Professional Documents

Culture Documents

Solutions To Revision

Uploaded by

KZOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Solutions To Revision

Uploaded by

KZCopyright:

Available Formats

1

BSB110 ACCOUNTING

SOLUTIONS TO REVISION QUESTIONS FOR FINAL EXAM

QUESTION 1

(a) Gatton Gardeners Cash Flow Statement

For the year ended 30 June 2007

Inflow

(Outflow)

Cash flows from operating activities

Receipts from customers

Payments to suppliers & employees

Net cash provided by operations

Cash flows from investing activities

Purchase of equipment

Purchase of land

Net cash used in investing activities

Cash flows from financing activities

Capital contributed

Increase in mortgage

Drawings

Net cash used in financing activities

Net (decrease) in cash held

Cash at beginning of year

Cash at end of year

241000

(221000)

20000

(3000)

(10000)

(13000)

3000

30000

(40200)

(7200)

(200)

5200

5000

(b) --cash is not related to profitprofit of $1600 and cash decreased by $200

--profit is based on accrual accounting measured as revenue earned less expenses incurred

not cash in or cash out

--need to be clear about difference between cash balance and profit

--best way to explain to Gary is via the Cash Flow Statement

--the cash provided by operating activities ie. Related to profit activities is $20,000 ie. the

cash inflows from profit activities is much greater than the accrual profit of $1600.

--need to explain how cash decreasedhe invested in additional assets equipment and land

total of $13,000

--he withdrew $40,200 and this is the major contributor to decline in cash balancethis

amount does not affect profit but does affect cash balance

--he increased the mortgage and did contribute additional capital but only to the extent of total

of $33,000

--so overall the major factor causing the decrease in cash is the drawings he made

BSB110 2014 revision solutions

QUESTION 2

(a)

Kody Anthony

Cash Flow Statement for the year ended 30 June 2006

Cash Flows from Operating Activities:

Receipts from customers

Payments to suppliers and employees

Net Cash provided by Operating Activities

39,300

(35,700)

Cash Flows from Investing Activities:

Payment for land

Payment for plant and equipment

Net Cash used in Investing Activities

(15,000)

(3,300)

Cash Flows from Financing Activities:

Capital contributions

Proceeds from Long-term loan

Drawings

Net Cash provided by Financing Activities

9,000

12,000

(3,600)

3,600

(18,300)

17,400

Net increase in cash held

2,700

Cash held at the beginning of the financial year

Cash held at the end of the financial year

(1,200)

$1,500

(b) See Lecture Notes

QUESTION 3

(a)

Albert Clarence

Cash Flow Statement for the financial year ended 30 June 2005

Cash flows from operating activities

Receipts from customers

41470

Payments to suppliers and employees

(23085)

Net cash provided by operating activities

18385

Cash flows from investing activities

Payments for purchase of office furniture

(13600)

Payments for purchase of delivery vehicles

(26835)

Net cash used in investing activities

(40435)

Cash flows from financing activities

Increase in borrowings

11640

Capital contributed

15000

Drawings

(7535)

Net cash provided by financing activities

19105

Net (decrease) in cash held

(2945)

Cash at beginning of year

260

Cash at end of year

$(2685)

(b)

BSB110 2014 revision solutions

Net profit = Accrual basis accounting $6030.

Ie. Revenue EARNED less expenses INCURRRED. Not just cash items but includes all

accruals, prepayments, and credit transactions

Cash flows = only cash items included

Net decrease in cash = $2945

Net profit is related to cash flows from operations

But cash flows from operations does not include: depreciation, Bad debts expense,

Prepaid expenses, Accrued expenses, Credit transactions

ONLY CASH

Cash profit

Cash is used for other purposes besides profit, ie. Investing and Financing

Investing = purchase and sale of non current assets

Financing = liabilities and equity

For Albert,

- cash used in investing

$40435

- net cash inflow from financing

$19105

-net cash provided from ops

$18385

Main reason why cash decreased was the Investing activities

QUESTION 4

(a)

Louisa Hannah

Cash Flow Statement for the year ended 30 June 2006

Cash flows from operating activities

Receipts from customers

5980

Payments to suppliers

(3420)

Net cash provided by operating activities

Cash flows from investing activities

Purchase of office equipment

(2100)

Purchase of delivery vehicles

(1550)

Net cash used in investing activities

Cash flows from financing activities

Proceeds from borrowings

1600

Capital contributed

1000

Drawings

(1230)

Net cash provided by financing activities

Net increase (decrease) in cash held

Cash at beginning of year

Cash at end of year

(b)

2560

(3650)

1370

________________

280

______(100)_____

______$180______

Can a company have a good net profit and little cash generated from operations in the

same year? Provide an explanation including examples to justify your answer.

Yes net profit based on accrual accounting - if large amounts of sales on credit but

little amount of collections from customers

Also if payments to suppliers is greater then purchases on credit

Then there will be little cash generated from operations but large profit

Cash flow Statement based on CASH flowsnot accrual accounting.

BSB110 2014 revision solutions

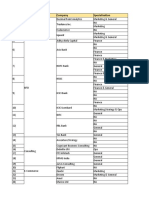

QUESTION 5

(1)

Date

INVENTORY CARDAVERAGE COST

Explanation

Un

it

Jan 1

Balance

Mar 3

Purchase 5

Apr 9

Sold 6

May10

Aug 22

Purchase 6

Sold 4

Purchases

Unit

Total

Cost

Cost

1608

Cost of Goods Sold

Un Unit Total

it

Cost Cost

1620

1500

6000

1560

14040

9360

1560

4680

6400

9

5

1600

1600

14400

8000

8040

6

Un

it

Balance

Unit

Total

Cost

Cost

1560

9720

4

1600

Total

$15760

Ending Inventory = $ .....8000...........

Cost of Goods Sold = $ ...15760.........

(2)

Date

Explanation

Jan 1

Balance

Mar 3

Purchase

Apr 9

May

10

Aug

22

INVENTORY CARD--FIFO

Purchases

Cost of Goods Sold

Unit Unit

Total

Unit Unit

Total

Cost

Cost

Cost

Cost

5

1608

8040

Sales--6

Purchase

1620

1500

6000

1608

3216

9720

Sales4

TOTAL

17760

1608

4824

1620

1620

Balance

Unit

Total

Cost

Cost

1500 6000

1500

6000

1608

8040

1608

4824

1608

4824

1620

9720

1620

8100

Unit

15660

Ending Inventory = $8100

Cost of Goods Sold = $15660

(3) The calculations are different because we have used two different inventory costing

methods for the inventory cardsFIFO and Average Cost

Note that in this question, inventory purchase price (cost) rose during the month.

The effect of this is dependent on the Inventory Costing method used

--FIFO ending inventory (asset) is higher than Average Cost

--FIFO Cost of Goods Sold (expense) is lower than Average Cost

--thus FIFO profit is higher than Average Cost.

The opposite effects would occur if inventory purchase price fell during the period

BSB110 2014 revision solutions

(4) The best valuation of inventory depends on what management wants to achieve and its

goals for the firm.

Because, the costing method used affects assets and profits

Management must choose the most appropriate method

Depending on the type of inventory that the firm is selling

This then in an important decision for Management

The items affected by the inventory costing method are:

*COGS

*Gross Profit

*Net Profit

*Inventory in the Balance Sheet and

*Owners Equity (as net profit is affected)

--The specific unit cost method assigns each inventory item its particular cost. The specific

unit cost method is used for inventory items that are individually identifiable, like jewels and

motor vehicles.

--The average cost method assigns the weighted-average cost of inventory available during

the period to ending inventory and cost of goods sold.

--Under the first-in, first-out (FIFO) method, the first inventory costs incurred during the

period are assigned to cost of goods sold. The latest unit costs are assigned to ending

inventory. When prices are rising, FIFO produces the highest reported profit.

--Under the last-in, first-out (LIFO) method, the last inventory costs incurred during the period

are the first to be assigned to cost of goods sold. The earliest unit costs of the period are

assigned to ending inventory. When prices are rising, LIFO produces the lowest

reported profit.

In general: FIFO results in the ending inventory being valued at the most current cost. The

earliest costs of the period are assigned to cost of goods sold, leaving the last (that is, the most

current) costs for ending inventory. LIFO results in the cost of goods sold amount being

valued at the last (the most current) cost.

QUESTION 6

Date

Apr 1

2

10

18

22

Explanation

(1) Inventory Card--FIFO

Purchases

Cost of Goods Sold

Unit

Unit

Total Unit

Unit

Total

Cost

Cost

Cost

Cost

Balance

Purchase

12

225

2700

Sales--10

Purchase

Sales--16

Sales--4

14

230

220

1540

225

675

3220

220

1540

12

225

2700

225

2025

225

2025

14

230

3220

Unit

225

2025

230

1610

230

1610

230

920

230

690

TOTAL

Ending Inventory = $ 690

Balance

Unit

Total

Cost

Cost

220

1540

6770

Cost of Goods Sold = $ 6770

BSB110 2014 revision solutions

Date

Apr 1

Explanation

(2) Inventory CardAverage Cost

Purchases

Cost of Goods Sold

Unit Unit Total Unit Unit

Total

Cost Cost

Cost

Cost

Balance

Purchase

Sales--10

7

12

225

2700

19

10

10

Purchase

18

Sales--16

16

22

Sales--4

14

230

14/4

(b)

11/3

16/3

5228.42

227.3

226

681.97

227.32 3637.16

26

909.29

2008.42

1591.26

6778.03

Highest profit for April is the method with the LOWEST cost of goods sold = FIFO.

1,400

1,400

Accounts PayableGolden Ltd

Inventory

250

Accounts PayableGolden Ltd

Cash

1,150

250

1,150

Accounts ReceivableP. Scott

Sales

900

Cost of Goods Sold

Inventory

300

Sales Returns and Allowances

Accounts ReceivableP. Scott

150

Inventory

Cost of Goods Sold

21/3

4240

Cost of Goods Sold = $6778.03

QUESTION 7

(a)

5/4

Inventory

Accounts PayableGolden Ltd

10/4

223.1

579

23

5920

Ending Inventory = $681.97

223.15 2231.58

79

3220

TOTAL

(3)

Unit

Balance

Unit Total

Cost Cost

220

1540

Cash

900

300

150

50

50

750

Accounts Receivable

750

BSB110 2014 revision solutions

(c) 1. Sales - Sales Returns & Allowances = Net Sales = $21,500 - $165 = $21,335

2. Net Sales - Cost of Goods Sold = Gross Profit = $21,335 - $15,975 = $5,360

3. Gross Profit - Operating Expenses = Net Profit = $5,360 - $1,650 = $3,710

QUESTION 8

(EXTRACT) CASH RECEIPTS

JOURNAL

Total to date

56,431

Total to date

NSF

(540)

Bank Charges

Note Receivable

2,650

Interest earned

(EXTRACT) CASH PAYMENTS JOURNAL

68,798

35

74

TOTAL

$58,615

TOTAL

$68,833

CASH AT BANK ACCOUNT

Balance

Date

PR

1 Oct

Bal

31 Oct

CRJ

31 Oct

CPJ

Debit

Credit

Debit

Credit

2,287

58,615

60,902

68,833

7,931

Bank Reconciliation at 31October

Balance as per Bank Statement 31 October--credit

6,484 CR

Add deposits in transit

2,937

9,421

Less Outstanding cheques

18,432

9011 o/d

Less Bank error on cheque no. 424

1080

Agrees with balance as per ledger cash account--credit

7,931 CR

BSB110 2014 revision solutions

QUESTION 9

Cash Receipts Journal

Total to date

Bill Receivable

NSF

$

4778

650

(100)

$5328

Cash Payments Journal

Total to date

Bank charges

CASH AT BANK A/C

DEBIT

CREDIT

April 1 Balance

April 30 CRJ

CPJ

$

3896

25

$3921

BALANCE

13641

18969

15048

5328

3921

Bank Reconciliation

As at 30 April

Balance as per Bank Statement 30 April

Add outstanding deposit

15405 CR

570

15975

100

15875

less bank error on Chq no. 828

less Unpresented cheques:

No. 818

369

827

248

830

210

Balance as per Cash at Bank A/C in ledger 30 April

827

$15048 DR

QUESTION 10

CREDIT SALES

April $15600

May $14500

June $12800

July $16100

August $11200

TOTAL

Schedule of Cash Collections

JULY

AUGUST

1560

5800

1450

6400

5120

8050

$13760

$14620

SEPTEMBER

1280

6440

5600

$13320

BSB110 2014 revision solutions

QUESTION 11

Hannah's Hair Fashions--Cash Budget for May

Cash balance at 1 May

775

Add receipts

Collections from customers

60% of May sales 2200

1320

40% of April sales 1760

704

Cash available

2799

Less payments

Purchases

70% of May 1320

924

30% of April 1020

306

Rates

Rent

Wages

New equipment

Total payments

Cash balance at 31 May

(ii)

270

150

550

180

2380

$419

If Hannah wants to maintain a cash balance of $600 she will need to CONTRIBUTE

additional cash of ($600 419) = $181

QUESTION 12

(a)

Cash Receipts Journal

Total to date

Dividend received

NSF

Cash Payments Journal

Total to date

Fee

Int. on O/D

387

100

(22)

$465

CASH AT BANK A/C

DEBIT

CREDIT

May 31 Balance

June 30 CRJ

CPJ

465

551

Bank Reconciliation As at 30 June

Balance as per Bank Statement 30 June

Add Unpresented cheques

No. 7392

200

7407

21

7411

135

less Deposits not yet credited

less Bank error Chq No 7412

Agrees balance as per ledger 30 June

17

16

$

459

10

82

$551

BALANCE

3742 CR

3277 CR

3828 CR

3532DR

356

3888

33

3855

27

$3828 CR

BSB110 2014 revision solutions

10

(b) Bank Rec is an EXTERNAL, INDEPENDENT check of cash recordsvery

strong control as it is TOTAL separation of custodianship and record keeping

YES__DEFIN ITELY WORTH DOINGas need to find items that Bank knows about and

the firm does not e.g. bill receivable collected; bank charges; NSF cheques ; direct debits

--need to confirm that all cheques have been presented and all deposits make INTACT

--in this questiondeposit of the 8th June has not yet been made at the bank

--need to check to see what has happenedcould be an indication of very big FRAUD

perhaps

--therefore Bank RecsEXCELLENT form of internal control

(c)

Country Motors Ltd

Collections from Customers

Credit Sales (70% of total sales)

June

36 400

July

38 500

Aug

40 600

September

42 000

September

(5%) 1820

(15%) 5775

(80%) 32480

October

(5%) 1925

(15%) 6090

(80%) 33600

$41615

$40075

Schedule of Cash Receipts

September

18 000

40075

$58075

Cash Sales (30%)

Collection from Customers

Interest

Total

QUESTION 13

(a)

Cost = 160000 RV = 20000 Depreciable Amount = 140000

Straight line

140000

4

for 2000

for 2001

Reducing balance =

for 2000

for 2001

Units of production = per unit

for 2000 = 80000 x 70c

for 2001 = 60000 x 70c

October

18 600

41615

2 000

$62215

EUL = 4 years

= 35000 p.a.

= 35000

= 35000

=

=

=

=

40% of 160000

64000

40% of 96000

38400

140000

= 200000 = 70c/unit

= $56000

= $42000

Total depreciation exp = $140000 under all methods as total exp

= Total depreciable amount

The different methods merely allocate that total depreciable amount in a

different way

(b)

land

$450000 (not depreciable)

bldgs $675000

plant $82400

BSB110 2014 revision solutions

11

Depreciation under HC accounting

= ALLOCATION of COST of asset over its useful life

attempts to measure the decline in service potential of the asset

decline caused by wear and tear

technical obsolescence

commercial obsolescence

in fact = allocation of depreciable amount

LAND not depreciated as its service potential does not

Depreciation is NOT a valuation technique, i.e. does not show in VALUE

Depreciation is NOT a measure of current worth of asset

the fact that L & B can be sold for $1,500,000 is IRRELEVANT

must still depreciate bldgs regardless of current value

same for plant dep difference between cost and market value

Depreciation does NOT create cash reserves

depreciation cash, nothing to do with cash

a BOOK entry to allocate cost and show the EXPENSE of using the asset

QUESTION 14

(a)

(i)

Straight lineuniform charges over the life of an assetequal amounts each year

depreciation is a function of time

--ideal for buildings

(ii)

Reducing Balanceaccelerated depreciation i.e. greater depreciation in early years as

compared to later years when smaller depreciation

--ideal for assets which are used a lot in early years and then not so much in later

yearsequipment which deteriorates quickly

--or computer equipment which suffers from technical and commercial obsolescence

and thus greater depreciation in early years of life

(iii)

units of productiondepreciation is a function of USErequires extra record

keeping to measure the production output (or usage) of the asset

--ideal for assets whose usage can be measured easily e.g. machines which produce

units; or e.g. motor vehiclesuse kilometres travelled

(b)

Note: cost of asset = 15,000 + 600 + 400 = $16,000

Year

30/6/99

30/6/00

Note:

Reducing Balance

Depn

Book value

4800

11200

3360

7840

Depn

3750

3750

Straight Line

Book Value

12250

8500

Depn

3750

3000

Units of Use

Book Value

12250

9250

RB = 30% of 16000; 30% of 11200

Straight Line = (16000 -1000) / 4 = 3750 per year

Units of use:

Depreciation per unit = (16000 -1000) / 360000 = 0.041666 per unit

Depreciation year 1 = 0.041666 x 90000 units = 3750 (round to nearest dollar)

Depreciation year 2 = 0.041666 x 72000 units = 3000 (round to nearest dollar)

(c)

1. Alex says price of truck NOW = price of truck 1 year ago

BUT depreciation does NOT equal market price or decrease in market

Price, hence, Alex is WRONG. Depreciation is not a valuation technique.

2. Alex says in 2nd year VALUE will drop---WRONG again.

BSB110 2014 revision solutions

12

Depreciation is not a valuation technique.

3. Alex says cash obtained from depreciation.

WRONG, as depreciation does not equal cash

Depreciation is a book entry and has nothing to do with cash.

Depreciation does not put aside funds or create any funds for replacement

Depreciation simply decreases profits and decreases assets

4. What depreciation is = allocation of the depreciable cost of the asset over the assets

useful lifeto show that the asset has been used to produce revenue.

Matching revenues and expenses.

Depreciable cost = cost less residual value.

QUESTION 15

(a) Book value of asset=cost less accumulated depreciation

Depreciation is simply an ALLOCATION of the cost of the asset over the useful life

--depreciation is NOT a valuation technique i.e. selling price is NOT what book value equals

--depreciation is NOT a measure of efficiency or value of asset i.e. efficient value of asset is

not what book value equals

NBBook Value is also written down value

The production manager and the managing director are BOTH WRONG IN THEIR

ARGUMENTS

(b) (i)

Year 1

2

3

4

Straight line

Depreciation

Carrying

amount

7500

32500

7500

25000

7500

17500

7500

10000

Reducing balance 37.5%

Depreciation

Carrying

amount

15000

25000

9375

15625

5625

10000

-----10000

Units of Production

Depreciation

Carrying

amount

8250

31750

9000

22750

6750

16000

6000

10000

Workings

Straight line = (40000 10000) /4 = 7500 p.a.

Units of Production = (40000-10000)/200000 =15 cents per klm

(ii)

Depreciation DOES affect ANNUAL profit figuresdifferent deprn expense

depending on the method usedsee table above to illustrate

--the higher the deprn exp, the lower the profit for the year

--over the life of the asset, the total deprn expense is the same regardless of the

method usedthe total deprn exp must always equal the depreciable amount==cost

less residual valuesee the table abovefor all methods, the total deprn expense is

$30,000

--accounting is concerned with periodic profitaccounting period convention

therefore the choice of a depreciation method is critical to profit determination

BSB110 2014 revision solutions

13

QUESTION 16

Sales Budget - 2nd Quarter

1st month

2nd month

3rd month

$4,200

$5,400

$7,200

Multiply number of units by unit cost.

Total

$16,800

Purchases, Cost of Goods Sold, and Inventory Budget

+

=

1

2

3

4

5

1st month

$2,100

1,080

3,180

6004

$2,580

Cost of Goods Sold1

Desired Ending Inventory2

Subtotal

Beginning Inventory3

Purchases

2nd month

$2,700

1,440

4,140

1,080

$3,060

3rd month

$3,600

1,2005

4,800

1,440

$3,360

Cost of Goods Sold is 50% of budgeted sales: $3/$6 = 50%

Desired Ending Inventory is 40% of the following months Cost of Goods Sold.

Beginning Inventory is 40% of current months Cost of Goods Sold (or simply last

months Ending Inventory!)

Beginning Inventory is 200 units $3 ea = $600

The next months projected Cost of Goods Sold = 1,000 units $3 ea = $3,000; Ending

Inventory = 40% $3,000 = $1,200

QUESTION 17

(a)

(i)

contribution margin = sales variable costs

= $20 - $9.50 = $10.50

(ii)

breakeven (units)

=

fixed expenses / contribution margin

=

$15,000 / $10.50 = 1,428.5714 units

=

1,429 units (rounded to nearest unit)

Breakeven (dollars) = breakeven (units) x selling price per unit

= 1,429 x $20

= $28,580

(iii) NEW contribution margin = sales variable costs

= $20 - $10 = $10

NEW breakeven (units) =

fixed expenses / contribution margin

= $15,000 / $10

= 1,500 units

NEW breakeven (dollars) = breakeven (units) x selling price per unit

= 1,500 x $20

= $30,000

Contribution Margin Income Statement

Sales (2,000 x $20)

Less Variable expenses (2,000 x $10)

Contribution margin

Less Fixed costs

Net profit

40,000

20,000

20,000

15,000

5,000

BSB110 2014 revision solutions

Total

$8,400

1,200

9,600

600

$9,000

14

Check calculation: if sell 2,000 balls then that is 500 above the break even point. Every sale

above the break even point earns the CM per unit in profit. 500 x $10 = $5000 = profit as

per the profit and loss statement.

QUESTION 18

Cayden Kent

a. Contribution margin per unit:

Sale price......................................

Variable expenses..................................

Contribution margin per unit....................

b. Break even sales

in units

Fixed expenses

Contribution margin per unit

$1200

$6

200 meals

=

=

=

c. Breakeven sales in $

d.

Sales revenue (200 $9)

Less Variable expenses (200 $3)

Contribution margin

Less Fixed expenses

Profit

e. Target sales in units

9

3

$6

200 x $9

= $1800

$1800

600

1200

1200

$ 0

Fixed expenses + Profit

Contribution margin

1200 + 900

=

$6

= 350 meals

Target sales in $

= 350 x $9

= $3150

To earn target profit of $900, Cayden Kent must sell 350 meals.

=

f. Verify this by preparing a Contribution Margin format Income Statement

Sales (350 x $9)

3150

Less Variable expenses (350x $3)

1050

Contribution Margin (7875 x $40)

2100

Less Fixed expenses

1200

Net profit

$900

QUESTION 19

Sales

Less: Variable Expenses

Cost of Goods Sold

Marketing Expense

General Expense

Contribution Margin

Less: Fixed Expenses

Marketing Expense

$280,000

$120,000

24,500

35,000

179,500

100,500

10,500

BSB110 2014 revision solutions

15

General Expense

Net Profit

35,000

45,500

$ 55,000

BSB110 2014 revision solutions

16

QUESTION 20

(a)

Clarence Enterprises

Purchases, Cost of Goods Sold and Inventory Budget

August

September

Total

Cost of Goods Sold

68000

62400

130400

+ ending Inv. **

42440

49160

49160

110440

111560

179560

- Beginning Inv

69000

42440

69000

Total Purchases

41440

69120

110560

** ending inventory = 5000 plus 60% of the budgeted cost of good sold for the

following month

August = 5000 + 60% of 62400

September = 5000 + 60% of (80% of 92000)

(b)

Budgeted Income Statement

for the month of September

Sales

78000

Less cost of Goods Sold

62400

Gross Profit

15600

Less operating expenses

15000

Net Profit

600

QUESTION 21

(a)

Liquidity = ability to pay debts in short term

Current Ratio = amount of CA available to pay CL --Rule of thumb is 2:1.

For 2000 good just above rule of thumb

--Improved since 1999 = good

Acid Test Ratio = amount of very liquid assets available to pay CL

--A mere stringent test of liquidity--Rule of thumb is 1:1.

For 2000 good just above rule of thumb

--Improved since 1999 = good

Inventory T/O very industry dependent

no information here as to what industry, difficult to comment higher the better

increased since 1999= good

at 3.75 times not a fruit shop which should have T/O of roughly 185 times

approximately

must be selling slow moving items that have long shelf life

BSB110 2014 revision solutions

17

A/Cs Rec T/O increased since 1999 good higher better

convert to average collection period and compare to average credit period

365

6.98 52.29 days

if credit period is 30 days then this is good.

Financial Stability = ability to pay debts in long term

ability to service debts from current profits

Debt Ratio = decreased since 1999 good the lower the better

above 70% is not good in Australia

- 60% is good level and secure

need to look at decreasing the debt and increasing the OE in equity structure

Times Interest Earned = ability to pay interest out of profits

coverage of interest--3 or 4 times is safe. 2000 figure = good

has increased since 1999 good

Profitability ability of business to generate profits-- overall good

rate of return on net sales = 6% in 2000, a large increase from 1999 good

= sales are producing dollars.

rate of return on total assets = 16.70% in 2000 tripled from 1999 excellent

the assets are working efficiently

management is using assets in a good combination

(b) Other information:

-- industry averages

horizontal analysis of the 2 years given

trend analysis of past 3 or 4 years data

common size financial statements

any info about the firm management or directors reports etc.

cash flow statement

Any relevant piece of data.

QUESTION 22

Profitability Analysis:

The profit ratio measures the profit per dollar of sales. Profitability has fallen sharply

from 15.00% in 1998 to 6.67% in 1999 as indicated by the profit ratio. In other words,

for every dollar of sales, the company is only earning 6.67 cents. This is of major

concern.

The rate of return on net assets measures the return earned by management through

activities; shows the success a company has in using its assets to earn a profit. This ratio

has also dropped from 15.52% to 9.04% indicating that the ability of the assets to

generate profits has declined. This, too, is of major concern.

Liquidity Analysis:

The current ratio measures the company's ability to satisfy its obligations in the shortterm. The company's current ratio has fallen from 7.00 times to 2.33 times, indicating

that it is finding it more difficult to pay its debts as and when they fall due. This is an

area of concern, although 2.33 times is satisfactory - a rule of thumb is usually 2:1.

The quick ratio tells us whether the company could pay all of its current liabilities if

they became due and payable immediately. The company's quick ratio has fallen

BSB110 2014 revision solutions

18

dramatically from 4.00 times to 1.11 times. This is an area of concern, although 1.11

times is satisfactory - a rule of thumb is usually 1:1.

The inventory turnover ratio is a measure of the adequacy of inventory and how

efficiently it is being managed. Inventory turnover has increased slightly between 1998

and 1999. The higher the turnover, the better, as it means that inventory is being turned

over more frequently. Steps should be taken to try to increase this.

Financial Stability Analysis:

The debt ratio measures the proportion of the company's assets financed by debt. The

debt ratio is a measure of the relationship between total liabilities and total assets. The

company's debt position has deteriorated dramatically between 1998 and 1999. In 1998

only 9.09% of the entity was debt financed, whereas in 1999, this amount has increased

to 35.14%. Upon further investigation, a long term loan of $24,000 was taken out to

purchase non-current assets. This is a perfectly acceptable strategy. Also, the ratio is

well below 50% so there is no need for alarm at this stage.

QUESTION 23

(i)

PROFITABILITY shows the ability of the firm to earn profits

Profit Margin has improved from 97 to 98. Shows the % of each $ of

sales that is profit.

LIQUIDITY shows the ability of the firm to pay its debts in the short term

Current ratio current assets to current liabilities has decreased from 97

to 98. Rule of thumb is usually 2:1; was OK for 97 at 2.3:1 and has

declined in 98 to below the 2:1 benchmark. But beware of Rules of Thumb

as they are only averages and should look at the industry. Also the more

liquid the firm, the less profitable. As liquid assets are not usually

profitable.

Quick ratio more stringent test of liquidity only "quick" assets included in

numerator rule of thumb 1:1; OK for 97 and then decreased to 0.67:1. Not

too bad though.

Inventory T/O measures number of times inventory is turned over during

year. Has decreased from 97 to 98. Industry dependent.

Receivables T/O measures how quickly the cash is received from

receivables has decreased. Compare to average credit period of 30

days.

FINANCIAL STABILITY shows the ability of the firm to survive in long run

security

Debt Ratio shows % of assets funded by outside debt. In Australia, 60%

is the maximum preferred Rose Wines very stable with only 30%+ then

increase to 34.3% therefore very secure.

(ii)

Profitability Rate of Return of Assets measures return that assets produced

Liquidity Receivables Collection Period convert receivables T/O to Days

Inventory T/O period covert inventory T/O to Days

Financial Stability - Times interest earned shows how well net profit covers interest

expense commitment

(iii)

BSB110 2014 revision solutions

19

would expect this to be the case

ie. profit margin increased and current ratio decreased

profitability versus liquidity

liquid assets are generally not profitable eg. cash at bank earns very low interest, prepaid

expenses earn no interest, the more liquid the assets the less profitable the firm and

vice versa

here--less liquid increased profits

(iv)

would expect this to be the case

ie. profit margin increased and inventory T/O decreased

profitability versus liquidity

they usually move in opposite directions

though an increased inventory T/O would likely lead to increased profits as selling more

but perhaps cost of sales is too high to allow for much increase in profits

(v) Other info

(vi)

= Industry averages, Past years data, Trend analysis

Info re: economic climate , Investor's preference for risk and returns

Changing dep'n method affects dep'n exp and accumulated dep'n net assets

affects net profit and Total Assets

all ratios which include there two items will be affected

NOT LIQUIDITY ratios.

PROFITABILITY

FINANCIAL STABILITY

Profit margin

Rate of return on assets

Times Interest Earned

Debt Ratio

QUESTION 24

(a)

Inventory T/O increase means good newsinventory was sold more quickly therefore better

liquiditymore sales alsowould also expect this would lead to higher potential profits

Receivables T/O increase means good newscollected money from customers more quickly

quicker cash collectionbetter liquidityless problems with bad debts perhapsthis does

not affect profitability

BUT net profit decreasedtherefore COGS must have been increased at a GREATER rate

than sales OR operating expenses have increased at a greater rate than sales

Overall any kind of expense must have risen at a greater rate than the increased turnover

(b) PART (i) FOR THIS SECTION NEED TO LOOK JUST AT THE RATIOS GIVEN

CANNOT DO COMPLETE DISCUSSION BECAUSE OF THE LACK OF DATA AND

THE LIMITATIONS AS PER SECTIONS (ii) and (iii)

PROFITABILITY

Ability of firm to generate profits

Profit Margin=the return on sales

Has decreased from 10% to 7% --on the face of itnot a good signbut at least profits are

being earned

BSB110 2014 revision solutions

20

Return on Assets=measures the efficiency of the assets

Decreased from 15% to 11%--not good to have a decreasebut profits are being earned

Overall profitability is OK for 19X9 but the decreases are a cause for concern

LIQUIDITY

Ability of firm to pay its short term debts as they fall due

Current Ratio = current assets compared to current liabilities

Decreased from X8 to X9 was 2:1=rule of thumb

Beware use of the Rule of Thumbtoo much liquidity can lead to decreased profitability

Quick Ratio = more stringent test of liquidityrule of thumb here is 1:1firm quick ratio

has DECREASED cause for concern

Both these measures are STATIC measures of liquidityfor a more complete analysis look at

Receivables collection period and Inventory T/O

Receivables collection period = no. of days to collect accounts receivablecompare to

credit period for firmusual credit period is 30 daysthis firm was doing well at 30 days

and has now DECLINED to 45 daystaking longer to collect receivablesleads to

decreasing cash balancescould lead to BAD DEBTS

Inventory T/O = no. of times inventory is turned over during the yearmore times the better

higher T/O would lead to higher liquidityhas DECREASED in this case form 33 times to

28 timesthe firm must not be selling perishablesfruit shop T/O would be 60 or greater

timesMercedes Benz retailer T/O around 15 times approx

OVERALL, all liquidity ratios have worsened

FINANCIAL STABILITY

Ability of firm to survive in the futurelong term liquidity

Debt Ratio = % of assets funded by debt as opposed to equityaverage in Aust approx 60%

The more debt in a firmthe higher interest expense and the lower the profits and the more

debt repayments

Has increasedBAD newsfrom .64 up to .72 above Aust Averagemore debt to service

and repay

Times Interest Earnedability of profits to cover interest expenserule of thumb around 3

or 4 times

--has DECLINED from 2 down to 1.7area of concern

OVERALL financial stability has worsened.

FOR THE FIRM OVERALL ALL AREAS HAVE WORSENED FROM X8 TO X9

(ii)

NONOT ENOUGH INFORMATION TO MAKE A DECSION

OTHER INFO NEEDED;

--industry averages

--past years data to see if the decline is a trend

--trend analysis

--info re the economic climate

--the friends preference for risk and return

(iii) LIMITATIONS

--based on past data

--based on historical cost measurement

--based on year-end data

--limited disclosures by certain companies

--entities may not be comparable

BSB110 2014 revision solutions

21

e.g. different industries

different accounting methods

different sizes

--must consider info in other reports

--existence of extraordinary items can cause problems in the analysis

BSB110 2014 revision solutions

You might also like

- UPRCT - OSD Third EditionDocument193 pagesUPRCT - OSD Third EditionKZNo ratings yet

- (Final)Document10 pages(Final)KZNo ratings yet

- Finite ElementsDocument9 pagesFinite ElementsKZNo ratings yet

- Mswin 9Document388 pagesMswin 9KZNo ratings yet

- Grossman Hart 86Document30 pagesGrossman Hart 86KZNo ratings yet

- Grossman Hart 86Document30 pagesGrossman Hart 86KZNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5782)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Electric Vehicles OverviewDocument5 pagesElectric Vehicles OverviewHannu JaaskelainenNo ratings yet

- Accounting For DividendsDocument6 pagesAccounting For DividendsAgatha Apolinario100% (1)

- Chronological Order PF The History of Philippine Central BankDocument2 pagesChronological Order PF The History of Philippine Central BankAbigail FormaranNo ratings yet

- Corp Fin Session 7-8 How Firms Raise CapitalDocument25 pagesCorp Fin Session 7-8 How Firms Raise Capitalmansi agrawalNo ratings yet

- Chapter 7 Naked EconomicsDocument34 pagesChapter 7 Naked EconomicsIker EspañaNo ratings yet

- Curd Manufacturing DPR by NiftemDocument25 pagesCurd Manufacturing DPR by NiftemYo SamNo ratings yet

- Chapter 10 SolutionsDocument21 pagesChapter 10 SolutionsFranco Ambunan Regino75% (8)

- Audit Theory For InvestmentDocument6 pagesAudit Theory For InvestmentCharlene Mina100% (1)

- Sectrans DigestDocument2 pagesSectrans DigestChic PabalanNo ratings yet

- Directors' Resolution Approving Transfer of SharesDocument1 pageDirectors' Resolution Approving Transfer of SharesLegal Forms100% (1)

- Accenture Case WorkbookDocument23 pagesAccenture Case Workbookjasonchang24No ratings yet

- Pru Life UK - Appform - Individual InsuranceDocument8 pagesPru Life UK - Appform - Individual InsuranceAlessandro SilvaNo ratings yet

- HR Functions of IDLC Securities LimitedDocument48 pagesHR Functions of IDLC Securities LimitedAsif Rajian Khan AponNo ratings yet

- MADS 6601 Course Outline Spring 2012Document6 pagesMADS 6601 Course Outline Spring 2012arjkt564No ratings yet

- Top 20 Sno Domain Companies SpecialisationsDocument4 pagesTop 20 Sno Domain Companies SpecialisationsUjjwalPratapSinghNo ratings yet

- Se2cal Notice 1208160011799234Document2 pagesSe2cal Notice 1208160011799234Jyotsana SharmaNo ratings yet

- Interpretation of Penal StatutesDocument37 pagesInterpretation of Penal StatutesKrishna Chaithanya Reddy PolamNo ratings yet

- Cpu May StatmenetDocument122 pagesCpu May StatmenetSolomon TekalignNo ratings yet

- Cash Management KXDocument14 pagesCash Management KXRana7540No ratings yet

- Worldwide Fundraisers Handbook PDFDocument35 pagesWorldwide Fundraisers Handbook PDFady_eft100% (3)

- Since All The Data Needed To Construct An Income Statement Are AvailableDocument3 pagesSince All The Data Needed To Construct An Income Statement Are AvailableShay MortonNo ratings yet

- Definition of Vice PresidentDocument7 pagesDefinition of Vice PresidentanjasNo ratings yet

- Consolidated Balance Sheet As at March 31, 2016: Godrej Industries LimitedDocument4 pagesConsolidated Balance Sheet As at March 31, 2016: Godrej Industries Limitedbhoopathi ajithNo ratings yet

- Payslip: Employee Code Name Fathers Name Designation PF No. Esi NoDocument17 pagesPayslip: Employee Code Name Fathers Name Designation PF No. Esi NoRam RamNo ratings yet

- Maximizing Shareholder WealthDocument12 pagesMaximizing Shareholder WealthDung PhamNo ratings yet

- Taxation (Vietnam) : Thursday 8 June 2017Document11 pagesTaxation (Vietnam) : Thursday 8 June 2017annarosaNo ratings yet

- Solution - Depreciation and Tax Review ProblemsDocument7 pagesSolution - Depreciation and Tax Review ProblemsNhuNgocHuynh100% (3)

- MG6863 EngineeringEconomicsquestionbank 2Document20 pagesMG6863 EngineeringEconomicsquestionbank 2Dhamotharan SivasubramaniamNo ratings yet

- MOHAMADOU AWALOU PGE 5 Forage 16A181EMDocument13 pagesMOHAMADOU AWALOU PGE 5 Forage 16A181EMAwalou MohamadNo ratings yet

- Management Advisory Services - Final RoundDocument14 pagesManagement Advisory Services - Final RoundRyan Christian M. CoralNo ratings yet