Professional Documents

Culture Documents

Agriculture Insurance New Final

Uploaded by

rajthakur04Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Agriculture Insurance New Final

Uploaded by

rajthakur04Copyright:

Available Formats

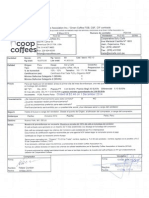

VIVEK COLLEGE OF COMMERCE

CHAPTER

INTRODUCTION OF AIC INDIA LIMITED

Agriculture Insurance Company of India Limited (AIC) offers yield-based

and weather-based crop insurance programs in almost 500 districts of India. It

covers almost 20 million farmers, making it the biggest crop insurer in the

world in number of farmers served. Agriculture Insurance Company of India

Limited is a limited company headquartered out of New Delhi, India [1]

AIC aims to provide insurance coverage and financial support to the farmers in

the failure of any of the notified crop as a result of natural calamities, pests and

diseases to restore their creditworthiness for the ensuing season; to encourage

the farmers to adopt progressive farming practices, high value in-puts and

higher technology; to help stabilize farm incomes, particularly in disaster years.

AGRICULTURE INSURANCE

VIVEK COLLEGE OF COMMERCE

The plan provides comprehensive risk insurance for yield losses due to natural

fire and lightning, storms, hailstorms, cyclone, typhoon, tempest, hurricane,

tornado flood, inundation, landslide, drought, dry spells, pests/diseases, etc.[1

CHAPTER

PROFILE OF AIC

Agriculture Insurance Company of India Limited (AIC) has been formed at

the behest of Government of India, consequent to the announcement by the then

Hon'ble Union Finance Minister in his General Budget Speech FY 2002-03 that,

"to subserve the needs of farmers better and to move towards a sustainable

actuarial regime, it was proposed to set up a new Corporation for Agriculture

Insurance".

AIC has taken over the implementation of National Agricultural Insurance

Scheme (NAIS) which, until FY 2002-03 was implemented by General

Insurance Corporation of India. In addition, AIC also transacts other insurance

businesses directly or indirectly concerning agriculture and its allied activities.

Share Capital

Authorised Share Capital - Rs. 1500 Crores

Paid-up Share Capital - Rs. 200 Crores

Promoters (Share Holding)

General Insurance Corporation of India - 35 %

National Bank for AgricultureAnd Rural Development (NABARD) -

30%

AGRICULTURE INSURANCE

VIVEK COLLEGE OF COMMERCE

National Insurance Company Limited - 8.75 %

The New India Assurance Company Limited - 8.75 %

The Oriental Insurance Company Limited - 8.75 %

United India Insurance Company Limited - 8.75 %

Significant Dates

Incorporation - 20th December, 2002

Commencement of Business - 1st April, 2003

Registered Office and Head Quarters

13th Floor,

AMBA DEEP", 14, Kasturba Gandhi Marg, New Delhi - 110 001,

INDIA

Ph. No

011-46869800

Fax No

011-46869815

E-Mail : aicho@aicofindia.com

AGRICULTURE INSURANCE

VIVEK COLLEGE OF COMMERCE

CHAPTER

INCORPORATION AND COMMENCEMENT OF BUSINESS

AIC was incorporated on 20 December 2002 with an authorized capital of Rs.

1500 crore. The initial paid-up capital was Rs. 200 crores, which was subscribed

by the promoting companies, General Insurance Corporation of India GIC

(35%), NABARD (30%) and the four public-sector general insurance

companies (8.75%) each, viz., National Insurance Co. Ltd., Oriental Insurance

Co. Ltd., New India Assurance Co. Ltd., and United India Insurance Co. Ltd.[2][3]

AIC is under the administrative control of Ministry of Finance, Government of

India, and under the operational supervision of Ministry of Agriculture,

Government of India. Insurance Regulatory and Development Authority

(IRDA), Hyderabad, India, is the regulatory body governing AIC.

AIC commenced its business operations from 1 April 2003 by taking over the

implementation of the "National Agricultural Insurance Scheme" (NAIS) from

GIC. AIC has been designated by the Govt., of India as the "Implementing

Agency" of NAIS, its country-wide crop insurance program.

AGRICULTURE INSURANCE

VIVEK COLLEGE OF COMMERCE

CHAPTER

COMPANY'S VISION & MISSION

COMPANY'S VISION

Accelerate the economic momentum of the Nation by bringing

financial

stability to rural India.

innovate and develop rural-oriented and farmer-friendly insurance

products for

all agricultural allied risks.

Cast a protective net over agricultural and allied activities from natural

perils

and risks.

COMPANY'S MISSION

Agricultural insurance products be designed and developed on scientific

basis

and sound insurance principles to address diverse needs of farmers;

Improve delivery and service of agricultural insurance so as to bring the

remotest and poorest farmer under its umbrella in an economical and

effective

manner;

Create widespread awareness about agricultural insurance as the principal

risk

mitigation tool, and thus establish it as an effective bulwark of the rural

economy

CHAPTER

5

AGRICULTURE INSURANCE

VIVEK COLLEGE OF COMMERCE

COMPANY'S ACTIVITIES

Agriculture and allied insurance products, insuring more than 35 crops

during Kharif and 30 crops during Rabi season.

Implementing Agency for "National Agricultural Insurance Scheme" and

"Weather Based Crop Insurance Scheme", the Crop Insurance Schemes of

the Government.

Create innovative, tailor-made & farmer-friendly insurance products for

specific risk perceptions.

AGRICULTURE INSURANCE

VIVEK COLLEGE OF COMMERCE

MANAGEMENT OF AIC OF INDIA. LTD.

S No.

Name

Designation

Sh.Plappallil Joseph

Chairman-cum-Managing Director & Chief

Joseph

Executive Officer

Sh.Malay Kumar Poddar

General Manager & Chief of Internal Audit

Sh. Rajeev Chaudhary

General Manager & Chief Risk Officer

Sh. Avinanda Ghosh

General Manager & Chief Finance Officer

Sh. Rampal Singh Rawat

Chief Manager & Chief Investment Officer

Sh. Ajay Singhal

Chief Manager & Chief Marketing Officer

Sh. Sukanta Roy

Chowdhury

Smt. Megha Garg

Manager & Chief Compliance Officer

Appointed Actuary

AGRICULTURE INSURANCE

VIVEK COLLEGE OF COMMERCE

CHAPTER

CROP INSURANCE

Background and early attempts at Crop Insurance

Crop insurance as a concept for risk management in agriculture has emerged in

India since the turn of the twentieth century. From concept to implementation, it

has evolved sporadically but continuously through the century and is still

evolving in terms of scope, methodologies and practices.

India is an agrarian country, where the majority of the population depends on

agriculture for their livelihood. Yet, crop production in India is dependent

largely on the weather and is severely impacted by its vagaries as also by attack

of pests and diseases. These unpredictable and uncontrollable extraneous perils

render Indian agricultural and extremely risky enterprise. It is here that crop

insurance plays a pivotal role in anchoring a stable growth of the sector.

AGRICULTURE INSURANCE

VIVEK COLLEGE OF COMMERCE

AGRICULTURE INSURANCE

VIVEK COLLEGE OF COMMERCE

CHAPTER

DIFFERENT TYPES OF CROP INSURANCE SCHMES

FIRST EVER CROP INSURANCE SCHEME - 1972

From beginning of the seventys decade, different experiments on crop

insurance were undertaken on a limited, ad-hoc and scattered scale. The first

crop insurance program was introduced in 1972-73 by the General Insurance

Department of Life Insurance Corporation of India on H-4 cotton in Gujarat.

Later, the newly set up General Insurance Corporation of India took over the

experimental scheme and subsequently included Groundnut, Wheat and Potato

and implemented in the states of Gujarat, Maharashtra, Tamil Nadu, Andhra

Pradesh, Karnataka and West Bengal.

This experimental scheme was based on "Individual Approach". It continued

upto 1978-79 and covered only 3110 farmers for a premium of 4.54 lakhs

against claims of 37.88 lakh.

It was realized that crop insurance programs based on the individual farm

approach would not be viable and sustainable in this country.

10

AGRICULTURE INSURANCE

VIVEK COLLEGE OF COMMERCE

CHAPTER

PILOT CROP INSURANCE SCHEME (PCIS) - 1979

Professor V. M. Dandekar, often referred to as the Father of Crop Insurance in

India, suggested an alternate Homogeneous Area approach for crop

insurance

in

the

mid-seventies.

11

AGRICULTURE INSURANCE

VIVEK COLLEGE OF COMMERCE

Based on this Area approach, the General Insurance Corporation of India (GIC)

introduced a Pilot Crop Insurance Scheme (PCIS) from 1979. Participation by

the State Govts. was voluntary. The scheme covered cereals, millets, oilseeds,

cotton, potato, gram and barley. The risk was shared by GIC and the respective

State Govt. in the ratio of 2:1. The insurance Premium ranged from 5 to 10 per

cent of the Sum Insured.

This PCIS ran till 1984-85 by which 13 States had participated. The scheme

covered 6.27 lakh farmers for a Premium of 1.97 crore against Claims of 1.57

crore.

12

AGRICULTURE INSURANCE

VIVEK COLLEGE OF COMMERCE

CHAPTER

COMPREHENSIVE CROP INSURANCE SCHEME (CCIS) 1985

Based on the learnings from PCIS, the Comprehensive Crop Insurance Scheme

(CCIS) was introduced with effect from 1 st April 1985 by the Government of

India with the active participation of State Governments. The Scheme was

optional for the State Governments. The CCIS was implemented on

Homogeneous Area approach and was linked to short-term crop credit, that is,

all crop loans given for notified crops in notified areas were compulsorily

covered under the CCIS.

The salient features of the Scheme were:

1.

It covered farmers availing crop loans from Financial Institutions for

growing food crops & oilseeds on compulsory basis. The coverage was

restricted to 100% of crop loan subject to a maximum of ` 10,000/- per

farmer.

2.

The Premium rates were 2% for Cereals and Millets and 1% for Pulses and

Oil seeds. 50% of the Premium payable by Small & Marginal farmers was

subsidized by Central and State Governments in equal proportion.

3.

Premium & Claims were shared by Central & State Government in 2:1

ratio.

4.

The Scheme was optional to State Governments.

5.

The maximum Sum Insured was 100% of the crop loan, which was later

increased to 150%.

6.

CCIS was a multi-agency scheme, involving Government of India,

Departments of State Governments, Banking Institutions and GIC.

13

AGRICULTURE INSURANCE

VIVEK COLLEGE OF COMMERCE

15 States and 2 UTs had participated in the CCIS during its tenure from

Kharif 1985 to Kharif 1999. These were Andhra Pradesh, Assam, Bihar, Goa,

Gujarat, Himachal Pradesh, Karnataka, Kerala, Madhya Pradesh,

Maharashtra, Meghalaya, Orissa, Tamil Nadu, Tripura, West Bengal,

Andaman & Nicobar Islands and Pondicherry.

The States of Rajasthan,UttarPradesh, Jammu & Kashmir, Manipur and Delhi

had initially joined the Scheme but opted out after few yearIn this entire period,

the Scheme covered 7.63 crore farmers under an area of 12.76 crore hectares,

for a Sum Insured of 24,949 crore at a premium of 403.56 crore.

Correspondingly, the total claims outgo was 2303.45 crore, thus having a Claim

Ratio of 1 : 5.71. About 59.78 lakh farmers were benefitted, and the majority of

the claims were paid in the States of Gujarat - 1086 crore (47%); Andhra

Pradesh - 482 Crores (21%); Maharashtra - 213 Crores (9%); & Orissa - 181

Crores (8%).CCIS was eventually discontinued after Kharif 1999, to be

replaced by the improved and expanded National Agriculture Insurance

Scheme (NAIS), which is being continued till date.

14

AGRICULTURE INSURANCE

VIVEK COLLEGE OF COMMERCE

CHAPTER

EXPERIMENTAL CROP INSURANCE SCHEME (ECIS) - 1997

While the CCIS was being implemented, attempts were made to modify the

existing CCIS from time to time as demanded by the States. During the Rabi

1997-98 season, a new scheme, viz. Experimental Crop Insurance Scheme

(ECIS) was introduced in 14 districts of 5 States. The Scheme was similar to

CCIS, except that it was meant only for all small / marginal farmers with 100%

subsidy on Premium. The Premium subsidy and Claims were shared by the

Central and respective State Governments in the ratio of 4 : 1. The Scheme was

discontinued after one season due to its many administrative and financial

difficulties.

During its one season, the ECIS covered 4,54,555 farmers for a Sum Insured

of 168.11 crore at a Premium of 2.84 crore against which the Claims paid

were 37.80 crore.

15

AGRICULTURE INSURANCE

VIVEK COLLEGE OF COMMERCE

CHAPTER

PILOT SCHEME ON SEED CROP INSURANCE (PSSCI) - 2000

A Pilot Scheme on Seed Crop Insurance (PSSCI) was introduced in Kharif 2000

season in 11 States to provide financial security & income stability to the Seed

Growers in the event of failure of seed crop. It was also the objective to provide

stability to the infrastructure established by the State owned Seed Corporations

and State Farms, and to give a boost to the modern seed industry by bringing it

under scientific principles. All seed-producing organizations, under Govt. or

private

control,

producing

certain

classes

of

seed

for

identified

Crops/States/Areas were eligible. All farmers growing the Foundation &

Certified seed crops in the identified States /Areas, who had offered the seed

crop for certification and had got registered with the concerned Certification

Agency were eligible for coverage.

16

AGRICULTURE INSURANCE

VIVEK COLLEGE OF COMMERCE

CHAPTER

FARM INCOME INSURANCE SCHEME (FIIS) - 2003

NAIS protects the farmers only against the yield fluctuations. The price

fluctuations are outside the purview of this scheme. Farmers income is a

cumulative function of yield and market prices. In other words, a bumper

harvest tends to bring down the market prices of grains and vice versa.

Therefore, despite normal production, farmers often fail to maintain their

income level due to fluctuations in market prices. To take care of variability in

both the yield and market price, the government introduced a pilot project, viz.

Farm Income Insurance Scheme (FIIS) during Rabi 2003-04 season.

The objective of the scheme was to protect not only the income of the farmer,

but also to reduce the government expenditure on procurement at Minimum

Support Price (MSP).

FIIS was implemented on the basis of homogeneous area approach in respect

of rice and wheat crops only. The scheme was compulsory for loanee farmers

and voluntary for non-loanee farme` The premium rates were actuarial,

determined for each State at the District level, to be subsidised by the Govt. of

India.

Claims would arise if the actual income (current yield X current market price)

was lower than the guaranteed income (7 years average yield X level of

indemnity [80% or 90%] X MSP).

The Scheme was implemented during 2 seasons only, viz. Rabi 2003-04 season

in 18 Districts of 11 States for wheat/rice, and Kharif 2004 season in 19

17

AGRICULTURE INSURANCE

VIVEK COLLEGE OF COMMERCE

Districts of 4 States for rice alone. In all, the scheme covered 4.15 lakh farmers

for an area of 4.02 lakh hectares for a Sum Insured (i.e. guaranteed income)

of 420crore, collecting a premium of 28.5 crore and paid claims of 28.75 crore.

From Rabi 1999 season, the CCIS was discontinued and replaced by the

National Agriculture

Insurance

Scheme

(NAIS),

which

is

being

implemented to date as the flagship yield based crop insurance program of

the Government.

Parallelly, the implementation and administration of crop insurance

schemes, which were being done by General Insurance Corporation of

India (GIC), was taken over by Agriculture Insurance Company of India

Ltd. (AIC) since its commencement of business from 1st April 2003.

18

AGRICULTURE INSURANCE

VIVEK COLLEGE OF COMMERCE

CHAPTER

ROLE OF VARIOUS AGENCIES:

(A). ROLE & RESPONSIBILITIES OF FINANCIAL

INSTITUTIONS (FIs) :

For the purpose of the Scheme, the Scheduled Institutions engaged in disbursing

SAO loans as per the relevant guidelines of NABARD / RBI will be reckoned

as Financial Institutions.

Each scheduled Commercial bank shall with concurrence of IA fix Nodal points

which would deal with IA on behalf of branches in the division / district / state.

The Nodal points for Commercial banks will be minimum one level above the

Branch office. The Nodal points for Cooperative banks will be DCC Banks and

those for RRBs, their Head Office.

Nodal Points Would Be Designated For Implementation And These Banks

Would Attend To The Following Functions:

1. On receipt of the communication on notification of crops and areas from

the State Govt./ UT, the Nodal banks will communicate the same to the

branch offices under their control.

2. The FIs would advance additional loan to Loanee farmers to meet

requirement of Insurance charges / premium as applicable upto the extent

of crop loan.

3. Each such Nodal point would submit crop-wise, defined area-wise,

monthly Crop insurance Declarations to the Office of IA, in the

19

AGRICULTURE INSURANCE

VIVEK COLLEGE OF COMMERCE

prescribed format, along with Insurance charges payable on all crop loans

coming under the purview of the Scheme in case of Loanee farmers and

based on Proposals received in case of other farmers.

4. The Apex FIs shall issue appropriate instructions to Nodal banks as well

as crop loan disbursing branches to ensure smooth functioning of the

Scheme.

5. For insurable crop loans disbursed under Kissan Credit Card (KCC), the

FIs shall maintain all controls and records as

20

AGRICULTURE INSURANCE

VIVEK COLLEGE OF COMMERCE

CHAPTER

OTHER RESPONSIBILITIES OF FIS WILL BE:

To educate the farmers on the Scheme features.

To guide the farmers in filing the proposal forms and collecting the

required documents.

Following the guidelines while disbursing crop loans and ensuring

proper end-use of loan disbursed.

To prepare the consolidated statements for Loanee and Non-Loanee

members, forwarding the same to the branch along with the premium

amount

Maintaining the records of proposal forms, other relevant documents,

statements for the purpose of verification by the district committee or

representative of the insurer.

21

AGRICULTURE INSURANCE

VIVEK COLLEGE OF COMMERCE

SPECIAL CONDITIONS FOR FIS / NODAL BANKS / LOAN

DISBURSING POINTS:

1. FIs will submit Crop Insurance Declarations to IA on monthly basis,

where sum insured is on the basis of amount of loan disbursed and within

one month time from cut-off date for receipt of proposals, where sum

insured is on any other basis.

2. Claims received by the Nodal points, will be remitted to individual

branches/PACS with all particulars within seven days and these

branches/PACS will in turn credit the Accounts of beneficiary farmers

within seven days. The list of beneficiary farmers with claim amount will

be displayed by the branch / PACS.

3. The IA will have access to all relevant records/ledgers at the Nodal

point/Branch/PACS at all times.

4. The IA will be provided with all the norms / guidelines relating to SAO

crop loan disbursements as formulated by RBI / NABARD. Any

5. amendments / simplification of procedures / norms from time to time will

be duly made available to IA by the concerned institutions. In the absence

of such communication, IA shall be free to not take cognisance of such

modifications.In case a farmer is deprived of any benefit under the

Scheme due to errors / omissions / commissions of the Nodal Bank

22

AGRICULTURE INSURANCE

VIVEK COLLEGE OF COMMERCE

6. In case a farmer is deprived of any benefit under the Scheme due to errors

/omissions/ commissions of the Nodal Bank/Branch/PACS, the concerned

institutions only shall make good all such losses.

7. If the farmer is adopting mixed cropping, the sum insured of a crop

should be on the basis of it's proportionate area.

23

AGRICULTURE INSURANCE

VIVEK COLLEGE OF COMMERCE

CHAPTER

(B). ROLE & RESPONSIBILITIES OF STATE GOVERNMENT

UT ADMINISTRATION:

1. The State Government / UT will notify crop wise notified areas and

premium rates as applicable (in case of commercial/horticultural crops)

well in advance of each crop season.

2. The State Government / UT administration would, in advance provide to

the IA, Unit Area-wise yield data of immediate past 10 years for all crops

notified under the Scheme.

3. To the extent possible, the State Government / UT administration would

notify smaller defined areas for various crops, keeping in mind that

smaller areas will be more homogeneous and would be more reflective of

all crop losses, including localized perils like hailstorm, landslide etc.

4. The State Government shall issue the requisite Notification and

communicate to all participating FIs during every crop season. The

Notification of the State Government may essentially contain the

following information:

i. Crops and Defined areas notified in various districts.

ii. Premium rates and subsidy, if and as applicable for various

groups of farmers and crops.

iii. The cut-off dates for collection of proposals and remittance

of premium with Crop Insurance Declarations to IA.

24

AGRICULTURE INSURANCE

VIVEK COLLEGE OF COMMERCE

5. The State / UT administration will release it's contribution to Corpus

Fund as per the scale and dates fixed by MOA, the Government of India.

6. The State / Union Territory administration would ensure that Crop

Estimation Surveys (CES) in general, and estimation procedures in case

of multiple picking crops in particular be strengthened in order to furnish

accurate estimates of yield. Further, the State / UT administration will

assist IA in assessing the extent of crop loss of individual insured farmers

due to operation of localised perils.

7. To set up various monitoring Committees as required.

8. The final Yield data in the standard format for all Unit Areas for notified

crops for the crop season will be furnished to IA within the stipulated

date.

9. In case, the State /UT administration fail to furnish yield data based on

requisite number of CCEs or fail to furnish yield data within the

stipulated date, responsibility of such claims, if any arising out of such

data will totally rest with State / UT administration.

10.The IA will be allowed unrestricted access to records of CCEs at grass

root / District / State level.

11.State Government / UT Administration shall set up District Level

Monitoring Committee (DLMC), headed by the District Magistrate. The

members will be District Agriculture Officer, DCCB, Lead Bank

representative and IA. The committee will monitor implementation of

25

AGRICULTURE INSURANCE

VIVEK COLLEGE OF COMMERCE

Scheme by providing fortnightly crop condition reports and periodical

reports on seasonal weather conditions, loans disbursed, extent of area

cultivated, etc. The DLMC shall also monitor conduct of CCEs in the

district.

1. As the Scheme is optional to Non-loanee farmers, adequate publicity

will be provided to ensure maximum coverage of farmers through all

means available at the disposal of State / UT administration

CHAPTER

(C).

ROLE

AND

RESPONSIBILITIES

OF

THE

IMPLEMENTING AGENCY (IA):

1. Implementing Agency of the Scheme.

2. The IA shall open separate Accounts to deal with Corpus Fund and also

premiums received under the Scheme.

3. Building up crop yield database and preparation of Actuarial premium

rates through a Professional agency.

4. Underwriting and Claims finalization.

5. Responsibility for claims to the extent mentioned in the Scheme.

6. Negotiating Re-insurance arrangement in the international market.

7. Co-ordination in organizing training, awareness, publicity programmes.

8. Providing returns / statistics to the Government of India.

26

AGRICULTURE INSURANCE

VIVEK COLLEGE OF COMMERCE

9. Examining and exploring possibilities of setting up separate agency for

implementation of the Scheme.

27

AGRICULTURE INSURANCE

VIVEK COLLEGE OF COMMERCE

CHAPTER

(D). DUTIES OF FARMERS:

1. As the Scheme is compulsory for all Loanee farmers availing SAO loans

for notified crops, it is mandatory for all Loanee farmers to insist on

coverage of all eligible loans (as per the Scheme provisions) under the

Scheme.

2. If the farmer is adopting mixed cropping, the proportion of different crops

in a mixed cropping will have to be compulsorily declared.

3. In respect of Non-loanee farmers, the Proposals will be accepted only

upto stipulated cut-off date, which will be decided in consultation with

StateGovernment/UTadmn.

The important duties in case of Non-loanee farmers are as follows:

o The farmer desiring coverage should have an Account in the

branch of the designated bank.

o The farmer must approach the designated branch / PACS and

submit the proposal form in the prescribed format.

o The farmer must provide documentary evidence in regard to the

possession of cultivable land (copy of the pass book, 7/12 / land

extract or land revenue receipt should be enclosed).

o The farmer must furnish area sown confirmation certificate, if

required.

28

AGRICULTURE INSURANCE

VIVEK COLLEGE OF COMMERCE

29

AGRICULTURE INSURANCE

VIVEK COLLEGE OF COMMERCE

CHAPTER

NATIONAL AGRICULTURE INSURANCE SCHEME

(Rashtriya Krishi Bima Yojana - RKBY)

Objectives

The objectives of the NAIS are as under:1.

To provide insurance coverage and financial support to the farmers in the

event of failure of any of the notified crop as a result of natural calamities,

pests & diseases.

2.

To encourage the farmers to adopt progressive farming practices, high

value inputs and higher technology in Agriculture.

3.

To help stabilise farm incomes, particularly in disaster years.

Salient Features Of The NAIS Scheme

1. Crops Covered

2 States & Areas to be Covered

3. Farmers to be Covered

4. Risks Covered & Exclusions

5. Sum Insured / Limit of Coverage

6. Premium Rates

7. Premium Subsidy

8. Sharing of Risk

9. Area Approach and Unit of Insurance

30

AGRICULTURE INSURANCE

VIVEK COLLEGE OF COMMERCE

10. Seasonality Discipline

11. Estimation of Crop Yield

12. Levels of Indemnity & Threshold Yield

13. Nature of Coverage and Indemnity

14. Procedure for Approval & Settlement of Claims

15. Financial Support Towards Administration & Operating (A&O) Expenses

16. Corpus Fund

17. Reinsurance Cover

18. Management of the Scheme, Monitoring and Review

19. Implementing Agency

20. Benefits Expected from Scheme

21. Operational Modalities

31

AGRICULTURE INSURANCE

VIVEK COLLEGE OF COMMERCE

CHAPTER

GRIEVANCE REDRESSAL POLICY [GRP]

I. REGULATORY REQUIREMENT

According to Section 5 of the Insurance Regulatory and Development Authority

(Protection of policyholders' interests) Regulations 2002, every insurer shall

have in place proper procedures and effective mechanism to address complaints

and grievances of policyholders, efficiently and with speed.

II. DEFINITIONS

1. 'Grievance' shall mean any written communication by a Complainant that

expresses dissatisfaction about an action or lack of action by, or about the

standard of service of, the Company and/or its representative, in relation to

his/her insurance coverage by the Company.

Illustrations: Policy issuance (e.g. non-issuance, delay), Premium refund (e.g.

admissibility, quantum, delay), Claims (e.g. admissibility, quantum, delay)etc.

2. 'Company' shall mean Agriculture Insurance Company of India Limited

[AIC]

3. 'Complainant' shall mean any policyholder (including legal heirs, assigns, and

authorized representatives) who has a Grievance.

32

AGRICULTURE INSURANCE

VIVEK COLLEGE OF COMMERCE

4. 'Redressal' shall mean the final disposal of the Grievance through

communication to the Complainant (in case of non-redressal, stating reasons for

the same).

5. 'Regulator' shall mean the Insurance Regulatory and Development Authority

[IRDA].

6. 'Working Day' shall mean any day (other than Saturday, Sunday or Public

Holiday) on which the Company is open for business.

7. 'Week' shall mean consecutive seven Working Days.

III. GRIEVANCE REDRESSAL SET-UP OF AIC

1. Chief Grievance Redressal Officer [CGRO] - a designated Officer at HO, as

the representative of the Company for its Grievance Redressal Policy [GRP]

2. Grievance Redressal Officer [GRO] - a designated Officer at HO and each

RO, as the implementing officer of GRP at the respective office

3. Grievance Redressal Register [GRR] - in the prescribed format to keep track

of the Grievances and their Redressal, to be maintained by each designated

GRO at his respective office.

33

AGRICULTURE INSURANCE

OFFI

OFFIC

OFFIC

CE

ER

HO

LEVEL

NOT

CGR

O

VIVEK COLLEGE OF COMMERCE

RESPONSBILITIES

NOMINATIN

GG

AUTORITY

Representative of the Company CMD

BELO

for its

Grievance Redressal

Policy [GRP]

Appellate Authority for the

Grievance cases.

To apprise the Board and

SCALE

VI

other

Authorities

about

the

Company's GR

GRO

HO

NOT

Implementation and

BELO

compliance of

W IV

the Grievance Redressal Policy at the

CGRO

respective office. To report to CGRO

periodically about the GR status at

the

respective office.

RO

ANY

To suggest/recommend to CGRO,

OFFIC

Systemic amendments, if any, with a

ER

view to

minimize the incidence of

34

AGRICULTURE INSURANCE

VIVEK COLLEGE OF COMMERCE

CHAPTER

V. GRIEVANCE REDRESSAL PROCEDURE

1. A Grievance may be communicated by the Complainant to the Company

[GRO] in writing, through post, e-mail, fax, personal submission, etc. In case

of personal submission, a receiving signature is necessary.

2. Upon receipt of a Grievance, the GRO shall enter the details thereof in the

Grievance Redressal Register [GRR].

3. Within 5 (five) Working Days of receipt of a Grievance, an Acknowldgement

shall be sent by the GRO to the Complainant, containing details of the GRO

(name, designation, contact), Grievance (reference no., remarks, if any), and

Redressal (set-up & procedure, AND, estimated Redressal time/finalRedressal).

4. Effort should be made by GRO to redress every Grievance within 5 (five)

Working Days from the date of its receipt. If the same is achieved, it shall be

communicated to the Complainant in the Acknowledgement itself.

5. If the Grievance has not been redressed within 5 (five) Working Days from its

receipt, the Acknowledgement shall mention the estimated time limit of

Redressal (not exceeding 4 (four) Weeks from receipt).

6. If the Grievance has not been redressed by the end of 4 (four) Weeks of its

receipt, the GRO shall send to the Complainant a further letter informing the

reasons for such delay and the further estimated time limit (not exceeding 8

(eight) Weeks from receipt) for Redressal.

35

AGRICULTURE INSURANCE

VIVEK COLLEGE OF COMMERCE

7. If the Grievance has still not been redressed at the level of the GRO by the

end of 8 (eight) Weeks of its receipt, the matter can be escalated to Appeal by

the Complainant before the CGRO.

36

AGRICULTURE INSURANCE

VIVEK COLLEGE OF COMMERCE

CHAPTER

VI. APPEAL

1. The Appellate Authority under GRP shall be the CGRO.

2. A Complainant may escalate the Grievance to Appeal in the following

Circumstances:

1. If the Complainant has not received any of the mandated

communiqus (as

3. Per clauses 3 and 6 of Section V) within 2 (two) Weeks of the mandated

time

4. Limits. b) If the Grievance has not been redressed at the level of the GRO

by the end of 8 (eight) Weeks of its receipt.

5. c) If the Complainant is not satisfied with the Redressal of Grievance by

theGRO.

6. An Appeal can be preferred in writing within 12 (twelve) Weeks from the

date of communication of the Grievance to the Company. It is abundantly

clarified here that beyond this time limit the Complainant shall lose his

right to Appeal, and the Grievance shall be deemed to have been closed.

7. The Appellate Authority (CGRO) shall decide the Appeal (and thus close

the Grievance) within 4 (four) Weeks of receipt of Appeal (in case of non6 Redressal, stating reasons for the same). This final decision shall be

communicated to the Complainant by the CGRO.

8. The decision of the Appellate Authority (CGRO) shall be final and shall

close the Grievance. To this end, the Appellate Authority shall be guided

by the principles of natural justice, fair play and equity while deciding the

Appeal.

9. Any Grievance escalated to Appeal shall be automatically (online)

reported to the Regulator through integration of the Company's IT system

with that ofthe Regulator. Till such time as a suitable IT system is

37

AGRICULTURE INSURANCE

VIVEK COLLEGE OF COMMERCE

developed, the CGRO shall periodically report to the Regulator the

pending Appeal cases.

10.

11.

38

AGRICULTURE INSURANCE

VIVEK COLLEGE OF COMMERCE

CHAPTER

VII. FINAL REDRESSAL AND CLOSURE OF GRIEVANCE

1. A Grievance shall be treated as finally redressed and/or closed in any of

thefollowing circumstances:

a) Where the Complainant has indicated in writing, his/her acceptance of the

Company's Redressal of Grievance.

b) Where the Complainant has not preferred an Appeal within 12 (twelve)

Weeks from the date of communication of the Grievance to the Company.

c) Where the Appeal decision has been communicated to the Complainant by

the CGRO.

2. The final Redressal and closure of Grievance shall be communicated to the

Complainant by the GRO concerned (in Appeal cases, by the CGRO).

39

AGRICULTURE INSURANCE

VIVEK COLLEGE OF COMMERCE

CHAPTER

VIII. REVIEW AND REPORTING

1. The GRO shall periodically submit an analytical report to the CGRO in a

prescribed format (prescribed by CGRO from time to time), in respect of

Grievance Redressal status.

2. The GRO may suggest/ recommend to the CGRO, systemic amendments, if

any, with a view to minimizing the incidence of Grievance.

3. The CGRO shall periodically review the Grievance Redressal procedure,

reports submitted by the GRO, cases decided by various Consumer Fora,

Ombudsman and other judicial Bodies, in order to improve

a) The Grievance Redressal Policy of the Company

b) The process, systems & activities of the Company to reduce the incidence

ofthe Grievance.

40

AGRICULTURE INSURANCE

VIVEK COLLEGE OF COMMERCE

41

AGRICULTURE INSURANCE

You might also like

- Crop InsuranceDocument56 pagesCrop InsuranceMaridasrajanNo ratings yet

- IC 71 Agricultural InsuranceDocument411 pagesIC 71 Agricultural InsuranceJaswanth Singh RajpurohitNo ratings yet

- Crop Insurance in India ReportDocument8 pagesCrop Insurance in India ReportMaridasrajanNo ratings yet

- Working and Progress of Life Insurance Corporation of IndiaDocument21 pagesWorking and Progress of Life Insurance Corporation of IndiaarcherselevatorsNo ratings yet

- Awareness of Insurance in INDIADocument62 pagesAwareness of Insurance in INDIAJaikumarNo ratings yet

- Kotak Life Insurance Report on Products, Marketing Strategies and Customer BehaviourDocument61 pagesKotak Life Insurance Report on Products, Marketing Strategies and Customer BehaviourDivya SharmaNo ratings yet

- Lic Final ReportDocument109 pagesLic Final ReportAbhisek BanerjeeNo ratings yet

- Summer PROJECT Report: Bajaj AllianzDocument54 pagesSummer PROJECT Report: Bajaj AllianzChirag Mittal50% (2)

- Minor Project Report On Life Insurance Corporation of IndiaDocument59 pagesMinor Project Report On Life Insurance Corporation of IndiaKeshav Maheshwari100% (3)

- Crop Insurance in India (After Rectification) FinalDocument73 pagesCrop Insurance in India (After Rectification) Finalprayas sarkarNo ratings yet

- Insurance Sector in INDIADocument61 pagesInsurance Sector in INDIAAnkita JoshiNo ratings yet

- Competitive Study of Health Insurance Schemes in IndiaDocument9 pagesCompetitive Study of Health Insurance Schemes in IndiaMukesh Chauhan100% (1)

- Ijser: The Role of Insurance in Development of Economy in IndiaDocument12 pagesIjser: The Role of Insurance in Development of Economy in Indiaanurag edwardNo ratings yet

- Reliance Life Insurence Projected by Sudhakar Chourasiya MaiharDocument74 pagesReliance Life Insurence Projected by Sudhakar Chourasiya Maihars89udhakar100% (3)

- LicDocument55 pagesLicankitadeb33% (3)

- Micro Insurance in IndiaDocument22 pagesMicro Insurance in IndiaArun Guleria100% (3)

- ProjectDocument60 pagesProjectKhushboo SinghNo ratings yet

- New Black Book General Insurance 2017Document69 pagesNew Black Book General Insurance 2017Siddhesh VarerkarNo ratings yet

- Praful ProjectDocument63 pagesPraful Projectvikas yadavNo ratings yet

- Insurance ProjDocument20 pagesInsurance ProjMahesh ParabNo ratings yet

- Financial Analysis of Future Generali Life InsuranceDocument56 pagesFinancial Analysis of Future Generali Life InsurancesuryakantshrotriyaNo ratings yet

- Motor Policy With Reference To New India Assurance Company LTDDocument70 pagesMotor Policy With Reference To New India Assurance Company LTDkevalcool2500% (1)

- Customer Satisfaction Insurance Products of ICICI PrudentialDocument71 pagesCustomer Satisfaction Insurance Products of ICICI Prudentialkarthik_shabby15No ratings yet

- Insurance Promotion StudyDocument61 pagesInsurance Promotion StudyAnkit Jain100% (1)

- Reliance Life Insurance ReportDocument116 pagesReliance Life Insurance ReportTimothy Brown100% (1)

- Mba Insurance Black BookDocument59 pagesMba Insurance Black BookleanderNo ratings yet

- Research On Impact of Covid On Life Insurance SectorDocument89 pagesResearch On Impact of Covid On Life Insurance SectorShivani KambliNo ratings yet

- ICICI Prudential Life Insurance Vs LIC PriDocument53 pagesICICI Prudential Life Insurance Vs LIC PriPriya Aggarwal100% (2)

- Executive Summary: M.S.R.C.A.S.C BangaloreDocument72 pagesExecutive Summary: M.S.R.C.A.S.C BangaloreSubramanya Dg100% (2)

- Summer Internship ReportDocument32 pagesSummer Internship ReportRaghav SinglaNo ratings yet

- LIC Customer SatisfactionDocument51 pagesLIC Customer Satisfactionnikunj_shahNo ratings yet

- MCOM-I: Introduction to Life Insurance in IndiaDocument40 pagesMCOM-I: Introduction to Life Insurance in Indiakrittika03No ratings yet

- LIC Investment ManagementDocument179 pagesLIC Investment ManagementHarshitNo ratings yet

- Insurance Project On ULIP-K JAINDocument66 pagesInsurance Project On ULIP-K JAINkhushboo_jain100% (1)

- Project Report On Health Insurance by Satadru Biswas 2010 2012Document45 pagesProject Report On Health Insurance by Satadru Biswas 2010 2012Archana SinghNo ratings yet

- Project Report On Field Study in Insurance SectorDocument86 pagesProject Report On Field Study in Insurance Sectorsunny_choudhary@hotmail.com100% (1)

- MINOR PROJECT On InsuranceDocument53 pagesMINOR PROJECT On InsurancedivyaNo ratings yet

- Sonal Trivedi PDFDocument201 pagesSonal Trivedi PDFAshish RajputNo ratings yet

- Micro Insurance 2Document61 pagesMicro Insurance 2salmaNo ratings yet

- Micro Insurance FinalDocument88 pagesMicro Insurance Finaldeepak100% (1)

- A Project Report On Comparative Study On Unit Linked Insurance Policy vs. Mutual FundDocument112 pagesA Project Report On Comparative Study On Unit Linked Insurance Policy vs. Mutual FundnirajvasavaNo ratings yet

- Finacial Performance of Life InsuracneDocument24 pagesFinacial Performance of Life InsuracneCryptic LollNo ratings yet

- Study of Home Loans at LIC Housing Finance LtdDocument66 pagesStudy of Home Loans at LIC Housing Finance LtdOmkar Chavan100% (1)

- Insurance Sector of IndiaDocument66 pagesInsurance Sector of IndiaVijay94% (36)

- Project On Kotak Life InsuranceDocument50 pagesProject On Kotak Life Insurancesonyinn905833% (3)

- Motor Vehicle Insrance - Merlyn CoelhoDocument61 pagesMotor Vehicle Insrance - Merlyn CoelhoMerlyn CoelhoNo ratings yet

- Comparative Study of The Products of HDFC Standard Life Insurance Company and MetLife India Insurance CompanyDocument58 pagesComparative Study of The Products of HDFC Standard Life Insurance Company and MetLife India Insurance CompanyMayank Mahajan100% (2)

- Role of Insurance in India's Economic GrowthDocument4 pagesRole of Insurance in India's Economic Growth538Mansi ChaurasiaNo ratings yet

- InsuranceDocument6 pagesInsuranceGautam PareekNo ratings yet

- CROP INSURANCE ANALYSISDocument9 pagesCROP INSURANCE ANALYSISRAVI VARMANo ratings yet

- Crop Insurance Schemes HistoryDocument10 pagesCrop Insurance Schemes HistorySejal PriyaNo ratings yet

- Research Paper-1 farmers livelihoodDocument16 pagesResearch Paper-1 farmers livelihood0799ayushNo ratings yet

- A Major Project On Evaluation of NationalDocument12 pagesA Major Project On Evaluation of NationalTarun gargNo ratings yet

- Crop Insurance PDFDocument3 pagesCrop Insurance PDFAnonymous T5LcHCNo ratings yet

- Crop Insurance History and Schemes in IndiaDocument7 pagesCrop Insurance History and Schemes in IndiaNEERAJA UNNINo ratings yet

- Unit 10Document21 pagesUnit 10ChandrakantBangarNo ratings yet

- Untitled DocumentDocument4 pagesUntitled DocumentR Anantha KrishnanNo ratings yet

- Vaikunth Mehta National Institute of Co-Operative Management, PuneDocument13 pagesVaikunth Mehta National Institute of Co-Operative Management, PuneNilesh ThoraveNo ratings yet

- Crop Insurance PDFDocument21 pagesCrop Insurance PDFArafat RahmanNo ratings yet

- Public Sector Insurance Watermark 27Document6 pagesPublic Sector Insurance Watermark 27zoroNo ratings yet

- Sage Pastel Partner Courses...Document9 pagesSage Pastel Partner Courses...Tanaka MpofuNo ratings yet

- Motorcycle Industry Draft Report Final VersionDocument60 pagesMotorcycle Industry Draft Report Final VersionMuneer Gurmani0% (1)

- 048 Barayuga V AupDocument3 pages048 Barayuga V AupJacob DalisayNo ratings yet

- Ministry of Transportation Audit Finding DetailsDocument6 pagesMinistry of Transportation Audit Finding DetailsAmalia Resky100% (1)

- PEA144Document4 pagesPEA144coffeepathNo ratings yet

- Living To Work: What Do You Really Like? What Do You Want?"Document1 pageLiving To Work: What Do You Really Like? What Do You Want?"John FoxNo ratings yet

- Det Syll Divisional Accountant Item No 19Document2 pagesDet Syll Divisional Accountant Item No 19tinaantonyNo ratings yet

- Max232 DatasheetDocument9 pagesMax232 DatasheetprincebahariNo ratings yet

- OutSystems CertificationDocument7 pagesOutSystems CertificationPaulo Fernandes100% (1)

- PEFINDO Key Success FactorsDocument2 pagesPEFINDO Key Success Factorsanubhav saxenaNo ratings yet

- Operations ManagementDocument300 pagesOperations Managementsrcool100% (1)

- Solved in A Manufacturing Plant Workers Use A Specialized Machine ToDocument1 pageSolved in A Manufacturing Plant Workers Use A Specialized Machine ToM Bilal SaleemNo ratings yet

- Icade Annual Report 2012 Reference DocumentDocument470 pagesIcade Annual Report 2012 Reference DocumentIcadeNo ratings yet

- Tourism and Hospitality FlyerDocument2 pagesTourism and Hospitality FlyerHarsh AhujaNo ratings yet

- Cyber Security Assignment - Patent BasicsDocument6 pagesCyber Security Assignment - Patent BasicsTatoo GargNo ratings yet

- GA3-240202501-AA2. Presentar Funciones de Su OcupaciónDocument2 pagesGA3-240202501-AA2. Presentar Funciones de Su OcupaciónDidier Andres Núñez OrdóñezNo ratings yet

- Bills of ExchangeDocument31 pagesBills of ExchangeViransh Coaching ClassesNo ratings yet

- Moneyback and EndowmentDocument14 pagesMoneyback and EndowmentSheetal IyerNo ratings yet

- Intership ReportDocument81 pagesIntership ReportsunnyNo ratings yet

- VivithaDocument53 pagesVivithavajoansaNo ratings yet

- MIS - Systems Planning - CompleteDocument89 pagesMIS - Systems Planning - CompleteDr Rushen SinghNo ratings yet

- Ba206 Quiz1 ch1 3 Answers 2007Document4 pagesBa206 Quiz1 ch1 3 Answers 2007Lonewolf BraggNo ratings yet

- Global Marketing Test Bank ReviewDocument31 pagesGlobal Marketing Test Bank ReviewbabykintexNo ratings yet

- Sample Income StatementDocument1 pageSample Income StatementJason100% (34)

- 7 Steps To Eliminate DebtDocument4 pages7 Steps To Eliminate Debttiongann2535No ratings yet

- SHELF CORP SECRETS 3 FLIPPING CORPORATIONSDocument24 pagesSHELF CORP SECRETS 3 FLIPPING CORPORATIONSRamon RogersNo ratings yet

- Finance TestDocument3 pagesFinance TestMandeep SinghNo ratings yet

- Internship PresentationDocument3 pagesInternship Presentationapi-242871239No ratings yet

- Stocks&Commodities S&C 03-2017Document64 pagesStocks&Commodities S&C 03-2017Edgar Santiesteban Collado50% (2)

- AMUL Market AnalysisDocument59 pagesAMUL Market AnalysisHacking Master NeerajNo ratings yet