Professional Documents

Culture Documents

Accounting Interface Helpfile

Uploaded by

BryanCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Accounting Interface Helpfile

Uploaded by

BryanCopyright:

Available Formats

Accounting interface with

eZee Front Desk NextGen

Guidelines for configuring the interface.

Malaysia Regional Office

Block B-9-5 (Level 11), Menara Uncang Emas (VIVA HOME),

85, Jalan Loke Yew, 55200 Kuala Lumpur.

Tel No.: +6 03 9202 3511, +6 03 9281 2216

Fax No.: + 6 03 9281 2217

Web: www.ezeetechnosys.com.my

Email: inquiry@ezeetechnosys.com.my

Head Office:

113, International Trade Center, Majura Gate,

Surat 395002. Gujarat, India.

Tel No: +91-261-4004505, +91-97277-09911

Fax No: +91-261-2463913

Web: www.ezeetechnosys.com

Email: info@ezeetechnosys.com

Account Configuration: Front Desk :-

Sundry Debtor/Account Receivable:Sundry Debtor can be set as Room Wise or Single Ledger Wise.

Revenue/Income:-

Room Revenue can be set as Room Wise, Room Type Wise, Rate Type Wise or Single

Ledger.

Discount, Adjustment, Advance:Ledger or accounts can be map for Discount Give on Rent, Flat Discount give for the

Total Bill/Folio, other expenses like Adjustment and for the Advances given by Guest before

Check In.

Taxation:Set tax for Room Rent and Other Charges.

Other Setting:Journal Voucher can be post by Day to Day Wise, checked Out Date Wise or Day to Day

Summary Wise.

NOTE:Contra ledger for Payment/Receipt is essential only for Quick Book. During posting

we need to transfer the balance from Guest Ledger to city ledger. Both (Guest ledger and City

Ledger) comes under the type of Account Receivable or Payable. Quick book does not allow in

Journal Voucher as Account Payable/Account Receivable both side (Debit/Credit).

Outlet Posting (If using separate company database/File in accounting software) if

client want to make transaction in separate database for Front Desk and POS Sales. Then

please tick this Option and set the Account for posted transaction from pos outlet to room.

Otherwise leave this as it is.

POS Outlet :-

Sales & Cost of Goods Sold: Revenue Account:-Set Revenue Account for Outlet.

Gratuity Account:-Set Gratuity Account for Outlet

Cost of Goods Sold: - Set Cost of Goods Sold Account for Outlet.

Other Expenses: Item Discount:-Set Item Discount Account for Outlet.

Bill Discount:-Set Bill Discount for Account Outlet

Round off: - Set Round off value/Adjustment value Account for Outlet.

Un Settled/On Hold: - Set Un Settled Account for Outlet.

Tax Accounts & Tax Item:-

Set Tax Accounts & Tex Item Account for Outlet.

POS Store:-

Purchase A/c :Set Purchase Account for Store.

Round off: Set Round off value/Adjustment value Account for Store.

Discount: Set Discount Account for Store.

Tax Account (Input) :Set Tax Account for Store.

Misc Ledger :-

Misc Ledger Tab is used to Mapping a Misc Ledger like Front Desk City, POS vendor, Ledger,

Charges, Receivable, Room Type, Rate Type etc. Account with Accounting Product.

Payment :-

Payment Tab is used to Mapping a Payment like Front Desk, POS sale, POS Purchase, Banquet

etc. Account with Accounting Product.

Banquet :-

Revenue & Guest Ledger : Revenue:-Set Revenue Account for Banquet.

Guest Ledger:-Set Guest Ledger Account for Banquet.

Cost of Goods Sold: - Set cost of Goods sold Account for Banquet.

Other Expenses: Item Discount:-Set Item Discount Account for Banquet.

Bill Discount:-Set Bill Discount Account for Banquet.

Round off: - Set Round off Account for Banquet.

Tax Accounts :Set Tax Accounts for Banquet.

Common :-

POS Sale (Revenue) Type:POS Revenue can be set by Single Ledger, Menu Group, Menu Sub Group, Menu Item,

Receipt Type (Menu Group), Receipt Type (Menu Sub Group), or Receipt Type (Menu Item).

Cost Calculation Method:Cost calculation can be set by Default Purchase Price, Average Purchase Price, Average

Purchase Price Date Wise, Last Purchase Price, Last Purchase Price Date Wise, or Weighted

Average Cost.

Revenue Seperation By:Revenue Seperation can be set by Meal Plan, Revenue Break Down or None.

Payment/Receipt Account:Payment/Receipt Account can be set by Pay Type Wise or Multi Currency Wise.

Transaction: Front Desk Income:-

Front Desk Income is use to post Room Revenue data to Accounting Software.

Front Desk (Payment Received)

Front Desk (Payment Received) is use to Post Room related transaction like Received, Payable,

City Ledger posting etc... To Accounting Software.

POS Sale:-

POS Sale is used to post POS receipt Transaction to Accounting Software.

POS Purchase:-

POS Purchase is used to post Store Purchase Transaction to Accounting Software.

Banquet Sale :-

Banquet Sale is use to post Banquet related transaction to Accounting Software.

Thank You!

You might also like

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5782)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- PT ANEKA KARYA Revenue Recognition Construction ContractDocument7 pagesPT ANEKA KARYA Revenue Recognition Construction Contract30 Novita Kusuma WardhaniNo ratings yet

- Slides On The Ethiopian Tax System2Document26 pagesSlides On The Ethiopian Tax System2yebegashetNo ratings yet

- Fly Ash Brick Project: Feasibility Study Using CVP AnalysisDocument20 pagesFly Ash Brick Project: Feasibility Study Using CVP Analysissantiago gonzalez0% (1)

- TDS U - S. 194J Not Deductible On Payment For Outright Purchase of Copyright and Technical Know-HowDocument10 pagesTDS U - S. 194J Not Deductible On Payment For Outright Purchase of Copyright and Technical Know-HowheyaanshNo ratings yet

- Be QBDocument30 pagesBe QBSunny KumarNo ratings yet

- 34 Checklist Tax Audit Annexure I and II To Form No 3cd Revised 2008Document20 pages34 Checklist Tax Audit Annexure I and II To Form No 3cd Revised 2008Ankit PoddarNo ratings yet

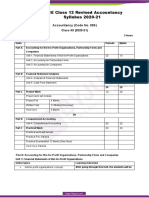

- CBSE Class 12 Revised Accountancy Syllabus 2020-21Document8 pagesCBSE Class 12 Revised Accountancy Syllabus 2020-21Harry AryanNo ratings yet

- MANAGEMENT INFORMATION REPORTDocument2 pagesMANAGEMENT INFORMATION REPORTLaskar REAZNo ratings yet

- Macroeconomics Measurement: Part 2: GDP and Real GDPDocument7 pagesMacroeconomics Measurement: Part 2: GDP and Real GDPManish NepaliNo ratings yet

- Projected Balance Sheet Creamy Buko StationDocument2 pagesProjected Balance Sheet Creamy Buko StationMyzy Rhael SunioNo ratings yet

- Good Corporate Governance and Earnings Management in IndonesiaDocument9 pagesGood Corporate Governance and Earnings Management in IndonesiaShania AngellaNo ratings yet

- UntitledDocument10 pagesUntitledRima WahyuNo ratings yet

- Tax Computation Part 1Document15 pagesTax Computation Part 1Neema EzekielNo ratings yet

- Chapter 9 Receivables Multiple Choice QuestionsDocument77 pagesChapter 9 Receivables Multiple Choice QuestionsNga Lê Nguyễn PhươngNo ratings yet

- Chapter Two Financial Analysis and Planning Part One-Financial Analysis 2.1Document17 pagesChapter Two Financial Analysis and Planning Part One-Financial Analysis 2.1TIZITAW MASRESHA100% (2)

- Estee Lauder Companies, Inc: Strategic Management: Case StudyDocument28 pagesEstee Lauder Companies, Inc: Strategic Management: Case StudyOwais_K_Rana_4635No ratings yet

- Project Report On Netflix: By, R P Preethi Iii BbaDocument12 pagesProject Report On Netflix: By, R P Preethi Iii BbaPreethi RaviNo ratings yet

- Saad - Self Graded PROBLEM SET-FOR THUR CLASS 4-23-1Document36 pagesSaad - Self Graded PROBLEM SET-FOR THUR CLASS 4-23-1Shehry VibesNo ratings yet

- Pell Corporation S Property Plant and Equipment and Accumulated Depreciation AccountsDocument1 pagePell Corporation S Property Plant and Equipment and Accumulated Depreciation AccountsLet's Talk With HassanNo ratings yet

- Manufacturing Accounts PDFDocument2 pagesManufacturing Accounts PDFJohn0% (1)

- CVP Analysis Effect on Profit Planning of Manufacturing IndustriesDocument64 pagesCVP Analysis Effect on Profit Planning of Manufacturing IndustriessmileNo ratings yet

- Cagayan Valley Drug Corp v CIR: Tax Credit for Senior CitizensDocument10 pagesCagayan Valley Drug Corp v CIR: Tax Credit for Senior CitizensAkiNo ratings yet

- AudcisDocument6 pagesAudcisJessa May MendozaNo ratings yet

- Multiple Choice Questions Agency Answer: D Diff: MDocument14 pagesMultiple Choice Questions Agency Answer: D Diff: Msamuel debebeNo ratings yet

- Barangay Structure and Barangay Officials Duties Powers and ResponsibilitiesDocument4 pagesBarangay Structure and Barangay Officials Duties Powers and ResponsibilitiesChaii86% (64)

- PTCL Financial ReportDocument26 pagesPTCL Financial Reportfazal hadiNo ratings yet

- FABM2 - Q1 - Module 5 Analysis and Interpretation of Financial StatementsDocument30 pagesFABM2 - Q1 - Module 5 Analysis and Interpretation of Financial StatementsEly BNo ratings yet

- Chapter 14 - TDS, TCS, Advance Tax - NotesDocument39 pagesChapter 14 - TDS, TCS, Advance Tax - Notesaastha tiwariNo ratings yet

- Accounting For Single Entry and Incomplete Records PDFDocument18 pagesAccounting For Single Entry and Incomplete Records PDFCj BarrettoNo ratings yet

- Earnings Statement: Total Hours For Hourly Period 11/22/20 - 11/28/20 Worked 41.09 Hours Ovrtime & Dbltime 4.57 HoursDocument2 pagesEarnings Statement: Total Hours For Hourly Period 11/22/20 - 11/28/20 Worked 41.09 Hours Ovrtime & Dbltime 4.57 HoursWilliam Harris100% (1)