Professional Documents

Culture Documents

AFM Capital Budgeting Assignment

Uploaded by

mahendrabpatelCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

AFM Capital Budgeting Assignment

Uploaded by

mahendrabpatelCopyright:

Available Formats

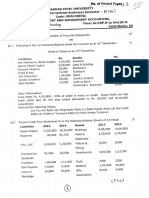

BBA SEM VI: Advance Financeial Management

Problem 9

Satya corporation is toying with the idea of replacing its existing machine. The following

are the relevant data

1. Existing Machine

2. New machine

Purchased 2 years ago

Capital cost of Rs 8,000

Remaining life 6 years

Estimated useful life 6 years

Salvage value Rs 500

Estimated salvage value Rs 800

Current book value Rs 2,600 and its

realisable market value Rs 3,000

Annual depreciation Rs 350

The replaced machine would permit an output expansion. As a result, sales is expected to

rise by Rs 1,000 per year, operating expenses would decline by Rs 1,500 per year. It

would require an additional inventory of Rs 2,000

Assuming corporate tax rate of 40% and cost of capital of 15%, advice the company

Problem 10

A large profit making company is considering the installation of a machine to process the

waste produced by one of its existing manufacturing process to be converted into a

marketable product. At present, the waste is removed by a contractor for disposal on

payment by the company of Rs 50 lacs per annum for next 4 years. The contract can be

terminated on installation of the aforesaid machine on payment of a compensation of Rs

30 lakhs before the processing operation starts. This compensation is not allowed as

deduction for tax purposes.

The machine required for carrying out the processing will cost Rs 200 lakhs to be

financed by a loan repayable in 4 equal instalments commencing from the end of year 1.

The interest rate is 16% p.a At the end of 4 th year, the machine can be sold for Rs 20

lakhs and the cost for dismantling and removal will be Rs 15 lakhs.

Sales and direct cost of the product emerging from waste processing for 4 years are

estimated as under:

Sales

Material consumption

Wages

Other expenses

Factory overheads

Depreciation ( As per income tax)

1

322

30

75

40

55

50

2

322

40

75

45

60

38

3

418

85

85

54

110

28

4

418

85

100

70

145

21

Initial stock required before commencement of the processing operations is Rs 20 lacs at

the start of year 1. The stock levels of materials to be maintained at the end of year 1,2

and 3 will be Rs 55 lacs and the stock at the end of year 4 will be nil. The storage of

Prepared By: Mahendra Patel, Parul Institute of Business Administration

Page 1

BBA SEM VI: Advance Financeial Management

material will utilise the space which otherwise would have been rented out for Rs 10 lakhs

per annum. Labour cost includes wages of 40 workers, whose transfer to this process will

reduce idle time payments of Rs 15 lacs in year 1 and Rs 10 lacs in year 2. Factory

overheads include apportionment of general factory overheads except to the extent of

insurance charges of Rs 30 lakhs per annum attributable to this venture.The companys

tax rate is 50% for revenue incomes.

Advice the management on the desirability of installing the machinery for processing the

waste. All calculation should form part of the answer. Required rate of return is 15%.

Problem 11

A company is setting up a plant at a cost of Rs 300 lakhs of investment in fixed assets. It

has to decide whether to locate the plant in a forward area (FA) or backward are (BA).

Locating in backward area means a cash subsidy of Rs 15 lakhs from the central

government. Besides the taxable profit to the extent of 20% is exempt for 10 years. The

project envisages a borrowing of RS 200 lakhs in either case. The cost of borrowing will

be 12% in forward area and 10% in backward area. However the revenue costs are

bound to be higher in the BA. The borrowing principle has to be repaid in 4 equal annual

instalments beginning from the end of year 4. With the help of following information and

by using Discounted Cash Flow technique you are required to suggest proper location for

the project. Assume straight-line depreciation with no residual value.

Earning before interest and tax (Rs in lakhs)

Year

FA

BA

1

-6

-50

2

34

-20

3

54

10

4

74

20

5

108

45

6

142

100

7

156

155

8

230

190

9

330

230

10

430

330

Assume

1. Discounting rate to be 15%

2. Rate of Income tax to be 50%

3. Central subsidy is not to affect depreciation or tax.

4. No other relief and rebates will be available to the company other than those

mentioned above.

Problem 12

X ltd. is considering two mutually exclusive projects X and Y. Following details are made

available to you:

Rs. In lacs

Project cost

Cash inflows

Year

Project Project

X

Y

1,000

1,000

Prepared By: Mahendra Patel, Parul Institute of Business Administration

Page 2

BBA SEM VI: Advance Financeial Management

1

2

3

4

5

200

150

320

450

500

200

600

250

100

150

Assume no residual value at the end of fifth year. The firms cost of capital is 10%.

Required, in respect of each of the two projects:

i. NPV using 10% discounting rate

ii. IRR and

iii. Profitability index

iv. Payback period

Problem 2

A company proposes to undertake two mutually exclusive projects AXE and BXE :

Initial capital outlay

Economic life (years)

After tax annual cash inflows

Year

1

2

3

4

5

6

7

AXE

Rs 22,50,000

4

6,00,000

12,50,000

10,00,000

7,50,000

-

BXE

Rs. 30,00,000

7

5,00,000

7,50,000

7,50,000

12,00,000

12,50,000

10,00,000

8,00,000

The companys cost of capital is 16%. Please calculate the net present value and IRR for

both the projects

Problem 3

Precision instruments is considering two mutually exclusive projects X and Y. Following

details are made available to you :

Rs. In lacs

Project X

Project Y

Project cost

Cash inflows

Year

1

2

3

700

700

100

200

300

500

400

200

Prepared By: Mahendra Patel, Parul Institute of Business Administration

Page 3

BBA SEM VI: Advance Financeial Management

4

5

450

600

100

100

Assume no residual value at the end of fifth year. The firms cost of capital is 10%.

Required, in respect of each of the two projects :

i. NPV using 10% discounting rate

ii. IRR and

iii. Profitability index

Problem 12

X ltd. is considering two mutually exclusive projects X and Y. Following details are made

available to you :

Rs. In lacs

Project X

Project Y

Project cost

Cash inflows

Year

1

2

3

4

5

1,000

1,000

200

150

320

450

500

200

600

250

100

150

Assume no residual value at the end of fifth year. The firms cost of capital is 10%.

Required, in respect of each of the two projects:

i. NPV using 10% discounting rate

ii. IRR and

iii. Profitability index

iv. Payback period

Problem 13

A company is considering as to which of two mutually exclusive projects it should

undertake. The finance directors thinks that the project with the higher NPV should be

chosen whereas the managing director thinks that the one with higher IRR should be

undertaken especially as both the projects have the same initial outlay and length of life.

The company anticipates a cost of capital of 10% and the net after tax cash flows of the

project are as follows

Year

Project X

Project Y

0

(200)

(200)

1

35

218

2

80

10

3

90

10

4

75

4

5

20

3

Prepared By: Mahendra Patel, Parul Institute of Business Administration

Page 4

BBA SEM VI: Advance Financeial Management

Required

1. Calculate the NPV and IRR of each project

2. state with reasons which project you would recommened

The discounting factors are as follows

Year

1

2

3

4

5

10%

0.91

0.83

0.75

0.68

0.62

Prepared By: Mahendra Patel, Parul Institute of Business Administration

20%

0.83

0.69

0.58

0.48

0.41

Page 5

You might also like

- AFM Capital BudgetingDocument16 pagesAFM Capital BudgetingmahendrabpatelNo ratings yet

- Questions on Capital Budgeting TechniquesDocument6 pagesQuestions on Capital Budgeting Techniqueskaf_scitNo ratings yet

- Financial Management-Capital Budgeting:: Answer The Following QuestionsDocument2 pagesFinancial Management-Capital Budgeting:: Answer The Following QuestionsMitali JulkaNo ratings yet

- Problems On Cash FlowsDocument4 pagesProblems On Cash FlowsDeepakNo ratings yet

- Question of Capital BudgetingDocument7 pagesQuestion of Capital Budgeting29_ramesh170100% (2)

- Project Financial Appraisal and SelectionDocument5 pagesProject Financial Appraisal and SelectionAbhishek KarekarNo ratings yet

- CAP II Group II June 2022Document97 pagesCAP II Group II June 2022aneupane465No ratings yet

- Time Value and Capital BudgetingDocument9 pagesTime Value and Capital BudgetingaskdgasNo ratings yet

- Finance Cap 2Document19 pagesFinance Cap 2Dj babuNo ratings yet

- Unit 2 Capital Budgeting Decisions: IllustrationsDocument4 pagesUnit 2 Capital Budgeting Decisions: IllustrationsJaya SwethaNo ratings yet

- CapbudgetingproblemsDocument3 pagesCapbudgetingproblemsVishal PaithankarNo ratings yet

- Corporate Finance - I Questions BSC Finance Sem IDocument36 pagesCorporate Finance - I Questions BSC Finance Sem IRahul SinghNo ratings yet

- 4 2illustrationDocument4 pages4 2illustrationRitwik BasudeoNo ratings yet

- AssignmentDocument3 pagesAssignmentChourasia HarishNo ratings yet

- Capital Budgeting Exercises for New Product Lines and MachineryDocument2 pagesCapital Budgeting Exercises for New Product Lines and MachinerybdiitNo ratings yet

- Corporate Valuation NumericalsDocument47 pagesCorporate Valuation Numericalspasler9929No ratings yet

- FDHDFGSGJHDFHDSHJDDocument8 pagesFDHDFGSGJHDFHDSHJDbabylovelylovelyNo ratings yet

- Capital Budgeting Techniques for Investment EvaluationDocument5 pagesCapital Budgeting Techniques for Investment EvaluationUday Gowda0% (1)

- Capital Budgeting 5Document9 pagesCapital Budgeting 5Sarvesh SharmaNo ratings yet

- Capital Budgeting Sums - 16-17 (2018 - 05 - 19 12 - 01 - 33 UTC) (2019 - 01 - 22 04 - 17 - 23 UTC) (2019 - 07 - 02 05 - 43 - 05 UTC) PDFDocument7 pagesCapital Budgeting Sums - 16-17 (2018 - 05 - 19 12 - 01 - 33 UTC) (2019 - 01 - 22 04 - 17 - 23 UTC) (2019 - 07 - 02 05 - 43 - 05 UTC) PDFutsavNo ratings yet

- 4a. Capital BudgetingDocument6 pages4a. Capital BudgetingShubhrant ShuklaNo ratings yet

- Capital Budgeting Evaluation Criteria Exercise Guide - NPV, IRR, Replacement Chain ApproachDocument4 pagesCapital Budgeting Evaluation Criteria Exercise Guide - NPV, IRR, Replacement Chain ApproachAnshuman AggarwalNo ratings yet

- Project Appraisal - Stages FlowchartDocument6 pagesProject Appraisal - Stages FlowchartAshokNo ratings yet

- PGP CF 2019 Additional Practice Questions - Nov 2019Document4 pagesPGP CF 2019 Additional Practice Questions - Nov 2019Deepannita ChakrabortyNo ratings yet

- CF - PWS - 5Document3 pagesCF - PWS - 5cyclo tronNo ratings yet

- Strategic Corporate Finance AssignmentDocument6 pagesStrategic Corporate Finance AssignmentAmbrish (gYpr.in)0% (1)

- Naveen Enterprises capital project DCF analysisDocument2 pagesNaveen Enterprises capital project DCF analysisSUBHAJYOTI PALNo ratings yet

- Capital Budgeting 1 - 1Document103 pagesCapital Budgeting 1 - 1Subhadeep BasuNo ratings yet

- CTFP Unit 6 Tax Planning and Managerial Decisions ProblemsDocument3 pagesCTFP Unit 6 Tax Planning and Managerial Decisions ProblemsKshitishNo ratings yet

- CBE - Corporate Finance - SPJG - FinalDocument16 pagesCBE - Corporate Finance - SPJG - FinalNguyễn QuyênNo ratings yet

- Cap BudgetingggDocument3 pagesCap BudgetingggSiva SankariNo ratings yet

- Assignment 2Document4 pagesAssignment 2Jayanth Appi KNo ratings yet

- Infosys LTD Standalone Audit Report To Shareholders For FY 2019Document3 pagesInfosys LTD Standalone Audit Report To Shareholders For FY 2019Sundarasudarsan RengarajanNo ratings yet

- Capital Budgeting Problems and ExercisesDocument7 pagesCapital Budgeting Problems and ExercisesRobert RamirezNo ratings yet

- Estimation of Project Cash Flows: RequiredDocument4 pagesEstimation of Project Cash Flows: Requiredjjayakumar_vjNo ratings yet

- Ex.C.BudgetDocument3 pagesEx.C.BudgetGeethika NayanaprabhaNo ratings yet

- 09 Cash FlowDocument1 page09 Cash FlowShekhar SinghNo ratings yet

- Corporate Financing Decisions, Spring 2016Document4 pagesCorporate Financing Decisions, Spring 2016Ashok BistaNo ratings yet

- Capital Budgeting3Document1 pageCapital Budgeting3Avishek GhosalNo ratings yet

- Capital Budgeting Decisions: Accepting Projects That Yields A Return Higher Than The Hurdle RateDocument76 pagesCapital Budgeting Decisions: Accepting Projects That Yields A Return Higher Than The Hurdle Ratef2016753No ratings yet

- HW3MGT517Document3 pagesHW3MGT517Jaya PaudwalNo ratings yet

- Financial Management Assignment on Working Capital Case Management for Land Rover's New SUV Model LR4Document4 pagesFinancial Management Assignment on Working Capital Case Management for Land Rover's New SUV Model LR4Anshul KhannaNo ratings yet

- Problems On Cash FlowsDocument14 pagesProblems On Cash FlowsAbin Jose100% (2)

- Cash Flow Estimation Class ExcerciseDocument5 pagesCash Flow Estimation Class ExcercisethinkestanNo ratings yet

- Time Value of Money SumsDocument13 pagesTime Value of Money SumsrahulNo ratings yet

- Capital Budgeting Exercise1Document14 pagesCapital Budgeting Exercise1Bigbi Kumar100% (1)

- Practice Problems - Capital Budgeting PDFDocument2 pagesPractice Problems - Capital Budgeting PDFRamainne RonquilloNo ratings yet

- Practice Problems - Capital Budgeting PDFDocument2 pagesPractice Problems - Capital Budgeting PDFRamainne RonquilloNo ratings yet

- MN20501 Lecture 9 Review ExerciseDocument3 pagesMN20501 Lecture 9 Review Exercisesamvrab1919No ratings yet

- Module 3 - Capital Budgeting - 3A - Questions 2022-23Document10 pagesModule 3 - Capital Budgeting - 3A - Questions 2022-23Manya GargNo ratings yet

- CF - PWS - 4Document2 pagesCF - PWS - 4cyclo tronNo ratings yet

- CV Et QP 2022 - PGPFDocument7 pagesCV Et QP 2022 - PGPFanish mahtoNo ratings yet

- Finance 2 Midterm Exam2022Document3 pagesFinance 2 Midterm Exam2022Tuğrul MahmutNo ratings yet

- Capital Budgeting Exercise1Document14 pagesCapital Budgeting Exercise1rohini jha0% (1)

- Accf 2204Document7 pagesAccf 2204Avi StrikyNo ratings yet

- IMT-59 Financial Management M2Document6 pagesIMT-59 Financial Management M2solvedcareNo ratings yet

- Capital BudgetingDocument5 pagesCapital BudgetingbballalNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: 2020 EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: 2020 EditionNo ratings yet

- Material Variance: Unit 2 Standard Costing (MA-06101355)Document12 pagesMaterial Variance: Unit 2 Standard Costing (MA-06101355)mahendrabpatelNo ratings yet

- BASIC FEATURE OF Financial StatementDocument6 pagesBASIC FEATURE OF Financial StatementmahendrabpatelNo ratings yet

- Assignenment 1 DT Unit 1Document9 pagesAssignenment 1 DT Unit 1mahendrabpatelNo ratings yet

- Financial Accounting IntroductionDocument15 pagesFinancial Accounting IntroductionmahendrabpatelNo ratings yet

- Advance Financial Management-IDocument5 pagesAdvance Financial Management-ImahendrabpatelNo ratings yet

- Meaning of Cost Reconciliation StatementDocument5 pagesMeaning of Cost Reconciliation StatementmahendrabpatelNo ratings yet

- 1 CostsheetDocument8 pages1 CostsheetNash ShahNo ratings yet

- Get Started Right AwayDocument2 pagesGet Started Right AwaymahendrabpatelNo ratings yet

- Ch1 6Document109 pagesCh1 6Tia MejiaNo ratings yet

- Historia Del Mondonguito A La ItalianaDocument7 pagesHistoria Del Mondonguito A La ItalianaJuan OrocoNo ratings yet

- MotivationDocument6 pagesMotivationmahendrabpatelNo ratings yet

- Capital BudgetingDocument24 pagesCapital BudgetingmahendrabpatelNo ratings yet

- Question BankDocument31 pagesQuestion BankmahendrabpatelNo ratings yet

- Unit V Cost of CapitalDocument24 pagesUnit V Cost of CapitalmahendrabpatelNo ratings yet

- SP Uni CA 2016 MayDocument4 pagesSP Uni CA 2016 MaymahendrabpatelNo ratings yet

- SP Uni CA 2016Document2 pagesSP Uni CA 2016mahendrabpatelNo ratings yet

- Amit ResumeDocument3 pagesAmit ResumemahendrabpatelNo ratings yet

- API Format 2017Document4 pagesAPI Format 2017mahendrabpatelNo ratings yet

- Cost and Management Accounting exam questions and ratiosDocument3 pagesCost and Management Accounting exam questions and ratiosmahendrabpatelNo ratings yet

- SP Uni CA 2013Document3 pagesSP Uni CA 2013mahendrabpatelNo ratings yet

- Capital StructureDocument37 pagesCapital StructuremahendrabpatelNo ratings yet

- TestDocument2 pagesTestmahendrabpatelNo ratings yet

- SP Uni CA 1Document4 pagesSP Uni CA 1mahendrabpatelNo ratings yet

- SP Uni CA 2015Document3 pagesSP Uni CA 2015mahendrabpatelNo ratings yet

- TestDocument2 pagesTestmahendrabpatelNo ratings yet

- What Is Cost Reconciliation Statement?Document2 pagesWhat Is Cost Reconciliation Statement?mahendrabpatelNo ratings yet

- A2Z FincialDocument3 pagesA2Z FincialmahendrabpatelNo ratings yet

- Instructor Effectiveness Form (IEF) Cronbach ReliabilitiesDocument3 pagesInstructor Effectiveness Form (IEF) Cronbach ReliabilitiesmahendrabpatelNo ratings yet

- Meaning of Cost Reconciliation StatementDocument5 pagesMeaning of Cost Reconciliation StatementmahendrabpatelNo ratings yet

- A2Z FincialDocument3 pagesA2Z FincialmahendrabpatelNo ratings yet

- DHAN BANK Final Approved COMPANY ListDocument84 pagesDHAN BANK Final Approved COMPANY Listcnu11082No ratings yet

- Want To Be A Trader?: TradersworldDocument189 pagesWant To Be A Trader?: TradersworldLuis MásNo ratings yet

- What Is Customer Relationship Management (CRM) ?Document4 pagesWhat Is Customer Relationship Management (CRM) ?MALAY KUMARNo ratings yet

- Viva Presentation: Ruchi Vinay ChavanDocument54 pagesViva Presentation: Ruchi Vinay ChavanPravin SarafNo ratings yet

- The World of Middle Kingdom Egypt (2000-1550 BC) : Contributions On Archaeology, Art, Religion, and Written SourcesDocument44 pagesThe World of Middle Kingdom Egypt (2000-1550 BC) : Contributions On Archaeology, Art, Religion, and Written Sourcesmai refaatNo ratings yet

- English: Quarter 1 - Module 1: Information Gathering For Through Listening For Everyday Life UsageDocument22 pagesEnglish: Quarter 1 - Module 1: Information Gathering For Through Listening For Everyday Life UsageGrayson RicardoNo ratings yet

- I Have Studied Under Many Efficient Teachers and I Have Learnt A Lot From ThemDocument1 pageI Have Studied Under Many Efficient Teachers and I Have Learnt A Lot From ThemSHENNIE WONG PUI CHI MoeNo ratings yet

- Latest Social Science Reviewer Part 18Document6 pagesLatest Social Science Reviewer Part 18vanessa b. doteNo ratings yet

- Churchil SpeechDocument5 pagesChurchil Speechchinuuu85br5484No ratings yet

- Ba English Adp English Part.1 & 2 Notes, Pu, Uos, Iub-Associate Degree ProgramDocument7 pagesBa English Adp English Part.1 & 2 Notes, Pu, Uos, Iub-Associate Degree ProgramFile Download100% (1)

- Kukla Mental PDFDocument1 pageKukla Mental PDFMarieta TsenkovaNo ratings yet

- Air Arabia 2017 Financial StatementsDocument62 pagesAir Arabia 2017 Financial StatementsRatika AroraNo ratings yet

- Environmental Activity PlanDocument2 pagesEnvironmental Activity PlanMelody OclarinoNo ratings yet

- Phrases for Fluent English Speech and WritingDocument2 pagesPhrases for Fluent English Speech and WritingmolesagNo ratings yet

- Excerpts From The Book 'The Lawless State (The Crimes of The U.S. Intelligence Agencies) ' by Morton H. Halperin, Jerry Berman, Robert Borosage, Christine Marwick (1976)Document50 pagesExcerpts From The Book 'The Lawless State (The Crimes of The U.S. Intelligence Agencies) ' by Morton H. Halperin, Jerry Berman, Robert Borosage, Christine Marwick (1976)Anonymous yu09qxYCM100% (1)

- #Sandals4School Sponsorship DocumentDocument9 pages#Sandals4School Sponsorship DocumentKunle AkingbadeNo ratings yet

- CR PCDocument9 pagesCR PCZ_JahangeerNo ratings yet

- Assignment 2 Sociology For EngineersDocument5 pagesAssignment 2 Sociology For EngineersLiaqat Hussain BhattiNo ratings yet

- Solution Manual For Fundamentals of Advanced Accounting 7th Edition by HoyleDocument44 pagesSolution Manual For Fundamentals of Advanced Accounting 7th Edition by HoyleJuana Terry100% (33)

- Bjorn MeioOrc Barbaro Hugo PDFDocument4 pagesBjorn MeioOrc Barbaro Hugo PDFRaphael VenturaNo ratings yet

- The Cape Gelidonya Wreck: Preliminary ReportDocument19 pagesThe Cape Gelidonya Wreck: Preliminary ReportSerena MonacoNo ratings yet

- 117258-2007-Bercero v. Capitol Development Corp.20181021-5466-8fcr51Document7 pages117258-2007-Bercero v. Capitol Development Corp.20181021-5466-8fcr51Ana RobinNo ratings yet

- Extra Exercises Past Simple Past PerfectDocument1 pageExtra Exercises Past Simple Past PerfectjurgitaNo ratings yet

- Proceedings of The Fourteenth Meeting of The GMS Tourism Working Group (TWG - 14)Document13 pagesProceedings of The Fourteenth Meeting of The GMS Tourism Working Group (TWG - 14)Asian Development Bank ConferencesNo ratings yet

- Evaluation and Comparison of Construction Safety Regulations in Kuwait Government SectorsDocument5 pagesEvaluation and Comparison of Construction Safety Regulations in Kuwait Government SectorsUntungSubarkahNo ratings yet

- 17106-Varsha Rani SonyDocument3 pages17106-Varsha Rani SonyshubhamNo ratings yet

- Sir Thomas WyattDocument4 pagesSir Thomas WyattNoraNo ratings yet

- BibliographyDocument8 pagesBibliographyVysakh PaikkattuNo ratings yet

- GST Invoice Format No. 20Document1 pageGST Invoice Format No. 20email2suryazNo ratings yet

- SOCSCI 1105 Exercise 3Document3 pagesSOCSCI 1105 Exercise 3Jerrold MadronaNo ratings yet