by the Building and Civil Engineering EDCs

for the industry in the 1990s [7]. Another, more recently

published, view of construction demand through to the

end of the century, draws on econometric forecasts in

suggesting significant growth in overall output[8]. Within

the total demand there may well be some resurgence in

public sector work as the need to upgrade the ageing

infrastructure becomes ever more urgent and stronger

growth in the demand for new private sector housing is

also very likely.

available in the existing construction workforce. Gann[9]

has provided a number of examples. These include fasttrack construction techniques used on many commercial

buildings and which require operatives skilled in handling

and installing a large number of prefabricated components.

They also extend to more sophisticated services in

industrial and commercial buildings which necessitate

electricians and engineers with greater technical knowledge

of microelectronic control systems. Where repair and

maintenance work has increased to fill the gap left by

shrinking new building markets, demands have arisen for

operatives with multiple skills, rather than a specialist single

skill qualification. Many maintenance workers do not have

the necessary skills to carry out the tasks required of them.

Skill shortages arise from changes in the nature of the

construction product and its associated services.

The Supply of Construction Skills

There are many variables which govern the supply of

construction skills available to a firm in a given location

at any particular point in time. Undoubtedly, some of the

shortages reported in the first section of this article are,

in reality, the consequences of some firms offering too

low a level of wages. The Building EDC[7] has detailed

the practice of "pay and poach" in labour markets, where

skills prove difficult to obtain, and such a practice serves

to accelerate labour turnover and create the appearance

of severe shortages. In other instances, skilled operatives

may temporarily leave the construction sector tofindwork

in other industries; some of these skilled craftsmen may

be tempted back by higher levels of remuneration. Whilst

firms in the South-Eastern labour markets may experience

difficulty in recruiting skilled labour, craftsmen in other

areas of the country may remain unemployed. There exist

real barriers to labour mobility and, for many, the cost

of housing is a major limitation in moving to the SouthEast. Some evidence on these points is provided by

Hogarth and Daniel[10].

CITB Training levels

This changing pattern of demand carries with it strong implications for the labour skill requirements. The observed shift

away from new housing has seemingly reduced the demand

for those traditional skills, such as bricklaying, and painting

and decorating, which are strongly associated with this type

of work. However, where training levels have fallen and

demand has then increased, as has happened in the SouthEastern region in recent years, skill shortfalls have inevitably

occurred. Equally, where the lower level of public sector

non-housing work has reduced demand for skills, such as

plant operators and steel-fixers, it is hardly surprising that

when private sector initiatives, such as London Docklands

and the Channel Tunnel, reactivate demand for the same

skills, shortages are revealed. Many of the older operatives

have left the industry and few younger workers have been

trained in these skills.

In other respects, changing demand has introduced

requirements for new labour skills which are not readily

Overall, the key to replenishing and expanding the

industry's stock of labour skills is through the recruitment

of new entrants and the quality of training which they

receive. Some indication of the recent trends in the

numbers of new entrants is provided in Table IV. The

series detailing all CITB trainees, whilst far from

comprehensive, provides a representative measure of the

declining number of trainees entering construction over

the last decade. Between 1977 and 1986, CITB operative

trainees declined by 24 per cent and the ratio of trainees

to all construction workers also fell significantly, despite

a small recovery after 1983. These declines were well

spread over almost all skilled trades but there were

significant falls in the number of bricklayers, carpenters

and painters trades highlighted in Table I.

Within the CITB totals, there have been some important

shifts between the various categories of trainee. In

particular, the numbers of apprentices have fallen

SKILL SHORTAGES IN THE CONSTRUCTION SECTOR 27

Table IV. Selected Traning Statistics for the

Downloaded by Universiti Teknologi MARA At 01:56 24 November 2015 (PT)

Constuction Sector

Year

All CITB

Trainees

(000)

1977

1978

1979

1980

1981

1982

1983

1984

1985

1986

62.8

65.1

65.3

69.0

60.7

55.0

49.8

48.4

48.5

47.8

NJCBI New Percentage of

Apprentice Trainees to All

Registrations Construction

Workers

(000)

10.2

10.8

12.4

14.0

11.4

9.3

8.9

7.3

8.7

7.5

8.0

7.0

6.8

6.3

5.3

6.2

6.1

6.3

6.4

6.5

Sources: Columns (1) and (3) are based on CITB returns. Column (2) is

taken from Incomes Data Services, Study 396 (1987).

markedly, especially since 1983 when the Youth Training

Scheme (YTS) was first established in the industry. The

National Joint Council for the Building Industry (NJCBI)

apprenticeship is only one of a number of such schemes

applicable to construction, but the statistics shown in

Table IV are representative of the declining trend in

apprentice numbers. Both the Building and Allied Trades

Joint Industrial Council (BATJIC) apprentice registrations

and those for local authority apprentices show similar

declining trends. The Federation of Master Builders

analysis of the 1987 BATJIC apprentice applications

shows that training activity is not scaled to employer

numbers or output[ll]. The London area is the region

with the highest construction workload, yet it had the

lowest apprentice registration on this particular scheme.

Since 1983, the Youth Training Scheme managed by the

CITB has recruited some 18,000 trainees annually,

although the data for 1986 indicates that only 80 per cent

of these starters actually completed the one-year course

and, of those completing, some 90 per cent found

employment within the industry. This YTS scheme has

now been extended to two years and many employers

undoubtedly operate it as a low cost alternative to

apprenticeship. Other trainees enter the industry through

training schemes not controlled by the CITB, such as the

local authority schemes and those which are collegebased. There are no grounds for supposing that these

numbers have been increasing, whilst CITB-controlled

training numbers have been falling.

Other Industry Training

Two other sources of trainee supply are worthy of

mention. The government (Training Agency) operates

a range of schemes, apart from YTS, for training hitherto

unemployed people; schemes such as the Community

Programme have produced a supply of construction skills

to various quality levels. Many of these schemes aim at

retraining adults over a comparatively short period and

hence the quality of this training falls a long way short

of the 3-year indentured apprenticeship. Within the

construction sector, a significant amount of informal onthe-job training has always taken place, although there

are no exact figures on the extent and quality of such

training. When the numbers from these various sources

are added to the CITB totals shown in Table IV the supply

of trainees is much enhanced; Andrew[12] has recently

put the overall figure for 1987-88 as high as 70,000.

However, there remains considerable variation in the

quality of training being given and there is very little

overall control in matching specific skills training to the

changing needs of the industry. These points are well

argued by both Gann[9] and Stewart[6].

In September 1988 the Government launched its

Employment Training (ET) scheme to replace all its

existing adult training programmes. ET is targeted on

unemployed adults and the CITB is initially planning to

harness the new initiative to a standard scheme for training

up to 6,000 adults a year[13]. ET is to be specially tailored

to local labour market needs and the programme is to be

delivered through a network of managing agents who will

organise the off-the-job training and arrange practical work

experience with construction firms. It is clear that ET

depends for its success on firms being willing to provide

places for the prospective trainees. Whilst the direct wage

costs to the firms will be met by government funding it

remains to be seen whether enough contractors will be

prepared to provide training to a good standard.

Some Explanations of Low Training

The main reason for the recent decline in training at a time

when output is growing, is the growth of self-employment

and labour-only subcontracting and the corresponding

demise of direct employment of labour. Between 1980 and

1987 the self-employed share of the construction

workforce grew from 21.6 to an estimated 33.5 per cent.

In the high activity regions of the South-East, the majority

of construction operatives are now self-employed and use

of labour-only subcontracting is commonplace. The

reluctance of self-employed operatives and small labouronly firms to carry out any sort of training is well-known;

see, for example, Langford[14]. The CITB, the

construction employers' federations, the trade unions

(especially the Union of Construction, Allied Trades and

Technicians (UCATT)) and the construction press have

all drawn attention to the problems posed for training by

the move away from practices of direct employment.

Firms in areas of existing skill shortages are often

reluctant to train their own workers since pay-and-poach

labour market practices will usually mean that the trained

operative will be attracted away, before the training firm

can fully benefit from its training investment. This is a

particular problem for the local authority sector with its

28 SKILL SHORTAGES IN THE 1990s

Downloaded by Universiti Teknologi MARA At 01:56 24 November 2015 (PT)

relatively lower rates of pay. In regions of labour shortage,

the DLOsfindit especially difficult to obtain and hold skilled

craftsmen despite their comparatively higher commitment

to training. The CITB has attempted to alleviate this problem

by drawing labour-only subcontractors into its training fold.

But the problem of too low a level of training to meet the

short-term demand for skills remains with the industry.

Training in the construction sector is not perceived as a

sufficiently profitable activity for many firms. Despite the

lower costs of training, established by YTS subsidies, a large

number of firms have not responded to this price incentive.

Most construction firms plan on a very short-term basis

and they prefer to recruit skilled manpower for specific

contracts, rather than on a continuous basis. The commitment to training is frequently considered an unacceptable

cost overhead in the face of uncertain future contracts; there

is little information available on the exact costs of training

in construction. Almost certainly in the absence of YTS,

levels of training today would be much lower than they are.

Future Prospects

Demand for construction products and services is likely to

remain strong in the period through to the year 2000 and

much of this demand will continue to concentrate on the

South-Eastern region; fuller details can be found in Building

Britain 2001[8]. If skill shortages are to be avoided in the

medium and longer term, more trainees will need to be

recruited to the industry and their skill qualifications will

need to be more closely matched to the output demand.

Moreover, it is important that training numbers are adjusted

to the regional balance of work so that more trainees are

available to the South-Eastern labour market where skill

demand is highest. Present practices of London contractors

recruiting craftsmen from the Northern regions and paying

travel and lodging expenses provides only a short-term

solution and this practice may well run into difficulties as

workloads in other regions increase.

The CITB, the Training Agency and associated agencies

are well aware of the present shortage problems and various

initiatives have been forthcoming over the last two years

to try to ease the problem but, in the longer term,

recruitment difficulties may well lie ahead as the national

workforce pool will shrink appreciably in the 1990s. The

construction sector has rarely in the past been able to attract

school-leavers with better qualifications and in the future

it is likely to have to struggle to obtain its share of those

young people with lower qualifications; see the views of

industry practitioners on this aspect[4]. The industry may

need to improve its image if it is to be successful in recruiting

the numbers of trainees it needs in the near future and new

methods of recruitment and training might be required. In

this context the quality of training on offer is likely to prove

relevant and perhaps there are lessons to be learnt from

the comparative studies of vocational training in Britain with

training in France and West Germany, as produced by Prais

and his associates at the National Institute for Economic

Research[15]. Compared with these European countries, the

UK quality of craft training for the building trades is claimed

to be significantly inferior.

Unless the problem of skill shortages can be eradicated in

the longer term, the construction sector will face growing

labour cost difficulties which will restrict growth. Normal

skill mobility responses are unlikely to be sufficient to solve

shortages, given that demand is expected to grow

significantly in regions outside the South-East. Already

higher wage rates have become established in the overheated London market[16] and such costs must find their

way through into higher prices for buildings. Construction

clients will seek alternative locations wherever feasible, but

some buildings will never be commissioned and, in an

increasingly international environment the more so after

1992 others will be built abroad to the disadvantage of

the UK and its construction sector.

References

1. Building EDC, Building Skills for Tomorrow's Jobs, Nationa

Economic Development Office, 1984.

2. Law, P., Guest, P. and Steadman, R., "Death of the

Craftsman", Building,30 January 1987, pp. 26-9.

3. Construction Industry Training Board, CITB Annual Report

1986-87, 1987, p. 7.

4. Guest, P. and Pepinster, C., "Labour Pains", Building, 22

January 1988, pp. 30-2.

5. Frain, M., "The Construction Industry", Skills Bulletin No.

5, The Training Commission, Summer 1988.

6. Stewart, A., Planning Homes and Jobs: The Sheffield

Report, University of Warwick, 1988.

7. Building and Civil Engineering EDCs, Construction to 1990,

National Economic Development Office, 1984.

8. Centre for Strategic Studies in Construction, Building

Britain 2001, University of Reading, 1988.

9. Gann, D., "Construction Employment, Skills and Training:

Recent Trends and Future Prospects", (mimeographed),

Science Policy Research Unit, University of Sussex,

February 1988.

10. Hogarth, T. and Daniel, WW., "The Long-distance

Commuters", New Society, 29 May 1987, pp. 11-13.

11. Federation of Master Builders, Manpower and Training

Survey, FMB, December 1987.

12. Andrew, J., "Training Survey Defines the Skills Crisis",

Building Today, 28 February 1988, pp. 21-2.

13. D'Arcy, J., "ET to the Aid of Inner Cities", Contract

Journal, 28 July 1988, pp. 22-3.

14. Langford, D., "Labour-only Sub-contracting", CIOB

Technical Information Note, No. 57, Chartered Institute of

Building, 1985.

15. Prais, S.J. and Steedman, H., "Vocational Training in France

and Britain: The Building Trades", National Institute

Economic Review, No. 116, May 1986, pp. 45-55.

16. Gosney, J., "Builders' Fight to Keep the Lid on Costs",

Contract Journal, 13 August 1987, pp. 14-15.

Geoffrey Briscoe is attached to the Department of Civil Engineering and Building, Coventry Polytechnic, UK.

This article has been cited by:

Downloaded by Universiti Teknologi MARA At 01:56 24 November 2015 (PT)

1. Michael C. P. Sing, D. J. Edwards, Henry J. X. Liu, P. E. D. Love. 2015. Forecasting Private-Sector Construction Works:

VAR Model Using Economic Indicators. Journal of Construction Engineering and Management 141, 04015037. [CrossRef]

2. Geoff Briscoe, Andrew Dainty, Sarah Millett. 2000. The impact of the tax system on selfemployment in the British

construction industry. International Journal of Manpower 21:8, 596-614. [Abstract] [Full Text] [PDF]

3. DG Proverbs, GD Holt, PO Olomolaiye. 1999. The management of labour on high rise construction projects: an international

investigation. International Journal of Project Management 17, 195-204. [CrossRef]

You might also like

- 16 JLKJLKJLKDocument1 page16 JLKJLKJLKasyrafmuhddNo ratings yet

- Gmail - QuotationDocument3 pagesGmail - QuotationasyrafmuhddNo ratings yet

- SachaTanArtisan Wall 170711 PDFDocument1 pageSachaTanArtisan Wall 170711 PDFasyrafmuhddNo ratings yet

- SachaTanArtisan Wall 170711 PDFDocument1 pageSachaTanArtisan Wall 170711 PDFasyrafmuhddNo ratings yet

- V225-MBW-Extension of Closing Date No. 3-STKDocument10 pagesV225-MBW-Extension of Closing Date No. 3-STKasyrafmuhddNo ratings yet

- AI 14 - Screeding For Planter Box PDFDocument4 pagesAI 14 - Screeding For Planter Box PDFasyrafmuhddNo ratings yet

- Piling Layout - 169BP PDFDocument1 pagePiling Layout - 169BP PDFasyrafmuhddNo ratings yet

- SachaTanArtisan Wall 170711 PDFDocument1 pageSachaTanArtisan Wall 170711 PDFasyrafmuhddNo ratings yet

- SachaTanArtisan Wall 170711 PDFDocument1 pageSachaTanArtisan Wall 170711 PDFasyrafmuhddNo ratings yet

- SachaTanArtisan Wall 170711 PDFDocument1 pageSachaTanArtisan Wall 170711 PDFasyrafmuhddNo ratings yet

- Gmail - RE - BUV - VQR No.095 EPOWER - Fire Ctop For Learning ThreatreDocument48 pagesGmail - RE - BUV - VQR No.095 EPOWER - Fire Ctop For Learning ThreatreasyrafmuhddNo ratings yet

- 01.variation Quotation 095Document33 pages01.variation Quotation 095asyrafmuhddNo ratings yet

- AI 14 - Screeding For Planter Box PDFDocument4 pagesAI 14 - Screeding For Planter Box PDFasyrafmuhddNo ratings yet

- Piling Layout - 169BP PDFDocument1 pagePiling Layout - 169BP PDFasyrafmuhddNo ratings yet

- Minutes of Meeting No. 3Document33 pagesMinutes of Meeting No. 3asyrafmuhddNo ratings yet

- 20171106-MST - Prelim BP V1-14 (R1)Document12 pages20171106-MST - Prelim BP V1-14 (R1)asyrafmuhddNo ratings yet

- V225-MBW-Extension of Closing Date No. 3-SBRDocument2 pagesV225-MBW-Extension of Closing Date No. 3-SBRasyrafmuhddNo ratings yet

- Sin1111500 13 3 25Document95 pagesSin1111500 13 3 25asyrafmuhddNo ratings yet

- V225-MBW-Extension of Closing Date No. 3-KPDocument4 pagesV225-MBW-Extension of Closing Date No. 3-KPasyrafmuhddNo ratings yet

- Verified Claim CC 31Document42 pagesVerified Claim CC 31asyrafmuhddNo ratings yet

- Claim M&e Westin No.31 Verified by C.O.W - WSPDocument57 pagesClaim M&e Westin No.31 Verified by C.O.W - WSPasyrafmuhddNo ratings yet

- FCR Compilation - Submit PDFDocument44 pagesFCR Compilation - Submit PDFasyrafmuhddNo ratings yet

- FCR Compilation - SubmitDocument2 pagesFCR Compilation - SubmitasyrafmuhddNo ratings yet

- FCR Compilation - Submit PDFDocument44 pagesFCR Compilation - Submit PDFasyrafmuhddNo ratings yet

- V225-MBW-Extension of Closing Date No. 3-KPDocument2 pagesV225-MBW-Extension of Closing Date No. 3-KPasyrafmuhddNo ratings yet

- Gmail - SkyMeridien - FCR Compilation PDFDocument1 pageGmail - SkyMeridien - FCR Compilation PDFasyrafmuhddNo ratings yet

- FCR Compilation - SubmitDocument3 pagesFCR Compilation - SubmitasyrafmuhddNo ratings yet

- Gmail - SkyMeridien - FCR Compilation PDFDocument1 pageGmail - SkyMeridien - FCR Compilation PDFasyrafmuhddNo ratings yet

- 6191 139 CMGD pk1Document2 pages6191 139 CMGD pk1asyrafmuhddNo ratings yet

- V225-MBW-Extension of Closing Date No. 3-JASDocument1 pageV225-MBW-Extension of Closing Date No. 3-JASasyrafmuhddNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5782)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Kitchen Operations by GrahamMcLean, Deirdre DarkDocument449 pagesKitchen Operations by GrahamMcLean, Deirdre DarkLivia Moreanu100% (3)

- Purpose of Business EnterprisesDocument30 pagesPurpose of Business Enterpriseswolfey cloudNo ratings yet

- Mock InterviewDocument27 pagesMock InterviewKETUA PROGRAM TEKNOLOGI MAKLUMAT100% (1)

- GR No 37687Document1 pageGR No 37687ailynvdsNo ratings yet

- Designing a Loyalty Program for Arvind Mills Channel PartnersDocument64 pagesDesigning a Loyalty Program for Arvind Mills Channel Partnerstadashad0% (1)

- Pre-Feasibility Study for Distribution Agency ProjectDocument20 pagesPre-Feasibility Study for Distribution Agency ProjectschakirzamanNo ratings yet

- Diversity in The Global Work Culture Harris 1996Document17 pagesDiversity in The Global Work Culture Harris 1996mobile birNo ratings yet

- Europe 2020: Multi-level governance key to strategy successDocument8 pagesEurope 2020: Multi-level governance key to strategy successAndrei PopescuNo ratings yet

- Macro Macro Objectives - KEYDocument24 pagesMacro Macro Objectives - KEYRobin Kuo100% (1)

- Saratoga County 2012 SalariesDocument29 pagesSaratoga County 2012 SalariesSaratogianNewsroomNo ratings yet

- 486 Harassment Training - 2021Document35 pages486 Harassment Training - 2021Jay SmetanaNo ratings yet

- Understanding The Purpose of A Job InterviewDocument4 pagesUnderstanding The Purpose of A Job Interviewuphie zakiNo ratings yet

- Human Recourse Management (MGMT 232)Document183 pagesHuman Recourse Management (MGMT 232)Emebet Tesema100% (1)

- Sid17273-Bsbhrm501-Task 2Document9 pagesSid17273-Bsbhrm501-Task 2Kelvin AnthonyNo ratings yet

- CF Fcs Advancednutritionwellness1Document5 pagesCF Fcs Advancednutritionwellness1api-243920578No ratings yet

- Child LabourDocument14 pagesChild LabourPriNo ratings yet

- HR Training Development EmployeesDocument30 pagesHR Training Development EmployeesAamir ShahzadNo ratings yet

- Lecture 2 - Build Up RatesDocument22 pagesLecture 2 - Build Up Ratesshahiransalleh100% (4)

- Labor Union Personality Despite DisaffiliationDocument3 pagesLabor Union Personality Despite DisaffiliationDeaNo ratings yet

- CHAPTER 8. NICsDocument32 pagesCHAPTER 8. NICsAmanda RuseirNo ratings yet

- Labor Case FlowDocument1 pageLabor Case FlowVincent Apalla100% (1)

- Improving Performance Reviews: White PaperDocument13 pagesImproving Performance Reviews: White PaperAndi KermaputraNo ratings yet

- REwards N StartegyDocument28 pagesREwards N StartegykalpeshNo ratings yet

- Effects of Globalization in The PhilippinesDocument2 pagesEffects of Globalization in The PhilippinesEdmar OducayenNo ratings yet

- Informal ReportDocument12 pagesInformal Reportapi-459534961No ratings yet

- Impact of Healthcare Services On Outpatient Satisfaction in Public and Private Hospitals A Study of Hospitals in Mumbai Navi Mumbai Thane Pune and Surat Satvinder Singh Bedi PDFDocument385 pagesImpact of Healthcare Services On Outpatient Satisfaction in Public and Private Hospitals A Study of Hospitals in Mumbai Navi Mumbai Thane Pune and Surat Satvinder Singh Bedi PDFkanna_dhasan25581No ratings yet

- Future of HR MetricsDocument52 pagesFuture of HR MetricsLokesh Babu MNo ratings yet

- GD & Assignment TopicsDocument4 pagesGD & Assignment TopicsS Dhulasi RamNo ratings yet

- Formal Research Proposal TopicsDocument3 pagesFormal Research Proposal TopicsNomad1971No ratings yet

- Tieu Luan Mau 2Document7 pagesTieu Luan Mau 2Bảo MinhNo ratings yet