Professional Documents

Culture Documents

Chap-9, The Cost of Capital, 2015 PDF

Uploaded by

Md. Monirul islamOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Chap-9, The Cost of Capital, 2015 PDF

Uploaded by

Md. Monirul islamCopyright:

Available Formats

What Sources of Long-term Capital

Do Firms Use?

CHAPTER 9

The Cost of Capital

Long-Term

Capital

Long-Term

Debt

Sources of capital

Component costs

WACC

Adjusting for flotation costs

Adjusting for risk

Preferred

Stock

Common

Stock

Retained

Earnings

New Common

Stock

9-2

What Is Cost of Capital?

Capital Components

From investors point of view:

The minimum return a firm needs to earn to satisfy

all of its investors

The weighted average of required returns of the

securities used to finance the firm

From firms point of view:

The various types of debt, preferred stock,

and common equity shown on the B/S

The sources of funding that come from

investors

A/P, accruals, and deferred taxes are not the

The cost of capital for the firm as a whole

The cost of capital depends primarily on the use of

sources of funding that come from investors

They are not the components of the cost of capital

the funds, not the source

9-3

Before-tax vs. After-tax Capital

Costs

Calculating the WACC

WACC = wdrd(1-T) + wpsrp + wcsrs

9-4

The ws refer to the firms capital structure

weights.

rd= cost of debt

rp= cost of preferred stock

rs= cost of common stock

T= tax rate

Tax effects associated with financing can be

incorporated either in capital budgeting CFs

or in cost of capital

Most firms incorporate tax effects in the cost

of capital. Therefore, focus on A-T costs

Only cost of debt is affected

Why tax-adjust, i.e. why rd(1-T)?

9-5

9-6

Historical (Embedded) Costs vs.

New (Marginal) Costs

A Three-Step Procedure for

Estimating Firm WACC

1. Define the firms capital structure by

The cost of capital is used in raising

and investing new capital

determining the weight of each source of

capital.

2. Estimate the opportunity cost of each source

So, we should focus on marginal costs

of financing.

We will use the current market value of each source of

capital based on its current, not historical, costs.

3. Calculate a weighted average of the costs of

each source of financing.

9-7

A Template for Calculating WACC

The following template demonstrates how to carry out

the calculation of the WACC from the previous Equation:

(1)

Source of

Capital

(2)

(3)

Determining the Firms Capital

Structure Weights

(4)

The weights are based on debt (excluding A/P

and accruals), preferred stock, and common

equity

Product of (2)

and (3)

Debt

wd

rd (1-T)

wdrd (1-T)

Preferred Stock

wps

rp

wpsrp

Common Stock

wcs

rs

wcsrs

Sum=

Market Value

A-T Cost of

Weights

Financing

9-8

100%

Ideally, the weights should be based on observed

market values

Sometimes all market values may be readily available

We generally use book values for debt and market

values for equity

9-9

9-10

Example: Calculating WACC

Example: Calculating WACC

WACC for Templeton Extended Care Facilities, Inc.

In the spring of 2012, Templeton was considering the

acquisition of a chain of extended care facilities and wanted

to estimate its own WACC as a guide to the cost of capital

for the acquisition. Templetons capital structure consists of

the following:

Templeton contacted the firms investment banker to

get estimates of the firms current cost of financing and

was told that if the firm were to borrow the same

amount of money today, it would have to pay lenders

8%; however, given the firms 25% tax rate, the aftertax cost of borrowing would only be 6% = 8%(1-.25).

Preferred stockholders currently demand a 10% rate of

return, and common stockholders demand 15%.

Templetons CFO knew that the WACC would be

somewhere between 6% and 15% since the firms

capital structure is a blend of the three sources of

capital whose costs are bounded by this range.

9-11

9-12

Example: Calculating WACC

STEP 2: Opportunity cost of each source is given

STEP 3: Solve

(1)

(2)

Source of

Capital

9-13

(4)

=

Product of (2)

and (3)

Debt

0.250

0.060

0.01500

Preferred Stock

0.125

0.100

0.01250

Common Stock

0.625

0.150

Sum=

100%

0.09375

0.12125

STEP 4: Analyze

Templetons CFO estimated that the firm's WACC is 12.125%, which lies

within the range between the highest cost of source of capital (common

stock at 15%) and the lowest (debt at 6%).

9-14

The Cost of Debt (rd)

Example: Check Yourself

After completing her estimate of Templetons WACC, the

CFO decided to explore the possibility of adding more lowcost debt to the capital structure. With the help of the firms

investment banker, the CFO learned that Templeton could

probably push its use of debt to 37.5% of the firms capital

structure by issuing more debt and retiring (purchasing) the

firms preferred shares. This could be done without

increasing the firms costs of borrowing or the required rate

of return demanded by the firms common stockholders.

What is your estimate of the WACC for Templeton under this

new capital structure proposal?

(3)

Market Value

A-T Cost of

Weights

Financing

Method 1: Ask an investment banker what the

coupon rate would be on new debt

Method 2: Find the bond rating for the firm

and use the yield on other bonds with a

similar rating

Method 3: Find the yield on the firms debt, if

it has any

WACC = wdrd(1-T) + wcsrs

=0.375 x 0.06 + 0.625 x 0.15=11.625%.

9-15

Example-1: Before Tax Cost of

Debt

Components of Cost of Debt

The pretax rd is the financing cost associated

with new funds through LT borrowing

A 15-year, 12% semiannual bond sells for $1,153.72.

The before-tax cost of debt (rd) by applying the bond

pricing formula will be as follows:

The rd is the rate of return the firms lenders

demand when they loan money

9-16

The pretax rd =YTM

$1,153.72 =

Net proceeds are the funds received from the sale of

a debt security.

$60

$1,000

{1 (1 + rd / 2) 215 } +

rd / 2

(1 + rd / 2) 215

rd = 10%

Flotation costs are the total costs of issuing and

selling a security which include underwriting costs

and administrative costs

9-17

9-18

Example-1: Cost of Debt with

Flotation Cost

Example-2: The Cost of Debt

Humble Manufacturing is interested in measuring its overall

cost of capital. The firm is in the 40% tax bracket. The firm

can raise an unlimited amount of debt by selling $1,000par-value, 10% coupon interest rate, 10-year bonds on

which annual interest payments will be made. To sell the

issue, an average discount of $30 per bond must be given.

The firm must also pay flotation costs of $20 per bond.

What is the after-tax cost of debt?

(VB F) =

CI

M

{1 (1 + rd ) n } +

rd

(1 + rd )n

($1,000 $50) =

$100

$1,000

{1 (1 + rd ) 10 } +

rd

(1 + rd )10

= 10.83%

What will be the YTM on a debt that has par value of

$1,000, a coupon interest rate of 5%, time to

maturity of 10 years and is currently trading at $900?

What will be the cost of debt if the tax rate is 30%?

Solution:

(VB F) =

CI

M

{1 (1 + rd ) n } +

rd

(1 + rd )n

$50

$1000

{1 (1 + rd ) 10 } +

= 0.0638

rd

(1 + rd )10

Thus, A - T cost of debt (YTM) = rd (1 - T)

Net proceeds: $1,000$30-$20= $950

$900 =

A-T cost of debt (YTM)

will be: rd = rd (1-T)

=10.83% (1-0.40) =

6.5%

= 0.0638 (1 - 0.30) = 4.47%

*F= Flotation costs are very small, so ignore them

9-19

9-20

The Cost of Preferred Stock (rp)

Example-3: The Cost of Debt

Basket Wonders has a 15-year, 12% semiannual

coupon bond which sells for $1,153.72 with 0

flotation cost. What is the cost of debt (r d) given

the tax rate 40%?

The rp is the rate of return on investment of

the preferred shareholders

Solution:

$120 / 2

$1000

$1153.7 =

{1 (1 + rd / 2) 30 } +

rd / 2

(1 + rd / 2)30

Annualized rd = 5% 2 = 10%

The rp can be inferred from its trading price and

the fixed dividend:

rP = DPs / P0

Thus, A - T cost of debt (YTM) = rd (1 - T)

= 0.10 (1 - 0.40) = 6%

*Flotation costs are small, so ignore them

The cost is not adjusted for taxes since

dividends are paid to preferred stockholders out

of A-T income.

9-21

9-22

Example-2: The Cost of Preferred

Stock

Example-1: The Cost of Preferred

Stock

Assume that Basket Wonders has preferred

stock outstanding with par value of $100,

dividend per share of $10, and a current market

value of $111.10 per share.

rp = $10 / $111.10= 9%

9-23

Preferred stock: The

firm can sell 11% (annual

dividend) preferred stock

at its $100-per-share par

value. The cost of issuing

and selling the preferred

stock is expected to be $4

per share. An unlimited

amount of preferred stock

can be sold under these

terms.

rps =

Dps

Nps

Dps = 0.11 $100 = $11

Nps = $100 $4 (flo. cos t)

= $96

$11

rps =

= 11.5%

$96

9-24

Example-3: The Cost of Preferred

Stock

Example-4: The Cost of Preferred

Stock

Preferred stock:

The cost of preferred

stock if PPs =

$113.10; dividend =

10% paid quarterly,

Par = $100; flotation

cost (F) = $2, will

be:

Preferred stock:

The Cost of preferred

stock if PPs =

$116.95; dividend =

10% paid quarterly,

Par = $100; flotation

cost (F) = $5%, will

be

Dps

Pps - FlotationCost)

$10

$113.10 - $2

= 0.090 = 9.00%

=

Dps

Pps (1 - F)

0.1($100)

$116.95(1 - 0.05)

$10

=

$111.10

= 0.090 = 9.00%

=

9-25

Is Preferred Stock More or Less Risky

to Investors Than Debt?

More risky!

9-26

Why Is the Yield on Preferred Stock

Lower Than Debt?

A firm is not bound to pay preferred dividend

However, firms try to pay preferred dividend,

otherwise,

Firms cannot pay common dividend

It is difficult to raise additional funds

Preferred stockholders may gain control of firm

Corporations own most preferred stock,

because 70% of preferred dividends are

nontaxable to corporations

For the issuing firm, preferred stock often has a

lower B-T yield than the B-T yield on debt

The A-T yield to investors and A-T cost to the

issuer are higher on preferred than on debt

Consistent with the higher risk and the A-T yield

9-27

Illustrating the differences between

A-T yield on debt and preferred stock

Recall, that the firms tax rate is 40%, and its BT costs of debt and preferred stock are r d =

10% and rps = 9%, respectively.

A-T rps = rps {rps (1 0.3)(T)}

= 9% - {9% (0.7)(0.4)} = 6.48%

A-T rd = 10% - 10% (0.4)

= 6.00%

A-T Risk Premium on Preferred = 0.48%

9-28

The Cost of Common Stock (rs)

The rs is the rate of return investors expect

to receive from investing in firms stock

This return comes in the form DY and CGY

Harder to estimate since stockholders do not

have a contractually defined return

Three approaches to estimating the rs

9-29

Dividend growth model

CAPM

Before-tax cost of debt plus risk premium

9-30

Three Ways to Determine the Cost

of Common Stock, rs

DGM:

Or

CAPM:

Example of DGM: Cost of Common

Stock

Humble Manufacturing is interested in measuring its

overall cost of capital. The firm is in the 40% tax bracket.

rs = D1 / P0 + g

Current investigation has gathered the following data:

rs = D1 / Ns+ g

Common Stock: The firms common stock is currently

selling for $80 per share. The firm expects to pay cash

dividends of $6 per share next year. The firms dividends

have been growing at an annual rate of 6%, and this rate

is expected to continue in the future. The stock will have

to be underpriced by $4 per share, and flotation costs are

expected to amount to $4 per share. The firm can sell an

unlimited amount of new common stock under these

terms.

rs = rRF + (rM rRF)

B-T Cost of Debt Plus Risk-Premium*:

rs = rd + RP

Ns =Net proceeds from the sale of common stock

*A RP is expected return for common stock over debt, not the same

as RP in CAPM

9-31

Example of DGM: Cost of Common

Stock

rs =

Example of DGM: Cost of Common

Stock

If D0 = $4.19, P0 = $50, and g = 5%, whats

the cost of common equity based upon the DCF

approach?

When g is constant

rs =

9-32

D1

+g

Ns

D1 = D0 (1+g)

D1 = $4.19 (1 + .05)= $4.3995

rs = D1 / P0 + g

= $4.3995 / $50 + 0.05 = 13.8%

$6

+ 6%

$80 - $4

= 8.3% + 6% = 14.3%

9-33

Example of CAPM: Cost of Common

Stock

9-34

Example of B-T Cost of Debt Plus RiskPremium: Cost of Common Stock

If rd = 10% and RP = 4%, what is rs using

B-T Cost of Debt Plus Risk-Premium?

If the rRF = 7%, RPM = 6%, and the firms

beta is 1.2, whats the cost of common

equity based upon the CAPM?

Solution: rs = kd + RP

rs = 10.0% + 4.0% = 14.0%

rs = rRF + (rM rRF)

= 7.0% + (6.0%)1.2 = 14.2%

9-35

This RP is not the same as the RPM in CAPM;

rather it is RP in expected return for common

stock over debt

This method produces a ballpark estimate of rs,

and can serve as a useful check.

9-36

Why Is There a Cost for Retained

Earnings?

What Is a Reasonable Final

Estimate of rs?

Method

CAPM

DGM

B-T rd + RP

Average

Estimate

14.2%

13.8%

14.0%

14.0%

R/Es can be reinvested or paid out as dividends

Investors could buy other securities and earn a

return

If retained, there is an opportunity cost

Generally, the three methods will not agree.

We must decide how to weight we will use an average

of these three.

9-37

Example of Cost of Retained

Earnings

Investors could buy similar stocks and earn rs

Firm could repurchase its own stock and earn rs

Therefore, rs is the cost of R/Es

9-38

Example of Cost of Retained

Earnings

Humble Manufacturing is interested in measuring

its overall cost of capital. The firm is in the 40%

tax bracket. Current investigation has gathered

the following data:

rr = rs =

Retained earnings: The firm expects to have

$225,000 of retained earnings available in the

coming year. Once these retained earnings are

exhausted, the firm will use new common stock

as the form of common stock equity financing.

D1

+g

P0

$6

+ 6%

$80

= 7.5% + 6% = 13.5%

=

9-39

If issuing new common stock incurs a

flotation cost of 15% of the proceeds,

what is re? P0 = $50, g=5%, D0=$4.19

Why is the cost of retained earnings

cheaper than the cost of issuing new

common stock?

9-40

When a company issues new common stock

they also have to pay flotation costs to the

underwriter

re =

D 0 (1 + g)

+g

P0 (1 - F)

Issuing new common stock may send a

negative signal to the capital markets, which

may depress the stock price

$4.19(1.05)

+ 5.0%

$50(1 - 0.15)

$4.3995

+ 5.0%

$42.50

= 15.4%

=

9-41

9-42

Ignoring floatation costs, what is

the firms WACC?

Flotation costs

Flotation costs depend on the risk of the firm

and the type of capital being raised.

WACC

The flotation costs are highest for common

equity. However, since most firms issue equity

infrequently, the per-project cost is fairly small.

= wdrd(1-T) + wpsrp + wcsrs

= 0.3(10%)(0.6) + 0.1(9%) + 0.6(14%)

= 1.8% + 0.9% + 8.4%

= 11.1%

We will frequently ignore flotation costs when

calculating the WACC.

9-43

Should the company use the

composite WACC as the hurdle rate

for each of its projects?

What factors influence a

companys composite WACC?

Market conditions

9-44

The firms capital structure and dividend

policy

The firms investment policy. Firms with

riskier projects generally have a higher

WACC

NO! The composite WACC reflects the risk of

an average project undertaken by the firm.

Therefore, the WACC only represents the

hurdle rate for a typical project with average

risk.

Different projects have different risks. The

projects WACC should be adjusted to reflect

the projects risk.

9-45

What are the three types of

project risk?

Risk and the Cost of Capital

Rate of Return

(% )

Acceptance Region

W ACC

12.0

Rejection Region

10.5

10.0

9.5

8.0

9-46

Risk L

Risk A

Risk H

Stand-alone risk

Corporate risk

Market risk

Risk

9-47

9-48

How is each type of risk used?

Problem Areas in Cost of Capital

Market risk is theoretically best in most

situations

However, creditors, customers, suppliers, and

employees are more affected by corporate risk

Therefore, corporate risk is also relevant

Depreciation-generated funds

Privately owned firms

Measurement problems

Adjusting costs of capital for different risk

Capital structure weights

9-49

How are risk-adjusted costs of capital

determined for specific projects or

divisions?

9-50

Finding a divisional cost of capital:

Using similar stand-alone firms to

estimate a projects cost of capital

Subjective adjustments to the firms

composite WACC.

Comparison firms have the following

characteristics:

Attempt to estimate what the cost of capital

would be if the project/division were a standalone firm. This requires estimating the

projects beta.

Target capital structure consists of 40%

debt and 60% equity.

rd = 12%

rRF = 7%

RPM = 6%

DIV = 1.7

Tax rate = 40%

9-51

Calculating a divisional cost of capital

Divisions required return on equity

= rRF + (rM rRF)

= 7% + (6%)1.7 = 17.2%

Divisions weighted average cost of capital

rs

WACC = wd rd ( 1 T ) + wc rs

= 0.4 (12%)(0.6) + 0.6 (17.2%) =13.2%

Typical projects in this division are acceptable if

their returns exceed 13.2%.

9-53

9-52

Exercise Problem:9-1

David Ortiz Motors has a target capital structure

of 40% debt and 60% equity. The yield to

maturity on the companys outstanding bonds is

9%, and the companys tax rate is 40%. Ortizs

CFO has calculated the companys WACC as

9.96%. What is the companys cost of equity

capital?

Solution:

0.0996 = 0.6(requity ) + 0.4(1 - 0.4)(0.09)

requity = 13%

9-54

Exercise Problem:9-2

Exercise Problem:9-7

A companys 6% coupon rate, semiannual

payment, $1,000 par value bond which matures

in 30 years sells at a price of $515.16. The

companys federal-plus-state tax rate is 40%.

What is the firms component cost of debt for

purposes of calculating the WACC?

Solution:

Tunney Industries can issue perpetual preferred

stock at a price of $50 a share. The issue is

expected to pay a constant annual dividend of

$3.80 a share. The flotation cost on the issue is

estimated to be 5%. What is the companys cost

of preferred stock, rpref

Solution:

rPr ef

515.16 =

3.8

=

= 8%

50(1 - 0.05)

30

[1

i/2

(1 + i / 2)

60

1,000

(1 + i / 2)60

i = 12%

Cost

9-55

of

debt = 12%(1

0.4) = 7.2%

9-56

10

You might also like

- Calculate WACC to Evaluate New ProjectsDocument52 pagesCalculate WACC to Evaluate New ProjectsksachchuNo ratings yet

- CPA Review Notes 2019 - BEC (Business Environment Concepts)From EverandCPA Review Notes 2019 - BEC (Business Environment Concepts)Rating: 4 out of 5 stars4/5 (9)

- WACCDocument30 pagesWACCIvan ChiuNo ratings yet

- Fin 221 Nov 06 Discussion Chapter 10 Cost CapitalDocument18 pagesFin 221 Nov 06 Discussion Chapter 10 Cost CapitalPranav Pratap SinghNo ratings yet

- CH.5 The Cost of CapitalDocument49 pagesCH.5 The Cost of CapitalMark KaiserNo ratings yet

- Chapter 9 Cost of Capital AnalysisDocument32 pagesChapter 9 Cost of Capital AnalysisZahra SarwarNo ratings yet

- Chapter 10Document28 pagesChapter 10Hery PrambudiNo ratings yet

- Chapter Two: Cost of Capital & Capital Structure TheoriesDocument17 pagesChapter Two: Cost of Capital & Capital Structure TheoriesBaharu AbebeNo ratings yet

- Chapter 4 Cost of CapitalDocument70 pagesChapter 4 Cost of CapitalYến NhiNo ratings yet

- The Cost of Capital: Sources of Capital Component Costs Wacc Adjusting For Flotation Costs Adjusting For RiskDocument41 pagesThe Cost of Capital: Sources of Capital Component Costs Wacc Adjusting For Flotation Costs Adjusting For RiskSheikh OsamaNo ratings yet

- Cost of Capital PPT at Bec Doms On FinanceDocument44 pagesCost of Capital PPT at Bec Doms On FinanceBabasab Patil (Karrisatte)No ratings yet

- 7 - Cost of CapitalDocument20 pages7 - Cost of CapitalYeano AndhikaNo ratings yet

- The Cost of CapitalDocument45 pagesThe Cost of CapitalBabasab Patil (Karrisatte)No ratings yet

- The Cost of Capital: Sources of Capital Component Costs Wacc Adjusting For Flotation Costs Adjusting For RiskDocument28 pagesThe Cost of Capital: Sources of Capital Component Costs Wacc Adjusting For Flotation Costs Adjusting For RiskKharisma NNo ratings yet

- The Cost of Capital: Sources of Capital Component Costs Wacc Adjusting For Flotation Costs Adjusting For RiskDocument37 pagesThe Cost of Capital: Sources of Capital Component Costs Wacc Adjusting For Flotation Costs Adjusting For RiskMohammed MiftahNo ratings yet

- Topic 5 (2012-13A) MPDocument32 pagesTopic 5 (2012-13A) MPJessica Adharana KurniaNo ratings yet

- CHAPTER 9 The Cost of CapitalDocument37 pagesCHAPTER 9 The Cost of CapitalAhsanNo ratings yet

- Bu8201 Tutorial 7 Presentation - FinalDocument32 pagesBu8201 Tutorial 7 Presentation - FinalArvin LiangdyNo ratings yet

- The Cost of Capital: Sources of Capital Component Costs Wacc Adjusting For Flotation Costs Adjusting For RiskDocument30 pagesThe Cost of Capital: Sources of Capital Component Costs Wacc Adjusting For Flotation Costs Adjusting For RiskSoorajKumarMenghwarNo ratings yet

- Cost of CapitalDocument20 pagesCost of CapitalGagan RajpootNo ratings yet

- 5 - Ga5ech9Document32 pages5 - Ga5ech9Marlyn RichardsNo ratings yet

- FINANCIAL MANAGEMENT MODULE 1 6 Cost of CapitalDocument27 pagesFINANCIAL MANAGEMENT MODULE 1 6 Cost of CapitalMarriel Fate CullanoNo ratings yet

- WACCDocument54 pagesWACCAshfaque ul haqueNo ratings yet

- WACC Summary SlidesDocument29 pagesWACC Summary SlidesclaeNo ratings yet

- Cost of Capital CalculationsDocument9 pagesCost of Capital CalculationsTalha JavedNo ratings yet

- Cost of CapitalDocument56 pagesCost of CapitalAli JumaniNo ratings yet

- Cost of Capital Components Debt Preferred Common Equity WaccDocument44 pagesCost of Capital Components Debt Preferred Common Equity WaccMahmoud Nabil Al HadadNo ratings yet

- WACC and Cost of CapitalDocument6 pagesWACC and Cost of Capitalzx zNo ratings yet

- FM3.2 - Cost of CapitalDocument26 pagesFM3.2 - Cost of CapitalAbdulraqeeb AlareqiNo ratings yet

- Ibf PPT Lecture # 15 (09012024) (Wacc)Document57 pagesIbf PPT Lecture # 15 (09012024) (Wacc)Ala AminNo ratings yet

- CH 11 SolDocument9 pagesCH 11 SolCampbell YuNo ratings yet

- Ch13Document44 pagesCh13Vindy Artissya Ryzkha100% (1)

- Cost of CapitalDocument44 pagesCost of CapitalnewaznahianNo ratings yet

- 2.6. Cost of CapitalDocument34 pages2.6. Cost of Capitalaprilia wahyu perdaniNo ratings yet

- Financial Management - Cost of CapitalDocument23 pagesFinancial Management - Cost of CapitalSoledad Perez50% (2)

- The Cost of Capital: Sources of Capital Component Costs Wacc Adjusting For RiskDocument22 pagesThe Cost of Capital: Sources of Capital Component Costs Wacc Adjusting For RiskKaziRafiNo ratings yet

- FM11 CH 09 Cost of CapitalDocument54 pagesFM11 CH 09 Cost of CapitalMadeOaseNo ratings yet

- HOMEWORK 10Document4 pagesHOMEWORK 10Gia Hân TrầnNo ratings yet

- The Weighted Average Cost of Capital and Company Valuation: Fundamentals of Corporate FinanceDocument30 pagesThe Weighted Average Cost of Capital and Company Valuation: Fundamentals of Corporate FinancedewimachfudNo ratings yet

- Chapter # 06 - Cost of CapitalDocument36 pagesChapter # 06 - Cost of CapitalshakilhmNo ratings yet

- Week 5 Cost of CapitalDocument5 pagesWeek 5 Cost of CapitalhnoamanNo ratings yet

- 1. True2. True 3. TrueDocument15 pages1. True2. True 3. TrueMahmoud Nabil Al HadadNo ratings yet

- The Cost of Capital: Presented By:-Yash GuptaDocument25 pagesThe Cost of Capital: Presented By:-Yash Guptayashgupta29039531No ratings yet

- Cost of Capital Components Debt Preferred Common Equity WaccDocument55 pagesCost of Capital Components Debt Preferred Common Equity Waccfaisal_stylishNo ratings yet

- Cost of CapitalDocument45 pagesCost of CapitalG-KaiserNo ratings yet

- Cost of Capital PDFDocument34 pagesCost of Capital PDFMera SamirNo ratings yet

- Unit 2 Cost of CapitalDocument16 pagesUnit 2 Cost of CapitalFalguni ChaudhariNo ratings yet

- Integrated Case - Cost of CapitalDocument23 pagesIntegrated Case - Cost of Capitalfaris prasetyoNo ratings yet

- Determining the Cost of CapitalDocument39 pagesDetermining the Cost of Capitalndet01No ratings yet

- Lecture 1Document29 pagesLecture 1nourkhaled1218No ratings yet

- Cost of CapitalDocument23 pagesCost of CapitalAsad AliNo ratings yet

- The cost of debt for a firm is equal to the yield to maturity on its outstanding long-term debt, which can be observed in the marketplace.The answer is CDocument36 pagesThe cost of debt for a firm is equal to the yield to maturity on its outstanding long-term debt, which can be observed in the marketplace.The answer is CBarakaNo ratings yet

- Corporate Finance PDFDocument56 pagesCorporate Finance PDFdevNo ratings yet

- Chapter 11 (Financial Management)Document48 pagesChapter 11 (Financial Management)tsy0703No ratings yet

- Calculating WACC and Project NPV with Changing Floatation CostsDocument18 pagesCalculating WACC and Project NPV with Changing Floatation CostsYoga Pratama Rizki FNo ratings yet

- The Cost of Capital: Answers To Seleected End-Of-Chapter QuestionsDocument9 pagesThe Cost of Capital: Answers To Seleected End-Of-Chapter QuestionsZeesun12No ratings yet

- WaccDocument33 pagesWaccAnkitNo ratings yet

- FIMsDocument81 pagesFIMsMd. Monirul islamNo ratings yet

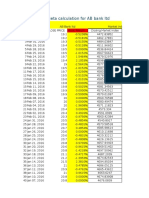

- Ab Bank BetaDocument18 pagesAb Bank BetaMd. Monirul islamNo ratings yet

- Stock Valuation of Square PharmaceuticalsDocument4 pagesStock Valuation of Square PharmaceuticalsMd. Monirul islamNo ratings yet

- International Financial Markets 03Document32 pagesInternational Financial Markets 03Md. Monirul islamNo ratings yet

- Chap-1, An Overview of Financial Management and The Financial Environment' 2015Document9 pagesChap-1, An Overview of Financial Management and The Financial Environment' 2015Md. Monirul islam100% (1)

- Final Project-Money MarketDocument60 pagesFinal Project-Money MarketSneha Dubey50% (4)

- Corporate Strategy - Plan For A Diversified CompanyDocument49 pagesCorporate Strategy - Plan For A Diversified CompanyRavi GuptaNo ratings yet

- Channel Partnership AgreementDocument3 pagesChannel Partnership AgreementNova SarmahNo ratings yet

- Final accounts for year ending 1992Document50 pagesFinal accounts for year ending 1992kalyanikamineniNo ratings yet

- Journal Home GridDocument1 pageJournal Home Grid03217925346No ratings yet

- Break-Even Analysis and CVP Calculations for Multiple CompaniesDocument2 pagesBreak-Even Analysis and CVP Calculations for Multiple CompaniesKayla Shelton0% (1)

- UNDERSTANDING THE BASICS OF ACCOUNTING AND FINANCEDocument99 pagesUNDERSTANDING THE BASICS OF ACCOUNTING AND FINANCEArnel De Los SantosNo ratings yet

- Soft Offer Iron Ore 64.5Document3 pagesSoft Offer Iron Ore 64.5BernhardNo ratings yet

- Account Statement: MR - Shyamal Kumar ChatterjeeDocument2 pagesAccount Statement: MR - Shyamal Kumar ChatterjeeBikram ChatterjeeNo ratings yet

- Ncap Tools Illustrative Examples Fair Value MeasurementDocument8 pagesNcap Tools Illustrative Examples Fair Value MeasurementClea Marie MissionNo ratings yet

- Budgetary Control - L G ElectonicsDocument86 pagesBudgetary Control - L G ElectonicssaiyuvatechNo ratings yet

- 5769 - Toa Test Bank 74Document12 pages5769 - Toa Test Bank 74Rod Lester de GuzmanNo ratings yet

- JALANDHAR DISTRICT PROFILE: DEMOGRAPHICS, INDUSTRY, AGRICULTURE, BANKING OVERVIEWDocument5 pagesJALANDHAR DISTRICT PROFILE: DEMOGRAPHICS, INDUSTRY, AGRICULTURE, BANKING OVERVIEWsai pujitha nayakantiNo ratings yet

- G.o.No 243Document2 pagesG.o.No 243nmsusarla999No ratings yet

- SC-EBRD OriginalDocument6 pagesSC-EBRD OriginalKorporativac KonsaltingićNo ratings yet

- Principles of Banking MCQsDocument34 pagesPrinciples of Banking MCQsUmar100% (2)

- FM-capital Structure AnalysisDocument19 pagesFM-capital Structure AnalysisNikhil ReddyNo ratings yet

- Salary Slip MayDocument1 pageSalary Slip MayselvaNo ratings yet

- Department Restructuring and New LeadershipDocument25 pagesDepartment Restructuring and New Leadershipsathish kumar100% (2)

- The Economist EU 06.24.2023Document76 pagesThe Economist EU 06.24.2023sahilmkkrNo ratings yet

- AngelHub IR One-Pager English (20190726) 1Document1 pageAngelHub IR One-Pager English (20190726) 1wayaNo ratings yet

- Chapter 13-A Regular Allowable Itemized DeductionsDocument13 pagesChapter 13-A Regular Allowable Itemized DeductionsGeriel FajardoNo ratings yet

- Gautam Baid Q&ADocument9 pagesGautam Baid Q&AFahad SiddiqueeNo ratings yet

- Bclte Part 2Document141 pagesBclte Part 2Jennylyn Favila Magdadaro96% (25)

- HDocument21 pagesHFaizal KhanNo ratings yet

- fn3092 Exc 13Document26 pagesfn3092 Exc 13guestuser1993No ratings yet

- Learning The LegaleseDocument30 pagesLearning The LegaleseapachedaltonNo ratings yet

- CHAPTER-I INTRODUCTIONDocument66 pagesCHAPTER-I INTRODUCTIONMohan JohnnyNo ratings yet

- Csc-Roii-Acic and Lddap of Payment For Online TrainingDocument4 pagesCsc-Roii-Acic and Lddap of Payment For Online TrainingJale Ann A. EspañolNo ratings yet

- HKSI LE Paper 11 Pass Paper Question Bank (QB)Document10 pagesHKSI LE Paper 11 Pass Paper Question Bank (QB)Tsz Ngong KoNo ratings yet