Professional Documents

Culture Documents

Pymnts - Digital Identity Tracker FINAL March 2016

Uploaded by

Prashant KarpeCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Pymnts - Digital Identity Tracker FINAL March 2016

Uploaded by

Prashant KarpeCopyright:

Available Formats

Digital Identity TrackerTM

powered by

MARCH 2016

Retail

Social

SECURE

INTERACT

STORE

GENERATE

Healthcare

Banking

Access

Digital Identity TrackerTM

powered by

Cover Story

Convenience Trumps Security for Consumers

In a recent survey focused on how U.S. consumers are handling the shift to EMV-compliant POS systems, the

responses revealed that consumers have little incentive to choose safe and secure payment options. Perhaps

even more notable, the survey, which was conducted by the online fraud prevention company Trustev, indicates

that while in-store transactions may be more secure as a result of EMV but, as a result, online fraud, which is

unaffected by EMV adoption, seems to be ramping up faster than it had prior to the shift to chip-enabled credit

and debit cards.

Of the survey participants, only 1.1 percent indicated the use of mobile payments widely considered to be

the best defense against fraudsters as the payment method most often used to pay for purchases, while

almost 61 percent and 29 percent said they primarily use debit cards and credit cards, respectively. On the

heels of the survey release, PYMNTS spoke with Rurik Bradbury, Trustevs CMO (and now VP, Identity Solutions

at TransUnion, which recently acquired Trustev), to discuss the ramifications of the shift to EMV and the

general state of digital payments fraud.

The ripple effect of EMV, Bradbury said, is what hes focused on this year. As more stores start enforcing

the use of chip-enabled cards, he said, the spike in online fraud has been remarkable. Thats the seismic

aftershock effect of that October (2015) rule change, he said. The same happened in countries preceding

the U.S. with EMV. With the EMV adoption, what has happened in other countries Australia, Canada, the

U.K. has been a big rise in online fraud. Fraudsters, he said, are professionals, and they readily adapt to the

changing marketplace. By making it more difficult to commit fraud in-store with EMV, the shift to online (the

next easiest place) has accelerated. So what happened after EMV came in countries? Online fraud increased

by 80-to-100 percent in the three-year period following.

Prior to EMV (and still today where still in use), swipe card payments in stores, Bradbury said, were extremely

weak against fraud. You sign for something and they barely check the signature and it could be anything. You

could write, Mickey Mouse, in many cases and you would just walk out with the goods. EMV, Bradbury said,

offers very strong protection in-store against fraud. But that doesnt mean consumers like it, he said. And, he

added, the chip cards are prohibitively expensive for card companies to both produce and replace old cards

with.

On top of that, he said, the switch to EMV has been costly to monthly subscriber services, like Spotify and

Netflix, as well as other companies and services that have consumers card information on file for automatic

payments. Bradbury referred to this type of recurring auto payment setup as the holy grail for businesses. But,

with all the card turnover recently, he said, that kind of business model of billing a credit card on file is less of

a sure thing.

2016 PYMNTS.com all rights reserved

Cover Story

As far as consumers and chip-enabled cards go, Bradbury said, anything that even slightly makes a purchase

experience less convenient or easy is unpalatable for consumers. And now, with chip cards, in one store

a consumer may swipe and in another they may use the chip and, he said, most consumers seem to find it

rather annoying.

Traditionally, he said, banks and merchants have held the liability for card fraud, such that consumers dont

care that much about security, because theyre not liable. As a result, he said, Its conditioned consumers to

place convenience far ahead of security and created this strange ecosystem where consumers dont do very

much to stay secure, because they dont have very much skin in the game. He added that for consumers, I

think convenience trumps basically everything.

By extension, what goes for consumers goes for fraudsters. Because EMV is strong against fraud in-store, it

has pushed more fraud online, Bradbury said. Its kind of like a balloon with air, he said. If you squeeze one

side, it only gets bigger.

Before EMV even kicked in, he said, the fraud rate for eCommerce transactions almost doubled from 2014 to

2015. In 2014, he said, .68 percent of total revenues for eCommerce transactions were lost through fraudulent

transactions; in 2015, it was 1.32 percent. With the EMV shift and the identity shift, he said, the amount of

money spent online goes up 15 percent each year, and fraud just gets bigger and bigger. So the real question

is: Are there ways for merchants of banks to let consumers do business in a hassle-free way that are also more

secure?

The hassle for merchants, Bradbury said, is manual review of transactions. For example, he mentioned one

large retailer that has 300 people conducting manual reviews. While this is an extraordinary case, he said, it is

common for online merchants to have many people dedicated to manual reviews, which is time-consuming

and costly. All of these companies have reached a kind of breaking point where theyve got just far too many

people doing manual reviews, he said.

With software integrations like TransUnion/Trustev, he said, data such as email behavior, IP addresses,

browsing behavior, device and speed of purchase, is checked automatically and quickly. Its really kind of

detective work, he said.

But, while fraudsters are the perpetrators of costly detours, consumers are still in the drivers seat and,

Bradbury said, theres no reason to expect consumers to take on any additional risk burden in the future. So the

focus needs to be on staying ahead of the fraudsters and beating fraud.

In part, he said, new payment technology may help in the long run, but widespread adoption will take time. I

think that Apple Pay, Android Pay and Samsung Pay are chipping away, he said. Theyre finding more use

cases where it actually makes sense to use them. Consumer adoption is growing very slowly, but is growing.

Its a long-term process.

When it comes to fraud, time equals major losses. The race is on.

2016 PYMNTS.com all rights reserved

Whats Inside

Whats Inside

As our lives become more digital by the day, our digital footprints grow, as does the possibility for

compromised identities and security hacks. Meanwhile, the traditional username/password method of online

authentication grows increasingly antiquated as users tire of their weaknesses and the struggle to remember

them. In an effort to refine the digital identification process, a growing number of providers are turning toward

new and innovative authentication solutions.

Heres a look at some notable news nuggets around the world of Digital Identity:

Digital security has been claiming headlines recently due to Apples legal issues with the FBI surrounding the

San Bernardino iPhone case. Apple earned support from Judge James Orenstein, who cited the All Writs Act

when arguing that the government would be overstepping its boundaries if it were to force Apple to extract

information from one of its devices.

Elsewhere in the digital identification realm, selfies are experiencing yet another moment in the spotlight. In

fact, taking photos of yourself could be the latest trend in digital identification. After testing Selfie Pay in the

Netherlands and the U.S., MasterCard is bringing the photo-based authentication process to the U.K. Users

supply a picture of themselves to MasterCard, which is then compared to an image they provide via a phone

app when they go to check out for online purchases.

Selfie Pay will also allow users to access their accounts through fingerprint identification, a solution that

highlights the growing biometric sign-in trend. Another company exploring this type of authentication is Wells

Fargo, which is preparing to launch eye scan and voice recognition technology within its commercial banking

app.

Users will be able to gain access to their accounts by pointing their phones front-facing cameras at their eyes.

The Wells Fargo app will then identify users by verifying the blood vessel patterns in the whites of their eyes.

See the Trackers News section to discover more innovative solutions surrounding Digital Identity and online

verification.

March Tracker Updates

In this issue of the Tracker, our provider directory has grown to include 110 total players in the Digital Identity

space, including 9 new additions: Acxiom, Aratek, Auric Systems, BIO-key, Encap Security, FireEye, Socure,

TransUnion and Trustev.

2016 PYMNTS.com all rights reserved

Whats Inside

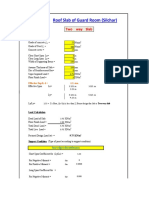

The Digital Identity Ecosystem

The Digital Identity Ecosystem lists the new providers added in each of the four key

digital identity capability areas.

Store

Generate

Create account number, ID or credentials

used to access account or transaction

Certification authorities

Tokenization providers

Safely store sensitive information

Big data and analytics

Cloud storage

Data encryption

EMV card and chip providers

Secure

Ensure the user is who they say they are

EMV and smart card technology

and software solutions

Interact

Manage the process of moving sensitive

data between entities

End-to-end encryption services

Data and device profiling

Networks/gateways/ecosystem

Biometric companies

Payment services

2016 PYMNTS.com all rights reserved

News and Trends

Generate

Visa migrates from alternate PAN to tokenization

Visa announced that it will phase out support for issuers alternate PANs in its cloud-based payments service.

Instead, all issuers will need to migrate to a tokenization solution. Alternate PANs were used to support mobile

wallet programs, but now Visa issuers will need to migrate to Visa Token Service.

Gemalto and PROSA partner for mobile payments in Mexico

Gemalto and PROSA recently announced their partnership to deliver a mobile payments solution to Mexico.

With Gemaltos Allynis Trusted Hub, banks can deliver their own mobile wallet service utilizing host card

emulation. PROSA will provide identification and verification services and card digitalization. Payments will be

also secured with Gemaltos tokenization platform.

MasterCard partners to expand tokens to issuer wallets

MasterCard announced a deal with Giesecke & Devrient to use MasterCards Digital Enablement Services, along

with G&Ds Convego CloudPay solution. The solution enables G&D to implement industry-standard tokenization

technology for their issuer HCE wallets.

Bell ID adding support to Android Pay integration

Mobile payments specialist Bell ID is adding support for Android Pay integration and will enable bank issuers

to offer Android Pay with its own tokenization service. The integration, according to the press release, is

intended to enhance issuing banks security because they will not have to share account data and it should

also help lower costs because they will not have to pay tokenization fees.

TD Bank Group adopts Visas tokenization technology

TD Bank Group (Canada) has added Visas tokenization solution to its mobile app. The technology will,

according to the TD Bank Group press release, allow customers to make mobile payments without having to

share sensitive data.

Interact

Socure joins FIDO Alliance

Digital identity verification company Socure announced last month that it joined FIDO (Fast IDentity Online)

Alliance. The company will contribute its knowledge via their Social Biometrics tools, which help create open

specifications to help enhance the authentication process. In joining FIDO, Socure is among a collection of top

industry leaders such as MasterCard, Bank of America and Wells Fargo in pursuit of making authentication

simpler yet stronger.

2016 PYMNTS.com all rights reserved

News and Trends

Visa opens up network with Visa Developer launch

Last month, Visa announced the launch of Visa Developer, which will enable software application developers

to have open access to Visas payments technology, products and service. Visa Developer will enhance the

creation of new, easier and more secure ways to pay and implies a new distribution platform for Visa products.

Bluefin Payment Systems and WorldNet partner on PCI-validated P2PE

Bluefin Payment Systems and WorldNet have partnered to add Bluefins Decryptx PCI-Validated Point-to-Point

Encryption (P2PE) solution to Worldnets global payment platform. Through the partnership, Bluefin will also

provide payment processing services to their global merchants.

MasterCards Selfie Pay coming to the U.K.

After testing selfie pay in the U.S. and Netherlands, MasterCard is looking to roll out its solution in the

U.K. Created for online purchases, the solution enables consumers to use their fingerprints or a photo of

themselves to validate their identity. For authentication, a photo is taken via a phone app and then compared

with a photo the user has already supplied to MasterCard.

Payment security most important feature on mobile apps

Recently released research from ACI Worldwide reveals payment security as the most important concern for

retailers, in regard to their mobile apps (72 percent). Integrated loyalty options (71 percent) and seamless

ordering (55 percent) are other high-ranking considerations/concerns. Despite the high interest in security, the

research shows that EMV liability compliance still widely has not been met. Despite the Oct. 1, 2015 deadline,

only 8.5 percent of the survey respondents claimed to be compliant, while almost 50 percent reported being

prepared or somewhat prepared.

Store

MasterCard and Curve merge physical, digital payments

U.K.-based startup Curve has launched a new solution that combines an unlimited number of bank cards into

one physical payment card, which is then synced and managed via a mobile app. The card supports chip-andPIN, magstripe and contactless payments technology. The solution is built on the MasterCard network and

enables the ability for a user to combine an unlimited number of bank cards onto one physical payment card

that can be used anywhere MasterCard is accepted.

Fujitsu launches its new tablet advanced security features

Fujitsu recently launched its new device, the Tablet STYLISTIC Q736, with different security features for

authentication and data storage. Authentication is enabled via palm vein biometrics and contactless smart

cards. Encrypted drives, along with Intels TPM, provides secured storage of security keys and passwords.

2016 PYMNTS.com all rights reserved

News and Trends

Amazon falls back in love with encryption support

Amazon recently announced that it will bring back encryption support for its Fire OS, as the companys prior

decision to drop encryption features on the Fire OS fueled significant backlash. The decision was based on

the determination that not many consumers used the feature, however, critics inspired the company to reverse

course.

Apples privacy stance gets court support

Apple recently received support from a federal magistrate judge that could set precedent for the companys

ongoing battle with the FBI in the San Bernardino iPhone case. In a 50-page ruling, Judge James Orenstein

referenced the 1789 statute known as the All Writs Act, which has been the same one that Apples legal team

has used as to why they think the FBIs request should be tossed. Under the guidance of that act, the judge said

the government was overstepping its authority by requiring Apple to provide it with data from an iPhone.

Secure

Google analyzes security key benefits

Google recently released a research report on the use of security keys. The report evaluated the use of FIDO

U2F-based Security Keys, made by Yubico, by 50,000 Google employees for two years. The main conclusions

are that the solution reduces authentication time, reduced authentication failure (Google experienced zero

failures during its implementation), and enhances security, considering there is no identifiable information of

the user on the token.

MorphoTrust wins new contracts to provide fingerprint identification in New York and West Virginia

MorphoTrust recently signed new contracts for fingerprint identification services with the New York State

Division of Criminal Justice Services and the West Virginia State Police. The services will be primarily

integrated into background checks for applicants for jobs in positions of public trust, such as education and

law enforcement.

Gemalto and partners launching biometric authentication platform

Gemalto, Fingerprint Cards, Precise Biometrics and STMicroelectronics announced they are launching an

end-to-end biometric fingerprint authentication solution. The biometrics offering looks beyond the use of

conventional username and password configurations and can be deployed across payments and eTicketing.

The technology includes fingerprint sensors noted for extreme low power consumption, fingerprint software

from Precise Biometrics, and features from Gemalto that would be used to manage the biometric solution over

its entire lifecycle, via hub technology.

2016 PYMNTS.com all rights reserved

News and Trends

Wells Fargo to offer eye scan security tech

Later this year, Wells Fargo will launch a new feature for identifying clients using the banks commercial

banking app, using eye scan or face and voice recognition technology. The solution will use a smartphones

front-facing camera to verify the pattern of blood vessels in the whites of a users eyes. The move comes as

Apple and Samsung are installing fingerprint scanners on their phones and other big consumer banks, like

Chase and BoA, are allowing biometric sign-ins.

Socure enhances verification solutions and earns SOC 2 Type 1 report

Digital identity verification company Socure recently announced that it has been focusing on streamlining

and enhancing its authentication solutions. The organizations Social Biometrics Platform and flagship ID+

technology have been refined with the goal of strengthening features like consumer identity resolution and

the solutions predictive abilities. The company also announced that it has successfully undergone the Service

Organization Control (SOC) 2 Type 1 audit and earned its report, making it the first organization to have its

digital identity verification solution meet this trusted quality standard.

Digital Insight integrated Android Fingerprint ID

Digital Insight recently introduced Android fingerprint ID to its mobile banking app. The new integration pairs

with other biometric solutions already available in the app, such as Apple Touch ID and EyeVerifys Eyeprint

ID. Android Fingerprint ID allows bank customers and credit union members to log into their mobile banking

application without entering traditional login credentials. It will be available on any device that runs the Android

6.0 Marshmallow operating system and has a physical fingerprint sensor that supports the Android Fingerprint

API.

Zwipe launches card with biometric sensor

Norwegian startup Zwipe recently announced the launch of Zwipe ID, a card that includes a biometric sensor

for authentication and storage of user data. The solution is targeted for the global access control market.

2016 PYMNTS.com all rights reserved

Player Directory All players are listed in alphabetical order

Generate

Store

Secure

Interact

Customers/volume: 19,000 merchant accounts, 30,000 users handling corporate,

government and eCommerce payments

Customer focus: Manufacturing, consulting, engineering, transportation, supply

Launch date: 1999

3Delta Systems, Inc., based in Chantilly, Virginia, is an innovative payment solutions company. 3DSI recently

surpassed a lifetime processing milestone of $100 billion. Since 1999, 3DSI has served more than 7,000

corporations and government agencies.

Generate

Store

Secure

Interact

Customer focus: Financial institutions, payment services, providers, eCommerce, travel

Geographies: North America, Germany, United Kingdom, Asia

Launch date: 2004

41st Parameter, part of Experian, is the global leader in device recognition and intelligence using patented

technologies and have years of expertise to identify devices without cookies, without compromising privacy

and without impacting performance.

2016 PYMNTS.com all rights reserved

10

Player Directory

Generate

Store

Secure

Interact

Customer focus: Retail, financial, government, hospitality, education, transit

Geographies: North America, Europe, Africa, and Australia

Launch date: 1795

ABnotes primary products include financial cards, identification and credential cards, transit cards, hotel,

facility and theme park access cards and membership programs, retail plastic cards, barcodes and labels, and

secure documents.

Generate

Store

Secure

Interact

Key products: Fraud protection, chargeback management, payment gateway solutions

Customer focus: Travel, retail, digital download, social network

Launch date: 2007

Accertify Inc., a wholly-owned subsidiary of American Express, offers a suite of products and services that help

eCommerce companies grow their businesses by driving down the total cost of fraud, simplifying business

processes, and ultimately increasing revenue.

2016 PYMNTS.com all rights reserved

11

Player Directory

Generate

Store

Secure

Interact

Key products: Internet PIN debit, authentication services

Customer focus: Consumers, merchants, issuers and financial institutions

Launch date: 2008

Acculynk secures online transactions with a suite of software-only services backed by a patented

authentication and encryption framework that provides greater security for issuers, EFT networks, merchants

and payment processors.

Generate

Store

Secure

Interact

Customers/volume: ACI has more than 5,600 customers, including 18 of the Top 20 banks and 300 of the

leading retailers globally

Customer focus: Banks, retailers, billers and processors

Launch date: 1975

ACI Worldwide, the Universal Payments company, powers electronic payments and banking, processing $13

trillion each day in payments and securities transactions.

2016 PYMNTS.com all rights reserved

12

Player Directory

Generate

Store

Secure

Interact

New!

Products: SAAS & applications, data, data analytics, marketing services

Launch date: 1987

Acxiom is an enterprise data, analytics, and software as a service company that uniquely fuses trust,

experience and scale to fuel data-driven results. For over 40 years, Acxiom has been an innovator in harnessing

every important source and use of data to strengthen connections between people, businesses and their

partners. Acxiom offers identity solutions: Identity Data On Demand, Verification and Authentication, and

Identity Batch Solutions.

Generate

Store

Secure

Interact

Customer focus: eCommerce, mobile commerce, mail/phone order,

call center and brick-and-mortar channels

Launch date: 1975

Adaptive Payments is a payment authentication company that enables easy, safe, secure and authenticated

transactions to occur using the cardholders PIN or other data known to the cardholder, to authenticate debit

and credit transactions.

2016 PYMNTS.com all rights reserved

13

Player Directory

Generate

Store

Secure

Interact

Customer focus: Government (criminal identification), contact centers, financial services,

telecommunications and enterprises

Geographies: 40 countries

Launch date: 2004

AGNITiO offers worldwide market Voice ID products. AGNITiOs Voice ID is used by government organizations

to prevent crime, identify criminals and provide evidence for lawsuits in over 35 countries. AGNITiOs Voice ID

Products are also used by a number of leading customers and partners in contact centers, financial services,

telecommunications and enterprise security sectors.

Generate

Store

Secure

Interact

Products: Identity, password manager

Customer focus: Health care, education, banking

Launch date: 2011

Allweb Technologies provides identity authentication and password management solutions. It offers a secure

two-factor authentication solution with multiple options for identity authentication to end users. User identity

is verified either by matching a one-time use PIN code texted to the users cellphone or by matching fingerprint

templates in real-time.

2016 PYMNTS.com all rights reserved

14

Player Directory

Generate

Store

Secure

Interact

Customer focus: Consumer, small business, merchant

Customers/volume: 107.2 million cards in force

Geographies: 137 countries

American Express, incorporated on June 10, 1965, is a global financial services company. The companys

principal products and services are charge and credit payment card products and travel-related services

offered to consumers and businesses worldwide.

Generate

Store

Secure

Interact

Key products: Touch ID, Apple Pay

Revenue: $182.8 billion

Geographies: 147 countries

Apple Inc. designs, manufactures, and markets personal computers and related personal computing and

mobile communication devices along with a variety of related software, services, peripherals, and networking

solutions. Apple introduced Touch ID, a fingerprint recognition feature, available on iPhone 5S, 6, and 6 Plus.

2016 PYMNTS.com all rights reserved

15

Player Directory

Generate

Store

Secure

Interact

New!

Products: Fingerprint Software System, Scanner, Identity Card Fingerprint readers,

Fingerprint Token

Customer focus: Policy, government, telecom, social security, tobacco, power, finance and insurance

Launch date: 2004

Aratek offers biometric solutions around the world.Aratek provides a complete range of fingerprint image

processing, matching and fingerprint searching software and hardware products.

Generate

Store

Secure

Interact

Products: N-Kd Secure Authentication

Customer focus: Financial services organizations, banks, online merchants

Arcanum Technology provides an innovative and cost-effective authentication solution that helps financial

services organizations, banks and online merchants create a safe and secure business environment for their

customers. The companys breakthrough N-Kd system elevates the authentication process with an expanded

character set and an innovative cypher algorithm that generates a series of tokenized values every step in the

process.

2016 PYMNTS.com all rights reserved

16

Player Directory

Generate

Store

Secure

Interact

Key products: Processors, multimedia, physical & system IP,

development tools, security, Internet of Things

Customer focus: Automotive, consumer entertainment, digital imaging,

mass storage, networking, security, wireless industries

Launch date: 1990

ARM designs scalable, energy efficient-processors and related technologies to deliver the intelligence in

applications ranging from sensors to servers, including smartphones, tablets, enterprise infrastructure and

the Internet of Things. The ARM business model involves the designing and licensing of IP rather than the

manufacturing and selling of actual semiconductor chips.

Generate

Store

Secure

Interact

Key products: Payment card solutions, on-demand, customized card marketing and production

Customer focus: Financial services, retail and merchant services

Launch date: 2000

Arroweye offers the first fully digital card solution approved by Visa, MasterCard, American Express and

Discover, and the company continues to partner with some of the largest prepaid, credit/debit card programs in

the financial and card services industries.

2016 PYMNTS.com all rights reserved

17

Player Directory

Generate

Store

Secure

Interact

Customer focus: Financial services, high tech/independent software vendors, manufacturing, health care,

digital media, gaming, others

Geographies: United States, EMEA, APAC

Launch date: 2001

Arxans technology defends applications against attacks, detects when an attack is being attempted ,and

responds to them with alerts and repairs. It currently runs on more than 500 million devices across a range of

industries.

Generate

Store

Secure

Interact

Key products: Front end solutions (ID identification), solutions

Customer focus: Airports, secured facilities, regulated commercial and public services

Geographies: 90 countries

AU10TIX Limited is a pioneer of multi-channel (front-end, online, mobile) ID authentication and record generation

solutions. The company develops and implements solutions that automate the capture, authentication,

validation and generation of digital records of identifying documents such as Passports, identity cards, driving

licenses etc. AU10TIX Limited is a subsidiary of ICTS International B.V (Established 1982; Nasdaq symbol

ICTSF) - a global provider of security services and solutions for airports, border crossings and sensitive facilities.

2016 PYMNTS.com all rights reserved

18

Player Directory

Generate

Store

Secure

Interact

New!

Products: Credit card storage, transaction processing software,

cryptographic key management, custom PCI solutions

Launch date: 1987

Auric Systems International, a trusted leader in PCI compliant solutions, has been producing payment

transaction processing applications since 1987.From cryptographic key management to tokenized credit card

storage, it provides PCI compliant solutions tailored to payment processing needs.

Generate

Store

Secure

Interact

Key products: Authentication

Customer focus: Financial services, government, health care

Launch date: 2009

Authasas was founded in 2009 and is headquartered in Amsterdam, The Netherlands. Authasas is a software

development and marketing company dedicated to delivering strong authentication to the global marketplace.

2016 PYMNTS.com all rights reserved

19

Player Directory

Generate

Store

Secure

Interact

Products: HCE, tokenization, secure element and smart card management, EMV migration

Customer focus: Banks, payment processors, perso. bureaus, mobile network operators, government

Launch date: 1993

Bell IDs software issues and manages credentials on smartphones, smart cards and connected devices. It

integrates with third party technology and simplifies the issuing complexities of payment, identity, loyalty and

transit applications. Bell ID has the expertise to manage the lifecycle of any application on chip card as well as

NFC-enabled mobile device.

Generate

Store

Secure

Interact

Products: Behavioral authentication, RAT detection, fraudulent activity

Customer focus: Banking, eCommerce, enterprise

Launch date: 2011

BioCatch provides behavioral biometric, authentication and malware detection solutions for mobile and Web

applications. Available as a cloud-based solution, BioCatch proactively collects and analyzes more than 500

cognitive parameters to generate a unique user profile.

2016 PYMNTS.com all rights reserved

20

Player Directory

Generate

Store

Secure

Interact

New!

Products: Software solutions, fingerprint readers

Customer focus: Health care, blood centers, enterprise, education, government, retail

Launch date: 1993

BIO-key designs and develops advanced fingerprint biometric security solutions. The companys complete

algorithms and middleware solutions lead to robust applications in various verticals around the globe, while

software toolkits and infrastructure components offer authentication security.

Generate

Store

Secure

Interact

Products: Digital commerce platform

Customer focus: Enterprise-scale merchants

Launch date: 2013

Bitnet provides a digital commerce platform enabling enterprise-scale merchants to accept bitcoin payments.

Bitnet has offices in San Francisco, California, and Belfast, Northern Ireland.

2016 PYMNTS.com all rights reserved

21

Player Directory

Generate

Store

Secure

Interact

Products: PayConex platform, P2P, tokenization

Customer focus: Enterprises, financial institutions, SMEs

Launch date: 2007

Bluefin Payment Systems provides secure payment technology for enterprises, financial institutions and smallmedium sized businesses worldwide. Bluefins innovative and proprietary PayConex Platform includes PCIvalidated Point-to-Point Encryption (P2PE), QuickSwipe mobile POS, Ecommerce, tokenization, international

payments and more.

Generate

Store

Secure

Interact

Products: Omni-channel fraud scoring; credit risk & chargeback prevention; anti-money laundering;

data breach detection; others

Customer focus: Financial services, homeland security, mobile payments, hardware, software, marketing,

health Care, identity fraud

Customers/volume: 6 of the top 10 global banks

Brighterion offers the worlds deepest and broadest portfolio of artificial intelligence and machine learning

technologies which provides real-time intelligence that matters from all data sources, regardless of type,

complexity and volume.

2016 PYMNTS.com all rights reserved

22

Player Directory

Generate

Store

Secure

Interact

Key products: Consumer authentication, alternative payments, mobile, big data, solution design

Customer focus: Merchants and banks

Geographies: United States, Europe and Africa

Bluefin Payment Systems provides secure payment technology for enterprises, financial institutions and smallmedium sized businesses worldwide. Bluefins innovative and proprietary PayConex Platform includes PCIvalidated Point-to-Point Encryption (P2PE), QuickSwipe mobile POS, Ecommerce, tokenization, international

payments and more.

Generate

Store

Secure

Interact

Products: Smart cards, cards, software, readers & terminals

Customer focus: National ID, health care, gaming, stored value

Geographies: 36 countries

Since 1998, CardLogix has manufactured cards that have shipped to more than 36 countries around the world.

With expertise in card and chip technology, as well as card operating systems, software, development tools,

and middleware, CardLogix has been at the forefront of smart card technology.

2016 PYMNTS.com all rights reserved

23

Player Directory

Generate

Store

Secure

Interact

Key products: Cloud-based payments and host card emulation (HCE),

Customer focus: tokenization, and value-added services

OEMs, banks, MNOs, merchants, program managers

Launch date: 2007

Carta Worldwide is an award-winning leader in digital transaction processing and enablement technologies,

including cloud-based payments and host card emulation (HCE), tokenization, and value-added services such

as digital offers, loyalty and stored value solutions. Carta empowers OEMs, banks, MNOs, merchants, program

managers and others to enable existing cardholder accounts or issue new and innovative products for the

digital world.

Generate

Store

Secure

Interact

Key products: Mobile trackpad, touch solutions, mobile flash solutions

Customer focus: Mobile

Launch date: 2001

Ciptor is a value-added specialty distributor of IT Security taking award-winning vendors to customers

in Scandinavia, EMEA and Asia Pacific. Ciptor supplies software and solutions to enterprise, business and

government customers in the region.

2016 PYMNTS.com all rights reserved

24

Player Directory

Generate

Store

Secure

Interact

Key products: Payment, proximity detection, access & security, IoT

Customer focus: Bank operators, Telco operations, integrators, cybersecurity companies, retailers

Launch date: 2013

CopSonic is a carried spin-off launched in September 2013. CopSonic develops and markets a SDK for

sonic and ultrasonic multi-factor authentication. The CopSonic technology is a new universal contactless

communication protocol for security, payment and tracking. It is already available for 30 billion smart devices

existing worldwide, including: feature phones, smartphones, tablets, TV-box, computers, game consoles, and

Internet of Things devices.

Generate

Store

Secure

Interact

Key products: Mobile trackpad, touch solutions, mobile flash solutions

Customer focus: Mobile

Launch date: 2001

CrucialTec, a business dedicated to mobile input solutions, developed TSP (Matrix Switching-Touchscreen

Panel), a new capacitive touchscreen. The company supplies products along with UI and software, and

produces its MFM (Mobile Flash Module), an associated business, based on optical technology.

2016 PYMNTS.com all rights reserved

25

Player Directory

Generate

Store

Secure

Interact

Key products: Smart card middleware, JAVA card framework, PKI

Customer focus: Defense, automotive, financial, government, retails, industry

Launch date: 2000

cryptovision is a specialist for cryptography and electronic identity solutions. The Germany-based company

has been specializing in this field for 15 years, with hundreds of successful projects delivered. More than 100

million people worldwide make use of cryptovision products everyday in such diverse sectors as defense,

automotive, financial, government, retail and more.

Generate

Store

Secure

Interact

Products: Facial recognition

Customer focus: Financial services, law enforcement and security, health care, defense, intelligence,

marketing and customer service applications

Launch date: 1999

CyberExtruder is known for its work in the field of computer vision for its reconstruction technology which

transforms 2D images of people to 3-D models of them. First used by the entertainment industry to personalize

video games and apps for mobile devices, the companys technology continued to advance and garnered

interest from the security community.

2016 PYMNTS.com all rights reserved

26

Player Directory

Generate

Store

Secure

Interact

Customer focus: Government, commercial enterprises

Geographies: Australia, Europe, Africa, the Middle East, Asia, and the Americas

Launch date: 2002

As a privately held software company and biometrics industry major, Daon was founded to build biometric

software products that would allow people to authenticate themselves in person or online in a secure,

convenient and flexible manner, thus eliminating the threat of security breaches and device fraud.

Generate

Store

Secure

Interact

Key products: Password manager, automatic filling, digital wallet

Customer focus: Persons

Launch date: 2009

Dashlane makes identity and payments simple and secure through its world-leading password manager and

secure digital wallet. It is the solution for the common problem encountered by hundreds of millions of Web

users worldwide that of registering, logging in and checking out on every website and every device. Millions

of people use Dashlane to manage their passwords, automatically log in, generate strong passwords, pay on

any website with any card without typing, and more.

2016 PYMNTS.com all rights reserved

27

Player Directory

Generate

Store

Secure

Interact

Customer focus: Acquirers, merchants and financial institutions

Geographies: 185 countries

Launch date: 1996

Discover Network offers unique payments solutions through its open, flexible and highly secure network.

They are an ever-expanding payments network that markets and supports a full range of innovative payment

solutions for customers globally.

Generate

Store

Secure

Interact

Products: Authentication, payment, regulatory solutions

Customer focus: Financial institutions, government entities, payment companies

Launch date: 1995

Early Warning provides innovative risk management solutions to a diverse network of 2,100 financial

institutions, government entities and payment companies, enabling businesses and consumers to transact

with security and convenience. Owned and governed by five of the largest banks in the United States, its

business model facilitates a data exchange system based on collaborative intelligence and trusted exchange.

2016 PYMNTS.com all rights reserved

28

Player Directory

Generate

Store

Secure

Interact

Key products: Marketing & lead management, fraud protection,

credit risk assessment, collections & recovery

Customer focus: Financial services, higher education, insurance, automotive, telecom & utilities, retail

Customers/volume: $123 billion

eBureau provides a suite of predictive analytics and real-time information solutions to help companies acquire

customers, manage risks and maintain customer relationships. Clients span across numerous industries

and rely on the companys business and consumer scoring, identity verification, authentication, location and

monitoring services to make instant, data-driven decisions about consumers and businesses.

Generate

Store

Secure

Interact

New!

Products: Smarter Authentication Platform

Customer focus: Banking, enterprise, identity providers, health care

Launch date: 2006

Encap Security is a supplier of device-based strong authentication and e-signature solutions for the financial

services industry. Its Smarter Authentication Platform is seamlessly integrated into customers infrastructure

and delivers uncompromising security and user experience across all applications, channels and devices at

Internet scale.

2016 PYMNTS.com all rights reserved

29

Player Directory

Generate

Store

Secure

Interact

Customer focus: Enterprise, critical infrastructure, financial institutions, governement, law enforcement

Revenue: $660 million

Geographies: 150+ countries

Consumers, citizens and employees increasingly expect anywhere and anytime experiences whether they are

making purchases, crossing border payments or logging onto corporate networks. They also expect the ecosystems that

allow this freedom and flexibility to be entirely reliable and secure. Entrust Datacard offers the trusted identity and secure

transaction technologies that make these ecosystems possible

Generate

Store

Secure

Interact

Customer focus: Retailers, insurance firms, utilities, government,

banks, credit unions, other financial institutions

Customers/volume: 600 million customers and 81 million businesses

Geographies: 19 countries

Equifax is a global leader in consumer, commercial and workforce information solutions that provides

businesses of all sizes and consumers with insight and information they can trust.

2016 PYMNTS.com all rights reserved

30

Player Directory

Generate

Store

Secure

Interact

Key products: eCommerce, payment, chargeback fraud

Customers/volume: Seven of the top ten eCommerce brands, seven of the top nine

U.S. card issuers, two of the top five U.K. card issuers and more than

2,100 eCommerce businesses around the world

Launch date: 2005

Ethoca is a global provider of collaboration-based technology that enables card issuers, eCommerce

merchants and online businesses to increase card acceptance, stop fraud, recover lost revenue and eliminate

chargebacks.

Generate

Store

Secure

Interact

Customer focus: Automotive, public sector, health, communications, utilities, credit unions, collections

Revenue: $4.8 billion

Geographies: 80 countries

Experian is a global information services company, providing data and analytical tools to clients around

the world. They help businesses to manage credit risk, prevent fraud, target marketing offers and automate

decision making. Experian also helps people to check their credit report and credit score, and protect against

identity theft.

2016 PYMNTS.com all rights reserved

31

Player Directory

Generate

Store

Secure

Interact

Products: Eyeprint ID

Customer focus: Device manufacturers, financial institutions, government agencies, healthcare services

Launch date: 2012

EyeVerify Inc. is the creator of Eyeprint ID transforming a picture of your eye into a key that protects your

digital life. Eyeprint ID is a highly accurate biometric technology for smart devices that delivers a passwordfree mobile experience with convenient, secure, private authentication. This patented solution uses the existing

cameras on mobile devices to image and pattern match the blood vessels in the whites of the eye and other

micro features in and around the eye.

Generate

Store

Secure

Interact

Products: Hardware and software solutions for iris identity

Customer focus: Governments, businesses, consumers

Geographies: Europe, North America, United Arab Emirates, Lain America, Asia

EyeLock Inc. is an iris-based identity management technology company that focuses on developing systems

for border control, logical access, global access control, and identity management sectors. The company

offers its solutions to eliminate cyber fraud, identity theft, and unauthorized access to secure environments.

It serves governments, businesses, and consumers through its distributors in Europe and North America; and

partners in the United Arab Emirates, Latin America, and Asia. As of September 1, 2015, EyeLock Inc.

2016 PYMNTS.com all rights reserved

32

Player Directory

Generate

Store

Secure

Interact

Key products: Face, voice and facial recognition, video chat

Customer focus: Banking, payments, insurance and gambling industries,

police, security and local government

Launch date: 2013

Facebanx has developed fully integrated facial recognition technology that works via webcams, mobile phones

and tablets. Facebanx uses cloud-based technology to allow multiple users unlimited access worldwide either

on a manual or automated basis. It is a valuable ID verification solution in the registration, single sign-on and

KYC process. Facebanx aids AML and helps to minimize chargebacks.

Generate

Store

Secure

Interact

Products: Face recognition platform

Customer focus: Retail, law enforcement, airports & transportation, commercial security, gaming

Geographies: 2007

FaceFirst, LLC. is a biometric face recognition software company that uses its deep domain knowledge to

solve problems of vital importance to the nation and the world in law enforcement, public safety, national

security and transportation. It matches individual faces from a live image with the face of an individual

contained in the systems database.

2016 PYMNTS.com all rights reserved

33

Player Directory

Generate

Store

Secure

Interact

Customer focus: Acquirers, issuers, retailers and eCommerce

Geographies: 90 countries

Launch date: 2008

Feedzai is a data science company that uses real-time, machine-based learning to help payment providers,

banks and retailers prevent fraud in omnichannel commerce. Feedzai is a global company, with U.S.

headquarters in San Mateo and is backed by SAP Ventures, big data investment firm Data Collective, and other

international investors.

Generate

Store

Secure

Interact

Customer focus: Financial services, insurance, public sector, pharma and life sciences, education, retail,

manufacturing, technology, telecommunications, transportation and travel

Revenue: $789 million

Geographies: 80+ countries

FICO delivers superior predictive analytics that drive smarter decisions. The companys groundbreaking use of

mathematics to predict consumer behavior has transformed entire industries and revolutionized the way risk is

managed.

2016 PYMNTS.com all rights reserved

34

Player Directory

Generate

Store

Secure

Interact

New!

Customer focus: Government, utilities, retail, pharmaceuticals

Geographies: 67 countries

Launch date: 2004

FireEye protects both large and small organizations committed to stopping advanced cyber threats, data

breaches, and zero-day attacks. Organizations across various industries trust FireEye to secure their critical

infrastructure and valuable assets, protect intellectual property and avoid bad press, costly fixes, and

downtime. FireEye has invented a purpose-built, virtual machine-based security platform that provides real-time

threat protection to enterprises and governments worldwide against the next generation of cyberattacks.

Generate

Store

Secure

Interact

Customer focus: Financial services, insurance, public sector, pharma and life sciences, education, retail,

manufacturing, technology, telecommunications, transportation and travel

Revenue: $789 million

Geographies: 80+ countries

First Data is a global leader in payment technology and services solutions. With 24,000 owner-associates, the

company provides secure and innovative payment technology and services to more than 6 million merchants

and financial institutions around the world, from small businesses to the worlds largest corporations.

2016 PYMNTS.com all rights reserved

35

Player Directory

Generate

Store

Secure

Interact

Key products: Online merchants

Customer focus: Elastic identity, cyber intelligence, behavorial analysis

Launch date: 2013

Forter delivers real-time fraud prevention solutions for online merchants. Forter delivers a plug-and-play

technology which allows online merchants to get a simple approve/decline answer for every transaction in realtime and delivers full merchant protection in case of a chargeback.

Generate

Store

Secure

Interact

Customer focus: Financial services & retail, government, identity & access security, machine to machine,

mobile, transport, training, buy online

Geographies: 190 countries

Launch date: 2006

Gemalto offers digital security solutions with 2014 annual revenues of $2.8 billion and more than 14,000

employees operating out of 99 offices and 34 research and software development centers, located in 46

countries.

2016 PYMNTS.com all rights reserved

36

Player Directory

Generate

Store

Secure

Interact

Customer focus: Retail, ISP and web host, education, financial services,

health care, government, developer

Customers/volume: 100,000 customers

Geographies: 150 countries

A wholly owned subsidiary of Symantec, Corp., GeoTrust is a low-cost digital certificate provider. GeoTrusts

range of digital certificate and trust products enable organizations of all sizes to maximize the security of their

digital transactions cost-effectively.

Generate

Store

Secure

Interact

Key products: Drivers license; electronic EU resident permits; electronic payment;

electronic vehicle registration cards; health care cards; national ID cards;

passports; payment cards; SIM cards and OTA; strong authentication

Customer focus: Banknote, mobile security, government solutions

Geographies: 32 countries across every continent

Giesecke & Devrient is a global technology provider with its headquarters in Munich, Germany, and 58

subsidiaries, joint ventures, and associated companies in 32 countries across every continent.

2016 PYMNTS.com all rights reserved

37

Player Directory

Generate

Store

Secure

Interact

Products: PKI Solutions, identity & access management, IoT

Geographies: United States, Europe, Asia

Launch date: 1996

GlobalSign, founded in 1996, is a provider of identity services for the Internet of Everything (IoE), mediating

trust to enable safe commerce, communications, content delivery and community interactions for billions of

online transactions occurring around the world at every moment.

Generate

Store

Secure

Interact

Key products: Web, mobile, business, media, geo, specialized search, home & office, social

Revenue: $66 billion

Launch date: 1998

Google is a global technology leader focused on improving the ways people connect with information. Googles

innovations in Web search and advertising have made its website a top Internet property and its brand one of

the most recognized in the world.

2016 PYMNTS.com all rights reserved

38

Player Directory

Generate

Store

Secure

Interact

Customer focus: Financial, military, consumer, enterprise, government

Geographies: 10 countries

Launch date: 2007

GO-Trust Technology Inc. was the innovator of the secure microSDs and the first company to deliver hardware

security for mobile devices using the SD and microSD form factor. Its vision is to provide the most robust,

service provider independent, privacy and security solutions for all open architecture mobile devices.

Generate

Store

Secure

Interact

Key products: End-to-end encryption, data security

Customer focus: Restaurant, petroleum, laundry, municipalities, nonprofit,

hospitality, education, parking, retail, correctional

Launch date: 1997

Heartland Payment Systems, payment processors in the United States, delivers credit/debit/prepaid card

processing and security technology through Heartland Secure and its comprehensive breach warranty.

Heartland also offers point of sale, mobile commerce, eCommerce, marketing solutions, payroll solutions, and

related business solutions and services to more than 300,000 business and educational locations nationwide.

2016 PYMNTS.com all rights reserved

39

Player Directory

Generate

Store

Secure

Interact

Products: Access control, asset tracking, border protection, embedded solutions, identity

Customer focus: management, secure transactions

Banking & financial, education, enterprise & corporate, government, health care

Geographies: 100 countries

HID Global is focused on creating customer value and is the supplier of choice for OEMs, integrators, and

developers serving a variety of markets that include physical access control; IT security, including strong

authentication/credential management; card personalization; visitor management; government ID; and

identification technologies for technologies for a range of apps.

Generate

Store

Secure

Interact

Key products: Information analytics, unified information access, information archiving, eDiscovery,

enterprise content management, data protection, marketing optimization

Customer focus: IT, legal & compliance, marketing

HP Autonomy processes human information, or unstructured data, including social media, email, video, audio,

text and webpages. Autonomys management and analytic tools for structured information, together with its

ability to extract meaning in real-time from all forms of information, is unique for companies seeking to get the

most out of their data.

2016 PYMNTS.com all rights reserved

40

Player Directory

Generate

Store

Secure

Interact

Key products: Biometric security SDK, key password manager, token

Customer focus: All (software developers, enterprises, device manufacturers)

Launch date: 2014

HYPR is a sector agnostic platform enabling secure biometric authentication. From software developers to

enterprises and device manufacturers, the company aims to replace the use of passwords with a unified

biometric identity protocol.

Generate

Store

Secure

Interact

Key products: Online fraud prevention, anti-money laundering, merchant risk

Customer focus: Online merchants, acquiring banks, payment processors and gateways, payments

services providers, digital currency exchanges, and financial institutions

IdentityMinds risk management platform builds reputations used in evaluating anti-fraud, merchant account

applications, consumer account origination, identity verification services, anti-money laundering, and more.

These reputations are shared during analysis, so everyone can benefit from the network effect while

protecting the privacy of the entities.

2016 PYMNTS.com all rights reserved

41

Player Directory

Generate

Store

Secure

Interact

Key products: Digital certificates, trusted authentication, mobility, cloud services

Customer focus: Global government, education, retail, transportation, health care

Launch date: 2007

Identiv establishes trust in the connected world, including premises, information, and everyday items. CIOs,

CSOs, and product departments rely upon Identivs trust solutions to reduce risk, achieve compliance, and

protect brand identity.

Generate

Store

Secure

Interact

Key products: Identity solutions, authentication, encryption, digital signing

Customer focus: Banks, corporates, government

Geographies: 175 countries

IdenTrust provides a legally and technologically interoperable environment for authenticating and using

identities. IdenTrust enables end-users to have a single identity that can be used with any bank, any application,

and across any network.

2016 PYMNTS.com all rights reserved

42

Player Directory

Generate

Store

Secure

Interact

Customer focus: Financial services, tax, distance learning, health care,

insurance, retail, gaming, telecommunications, eCommerce

Geographies: United States, Canada, United Kingdom

Launch date: 2003

IDology, Inc. provides real-time technology solutions that verify an individuals identity and age in a consumernot-present environment to prevent fraud and meet compliance regulations. It allows customers to control

the entire proofing process and provides the flexibility to make configuration changes that are deployed

automatically.

Generate

Store

Secure

Interact

Customer focus: Medium to large contact centers

Customers/volume: 40 installed locations, 35,000 desktop licenses, and repeat Fortune 100 clients

Launch date: 1996

IntraNext provides products and services to the call center industry. The company focuses on helping clients

run efficient contact centers for better customer service capabilities.

2016 PYMNTS.com all rights reserved

43

Player Directory

Generate

Store

Secure

Interact

Customer focus: Finance, retail, travel, sharing economy, gaming, telecommunications

Geographies: 210 countries

Launch date: 2012

IDology, Inc. provides real-time technology solutions that verify an individuals identity and age in a consumernot-present environment to prevent fraud and meet compliance regulations. It allows customers to control

the entire proofing process and provides the flexibility to make configuration changes that are deployed

automatically.

Generate

Store

Secure

Interact

Key products: Count Complete, Central, Access

Customer focus: Online & multichannel retailers, payment processors, insurances, gaming, telco, travel

Kounts SaaS platform is designed for businesses operating in card-not-present environments and detects

fraud.

2016 PYMNTS.com all rights reserved

44

Player Directory

Generate

Store

Secure

Interact

Customer focus: Small business store, large enterprise, government,

Geographies: education, students, business partners, military

160+ countries

Launch date: 1984

Lenovo is a $34 billion personal technology company and the worlds largest PC vendor and a global Fortune

500 company. Lenovo has been the fastest growing major PC company for more than four years and creates a

full range of personal technology products, including smartphones, tablets and smart TVs.

Generate

Store

Secure

Interact

Geographies: 80 countries

Launch date: 2012

LiveEnsure is the interactive authentication innovation company. LiveEnsure authenticates user security

context via their smart devices as they access a site, cloud or app with scan-to-screen, app-to-app, or screento-tap engagement.

2016 PYMNTS.com all rights reserved

45

Player Directory

Generate

Store

Secure

Interact

Key products: Secure card reader authenticators, card personalization and issuance,

PIN issuance and management, small document scanners, protection services

Customer focus: Retail, finance, governement, health care

Launch date: 1972

MagTek is a manufacturer of electronic systems for the reliable issuance, reading, transmission and security

of cards, checks, PINs and identification documents. Its products include secure card reader/authenticators,

encrypting check scanners, PIN pads and distributed credential personalization systems.

Generate

Store

Secure

Interact

Customer focus: Consumers, merchats, business partners, governments

Revenue: $9.5 billion

Geographies: Asia Pacific, Middle East and Africa, Europe, Latin America & Caribbean, and North

America; 210 Countries

MasterCard operates a payments processing network, connecting consumers, financial institutions,

merchants, governments and businesses. MasterCards products and solutions make everyday commerce

activities such as shopping, traveling, running a business and managing finances easier, more secure and

more efficient for everyone.

2016 PYMNTS.com all rights reserved

46

Player Directory

Generate

Store

Secure

Interact

Customer focus: Communications and media, financial services,

manufacturing and resources, retails, consumer products and services

Revenue: $86.8 billion

Geographies: 190 countries

Founded in 1975, Microsoft is a worldwide leader in software, services, devices and solutions that help people

and businesses realize their full potential.

Generate

Store

Secure

Interact

Products: Civil identity (ID), Public & border security (Check ID),

digital ID and smart transactions, biometric terminals

Customer focus: Government identity, public security, critical infrastructure,

transportation and business markets

Launch date: 2005

Morpho employs more than 8,600 people in 55 countries. Morpho is one of the leading suppliers of SIM cards,

smart cards, trace detection equipment and gaming terminals. With integrated systems operating in more than

100 countries, Morphos solutions simplify and secure the lives of people around the world.

2016 PYMNTS.com all rights reserved

47

Player Directory

Generate

Store

Secure

Interact

Key products: Multifactor Authentication Client Desktop & Client Edition, server

Customer focus: Device manufacturers, mobile networks operators,

identity service providers, security vendors

Launch date: 2011

Based in Palo Alto, California, the company was founded in November 2011 to unify the silos that plague

current online authentication technologies. NokNokLabs ambition is to fundamentally transform online

authentication by enabling end-to-end trust across the Web in a manner that is natural to end-users while

providing strong security and proof of identity.

Generate

Store

Secure

Interact

Key products: Early fraud detection, behavior piercing, behavioral analytics,

web fraud, advanced threat detection

Customers/volume: Fortune 100 companies

Launch date: 2008

NuData Security, Inc. provides advanced Web security solutions to enterprises through proprietary behavior

analytics and countermeasures. NuDetect examines users in real-time through context aware measures

including behavior signatures unique to a customers business and those common across the NuData security

cloud.

2016 PYMNTS.com all rights reserved

48

Player Directory

Generate

Store

Secure

Interact

Customer focus: Access management, aerospace and defense, automatic fare collection,

automotive, computing, consumer, cyber security, eGovernment, health care,

industrial, lighting, portable devices

Launch date: 2006

NXP Semiconductors has its expertise in high-performance mixed signal electronics and is driving innovation

in the areas of connected car, security, portable and wearable, and the Internet of Things.

Generate

Store

Secure

Interact

Customer focus: Financial institutions, mobile network operators, government and corporate

entities, transportation authorities, retailers, Internet of Things providers

Customers/volume: 2,000 financial institutions

Geographies: 140 countries

OT specializes in digital security solutions in the mobility space. Present in the payments, telecommunications

and identity markets, Oberthur offers end-to-end solutions in the smart transactions, mobile financial services,

machine-tomachine, digital identity and transport & access control fields. OTs international network serves

clients in 140 countries.

2016 PYMNTS.com all rights reserved

49

Player Directory

Generate

Store

Secure

Interact

Customer focus: Access management, aerospace and defense, automatic fare collection,

automotive, computing, consumer, cyber security, eGovernment, health care,

industrial, lighting, portable devices

Launch date: 2006

On Track Innovations Ltd. (oti) is a leader in contactless and near field communications (NFC) applications

based on its extensive patent and IP portfolio. Oti markets and supports its solutions through a global network

of regional offices and alliances.

Generate

Store

Secure

Interact

Customer focus: Nonprofits, education, political campaigns, government, enterprise

Customers/volume: 165 million active customer accounts

Geographies: 203 countries

PayPal gives people better ways to send money without sharing their personal financial information and with

the flexibility to pay using their PayPal account balances, bank accounts, PayPal Credit and credit cards.

2016 PYMNTS.com all rights reserved

50

Player Directory

Generate

Store

Secure

Interact

Products: Identiy management solutions

Customer focus: Financial services, public sector, health care, managed service providers

Launch date: 2002

Since 2003, Ping Identity has been providing identity and access management (IAM) solutions that give

customers and employees one-click access to any application from any device. Over 1,200 companies,

including half of the Fortune 100, rely on its award-winning products to make the digital world a better

experience for over a billion people.

Generate

Store

Secure

Interact

Key products: Digital communications products and services

Customer focus: Mobile, automotive, education, health care,

Internet of Everything, networking, Smart Home

Geographies: 1985

QUALCOMM, Inc. manufactures digital wireless communications equipment. The company licenses its code

division multiple access (CDMA) and orthogonal frequency division multiplexing access intellectual property to

other companies, and produces CDMA-based integrated circuits, and produces equipment and software used

to track workers and assets, and software for wireless content enablement.

2016 PYMNTS.com all rights reserved

51

Player Directory

Generate

Store

Secure

Interact

Customer focus: Communications, media and entertainment solutions,

energy solutions, health care and life sciences solutions, public sector

Revenue: $6 billion

RSA is the security division of EMC. The security partner of more than 90 percent of the Fortune 500, they help

the worlds leading organizations with security concerns.

Generate

Store

Secure

Interact

Customer focus: Electronics equipment, consumer electronics

Geographies: 90 countries

Launch date: 1938

For over 70 years, Samsung has led the global market in high-tech electronics manufacturing and digital media.

2016 PYMNTS.com all rights reserved

52

Player Directory

Generate

Store

Secure

Interact

Products: Mobile tokens, authentication and authorization services, card management systems

Geographies: Australia, New Zealand

Launch date: 1998

Salt Group is an Australian IT Security company helping businesses and organisations with their electronic

service delivery needs. The company works with financial services, large corporates and government to

develop strategies and design solutions to enable businesses to better manage their risks and obligations in

delivering services electronically.

Generate

Store

Secure

Interact

Key products: Storage (hard drive), backup & recovery services (cloud, hybrid cloud)

Customer focus: Persons and business

Launch date: 1997

Seagate is a global data storage solutions provider, developing products that enable people and businesses

around the world to create, share, and preserve their most critical memories and business data. Over the years

the amount of stored information has grown, confirming the need to successfully store and access huge

amounts of data. As demand for storage technology grows, the need for greater efficiency and more advanced

capabilities continues to evolve.

2016 PYMNTS.com all rights reserved

53

Player Directory

Generate

Store

Secure

Interact

Key Products: briidge.net Connect, briidge.net Exchange

Customer focus: Banking & financial services, government, payments, telecoms & utilities

Launch date: 2008

SecureKey is the identity and authentication provider for organizations that deliver online consumer services.

SecureKey eliminates the need to store passwords by securely linking consumer ID to trusted devices, while

providing consumers with the choice, control and convenience over how they access the services they want.

SecureKey delivers a high-performance, easy-to-use, strong dynamic authentication platform that reduces the

burden, cost, and risks associated with authenticating GENERATE millions of consumers while also improving

the user experience.

Generate

Store

Secure

Interact

Customer focus: Financial, commercial, federal, medical

Launch date: 2000

SecurityMetrics is a leading provider and innovator in data security and compliance for organizations

worldwide. The companys mission is to help organizations comply with financial, government, and health care

mandates through innovative security tools, caring customer support, and qualified expertise.

2016 PYMNTS.com all rights reserved

54

Player Directory

Generate

Store

Secure

Interact

Key Products: Branded mobile payments, frictionless payments, FonePrint Technology

Customer focus: Mobile login & payment

Launch date: 2012

SEKUR Me, Inc. eliminates online payment friction for eCommerce and mCommerce sites. Its patented

technology combines single-click convenience with multi-factor authentication, providing a high level of

security with an unmatched level of convenience by eliminating user IDs and passwords for safer logins.

Generate

Store

Secure

Interact

Products: Cards & apps, tokenization, & HCE, security

Customer focus: Banks, OEMs & MNOs, transit and access, merchants

Launch date: 2010

Sequent enables banks, transit agencies and any other issuer to securely digitize their credit, debit, transit,

loyalty or ID cards and distribute them to their own application, and to any other application using the

Sequent Platform. Sequents APIs empower the app developer community to bring cards to all apps on

mobile, wearable, and other connected devices enabling consumers to make payments, redeem offers, open

doors, and ride transit systems. Sequent Platform includes: Token Service Platform (TSP), Card and Wallet

Management Platform, and Trust Authority.

2016 PYMNTS.com all rights reserved

55

Player Directory

Generate

Store

Secure

Interact

Key Products: Dollars On The Net

Customer focus: Hospitality, retail, food & beverage, eCommerce

Launch date: 2001

Shift4 develops enterprise payment solutions and provides merchants with real-time electronic payment

authorization, auditing, reporting, and settlement functionality. It provides the access, control, and flexibility

required to enable high speed and low cost transactions.

Generate

Store

Secure

Interact

Products: Machine learning, device fingerprinting

Customer focus: Travel, digital cash, on-demand, online marketplace, eCommerce, payment gateway

Launch date: 2011

Using large-scale machine learning technology to predict fraudulent behavior with unparalleled accuracy,

Sift Science leverages a global network of fraud data. Our flexible, adaptive, and automated solution helps

businesses of all sizes detect and prevent fraud.

2016 PYMNTS.com all rights reserved

56

Player Directory

Generate

Store

Secure

Products: ID+ (digital identity verification), Perceive (remote facial biometrics),

Business Verification

Customer focus: Financial institutions, sharing economy

Launch date: 2012

Interact

New!

Socure provides digital identity verification. Its technology applies machine-learning techniques with trusted

online/offline data intelligence from email, phone, address, IP, social media and the broader Internet to

authenticate identities in real-time.

Generate

Store

Secure

Interact

Customer focus: Technology (mobile, tablet, Notebook PC), automobiles, wearables

Geographies: China, South Korea, Taiwan, United States, Japan and other countries

Launch date: 1986