Professional Documents

Culture Documents

SX40 Leaflet PDF

Uploaded by

Nikhil SharmaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

SX40 Leaflet PDF

Uploaded by

Nikhil SharmaCopyright:

Available Formats

INDEX OF INDIA

Key Features

About

SX40 is the flagship Index of MCX-SX. A free float based index of 40

large cap - liquid stocks representing diversified sectors of the economy.

SX40 is designed to measure the economic performance with better

representation of various industries and sectors based on ICB, leading

global Industry Classification system from FTSE. The Index is devised to

oer cost-eective support for investment and structured products

such as index futures and option, index portfolio, exchange traded

funds, Index funds, etc.

Objective

SX40 is designed to be a performance benchmark and to provide for

ecient investment and risk management instrument. It would also

help in structuring passive investment vehicles.

Investability

Free-float weighted to bolster ecient investability.

Transparency

Index rules are overseen by an independent index committee

comprising of leading investment industry professionals, academicians,

and financial experts. The Committee also monitors constituent

liquidity to ensure ecient portfolio trading while keeping index

turnover to a minimum. Complete details of these guidelines, including

the criteria for index additions and removals, policy statements, and

research papers are freely and transparently available in public domain.

These guidelines provide complete transparency and fairness.

Availability

Calculated and disseminated based on real time basis.

Superior return & risk adjusted return

A unique Index of India

benchmarking global best practices

of index designing

Better Reflection of the Organised

Sector in the Economy through

enhanced industry representation

using ICB of FTSE

Rule based, transparent & replicable

Industry capping eliminates industry

bias and enhances Index stability

Lower churning rate

Low cost for funds (MFs, ETFs)

construction and maintenance

Low tracking error for passive portfolio management (MFs, ETFs etc)

Selection Criteria

Underlying stocks must have a

positive net-worth

The stock must have free float of at least

10% & within top 100 liquid companies

Industry capping at 20% ()2% band

Fast Entry for companies with better

free float market cap and liquidity

Top 40 companies meeting above

criteria constitute SX40

www.mcx-sx.com

INDEX OF INDIA

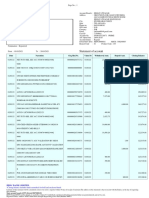

Performance

125

Index Returns (%)

SX40

Nifty Sensex

FY 2010-11

11.7

11.1

10.9

115

FY 2011-12

-8.8

-9.2

-10.5

110

FY 2012-13*

14.2

14.0

14.3

2010 2013*

16.3

15.0

13.5

SX40

120

NIFTY

SENSEX

105

100

95

90

85

Apr10

Aug-10

Dec-10

Apr-11

Aug-11

Dec-11

Apr-12

Dec-12

Aug-12

Constituents

ACC Ltd.

Ambuja Cements Ltd.

Asian Paints Ltd.

Bajaj Auto Ltd.

Bharat Petroleum Corp Ltd.

Bharti Airtel Ltd.

BHEL

Cairn India Ltd.

Cipla Ltd.

Coal India Ltd.

Dr. Reddy's Laboratories

Gail (India) Ltd.

HCL Technologies Ltd.

HDFC Bank Ltd.

HDFC Ltd.

Hero Motocorp Ltd.

Hindalco Industries Ltd.

Hindustan Unilever Ltd.

ICICI Bank Ltd.

Infosys Ltd.

ITC Ltd.

Jaiprakash Associates Ltd.

Jindal Steel & Power Ltd.

Larsen & Toubro Ltd.

Lupin Ltd.

Mahindra & Mahindra Ltd.

Maruti Suzuki India Ltd.

Ntpc Ltd.

Oil and Natural Gas Corp.

Power Grid Corp. Ltd.

Reliance Industries Ltd.

Sun Pharmaceuticals Ind.

Tata Consultancy Serv Ltd.

Tata Motors Ltd.

Tata Power Co Ltd.

Tata Steel Ltd.

Titan Industries Ltd.

United Spirits Ltd.

Wipro Ltd.

Zee Entertainment Ltd.

Quick Facts

Industry Weights (%)*

Basic Materials

Consumer Goods

Consumer Services

Financials

Health Care

Industrials

Oil & Gas

Technology

Telecommunications

Utilities

SX 40

4.7

18.2

0.7

22.0

5.1

14.8

14.8

14.2

2.4

3.1

Nifty

4.6

14.7

0.0

29.4

4.9

15.5

13.1

12.7

2.1

3.1

Sensex

5.9

17.2

0.0

26.4

4.5

12.0

14.7

14.2

2.7

2.5

Index Universe:

Large Cap companies

Index Characteristics (%)

SX40

Nifty

Sensex

Weight of the largest

constituent*

Index Basket Recasting:

Semi-Annually

9.4

8.8

10.3

Top 10 Holding*

62.4

57.4

67.8

Minor Share Issuance

adjustment: Monthly

No. of Companies: 40

Index Launch:

February 11, 2013

Base Date:

March 31, 2010

Base Value:10,000

Currency: Indian Rupee

International Practices

Parameters

Minimum Free Float

SX-40

10%

International Practices

NSE

FTSE-25%, CAC 20%, S&P 500- 50%

10%

Liquidity

Within Top 100 NIKKEI: Turnover as Liquidity

Review

Semi-Annually Quarterly, Half yearly, Annual, Need Based Semi-Annually

Minor Share Issuance adjustment

Free Float Change

Monthly

DAX, FTSE: QTRLY, 10% and above

changed else annual, Nasdaq, S&P 500

Qtrly if less than 5%

Industry Cap

20%

TSX &various variants of other Indices

Industry

Classification

ICB

STOXX/ FTSE, NASDAQ, NYSE, LSE,

Kuwait SE, SGX, Taiwan SX

Impact cost

Monthly

No

Internal

*As on January 31, 2013

Exchange Square, Suren Road, Andheri (E), Mumbai - 400 093

Tel.: +91-22-6731 9000 Fax: +91-22-6731 9004

Email: index@mcx-sx.com

Disclaimer: All the information in the brochure, including, but not limited to, characters, data, charts and tables (hereinafter referred to as information) are properties of MCX-SX Stock Exchange Ltd. (hereinafter referred to as MCX-SX) except

brands names and logos if any belonging to other persons. The contents of this documentare solely for informationalpurposes. It is not intended to be used as trading advice by anybody and should not in any way be treated as a

recommendation to trade. While the information in the document has been compiled from sources believed to be reliable and in good faith, recipients and audience of this document may note that the contents thereof including text,

graphics, links or other items are provided without warranties of any kind. MCX Stock Exchange Ltd.(MCX-SX) expressly disclaims any warranty as to the accuracy, correctness, reliability, timeliness, merchantability or fitness for any particular

purpose and shall not be liable for any damage or loss of any kind, howsoever caused as a result (direct or indirect) of the use of the information or data contained in this document.The charts and graphs may reflect hypothetical historical

performance. All information presented prior to the index inception date is back-tested. Back-tested performance is not actual performance, but is hypothetical. SX-40 and the SX40 logo are proprietary trademarks of MCX-SX.

You might also like

- 8976.8752.format For Training ReportDocument9 pages8976.8752.format For Training ReportNikhil SharmaNo ratings yet

- Project Report On AirtelDocument91 pagesProject Report On AirtelNikhil SharmaNo ratings yet

- The Coca-Cola Story: Glorious Past, Challenging FutureDocument13 pagesThe Coca-Cola Story: Glorious Past, Challenging FutureNikhil SharmaNo ratings yet

- Ifb ProjectDocument59 pagesIfb Projectamanmakkar123456_316100% (1)

- Micro MaxDocument28 pagesMicro MaxNikhil SharmaNo ratings yet

- Forcasting MethodDocument3 pagesForcasting MethodSumit AcharyaNo ratings yet

- ThankyouDocument1 pageThankyouNikhil SharmaNo ratings yet

- Raman TalwarDocument91 pagesRaman TalwarAlisha SharmaNo ratings yet

- Integrated Learning Project: VISHAL Sharma CUN120501101 Bba-3YDocument1 pageIntegrated Learning Project: VISHAL Sharma CUN120501101 Bba-3YNikhil SharmaNo ratings yet

- Project Report On MarutiDocument39 pagesProject Report On MarutiNikhil SharmaNo ratings yet

- Report of IFBDocument28 pagesReport of IFBNikhil SharmaNo ratings yet

- Working Capital ReportDocument61 pagesWorking Capital ReportNikhil SharmaNo ratings yet

- Project Report On MCDocument31 pagesProject Report On MCNikhil SharmaNo ratings yet

- Project Report On Coca ColaDocument43 pagesProject Report On Coca ColaNikhil SharmaNo ratings yet

- E Commerce in IndiaDocument7 pagesE Commerce in Indiasohalsingh1No ratings yet

- Swot of Emcomer PDFDocument10 pagesSwot of Emcomer PDFNikhil SharmaNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5782)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- 7.2 Valuation of Contingent ClaimsDocument27 pages7.2 Valuation of Contingent ClaimsPunit SharmaNo ratings yet

- Absorption Costing, Marginal CostingDocument29 pagesAbsorption Costing, Marginal Costinggopeshtripathi786No ratings yet

- 10 Price Action Bar Patterns You Must KnowDocument8 pages10 Price Action Bar Patterns You Must Knowbengotek100% (1)

- Accountancy Review: Assignment Lpu Review For Submission After April 30, 2020Document5 pagesAccountancy Review: Assignment Lpu Review For Submission After April 30, 2020jackie delos santosNo ratings yet

- RAROC Models ExplainedDocument27 pagesRAROC Models ExplainedA. Saeed KhawajaNo ratings yet

- The Fundamentals of Alternative Investments: Laney Sanders, CFA Assistant Chief Investment Officer LasersDocument47 pagesThe Fundamentals of Alternative Investments: Laney Sanders, CFA Assistant Chief Investment Officer LasersRayane M Raba'aNo ratings yet

- A. P 600,000 and P5,500,000: Financial Statement AnalysisDocument20 pagesA. P 600,000 and P5,500,000: Financial Statement AnalysisDivine Cuasay100% (1)

- Foreign Exchange RiskDocument18 pagesForeign Exchange RiskAyush GaurNo ratings yet

- Lecture 4 - ReformattingDocument31 pagesLecture 4 - ReformattingnopeNo ratings yet

- 1.1 IF - Cheat Sheet 1 PDFDocument33 pages1.1 IF - Cheat Sheet 1 PDFPradeep Arora100% (1)

- Peran Brand Awareness Memediasi Pengaruh Viral Marketing Terhadap Keputusan PembelianDocument9 pagesPeran Brand Awareness Memediasi Pengaruh Viral Marketing Terhadap Keputusan PembelianNatasya UtariNo ratings yet

- Binomial Option Pricing Model: T-1 T, U T, DDocument4 pagesBinomial Option Pricing Model: T-1 T, U T, DVincent AlexNo ratings yet

- Statement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument12 pagesStatement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceChelana JainNo ratings yet

- Sterlite Technologies PDFDocument302 pagesSterlite Technologies PDFbardhanNo ratings yet

- GCG ASIA Company Introduction - V3.0Document33 pagesGCG ASIA Company Introduction - V3.0Alfonsus ToribioNo ratings yet

- Tata Balanced Advantage Fund Nfo Scheme BrochureDocument4 pagesTata Balanced Advantage Fund Nfo Scheme BrochureNaveen VaryaniNo ratings yet

- Cory Janssen Chad Langager Casey Murphy: Fundamental Analysis Technical AnalysisDocument43 pagesCory Janssen Chad Langager Casey Murphy: Fundamental Analysis Technical AnalysisRahul ChaudharyNo ratings yet

- Etextbook PDF For Financial Markets and Institutions 7th Edition by Anthony SaundersDocument61 pagesEtextbook PDF For Financial Markets and Institutions 7th Edition by Anthony Saundersronald.allison470100% (36)

- QUESTION PAPER 36195 (Solution)Document17 pagesQUESTION PAPER 36195 (Solution)Faizu KhamNo ratings yet

- Finance Applications and Theory 4Th Edition Cornett Test Bank Full Chapter PDFDocument62 pagesFinance Applications and Theory 4Th Edition Cornett Test Bank Full Chapter PDFheulwenvalerie7dr100% (8)

- SecuritiesDocument528 pagesSecuritiesAnonymous j6xVyah1RJ100% (5)

- Role of Foreign Institutional Investment in IndiaDocument2 pagesRole of Foreign Institutional Investment in Indiakeerthikrishnan100% (1)

- An Assignment On Ratio Analysis AutoDocument20 pagesAn Assignment On Ratio Analysis AutoMehedi HasanNo ratings yet

- The Philippine Stock ExchangeDocument23 pagesThe Philippine Stock Exchangetelos12281149No ratings yet

- An Inquiry Into The Etf Experiences in American and Indian MarketsDocument11 pagesAn Inquiry Into The Etf Experiences in American and Indian MarketsszaszaszNo ratings yet

- Accounting For Share Capital Mcq's XiiDocument5 pagesAccounting For Share Capital Mcq's XiiNssnehNo ratings yet

- Regulatory Framework of Commodity FutureDocument38 pagesRegulatory Framework of Commodity FutureGeetha DevadasNo ratings yet

- VPA - Stock Trading & Investing Using - Anna CoulingDocument433 pagesVPA - Stock Trading & Investing Using - Anna CoulingViniciusNo ratings yet

- Treasury Q Bank With Explanations and Case StudiesDocument501 pagesTreasury Q Bank With Explanations and Case StudiesarunNo ratings yet

- CreditAccess Grameen - Company Update - 07102021 - 07!10!2021 - 10Document7 pagesCreditAccess Grameen - Company Update - 07102021 - 07!10!2021 - 10pr SinggNo ratings yet