Professional Documents

Culture Documents

Tax office audit report on Hyundai Engineering

Uploaded by

Shahaan ZulfiqarOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Tax office audit report on Hyundai Engineering

Uploaded by

Shahaan ZulfiqarCopyright:

Available Formats

OFFICE OF THE

COMMISSIONER INLAND REVENUE, SPECIAL ZONE

REGIONAL TAX OFFICE, MULTAN

No.

Dated:-

Member (Accounting),

Federal Board of Revenue,

Islamabad.

Subject:-

AUDIT PARAS ON M/S HYUNDAI ENGINEERING AND CONSTRUCTION

COMPANY LTD, PRESENTATION OF REPORT TO PAC.

Please refer to Federal Board of Revenues letter No. C.No.3(9)S(IROPERATIONS)/2016/17832-R dated: 11.02.2016 on the above noted subject.

Following Audit Observations were made by the Audit Authorities in the subject

mentioned case.

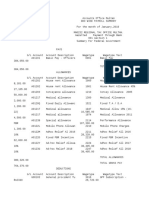

Para/

PDP #

Tax Year

Loss

of

revenue

pointed out

Audit Observations

1.1/244

2001-02

32,243,730

//

//

1.3/257

3.4/254

4.1/245

2002-03

2003

2003

2003

1997-98

63,280,035

56,763,472

61,499,074

55,349,170

81,679,059

Loss of revenue amounting to rs 252,287,237/- due to

non/proper taxation of exchange loss.

//

//

Non levy of Penalty

Non levy of Additional Tax u/s 205

Excess determination of refund

The answers of the given questions are as under:

a)

Questions

Whether Audit

correct?

Observation is

Answers

No

The Audit Observation whether exchange gain/loss is to be

treated as other income as held by External Audit

Authorities or is part of business income/ (loss as carried

forward) by the taxpayer. Brief such of the case are such that

the External Audit Authorities treated the exchange gain as

declared by the taxpayers as part of other income and proposed

to assess as a separate block. The department initially

contested the audit observation on the ground that in another

similar case of M/s AES Lal Pir (Pvt) Ltd the similar audit

observation was made and the department proceeded to

finalize the same as proposed by Audit. However, the said

treatment could neither with stand the said treatment the test of

the first appeal nor that or ATIR and was ultimately deleted.

The Para in the case of M/s Hyundai Engineering &

Construction Co, Ltd was contested as under:

CONTESTED

The unrealized foreign exchange gain / loss relates to assets

and liabilities of the taxpayer which were receivable / payable

in foreign currency. In case of fluctuation in PKR-USD parity,

the loss or gain is recognized as the case may be on the basis

of year-end translation of assets / liabilities in PKR. This

treatment is in line with the financial reporting framework

envisaged under the corporate laws of Pakistan.

For taxation purpose, the foreign exchange gain or loss is

recognized at the extent it relates to a payment made or

received by the person. The gain or loss resulting from yearend translation of assets is classified as Notional Income

which does not attracts the incident of taxation.

b)

c)

If the Audit Observation is correct,

The above noted treatment adopted by the taxpayer is duly

endorsed by Hoble Income Tax Appellate Tribunal in its

judgment reported as (1997) 76 TAX 137 (Trib.)whereby it

was held that the gain arising to assessee from year-end

translation of assets / liabilities in foreign currency does not

tantamount to real income and is not taxable under the law.

On the pressure of Audit Authorities, thereafter, the department

proceeded to add the amount of exchange gain towards total

income treating the exchange gain as part of business income

instead of other income. The said treatment has been carried

out u/s 66A of the repealed ordinance vide order dated:

30.12.2011 (based on the judgment of M/s Elli Lilly). The

relevant case law has already been discussed in DAC meeting

held on 25.09.2015 and 11.10.2015 and copies of the same

have been handed over to the Audit Authorities. During the

course of instant meeting, the External Audit Authority

proposed to verify the amount of BF losses for period relevant

to the Audit observation as referred to above. The same was

shown to the Audit Authorities in the shape of copies of

respective assessment/appeal effect orders for the years 199596 to 2001-02. The issues were discussed at length and it was

decided in principle that the Audit observation is

recommended to be settled in the light of action already taken

by the department.

Para was contested as above.

whether

has taken

However, amount of exchange gain was added towards total

sufficient measures to retrieve loss

income treating the exchange gain as part of business income

of revenue?

instead of other income, due to BF loss, no demand created.

Whether department has taken

No official/officer involved in mal-practice.

department

cognizance of the mal-practice

involved in this case, and has taken

fixed

d)

responsibility

on

the

officers/officials involved?

Names of the officers/officials

involved and disciplinary action

e)

taken against them; and

Any other matter bearing direct

relevance with the issue, and needs

to

be

explanation/clarification

before PAC.

As regard the Para 4.1/245 excess determination of refund was also contested. During DAC meeting

on 19/04/2010 reply of the department was under examination with Audit Authorities (Copy enclosed).

(MUHAMMAD ABID RAZA BODLA)

Commissioner

You might also like

- AUDIT REPORT-GB RevenuesDocument27 pagesAUDIT REPORT-GB RevenuesAbid KhawajaNo ratings yet

- Philippine Court Decision on Tax Overpayment ClaimDocument9 pagesPhilippine Court Decision on Tax Overpayment ClaimNash LedesmaNo ratings yet

- Deferred Tax-Accounting Standard-22-Accounting For Taxes On IncomeDocument6 pagesDeferred Tax-Accounting Standard-22-Accounting For Taxes On IncomerlpolyfabsmaheshNo ratings yet

- Latest Circulars, Notifications and Press Releases: 2. This Notification Shall Come Into Force From The 1Document0 pagesLatest Circulars, Notifications and Press Releases: 2. This Notification Shall Come Into Force From The 1Ketan ThakkarNo ratings yet

- 142 150Document7 pages142 150NikkandraNo ratings yet

- 6 Miscellaneous TransactionsDocument4 pages6 Miscellaneous TransactionsRichel ArmayanNo ratings yet

- CIRT Audit Report Highlights Rs. 423m IrregularitiesDocument27 pagesCIRT Audit Report Highlights Rs. 423m IrregularitiesHamid AliNo ratings yet

- Audit Check Sheet GuideDocument17 pagesAudit Check Sheet GuideJayant JoshiNo ratings yet

- Bureau of Internal Revenue: Republic of The Philippines Department of FinanceDocument4 pagesBureau of Internal Revenue: Republic of The Philippines Department of FinanceHanabishi RekkaNo ratings yet

- Bureau of Internal RevenueDocument13 pagesBureau of Internal Revenuenathalie velasquezNo ratings yet

- Philam v. CIRDocument3 pagesPhilam v. CIRJohn AguirreNo ratings yet

- 15 04 16 Case2Document26 pages15 04 16 Case2tamanna.vkacaNo ratings yet

- AR On RefundDocument54 pagesAR On Refundimran mughalNo ratings yet

- Ruling: Before The Authority For Advance Rulings (Income Tax) New Delhi PresentDocument31 pagesRuling: Before The Authority For Advance Rulings (Income Tax) New Delhi PresentSushil GuptaNo ratings yet

- IAS 12 Income Taxes Study GuideDocument42 pagesIAS 12 Income Taxes Study GuideHaseeb Ullah KhanNo ratings yet

- Maramag Water District Bukidnon Executive Summary 2020Document6 pagesMaramag Water District Bukidnon Executive Summary 2020cpa126235No ratings yet

- 2013 inDocument3 pages2013 inRahul KumarNo ratings yet

- Revenue Memorandum Order No. 53-98Document25 pagesRevenue Memorandum Order No. 53-98johnnayel50% (2)

- CIR v. SONY PHILIPPINES Ruling on Letter of Authority ScopeDocument4 pagesCIR v. SONY PHILIPPINES Ruling on Letter of Authority ScopeclarkorjaloNo ratings yet

- Icici Prudential Life Insurance Appeals Tax Tribunal OrderDocument62 pagesIcici Prudential Life Insurance Appeals Tax Tribunal OrderhhhhhhhuuuuuyyuyyyyyNo ratings yet

- R.kasi Vishwanathan & Bros. V Assist CIt (2014) 42 Taxmann - Com 176 Section 139 (5) - It 475-11 28.3.2016Document7 pagesR.kasi Vishwanathan & Bros. V Assist CIt (2014) 42 Taxmann - Com 176 Section 139 (5) - It 475-11 28.3.2016Prabhash ChandNo ratings yet

- Government Accounting ManualDocument10 pagesGovernment Accounting ManualRyan DberkyNo ratings yet

- REVENUE MEMORANDUM ORDER NO. 1-2015 Issued On January 7, 2015 FurtherDocument15 pagesREVENUE MEMORANDUM ORDER NO. 1-2015 Issued On January 7, 2015 FurtherGoogleNo ratings yet

- Critical Analysis of Income Tax Ordinance 2010Document16 pagesCritical Analysis of Income Tax Ordinance 2010Dilnawaz KhanNo ratings yet

- My Tax Espresso Newsletter Apr2023Document18 pagesMy Tax Espresso Newsletter Apr2023Claudine TanNo ratings yet

- Registration, Taxation & Accounting Compliance of Construction IndustryDocument52 pagesRegistration, Taxation & Accounting Compliance of Construction IndustryJohn Erick FernandezNo ratings yet

- Taxation Laws - Ms. de CastroDocument54 pagesTaxation Laws - Ms. de CastroCC100% (1)

- Food Corporation of India - 41202411354277Document9 pagesFood Corporation of India - 41202411354277abhimanyu7004No ratings yet

- © The Institute of Chartered Accountants of IndiaDocument9 pages© The Institute of Chartered Accountants of IndiaGJ ELASHREEVALLINo ratings yet

- Steag State Power, Inc vs. Commissioner of Internal Revenue FactsDocument40 pagesSteag State Power, Inc vs. Commissioner of Internal Revenue FactsRyannDeLeonNo ratings yet

- GST Refund ReportDocument52 pagesGST Refund Reportarpit85No ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document4 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Audit Assessments and Monitoring of Withholding Taxes by Syed Riazuddin AdvocateDocument28 pagesAudit Assessments and Monitoring of Withholding Taxes by Syed Riazuddin AdvocateAsad MehmoodNo ratings yet

- Adjudication - Case (1) .Docx 1Document14 pagesAdjudication - Case (1) .Docx 1aliciag4342No ratings yet

- Service Tax Audit: A Guide for ProfessionalsDocument13 pagesService Tax Audit: A Guide for ProfessionalsrohitNo ratings yet

- Income Tax ComplianceDocument4 pagesIncome Tax ComplianceJusefNo ratings yet

- RR 22-2020 (Notice of Discrepancy) PDFDocument3 pagesRR 22-2020 (Notice of Discrepancy) PDFilovelawschoolNo ratings yet

- Order 122Document9 pagesOrder 122Zaid NaveedNo ratings yet

- Form Sr. Instruction Instructions For Filling in Return Form & Wealth StatementDocument8 pagesForm Sr. Instruction Instructions For Filling in Return Form & Wealth StatementajgondalNo ratings yet

- Government Accounting DiscussionDocument8 pagesGovernment Accounting DiscussionSamantha Alice LysanderNo ratings yet

- 518 Hand-Outs 6Document8 pages518 Hand-Outs 6RALLISONNo ratings yet

- p2 - Guerrero Ch11Document24 pagesp2 - Guerrero Ch11JerichoPedragosa100% (2)

- Cit Vs Tei Technologies Pvt. LTD On 27 August, 2012Document18 pagesCit Vs Tei Technologies Pvt. LTD On 27 August, 2012chandravadan_patilNo ratings yet

- Proforma of A Reconciliation StatementDocument5 pagesProforma of A Reconciliation StatementAtul Mumbarkar50% (2)

- Silicon Philippines V CirDocument2 pagesSilicon Philippines V CirKia BiNo ratings yet

- Exercise AC 518 2nd Sem 2016Document2 pagesExercise AC 518 2nd Sem 2016RALLISONNo ratings yet

- CIR vs Isabela Cultural CorpDocument13 pagesCIR vs Isabela Cultural CorpmifajNo ratings yet

- Green Valley Marketing Corp. v. Commissioner of Internal Revenue, C.T.A. Case No. 8988, (November 3, 2017) PDFDocument42 pagesGreen Valley Marketing Corp. v. Commissioner of Internal Revenue, C.T.A. Case No. 8988, (November 3, 2017) PDFKriszan ManiponNo ratings yet

- MTF Tax Journal November 2021Document15 pagesMTF Tax Journal November 2021Christine Jane RodriguezNo ratings yet

- Executive Summary: Highlights of Financial OperationsDocument12 pagesExecutive Summary: Highlights of Financial OperationsJaniceNo ratings yet

- Delloite CIT (A) PDFDocument7 pagesDelloite CIT (A) PDFshashi vermaNo ratings yet

- TDS Year of Receipt 26asDocument8 pagesTDS Year of Receipt 26asDr G D PadmahshaliNo ratings yet

- Allowable DeductionsDocument118 pagesAllowable DeductionsPrincess Hazel GriñoNo ratings yet

- BIR clarifies audit program and tax agent responsibilitiesDocument2 pagesBIR clarifies audit program and tax agent responsibilitiesCkey ArNo ratings yet

- Rmo 43-90 PDFDocument5 pagesRmo 43-90 PDFRieland Cuevas67% (3)

- 01-Mun of Himamaylan09 Audit Report - COA ANNUAL AUDIT REPORT 2009Document50 pages01-Mun of Himamaylan09 Audit Report - COA ANNUAL AUDIT REPORT 2009himamaylancitywatchNo ratings yet

- Atlas Consolidated Mining v. CirDocument2 pagesAtlas Consolidated Mining v. CirImmah Santos100% (1)

- Naya' Form 3Cd: 1. Non-Compliance With Provisions of Tax Deduction at Source (Clause 27) : Delays andDocument6 pagesNaya' Form 3Cd: 1. Non-Compliance With Provisions of Tax Deduction at Source (Clause 27) : Delays andrakeshca1No ratings yet

- S 0232 01Document50 pagesS 0232 01Shahaan ZulfiqarNo ratings yet

- Revised PM PACKAGEDocument14 pagesRevised PM PACKAGEShahaan ZulfiqarNo ratings yet

- Slip 0232 01 2019Document513 pagesSlip 0232 01 2019Shahaan ZulfiqarNo ratings yet

- Regularization Application To CCIRDocument7 pagesRegularization Application To CCIRShahaan ZulfiqarNo ratings yet

- Para No Cases Under Process Amount Pointed Out by Audit Amount Charged But Not Recovered Amount Recovered and VerifiedDocument5 pagesPara No Cases Under Process Amount Pointed Out by Audit Amount Charged But Not Recovered Amount Recovered and VerifiedShahaan ZulfiqarNo ratings yet

- Assistance Package For Families of Government Employees Who Die in Service - Sanction of Full Pay and Allowances - Request RegardingDocument5 pagesAssistance Package For Families of Government Employees Who Die in Service - Sanction of Full Pay and Allowances - Request RegardingShahaan ZulfiqarNo ratings yet

- Para No Satisfactory Reply Amount Pointed Out by Audit Amount Charged But Not Recovered Amount Recovered and VerifiedDocument5 pagesPara No Satisfactory Reply Amount Pointed Out by Audit Amount Charged But Not Recovered Amount Recovered and VerifiedShahaan ZulfiqarNo ratings yet

- Chairman, Federal Board of Revenue, IslamabadDocument3 pagesChairman, Federal Board of Revenue, IslamabadShahaan ZulfiqarNo ratings yet

- Dependency and No Marriage CertificatesDocument5 pagesDependency and No Marriage CertificatesShahaan ZulfiqarNo ratings yet

- Certificate UsmanDocument1 pageCertificate UsmanShahaan ZulfiqarNo ratings yet

- Summary Position of RTO Multan with Amounts Pointed Out, Recovered and PendingDocument6 pagesSummary Position of RTO Multan with Amounts Pointed Out, Recovered and PendingShahaan ZulfiqarNo ratings yet

- Para No Amount Pointed Out by Audit Amount Charged But Not Recovered Amount Recovered and Verified Amount Recovered But Un-VerifiedDocument7 pagesPara No Amount Pointed Out by Audit Amount Charged But Not Recovered Amount Recovered and Verified Amount Recovered But Un-VerifiedShahaan ZulfiqarNo ratings yet

- Certificate EmanDocument1 pageCertificate EmanShahaan ZulfiqarNo ratings yet

- Para No. Cases Under Process Satisfactory Reply Amount Pointed Out by Audit Amount Recovered & VerifiedDocument5 pagesPara No. Cases Under Process Satisfactory Reply Amount Pointed Out by Audit Amount Recovered & VerifiedShahaan ZulfiqarNo ratings yet

- R 0232 01Document357 pagesR 0232 01Shahaan ZulfiqarNo ratings yet

- Para No Satisfactory Reply Subjudice Amount Pointed Out by Audit Amount Recovered and VerifiedDocument4 pagesPara No Satisfactory Reply Subjudice Amount Pointed Out by Audit Amount Recovered and VerifiedShahaan ZulfiqarNo ratings yet

- Para No Amount Pointed Out by Audit Amount Charged But Not Recovered Amount Recovered and Verified Amount Recovered But Un-VerifiedDocument7 pagesPara No Amount Pointed Out by Audit Amount Charged But Not Recovered Amount Recovered and Verified Amount Recovered But Un-VerifiedShahaan ZulfiqarNo ratings yet

- Para No Amount Pointed Out by Audit Amount Charged But Not Recovered Amount Recovered and Verified Amount Recovered But Un-VerifiedDocument7 pagesPara No Amount Pointed Out by Audit Amount Charged But Not Recovered Amount Recovered and Verified Amount Recovered But Un-VerifiedShahaan ZulfiqarNo ratings yet

- Para No Cases Under Process Amount Pointed Out by Audit Amount Charged But Not Recovered Amount Recovered and VerifiedDocument5 pagesPara No Cases Under Process Amount Pointed Out by Audit Amount Charged But Not Recovered Amount Recovered and VerifiedShahaan ZulfiqarNo ratings yet

- Para No Amount Pointed Out by Audit Amount Charged But Not Recovered Amount Recovered and Verified Amount Recovered But Un-VerifiedDocument6 pagesPara No Amount Pointed Out by Audit Amount Charged But Not Recovered Amount Recovered and Verified Amount Recovered But Un-VerifiedShahaan ZulfiqarNo ratings yet

- Para No Satisfactory Reply Subjudice Amount Pointed Out by Audit Amount Recovered and VerifiedDocument4 pagesPara No Satisfactory Reply Subjudice Amount Pointed Out by Audit Amount Recovered and VerifiedShahaan ZulfiqarNo ratings yet

- Para No Satisfactory Reply Unsatisfactory Reply Amount Pointed Out by Audit Amount Recovered and VerifiedDocument5 pagesPara No Satisfactory Reply Unsatisfactory Reply Amount Pointed Out by Audit Amount Recovered and VerifiedShahaan ZulfiqarNo ratings yet

- Para No Cases Under Process Amount Pointed Out by Audit Amount Charged But Not Recovered Amount Recovered and VerifiedDocument6 pagesPara No Cases Under Process Amount Pointed Out by Audit Amount Charged But Not Recovered Amount Recovered and VerifiedShahaan ZulfiqarNo ratings yet

- Para No Satisfactory Reply Unsatisfactory Reply Amount Pointed Out by Audit Amount Recovered and VerifiedDocument4 pagesPara No Satisfactory Reply Unsatisfactory Reply Amount Pointed Out by Audit Amount Recovered and VerifiedShahaan ZulfiqarNo ratings yet

- Para No Cases Under Process Amount Pointed Out by Audit Amount Charged But Not Recovered Amount Recovered and VerifiedDocument5 pagesPara No Cases Under Process Amount Pointed Out by Audit Amount Charged But Not Recovered Amount Recovered and VerifiedShahaan ZulfiqarNo ratings yet

- Para No Amount Pointed Out by Audit Amount Charged But Not Recovered Amount Recovered and Verified Amount Recovered But Un-VerifiedDocument6 pagesPara No Amount Pointed Out by Audit Amount Charged But Not Recovered Amount Recovered and Verified Amount Recovered But Un-VerifiedShahaan ZulfiqarNo ratings yet

- Para No Cases Under Process Amount Pointed Out by Audit Amount Charged But Not Recovered Amount Recovered and VerifiedDocument6 pagesPara No Cases Under Process Amount Pointed Out by Audit Amount Charged But Not Recovered Amount Recovered and VerifiedShahaan ZulfiqarNo ratings yet

- Para NO Cases Under Process Amount Pointed Out by AuditDocument6 pagesPara NO Cases Under Process Amount Pointed Out by AuditShahaan ZulfiqarNo ratings yet

- Para No Amount Pointed Out by Audit Amount Charged But Not Recovered Amount Recovered and Verified Amount Recovered But Un-VerifiedDocument5 pagesPara No Amount Pointed Out by Audit Amount Charged But Not Recovered Amount Recovered and Verified Amount Recovered But Un-VerifiedShahaan ZulfiqarNo ratings yet

- Para No Amount Pointed Out by Audit Amount Charged But Not Recovered Amount Recovered and Verified Amount Recovered But Un-VerifiedDocument5 pagesPara No Amount Pointed Out by Audit Amount Charged But Not Recovered Amount Recovered and Verified Amount Recovered But Un-VerifiedShahaan ZulfiqarNo ratings yet

- Sciencedirect Sciencedirect SciencedirectDocument7 pagesSciencedirect Sciencedirect SciencedirectMohamed Amine NZNo ratings yet

- The NF and BNF Charts from the Trading RoomDocument23 pagesThe NF and BNF Charts from the Trading RoomSinghRaviNo ratings yet

- Cambridge O Level: Agriculture 5038/12 October/November 2020Document30 pagesCambridge O Level: Agriculture 5038/12 October/November 2020Sraboni ChowdhuryNo ratings yet

- Chapter 4-Market EquilibriumDocument24 pagesChapter 4-Market EquilibriumAiman Daniel100% (2)

- Consular Assistance For Indians Living Abroad Through "MADAD"Document12 pagesConsular Assistance For Indians Living Abroad Through "MADAD"NewsBharatiNo ratings yet

- Railway noise source modeling and measurement methodsDocument78 pagesRailway noise source modeling and measurement methodsftyoneyamaNo ratings yet

- High Performance, Low Cost Microprocessor (US Patent 5530890)Document49 pagesHigh Performance, Low Cost Microprocessor (US Patent 5530890)PriorSmartNo ratings yet

- 2.1-Islamic Law of Contract and SalesDocument39 pages2.1-Islamic Law of Contract and SalesAllauddinagha100% (1)

- Keyence cv700 - Man2Document232 pagesKeyence cv700 - Man2kamaleon85No ratings yet

- Drift Punch: Product Features ProfilesDocument3 pagesDrift Punch: Product Features ProfilesPutra KurniaNo ratings yet

- The Barber of SevilleDocument1 pageThe Barber of SevilleAine MulveyNo ratings yet

- Multinational Business Finance 12th Edition Slides Chapter 12Document33 pagesMultinational Business Finance 12th Edition Slides Chapter 12Alli Tobba100% (1)

- Index and Sections Guide for Medical DocumentDocument54 pagesIndex and Sections Guide for Medical DocumentCarlos AndrésNo ratings yet

- Iso 9117-3 2010Document10 pagesIso 9117-3 2010havalNo ratings yet

- Sample COBOL ProgramsDocument35 pagesSample COBOL Programsrahul tejNo ratings yet

- 28 GHZ Millimeter Wave Cellular Communication Measurements For Reflection and Penetration Loss in and Around Buildings in New York CityDocument5 pages28 GHZ Millimeter Wave Cellular Communication Measurements For Reflection and Penetration Loss in and Around Buildings in New York CityJunyi LiNo ratings yet

- Installation Guide for lemonPOS POS SoftwareDocument4 pagesInstallation Guide for lemonPOS POS SoftwareHenry HubNo ratings yet

- Ceramic Tiles Industry Research ProjectDocument147 pagesCeramic Tiles Industry Research Projectsrp188No ratings yet

- Imaging With FTK ImagerDocument9 pagesImaging With FTK ImagerRobert LeighNo ratings yet

- B. Com II Year Economics Previous Year QuestionsDocument11 pagesB. Com II Year Economics Previous Year QuestionsShashiMohanKotnalaNo ratings yet

- Moral Agent - Developing Virtue As HabitDocument2 pagesMoral Agent - Developing Virtue As HabitCesar Jr Ornedo OrillaNo ratings yet

- Essential Components of an Effective Road Drainage SystemDocument11 pagesEssential Components of an Effective Road Drainage SystemRaisanAlcebarNo ratings yet

- Plastic RecyclingDocument14 pagesPlastic RecyclingLevitaNo ratings yet

- Manual For Master Researchpproposal - ThesisDocument54 pagesManual For Master Researchpproposal - ThesisTewfic Seid100% (3)

- Bank 12Document19 pagesBank 12Shivangi GuptaNo ratings yet

- CourseLab 2 4 PDFDocument252 pagesCourseLab 2 4 PDFLiliana StanescuNo ratings yet

- Emily Act 3 GraficoDocument13 pagesEmily Act 3 Graficoemily lopezNo ratings yet

- Chapter 2 (Teacher)Document19 pagesChapter 2 (Teacher)ajakazNo ratings yet

- J S S 1 Maths 1st Term E-Note 2017Document39 pagesJ S S 1 Maths 1st Term E-Note 2017preciousNo ratings yet

- History of Architecture in Relation To Interior Period Styles and Furniture DesignDocument138 pagesHistory of Architecture in Relation To Interior Period Styles and Furniture DesignHan WuNo ratings yet