Professional Documents

Culture Documents

Chapter 11

Uploaded by

Kamran AhmedCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Chapter 11

Uploaded by

Kamran AhmedCopyright:

Available Formats

Chapter 11

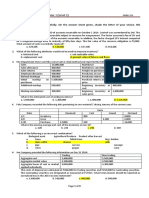

Stockholders' Equity: Paid-in Capital

Results Reporter

Out of 7 questions, you answered 5 correctly, for a final grade of 71%.

5 correct (71%)

2 incorrect (29%)

0 unanswered (0%)

Please answer all questions

Your Results:

The correct answer for each question is indicated by a

CORRECT

Which of the following is true regarding corporations?

A)The president and various vice presidents are elected by the

stockholders.

B) A proxy is a temporary president hired by the board of directors.

C) Corporate charters are issued by the federal government.

D)A corporation is a separate legal entity that may sue and be sued as if

it were a person.

Feedback: Correct.

INCORREC

T

John Hill owns 51% of the capital stock of Hill Corporation. Which of the following

actions would not be permissible for John Hill to take?

A)To cause those persons he chooses to become directors of the

corporation.

B)To serve personally both as a director and as president of the

corporation.

C)To arrange for members of his immediate family to become directors

and/or officers of the corporation.

D)To withdraw from the corporation such amounts of the paid-in capital

and retained earnings as he decides to be appropriate.

Feedback: Incorrect, d is the correct answer.

CORRECT

In the closing of the accounts at the end of the period, which of the following is

closed directly into the Retained Earnings account?

A)

B)

The Income Summary account.

The Capital Stock account.

C)

Revenue and expense accounts.

D)

The Dividends Payable account.

Feedback: Correct.

CORRECT

Which of the following best describes the relationship between revenue and

retained earnings?

A)Revenue increases net income, which in turn increases retained

earnings.

B)Revenue represents a cash receipt; retained earnings is an element of

stockholders' equity.

C)Revenue represents the price of goods sold or services rendered;

retained earnings represents cash available for paying dividends.

D) Retained earnings is equal to revenue minus expenses.

Feedback: Correct.

INCORREC

T

The accountant for Bernardo Corporation failed to record a dividend declared in

December of 1999. On Bernardo Corporation's balance sheet at December 31,

1999:

A) Assets and stockholders' equity are both overstated.

B) Liabilities are understated and retained earnings are overstated.

C) Cash and liabilities are both overstated.

D)The balance sheet is accurate, since the dividends have not been paid

yet.

Feedback: Incorrect, b is the correct answer.

CORRECT

If a corporation issues some of its common stock in exchange for assets other than

cash, the transaction should be recorded at the:

A) Current market value of the assets received.

B)

Stated value of the shares issued.

C)

Par value of the shares issued.

D)

Book value of the shares issued.

Feedback: Correct.

CORRECT

Quinta Corporation is authorized to issue 1,000,000 shares of $5 par value capital

stock. The corporation issued half the stock for cash at $20 per share, earned

$200,000 during the first three months of operation, and declared a cash dividend

of $50,000. The total paid-in capital of Quinta Corporation after three months of

operation is:

A)

$2,500,000.

B)

$5,000,000.

C)

D)

Feedback: Correct.

$10,000,000.

$10,150,000

You might also like

- Chapter 09, Modern Advanced Accounting-Review Q & ExrDocument28 pagesChapter 09, Modern Advanced Accounting-Review Q & Exrrlg481467% (3)

- CH 04Document7 pagesCH 04Tien Thanh Dang50% (2)

- CHAPTER 11 Without AnswerDocument3 pagesCHAPTER 11 Without Answerlenaka0% (1)

- Chapter 13 - Build A Model SpreadsheetDocument6 pagesChapter 13 - Build A Model Spreadsheetdunno2952No ratings yet

- Advanced Accounting Test Bank Chapter 07 Susan Hamlen PDFDocument60 pagesAdvanced Accounting Test Bank Chapter 07 Susan Hamlen PDFsamuel debebeNo ratings yet

- Chapter 15-Financial Planning: Multiple ChoiceDocument22 pagesChapter 15-Financial Planning: Multiple ChoiceadssdasdsadNo ratings yet

- Analysis of DELLDocument12 pagesAnalysis of DELLMuhammad Afzal100% (1)

- Dividends Exercises Chapter 9 For AssignmentDocument3 pagesDividends Exercises Chapter 9 For AssignmentYami Sukehiro100% (1)

- Cbmec-2: (Group 3-9:00-10:30 TTH)Document73 pagesCbmec-2: (Group 3-9:00-10:30 TTH)Kin Salamanes100% (1)

- FAR-05 Book Value Per ShareDocument2 pagesFAR-05 Book Value Per ShareKim Cristian MaañoNo ratings yet

- 06Document61 pages06Ahmed El Khateeb100% (1)

- The Value of Common Stocks Multiple Choice QuestionsDocument5 pagesThe Value of Common Stocks Multiple Choice QuestionsNgọc LêNo ratings yet

- Introduction To Business Combinations: Summary of Items by TopicDocument30 pagesIntroduction To Business Combinations: Summary of Items by TopicKyla Ramos DiamsayNo ratings yet

- Toa Quizzer 1: Multiple ChoiceDocument18 pagesToa Quizzer 1: Multiple ChoiceRukia KuchikiNo ratings yet

- All in CupDocument11 pagesAll in CupRosemarie Qui0% (1)

- Intermediate Accounting I - Introduction PDFDocument6 pagesIntermediate Accounting I - Introduction PDFJoovs JoovhoNo ratings yet

- Lesson 4 Expenditure Cycle PDFDocument19 pagesLesson 4 Expenditure Cycle PDFJoshua JunsayNo ratings yet

- Chapter 13 Test Bank Romney AisDocument35 pagesChapter 13 Test Bank Romney AisEarl QuimsonNo ratings yet

- Stock ValuationDocument79 pagesStock ValuationRodNo ratings yet

- EXERCISES On EARNINGS PER SHAREDocument4 pagesEXERCISES On EARNINGS PER SHAREChristine AltamarinoNo ratings yet

- Vol 2. SampleDocument23 pagesVol 2. SamplevishnuvermaNo ratings yet

- Case 2Document4 pagesCase 2Chris WongNo ratings yet

- MA Cabrera 2010 - SolManDocument4 pagesMA Cabrera 2010 - SolManCarla Francisco Domingo40% (5)

- Decentralized and Segment ReportingDocument44 pagesDecentralized and Segment ReportingShaina Santiago AlejoNo ratings yet

- Prequalifying Exam Level 2 3 Set B FSUU AccountingDocument9 pagesPrequalifying Exam Level 2 3 Set B FSUU AccountingRobert CastilloNo ratings yet

- Kunci Jawaban Intermediate AccountingDocument41 pagesKunci Jawaban Intermediate AccountingbelindaNo ratings yet

- Problem No. 1: QuestionsDocument3 pagesProblem No. 1: QuestionsPamela Ledesma SusonNo ratings yet

- Re & BVDocument3 pagesRe & BV-100% (1)

- 2 Presentation of Financial Statements - Lecture Notes PDFDocument14 pages2 Presentation of Financial Statements - Lecture Notes PDFCatherine RiveraNo ratings yet

- Module 6 - Operating SegmentsDocument3 pagesModule 6 - Operating SegmentsChristine Joyce BascoNo ratings yet

- Management Services101Document24 pagesManagement Services101Jan ryanNo ratings yet

- Fin33 3rdexamDocument3 pagesFin33 3rdexamRonieOlarteNo ratings yet

- N. Cruz-Course Material For Strategic Cost ManagementDocument134 pagesN. Cruz-Course Material For Strategic Cost ManagementEmmanuel VillafuerteNo ratings yet

- HK (Ifric) Int 12Document41 pagesHK (Ifric) Int 12Wahid Ben MohamedNo ratings yet

- MAS 2 Prelim Exam To PrintDocument3 pagesMAS 2 Prelim Exam To PrintJuly LumantasNo ratings yet

- Developing Operational Review Programme For Managerial and AuditDocument26 pagesDeveloping Operational Review Programme For Managerial and AuditruudzzNo ratings yet

- 8 Responsibility AccountingDocument8 pages8 Responsibility AccountingXyril MañagoNo ratings yet

- Relevant Costing Simulated Exam Ans KeyDocument5 pagesRelevant Costing Simulated Exam Ans KeySarah BalisacanNo ratings yet

- DocxDocument40 pagesDocxJamaica DavidNo ratings yet

- 4A8 FormationDocument5 pages4A8 FormationCarl Dhaniel Garcia SalenNo ratings yet

- Acct 3Document25 pagesAcct 3Diego Salazar100% (1)

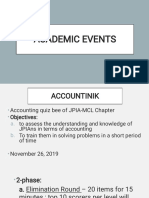

- JPIA-MCL Academic-EventsDocument17 pagesJPIA-MCL Academic-EventsJana BercasioNo ratings yet

- MAS 7 Exercises For UploadDocument9 pagesMAS 7 Exercises For UploadChristine Joy Duterte RemorozaNo ratings yet

- ACTIVITY 5 Interim Reporting PDFDocument2 pagesACTIVITY 5 Interim Reporting PDFEstiloNo ratings yet

- CHAPTER 9 Without AnswerDocument6 pagesCHAPTER 9 Without AnswerlenakaNo ratings yet

- CFF 3 Im 04Document33 pagesCFF 3 Im 04AL SeneedaNo ratings yet

- ch15Document45 pagesch15ChrohimeNo ratings yet

- MULTIPLE CHOICE - Capital BudgetingDocument9 pagesMULTIPLE CHOICE - Capital BudgetingMarcuz AizenNo ratings yet

- Chapter 11 AISDocument4 pagesChapter 11 AISMyka ManalotoNo ratings yet

- 1617 1stS MX NBergonia RevDocument11 pages1617 1stS MX NBergonia RevJames Louis BarcenasNo ratings yet

- Capital BudgetingDocument44 pagesCapital Budgetingrisbd appliancesNo ratings yet

- FIN 2 Financial Analysis and Reporting: Lyceum-Northwestern UniversityDocument7 pagesFIN 2 Financial Analysis and Reporting: Lyceum-Northwestern UniversityAmie Jane MirandaNo ratings yet

- Mas-07: Responsibility Accounting & Transfer PricingDocument7 pagesMas-07: Responsibility Accounting & Transfer PricingClint AbenojaNo ratings yet

- Fund, Which Is Separate From The Reporting Entity For The Purpose ofDocument7 pagesFund, Which Is Separate From The Reporting Entity For The Purpose ofNaddieNo ratings yet

- Chapter 1Document7 pagesChapter 1Hoàng Thanh NguyễnNo ratings yet

- Financial ManagementDocument13 pagesFinancial ManagementEliNo ratings yet

- ToaDocument5 pagesToaGelyn CruzNo ratings yet

- Financial Accounting and Reporting PartDocument6 pagesFinancial Accounting and Reporting PartLalaine De JesusNo ratings yet

- Interim Financial ReportingDocument3 pagesInterim Financial ReportingHalina ValdezNo ratings yet

- Auditing Theory Finals PDF FreeDocument11 pagesAuditing Theory Finals PDF FreeMichael Brian TorresNo ratings yet

- #3 Deferred Taxes PDFDocument3 pages#3 Deferred Taxes PDFjanus lopezNo ratings yet

- E. All of The Above. A. Total Revenue Equals Total CostDocument22 pagesE. All of The Above. A. Total Revenue Equals Total CostNicole KimNo ratings yet

- Intermediate Accounting 3 Basic and Diluted Earnings Per Share: Quiz 11Document1 pageIntermediate Accounting 3 Basic and Diluted Earnings Per Share: Quiz 11Airon BendañaNo ratings yet

- Incometaxation1 PDFDocument543 pagesIncometaxation1 PDFmae annNo ratings yet

- Chap013 PDFDocument725 pagesChap013 PDFALYSSA MAE ABAAGNo ratings yet

- ACCT 202 PQ4 SPR 18Document9 pagesACCT 202 PQ4 SPR 18catacutantriciamae13No ratings yet

- Cambridge International Examinations Cambridge International Advanced Subsidiary and Advanced LevelDocument12 pagesCambridge International Examinations Cambridge International Advanced Subsidiary and Advanced LevelewgwrgNo ratings yet

- Fair Value Fair ValueDocument4 pagesFair Value Fair ValueJay Ann DomeNo ratings yet

- Financial Analysis of Divi's LaboratoriesDocument15 pagesFinancial Analysis of Divi's LaboratoriesShivani DesaiNo ratings yet

- DDMPR Q1 2021 Quarterly ReportDocument36 pagesDDMPR Q1 2021 Quarterly ReportChristian John RojoNo ratings yet

- Acounting and Financial ManagementDocument144 pagesAcounting and Financial ManagementyoursonesNo ratings yet

- Aecon - Project IDocument39 pagesAecon - Project IRaji MohanNo ratings yet

- Latih Soal Kieso E5-6 E5-12Document4 pagesLatih Soal Kieso E5-6 E5-12Agung Setya NugrahaNo ratings yet

- RTDocument58 pagesRTKyaw Htin WinNo ratings yet

- Dublin LTDDocument4 pagesDublin LTDXianFa WongNo ratings yet

- Klabin S.A. and Subsidiaries: (Convenience Translation Into English From The Original Previously Issued in Portuguese)Document66 pagesKlabin S.A. and Subsidiaries: (Convenience Translation Into English From The Original Previously Issued in Portuguese)Klabin_RINo ratings yet

- Z 15030000120164005 CH 06Document48 pagesZ 15030000120164005 CH 06Hanna GabriellaNo ratings yet

- CH-2 Basic Concept of Macroeconomics PDFDocument16 pagesCH-2 Basic Concept of Macroeconomics PDF1630 Gursimran Saluja ANo ratings yet

- Tarc Acc t13Document4 pagesTarc Acc t13Shirley VunNo ratings yet

- Sol. Man. - Chapter 15 - Accounting For CorporationsDocument15 pagesSol. Man. - Chapter 15 - Accounting For Corporationspehik100% (1)

- Exercises of Accounting N PDocument34 pagesExercises of Accounting N PVan caothaiNo ratings yet

- Problems Week 1 2Document6 pagesProblems Week 1 2Maria Jessa HernaezNo ratings yet

- Ch09 BudgetingDocument118 pagesCh09 Budgetingemanmaryum7No ratings yet

- ACTExamsDocument36 pagesACTExamsKaguraNo ratings yet

- Ifma Fmpv3-0 F-B Ch2Document87 pagesIfma Fmpv3-0 F-B Ch2Mohamed IbrahimNo ratings yet

- 1st Exam 1s2021Document6 pages1st Exam 1s2021Benjamin Jr VidalNo ratings yet

- Planning For Growth - Minicase Auto Saved)Document5 pagesPlanning For Growth - Minicase Auto Saved)Ahmed Salim100% (2)

- Healthy Life Supplements: San Isidro CollegeDocument8 pagesHealthy Life Supplements: San Isidro CollegeHarold Beltran DramayoNo ratings yet

- Midterm Examination - ABCDocument5 pagesMidterm Examination - ABCMaria DyNo ratings yet