Professional Documents

Culture Documents

FORTUNE: Caterpillar Serious Consideration

Uploaded by

FortuneOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

FORTUNE: Caterpillar Serious Consideration

Uploaded by

FortuneCopyright:

Available Formats

·PauI J. Gaeta· To "Gregory Folley" <Folley-Gregory_S@cat.

com>

<Paul.Gaeto@cat.com>

"

cc "Kathryn Himes" <HIMES_KATHRYN_S@cat.com>, "Jerry

11/20/200908:01 AM Duggan" <Duggan_Jerry_W@cat.com>

bee

Subject Fw: Healthcare Reform

Caterpllar: Confidential Green Retain Untlt 02126/2011

~l~",

Greg:

Please see Jerry's note below summarizing the impact on Caterpillar of the

House version of the Healthcare Reform Bill. The most significant issue is

the elimination of the tax exemption on the Part D subsidy. Corporate

Accounting has advised that we would have a one-time write-off of a tax

deferred asset of up to $110 million when the legislation is passed. The

annual impact going forward would be around $8 million. The other versions

of healthcare reform legislation being circulated contain a similar

provision.

Katie and Jerry are putting together a letter for you to send to key

members of Congress. We will be reviewing it in the next few days. Please

let me know if you want to meet to discuss in advance.

Paul

Original Message

From: Jerry W. Duggan

Sent: 11/19/2009 04:19 PM CST

To: Kathryn Himes; Valerie Johnson

Cc: Paul Gaeto

SUbject: Healthcare Reform

Here is the latest update on impact of the various provisions of the House

Bill:

Medicare Part D Subsidy

Current estimates are that if we lose the tax-free treatment, we will

need to take a one time tax charge at time of enactment that could be

as high as $llOm. Corporate Accounting is working with Towers Perrin

to more finely tune the estimate as it will be impacted by our

announcement related to retiree coordinator model. If we can delay

the implementation, would have a favorable impact from a cash flow

perspective but will not delay the time when we would need to

recognize the tax charge. We could also impact the amount of the tax

charge if we were to announce a plan design change related to our

retiree healthcare for the impacted population (bargained and

pre-1991 retirees) prior to the enactment. If we announced after the

enactment, we would still incur the tax charge.

Offer coverage for dependents through age 26

We could have as much as a $20m annual impact to Cat. We currently

have on average about 1,730 dependents for each age 14 - 18, while

only 600 on average for each age 19 - 26. Worst case scenario is

that with the bill, all eligible dependents 19 - 26 are added to our

plan (and we assume 1,730 eligible for each age 19-26). Based on our

CONFIDENTIAL BUSINESS INFORMATION CAT_WAXMAN_000360

history for cost per dependent in these age brackets, the additional

cost would be $20m annually. I think this is the worst case scenario

as I doubt all would be added but really have no way to know how many

would.

Elimination of Lifetime Max

Towers Perrin is still finalizing the impact on the remeasurement but

current estimate is that elimination of our ability to enforce the

lifetime max on benefits for pre-1991 retirees would result in an

annual impact of approximately $5m.

Health Insurance for part-time

We currently have about 250 part-time employees. If we assume that

translates into a total of 600 members and assuming our average per

member per year healthcare cost of $4000, annual cost could be $2.4m

Prohibition against post-retirement reductions of retiree healthcare

Impact is unknown depending on final definition of the regs

Extension of COBRA

Still trying to estimate impact

Have confirmed that we do not have any plans for which an individual

premium is in excess of 27.5% of the COBRA rate.

Have confirmed that we do not have any plans for which a family premium

is in excess of 35% of the COBRA rate.

In the "payor play" mandate, guidance has been that the 8% would apply to

Box 1 W2 wages. In 2008, total Box 1 W2 wages (excluding Solar, Progress

Rail and Anchor Coupling) for Caterpillar were approximately $3.5b. 8% of

this total would be $280 million. Our current healthcare spend for active

employees is approx $305m so we would need to give serious consideration to

this option.

Please let me know any comments you have on the above summary.

Regards,

Jerry Duggan

Healthcare Benefits

Human Services Division

(309) 675-4676 AB4360

CONFIDENTIAL BUSINESS INFORMATION

You might also like

- Collaborative Financial Solutions, LLC Cost-of-Living Adjustments: What They Are and Why They MatterDocument4 pagesCollaborative Financial Solutions, LLC Cost-of-Living Adjustments: What They Are and Why They MatterJanet BarrNo ratings yet

- Designing A Basic Income Guarantee For Canada-BROADWAY ET AL-qed - WP - 1371Document32 pagesDesigning A Basic Income Guarantee For Canada-BROADWAY ET AL-qed - WP - 1371william_V_LeeNo ratings yet

- Autor Et Al, The $800 Billion Paycheck Protection ProgramDocument26 pagesAutor Et Al, The $800 Billion Paycheck Protection Programtomislav javisNo ratings yet

- Labor Markets and Health Care Refor M: New Results: Executive SummaryDocument6 pagesLabor Markets and Health Care Refor M: New Results: Executive Summaryapi-27836025No ratings yet

- LTE, State of City Address Response, 1-15-10, LLDocument1 pageLTE, State of City Address Response, 1-15-10, LLapi-25966063No ratings yet

- Fiscal CliffDocument3 pagesFiscal CliffVikram RathodNo ratings yet

- Will Federal Health Legislation Cause The Deficit To SoarDocument2 pagesWill Federal Health Legislation Cause The Deficit To SoarthecynicaleconomistNo ratings yet

- Letters Urging Support of Multi-Employer Pension ReformDocument19 pagesLetters Urging Support of Multi-Employer Pension ReformLaborUnionNews.comNo ratings yet

- Response To Questions: Economy, Healthcare, Education, Energy, and Foreign PolicyDocument8 pagesResponse To Questions: Economy, Healthcare, Education, Energy, and Foreign PolicyMichael D. BallantineNo ratings yet

- Target Benefit Pension Plans Are Our Future by Robert L. BrownDocument2 pagesTarget Benefit Pension Plans Are Our Future by Robert L. BrownEvidenceNetwork.caNo ratings yet

- Macro Effects of IRADocument21 pagesMacro Effects of IRAmuhammad.nm.abidNo ratings yet

- Replacing The SequesterDocument6 pagesReplacing The SequesterCenter for American ProgressNo ratings yet

- EntitlementsDocument4 pagesEntitlementsRichard HortonNo ratings yet

- Veto Letter Dayton To DaudtDocument5 pagesVeto Letter Dayton To DaudtGoMNNo ratings yet

- Tax 2011Document42 pagesTax 2011murabitomNo ratings yet

- Wage Subsidies: A Multi-Trillion Dollar Market Distortion That America Cannot AffordDocument13 pagesWage Subsidies: A Multi-Trillion Dollar Market Distortion That America Cannot AffordJason PyeNo ratings yet

- Obamacare Is UNCONSTITUTIONAL & COMMUNISTICDocument263 pagesObamacare Is UNCONSTITUTIONAL & COMMUNISTICLevitator50% (2)

- 3.23.11 Final - MMB - Letter To Abeler - HannDocument2 pages3.23.11 Final - MMB - Letter To Abeler - Hanntom_scheckNo ratings yet

- Office of Fiscal Analysis: OFA Fiscal Note State Impact: Municipal Impact: ExplanationDocument11 pagesOffice of Fiscal Analysis: OFA Fiscal Note State Impact: Municipal Impact: ExplanationHelen BennettNo ratings yet

- Opinion - Jobs Aren't Being Destroyed This Fast Elsewhere. Why Is That - The New York TimesDocument2 pagesOpinion - Jobs Aren't Being Destroyed This Fast Elsewhere. Why Is That - The New York TimesJustBNo ratings yet

- 10 7 Baucus LetterDocument27 pages10 7 Baucus LetterBrian AhierNo ratings yet

- Issues and Concerns with the Philippines' Comprehensive Tax Reform PackageDocument4 pagesIssues and Concerns with the Philippines' Comprehensive Tax Reform PackageKim PajinagNo ratings yet

- Will The Estate Tax Stay Repealed For 2010?: Synergy Financial GroupDocument4 pagesWill The Estate Tax Stay Repealed For 2010?: Synergy Financial GroupgvandykeNo ratings yet

- AWC LowlightsDocument2 pagesAWC LowlightsbobologyNo ratings yet

- TownsvilleDocument18 pagesTownsvillePolitical AlertNo ratings yet

- Draft Hiring Incentives To Restore Employment (HIRE)Document4 pagesDraft Hiring Incentives To Restore Employment (HIRE)api-25909546No ratings yet

- WFP MemoDocument3 pagesWFP MemoJimmyVielkindNo ratings yet

- The Cost of Current PolicyDocument8 pagesThe Cost of Current PolicyCommittee For a Responsible Federal BudgetNo ratings yet

- Healthcare BillDocument3 pagesHealthcare Billtony_lima_2No ratings yet

- Repealing The Death Tax Will Create Jobs and Boost EconomyDocument22 pagesRepealing The Death Tax Will Create Jobs and Boost EconomyFamily Research CouncilNo ratings yet

- 02-28-08 MoJo-Primer - Obama Vs Clinton On The Top 10 EconomicDocument4 pages02-28-08 MoJo-Primer - Obama Vs Clinton On The Top 10 EconomicMark WelkieNo ratings yet

- AlamedaCourtyReportonPensions February 2010Document5 pagesAlamedaCourtyReportonPensions February 2010btmurrellNo ratings yet

- IMFNov 1303Document6 pagesIMFNov 1303Committee For a Responsible Federal BudgetNo ratings yet

- Sponsorship Speech On GSIS Members Rights and Benefits Act of 2011Document10 pagesSponsorship Speech On GSIS Members Rights and Benefits Act of 2011Ralph RectoNo ratings yet

- HHRG 117 Ba00 Wstate Yellenj 20210323Document12 pagesHHRG 117 Ba00 Wstate Yellenj 20210323Joseph Adinolfi Jr.No ratings yet

- 01-12-09 AlterNet-Note To Obama - Thinking Small Will Lead To Disaster by Robert KuttnerDocument3 pages01-12-09 AlterNet-Note To Obama - Thinking Small Will Lead To Disaster by Robert KuttnerMark WelkieNo ratings yet

- 10 Big Tax Breaks For The Rest of Us: Jeff SchnepperDocument4 pages10 Big Tax Breaks For The Rest of Us: Jeff Schneppergoofy101No ratings yet

- A Win-Win Approach To Financing Health Care ReformDocument2 pagesA Win-Win Approach To Financing Health Care ReformanggiNo ratings yet

- Covid-19 Resource PDFDocument5 pagesCovid-19 Resource PDFCat SalazarNo ratings yet

- A Guide To 2013 Tax Changes (And More)Document15 pagesA Guide To 2013 Tax Changes (And More)Doug PotashNo ratings yet

- Options To Finance Medicare For All: $500 BillionDocument6 pagesOptions To Finance Medicare For All: $500 BillionBradyNo ratings yet

- In Brief Charter Oak Health PlanDocument2 pagesIn Brief Charter Oak Health PlanKarimah bint Abdul-AzizNo ratings yet

- Update 2 28 01Document9 pagesUpdate 2 28 01Committee For a Responsible Federal BudgetNo ratings yet

- ARRA BirthdayDocument9 pagesARRA BirthdayCommittee For a Responsible Federal BudgetNo ratings yet

- GlenbrookSouth ArZu Neg 01 Niles Round 3Document43 pagesGlenbrookSouth ArZu Neg 01 Niles Round 3EmronNo ratings yet

- Progressive SuperannuationDocument2 pagesProgressive Superannuationpeter_martin9335No ratings yet

- PEI Proposal Could Spark Canada Pension Plan Reform by Robert BrownDocument2 pagesPEI Proposal Could Spark Canada Pension Plan Reform by Robert BrownEvidenceNetwork.caNo ratings yet

- Health BillsDocument28 pagesHealth BillsBrian AhierNo ratings yet

- US Economic Outlook: Three Big Questions On US StimulusDocument15 pagesUS Economic Outlook: Three Big Questions On US StimulusGugaNo ratings yet

- case-UST IncDocument10 pagescase-UST Incnipun9143No ratings yet

- ACA SummaryDocument9 pagesACA SummaryScottRobertLaneNo ratings yet

- C CCCCCCCCDocument2 pagesC CCCCCCCCapi-118535366No ratings yet

- Capital Investments, Capital ReturnsDocument9 pagesCapital Investments, Capital ReturnsCitizen Action of New YorkNo ratings yet

- 13 February 2013Document5 pages13 February 2013api-110464801No ratings yet

- CBO Grassley Letter On Enhanced Unemployment BenefitsDocument8 pagesCBO Grassley Letter On Enhanced Unemployment BenefitsStephen LoiaconiNo ratings yet

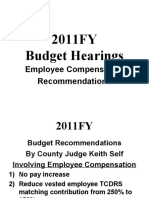

- 2011FY Budget HearingsDocument19 pages2011FY Budget HearingsccdatxNo ratings yet

- The Organizer: February 2009Document4 pagesThe Organizer: February 2009IATSENo ratings yet

- Make Taxes Great Again: The Good, the Bad and the Ugly About Tax ReformFrom EverandMake Taxes Great Again: The Good, the Bad and the Ugly About Tax ReformNo ratings yet

- Relativity SuitDocument56 pagesRelativity SuitFortune100% (1)

- Omega Advisors Inc. Letter To Investors 9.21.16Document5 pagesOmega Advisors Inc. Letter To Investors 9.21.16Fortune100% (1)

- Omega Advisors Inc. Letter To Investors 9.21.16Document5 pagesOmega Advisors Inc. Letter To Investors 9.21.16Fortune100% (1)

- Utimco ActiveDocument20 pagesUtimco ActiveFortune100% (4)

- Caspersen Andrew ComplaintDocument14 pagesCaspersen Andrew ComplaintFortuneNo ratings yet

- Cals TrsDocument6 pagesCals TrsFortuneNo ratings yet

- Pe Irr 06 30 15Document4 pagesPe Irr 06 30 15Fortune100% (1)

- PrimDocument6 pagesPrimFortuneNo ratings yet

- Foia q1 2016 OperfDocument7 pagesFoia q1 2016 OperfFortuneNo ratings yet

- Washington State Investment Board Portfolio Overview by Strategy December 31, 2015Document7 pagesWashington State Investment Board Portfolio Overview by Strategy December 31, 2015FortuneNo ratings yet

- Cals TrsDocument6 pagesCals TrsFortuneNo ratings yet

- SEC Servergy SuitDocument26 pagesSEC Servergy SuitFortuneNo ratings yet

- UberDocument33 pagesUberTechCrunch67% (3)

- Lisa Lee CVC ComplaintDocument23 pagesLisa Lee CVC ComplaintFortune100% (1)

- Bain Capital LP LetterDocument1 pageBain Capital LP LetterFortune100% (1)

- EEOC Decision Sexual Orientation Title VIIDocument17 pagesEEOC Decision Sexual Orientation Title VIIFortuneNo ratings yet

- Ab 2833Document4 pagesAb 2833FortuneNo ratings yet

- Square FilingDocument21 pagesSquare FilingFortuneNo ratings yet

- Herington v. Milwaukee Bucks ComplaintDocument20 pagesHerington v. Milwaukee Bucks ComplaintFortuneNo ratings yet

- Gilt Groupe FilingDocument25 pagesGilt Groupe FilingFortuneNo ratings yet

- Fanduel v. SchneidermanDocument17 pagesFanduel v. SchneidermanFortuneNo ratings yet

- Tarrus Richardson ComplaintDocument26 pagesTarrus Richardson ComplaintFortuneNo ratings yet

- Don Blankenship IndictmentDocument43 pagesDon Blankenship IndictmentFortuneNo ratings yet

- University of Texas Investment Management Company Private Investments Fund Performance (Active Relationships)Document18 pagesUniversity of Texas Investment Management Company Private Investments Fund Performance (Active Relationships)FortuneNo ratings yet

- LC RFI PreambleDocument7 pagesLC RFI PreambleFortuneNo ratings yet

- 50 Cent BankruptcyDocument5 pages50 Cent BankruptcyFortuneNo ratings yet

- LC RFI PreambleDocument7 pagesLC RFI PreambleFortuneNo ratings yet

- SEC Order On KKRDocument12 pagesSEC Order On KKRFortuneNo ratings yet

- EEOC v. UPS 071515Document16 pagesEEOC v. UPS 071515Fortune100% (1)

- Yair V MattesDocument19 pagesYair V MattesFortuneNo ratings yet

- Basic Human NeedsDocument4 pagesBasic Human NeedsDyanaLidyahariWinarkoNo ratings yet

- Levels of Organization Answers PDFDocument3 pagesLevels of Organization Answers PDFKevin Ear Villanueva100% (4)

- Post Stroke DepressionDocument15 pagesPost Stroke DepressionJosefina de la IglesiaNo ratings yet

- SenateDocument261 pagesSenateTinsae Mulatu86% (7)

- Nursing Research Group Assignment UoDDocument6 pagesNursing Research Group Assignment UoDShadrech MgeyekhwaNo ratings yet

- Herbal Remedies For Treatment of HypertensionDocument22 pagesHerbal Remedies For Treatment of HypertensionIan DaleNo ratings yet

- Diagnostic Cytopathology: Dr. Sanjiv Kumar Asstt. Professor, Deptt. of Pathology, BVC, PatnaDocument51 pagesDiagnostic Cytopathology: Dr. Sanjiv Kumar Asstt. Professor, Deptt. of Pathology, BVC, PatnaMemeowwNo ratings yet

- Addisons DiseaseDocument1 pageAddisons DiseaseAndreia Palade100% (1)

- Checklist of Documentary Requirements Maternity Benefit Reimbursement ApplicationDocument3 pagesChecklist of Documentary Requirements Maternity Benefit Reimbursement Applicationrhianne_lhen5824No ratings yet

- Clean Premises & Equipment PDFDocument11 pagesClean Premises & Equipment PDFGiabell100% (2)

- Myanmar OH Profile OverviewDocument4 pagesMyanmar OH Profile OverviewAungNo ratings yet

- IB Chemistry SL Revision Option DDocument6 pagesIB Chemistry SL Revision Option DMinh MinhNo ratings yet

- Wikipedia - Acanthosis Nigricans (CHECKED)Document6 pagesWikipedia - Acanthosis Nigricans (CHECKED)pixoguiasNo ratings yet

- Gait Abnormalities and Pediatric Orthopedic ConditionsDocument10 pagesGait Abnormalities and Pediatric Orthopedic ConditionsRajan PatelNo ratings yet

- Diabetes Treatment Report ProposalDocument4 pagesDiabetes Treatment Report ProposalrollyNo ratings yet

- ReferDocument189 pagesReferrameshNo ratings yet

- PHARMACEUTICAL INORGANIC CHEMISTRY: Radiopharmaceuticals: December 2017Document7 pagesPHARMACEUTICAL INORGANIC CHEMISTRY: Radiopharmaceuticals: December 2017pankaj dagurNo ratings yet

- Getting The Most Out of The Fit Note GP GuidanceDocument28 pagesGetting The Most Out of The Fit Note GP GuidanceLaurensia Erlina NataliaNo ratings yet

- CV Muhammad Faris Ihsan 13 April 2021Document3 pagesCV Muhammad Faris Ihsan 13 April 2021Muhammad Faris IhsanNo ratings yet

- Mission: DirectorateDocument7 pagesMission: DirectorateSRP GamingNo ratings yet

- Top 10 Tips Flyer 8.5x11-English 10-18Document1 pageTop 10 Tips Flyer 8.5x11-English 10-18Maren JensenNo ratings yet

- Material Safety Data Sheet Dibutyl PhthalateDocument4 pagesMaterial Safety Data Sheet Dibutyl PhthalateKameliza Saranghe Choi-siwon SujuelfNo ratings yet

- Literature ReviewDocument5 pagesLiterature Reviewapi-582477812No ratings yet

- National Transportation Strategy: Kingdom of Saudi Arabia Ministry of TransportDocument100 pagesNational Transportation Strategy: Kingdom of Saudi Arabia Ministry of Transportvprajan82No ratings yet

- OSCARES V MAGSAYSAY MARITIME DEC 2, 2020 GR No 245858Document10 pagesOSCARES V MAGSAYSAY MARITIME DEC 2, 2020 GR No 245858John Leonard BernalNo ratings yet

- Podartis Diabetic Foot WebinarDocument3 pagesPodartis Diabetic Foot WebinarmaklluxNo ratings yet

- Volume 1. No.1 Tahun 2019, e-ISSN:: ST STDocument10 pagesVolume 1. No.1 Tahun 2019, e-ISSN:: ST STDicky CaritoNo ratings yet

- Emergency Action Code 2013Document200 pagesEmergency Action Code 2013MiguelNo ratings yet

- Urban HydrologyDocument39 pagesUrban Hydrologyca rodriguez100% (1)