Professional Documents

Culture Documents

Mvat Act

Uploaded by

Timothy BrownOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Mvat Act

Uploaded by

Timothy BrownCopyright:

Available Formats

MVAT - Maharashtra Value Added Tax.

INTRODUCTION

MVAT Act, 2002, has been introduced in the state of Maharashtra

w.e.f. 01042005.As the name suggests, VAT i.e. Value Added Tax is a

tax upon every value addition. Prior to 01042005, Maharashtra had first

stage singlepoint levy system of taxation implemented through the

Bombay Sales Tax Act, 1959. Under that system, only manufacturers and

importers were required to pay the tax on the first sale taking place in the

state. As against this, VAT system contemplates tax at every stage in the

entire chain of transactions relating to the same goods. The concept has

become quite familiar with our fellow brothers and need not be explained

further with the help of examples etc. Suffice it to say, VAT is leviable on

each sale happening in respect of the same goods.

A question frequently is asked whether positive value addition at

every stage is necessarily required under VAT. The scheme of MVAT Act,

2002, does not require such value addition at every stage. Even if the

seller sells the goods at cost price, without adding any margin for his

expenses or profit etc., VAT is leviable on that sale. Value addition also

does not mean enhancement of the intrinsic value of the goods. To give

an example, A purchases motor car and fits accessories therein like air

conditioner, music system etc. In this case, there is positive value addition

to the intrinsic value of the goods and VAT is certainly applicable on the

sale of such motor car.

In another case, A purchases the said motor car and sells in the

same condition without any refurbishment. In that case too, VAT is

payable on the sale of such car although there is no value addition made

by the seller therein.

MVAT - Maharashtra Value Added Tax.

Value addition can also be in the nature of expenses incurred on the

procurement of the goods and marketing thereof without adding anything

into the intrinsic value of the goods such as selling expenses, advertising

expenses, transport etc. Even in such cases, VAT is applicable on the sale

of such goods. Another frequent query is in respect of the case where

goods are sold at a loss. In that case too, VAT is applicable on the sale

price although offsetting the purchase tax against such sales tax may

result into a refund. There is no express prohibition under MVAT Act to

claim refund in such cases.

MVAT - Maharashtra Value Added Tax.

The MVAT Act, 2002.

Introduction of MVAT Act, 2002:

The Maharashtra Value Added Tax 2002 (Herein after called as MVAT

Act) has replaced the Bombay Sales Tax Act, 1959 on & w. e. f. 1st April

2005 and now the sales tax is collected by the Maharashtra government

under MVAT Act, 2002.

When the sales tax was collected under The B. S. T. Act, 1959,

What was the reason to introduce the new MVAT Act, 2002?

What is the difference between the two Acts?

Why the government felt the need to replace the B. S. T. Act?

The basic difference is the charging of sales tax. Under the B.S.T. Act,

1959 it was a single point levy of tax i.e. tax collection was at first

stage and other stages are allowed as resales and no tax payable on

subsequent stages.

However to increase the revenue, the Govt. of Maharashtra in the BST

regime.

Introduced resale tax which was maximum at 0.5 percent on

sales. Under the MVAT Act, 2002 the concept of collection of sales tax

has changed and now the sales tax is collected at every stage of value

addition till the goods reaches to the end user or consumer.

MVAT - Maharashtra Value Added Tax.

Scope Of MVAT.

The MVAT Act, 2002 deals with the law relating to the levy of tax

on the sale or purchase of certain goods in the State of Maharashtra. The

word State wherever used in the MVAT Act means the State of

Maharashtra.

Registration Liability:

Section 3 (4) prescribes the limits of turnover of sales for the

purpose of attracting registration liability. It must be borne in mind that it

is only the turnover of sales which has to be computed for this purpose

and not the turnover of purchases. The said limits are as under:

Category Of Dealer Limit Of Turnover Of Sales

Other Conditions

Importer Rs. 1,00,000/ Value of taxable goods sold or purchased during

the year is not less than Rs. 10,000/ Others Rs. 10,00,000/ Value of

taxable goods sold or purchased during the year is not less than Rs.

10,000/

Importer, here, means as defined u/s. 2(13) and is a dealer who

brings any goods into the state or to whom any goods are dispatched from

any place outside the state. Thus, he can be a dealer who receives the

goods from other states either by way of stock transfers or by way of

interstate purchases or by importing the goods from a foreign country.

The condition of minimum value of imported goods is conspicuously

absent in this section as compared to the corresponding section under the

BST Act. Therefore, a dealer who is an importer in the sense described

above, even for a negligible amount, would be liable for registration if his

turnover of sales exceeds Rs. 1,00,000/.

MVAT - Maharashtra Value Added Tax.

INCIDENCE OF TAX

The charging section is contained in section 4 which reads as

under: Subject to the provisions of this Act and rules, there shall be paid

by every dealer or, as the case may be, every person, who is liable to pay

tax under this Act, the tax or taxes leviable in accordance with the

provisions of this Act and rules. Thus, it is clear that every dealer/person

who is liable to pay tax is required to pay taxes in accordance with the

provisions of the Act and rules. The term person liable to pay tax has not

been expressly defined under the Act. However, considering the

provisions of section 3, 4, 5 and 6 collectively, one can infer that VAT is

payable only on the sales of goods where the threshold limit of turnover

of sales is crossed by the dealer. It is pertinent to note that there is no

provision for purchase tax under MVAT Act.

MVAT - Maharashtra Value Added Tax.

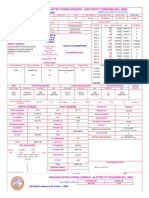

SCHEDULES AND RATE OF TAX

All the goods are classified under Schedules A to E.

Schedule A covers goods, which are generally necessities of life.

Goods covered by Schedule A are free from tax. Some of the items

covered by Schedule A are agricultural implements, cattle feed, books,

bread, fresh vegetables, milk, sugar, fabrics, plain water, etc.

Schedule B covers jewellery, diamonds, precious stones and

imitation jewellery. Goods covered by Schedule B are subject to tax at

1%.

Goods covered by Schedule C are subject to tax @ 5%. Schedule

C covers items of daily use or raw material items like drugs, readymade

garments, edible oil, utensils, iron and steel goods, non-ferrous metal, IT

products, oil seeds, paper, ink, chemicals, sweetmeats, farsan, industrial

inputs, packing materials etc.

Schedule D covers liquor which was subject to 20% tax up to 30th

June, 2009. With effect from 1st July, 2009, rate of tax is increased to

25%. It also covers various types of motor spirits that are subject to tax

from 4% to 34%.

All items which are not covered in any of the above Schedules are

automatically covered in residuary Schedule E. Goods covered by

Schedule E are subject to tax at 12.5%.

VI. EXEMPTIONS

Following sales transactions are exempt from payment of tax under

MVAT Act:

MVAT - Maharashtra Value Added Tax.

Interstate sale is exempt from payment of sales tax and it may be

liable to tax under C.S.T. Act. [Section 8(1)]

Sales taking place outside the state as determined under Section 4

of the C.S.T. Act. [Section 8(1)]

Sales in the course of import or export [Section 8(1)]

Sales of fuels and lubricants to foreign aircrafts. [Section 8(2)]

Inter se sales between Special Economic Zones, developers of

SEZ, 100% EOU, Software Technology Parks and Electronic Hardware

Technology Park Units subject to certain conditions. [Section 8(3)]

Sales to any class of dealers specified in the Import and Export

Policy notified by the Government of India [8(3A)]. This is subject to

issue of notification by State Government under this Section. However,

no such notification is issued till today.

As per Section 8(3B), the State Government may, by general or

special order, exempt fully or partially sales to the Canteen Stores

Department or the Indian Naval Canteen Services.

Under power granted u/s. 8(3C), the State Government, by general

order, has exempted fully the sale by transfer of property in goods

involved in the processing of textile covered in column 3 of the First

Schedule to the Additional Duties of Excise (Goods of Special

Importance) Act, 1957.

Sales effected by manufacturing units covered by Package Scheme

of Incentives and under exemption mode are exempt from payment of

tax u/s. 8(4).

MVAT - Maharashtra Value Added Tax.

As per Section 8(5), the State Government may, by general or

special order, exempt fully or partially sales to specific category of

dealers mentioned in this sub Section. By Notification dated 19-4-2007

concessional rate of tax @ 4% is provided for sale to specified Electric

Power Generating and Distribution Companies, MTNL, BSNL, other

specified telephone service providers and telecom infrastructure

providers.

One more notification dated 29th June, 2009 is issued by the State

Government u/s. 8(5) by which sale of certain specific goods for

satellite launch system to the Department of Space; Government of

India is exempted from payment of tax with effect from 1st July, 2009.

The State Government may issue the notification to grant refund of

any tax levied on and collected from any class or classes of dealers or

persons or as the case may be, charged on the purchases or sales made

by such class or classes of dealers or persons. (Section 41). At present

this notification is issued for grant of refund in case of Consulate and

Diplomat authorities.

As per Section 41(4)(b) read with notification dated 30-11-2008

issued under the said section, the sale of motor spirit at retail outlets is

exempted from tax, if the retail outlet purchases the same from

registered dealer.

VII. SET-OFF (INPUT TAX CREDIT)

Section 48 of the MVAT Act provides for grant of input tax credit to any

registered dealer in respect of any tax paid on his purchases subject to

conditions provided in the rules made in this behalf by the State

Government. The provisions for grant of set-off are contained in Rules 52

8

MVAT - Maharashtra Value Added Tax.

to 55 of the MVAT Rules, 2005. There are changes in rules from time to

time. The updated position of set-off Rules as on 01.07.2009 can be

summarized as under.

Important conditions:

1.

To be eligible for set off, a dealer must be registered under MVAT

Act at the time of purchase of goods, except as provided in Rule

55(1)(a).

2.

As per rule 52 set off is available on RD purchases of goods being

capital assets and goods, the purchases of which are debited to Profit

and Loss Account or Trading A/c.

3.

Following sums are eligible for set off:

(i) Tax paid separately on purchases effected within the State and

supported by Tax Invoice. Entry tax paid under Maharashtra Entry Tax

on Goods Act as well as Maharashtra Entry Tax on Motor Vehicles Act.

MVAT - Maharashtra Value Added Tax.

Registration Under MVAT Act

WHY TO OBTAIN REGISTRATION CERTIFICATE?

1 Obtaining of registration certificate is statutory obligation of every

dealer, who is liable to pay tax under the Act.

2 It empowers the dealer to collect tax.

3 A registered dealer gets the benefits of set off (input tax credit)

4 Business without registration invites penalty/prosecution.

5 Nobody would like to buy goods from unregistered dealer.

Who should apply for the registration?

The dealer who attains or crosses prescribed turnover of purchase or sale

should apply for registration under VAT Act within 30 days from the date

on which turnover crossed the prescribed limit.

Note: Once a dealer exceeds the prescribed turnover and fulfils the

conditions as mentioned in table below, then the liability to pay taxes

under the Act commences from the time of transaction by which the

turnover exceeds the prescribed limit.

What happens if not applied in time for registration?

When a dealer does not apply within 30/ 60 days from the date of

exceeding the prescribed turnover of purchases or sales than certificate of

registration will be issued with effect from the date of uploading of the

application. Therefore, from the date of starting of business till the date of

uploading of the application, the dealer will be treated as unregistered.

Provisions of Penalty for unregistered dealers:

If dealer does not apply in time and remains unregistered, it is an offence

under the Act.

10

MVAT - Maharashtra Value Added Tax.

Benefits of Registration:

i. He can claim set off of tax paid on the purchase if eligible to get any.

ii. He can issue various declarations prescribed C.S.T. Acts like Form C

etc.

iii. Registered dealers are preferred while awarding the government

contracts. The above mentioned benefits are denied to an unregistered

dealer.

Disadvantages of non registration:

1 Unregistered dealer is liable to pay tax on the sales affected by him but

he cannot collect tax.

2 He cannot claim any set off or refund of the tax paid by him.

3 Purchases at concessional rate of tax not available to him. He cannot

issue forms or declarations like Form C etc.

4 No authenticity in the market as majority of dealers purchases goods

from registered dealers only.

5 Possibilities of non consideration for awarding the government contract.

6 Imposition of penalty and prosecution for remaining unregistered.

11

MVAT - Maharashtra Value Added Tax.

New Composition scheme for MVAT

Dealer & Its Applicability

Deputy Chief Minister of the Maharashtra state announced the new

composition scheme for retailers in his budget speech. The sales tax

department comes with the trade circular No. VAT/AMD/2014/8/ADM-8

dated 20/09/2014 regarding the new retailers composition scheme. The

old composition scheme is expired with effect from 30thSeptember 2014.

The new composition scheme will be effective from 1st October 2014.

Who is the eligible dealer for the new composition scheme?

Following is the list of the conditions for the eligible dealer for

composition scheme.

1. The dealer should be register under MVAT act 2002

2. Applicant dealer should be a retailer, as explain in section 42 (1) (b) of

MVAT Act. At least 90% of sales should be to the end user (i.e. to the

person who is not dealer)

3. The applicant dealer should not be a manufacture or an importer.

4. The turnover of sales of goods should not exceed rupees fifty lack in

the previous year in which new composition scheme is applied. While

calculation the turnover the turnover of sales of goods, turnover of sale of

high speed diesel or any other kind of motor sprit covered by entry 5 and

10 of the SCHEDULE D of the MVAT act and furnishing fabric covered

by entry 101 of SCHEDULE C of MVAT act is not considered.

5. The goods should be purchase from register dealer. However, this

condition is not applicable to the tax-free goods, packing material used

for packing of the goods, resold by him.

6. The dealer who is opt composition scheme from 1st October 2014

should be liable to file six monthly returns during the year 2014-2015.

12

MVAT - Maharashtra Value Added Tax.

The dealer who is liable to file monthly or quarterly return during the

year 2014-15 shall not eligible to opt composition scheme.

What is the rate of Composition amount?

There are two options provided for payment of composition money.

Option 1 If dealer opt to pay composition amount on total turnover of

sales, then he shall pay 1% on entire turnover of sales including tax free

goods.

Option 2 If dealer opt to pay composition amount on turnover of sales

of taxable goods only, then he shall pay 1.5% on such turnover of sales.

What are the consequences after application of composition scheme?

1.

Composition amount or tax shall not be collected separately by

composition dealer

2.

Composition dealer cannot issue the tax invoice. However, he can

issue the cash memo, sales bill, etc. if value of goods sold exceeds Rs.

fifty.

3.

Composition dealer shall not eligible to claim set-off under MVAT

rule 2005 in respect of purchase of goods, for which composition has

been availed. Set-off of packing material used for packing of the goods

for which composition scheme is applied is not available. However, it is

clarified that dealer can claim set-off on purchase of capital assets,for

which benefit of composition is not availed.

4.

A dealer opting for composition scheme is not eligible for set off.

Therefore, dealer opting for composition scheme shall be required to

reverse the set off, already claimed, on the purchase of the goods held in

stock on the day of opting for new composition scheme. For example, is

there is a closing stock of Rs. 5 lacks and set off of Rs. 25000. The dealer

is required to pay Rs.25000 in addition to composition amount in his first

composition return. The reversal of the set-off is required to show in the

13

MVAT - Maharashtra Value Added Tax.

row (e) of box 14 of the returns in Form 232 or row (e) of box 13 of the

returns in Form 233, as the case may be.

5.

The composition dealer is required to file six monthly return.

When and how dealer can join composition scheme?

A dealer can join new composition scheme from 1st October 2014 or

from 1st April of any subsequent year. An eligible dealer, whether old

composition dealer or fresh applicant desiring to opt for new composition

scheme would be required to upload an application in Form 4A on

http://mahavat.gov.in on or before 31st October 2014.

If dealer is desire to opt for new composition scheme for the year 201516 or thereafter shall upload an application in Form 4A on

http://mahavat.gov.in on or before 30th April of the respective year. From

financial year 2015-16 newly register dealer shall indicate his option in

From 101 itself for application of new composition scheme.

Is composition scheme is really beneficially to the dealer?

It is depends upon the dealers turnover, gross profit ratio and normal tax

rates applicable to the goods.

14

MVAT - Maharashtra Value Added Tax.

Compositing Works Contracting

The provisions relating to composition schemes are given in

Section 42 of MVAT Act. Subsection (3) of section 42 specifically

provides for two types of composition schemes for works contractors.

These two schemes are as follows:

1. Composition Scheme for Construction Contracts: (5%

Composition Scheme)

Under this scheme, dealer has to pay VAT @5% on the total

contract value. However, this option can be exercised only in case of

construction contracts notified in Notification No. VAT.1506/CR134/Taxation-1 dt. 30/11/2006. The notified construction contracts are as

follows for which 5% composition scheme can be opted:

(A) Contracts for construction of,i. Buildings,

ii. Roads,

iii. Runways,

iv. Bridges,

v. Railway overbridges,

vi. Dams,

vii. Tunnels,

viii. Canals,

ix. Barrages,

x. Diversions,

15

MVAT - Maharashtra Value Added Tax.

xi. Rail tracks,

xii. Causeways, Subways, Spillways,

xiii. Water supply schemes,

xiv. Sewerage works,

xv. Drainage,

xvi. Swimming pools,

xvii. Water Purification plants and

xviii. Jettys

(B) Any works contract incidental or ancillary to the contracts mentioned

in paragraph (A) above, if such work contracts are awarded and executed

before the completion of the said contracts.

If the dealer opts for 5% composition scheme, input credit in excess of

4% of purchase price can be availed i.e. there will 4% retention in setoff

according to Rule 53(4)(b) of MVAT Rules

and balance setoff can be availed.

2. Composition for all types of Works Contracts: (8% Composition

Scheme)

Here, dealer may choose to pay VAT @8% on total contract value less the

amount paid towards works contract executed by a registered subcontractor. In case dealer opts for 8%

composition scheme, 36% percent of total setoff amount is disallowed

and balance 64% setoff can be availed as per Rule 53(4)(a) of MVAT

Rules.

16

MVAT - Maharashtra Value Added Tax.

3. Composition scheme for Builders and Developers: (1%

Composition Scheme)

Under this scheme, registered dealers undertaking construction of flats,

dwellings or buildings or premises may choose to pay VAT @1% of the

agreement amount specified in the agreement or agreement value adopted

for stamp duty purposes whichever is higher. If he chooses to opt for this

scheme, he cannot avail any input tax credit in respect of purchases

effected by him. Further, he is not allowed to make any purchase against

C form. Also, he cannot issue tax invoice and also not eligible for to

issue Form No. 409 to the subcontractor.

Works Contract TDS:

As per provisions of Rule 40 of MVAT Rules, notified employers are

required to deduct TDS, known as works contract TDS or WCT TDS

from the amount payable to the contractor. The rate of TDS shall be 2% if

the contractor is a registered dealer. If the contractor is unregistered, rate

of tax deduction shall be 5%. The deductor needs to file WCT TDS return

in form No. 424 before 30th June every year.

17

MVAT - Maharashtra Value Added Tax.

Composition Scheme for Bakers

Composition scheme under VAT regime can be said to be a simplified

scheme for calculating, charging, collection and payment of sales/vat tax.

The basic idea of introducing the scheme is to enable small business men

in resale and retails business to carry business without maintaining

detailed accounts, enabling easy calculation of tax payable by them. This

saves them from rigors of regular scheme under MVAT law. Section 42(1)

of Maharashtra Value Added Tax Act, 2002 (MVAT, 2002) empowers

State Government to Notify Composition Scheme for dealers in State of

Maharashtra who are engaged in business of resale and retail. State

Government has notified Composition Scheme vide notification No. VAT1505/CR-105/Taxation-1 dated 1st June 2005 and amended form time to

time.

Separate scheme have been notified in the above mentioned

notification as applicable to:

1. Restaurants,

Eating

House,

Refreshment

Room,

Boarding

Establishment, Factory Canteen, Clubs, Hotels and Caterers

2. Bakers

3. Retailers

4. Dealers in Second-hand Motor Vehicles

Composition Scheme under section 42(1) shall not apply to a dealer

1. who is a manufacturer or

2. who is an importer or

18

MVAT - Maharashtra Value Added Tax.

3. who purchases any goods from a registered dealer whose sales of the

said goods are not liable to tax by virtue of the provisions contained

in sub-section (1) of section 8 or

4. who sells at retail liquor including liquor imported from out of India,

Indian Made Foreign Liquor or Country Liquor except as provided

in sub-section (2)

Scheme as Applicable to Bakers

(a) What are class of sales and purchases which are eligible for enabling

benefit under this scheme ?

(b) What is Composition Amount Payable (Tax payable)

1. % of the first Fifty Lakh rupee of the total turnover of sales of

goods referred above in (a) goods imported out of Maharashtra

State, if any, including bread in loaf, rolls, or in slices, toasted or

otherwise,

2. in the case of a registered dealer and 6 per cent. of the first Fifty

Lakh rupee of the total turnover of sales of goods referred to in (a)

above and goods imported out of Maharashtra State, if any

including bread in loaf, rolls, or in slices, toasted or otherwise

(c) Conditions in which this scheme will be applicable to retailers

i.

The claimant dealer shall be certified by the Joint Commissioner

for the purpose of claiming benefit under this entry,

ii.

The claimant dealer shall not be entitled to claim any set off under

the MVAT Rules, in respect of the purchases corresponding to any

goods which are sold or resold or used in packing of goods referred

in (a) above,

19

MVAT - Maharashtra Value Added Tax.

iii.

The turnover of sales of bakery products including bread has not

exceeded rupees Fifty Lakh in the year previous to which the

composition is availed and if the dealer was not liable for

registration under the BST Act, 1959 or under MVAT Act, 2002, in

the immediately preceding year, then he shall be entitled to claim

the benefit of the scheme in respect of the first Fifty Lakh rupees of

the total turnover of sales in the current year,

iv.

The claimant dealer shall apply in the Form-3 appended to this

notification to Joint Commissioner of Sales Tax (Registration) in

case of dealers in Mumbai and in other Cases with Joint

Commissioner of Sales Tax (VAT Administration),

v.

The to join composition will effective from the date of registration

if the dealer applies for Composition Scheme at the time of

Registration,

vi.

If the Dealer opts for Composition Scheme form 1st April, 2011 he

shall apply from on or before 30th June 2011,

vii.

If the Dealer opts for composition at any time on or after 1st April

of any year then the option shall be effective only form the

beginning of next financial year,

viii.

The application should be made to the assessing authority who was

in charge of the case on 31st March 2005 before 15th June 2005 or

as the case may be, to the registering authority at the time of

application for Registration Certificate under the Act,

20

MVAT - Maharashtra Value Added Tax.

ix.

Subject to condition (iii), if the option to join the composition

scheme is exercised, in any year then it can be changed only at the

beginning of the next year,

x.

The claimant dealer shall not be eligible to issue Tax Invoice in

respect of sales of goods referred in (a) above,

xi.

The claimant dealer shall not be eligible to recover the composition

amount from any customer separately,

xii.

Before 1st April 2011 the turnover limits were Rupees Thirty

Lakhs

Composition Scheme for Retailers

Composition scheme under VAT regime can be said to be a

simplified scheme for calculating, charging, collection and payment of

sales/vat tax. The basic idea of introducing the scheme is to enable small

business men in resale and retails business to carry business without

maintaining detailed accounts, enabling easy calculation of tax payable

by them. This saves them from rigors of regular scheme under MVAT

law.

Section 42(1) of Maharashtra Value Added Tax Act, 2002 (MVAT,

2002) empowers State Government to Notify Composition Scheme for

dealers in State of Maharashtra who are engaged in business of resale

and retail. State Government has notified Composition Scheme vide

notification No. VAT-1505/CR-105/Taxation-1 dated 1st June 2005 and

amended form time to time.

Separate scheme have been notified in the above mentioned

notification as applicable to:

21

MVAT - Maharashtra Value Added Tax.

1. Restaurants,

Eating

House,

Refreshment

Room,

Boarding

Establishment, Factory Canteen, Clubs, Hotels and Caterers

2. Bakers

3. Retailers

4. Dealers in Second-hand Motor Vehicles

Composition Scheme under section 42(1) shall not apply to a dealer

1. who is a manufacturer or

2. who is an importer or

3. who purchases any goods from a registered dealer whose sales of

the said goods are not liable to tax by virtue of the provisions

contained in sub-section (1) of section 8 or

4. who sells at retail liquor including liquor imported from out of

India, Indian Made Foreign Liquor or Country Liquor except as

provided in sub-section (2)

Scheme Applicable to Retailers

Who is dealer engaged in Retailing ?

For the purpose of composition scheme for retailers, a dealer shall be

considered to be engaged in the business of selling at retail if 9/10th of

his turnover of sales consists of sales made to persons who are not

dealers. In case of any question arises to determine whether any particular

dealer is a retailer or not, then the question shall be referred to the Joint

Commissioner, who shall after hearing the dealer, if necessary, decide the

question. The order made by the Joint Commissioner shall be final.

22

MVAT - Maharashtra Value Added Tax.

What are class of sales and purchases which are eligible for enabling

benefit under this scheme ?

The scheme shall be applicable to total turnover of sales made by

a registered dealer, who is a retailer as provided in section 41 (and

explained above), of any goods excluding the turnover of resales if any,

effected by him, of the following goods:1. Foreign liquor, as defined in rule 3(6)(1) of the Bombay Foreign

Liquor Rules, 1953.

2. Country liquor, as defined in Maharashtra Country Liquor Rules,

1973.

3. Liquor imported from any place outside the territory of India as

defined, from time to time, in rule 3(4) of the Maharashtra Foreign

Liquor (Import and Export) Rules,1963.

4. Drugs covered by the entry 29 of the Schedule C appended to the

Act.

5. Motor Spirits notified by the State Government under subsection

(4) of section 41 of the Act.

Composition Amount (Tax payable)

The composition amount shall be, calculated on the,

Excess, if any, of the total turnover of sales, including turnover of

sales of tax - free goods but excluding liquor, Drugs, and Motor

Spirits referred above, in respect of any six monthly period

over the turnover of purchases including turnover of purchases of

tax free goods, but excluding liquor, Drugs, Motor Spirits referred

23

MVAT - Maharashtra Value Added Tax.

to in column (3) of this entry , in respect of the said six month

period.

The turnover of purchases shall be increased by the amount of tax

collected by the vendor of the retailer separately from the retailer.

The Tax payable on amount so calculated above is

1) at the rate of 5 per cent for the retailers whose aggregate of the

turnover of sales of goods, covered by schedule A and goods

taxable at the rate of 4 per cent., if any, is more than 50 per cent. of

the total turnover of sales; excluding the turnovers of liquor, drugs

and motor spirits referred to columns 3 of this entry

2) at the rate of 8 per cent. in any other case.

Conditions in which this scheme will be applicable to retailers

i.

The selling dealer does not collect tax separately in respect of the

sales specified above.

ii.

The claimant dealer shall not be entitled to claim any set off under

the Maharashtra Value Added Tax Rules, 2005, in respect of the

purchases corresponding to any goods which are sold or resold or

used in packing of such goods sold.

iii.

The turnover of sales of such goods does not exceeded rupees fifty

lakh in the year previous to which the composition is availed of

and if the dealer was not liable for registration, in the immediately

preceding year, then he shall be entitled to claim the benefit of the

24

MVAT - Maharashtra Value Added Tax.

scheme in respect of the first fifty lakh rupees of the total turnover

of sales in the current year

iv.

The turnover of purchases referred to above shall be reduced by the

amount of every credit of any type received by the selling dealer

from any of his vendors whether or not such credit is in respect of

any goods purchased by the selling dealer from the said vendor.

v.

In respect of the six monthly period starting on the 1st April 2005,

for calculating the excess, 5/6th of the turnover of sales of the six

monthly period is to be considered instead of the entire turnover of

sales for that period.

vi.

The claimant dealer shall apply in the Form-4 appended to the

notification for exercising the option to pay tax under the

composition scheme. The application should be made to the

assessing authority who was in charge of the case on the 31st

March 2005 before the 15th June 2005 or as the case may be, to the

registering authority at the time of application for Registration

Certificate under the Act.

vii.

Subject to condition (iii), if the option to join the composition

scheme is exercised, in any year then it can be changed only at the

beginning of the next year.

viii.

The claimant dealer shall not be eligible to recover composition

amount from any customer separately.

ix.

The claimant dealer is not a manufacturer or importer.

x.

The taxable goods resold are purchased from registered dealers.

25

MVAT - Maharashtra Value Added Tax.

xi.

Purchases of tax free goods may be from registered dealers as well

as from unregistered dealers.

xii.

Any other purchases from unregistered dealers are meant only for

packing of goods resold.

26

MVAT - Maharashtra Value Added Tax.

Conclusion

In nutshell, it can be stated that a person effecting sales has to

ascertain that whether he is doing so in the capacity of a dealer having

regard to the frequency, continuity, regularity, volume etc. of the

transactions. Refer Supreme Court judgment in the case of State of

Gujarat vs. Raipur Manufacturing Co. Ltd. (19 STC 1).

Once it is established that he is a dealer carrying on a business

having regard to the peculiar definitions of the terms under the MVAT

Act, he has to ascertain the total turnover of sales so as to determine his

registration liability. The incidence of tax will be on the transactions of

sales effected during the course of business by the dealer and not

otherwise. The liability of tax has to be discharged taking into

consideration the rates of tax as per schedules.

Although the Act nowhere confers an express right to collect the

taxes from the buyers, there is no prohibition to recover the taxes form

the buyers as well. Considering all the provisions of the Act

harmoniously, it can be concluded that the dealer can collect the taxes

separately through the invoices only equal to his liability of tax on the

said transaction.

27

MVAT - Maharashtra Value Added Tax.

Webliography

www.finance.indiamart.com

www.caclubindia.com

www.servicetax.gov.in

www.management paradise.com

www.tax4india.com

www.wisegeek.com

www.wikipedia.com

28

You might also like

- Neha Agarwal Resume B.Com M.Com Mumbai UniversityDocument2 pagesNeha Agarwal Resume B.Com M.Com Mumbai UniversityTimothy BrownNo ratings yet

- Ansari Afreen BanoDocument1 pageAnsari Afreen BanoTimothy BrownNo ratings yet

- Shiv Parvati Building A' Wing Mahesh ParkDocument1 pageShiv Parvati Building A' Wing Mahesh ParkTimothy BrownNo ratings yet

- Subject: Resignation For ACEDocument1 pageSubject: Resignation For ACETimothy BrownNo ratings yet

- MHT-CET 2018 exam dates and fees for BE/BTech, BPharm and other coursesDocument2 pagesMHT-CET 2018 exam dates and fees for BE/BTech, BPharm and other coursesTimothy BrownNo ratings yet

- Mahatma GandhiDocument3 pagesMahatma GandhiTimothy BrownNo ratings yet

- GST For Exporter Importer With Photo.Document4 pagesGST For Exporter Importer With Photo.ABNo ratings yet

- Jayesh 33Document1 pageJayesh 33Timothy BrownNo ratings yet

- Food DeclarationDocument1 pageFood DeclarationTimothy BrownNo ratings yet

- N.K.T. International School and Shri. Shankar Shetty Junior College of Science & CommerceDocument4 pagesN.K.T. International School and Shri. Shankar Shetty Junior College of Science & CommerceTimothy BrownNo ratings yet

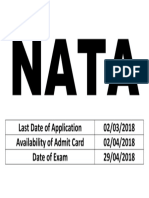

- Last Date of Application 02/03/2018 Availability of Admit Card 02/04/2018 Date of Exam 29/04/2018Document1 pageLast Date of Application 02/03/2018 Availability of Admit Card 02/04/2018 Date of Exam 29/04/2018Timothy BrownNo ratings yet

- Daily ScheduleDocument3 pagesDaily ScheduleTimothy BrownNo ratings yet

- Sitaram SurjarDocument1 pageSitaram SurjarTimothy BrownNo ratings yet

- Taj MahalDocument3 pagesTaj MahalTimothy BrownNo ratings yet

- Lake PalaceDocument6 pagesLake PalaceTimothy BrownNo ratings yet

- New Microsoft Office Word DocumentDocument1 pageNew Microsoft Office Word DocumentTimothy BrownNo ratings yet

- Project On Elasticity of DemandDocument11 pagesProject On Elasticity of Demandjitesh82% (50)

- Irctcs E-Ticketing Service Electronic Reservation Slip (Personal User)Document1 pageIrctcs E-Ticketing Service Electronic Reservation Slip (Personal User)Timothy BrownNo ratings yet

- Khan Mariya Afzal: "Plagiarism"Document16 pagesKhan Mariya Afzal: "Plagiarism"Timothy BrownNo ratings yet

- 1st Receipt 45000Document1 page1st Receipt 45000Timothy BrownNo ratings yet

- MotivationDocument24 pagesMotivationTimothy BrownNo ratings yet

- Safdasf Asdfsaf Asasf Saf Safd Sadf Asf Sadf Sadf Asdf Saf As FDDocument1 pageSafdasf Asdfsaf Asasf Saf Safd Sadf Asf Sadf Sadf Asdf Saf As FDTimothy BrownNo ratings yet

- Climate of MaharashtraDocument4 pagesClimate of MaharashtraTimothy BrownNo ratings yet

- Doctors and Chemists Visited ReportDocument2 pagesDoctors and Chemists Visited ReportTimothy BrownNo ratings yet

- Michael JacksonDocument1 pageMichael JacksonTimothy BrownNo ratings yet

- Email ID for Career ProfileDocument3 pagesEmail ID for Career ProfileTimothy BrownNo ratings yet

- Inv Date Inv No Type Debit Rs Credit Rs Balance Opening Bal 164,006Document4 pagesInv Date Inv No Type Debit Rs Credit Rs Balance Opening Bal 164,006Timothy BrownNo ratings yet

- Haathi Mere Saathi: Phi Phenomenon Photographing Motion Picture Camera Animation CGI Computer Animation Visual EffectsDocument2 pagesHaathi Mere Saathi: Phi Phenomenon Photographing Motion Picture Camera Animation CGI Computer Animation Visual EffectsTimothy BrownNo ratings yet

- Tanishq ElevatorsDocument5 pagesTanishq ElevatorsTimothy BrownNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5783)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Free Payroll Book PDFDocument27 pagesFree Payroll Book PDFGspr BoJoyNo ratings yet

- Payment Information Summary of Account ActivityDocument4 pagesPayment Information Summary of Account Activitycory100% (1)

- Ordillas, Jamaica-CceDocument3 pagesOrdillas, Jamaica-CceJimBarry Silvestre OrdillasNo ratings yet

- Leonard 2Document8 pagesLeonard 2Leonard CañamoNo ratings yet

- Fair Price Gold CalculatorDocument8 pagesFair Price Gold CalculatorSacred MindNo ratings yet

- CIR Vs First ExpressDocument7 pagesCIR Vs First ExpressGhreighz GalinatoNo ratings yet

- Mumbai Airport To Home PDFDocument2 pagesMumbai Airport To Home PDFkeepharmaNo ratings yet

- Department Order No. 29Document1 pageDepartment Order No. 29Nancy MabaleNo ratings yet

- OutputDocument7 pagesOutputUna Balloons0% (1)

- Blessing Plastic: Tax Invoice Original For CompanyDocument1 pageBlessing Plastic: Tax Invoice Original For CompanyCharles NaveenNo ratings yet

- UPI in IndiaDocument47 pagesUPI in Indiaasde100% (2)

- Tax Invoice: Payment DetailsDocument2 pagesTax Invoice: Payment DetailsYashNo ratings yet

- Buyer Receipt for Used Toyota CorollaDocument1 pageBuyer Receipt for Used Toyota CorollaMoisés BoquinNo ratings yet

- ATM Transaction Card Type Transaction Type ISO Data Element Transaction DE-43.10 DE-43.11 DE-61.1 DE-61.2 Debit CreditDocument4 pagesATM Transaction Card Type Transaction Type ISO Data Element Transaction DE-43.10 DE-43.11 DE-61.1 DE-61.2 Debit CreditTanmoy HasanNo ratings yet

- Iesco Online BillDocument2 pagesIesco Online BillahsanNo ratings yet

- Income Tax Quiz 6Document3 pagesIncome Tax Quiz 6Calix CasanovaNo ratings yet

- Tax Return Summary for Tony & Jeannie NelsonDocument24 pagesTax Return Summary for Tony & Jeannie Nelsonさくら樱花No ratings yet

- RR 10-76Document4 pagesRR 10-76Althea Angela GarciaNo ratings yet

- Mepco Online BillDocument2 pagesMepco Online BillHafizummar Afzal0% (1)

- Ola Ride Receipt 19 Jan 2023Document3 pagesOla Ride Receipt 19 Jan 2023Anonymous Clm40C1No ratings yet

- 1.0 Accounting Period and MethodDocument22 pages1.0 Accounting Period and MethodJem ValmonteNo ratings yet

- ATX - UK Sample Questions SummaryDocument15 pagesATX - UK Sample Questions SummaryONASHI DEVNANI BBANo ratings yet

- AGICL AXIS BANK Statement MO NOV 2016 PDFDocument4 pagesAGICL AXIS BANK Statement MO NOV 2016 PDFSagar Asati67% (6)

- {0B4DBCDB-793E-4B7D-8581-4F3A27A08329}Document319 pages{0B4DBCDB-793E-4B7D-8581-4F3A27A08329}ashes_xNo ratings yet

- Invoice No. 3532Document2 pagesInvoice No. 3532AMIT TIWARINo ratings yet

- Version 2309Document1 pageVersion 2309kevin cosnerNo ratings yet

- 2019 Chicago TIF SummaryDocument7 pages2019 Chicago TIF SummaryCrainsChicagoBusinessNo ratings yet

- GST 7th Edition PDFDocument366 pagesGST 7th Edition PDFUtkarshNo ratings yet

- Schedule Iv: Provident Fund and Related ProvisionsDocument7 pagesSchedule Iv: Provident Fund and Related ProvisionsVachanamrutha R.VNo ratings yet

- Taxation Principles and Allowable Deductions QuizDocument4 pagesTaxation Principles and Allowable Deductions Quizwind snip3r reojaNo ratings yet