Professional Documents

Culture Documents

Antam Pe2008 Final e

Uploaded by

Dwi Okky SaputraOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Antam Pe2008 Final e

Uploaded by

Dwi Okky SaputraCopyright:

Available Formats

PT Antam Tbk

Performance Overview and Outlook

Investor Summit and Capital Market Expo 2008, Jakarta 26 November

November 2008

Disclaimer

This presentation is for information purposes only and is not intended

intended to advise you, we are

not advising you, and the contents of this presentation must not be construed as any advice

to you, on (a) whether to purchase any of our securities or, (b) if you hold an investment in

our securities, the value of your investment or how or whether you

you can effect any trades

relating to your investment. These queries should be addressed to

to a licensed broker or your

broker from or through whom you bought the relevant investment, respectively.

This presentation includes forwardforward-looking statements. Such forwardforward-looking statements

involve known and unknown risks, uncertainties and other factors which may cause the

actual results, performance or achievements of Antam to be materially

materially different from any

future results, performance or achievements expressed or implied by such forwardforward-looking

statements.

November 2008 Page 1

9M08 Production and Sales Performance

Commodity

9M 2007

9M 2008

% Change

Revenue Breakdown

Production

2%

Ferronickel (TNi)

12,258

14,026

14

Nickel Ore (wmt)

5,187,890

5,306,343

Gold (kg)

2,128

2,072

(3)

Silver (kg)

17,948

18,528

1,128,279

1,031,806

(9)

25%

38%

Bauxite (wmt)

35%

Sales

Ferronickel (TNi)

9,279

12,616

36

Nickel Ore (wmt)

5,194,541

4,536,557

(13)

3,730

6,424

72

Gold (kg)

Silver (kg)

Bauxite (wmt)

18,894

19,506

826,071

731,918

(11)

Ferronickel

Nickel Ore

Gold and silver

Bauxite

*Based on 9M08 sales

November 2008 Page 2

Sales and Profitability

12,008

Sales

Operating Profit

Rp Billion

Net Profit

6,796

5,629

247

177

2002

2,139

448

227

2003

5,132

3,251

2,859

1,711

7,577

1,097

810

2004

1,100

842

2005

2,404

1,553

2006

2,055

1,624

2007

9M08

November 2008 Page 3

Antam Sustaining Our Solid Fundamental

Focus

Focus on

on

sustained

sustained

performance

performance

through

through cost

cost

reductions

reductions

Cash preservation through rere-prioritization of growth projects

Revision of 2009 budgets to inline with recent decline in commodities

commodities prices

Full

Full

commitment

commitment

towards

towards future

future

growth

growth

Focus on the completion of financial close of the Tayan Chemical Grade

Alumina (CGA) Project. Antam expects the financial close and the start of

construction of the Tayan CGA project in 2009

FeNi IV project as our contingency plan following termination of Alliance

with BHP Billiton

Continued study of investment/acquisition of gold assets

assets

The optimization of the FeNi III smelter in 1H09

Discipline

Discipline in

in

face

face of

of global

global

market

market

conditions

conditions

Development of coal fired power plant through independent power producer

(IPP) scheme to lower ferronickel cash costs

Antam to use lower grade ore feed from Pomalaa mine to reduce ore

ore

transportation costs

The routine maintenance plan of the FeNi I smelter will be conducted

conducted inline

with market condition in 2009

November 2008 Page 4

Nickel Price Outlook Stabilisation

30

US$/lb

Nickel Price Movement

20022002-November 2008

Nickel Price Estimates (US$ per lb)

2008E 2009E

25

Brook Hunt

Citigroup

20

ANZ

Barclays

2010E

2011E 2012E

9.46

4.33

5.64

N/A

N/A

10.62

6.0

6.0

8.0

8.0

9.62

4.82

5.65

6.45

6.76

10.20

6.97

5.90

5.67

N/A

15

There is a possibility of lower

market nickel price from today

todays

price of around US$ 5 per lb.

10

5

0

2002

2004

2006

2008

November 2008 Page 5

Our Utmost Concern: Cash Preservation

Cash and Cash Equivalents vs.

Interest Bearing Debts

Cash preservation is currently

our utmost concern

5,000

Rp Billion

4,500

4,000

Refocusing our growth projects

to optimise cash utilisation

3,500

Cash and Cash Equivalents

3,000

2,500

2,000

Financial Ratios

1,500

Interest bearing debts

2004

Cash ratio

Gross

Operating

Net

ROI

ROE

ROA

219%

48%

38%

28%

30%

33%

13%

2005

82%

44%

34%

26%

33%

28%

13%

2006

96%

49%

43%

28%

35%

36%

21%

2007

9M08

264%

60%

57%

43%

66%

59%

43%

420%

36%

27%

21%

24%

20%

15%

1,000

500

0

2003

2004

2005

2006

2007

9M08

November 2008 Page 6

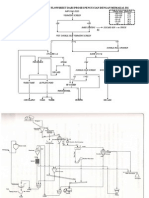

We are optimising the FeNi III smelter to reap

future benefits

The optimisation of the FeNi III smelter involves the

redesign part of furnace area:

FeNi III smelter complex

Handling of higher heat level

Improvement of furnace monitoring system

Stabilisation of furnace walls

Construction to take place in 1H09 for three months

The optimisation also coincides with current

commodities downturn

Ferronickel processing

November 2008 Page 7

We are adjusting our operations to market

conditions

In 2009, our ferronickel production is estimated at 11,50011,500-12,000 tonnes nickel contained in

ferronickel

We plan to use all of our ore feed requirement from Pomalaa nickel

nickel mine to save transportation costs

Several initiatives to cut costs, both on operational and nonnon-operational level

Ferronickel Production

18.532

17,000

TNi

14.474

11,500-12,000

8.933

7.945

7.338

2003

2004

2005

2006

2007

2008E

2009E

November 2008 Page 8

We are developing coal fired power plant to lower

ferronickel cash cost

Currently, coal is the most feasible

source of energy over hydro and gas

to replace our diesel powered power

plant

Capacity: 2 x 75 MW

Independent Power Producer (IPP) scheme

with scope of work includes: financial,

construction, test, commissioning, own,

operate & maintain

16 companies showed interest in

participating in the tender for the project

Antam expects construction of the coal fired

power plant to begin in 2009 with three

years contruction period

Power Plant III, 6 x 17MW

November 2008 Page 9

Our Future: Exploration Areas throughout

Indonesia

Nickel

Gold

Bauxite

In 9M08, we spent Rp128

Rp128 billion for

exploration activities

Coal

November 2008 Page 10

Shares Buyback

Buyback Transaction 13 October 24 November 2008

Transaction Date

Shares

Purchased

Average

Price

Amount Spent*

13 October 2008

1,700,000

Rp1,017

Rp1,728,500,000

24 October 2008

3,500,000

Rp958

Rp3,352,500,000

27 October 2008

5,750,000

Rp850

Rp4,887,500,000

28 October 2008

4,476,000

Rp770

Rp3,446,520,000

15,426,000

Rp869.64

Rp13,415,020,000

TOTAL

The buyback period is

from 13 Oc

October 2008

until 12 January

January 2009

We allocate up to Rp200

billion for shares

buyback

*Without taxes and levies

November 2008 Page 11

HR Management

As of September 2008, Antam has 2,618 permanent employees and

183 non permanent employees, totaling 2,801 employees.

In 9M08,

9M08, Antam

Antams labor cost amounted Rp551 billion with total costs of

Rp5.5 trillion, making the ratio of employees costs to total costs

costs of

10%.

HR management programs include among others:

Work safety is our priority

Revision of organisation structure and man power planning.

Implementation of Performance Based Management System

Development of leadership and specialist competencies

Improvement of remuneration system

Improvement of industrial relations

Induction for new employees

November 2008 Page 12

Our CSR Initiatives

Our CSR initiative is focused on four areas:

areas: well being, nature,

social and economics

economics.

Implementation of our CSR programs also involves participation

from the local government and community

As part of the State owned Enterprise Cares program, we

distributed 14,541 food and staples packages in the vicinity of our

operations at Pomalaa, North Maluku,

Maluku, Pongkor,

Pongkor, Cikotok,

Cikotok, Cilacap,

Cilacap,

Jakarta and Kijang.

Kijang.

We have signed an MoU with the Government of Southeast

Sulawesi to assist the economic and community development by

contributing Rp103 billion.

The Southeast Sulawesi government and Antam will manage the

fund in transparent and accountable manner to provide free

education and health services as well as infrastructure

development in the Southeast Sulawesi region.

Education is part of our CSR focus

Planting new trees by Antams

employees

November 2008 Page 13

Our Outlook Remains Robust

We

We have

have the

the strength

strength

to

to remain

remain resilient,

resilient,

continue

continue to

to grow

grow and

and

deliver

deliver solid

solid returns

returns in

in

current

current market

market

conditions

conditions

Lower ferronickel cash cost in the future following

development of coal fired power plant

Diversified portfolio

Solid growth projects based on scale of priority

Low debt level with good leverage capability

Focus on cash preservation

Focus on shareholders

shareholders value

Leadership to make tough decisions in current market

conditions

Positive commodities outlook

November 2008 Page 14

Thank You

Visit our website:

website: www.antam.com

November 2008 Page 15

You might also like

- Inventory Management (NTPC)Document118 pagesInventory Management (NTPC)Mohd Farhan Sajid33% (3)

- National Aluminium Company LimitedDocument6 pagesNational Aluminium Company Limitediasgaming2105No ratings yet

- Casestudy AdanipowerDocument27 pagesCasestudy Adanipoweranita singhalNo ratings yet

- Queensland LNG PresentationDocument76 pagesQueensland LNG PresentationAllyson JohnsonNo ratings yet

- Wednesday 12 June 2019: London Stock Exchange: AEX Irish Stock Exchange: AexDocument10 pagesWednesday 12 June 2019: London Stock Exchange: AEX Irish Stock Exchange: AexHussein BoffuNo ratings yet

- Budget Control System at NTPCDocument69 pagesBudget Control System at NTPCAbhijit Srijay100% (1)

- Cec 2009 ArDocument68 pagesCec 2009 ArKristi DuranNo ratings yet

- Afs Report - LuckyDocument18 pagesAfs Report - LuckyMKMikeNo ratings yet

- Inventory Management NTPCDocument118 pagesInventory Management NTPCsunuprvunlNo ratings yet

- Disinvestment in IndiaDocument143 pagesDisinvestment in IndiaDaksh DugarNo ratings yet

- Audit Internship ReportDocument17 pagesAudit Internship ReportHaider AliNo ratings yet

- Study of Inventory Control System and Trend Analysis in Mangalam Cement, Mangalam Cement LTDDocument64 pagesStudy of Inventory Control System and Trend Analysis in Mangalam Cement, Mangalam Cement LTDMustafa S TajaniNo ratings yet

- Maple Leaf Case Study AssignmentDocument7 pagesMaple Leaf Case Study AssignmentafzaalmoinNo ratings yet

- Kibo Mining CorpPresentation V3.1 181116Document32 pagesKibo Mining CorpPresentation V3.1 181116kaiselkNo ratings yet

- Umeme Brochure11Document8 pagesUmeme Brochure11Isaka IsseNo ratings yet

- NalcoDocument45 pagesNalcowww.sushilbeheraNo ratings yet

- KPC - Productivity Improvement 2014Document37 pagesKPC - Productivity Improvement 2014fransdaun100% (1)

- Company Analysis CheckedDocument13 pagesCompany Analysis CheckedhatafirmansyahNo ratings yet

- Atma Nirbhar Bharat Full Presentation Part 4Document21 pagesAtma Nirbhar Bharat Full Presentation Part 4Madhuchanda DeyNo ratings yet

- AatmaNirbhar Bharat Full Presentation Part 4 16-5-2020Document21 pagesAatmaNirbhar Bharat Full Presentation Part 4 16-5-2020DeshGujaratNo ratings yet

- NalcoDocument40 pagesNalcowww.sushilbeheraNo ratings yet

- Project On Working Capital Management On NalcoDocument56 pagesProject On Working Capital Management On NalcoItishree Mohapatra100% (3)

- Disinvestment in India: Abbas AliDocument143 pagesDisinvestment in India: Abbas AlishahipiyushNo ratings yet

- PAR Corporate Presentation - April 2010Document30 pagesPAR Corporate Presentation - April 2010Maxwell Amponsah-DacostaNo ratings yet

- LTN 20060310021Document20 pagesLTN 20060310021william zengNo ratings yet

- Bestway Cement Managerial AccountingDocument17 pagesBestway Cement Managerial AccountingArsalan RafiqueNo ratings yet

- Policy Measures - Industry Sector 5.1. Critique A. Energy Efficiency and Conservation in The Textile and Steel Sector IndustriesDocument14 pagesPolicy Measures - Industry Sector 5.1. Critique A. Energy Efficiency and Conservation in The Textile and Steel Sector IndustriesSathea NuthNo ratings yet

- Bestway Cement Managerial AccountingDocument18 pagesBestway Cement Managerial AccountingZia Ullah KhanNo ratings yet

- Curriculum Vitae - Jerry Anwar Halim, S.T.: Personal DetailsDocument3 pagesCurriculum Vitae - Jerry Anwar Halim, S.T.: Personal DetailsDodhy SetiawanNo ratings yet

- Captive-Coal 1248433300265Document8 pagesCaptive-Coal 1248433300265Veneet VishalNo ratings yet

- Corporate Heritage-ReviewedDocument14 pagesCorporate Heritage-Reviewedghufran007No ratings yet

- Pi Q1 2012Document36 pagesPi Q1 2012Thuo Paul ThuoNo ratings yet

- Bestway Cement Managerial AccountingDocument17 pagesBestway Cement Managerial AccountingFarahNo ratings yet

- Developing of Nuclear Energy For Power Generation Under Malaysia's ETPDocument105 pagesDeveloping of Nuclear Energy For Power Generation Under Malaysia's ETPCheehoong YapNo ratings yet

- 09 South Africa PPC Cement Full ReportDocument28 pages09 South Africa PPC Cement Full ReportLorena MartínezNo ratings yet

- Evaluation of Oil & Gas AssetsDocument14 pagesEvaluation of Oil & Gas AssetsRajat Kapoor100% (1)

- 2-2 Case Study Ash ResourcesDocument9 pages2-2 Case Study Ash ResourcesTin NguyenNo ratings yet

- Queensland Rail National (QRN)Document19 pagesQueensland Rail National (QRN)Louise LiNo ratings yet

- 420jjpb2wmtfx0 PDFDocument19 pages420jjpb2wmtfx0 PDFDaudSutrisnoNo ratings yet

- SIIL - Annual Report 2010-11Document188 pagesSIIL - Annual Report 2010-11SwamiNo ratings yet

- Remote Prospects A Financial Analysis of Adani S Coal Gamble in Australias Galilee BasinDocument68 pagesRemote Prospects A Financial Analysis of Adani S Coal Gamble in Australias Galilee BasinMukund VenkataramananNo ratings yet

- PEB Mar2014Document30 pagesPEB Mar2014bluemasNo ratings yet

- Stranded - Alpha Coal Project in Australia's Galilee BasinDocument39 pagesStranded - Alpha Coal Project in Australia's Galilee BasinGreenpeace Australia PacificNo ratings yet

- Strategy Management in OCCDocument20 pagesStrategy Management in OCCajish808No ratings yet

- Reforming The Public Sector (MGMT 242) - Fall 2020: Session 7: State Intervention in BusinessesDocument23 pagesReforming The Public Sector (MGMT 242) - Fall 2020: Session 7: State Intervention in BusinessesnabihaNo ratings yet

- Chairman Statement 2008Document3 pagesChairman Statement 2008Gyan PrakashNo ratings yet

- PNG Power Info Booklet 2016Document15 pagesPNG Power Info Booklet 2016Joel DirinNo ratings yet

- Why Pakistan Lags Behind?: The Need of Wind Power Industry Presented By: Karima RehmaniDocument11 pagesWhy Pakistan Lags Behind?: The Need of Wind Power Industry Presented By: Karima RehmaniKarima RehmaniNo ratings yet

- MicroDocument60 pagesMicrort2222No ratings yet

- MigaDocument32 pagesMigaDivyesh AhirNo ratings yet

- NTPC Company ProfileDocument11 pagesNTPC Company ProfileShahzad SaifNo ratings yet

- A Project Report On Ratio Analysis Of: Northern Coalfield LTD (A Subsidiary Co. of Coal India LTD)Document47 pagesA Project Report On Ratio Analysis Of: Northern Coalfield LTD (A Subsidiary Co. of Coal India LTD)Dhananjay Kumar100% (4)

- Namibia Energy Policy WhitepaperDocument73 pagesNamibia Energy Policy WhitepaperEd ChikuniNo ratings yet

- Perusahaan Perusahaan Perseroan (Perseroan (Persero Persero) PT) PT Aneka Tambang Aneka Tambang TBK TBK Presentasi Korporasi Presentasi KorporasiDocument12 pagesPerusahaan Perusahaan Perseroan (Perseroan (Persero Persero) PT) PT Aneka Tambang Aneka Tambang TBK TBK Presentasi Korporasi Presentasi KorporasichrstNo ratings yet

- 000 900 009 854Document11 pages000 900 009 854GustavoNo ratings yet

- Noc Reform CollinsDocument19 pagesNoc Reform Collinstsar_philip2010No ratings yet

- Study of Inventory Control System and Trend Analysis in Mangalam Cement, Mangalam Cement LTD by Shabbar HussainDocument65 pagesStudy of Inventory Control System and Trend Analysis in Mangalam Cement, Mangalam Cement LTD by Shabbar HussainSourav SenNo ratings yet

- The Digital Utility: Using Energy Data to Increase Customer Value and Grow Your BusinessFrom EverandThe Digital Utility: Using Energy Data to Increase Customer Value and Grow Your BusinessNo ratings yet

- Weekly Review HRS FAD WK 38 (14 - 20 Sep) & Plan WK 39 (21-27 Sep) - EditDocument33 pagesWeekly Review HRS FAD WK 38 (14 - 20 Sep) & Plan WK 39 (21-27 Sep) - EditDwi Okky SaputraNo ratings yet

- Weekly Review HRS FAD WK 38 (14 - 20 Sep) & Plan WK 39 (21-27 Sep) - EditDocument33 pagesWeekly Review HRS FAD WK 38 (14 - 20 Sep) & Plan WK 39 (21-27 Sep) - EditDwi Okky SaputraNo ratings yet

- Lampiran CDocument2 pagesLampiran CDwi Okky SaputraNo ratings yet

- Mining UnsriDocument1 pageMining UnsriDwi Okky SaputraNo ratings yet

- Iklan Lowongan AntamDocument1 pageIklan Lowongan AntamDwi Okky SaputraNo ratings yet

- Glo SaryDocument3 pagesGlo SaryDwi Okky SaputraNo ratings yet

- Aktivitas Penambangan BatubaraDocument1 pageAktivitas Penambangan BatubaraHaikal Marmora SiregarNo ratings yet

- Review #1Document4 pagesReview #1Dwi Okky SaputraNo ratings yet

- Rainbow Cake RecipeDocument9 pagesRainbow Cake RecipeDwi Okky SaputraNo ratings yet

- Figure 3. Photograph of Throw - Cast Blast.Document1 pageFigure 3. Photograph of Throw - Cast Blast.Dwi Okky SaputraNo ratings yet

- IntroductionDocument4 pagesIntroductionDwi Okky SaputraNo ratings yet

- Gambar: Line Form of Flowsheet Dari Proses Pencucian Dengan Memakai JigDocument4 pagesGambar: Line Form of Flowsheet Dari Proses Pencucian Dengan Memakai JigDwi Okky SaputraNo ratings yet

- Rock PropertiesDocument4 pagesRock PropertiesDwi Okky SaputraNo ratings yet

- BellaDocument6 pagesBellaDwi Okky SaputraNo ratings yet

- Affidavit of Consent To Travel A MinorDocument3 pagesAffidavit of Consent To Travel A Minormagiting mabayogNo ratings yet

- Course Syllabus - Labor Standards Law (Part 1) 2016Document4 pagesCourse Syllabus - Labor Standards Law (Part 1) 2016Val Cea100% (1)

- C-Profile Text - 2015 PT. Hydroraya Adhi PerkasaDocument11 pagesC-Profile Text - 2015 PT. Hydroraya Adhi Perkasadaniel_dwi_rahma100% (1)

- Atip Bin Ali V Josephine Doris Nunis & AnorDocument7 pagesAtip Bin Ali V Josephine Doris Nunis & Anorahmad fawwaz100% (1)

- RHP Final Reviewer Galing Sa PDF Ni SirDocument37 pagesRHP Final Reviewer Galing Sa PDF Ni SirAilene PerezNo ratings yet

- India International SchoolDocument15 pagesIndia International Schoolazimmuhammed673790No ratings yet

- Offshore banking_ financial secrecy, tax havens_ evasion, asset protection, tax efficient corporate structure, illegal reinvoicing, fraud concealment, black money _ Sanjeev Sabhlok's revolutionary blog.pdfDocument23 pagesOffshore banking_ financial secrecy, tax havens_ evasion, asset protection, tax efficient corporate structure, illegal reinvoicing, fraud concealment, black money _ Sanjeev Sabhlok's revolutionary blog.pdfVaibhav BanjanNo ratings yet

- Philippine Clean Water ActDocument91 pagesPhilippine Clean Water Actfirmo minoNo ratings yet

- UPS Full ProofDocument1 pageUPS Full Proofyotel52289No ratings yet

- Mordheim - Cities of Gold Slann Warband: Tommy PunkDocument5 pagesMordheim - Cities of Gold Slann Warband: Tommy PunkArgel_Tal100% (1)

- Fleeting Moments ZineDocument21 pagesFleeting Moments Zineangelo knappettNo ratings yet

- QB ManualDocument3 pagesQB ManualJCDIGITNo ratings yet

- Assessment WPS OfficeDocument17 pagesAssessment WPS OfficeMary Ann Andes CaruruanNo ratings yet

- AssignmentDocument22 pagesAssignmentHaris ChaudhryNo ratings yet

- 6 Surprising Ways To Beat The Instagram AlgorithmDocument5 pages6 Surprising Ways To Beat The Instagram AlgorithmluminenttNo ratings yet

- Practical TaskDocument3 pagesPractical TaskAAAAAAANo ratings yet

- Athenian Democracy DocumentsDocument7 pagesAthenian Democracy Documentsapi-2737972640% (1)

- Under The Crescent Moon: Rebellion in Mindanao By: Marites Danguilan Vitug and Glenda M. GloriaDocument2 pagesUnder The Crescent Moon: Rebellion in Mindanao By: Marites Danguilan Vitug and Glenda M. Gloriaapperdapper100% (2)

- CSR-PPT-29 01 2020Document44 pagesCSR-PPT-29 01 2020Acs Kailash TyagiNo ratings yet

- Universidad Abierta para Adultos (UAPA) : PresentadoDocument6 pagesUniversidad Abierta para Adultos (UAPA) : PresentadoWinston CastilloNo ratings yet

- Andres Felipe Mendez Vargas: The Elves and The ShoemakerDocument1 pageAndres Felipe Mendez Vargas: The Elves and The ShoemakerAndres MendezNo ratings yet

- The Harm Principle and The Tyranny of THDocument4 pagesThe Harm Principle and The Tyranny of THCally doc100% (1)

- The Economic Burden of ObesityDocument13 pagesThe Economic Burden of ObesityNasir Ali100% (1)

- Tafseer: Surah NasrDocument9 pagesTafseer: Surah NasrIsraMubeenNo ratings yet

- Activities Jan-May 16Document96 pagesActivities Jan-May 16Raman KapoorNo ratings yet

- EPLC Annual Operational Analysis TemplateDocument8 pagesEPLC Annual Operational Analysis TemplateHussain ElarabiNo ratings yet

- SynopsisDocument15 pagesSynopsisGodhuli BhattacharyyaNo ratings yet

- Chapter 2-Futurecast Applied To TourismDocument5 pagesChapter 2-Futurecast Applied To TourismAsya KnNo ratings yet

- Shopping For A Surprise! - Barney Wiki - FandomDocument5 pagesShopping For A Surprise! - Barney Wiki - FandomchefchadsmithNo ratings yet

- Calendar PLS MCLE MAY - JULYDocument1 pageCalendar PLS MCLE MAY - JULYBernard LoloNo ratings yet