Professional Documents

Culture Documents

Law May2015

Uploaded by

Dhawal TrivediCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Law May2015

Uploaded by

Dhawal TrivediCopyright:

Available Formats

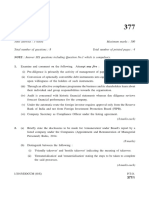

l4AY 2015

Time Allowed

;i:{f.!,T!ilN

Hours

Maximum Marks

100

MLR-H

English' except in the case of

Answers to questions are to be given only in

candidates who have opted for Hincli Medium

lf

a candidare has not opted

Medium, his/her answen in Hindi will not

for Hi.ndi

valued'

Question No. 1 is comPulsory'

Attempt atry five questions from tie remaining

t.

Answer the following questions

questions'

4x5

=2,0

(a)

'X' entered into a contract with 'Y' to suPply him 1'000 water bonles

time'

@ ( 5.00 per water bottle, to be delivered at a spcified

1'000 water

Thereafter, 'X' contracts with 'Z' for the purchase of

he

4.50 per water bottle, and Bt the same time told 'Z' that

enterd into with 'Y''

dicl so for tht purpose of performing his contract

each

'Z' failed to perform his conhact in due course and market Price of

Clonsequently' 'X'

water botde on that day was ? 5'i5 per water bonle

bottles @

the contract What

could not Procure any water bottle and 'Y' reschded

ftom 'Z' in the

would be the amount of darnages which 'X' could claim

1t 'Z' hd not informed

circumstances ? Wltat woukl be your answer

provisions of the

t}rc 'Y's coptract ? Explain with ref#ence to the

{ff;t

Indian Cootact Act- 1872'

MLR-H

I

The Institute of Chartered Accountants of India

P.T.O.

(2)

MLR-H

Marks

G) 'me DocEine of hdoor Management always protcts the prsons

(outsiders) dealing with a company." Explain the above stalemenl

Also, state the exceptions to th3 above nrle.

(o)

State with reasons whether the following statements sr conct or

incorect

(r)

'Faimess and Justice' arc two differEnt apprcaches as a source

of

ethical standards.

(ii)

Inclusion of environmental consideration as a pIt of

coryorate z

sFategy improvescoryorate performancc.

, (d)

Explai! the 'factors tlat lead to grapevine communic{tion'.

j

2. (a) Explain the meaning of 'Quasi-Contracts'. Stat the cfucumstancs which t

are

'O)

ideitified

as quasi contracts

by the Indian Contsact

Act

1872.

What are the 'Unibd Natiols Grridelines Tbemes' on

cotsrmer

important

pmtction ?

(c)

Explain thd types of Gmups in an organization wbich play an

role in solvin.g the d.ifficult problems in tbe organization.

MLR-E

The Institute of Chartered Accountants of India

(3)

MLR -

3. (a) (r)

Marks

Explain the 'time limit for payment of bonus' to ttre employees

in

differcnt circumstances under the provisions of the Payment of

Bonus Act, 1965.

(ii)

'N' is

cmployed in ABC Linited, a seasonal establishment.

The

factory was in operation from ld Marcb to 306 June during de

financial yezr 2014-15. Though,

'N'

was nod in continuous sewice

during this period, he had worked for 95 days. Refening to the

provisions of the Payrpent of Gratuity Lct" 1972, decide whether

'N' is entitled to gratuity.

O)

What is meatrt by 'Coryorate Govemance' ? State ttre 'measures

of

or

2x2

Corporate Govemance' with reference to Indian companies.

(c)

State witb reasons whethei folowing srqtements arc conect

-J

incorrecl

(i)l Rumous and gossips are synonymous.

(ii)

Lying brcaks down dle fust between individuals.

'4. (a) loard of Directors of PQR Limited wants to create a 'Debentue

Redemption Re.srve (DRR)' for the rcdemption of debenores issued

by the company under the provisions of the Companies Act, 2013.

Expiain the provisions of the Companies (Sharc Capital

ad Debentue)

Rules, 2014 in this regard.

MLR-H

The Institute of Chartered Accountants of India

P.T.O.

(4)

MLR -

(b)

Marks

Explain the meaning of'Sustainable Development' ? State the

special

responsibilities of the industries that are based on natural resources.

(c)

Write short notes on

(i)

The hess Communique

(ii)

The Press Notes

5. (a) (i)

What is meant

by 'Sam Re.ours Endorsement' of a bill of

exchange ? How does it differ from 'Sans Frais Etrdonement' ?

(ii)

'P', a major and 'Q',

minor executed

promissory note in

favour 4

of 'R'. Examine with reference to tle provisions of the Negotiable

lmtrumdti Act,

1881, tbe validiry

of the promissory note

and

ivhether ft is binding on 'P' and 'Q'.

(b)

Explain 6e cbncept of'electronic voting system' as provided by

tbe

Compante,s Act" 2013.

(c)

Explain the 'tbreats faced by atr accounting and finance

adheiring,

to

ethical principtres'

at the time of

professional duties.

MLR-H

The Institute of Chartered Accountants of India

professional

perforning his

'

(5)

MLR -

Marks

6. (a) Explain the conditioqs and the manner in which a comPany may issue

depository recipts in a foreign country under the Companies (Issue

of

Global Depository ReceiPts) Rules' 2014.

(b)

State whe(her the following statements are corect or incorrct

(i)

Agency coupted with interest is irrevocable.

(ii)

Depositin! of omaments in a bank locker is a bailnent.

(iii)

Defened shares also called foundcr's shares.

(iv)

Debentrrcs with voting rights can be issued only'

if

1x4

permitted by

the Articles of Association.

(c)

What is meanJ

by

'Emotional Inlelligence'

? Explain the

'Self-

Awareness and Self-Management Personal Clmpetencies' associated

i

with emotional intelligence.

7.

Answer aoy four of the fotlowing

(a)

An InsPector appoiotd uoder the Employeos' Provident Funds

and

Miscellaneous Provisions Act, 1952 makes an inspection at 8 a'm' (en

hour before factory tinings) and seeks to take copies sf the "Iacome

Tax Retums". How far inder the Act is his'action reasonable

MLR-H

The Institute of Chartered Accountants of India

P.T.O.

(6)

MLR -

(b)

II

Marks

Define the term 'Small Company' as contained in the Companies

Act,

2013.

(c)

The Annual General Meeting of KMP Linited was held on 306

April, I

2015. The Articles of Associatiotr of the company is silent regarding the

quorum

of the

present

in the above meeting, o]rt of tlie total 2,750 memben of the

General Meeting. Only 10 meqben were pe$onally

company. The Chairman adjoumed the meeting for watrt of quorumReferring to the provisions of the Conpanies Acr" 2013, etamine the

validity of Chairmatr's decision.

(d) Explain the various socio-psychological

factors responsible

for

developing negative afiiurde by an individual at workplace.

(e)

Siate the reasons for 'resistance to change' in an

MLR-H

The Institute of Chartered Accountants of India

organization.

('1)

MLR-H

(Ilindl Version)

3i

qtfiffi

6i

dFfi

Fr<ti

H crrqq T{ t srit * wr **e rtiQ { d t+ t

sfcfrm* ks+ R{ qrqqrff

nls{+H{

T+

qfr

iq

u, crii if

ffi d wrin t

frn'drr<l orfei+<roldrn

cFr{5qltqffi

tffiqtqc{-rl+Fd{{&s

Mrrks

l. Hqftfu(Fnl+rm{frq:

(q

ff

ffi qr qo

tqlftc scc c{ lft te !|6 +5+el fu+ | irdr{qq .x' i .z' t nq t +.so

'x'

'y' + src t

nh+c-c61<t+

5.00

1,000

tr

+ffi +t <{ i

qf+++rd

*pffic or fr<r fu w qip<

1,000

qr{ frl

Fc ani er qtq-q fuqr

dqT

rrq{

T6

rvi'y' * srq f*g qs .rf{*r + ftqqr +

t | 'z' rFFr rR !qq{ qt{*r y{r E'{+ C qst-o w rni sc k{

#* * ** *

t 5.2s nft *nm qr | .x, Eti q* st +r Et nk Td

""

fi (5r gr 'V' i wlrar mr< w i{qr fc cftffi { .x', ,z' t ffi

EtXc +

frlt

{ftn rqi'{

$qt{

ved

q{r m

++{.qlT

{ qssifrq

vefir

iff

{'rtd

qr.ror ym

wr drn, qft .z' +i .v' S +5**1

r qicftq qt-qq eftftqq, Is72 +qnqr<}

MLR-H

The Institute of Chartered Accountants of India

P.T.O.

(8)

MLR -

qffi

MaTKs

c6'

qqfr tqg qd6n 6d t r" sctff sq< 6r frdqi dfrs rgci-fifrcq *

Cg "q<ft-{ r{q

6r kdrfi s+E

oqqr<i of S e-drrq

6E

onur

rka +crqgfu'treftffrc w< vS I

(0

Gqe-dr'cd tqr+

ffiq

liiy

wffia

ql trrr*q qt-rq+

ei'$-c-m

fuununr

qc-er rrca

clfr{dwrl

nqftqner<a{gnd-<rt

FrO 6i $cr rq|q 6{dr t,

trq-fuq

qFr

rian oi $ari qrd qe+t er

Hqt dfrq

MLR-H

The Institute of Chartered Accountants of India

*'i

*t t t

$ sc'{ Ynkd 6{+

(e)

3. (qj (r) *rq $ff{

MLR - H

qftfrqq, le65 + nst{Fii

Marks

ffididttff$5q-dn+frsqqqSqr

(ii)

ABc

ftft's,

\'6,

ffi

cfrH

gF r ffiq q{

frfirn qRftsfrd

f<'i-d

'rl'

ol

sqdfu

i-q'rR

{ cI t qEft Ec

erqft { 'r' Ac<r *qr if r.6 qr, s{+ cs ffi 6rd fuI I sTlrli TTlf{

eftfrqq, tqrz + nEqrr] 6r r-dq ad Eq Froh d$q t+'qt 'v

zote-ts

?rf

isrcrfi ot qrd * :o qr

iE&qri *feqcsqrt

69 ffia

uvnm lcoq)orat Govematrce)'

mr qffws

{c{ { tTfi{d c{rm + sqFii (neasurcs) 6} {dlw

Ce; ff<qqkd {ff{qfu

11

'oq-qrc cq

r qrfftq e,qfirqt

.'rq{c

qqt'qqr4

tot tq+l-tl"orriqrcoquse'

qilt( futft( fus'rs Prrr]

2x2

qq$em, sq+ qftftqq,2013

S {Nc

Redcmption Reserve)'

6l Vq{ EFI

+iryrq-n f*qq, zotl

ttHqldftq

sl6--dr

+qIsqEI+

r'+ wrqr ctsr 6ic

E( sF{r]

{ w{

(Db"ntlre

1gi{t

F{t

MLR-H

The Institute of Chartered Accountants of India

trqfrktoqrs&t swrnm'

liiy el-eeffi *{qfrrqrsd*satt

n.

{qE{

n-+,

P'T.O.

(10)

MLR -

CA Fdir fu+|{T' (Sustai&ble

DevelopEenr)

Marks

6r ql{rq qq dfrq I n?fti6.

{mnt cr snqtftil sdfr * Hq r.r<rfrret

6E fraftfucwdfu<teqfrrfr

(i) {ll[qRTtrq

ftrfuq

o} c-ffiS

(The Prcss CoEmuDique)

(iD

1FnrrR-qt

qtafi

5. (q (i)

ftffqq-q*

*' qrkq rt-a, (satrs Rec4urs) yis-{ i

qq tftd

(sans rraisl

(ii)

(fhe Itcss Norer)

Wiw

qd

(o f+

qrq-cnqfu-er

ar+

eftcrc

t r qr

,R' + cq

qd

trd

tffi

iftoffi

ERr

q cft-dr-c" +t {e-dr Er qtqq

+{<{

Rrl frt

'6

6,no"ia"a;

fusRqfrf Et

qc+t++t+-+dit

.r@fi-o

qq dftq

The Institute of Chartered Accountants of India

II

dfrc

qfr,

frAqd

q-6qrr

+rtrqtroli qcc,ltT{r

t $Eqqf,{i, (threats) 6l wsdfrq

MLR -

rr gftdr.l-*) ,p, dr.e'otsrvo''cdrt

qftt{cq, zorr lrTtt

(eleaaodc votiDg systen)

Cc; dqr

fus s-+n ft-q

qr Elrs'Si 'Q' qdF' q+rs + C+ri + frd-69

qftfrqq, raer + nsqqi

.Fcr

t S3''

lftm-w qnotssory notey q{ (executed) fu{I 1 q{-s[!{ Rq

'P'

(11)

MLR-H

6.

(D Y{ Yrd

(conditions) qd

fu+{r

t'e-+

faqq, 2s1a

fre}c-d

rt*'

(maorer) qr

lM

q<ti-d qqt

t-st

Marks

k+q+ dfrq, Faq# fm

tS< lctouot

Depository Receipts)

(depository re.ceips)

erorc;ftqt

frf+ll

ifu( q.t vo-ff S

CO dficffFTqfrfudqqqlF&tolqqt'tea

tD ktqrttffi

fmE.qS

lx4

cD ,rerlqt+6detittq+r'ot+iqt

(iiD sfrrd d{r 6} dgrr6'

(iY)

qt<

w+

+ lpf,frqq

qr{-fit

C+; 'ri'*rf,-s.qrE{'

g-$

{i

S wr qrdr

3t-{cft tfr Ei, d}

(Emotional ltrtttignce;

qFrffi-dl

ErRfidfrq

s4{I

'

t w ufrnn t r riirrtmlg{ t

Fi em neq qkq-d

sTrdrsil (Persoasl compordcis)

. ffq{tffisr*.vrr{frq,

(q sffi

clcq frfu gi frkq lrqqn ffifrqq,

f+fttrr crd,

lffi'

8.00 qQ

t+Rqrn wqq n

(Incone tax neumsy

sq+ERrd

'rt6rffi,

<-o

ei cqm 6'{fl

fus *qr f+.

*'q<,td 3i{d t t

MLR-H

The Institute of Chartered Accountants of India

+ q-{'td ftTR \E'

ue q*; frtt"r wcr t gi 'rqrs{

lffi ti

q qfrfrcc

1e52

P.T.O.

(r2)

MLR-H

Cq o'q+ qfrfrqq, zot:

dhe

c{) KMp

fift

'ES

oq{'

Marks

Go"tt

compauy;

bl

vfiwfta

ftft|s

ftt qtfi- {Ftrq {rrT 30 q}e zors st {Eq-{ t | {Hi-q qqr

n* ryr1fr lquorunl

*'eft

d e'e.+

+ q{ffqq dq t r sri-ff tqr{

wft

* 5n z,rso {qR} { + +c- ro wEs qkrn uq t,ilfis( + | wqfr +

rqqa { qqqTi{qrdetmaftq rw* qfrfrqq,2013 +nrqqr+ 6r

td

gq

eqq *

W*+qe W

tqk

sdc

Frofq

rm r*nmo

qffma-dmH*qqilFdq

{efi or qtqlr sflHq

S6Cqa{'qft*dqrtrffiE

qMq

ffid di h t-{ct* qrq F6

(resistlace of chanse)

MLR-H

The Institute of Chartered Accountants of India

W<sil

tflqq

You might also like

- Business Development Strategy for the Upstream Oil and Gas IndustryFrom EverandBusiness Development Strategy for the Upstream Oil and Gas IndustryRating: 5 out of 5 stars5/5 (1)

- Corporate Governance: A practical guide for accountantsFrom EverandCorporate Governance: A practical guide for accountantsRating: 5 out of 5 stars5/5 (1)

- Due Diligence and Corporate Compliance Management: NoteDocument5 pagesDue Diligence and Corporate Compliance Management: Notesks0865No ratings yet

- Fundamental Analysis of Indiabulls StockDocument101 pagesFundamental Analysis of Indiabulls StockJaspreet SinghNo ratings yet

- CBSE Class 11 Business Studies Sample Paper-04Document8 pagesCBSE Class 11 Business Studies Sample Paper-04cbsestudymaterialsNo ratings yet

- M.Com. Management Accountancy Exam PaperDocument2 pagesM.Com. Management Accountancy Exam PaperSuryaNo ratings yet

- Paper 6 Commercial and Industrial Laws Arnd AuditingDocument5 pagesPaper 6 Commercial and Industrial Laws Arnd AuditingVelayudham ThiyagarajanNo ratings yet

- Due Diligence and Corporate Compliance Management: Roll No.........................Document5 pagesDue Diligence and Corporate Compliance Management: Roll No.........................sks0865No ratings yet

- Bba 3 Sem AccountsDocument9 pagesBba 3 Sem Accountsanjali LakshcarNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2015 (Result)Document8 pagesStandalone Financial Results, Limited Review Report For September 30, 2015 (Result)Shyam SunderNo ratings yet

- Standalone & Consolidated Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document12 pagesStandalone & Consolidated Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Due Diligence and Compliance ManagementDocument4 pagesDue Diligence and Compliance Managementsheena2saNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Accounting AndFinancial Management 2015-16Document4 pagesAccounting AndFinancial Management 2015-16Ashish AgarwalNo ratings yet

- Bachelor'S Degree Programme Term-End Examination December, 2012 Elective Course: Commerce Eco-14: Accountancy-IiDocument8 pagesBachelor'S Degree Programme Term-End Examination December, 2012 Elective Course: Commerce Eco-14: Accountancy-IiRohit GhuseNo ratings yet

- Question Papers Supplementary Exam 2007Document24 pagesQuestion Papers Supplementary Exam 2007ce1978No ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document9 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- COMPLIANCESDocument5 pagesCOMPLIANCESranjusanjuNo ratings yet

- Practice Test Paper (Executive) - 1Document91 pagesPractice Test Paper (Executive) - 1isha raiNo ratings yet

- Interim Order in The Matter of Sunshine Hi-Tech Infracon LimitedDocument17 pagesInterim Order in The Matter of Sunshine Hi-Tech Infracon LimitedShyam Sunder100% (1)

- Ycmou Mba-I Question Paper 2008 OctDocument25 pagesYcmou Mba-I Question Paper 2008 OctNinad NagpureNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Companies (Filing of Documents and Forms in XBRL) Rules, 2015Document13 pagesCompanies (Filing of Documents and Forms in XBRL) Rules, 2015Latest Laws TeamNo ratings yet

- PTP PP OS v0.2Document27 pagesPTP PP OS v0.2sanketpavi21No ratings yet

- Corporate Restructuring Tools and SchemesDocument4 pagesCorporate Restructuring Tools and SchemesBharat ThapaNo ratings yet

- B.com 1st Year Accounts Imp. Questions RS Mittal CCKDocument4 pagesB.com 1st Year Accounts Imp. Questions RS Mittal CCKAkshat GautamNo ratings yet

- Note: 1Document4 pagesNote: 1Ankur GuptaNo ratings yet

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document9 pagesStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document8 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Strategic Financial Management Last Four Attempts Question PapersDocument50 pagesStrategic Financial Management Last Four Attempts Question PapersNksNo ratings yet

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document5 pagesStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Mid-Term 2022 - CommercialDocument5 pagesMid-Term 2022 - CommercialStephne MarquardNo ratings yet

- CS Final - Financial Tresurs and Forex Management - June 2004Document4 pagesCS Final - Financial Tresurs and Forex Management - June 2004Rushikesh DeshmukhNo ratings yet

- B0Ill: Questions Are Compulsory and AttemptedDocument3 pagesB0Ill: Questions Are Compulsory and AttemptedmillerjoseNo ratings yet

- Ewu Mba Summer 2020 FinalDocument3 pagesEwu Mba Summer 2020 FinalChowdhury Mobarrat Haider AdnanNo ratings yet

- Financial Results & Limited Review For June 30, 2014 (Result)Document5 pagesFinancial Results & Limited Review For June 30, 2014 (Result)Shyam SunderNo ratings yet

- Part-B. If More Questions Are Answered, The Last Extra Answers Will Be IgnoredDocument1 pagePart-B. If More Questions Are Answered, The Last Extra Answers Will Be IgnoredRaju ReddyNo ratings yet

- New Syllabus: NOTE: 1Document32 pagesNew Syllabus: NOTE: 1suresh1No ratings yet

- Actuarial Society of India: ExaminationsDocument9 pagesActuarial Society of India: ExaminationsAmitNo ratings yet

- Rules of Merger - Demeerger FOR CA FIRMSDocument5 pagesRules of Merger - Demeerger FOR CA FIRMSPrikshit Wadhwa100% (1)

- Cma Question - r1 - Legal Environment of BusinessDocument12 pagesCma Question - r1 - Legal Environment of BusinessMuhammad Ziaul Haque100% (1)

- Paper 13Document2 pagesPaper 13VijayaNo ratings yet

- Calculate NPV of water supply project using discounted cash flow analysisDocument8 pagesCalculate NPV of water supply project using discounted cash flow analysisVijaya AgrawalNo ratings yet

- Standalone Financial Results, Auditors Report For March 31, 2015 (Result)Document10 pagesStandalone Financial Results, Auditors Report For March 31, 2015 (Result)Shyam SunderNo ratings yet

- CLSP PDFDocument3 pagesCLSP PDFMehboobElaheiNo ratings yet

- Capital Markets and Securities Laws in English Dec 2014Document4 pagesCapital Markets and Securities Laws in English Dec 2014சுப்பிரமணிய தமிழ்No ratings yet

- Economics of Pakistan Important QuestionsDocument7 pagesEconomics of Pakistan Important QuestionsKhalid MahmoodNo ratings yet

- 10 Classc10 Full SyllabusDocument2 pages10 Classc10 Full SyllabusKhushnuma Shafi Shah100% (1)

- 8Ep3IGviI9AUZtFkgxJ5T7TG6VRkiSDocument2 pages8Ep3IGviI9AUZtFkgxJ5T7TG6VRkiSThulasi KrishnaNo ratings yet

- $e ., - .22 - May, 2al9: of Af of 42Document12 pages$e ., - .22 - May, 2al9: of Af of 42Ekansh AroraNo ratings yet

- Standalone & Consolidated Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document9 pagesStandalone & Consolidated Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Cse Dec 21 Free Mock Test Series Subject: Setting Up of Business Entities and ClosureDocument5 pagesCse Dec 21 Free Mock Test Series Subject: Setting Up of Business Entities and ClosureSimran TrehanNo ratings yet

- Bachelor'S Degree ProgrammeDocument8 pagesBachelor'S Degree ProgrammeUjjval TrivediNo ratings yet

- Institute of Cost and Management Accountants of Pakistan Spring (August) 2012 ExaminationsDocument2 pagesInstitute of Cost and Management Accountants of Pakistan Spring (August) 2012 ExaminationsAmmar KashanNo ratings yet

- Advanced Financial Management Exam QuestionsDocument3 pagesAdvanced Financial Management Exam QuestionsRamakrishna NagarajaNo ratings yet

- CA IPCC Advance Accounts Paper May 2015Document11 pagesCA IPCC Advance Accounts Paper May 2015Abhay AnandNo ratings yet

- Corporate LawDocument272 pagesCorporate Lawcma_anuragNo ratings yet

- Initial Public Offering: An Introduction to IPO on Wall StFrom EverandInitial Public Offering: An Introduction to IPO on Wall StRating: 5 out of 5 stars5/5 (1)

- Income Tax Law for Start-Up Businesses: An Overview of Business Entities and Income Tax LawFrom EverandIncome Tax Law for Start-Up Businesses: An Overview of Business Entities and Income Tax LawRating: 3.5 out of 5 stars3.5/5 (4)

- Audit ReportDocument20 pagesAudit ReportDhawal TrivediNo ratings yet

- SA FY16 Annual AuditorsReportDocument8 pagesSA FY16 Annual AuditorsReportDhawal TrivediNo ratings yet

- The Doomsday ConspiracyDocument2 pagesThe Doomsday ConspiracyDhawal Trivedi100% (1)

- Jan Koum, The Ceo and Cofounder of Whatsapp, Once Lived On Food Stamps Before Facebook Made Him A BillionaireDocument4 pagesJan Koum, The Ceo and Cofounder of Whatsapp, Once Lived On Food Stamps Before Facebook Made Him A BillionaireDhawal TrivediNo ratings yet

- Wednesday 17 FebDocument1 pageWednesday 17 FebDhawal TrivediNo ratings yet

- Management MCQs from Chapters 2-3Document10 pagesManagement MCQs from Chapters 2-3Dhawal TrivediNo ratings yet

- Orders 21 112015Document1 pageOrders 21 112015Dhawal TrivediNo ratings yet

- 132016Document1 page132016Dhawal TrivediNo ratings yet

- Orders 3 November 2015: M/S Pushpak Motor PartsDocument2 pagesOrders 3 November 2015: M/S Pushpak Motor PartsDhawal TrivediNo ratings yet

- New Bombay Overall Summary 3 November 2015Document3 pagesNew Bombay Overall Summary 3 November 2015Dhawal TrivediNo ratings yet

- Chapter 3 PlanningDocument5 pagesChapter 3 PlanningDhawal TrivediNo ratings yet

- AnswersDocument1 pageAnswersDhawal TrivediNo ratings yet

- Cashflowstatementpdf 130123054534 Phpapp01 PDFDocument13 pagesCashflowstatementpdf 130123054534 Phpapp01 PDFSujay Vikram SinghNo ratings yet

- MISCFDocument1 pageMISCFDhawal TrivediNo ratings yet

- Cashflowstatementpdf 130123054534 Phpapp01 PDFDocument13 pagesCashflowstatementpdf 130123054534 Phpapp01 PDFSujay Vikram SinghNo ratings yet

- Cashflowstatementpdf 130123054534 Phpapp01 PDFDocument13 pagesCashflowstatementpdf 130123054534 Phpapp01 PDFSujay Vikram SinghNo ratings yet

- Cashflowstatementpdf 130123054534 Phpapp01 PDFDocument13 pagesCashflowstatementpdf 130123054534 Phpapp01 PDFSujay Vikram SinghNo ratings yet

- Tax ProjectDocument35 pagesTax ProjectDhawal TrivediNo ratings yet

- Standards On AuditingDocument53 pagesStandards On AuditingHimanshijainNo ratings yet

- Communication Noted PDFDocument33 pagesCommunication Noted PDFDhawal TrivediNo ratings yet

- Dhawal CostingDocument45 pagesDhawal CostingDhawal TrivediNo ratings yet

- GA3-240202501-AA2. Presentar Funciones de Su OcupaciónDocument2 pagesGA3-240202501-AA2. Presentar Funciones de Su OcupaciónDidier Andres Núñez OrdóñezNo ratings yet

- My Project Report On Reliance FreshDocument67 pagesMy Project Report On Reliance FreshRajkumar Sababathy0% (1)

- 01-9 QCS 2014Document8 pages01-9 QCS 2014Raja Ahmed HassanNo ratings yet

- 1 - Impact of Career Development On Employee Satisfaction in Private Banking Sector Karachi - 2Document8 pages1 - Impact of Career Development On Employee Satisfaction in Private Banking Sector Karachi - 2Mirza KapalNo ratings yet

- 7 Steps To Eliminate DebtDocument4 pages7 Steps To Eliminate Debttiongann2535No ratings yet

- Analyzing Transactions and Double Entry LectureDocument40 pagesAnalyzing Transactions and Double Entry LectureSuba ChaluNo ratings yet

- Financial Ratio Analysis and Working Capital ManagementDocument26 pagesFinancial Ratio Analysis and Working Capital Managementlucky420024No ratings yet

- IDA - MTCS X-Cert - Gap Analysis Report - MTCS To ISO270012013 - ReleaseDocument50 pagesIDA - MTCS X-Cert - Gap Analysis Report - MTCS To ISO270012013 - ReleasekinzaNo ratings yet

- Bharathiar University MPhil/PhD Management SyllabusDocument22 pagesBharathiar University MPhil/PhD Management SyllabusRisker RaviNo ratings yet

- IQA QuestionsDocument8 pagesIQA QuestionsProf C.S.PurushothamanNo ratings yet

- 2000 Chrisman McmullanDocument17 pages2000 Chrisman McmullanjstanfordstanNo ratings yet

- BudgetingS15 FinalExam 150304 2Document9 pagesBudgetingS15 FinalExam 150304 2FrOzen HeArtNo ratings yet

- Subcontracting Process in Production - SAP BlogsDocument12 pagesSubcontracting Process in Production - SAP Blogsprasanna0788No ratings yet

- Max232 DatasheetDocument9 pagesMax232 DatasheetprincebahariNo ratings yet

- MD - Nasir Uddin CVDocument4 pagesMD - Nasir Uddin CVশুভবর্ণNo ratings yet

- Ais 9 ImDocument117 pagesAis 9 ImSimonNisjaPutraZai100% (1)

- LPP Mod 2Document27 pagesLPP Mod 2ganusabhahit7No ratings yet

- Hotel Functions & Rooms Division GuideDocument6 pagesHotel Functions & Rooms Division GuideSean PInedaNo ratings yet

- Advanced Zimbabwe Tax Module 2011 PDFDocument125 pagesAdvanced Zimbabwe Tax Module 2011 PDFCosmas Takawira88% (24)

- How industrial engineering can optimize mining operationsDocument6 pagesHow industrial engineering can optimize mining operationsAlejandro SanchezNo ratings yet

- CVP Solutions and ExercisesDocument8 pagesCVP Solutions and ExercisesGizachew NadewNo ratings yet

- CE462-CE562 Principles of Health and Safety-Birleştirildi PDFDocument663 pagesCE462-CE562 Principles of Health and Safety-Birleştirildi PDFAnonymous MnNFIYB2No ratings yet

- Ctpat Prog Benefits GuideDocument4 pagesCtpat Prog Benefits Guidenilantha_bNo ratings yet

- A Dissertation Project Report On Social Media Marketing in IndiaDocument62 pagesA Dissertation Project Report On Social Media Marketing in IndiashaikhfaisalNo ratings yet

- 09 - Chapter 2 PDFDocument40 pages09 - Chapter 2 PDFKiran PatelNo ratings yet

- Audit Report Under Section 49 of The Delhi Value Added Tax Act, 2004 Executive SummaryDocument24 pagesAudit Report Under Section 49 of The Delhi Value Added Tax Act, 2004 Executive SummaryrockyrrNo ratings yet

- Supreme Court Dispute Over Liquidated DamagesDocument22 pagesSupreme Court Dispute Over Liquidated DamagesShuva Guha ThakurtaNo ratings yet

- Col 13147Document8 pagesCol 13147Lasantha DadallageNo ratings yet

- Umjetnost PDFDocument92 pagesUmjetnost PDFJuanRodriguezNo ratings yet

- Technical Analysis GuideDocument3 pagesTechnical Analysis GuideQwerty QwertyNo ratings yet