Professional Documents

Culture Documents

Lecture #3: Financial Analysis - Example (Celerity Technology)

Uploaded by

Jack JacintoOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Lecture #3: Financial Analysis - Example (Celerity Technology)

Uploaded by

Jack JacintoCopyright:

Available Formats

Lecture #3

FINANCIAL ANALYSIS

Financial Analysis example (Celerity Technology)

Perfect World all cash Lemonade stand

I/S and CF Differences (Taxes Depreciation, Amortization of Fees (Capitalized)

Capex (Non deductible)

Working Capital (Timing Differences) Changes in Balance Sheet

Financing Activities (New/repayment of debt)

Income Statement

Unlike the Balance Sheet that is a snap-shot at a particular time, the Income

Statements show the flow over time (one year / one quarter/ one month)

Measures profitability for that period

EBITDA

Cash Flow Statement

Working Capital

Capex (Maintenance / Growth Capex)

Acquisitions

Selling Assets/property Disposition of Assets

Principal Payments

Raising New Financing/IPO Equity

Beginning/Ending Cash

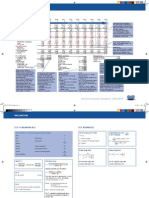

Celerity Technogy Company ("CTC")

Financial Statement Analysis

Balance Sheet (000's)

Current Assets

Cash

Accounts Receivable

Inventories

Prepaid Expenses

Total Current Assets

2008

2009

$ Change

% Change

50,000

45,000

30,000

10,000

135,000

70,000

60,000

35,000

9,000

174,000

20,000

15,000

5,000

(1,000)

39,000

40.0%

33.3%

16.7%

-10.0%

28.9%

2,500,000

450,000

50,000

3,000,000

(300,000)

2,700,000

2,500,000

550,000

75,000

3,125,000

(365,000)

2,760,000

100,000

25,000

125,000

(65,000)

60,000

0.0%

22.2%

50.0%

4.2%

21.7%

2.2%

200,000

250,000

50,000

25.0%

3,035,000

3,184,000

149,000

4.9%

35,000

12,000

10,000

20,000

77,000

40,000

10,000

8,000

10,000

68,000

5,000

(2,000)

(2,000)

(10,000)

(9,000)

14.3%

-16.7%

-20.0%

-50.0%

-11.7%

1,200,000

1,180,000

(20,000)

-1.7%

12,000

17,000

5,000

41.7%

Total Liabilties

1,289,000

1,265,000

(24,000)

-1.9%

Owners' Equity

Common Stock

Paid-in-Capital

Retained Earnings

Total Owners' Equity

1,000,000

746,000

1,746,000

1,000,000

24,200

894,800

1,919,000

24,200

148,800

173,000

0.0%

19.9%

9.9%

Total Liabilities & Owner's Equity

3,035,000

3,184,000

149,000

4.9%

Property and Equipment

Land

Building

Furniture & Equipment

Total Gross P&E

Less Accumulated Depreciaition

Net P&E

Long-Term Investments

Total Assets

Liabilities and Owners Equity

Current Liabilities

Accounts Payable

Accrued Income Taxes

Accrued Expenses

Current Portion of Long Term Debt

Total Current Liabilities

Long-Term Debt:

Deferred Income Taxes

Income Statement (000's)

2008

2009

Revenues by Geography

U.S.

Europe

Asia

Total Revenue

800,000

120,000

40,000

960,000

920,000

140,000

50,000

1,110,000

Cost of Revenues by Geography

U.S.

Europe

Asia

Total Cost of Revenue

220,000

100,000

25,000

345,000

270,000

115,000

35,000

420,000

Gross Profit

615,000

690,000

Operating Expenses

Administrative & General

Marketing Expenses

Other Operating Expenses

Total Operating Expenses

145,000

75,000

10,000

230,000

165,000

80,000

12,000

257,000

EBITDA

385,000

433,000

Operating Ratios for 2009

Rev. Growth

15.0%

16.7%

25.0%

15.6%

% Breakdown

82.9%

12.6%

4.5%

100.0%

Gross Margin

Gross Profit

70.7%

17.9%

30.0%

62.2%

650,000

25,000

15,000

690,000

As % of Sales

14.9%

7.2%

1.1%

23.2%

39.0%

(EBITDA Margin)

60,000

65,000

5.9%

Deprec.as % of Revenues

EBIT

325,000

368,000

33.2%

EBIT Margin

Interest Expense

130,000

120,000

10.0%

Interest Rate

EBT

195,000

248,000

78,000

99,200

40.0%

Tax Rate

117,000

148,800

13.4%

NI Margin

Depreciation

Taxes

Net Income

Cash Flow Statement (000's)

2009

Net Income

Plus Depreciation

Plus Deffered Taxes

Cash Income

148,800

65,000

5,000

218,800

Working Capital Activities

Change in Accounts Receivable

Change in Inventory

Change in Prepaid Expenses

Change in Accounts Payable

Change in Accrued Income Taxes

Change in Accrued Expenses

Total Change in Working Capital

(15,000)

(5,000)

1,000

5,000

(2,000)

(2,000)

(18,000)

Operating Cash Flow (OCF)

200,800

Investment Activities

Capital Expenditures

Investments (Change)

Total Financing Activities

Cash Available Before Financing Activities

Financing Activities

ST Debt Payments

LT Payments

Equity Contribution

Total Financing Activities

(125,000)

(50,000)

(175,000)

Interest Exp. / (Avg Debt incl. LT and ST)

Operating Ratios for 2009

1.4%

A/R Charge as % of Rev.

1.6%

WC as % of Revenues

11.3%

Capex as % Revenues

25,800

(10,000)

(20,000)

24,200

(5,800)

Free Cash Flow

20,000

Beginning Cash

50,000

Ending Cash

70,000

30,000

Total Debt Payments

You might also like

- Assign 1 - Sem II 12-13Document8 pagesAssign 1 - Sem II 12-13Anisha ShafikhaNo ratings yet

- Evaluacion Salud FinancieraDocument17 pagesEvaluacion Salud FinancieraWilliam VicuñaNo ratings yet

- Statement of Comprehensive Income (Income Statement)Document29 pagesStatement of Comprehensive Income (Income Statement)Alphan SofyanNo ratings yet

- Financial Statement Analysis: Learning ObjectivesDocument24 pagesFinancial Statement Analysis: Learning Objectiveshesham zakiNo ratings yet

- Submitted By: Salman Mahboob REGISTRATION NO.: 04151113057 Submitted To: Mr. Wasim Abbas Shaheen Class: Bs (Ba) - 4 Section: BDocument9 pagesSubmitted By: Salman Mahboob REGISTRATION NO.: 04151113057 Submitted To: Mr. Wasim Abbas Shaheen Class: Bs (Ba) - 4 Section: BtimezitNo ratings yet

- Course Code: Fn-550Document25 pagesCourse Code: Fn-550shoaibraza110No ratings yet

- Financial Planning and ForecastingDocument24 pagesFinancial Planning and ForecastingVenn Bacus Rabadon100% (1)

- Primo BenzinaDocument13 pagesPrimo BenzinaP3 Powers100% (1)

- Problems 1-30: Input Boxes in TanDocument24 pagesProblems 1-30: Input Boxes in TanSultan_Alali_9279No ratings yet

- CFA Lecture 4 Examples Suggested SolutionsDocument22 pagesCFA Lecture 4 Examples Suggested SolutionsSharul Islam100% (1)

- Ch02 P14 Build A ModelDocument6 pagesCh02 P14 Build A ModelKhurram KhanNo ratings yet

- Managerial Accounting FiDocument32 pagesManagerial Accounting FiJo Segismundo-JiaoNo ratings yet

- Income-: 2010-11 2009-10Document6 pagesIncome-: 2010-11 2009-10superjagdishNo ratings yet

- Ch02 P14 Build A Model AnswerDocument4 pagesCh02 P14 Build A Model Answersiefbadawy1No ratings yet

- InvestmentsDocument15 pagesInvestmentsDevesh KumarNo ratings yet

- Chapter 13Document11 pagesChapter 13Christine GorospeNo ratings yet

- 3rd Month RatiosDocument3 pages3rd Month Ratiosfazalwahab89No ratings yet

- Ch03 P15 Build A ModelDocument2 pagesCh03 P15 Build A ModelHeena Sudra77% (13)

- DCF ValuationDocument19 pagesDCF ValuationVIJAYARAGAVANNo ratings yet

- Honda Motor Co., Ltd.Document6 pagesHonda Motor Co., Ltd.zakihafifiNo ratings yet

- Solution To Ch02 P14 Build A ModelDocument4 pagesSolution To Ch02 P14 Build A Modeljcurt8283% (6)

- Corporate Finance Crasher 1Document116 pagesCorporate Finance Crasher 1Arpita PatraNo ratings yet

- Financial Statement Analysis UpdatedDocument8 pagesFinancial Statement Analysis UpdatedEmmanuel PenullarNo ratings yet

- DCF TakeawaysDocument2 pagesDCF TakeawaysvrkasturiNo ratings yet

- Chapter 31 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Document44 pagesChapter 31 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Falah Ud Din SheryarNo ratings yet

- Investment VI FINC 404 Company ValuationDocument52 pagesInvestment VI FINC 404 Company ValuationMohamed MadyNo ratings yet

- Non-GAAP Financial MeasuresDocument1 pageNon-GAAP Financial MeasuresAlok ChitnisNo ratings yet

- Chap 2 Financial Analysis & PlanningDocument108 pagesChap 2 Financial Analysis & PlanningmedrekNo ratings yet

- ABC Corporation: Statement of Financial Position 2015 AssetsDocument5 pagesABC Corporation: Statement of Financial Position 2015 AssetsroxetteNo ratings yet

- Fi 410 Chapter 3Document50 pagesFi 410 Chapter 3Austin Hazelrig100% (1)

- Assignment 3 Sem 1-11-12Document5 pagesAssignment 3 Sem 1-11-12Hana HamidNo ratings yet

- Financial Statements, Cash Flows, and TaxesDocument31 pagesFinancial Statements, Cash Flows, and Taxesjoanabud100% (1)

- S7 WEEK8 REI Corporate Finance 15 16Document6 pagesS7 WEEK8 REI Corporate Finance 15 16StefanAndreiNo ratings yet

- 6a02d65b A005 DCF Discounted Cash Flow ModelDocument8 pages6a02d65b A005 DCF Discounted Cash Flow ModelYeshwanth BabuNo ratings yet

- Dwnload Full Financial Management For Decision Makers Canadian 2nd Edition Atrill Solutions Manual PDFDocument35 pagesDwnload Full Financial Management For Decision Makers Canadian 2nd Edition Atrill Solutions Manual PDFbenboydr8pl100% (12)

- Free Elective Exercise No. 1-BalancedDocument17 pagesFree Elective Exercise No. 1-BalancedLoi PanlaquiNo ratings yet

- Elpl 2009 10Document43 pagesElpl 2009 10kareem_nNo ratings yet

- Chapter 2 - Basic Financial StatementsDocument12 pagesChapter 2 - Basic Financial StatementsParas AbbiNo ratings yet

- Chapter 10 - SHAREHOLDER VALUE ADDED (ECONOMIC PROFIT)Document10 pagesChapter 10 - SHAREHOLDER VALUE ADDED (ECONOMIC PROFIT)afwdemo Poppoltje1?No ratings yet

- Problems & Solutions On Fundamental AnalysisDocument8 pagesProblems & Solutions On Fundamental AnalysisAnonymous sTsnRsYlnkNo ratings yet

- Financial Management For Decision Makers Canadian 2nd Edition Atrill Solutions ManualDocument35 pagesFinancial Management For Decision Makers Canadian 2nd Edition Atrill Solutions Manualalmiraelysia3n4y8100% (26)

- Solution To Case 2: Bigger Isn't Always Better!Document9 pagesSolution To Case 2: Bigger Isn't Always Better!Muhammad Iqbal Huseini0% (1)

- Financial Planning and Forecasting PDFDocument29 pagesFinancial Planning and Forecasting PDFzyra liam styles100% (2)

- Mba8101: Financial and Managerial Accounting Financial Statement Analysis BY Name: Reg No.: JULY 2014Document9 pagesMba8101: Financial and Managerial Accounting Financial Statement Analysis BY Name: Reg No.: JULY 2014Sammy Datastat GathuruNo ratings yet

- Excel Advanced Excel For Finance - EXERCISEDocument106 pagesExcel Advanced Excel For Finance - EXERCISEghodghod123100% (1)

- BDP Financial Final PartDocument14 pagesBDP Financial Final PartDeepak G.C.No ratings yet

- Accounting For Financial ManagementDocument54 pagesAccounting For Financial ManagementEric RomeroNo ratings yet

- Chapter 2 Financial Statement and Analysis PDFDocument26 pagesChapter 2 Financial Statement and Analysis PDFRagy SelimNo ratings yet

- JKhoggesDocument6 pagesJKhoggesDegrace NsNo ratings yet

- Krakatau A - CGAR, BUMN, DupontDocument27 pagesKrakatau A - CGAR, BUMN, DupontJavadNurIslamiNo ratings yet

- FM 6 Financial Statements Analysis MBADocument50 pagesFM 6 Financial Statements Analysis MBAMisganaw GishenNo ratings yet

- Chapter 3 Short ProlemsDocument9 pagesChapter 3 Short ProlemsRhedeline LugodNo ratings yet

- Target: Our Brand PromiseDocument26 pagesTarget: Our Brand Promisejennmai85No ratings yet

- Bplan FinancialsDocument8 pagesBplan FinancialsInder KeswaniNo ratings yet

- Sewanee Manufacturing Inc. Summary Historical Operating and Balance Sheet ($ in Millions, Fiscal Year Ending December 31)Document6 pagesSewanee Manufacturing Inc. Summary Historical Operating and Balance Sheet ($ in Millions, Fiscal Year Ending December 31)Tran LyNo ratings yet

- Wiley CMAexcel Learning System Exam Review 2017: Part 2, Financial Decision Making (1-year access)From EverandWiley CMAexcel Learning System Exam Review 2017: Part 2, Financial Decision Making (1-year access)No ratings yet

- Understanding Business Accounting For DummiesFrom EverandUnderstanding Business Accounting For DummiesRating: 3.5 out of 5 stars3.5/5 (8)

- Wso CoverletterDocument1 pageWso CoverletterJack JacintoNo ratings yet

- TTS Turbo Macros v14!0!2Document11 pagesTTS Turbo Macros v14!0!2Jack JacintoNo ratings yet

- 2017-18 Celtics SchedulenbcsDocument1 page2017-18 Celtics SchedulenbcsJack JacintoNo ratings yet

- WSO Resume - DemolishedDocument1 pageWSO Resume - DemolishedJack JacintoNo ratings yet

- 05 01 Interview Question ModelDocument3 pages05 01 Interview Question ModelXintongHuangNo ratings yet

- Alibaba IPO Financial Model WallstreetMojoDocument62 pagesAlibaba IPO Financial Model WallstreetMojoSantanu ShyamNo ratings yet

- Networking WSODocument14 pagesNetworking WSOladyjacket420% (1)

- July 30th LindsayDocument1 pageJuly 30th LindsayJack JacintoNo ratings yet

- Blum Hours TrackingDocument1 pageBlum Hours TrackingJack JacintoNo ratings yet

- 07 DCF Steel Dynamics AfterDocument2 pages07 DCF Steel Dynamics AfterJack JacintoNo ratings yet

- 105 18 Subscription Revenue Model ExcelDocument6 pages105 18 Subscription Revenue Model ExcelJack JacintoNo ratings yet

- Lbo Model Long FormDocument6 pagesLbo Model Long FormadsadasMNo ratings yet

- 107 04 WMT AMZN CRM Working CapitalDocument12 pages107 04 WMT AMZN CRM Working CapitalJack JacintoNo ratings yet

- 107 15 Valuation Multiples Growth RatesDocument11 pages107 15 Valuation Multiples Growth RatesJack JacintoNo ratings yet

- Week Beginning Sunday January 1, 2012: Sunday Monday Tuesday Wednesday Thursday Friday SaturdayDocument2 pagesWeek Beginning Sunday January 1, 2012: Sunday Monday Tuesday Wednesday Thursday Friday SaturdayJack JacintoNo ratings yet

- Ult Guide Comms MLDocument68 pagesUlt Guide Comms MLJack JacintoNo ratings yet

- OilGas DCF NAV ModelDocument22 pagesOilGas DCF NAV ModelJack JacintoNo ratings yet

- Exam 1 Study Guide S15Document1 pageExam 1 Study Guide S15Jack JacintoNo ratings yet

- Conti LboDocument16 pagesConti LboJack JacintoNo ratings yet

- Startup Financial ModelDocument136 pagesStartup Financial ModelChinh Lê ĐìnhNo ratings yet

- Baseball Lineup CardDocument1 pageBaseball Lineup CardJack JacintoNo ratings yet

- Albert Saber MetricsDocument12 pagesAlbert Saber MetricsJack JacintoNo ratings yet

- HPCL - Driving Change Through Internal CommunicationDocument4 pagesHPCL - Driving Change Through Internal Communicationsudipta0% (1)

- Wall Street Prep DCF Financial ModelingDocument7 pagesWall Street Prep DCF Financial ModelingJack Jacinto100% (1)

- University Student Investment Banking Resume TemplateDocument1 pageUniversity Student Investment Banking Resume TemplateholyshnikesNo ratings yet

- 6 Interview Questions of Market KnowledgeDocument2 pages6 Interview Questions of Market KnowledgeJack JacintoNo ratings yet

- The Intelligent Investor NotesDocument19 pagesThe Intelligent Investor NotesJack Jacinto100% (6)

- DCF Model Analysis Business ValuationDocument11 pagesDCF Model Analysis Business ValuationJack Jacinto100% (2)

- HPCL (Final Draft)Document15 pagesHPCL (Final Draft)Jack JacintoNo ratings yet

- Elevator Pitch DraftDocument2 pagesElevator Pitch DraftJack JacintoNo ratings yet

- BusCom Intercompany SalesDocument13 pagesBusCom Intercompany SalesCarmela BautistaNo ratings yet

- F 13 Financial Accounting CpaDocument9 pagesF 13 Financial Accounting CpaMarcellin MarcaNo ratings yet

- Klash Private Limited Balance Sheet and Profit Loss AccountDocument2 pagesKlash Private Limited Balance Sheet and Profit Loss AccountAbdullahNo ratings yet

- LG Annual Report 2017 enDocument44 pagesLG Annual Report 2017 enjunaid sumra100% (1)

- Comm Law Rev 03.13.18 BeiDocument7 pagesComm Law Rev 03.13.18 Beikristian datinguinooNo ratings yet

- Global Capital MarketDocument42 pagesGlobal Capital MarketSunny MahirchandaniNo ratings yet

- Annual Report PT Sepatu Bata TBK 2015-2019Document15 pagesAnnual Report PT Sepatu Bata TBK 2015-2019Kevin LetsoinNo ratings yet

- Capital Gain & IFOS - PaperDocument6 pagesCapital Gain & IFOS - PaperVenkataRajuNo ratings yet

- Dividend Policy NotesDocument6 pagesDividend Policy NotesSylvan Muzumbwe MakondoNo ratings yet

- Course OutlineDocument4 pagesCourse Outlinetacamp daNo ratings yet

- Assignment AnswerDocument2 pagesAssignment AnswerMims ChiiiNo ratings yet

- Consolidations - Subsequent To The Date of AcquisitionDocument32 pagesConsolidations - Subsequent To The Date of AcquisitionAmina AbdellaNo ratings yet

- Lecture 4 - StockDocument29 pagesLecture 4 - StockThuận Nguyễn Thị KimNo ratings yet

- Voluntary Liquidation Under The Bvi Business Companies ActDocument7 pagesVoluntary Liquidation Under The Bvi Business Companies ActRenata ParettiNo ratings yet

- Excel Case 6Document2 pagesExcel Case 6Huế ThùyNo ratings yet

- Chapter 2 (ManAcc) Management Accounting and The Business EnvironmentDocument26 pagesChapter 2 (ManAcc) Management Accounting and The Business EnvironmentEVELINA VITALNo ratings yet

- Tybms Sem5 Iapm Apr19Document3 pagesTybms Sem5 Iapm Apr19Mayur BadheNo ratings yet

- Midterm Exam Schedule - Fall 2023 - Weekdays - WeekendDocument34 pagesMidterm Exam Schedule - Fall 2023 - Weekdays - Weekendabdul.fattaahbakhsh29No ratings yet

- Value Investor Insight-3-17-Causeway Capital, WydenDocument21 pagesValue Investor Insight-3-17-Causeway Capital, WydenWei HuNo ratings yet

- 9980 20170804 StatementDocument2 pages9980 20170804 StatementLyon Paing PhyoNo ratings yet

- 04 Super Projects ExhibitsDocument10 pages04 Super Projects ExhibitsYo shuk singhNo ratings yet

- Cashflows TestDocument1 pageCashflows TestNonilon RoblesNo ratings yet

- Itr 2Document141 pagesItr 2Maitri SaraswatNo ratings yet

- 522 114 Solutions-4Document5 pages522 114 Solutions-4Mruga Pandya100% (3)

- Problem 2 14 Case 2 1Document2 pagesProblem 2 14 Case 2 1Remie HadchitiNo ratings yet

- Investors Perception Towards Investment in Mutual FundsDocument56 pagesInvestors Perception Towards Investment in Mutual Fundstanya dhamija100% (1)

- Accounts Receivable and Inventory ManagementDocument54 pagesAccounts Receivable and Inventory ManagementYogeesh LNNo ratings yet

- Muqaddas Zulfiqar 30101 (B F)Document9 pagesMuqaddas Zulfiqar 30101 (B F)Muqaddas ZulfiqarNo ratings yet

- Accounting ScriptDocument4 pagesAccounting ScriptAlberto AlegadoNo ratings yet

- Problem #21 Preparation of Financial StatementsDocument4 pagesProblem #21 Preparation of Financial Statementsspp33% (3)