Professional Documents

Culture Documents

Health Affairs Medicare's New Physician Payment System PDF

Uploaded by

iggybauOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Health Affairs Medicare's New Physician Payment System PDF

Uploaded by

iggybauCopyright:

Available Formats

h e a lt h p o l ic y b r i e f

w w w. h e a lt h a f fa i r s .o r g

Health Policy Brief

a p r il 2 1 , 2 0 1 6

Medicares New Physician Payment System.

A 2015 law has the potential to transform

how Medicare pays physicians.

whats the issue?

For more than two decades Congress and the

federal government have wrestled with how

to pay physicians in the Medicare program,

which covers forty-seven million Americans.

In 2014 Medicare paid physicians and other

clinicians around $138 billion22 percent of

total Medicare spendingup from $59 billion

in 2000.

The primary challenge of physician payment is determining fair fees for physicians

and other clinicians. But, just as important,

the challenge extends to paying physicians in

a way that promotes efficient, effective, and

safe care; does not incentivize excessive and

unnecessary care; and fosters the judicious

use of medical resources since physicians order and direct the care that constitutes the

lions share of total Medicare spending.

An overwhelming body of research in recent

years found that medical care in the United

States was neither efficient nor as effective as

it could be. Inappropriate and excessive care is

common even as rising health care costs burden government, business, and families.

2016 Project HOPE

The People-to-People

Health Foundation Inc.

10.1377/hpb2016.7

Against this backdrop, government and

private-sector leaders have resolved to transform how physicians are paid in a way that

holds them more accountable for the care they

deliver. The latest salvo in this effort was the

Medicare Access and CHIP Reauthorization

Act (MACRA) of 2015, signed into law April

16, 2015. This policy brief does not discuss

MACRAs two-year extension of the Childrens

Health Insurance Program (CHIP) or provisions pertaining to issues other than physician

payment.

whats the background?

Physician payment under Medicare has been

contentious and fraught with problems from

the beginning. In the run-up to creation of the

program in 1965, physician interest groups

led by the American Medical Association

(AMA)lobbied heavily to assure that physicians would be paid the usual, customary,

and reasonable fees they were getting from

private insurers, and not fixed fees set by

government.

Congress went along with the interest

groups and codified that language. Fraud and

excessive billing was alleged almost immediately. The US Senate held hearings in July 1969

in which senators and policy experts accused

some providers of billing the government two

to four times what they billed private insurers.

The then-new program also bent to the will

of the physician interest groups by giving

oversight of care quality to physicians themselves. But concern about cost and quality accountability led Congress in 1972 to authorize

the Health Care Financing Administration

(now known as the Centers for Medicare and

h e a lt h p o l ic y b r i e f

m e dic a r e s n e w p h y sici a n pay m e n t s y s t e m

Medicaid Services [CMS]) to disallow any

costs unnecessary to the efficient provision

of care. At the same time, lawmakers created

Professional Standards Review Organizationsentities that would oversee care quality in Medicare.

138

billion

In 2014 Medicare paid physicians

and other clinicians around $138

billion.

In practice, the Health Care Financing Administration rarely challenged fees as unnecessary, and the Professional Standards Review

Organizationsnow known as Quality Improvement Organizationswere unevenly

effective.

In the mid-1980s a series of studies documented the widely varying fees that Medicare

was paying physicians around the country.

Research also found that physicians were

billing for procedures and surgery at rapidly

escalating rates that lacked any grounding in

the resources used. In 1989 this led Congress

to establish a fee formula called the resourcebased relative value scale. This scale was based

on a complex formula that gauges the amount

of physician work required to perform each

coded service, factoring in the cost of overhead and malpractice insurance. With fees for

thousands of codes in the Medicare physician

fee schedule, the scale is now continuously reviewed and revised.

CMS administers the fee schedule but is assisted in that task by the physician community

through the Relative Value Scale Update Committee (RUC). The RUC is run by the AMA.

Payment reform advocates complain that

CMS has essentially deputized the RUC to

calculate what physicians get paidan arrangement they assert is tantamount to the

fox guarding the chicken coop. Separately,

the Government Accountability Office and

the Medicare Payment Advisory Commission

have raised concerns that the RUCs reliance

on specialty societies to value their own services represents a conflict of interest. Indeed,

these watchdogs and other critics of the present payment system have long maintained that

given how the scale is structured, it inherently

rewards procedure-based specialty care, while

undervaluing primary and preventive care.

In fact, the resource-based relative value

scale and the physician fee schedule do not

currently attempt to base physicians fees on

the value of care to the patient or the outcomes

of care. As noted above, there are concerns

about a conflict of interest in regard to the

group overseeing the scale fee formula. And in

the case of the physician fee schedule, for ex-

ample, it remains grounded in a fee-for-service

payment model, which intrinsically gives physicians an incentive to increase the volume of

their services. In turn, as policy makers have

increasingly acknowledged, fee-for-service

payment risks promoting unnecessary and

inappropriate care.

In 1997 Congress tried to rein in physiciandriven costs by creating the Medicare Sustainable Growth Rate (SGR). The formula used to

calculate the SGR set an annual budget target

for physician payment based on a number

of factorsmost importantly, that it not exceed the growth in gross domestic product.

If spending exceeded the target, fees would

be cut in the following year such that overall

physician spending was limited to the target

amount. If spending was below the target, fees

would be increased in the following year to

meet the target amount.

The SGR quickly turned controversial when

in 2002 it yielded an almost 5 percent decline

in fees. Physician interest groups mobilized

to block future decreases, warning that physicians would see fewer Medicare beneficiaries,

or stop seeing them altogether. The AMA and

other physician interest groups lobbied Congress to repeal the SGR. Instead, Congress

enacted seventeen so-called doc fixes over

twelve years, freezing fees or granting small

increases.

However, the SGR provision remained on

the books, and the congressional overrides

led to a large (more than $100 billion) cumulative build-up in fee adjustments. By 2015

that build-up, if allowed to take place, would

have led to a whopping (and untenable) 21.2

percent reduction in physician fees. For a confluence of reasons, Congress finally agreed to

repeal the SGR provision. MACRA was the vehicle for that repeal. And the new law replaced

the SGR formula with a new Medicare physician payment system.

Laws passed between 2006 and 2010, including the Affordable Care Act (ACA), were forerunners to Congress approach in MACRA. For

example, Congress created the Physician Quality Reporting System in 2006 and the Physician Value-Based Payment Modifier in 2010.

And in 2009 Congress created the Electronic

Health Record (EHR) Incentive Program. The

ACA contains numerous provisions that promote transparency, accountability, payment

reform, and quality improvementincluding

the creation of Physician Compare, a website

mandated to, over time, contain compara-

h e a lt h p o l ic y b r i e f

tive performance and quality measures on

physicians. MACRAs new physician payment

system builds on and is synced up with these

efforts.

Physician

payment under

Medicare has

been contentious

and fraught with

problems from

the beginning.

m e dic a r e s n e w p h y sici a n pay m e n t s y s t e m

Its worth noting that in the context of the

ongoing political divisiveness surrounding

the ACA that MACRA passed with overwhelming bipartisan support: 39237 in the House

and 928 in the Senate.

whats in the law?

Between 2016 and 2019, MACRA will give physicians a fee increase of 0.5 percent per year.

From 2020 to 2025, no across-the-board fee

increase will be granted because physicians

treating Medicare beneficiaries will have been

asked to choose between two newly designed

payment paths. Both base payment on performance and quality metrics and participation

in efforts to improve care and restrain cost

growth.

Initially, physicians can choose a program

called the Merit-Based Incentive Payment

System (MIPS) or join an alternative payment

model such as an accountable care organization or patient-centered medical home. If they

make no choice or are deemed to be ineligible

for an alternative payment model incentive

payment, they will be assigned to MIPS.

At the same time, three existing payment

incentive and quality improvement initiatives will be dissolved as separate programs

and melded into MIPS. They are the Physician

Quality Reporting System, Meaningful Use,

and the Physician Value-Based Payment Modifier. The majority of physicians today participate in one or more of these programs.

Physicians in MIPS must report performance measures to CMS. Theyll then be graded on four factors: quality of care (30 percent);

resource use (30 percent); meaningful use of

EHRs (25 percent); and clinical practice improvement activities (15 percent).

High-scoring physicians will get a bonus,

and low-scoring physicians will see their

fees reduced. Physicians will be allowed to

choose on which quality measures they want

to be evaluated. For the calculation of payment bonuses and penalties (and for ease of

eventual consumer use through public reporting on Physician Compare), the Department

of Health and Human Services (HHS) will be

tasked with developing a composite score for

each physician based on these factors.

Maximum bonuses and penalties will be 4

percent in 2019, 5 percent in 2020, 7 percent in

2021, and 9 percent in 2022 and beyond. Additional funding of up to $500 million a year will

be provided for separate bonuses for exceptional performance, from 2019 through 2024.

Physicians choosing the alternative payment model path will have to join an accountable care organization or an approved

patient-centered medical home, or otherwise

be in an alternative payment model entity (see

discussion below) where payment is at least

partly based on quality performance and on

total spending. Payment tied to performance

must be 25 percent of a doctors or group practices Medicare revenue in 2019, increasing to

75 percent in 2022.

Physicians who join a CMS-approved alternative payment model will get an annual 5

percent bonus in their fees from 2019 to 2024.

And, starting in 2026, physicians in alternative payment models will receive an annual

across-the-board fee increase of 0.75 percent.

Physicians participating in MIPS will get a

0.25 percent annual increase.

MACRA authorizes $100 million for technical assistance to small practices (up to fifteen

professionals), $20 million per year from 2016

through 2020. And under MIPS, small practices (for example, those in rural areas) can

elect to report together as virtual groups

and receive a MIPS composite score for their

combined performance. The law also authorizes $75 million for physician groups to improve quality measure development.

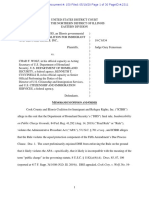

MACRA specifies a detailed pathway to implementation (see Exhibit 1), which began in

2015 with CMS seeking public comment. An

initial set of rules is expected by the end of

2016, although in February 2016 some physician groups signaled they might seek a delay

in MACRA rulemaking.

whats the debate?

On October 1, 2015, HHS published a request

for information on MACRAs implementation.

The request posed some seventy-five questions

on how the law should unfold. The questions

addressed overall design and in-the-weeds

technical details. Comments were due November 17, 2015, and are posted and publicly

available at Regulations.gov. Almost every major physician interest group and stakeholder

offered input.

h e a lt h p o l ic y b r i e f

m e dic a r e s n e w p h y sici a n pay m e n t s y s t e m

exhibit 1

Implementing the Medicare Access and CHIP Reauthorization Acts (MACRAs) physician payment reforms, 201622

MIPS and APMs begin operating

2016

Fee

updates

0.5%

2017

0.5%

2018

2019

2020

2021

2022

0.5%

0.5%

0%

0%

0%

Doctors treating Medicare beneficiaries will be

in one of two newly designed payment paths

MIPS*

(MeritBased

Incentive

Payment

System )

Annual fee

updates as of 2026

MIPS

APMs

MIPS MAXIMUM BONUS OR PENALTY (+/-)

Doctors

Clinical

practice

will be

improvement

graded

activities

on four

factors...

Meaningful

use of EHRs

15%

30%

... to

determine

bonuses or

penalties

Quality

of care

25%

30%

Resource

use

4%

5%

7%

9%

-4%

-5%

7%

-9%

(+/- 9%

continues

after 2022)

APMs ACROSS-THE-BOARD BONUS

APMs

(Alternative

payment

models)

Additional

funding

0.25% 0.75%

5%

5%

5%

5%

(5% bonus stops after 2024)

$15 million available every year for measure development

$20 million available every year for technical assistance to small practices

Up to $500 million authorized every year for MIPS bonuses

of up to 10% for exceptional performance (201924)

Timeline

Integration

of Medicaid claims

data into Physician

Compare

Higher-income

Medicare

beneficiaries

start paying

higher premiums

March 1 Comments

due to CMS on draft

plan for measure

development

April 16 HHS must

clarify how consumers

are protected if their

data is used in clinical

data registries

April 16

Report due to

Congress from GAO on

telehealth and remote

patient monitoring

May 1

Final measure

development plan due

from CMS

May 1

Annual update to

measure development

plan due from CMS

July 1

Study to Congress

from HHS on the integrating APMs into

Medicare Advantage

July 1

Initial report to Congress

from MedPAC on

physician spending and

ordering patterns

July 1

Report to

Congress from

MedPAC on

recommendations

for future fee

updates

Nov 1

Criteria for APM

advisory panel due

from HHS and final

list of initial MIPS

quality measures due

from CMS

2016

Signed into law on April 16, 2015, the Medicare

Access and CHIP Reauthorization Act of 2015

establishes a new system for paying physicians

in the Medicare program. The law specifies

a detailed pathway for implementation over

the next 7 years and beyond.

July 1

Final report to

Congress from

MedPAC on

physician

spending and

ordering patterns

* Three existing payment incentive and quality improvement initiatives are dissolved

and melded into MIPS starting in 2019: Physician Quality Reporting System,

Meaningful Use program, and Physician Value-Based Payment Modifier.

2017

2018

2019

2020

2021

2022

source Authors analysis. notes EHR is electronic health record. CMS is Centers for Medicare and Medicaid Services. HHS is Department of Health and Human

Services. GAO is Government Accountability Office. MedPAC is Medicare Payment Advisory Commission.

h e a lt h p o l ic y b r i e f

0.5

Between 2016 and 2019, MACRA

will give physicians a fee increase

of 0.5 percent per year.

m e dic a r e s n e w p h y sici a n pay m e n t s y s t e m

Mandated by MACR A, on December 18,

2015, CMS published a proposed plan for developing clinical quality measures for the new

payment system, including both MIPS and alternative payment models. Public comments

on this plan were due March 1, 2016. CMS has

pledged to post a final plan for measure development on May 1, 2016.

Comments on the MACRA request for information represent the initial salvos in what

promises to be a roller-coaster ride toward implementation. Space restrictions here prevent

a comprehensive analysis of the many complex

issues. But among the major ones are these:

MIPS versus alternative payment entities

Its clear that Congress wants the majority

of physicians, over time, to join alternative

payment entities. Thats consistent with the

Obama administrations approach under the

ACA and with bipartisan laws and marketplace dynamics over the past fifteen years

promoting larger groups practices, integrated

systems, a shift away from fee-for-service, and

promotion of Medicare Advantage as an alternative to traditional Medicare.

The ACA, for example, prods physicians

to become part of organizations (such as accountable care organizations) that embrace

payment methods that nurture quality improvement and can manage financial risk

for the health of covered populations. Under

MACRA, CMS is tasked with developing a

process to certify organizations as alternative payment models. The criteria surrounding that alone are likely to be contentious.

A multistakeholder groupthe Health Care

Payment Learning and Action Networkpublished a framework for developing such criteria in January 2016 that is likely to be used as a

template for alternative payment model rules.

As yet unclear is what path Medicare Advantage planswhich now cover one in five

Medicare beneficiarieswill need to take to

be deemed as alternative payment entities.

Larger potential bonuses (compared to

MIPS) and fee increases are inducement to

physicians to take the alternative payment

model path. Several physician groups noted in

their comments that many physicians are still

novices when it comes to quality reporting.

That cuts several ways. It could drive such physicians into larger alternative payment models, or it could lead some physicians to think

that they can do it as part of a smaller group.

Accountable care organizations are likely

to be the major alternative payment platform.

With some 400 accountable care organizations

now serving eight million Medicare beneficiaries, they could attract more and more physicians. As a side note, with their almost-certain

ramp-up under MACRA, accountable care

organizations will come under even more intense pressure and scrutiny; studies are mixed

on the results they have achieved to date.

MIPS design

Physician groups want CMS to create a MIPS

system that is, in the words of the American

College of Physicians, flexible, not prescriptive or rigid.

More pointedly, the AMA said: The current one-size-fits-all approach with its everexpanding requirements, flawed methodologies, and insufficient measures has created a

situation where manyperhaps mostphysicians are judged at least in part on cost and/or

quality measures that are largely irrelevant to

their practice. The goal in MIPS should be

to create a new program with a limited set of

requirements but with more options for meeting those requirements.

In contrast, employer and consumer groups

want CMS to impose clear requirements that

dont allow physicians to report and be judged

on a weak set of performance metrics. For example, they advocate physician accountability

in MIPS equal to that of alternative payment

entities. Indeed, the law specifies that MIPS

and alternative payment model quality metrics be comparablea possibly difficult task

for CMS to achieve.

How much risk should physicians take on in alternative payment models?

Minimal, said most physician groups. Substantial (more than nominal in the parlance

of the CMS proposal), said employer, insurer,

and consumer groups.

All stakeholders urge CMS to dramatically

improve risk adjustmentthe technical process by which quality measurement is adjusted

for mix of patients and their health status. In

contrast, physician interest groups want limited physician exposure to losses from taking

on insurance or financial risk. Physicians will

be much more willing to take accountability

for costs that they can affect through their own

performance, such as the costs of preventable

complications, than they are to take on risk for

h e a lt h p o l ic y b r i e f

m e dic a r e s n e w p h y sici a n pay m e n t s y s t e m

the total cost of care for a large patient population, the AMA said in its comments.

The new law

replaced the

Sustainable

Growth Rate with

a new Medicare

physician

payment system.

In contrast, Mayo Clinican integrated delivery systemcommented that the metrics

and rules used to establish payments in APMs

[alternative payment models] must reflect the

same type of risk assumed by integrated care

delivery systems and be similar to the rate

methodologies used for managed care models.

Meaningful measures

The vast majority of commenters, across

the stakeholder spectrum, recommended

that CMS adopt a smaller, common set of measures focused on population health, clinical

outcomes, and assessments of patient experiencefor both MIPS and the alternative

payment entities. Most also urged CMS to

eliminate overlapping, duplicative measures,

and topped out process measures that no

longer provide meaningful barometers of

quality of care or performance.

Progress on this front is already under way.

In February 2016 CMS and the insurance industry jointly released an initial set of core

physician performance measures intended to

replace existing overly complex measure sets.

In its MACR A comments, the AMA expressed concern about a too-rapid shift to

claims-based cost and outcome measures. We

would view proposals to dictate the percentage

of measures that must be based on outcomes

rather than process as highly premature, the

group said.

For their part, employer and consumer

groups want CMS to put more emphasis on

the results of patient experience surveys such

as those developed by the Agency for Healthcare Research and Qualitys Consumer Assessment of Healthcare Providers and Systems

(CAHPS) program. They also urge CMS to aggressively explore the use of patient-reported

outcomesinformation and data that patients

themselves document about their care. Physician groups, however, are divided on the utility of CAHPS and patient-reported outcomes.

The American College of Physicians, for example, requests that CAHPS surveys not be used

at all under MIPS.

Other comments ref lect near-universal

agreement that CMS should make more use

of the data contained in patient registries, as

CMS proposes. But how such registries can be

standardized is an open question.

Clinical practice improvement activities

Physician groups want wide latitude to

adapt to and implement the practice improvement component of the MIPS scoring system

(15 percent of the score). The law specifies a

host of areas it is designed to encourage physicians to focus on, such as care coordination

and adopting patient decision support and

shared-decision-making tools.

In the words of the American College of Surgeons: It is critical that CMS conduct pilot

testing to define improvement for the MIPS

program. CMS must account for the different

types of practices and the type of improvement

needed by those practices before this program

becomes punitive. Other stakeholder groups

see the practice improvement metric as an opportunity to improve both quality and the service component of physicians practices.

Electronic health records

Physician groups want CMSs EHR meaningful-use program to be substantially reengineered under MACRAconsistent with

their mounting criticism of the program over

the past several years. Specifically, they want

far less emphasis on data entry and check

the box use of EHRs; more emphasis on care

coordination, transitions of care, and quality

reporting; and greater inclusion of oral health

and behavioral health providers.

The AMA stated its desire as follows: The

current [meaningful-use] program fails to provide an avenue for innovation or ensure that

all care providers can participate. CMS should

therefore collaborate with national specialty

societies to develop alternatives or pilots that

could be optionally used to satisfy the [meaningful-use] component of the composite score.

Other stakeholders urge CMS to hold physicians accountable for extending the content

of EHRs and other physician-held data to consumers/patients. The National Partnership

for Women and Families, for example, noted

that patients with online access to the health

information in their providers EHRs overwhelmingly use this capabilityyielding better care and improved health outcomes.

Attribution

Physician groups want CMS to concentrate

on assessing the performance at the group

practice level under MIPS and avoid grading individual physicians. Some academics

h e a lt h p o l ic y b r i e f

agree. Experts from Dartmouth College and

the Brookings Institution, for example, commented: CMS should emphasize the development of mechanisms to aggregate patient

populations and attribute them to the groups

of physicians involved in their care. This will

improve the reliability and validity of the measurement effort, and secondly, further the

goals of [alternative payment model] formationencouraging physicians and systems to

work together to improve performance, share

information more effectively, and accept accountability for their populations.

Employer and consumer groups, in contrast, advise CMS to push toward performance

measures at the levels of the individual physician, where appropriate. Under the ACA, CMS

is mandated to assess performance and quality at the individual physician level.

Volume to valueslogan or sound policy?

Some critics argue that the volume-to-value

movement is, for now, based more on faith

than on strong evidence. For example, they

cite the experience of countries in Europe that

control spending primarily through regulating prices and fees in fee-for-service systems,

instead of through performance measurement

and payment incentives.

Critics also argue that value in medicine

is an elusive concept and not one likely to

About Health Policy Briefs

Written by

Steven Findlay

Health Journalist

Editorial review by

Robert Berenson

Institute Fellow

Urban Institute

Rob Lott

Deputy Editor

Health Affairs

Tracy Gnadinger

Associate Editor

Health Affairs

Health Policy Briefs are produced under

a partnership of Health Affairs and the

Robert Wood Johnson Foundation.

Cite as: Health Policy Brief: Medicares

New Physician Payment System, Health

Affairs, April 21, 2016.

Sign up for free policy briefs at:

www.healthaffairs.org/

healthpolicybriefs

m e dic a r e s n e w p h y sici a n pay m e n t s y s t e m

be pinned down through a single composite score. As yet, these critics further allege,

value has not been clearly pegged or produced

by accountable care organizations, patientcentered medical homes, or integrated health

care systems. Such criticisms are countered by

researchers who point to dozens of initiatives

that have yielded better care at lower cost with

approaches using measurement and incentive

payments.

whats next?

MACRA creates a payment system for physicians that will accelerate Medicares transition from fee-for-service to payment based on

performance metrics, patient experience, and

patient outcomes. But three years of complex

MACRA rulemaking lie ahead amid a stillentrenched fee-for-service system, continued

political rancor over the ACA, and a change

in administrations and a new Congress. The

trajectory of health care spending over the

next few years could also affect the urgency

and design components of MACRA implementation. The hundreds of comments on CMSs

request for information signal many areas of

tension but also areas of agreement. The major question is whether MACRA will succeed

at improving quality, reducing unnecessary

care, and lowering cost growth where past efforts have lagged or failed outright. n

resources

American Medical Association, Medicare Physician

Payment Reform: Understanding How MACRA Will Impact Physicians (Chicago, IL: AMA, 2016). Requires

free registration.

Robert A. Berenson, If You Cant Measure Performance, Can You Improve It? Journal of the American

Medical Association 315, no. 7 (2016):6456.

Robert A. Berenson and John D. Goodson, Finding

Value in Unexpected PlacesFixing the Medicare

Physician Fee Schedule, New England Journal of

Medicine 374, no. 14 (2016): 130609.

Centers for Medicare and Medicaid Services, The

Merit-Based Incentive Payment System (MIPS) and

Alternative Payment Models (APMs): Delivery System

Reform, Medicare Payment Reform, and the MACRA

(Baltimore, MD: CMS, 2016).

Suzanne Delbanco, Franois de Brantes, and

Tom Valuck, The Payment Reform Landscape:

Which Quality Measures Matter? Health Affairs

Blog, October 15, 2015.

Dhruv Khullar, Dave A. Chokshi, Robert Kocher,

Ashok Reddy, Karna Basu, Patrick H. Conway,

and Rahul Rajkumar, Behavioral Economics and

Physician CompensationPromise and Challenges, New England Journal of Medicine 372, no. 24

(2015):22813.

Medicare Access and CHIP Reauthorization Act of 2015,

Pub. L. No. 114-10 (April 16, 2015).

John OShea, Overcoming Challenges to Physician Payment Reform in a Post-SGR World (Washington, DC:

Heritage Foundation, March 16, 2016).

Meredith B. Rosenthal, Physician Payment after the

SGRthe New Meritocracy, New England Journal of

Medicine 373, no. 13 (2015):11879.

You might also like

- Medicare Revolution: Profiting from Quality, Not QuantityFrom EverandMedicare Revolution: Profiting from Quality, Not QuantityNo ratings yet

- Ib 33 PDFDocument12 pagesIb 33 PDFLatinos Ready To VoteNo ratings yet

- Mining for Gold In a Barren Land: Pioneer Accountable Care Organization Potential to Redesign the Healthcare Business Model in a Post-Acute SettingFrom EverandMining for Gold In a Barren Land: Pioneer Accountable Care Organization Potential to Redesign the Healthcare Business Model in a Post-Acute SettingNo ratings yet

- ACOS An Eye On Washington Quarterly (SGR)Document3 pagesACOS An Eye On Washington Quarterly (SGR)acosurgeryNo ratings yet

- Value Based ProgramsDocument8 pagesValue Based ProgramsPremium GeeksNo ratings yet

- 2015 Health Care Providers Outlook: United StatesDocument5 pages2015 Health Care Providers Outlook: United StatesEmma Hinchliffe100% (1)

- Acos 1Document2 pagesAcos 1api-377151267No ratings yet

- Macra QPP Fact SheetDocument14 pagesMacra QPP Fact SheetiggybauNo ratings yet

- Perspective: New England Journal MedicineDocument3 pagesPerspective: New England Journal MedicineAllen ZhuNo ratings yet

- APM Companion Paper Formatted FINALDocument11 pagesAPM Companion Paper Formatted FINALAnonymous 2zbzrvNo ratings yet

- Letter of Support For ACOs and MSSP NPRM Sign On 09202018Document3 pagesLetter of Support For ACOs and MSSP NPRM Sign On 09202018HLMeditNo ratings yet

- Cost Control in Health Care......................................Document11 pagesCost Control in Health Care......................................Rifat ParveenNo ratings yet

- Mar12 EntireReportDocument443 pagesMar12 EntireReportcaemonNo ratings yet

- Community Catalyst 2/25/11 Letter To HHS Secretary With Medicaid Cost-Savings SuggestionsDocument7 pagesCommunity Catalyst 2/25/11 Letter To HHS Secretary With Medicaid Cost-Savings SuggestionsSandy CohenNo ratings yet

- White Paper - Utilization Management Through The Lens of Value-Based CareDocument7 pagesWhite Paper - Utilization Management Through The Lens of Value-Based CarevamseeNo ratings yet

- Do You Know The Fair Market Value of Quality?: Jen JohnsonDocument8 pagesDo You Know The Fair Market Value of Quality?: Jen JohnsonG Mohan Kumar100% (1)

- Program Integrity White PaperDocument8 pagesProgram Integrity White PaperGovtfraudlawyerNo ratings yet

- Healthcare Inc. A Better Business ModelDocument13 pagesHealthcare Inc. A Better Business ModelrangababNo ratings yet

- Analysis of Us Health Care PolicyDocument7 pagesAnalysis of Us Health Care Policyapi-520841770No ratings yet

- Health Care Solutions From America's Business Community: The Path Forward For U.S. Health ReformDocument67 pagesHealth Care Solutions From America's Business Community: The Path Forward For U.S. Health ReformU.S. Chamber of CommerceNo ratings yet

- Bodenheimer PrimCareDocument4 pagesBodenheimer PrimCareJaume SanahujaNo ratings yet

- Transforming The Health Care Marketplace by Promoting Value PDFDocument7 pagesTransforming The Health Care Marketplace by Promoting Value PDFiggybauNo ratings yet

- Health Care Transparency Final PaperDocument19 pagesHealth Care Transparency Final Paperapi-242664158No ratings yet

- Running Head: Benchmark-Analysis of U.S. Health Care Policy 1Document7 pagesRunning Head: Benchmark-Analysis of U.S. Health Care Policy 1api-520843051No ratings yet

- 11 Hospi PerformanceDocument5 pages11 Hospi PerformancedoctoooorNo ratings yet

- Healthy California Act AnalysisDocument8 pagesHealthy California Act AnalysisDylan MatthewsNo ratings yet

- Arnold Ventures Comment On CY2024 MPFS RuleDocument9 pagesArnold Ventures Comment On CY2024 MPFS RuleArnold VenturesNo ratings yet

- Managed Care NPRM 09 2015Document3 pagesManaged Care NPRM 09 2015api-293754603No ratings yet

- A New Definition' For Health Care Reform: James C. Capretta Tom MillerDocument57 pagesA New Definition' For Health Care Reform: James C. Capretta Tom MillerFirhiwot DemisseNo ratings yet

- AHA Letter 2 To President-Elect Trump Regulatory ReliefDocument9 pagesAHA Letter 2 To President-Elect Trump Regulatory ReliefHLMeditNo ratings yet

- The Affordable Care ActDocument7 pagesThe Affordable Care ActalexNo ratings yet

- Mac Guineas Testimony Medicare Reform 12oct11Document12 pagesMac Guineas Testimony Medicare Reform 12oct11Committee For a Responsible Federal BudgetNo ratings yet

- NR526 Collaboration Cafe M3Document5 pagesNR526 Collaboration Cafe M396rubadiri96No ratings yet

- Abstract PorfolioDocument5 pagesAbstract Porfolioapi-271900931No ratings yet

- Making Health Reform WorkDocument26 pagesMaking Health Reform WorkCenter for American ProgressNo ratings yet

- EpisodeBasedPayment PerspectivesforConsiderationDocument24 pagesEpisodeBasedPayment PerspectivesforConsiderationHazelnutNo ratings yet

- U.S. Employers Expect Health Care Costs To Rise 4% in 2015: SEPTEMBER 2014Document4 pagesU.S. Employers Expect Health Care Costs To Rise 4% in 2015: SEPTEMBER 2014Automotive Wholesalers Association of New EnglandNo ratings yet

- chap 25Document20 pageschap 25falgz tempestNo ratings yet

- Stimulus 101: Understanding The HITECH Act and Meaningful UseDocument4 pagesStimulus 101: Understanding The HITECH Act and Meaningful UseConner FitzpatrickNo ratings yet

- Paper Cuts: Reducing Health Care Administrative CostsDocument48 pagesPaper Cuts: Reducing Health Care Administrative CostsCenter for American ProgressNo ratings yet

- Health Policy Brief: Accountable Care OrganizationsDocument6 pagesHealth Policy Brief: Accountable Care Organizationspalak32No ratings yet

- Module 4 - Purchasing Health ServicesDocument18 pagesModule 4 - Purchasing Health Services98b5jc5hgtNo ratings yet

- Medicare Policy: The Independent Payment Advisory Board: A New Approach To Controlling Medicare SpendingDocument24 pagesMedicare Policy: The Independent Payment Advisory Board: A New Approach To Controlling Medicare SpendingCatherine SnowNo ratings yet

- Health System Reform Short SummaryDocument11 pagesHealth System Reform Short SummarySteve LevineNo ratings yet

- Oregon Health Care Delivery Systems ReportDocument14 pagesOregon Health Care Delivery Systems ReportfrendirachmadNo ratings yet

- Ramos, Sioco Chapter 25 and 26Document59 pagesRamos, Sioco Chapter 25 and 26DOROTHY ANN SOMBILUNANo ratings yet

- Health Care Policy and Delivery Systems SyllabusDocument6 pagesHealth Care Policy and Delivery Systems SyllabusDeekay100% (1)

- Risk Adjustment Data Validation of Payments Made To Pacificare of California For Calendar Year 2007Document64 pagesRisk Adjustment Data Validation of Payments Made To Pacificare of California For Calendar Year 2007christina_jewettNo ratings yet

- IntroductionDocument6 pagesIntroductionbaralNo ratings yet

- KPMG Macra Brief - FinalDocument6 pagesKPMG Macra Brief - FinalrsumnerwhiteNo ratings yet

- ACO Final ReportDocument24 pagesACO Final ReportSowmya ParthasarathyNo ratings yet

- Health Payment Brief 2011Document8 pagesHealth Payment Brief 2011char2183No ratings yet

- IRG Health Care ReportDocument57 pagesIRG Health Care ReportAnthony DaBruzziNo ratings yet

- NSG 436 Analysis of A UDocument6 pagesNSG 436 Analysis of A Uapi-521018364No ratings yet

- Hospital Value-Based Purchasing Program: Collaboration Between Hospitals and Home Care)Document2 pagesHospital Value-Based Purchasing Program: Collaboration Between Hospitals and Home Care)Michael TapellaNo ratings yet

- Fact Sheet - Health Care - FINALDocument6 pagesFact Sheet - Health Care - FINALsarahkliffNo ratings yet

- September 21, 2009 The Honorable Max Baucus Chairman Senate FinanceDocument13 pagesSeptember 21, 2009 The Honorable Max Baucus Chairman Senate Financeapi-26254299No ratings yet

- "Bundling" Payment For Episodes of Hospital CareDocument29 pages"Bundling" Payment For Episodes of Hospital CareCenter for American Progress100% (1)

- HE Rrival Of: Verage AlesDocument6 pagesHE Rrival Of: Verage Alescjende1No ratings yet

- Excess Administrative Costs Burden The U.S. Health Care SystemDocument13 pagesExcess Administrative Costs Burden The U.S. Health Care SystemMakNo ratings yet

- Boston Mayor Executive Order 6-12-2020Document3 pagesBoston Mayor Executive Order 6-12-2020iggybauNo ratings yet

- Doe v. Trump 9th Circuit Denial of Stay of Preliminary InjunctionDocument97 pagesDoe v. Trump 9th Circuit Denial of Stay of Preliminary InjunctioniggybauNo ratings yet

- Bostock v. Clayton County, Georgia DecisionDocument119 pagesBostock v. Clayton County, Georgia DecisionNational Content DeskNo ratings yet

- AAFP Letter To Domestic Policy Council 6-10-2020Document3 pagesAAFP Letter To Domestic Policy Council 6-10-2020iggybauNo ratings yet

- COVID 19 FaceCovering 1080x1080 4 SPDocument1 pageCOVID 19 FaceCovering 1080x1080 4 SPiggybauNo ratings yet

- HR 6585 Equitable Data Collection COVID-19Document18 pagesHR 6585 Equitable Data Collection COVID-19iggybauNo ratings yet

- HR 6437 Coronavirus Immigrant Families Protection AcfDocument16 pagesHR 6437 Coronavirus Immigrant Families Protection AcfiggybauNo ratings yet

- HR 4004 Social Determinants Accelerator ActDocument18 pagesHR 4004 Social Determinants Accelerator ActiggybauNo ratings yet

- S 3609 Coronavirus Immigrant Families Protection ActDocument17 pagesS 3609 Coronavirus Immigrant Families Protection ActiggybauNo ratings yet

- 7th Circuit Affirming Preliminary Injunction Cook County v. WolfDocument82 pages7th Circuit Affirming Preliminary Injunction Cook County v. WolfiggybauNo ratings yet

- S 3721 COVID-19 Racial and Ethnic Disparities Task ForceDocument11 pagesS 3721 COVID-19 Racial and Ethnic Disparities Task ForceiggybauNo ratings yet

- SF StayHome MultiLang Poster 8.5x11 032620Document1 pageSF StayHome MultiLang Poster 8.5x11 032620iggybauNo ratings yet

- A Bill: in The House of RepresentativesDocument2 pagesA Bill: in The House of RepresentativesiggybauNo ratings yet

- HR 6763 COVID-19 Racial and Ethnic Disparities Task ForceDocument11 pagesHR 6763 COVID-19 Racial and Ethnic Disparities Task ForceiggybauNo ratings yet

- Milwaukee Board of Supervisors Ordinance 20-174Document9 pagesMilwaukee Board of Supervisors Ordinance 20-174iggybauNo ratings yet

- NCAPIP Recommendations For Culturally and Linguistically Appropriate Contact Tracing May 2020Document23 pagesNCAPIP Recommendations For Culturally and Linguistically Appropriate Contact Tracing May 2020iggybauNo ratings yet

- Doe v. Trump Preliminary Injunction Against Proclamation Requiring Private Health InsuranceDocument48 pagesDoe v. Trump Preliminary Injunction Against Proclamation Requiring Private Health InsuranceiggybauNo ratings yet

- Cook County v. Wolf Denial Motion To Dismiss Equal ProtectionDocument30 pagesCook County v. Wolf Denial Motion To Dismiss Equal ProtectioniggybauNo ratings yet

- ND California Order On Motion To CompelDocument31 pagesND California Order On Motion To CompeliggybauNo ratings yet

- WA v. DHS Order On Motion To CompelDocument21 pagesWA v. DHS Order On Motion To CompeliggybauNo ratings yet

- COVID-19 Data For Native Hawaiians and Pacific Islanders UPDATED 4-21-2020 PDFDocument2 pagesCOVID-19 Data For Native Hawaiians and Pacific Islanders UPDATED 4-21-2020 PDFiggybauNo ratings yet

- Doe v. Trump Denial of All Writs Injunction Against April 2020 Presidential ProclamationDocument9 pagesDoe v. Trump Denial of All Writs Injunction Against April 2020 Presidential ProclamationiggybauNo ratings yet

- Covid-19 Data For Asians Updated 4-21-2020Document2 pagesCovid-19 Data For Asians Updated 4-21-2020iggybauNo ratings yet

- Tri-Caucus Letter To CDC and HHS On Racial and Ethnic DataDocument3 pagesTri-Caucus Letter To CDC and HHS On Racial and Ethnic DataiggybauNo ratings yet

- Physician Association Letter To HHS On Race Ethnicity Language Data and COVID-19Document2 pagesPhysician Association Letter To HHS On Race Ethnicity Language Data and COVID-19iggybauNo ratings yet

- CDC Covid-19 Report FormDocument2 pagesCDC Covid-19 Report FormiggybauNo ratings yet

- Booker-Harris-Warren Letter To HHS Re Racial Disparities in COVID ResponseDocument4 pagesBooker-Harris-Warren Letter To HHS Re Racial Disparities in COVID ResponseStephen LoiaconiNo ratings yet

- Democratic Presidential Candidate Positions On ImmigrationDocument10 pagesDemocratic Presidential Candidate Positions On ImmigrationiggybauNo ratings yet

- MMMR Covid-19 4-8-2020Document7 pagesMMMR Covid-19 4-8-2020iggybauNo ratings yet

- Pete Buttigieg Douglass PlanDocument18 pagesPete Buttigieg Douglass PlaniggybauNo ratings yet

- Hong Kong's Health SystemDocument569 pagesHong Kong's Health SystemAmit Mishra100% (1)

- VA LettersDocument6 pagesVA LettersNews-Review of Roseburg OregonNo ratings yet

- Cost-Effectiveness of Asthmazolimide for AsthmaDocument20 pagesCost-Effectiveness of Asthmazolimide for AsthmaEric YoungNo ratings yet

- DBM Releases P7.92 Billion OCADocument3 pagesDBM Releases P7.92 Billion OCAMareca DizonNo ratings yet

- Annual: PerformanceDocument176 pagesAnnual: PerformanceArja WoldeNo ratings yet

- ACO Advance Payment Factsheet ICN907403Document8 pagesACO Advance Payment Factsheet ICN907403pultNo ratings yet

- The Economics of Animal Health and ProductionDocument385 pagesThe Economics of Animal Health and ProductionMarvelous Sungirai100% (2)

- WEF The Moment of Truth For Healthcare Spending 2023Document62 pagesWEF The Moment of Truth For Healthcare Spending 2023Junita KusbiantoNo ratings yet

- Important Questions Answers Why This Matters:: IndividualDocument7 pagesImportant Questions Answers Why This Matters:: Individualsashank varmaNo ratings yet

- Effect of Hygiene Guidelines On Knowledge, Attitudes, and Practices of Food Handlers at University CafeteriasDocument12 pagesEffect of Hygiene Guidelines On Knowledge, Attitudes, and Practices of Food Handlers at University CafeteriasOSCAR DE JESUS FLORESNo ratings yet

- Improving Patient Safety and Hospital Service Quality Through Electronic Medical Record: A Systematic ReviewDocument10 pagesImproving Patient Safety and Hospital Service Quality Through Electronic Medical Record: A Systematic ReviewRAHMA JUMILANo ratings yet

- NHSRC - Operational Guidelines On Maternal and Newborn HealthDocument46 pagesNHSRC - Operational Guidelines On Maternal and Newborn HealthNational Child Health Resource Centre (NCHRC)No ratings yet

- Health Care Disparities PaperDocument8 pagesHealth Care Disparities Paperapi-235633705No ratings yet

- Teks Presentasi Maju BeDocument3 pagesTeks Presentasi Maju BeGita FitrisiaNo ratings yet

- QipDocument12 pagesQipapi-315592452No ratings yet

- q3 - Week1 - Health 10 - Study ConceptDocument2 pagesq3 - Week1 - Health 10 - Study ConceptDhess Mulleda MantalaNo ratings yet

- Medicaid: Health Policy BriefDocument2 pagesMedicaid: Health Policy BriefArnold VenturesNo ratings yet

- National Repute Hospital - Circular No. EP-12-2023-22 Dated 23.05.2023Document2 pagesNational Repute Hospital - Circular No. EP-12-2023-22 Dated 23.05.2023vijay_prasad_asnNo ratings yet

- Ehealth in Empowered Communities: James A. Salisi, MD University Researcher IiDocument12 pagesEhealth in Empowered Communities: James A. Salisi, MD University Researcher IiWyn AgustinNo ratings yet

- CDC Activities Initiatives For COVID 19 ResponseDocument60 pagesCDC Activities Initiatives For COVID 19 ResponseCNBC.com87% (23)

- Gyne Onco Mission 2022Document5 pagesGyne Onco Mission 2022Dominque RabastoNo ratings yet

- Forgive Us All Reflection PaperDocument4 pagesForgive Us All Reflection Paper2C Lamsin, Estelle NerieNo ratings yet

- Job Description: OsitionDocument2 pagesJob Description: OsitionSanjeev JayaratnaNo ratings yet

- Federal Benefits Open Season Highlights 2023 Plan YearDocument12 pagesFederal Benefits Open Season Highlights 2023 Plan YearFedSmith Inc.100% (1)

- Nurs Fpx 4020 Assessment 4 Improvement Plan Tool Kit (1)Document5 pagesNurs Fpx 4020 Assessment 4 Improvement Plan Tool Kit (1)joohnsmith070No ratings yet

- M2 Health Care SystemDocument28 pagesM2 Health Care SystemClumsyMochi :ppNo ratings yet

- Work Experience Sheet: Instructions: 1. Include Only The Work Experiences Relevant To The Position Being Applied ToDocument2 pagesWork Experience Sheet: Instructions: 1. Include Only The Work Experiences Relevant To The Position Being Applied TosarahNo ratings yet

- Hospital Billing ScenariosDocument7 pagesHospital Billing Scenarioskrishna EnagaluruNo ratings yet

- Jurnal Posisi Kala II PartusDocument10 pagesJurnal Posisi Kala II Partusichsan gamingNo ratings yet

- Nutrition Foundation of IndiaDocument2 pagesNutrition Foundation of IndiaBalajiSinghNo ratings yet

- The Smear: How Shady Political Operatives and Fake News Control What You See, What You Think, and How You VoteFrom EverandThe Smear: How Shady Political Operatives and Fake News Control What You See, What You Think, and How You VoteRating: 4.5 out of 5 stars4.5/5 (16)

- The Russia Hoax: The Illicit Scheme to Clear Hillary Clinton and Frame Donald TrumpFrom EverandThe Russia Hoax: The Illicit Scheme to Clear Hillary Clinton and Frame Donald TrumpRating: 4.5 out of 5 stars4.5/5 (11)

- Democracy in One Book or Less: How It Works, Why It Doesn't, and Why Fixing It Is Easier Than You ThinkFrom EverandDemocracy in One Book or Less: How It Works, Why It Doesn't, and Why Fixing It Is Easier Than You ThinkRating: 4.5 out of 5 stars4.5/5 (10)

- The Courage to Be Free: Florida's Blueprint for America's RevivalFrom EverandThe Courage to Be Free: Florida's Blueprint for America's RevivalNo ratings yet

- Sully: The Untold Story Behind the Miracle on the HudsonFrom EverandSully: The Untold Story Behind the Miracle on the HudsonRating: 4 out of 5 stars4/5 (103)

- Witch Hunt: The Story of the Greatest Mass Delusion in American Political HistoryFrom EverandWitch Hunt: The Story of the Greatest Mass Delusion in American Political HistoryRating: 4 out of 5 stars4/5 (6)

- Faster: How a Jewish Driver, an American Heiress, and a Legendary Car Beat Hitler's BestFrom EverandFaster: How a Jewish Driver, an American Heiress, and a Legendary Car Beat Hitler's BestRating: 4 out of 5 stars4/5 (28)

- Stonewalled: My Fight for Truth Against the Forces of Obstruction, Intimidation, and Harassment in Obama's WashingtonFrom EverandStonewalled: My Fight for Truth Against the Forces of Obstruction, Intimidation, and Harassment in Obama's WashingtonRating: 4.5 out of 5 stars4.5/5 (21)

- Trumpocracy: The Corruption of the American RepublicFrom EverandTrumpocracy: The Corruption of the American RepublicRating: 4 out of 5 stars4/5 (68)

- The Fabric of Civilization: How Textiles Made the WorldFrom EverandThe Fabric of Civilization: How Textiles Made the WorldRating: 4.5 out of 5 stars4.5/5 (57)

- Game Change: Obama and the Clintons, McCain and Palin, and the Race of a LifetimeFrom EverandGame Change: Obama and the Clintons, McCain and Palin, and the Race of a LifetimeRating: 4 out of 5 stars4/5 (572)

- The Beekeeper's Lament: How One Man and Half a Billion Honey Bees Help Feed AmericaFrom EverandThe Beekeeper's Lament: How One Man and Half a Billion Honey Bees Help Feed AmericaNo ratings yet

- A Place of My Own: The Architecture of DaydreamsFrom EverandA Place of My Own: The Architecture of DaydreamsRating: 4 out of 5 stars4/5 (241)

- The Deep State: How an Army of Bureaucrats Protected Barack Obama and Is Working to Destroy the Trump AgendaFrom EverandThe Deep State: How an Army of Bureaucrats Protected Barack Obama and Is Working to Destroy the Trump AgendaRating: 4.5 out of 5 stars4.5/5 (4)

- Making a Difference: Stories of Vision and Courage from America's LeadersFrom EverandMaking a Difference: Stories of Vision and Courage from America's LeadersRating: 3 out of 5 stars3/5 (2)

- The Technology Trap: Capital, Labor, and Power in the Age of AutomationFrom EverandThe Technology Trap: Capital, Labor, and Power in the Age of AutomationRating: 4.5 out of 5 stars4.5/5 (46)

- Power Grab: The Liberal Scheme to Undermine Trump, the GOP, and Our RepublicFrom EverandPower Grab: The Liberal Scheme to Undermine Trump, the GOP, and Our RepublicNo ratings yet

- Pale Blue Dot: A Vision of the Human Future in SpaceFrom EverandPale Blue Dot: A Vision of the Human Future in SpaceRating: 4.5 out of 5 stars4.5/5 (586)

- 35 Miles From Shore: The Ditching and Rescue of ALM Flight 980From Everand35 Miles From Shore: The Ditching and Rescue of ALM Flight 980Rating: 4 out of 5 stars4/5 (21)

- Dirt to Soil: One Family’s Journey into Regenerative AgricultureFrom EverandDirt to Soil: One Family’s Journey into Regenerative AgricultureRating: 5 out of 5 stars5/5 (124)

- The Big, Bad Book of Botany: The World's Most Fascinating FloraFrom EverandThe Big, Bad Book of Botany: The World's Most Fascinating FloraRating: 3 out of 5 stars3/5 (10)

- Recording Unhinged: Creative and Unconventional Music Recording TechniquesFrom EverandRecording Unhinged: Creative and Unconventional Music Recording TechniquesNo ratings yet

- Transformed: Moving to the Product Operating ModelFrom EverandTransformed: Moving to the Product Operating ModelRating: 4 out of 5 stars4/5 (1)

- The Future of Geography: How the Competition in Space Will Change Our WorldFrom EverandThe Future of Geography: How the Competition in Space Will Change Our WorldRating: 4.5 out of 5 stars4.5/5 (4)

- Data-ism: The Revolution Transforming Decision Making, Consumer Behavior, and Almost Everything ElseFrom EverandData-ism: The Revolution Transforming Decision Making, Consumer Behavior, and Almost Everything ElseRating: 3.5 out of 5 stars3.5/5 (12)

- A Garden of Marvels: How We Discovered that Flowers Have Sex, Leaves Eat Air, and Other Secrets of PlantsFrom EverandA Garden of Marvels: How We Discovered that Flowers Have Sex, Leaves Eat Air, and Other Secrets of PlantsNo ratings yet