Professional Documents

Culture Documents

Mutual Fund

Uploaded by

Simmi KhuranaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Mutual Fund

Uploaded by

Simmi KhuranaCopyright:

Available Formats

International Journal of Engineering Technology, Management and Applied Sciences

www.ijetmas.com October 2014, Volume 2 Issue 5, ISSN 2349-4476

AN EMPIRICAL STUDY ON IMPACT OF FII AND OTHER

STOCK EXCHANGES VOLATILITY ON BSE STOCK

EXCHANGE VOLATILITY

Dr. Rakesh Kumar*

Miss Sarita Gautam**

* Dr. Rakesh Kumar: Assistant Professor, Department of Accountancy & Law Faculty of Commerce, Dayalbagh

Educational Institute, Deemed University, Dayalbagh Agra.

**Miss Sarita Gautam: Research Scholar, Department of Accountancy & Law Faculty of Commerce, Dayalbagh

Educational Institute, Deemed University, Dayalbagh Agra.

ABSTRACT

Purpose- Main purpose of this research paper is to measure impact of FII and other stock exchange volatility

on the BSE stock Exchange volatility.

Design and Methodology- In this paper various factors are considered under scope of the study which are

BSE Sensex, FII (Foreign Institutional Investment), Relationship among different foreign stock exchange

which are from the UK, USA and Japan. For the purpose of analyzing the data a period of 3 months (i.e. from

1 April 2014 to 30 June 2014) has been taken into consideration. In order to analyze the factors this study is

based on the Secondary data. The secondary data have been collected from Web site, BSE stock exchange

index collected from - www.moneycontrol.com and www.bseindia.com, data on investment (FII), have been

collected from ministry of finance, dipp.nic.in, sebi.gov.in and fipbindia.com, data of global indexes will be

collected from NASDAQ, London stock exchange & NIKKEI Websites and other information collected from

other sources of secondary data will be journals, books, newspapers, magazines and news. The appropriate

statistical techniques as correlation model, multivariate regression model etc. have been used for analyzing

the data.

Finding and Conclusion- This study have been found out that there is a close and direct relationship of the

BSE Sensex with the FTSE and NASDAQ Stock Exchange as well as there is inverse relationship of the BSE

Sensex with the FII and Nikkei.

Practical Implication- Through this study researcher can say that by analyzing these factors we can predict

the movement of the BSE Sensex. This study will helpful to the investor to predict the BSE stock movement

on the basis of other factors. And it will in the minimization of the risk and betterment of return for the

investor who invest in the secondary capital market or trade in the equity share.

Key Words - BSE Sensex, FII, FDI, Nikkei, FTSE, NASDAQ.

Introduction:

This paper mainly based on the empirical study of such factors which affect the volatility of the different

Indian Stock exchange. Volatility refers to fluctuation in the purchase and sale of shares in the stock market.

When the stock market value increases and then decreases for the next moment, and this cycle goes

continuously, it is called volatility in the market. In India there are various stock exchange indices. There are

23

Dr. Rakesh Kumar, Miss Sarita Gautam

International Journal of Engineering Technology, Management and Applied Sciences

www.ijetmas.com October 2014, Volume 2 Issue 5, ISSN 2349-4476

many factors which affect the companies who are listed in different Indian Stock Exchanges and by these

factors there is a deviation in the share prices. The growth of any country depends on the different factors.

Under this paper factors are as follows FII,

Global Sensex information NIKKEI, FTSE, NASDAQ etc.

In this study the BSE stock exchange of India selected as our main parameter on which the whole research

report based on it.

BSE Bombay Stock Exchange:

BSE is the Bombay Stock Exchange which is located on Dalal Street, Mumbai, Maharashtra India. It is

considered as 10th largest Stock market in the world with Nifty as of May 2014. It was established in the year

1875, formerly known as Bombay Stock Exchange Ltd, it is the oldest as well as a leading stock exchange of

India. It is also one of the Asias first stock exchanges. BSE provided the platform to the corporate sector for

raising capital efficiently. It mainly deals in equity, debt instrument, derivatives and mutual funds. It

calculates the amount in total market capitalization basis. BSE best popular equity index is S&P BSE

SENSEX. More than 5000 companies are listed in the BSE making it worlds no.1 exchange. It is having the

permanent recognition from Securities Contract Regulation Act, 1956 since 1875.The S&P BSE SENSEX is

also known as BSE 30 and S&P Bombay Stock Exchange Sensitive Index. This is the free float market

weighted stock index. There is 30 well established and financially sound companies are listed in BSE. These

30 major companies are the representative of the various industrial sectors of the Indian economy, from which

some of them are largest and most actively traded stocks. The S&P BSE Sensex is the beat of the native

Indian Stock Market, since 1 January 1986. On 1 April 1979, 100 are taken as the base value of the BSE

Sensex and 1978-79 is taken as the base year. BSE launched Dollex 30 on July 2001, it deals in the Dollar.

Due to Recessionary condition BSE market capitalization fell from 49% to 25% from 2008-2012.

BSE linked with the Standards and Poors and it becomes S&P BSE Sensex on 19 February 2013.

Sensex reached to the higher value than the Hang Seng index of Hong Kong for the first time on 13

March 2014.

In the current position On 24 March 2014- it reaches to the 22000, On 9 May 2014 it crossed the level

of 23000, On 13 May 2014 it reaches to the 24000 because of sustained capital inflows by FII and due

to exit poll results that NDA (BJP) form the Government.

On 16 May 2014 it crossed 25000 for the first time due to result of election have been declared and

NDA wins with the great difference.

Because of reformatory Budget on 7 July 2014 the value of Sensex goes to 26000.

FII (Foreign Institutional Investor):

Foreign Institutional investor refers to those institutions that made the investment from a foreign country for

the purpose of earning the highest profit , these institutions mainly deals in securities, real properties and

various assets and these firms are established outside India. After LPG (Liberalization privatization

Globalization) policy 1991, it gives the opportunity for the investment in the form of FII on the September

1992. Foreign Institutional Investment has received the portfolio investment in equities since 1993. Securities

and Exchange Board of India (SEBI) is the regulating authority for the FII investment, all Foreign Institutional

Investor must register with the SEBI.

FTSE 100:

FTSE 100, FTSE or Footsie is the name of the FTSE 100 Index, which is executed by the high capitalization

base London Stock Exchange. This FTSE 100 is regulated by the UK company law and it is widely tradable

stock exchange in the world. FTSE denotes the Financial Times Stock Exchange. This index started in the 3

24

Dr. Rakesh Kumar, Miss Sarita Gautam

International Journal of Engineering Technology, Management and Applied Sciences

www.ijetmas.com October 2014, Volume 2 Issue 5, ISSN 2349-4476

January 1984 with the base level of 1000. On 30 December 1999 it was reached at the highest level 6950.6 but

due to the recessionary condition financial crisis was going on from 2007-2010 because of this it was reached

at the lower level 3500 in 2009, From 2011 to nowadays it was still recovering and on 14 May 2014 it was

reached at 6894 which was highest since 1999.

NIKKEI 225:

Nikkei, the Nikkei Index or the Nikkei Stock Average is the different names of the NIKKEI 225 (Nikkei

Heikin Kabuki 225). Nikkei 225 governs by the Tokyo Stock Exchange. Since 1950, it is measured on a daily

basis by the Nihon KeizaiShimbum (Nikkei) newspaper. Those factors which affected the Nikkei index are

revised in once in a year and it is based on the price weighted index. From 1975 to 1985, it is also known as

the Nikkei Dow Jones Stock Average because of recently Nikkei is the widely tradable average in the

Japanese equity market.

NASDAQ 100:

NASDAQ 100 is the stock market comprises of the 102 stocks which are issued by the 100 largest listed nonfinancial companies. It is based on modified capitalization weighted index. These stock weights are

measured on the basis of market capitalization which included the certain rules that create the impact over

largest components. This index determines on the basis of exchange and it not only included the U.S. based

companies, means it also included the other than U.S. companies. Financial companies work as a separate

index in U.S. means NASDAQ does not comprise these financial indices. Because of these situations this

NASDAQ 100 criteria differ from the Dow Jones industrial average and S&P 500. On 31, January, 1985 the

NASDAQ 100 is established by the NASDAQ, for the purpose of the improvement in the profit of the New

York Stock Exchange.

Review of Literatures:

1) Roger D. Huang, Ronald W. Masulis, and Hans R. Stoll. Energy shocks and financial Markets

{1996} - They examine the contemporaneous and lead-lag correlations between daily returns of oil future

contracts and stock returns.There is a striking lack of Correlation between stock returns, other than oil

company returns, and oil futures returns.

2) ValentinaCorradi, Walter Distaso& Antonio Mele Macroeconomic Determinants of Stock Market

Volatility and Volatility Risk-Premiums {Oct. 2010} - In this paper they analyze the , Which type of

cyclical properties affected on stock volatility and risk premiums, for this purpose they develop the noarbitrage model and market requires the risk bearing capabilities for the volatility. Business cycle factors

are not creating the major impact over the level of stock market volatility.

3) Muhammad IrfanJavaidAttari, LuqmanSafdar The Relationship between Macroeconomic

Volatility and the Stock Market Volatility: Empirical Evidence from Pakistan {2013} - They used the

time series analysis and (EGARCH) Exponential Generalized Autoregressive Conditional

Heteroscedasticity analysis to identifying the macroeconomic variables and its impact over Pakistan Stock

Exchange. They have taken the Interest rates, inflation rates and gross domestic product as macroeconomic

variable. As a result, this study shows that there was a greater influence of the macroeconomic

variablesover Karachi stock market. Pakistan stock market is highly volatile, so the government must pay

attention towards it to make it less volatile.

4) Puja Padhi Stock Market Volatility in India: A Case of Select Scripts {Jan. 2006} - In this paper she

examines the relationship with the individual script with the combined indices and also identifies the

volatility between them. She taken five aggregate indices as a sample and individual companies are

determine by the GARCH model on (1, 1) basis. BSE 200 shows the highest ARCH coefficient and CNX

Nifty Junior shows the lowest ARCH coefficient.

25

Dr. Rakesh Kumar, Miss Sarita Gautam

International Journal of Engineering Technology, Management and Applied Sciences

www.ijetmas.com October 2014, Volume 2 Issue 5, ISSN 2349-4476

5) Pramod Kumar Saxena and KirtiKhanna Impact of Quarterly Results on Sensex and Market

Volatility - An Empirical Research {Mar. 2012} - In this paper they analyze that BSE AUTO and BSE

Teck have affected the Sensex widely as the coefficient of determination was .66 and .74 respectively.66 %

and 74% changes occurred in Sensex movements during the announcements of results was due to the

changes in the BSE AUTO and BSE Teck. This study finds out that low and moderate positive degree of

correlation as BSE FMCG, BSE Bankex and BSE IT.

6) Dr. Aurangzeb Factors Affecting Performance of Stock Market: Evidence from South Asian

Countries {Sep. 2012}-This study identifies the factor affecting performance of stock market in South

Asian Countries and he also tries to find out the long run relationship between the variables. Regression

results indicate that foreign direct investment and exchange rate have significant positive impact on

performance of stock market in south Asian countries while; interest rate has negative and significant

impact on performance of stock market in south Asia. Results also indicate the negative but insignificant

impact of inflation on stock market performance in south Asia.

7) Saurabh Singh, Dr. L. K. Tripathi And AnupamaPardesi FII Flow and Indian Stock Market: A

Causal Study {Jan. 2014}- This paper tries to Examine the relationship of FIIs with the performance of

Indian stock market and its impact on the performance of Indian stock market after 2007. It finds out that

there is by-directional causality between FII and Nifty as well as FII movement and SENSEX. P value is 0

which shows Nifty and Sensex returns do not cause FII purchase and FII sales. P value is .001 which is less

than 0.05 suggest that FII movements cause changes in the values of Nifty and Sensex. They use the

Granger causality test & Dickey-Fuller test.

Need of the Study:

Stock market plays a vital role in the growth of any country and also it plays a significant role in the

development of the industry. That person who wants to earn maximum profit from the stock market so for that

stock market is the best place from where he invests his money and earns high profit in less duration. Stock

market performance and industry growth and stability of the economy are related to each other. If stock

market performance goes better than its stronger and smoothen the industrial growth and it shows the

stability in the economy. If the stock market prices are falling down than it shows the fluctuation in industrial

growth and instability in the economy of the country.

In the various reviews of literatures Number of studies conducted in USA, UK, and South Asian

countries to find out the correlation between various variables and the fluctuations of stock prices.

Previous studies mainly well-thought-out the only one factor like- FII, Interest rate. The findings of

these studies show that with the minor variation different variables have the significant impact on

stock prices. Therefore, these results helped investors to make better predictions about the movement

of stock prices, whenever if these fundamentals change their position, then the value of shares will

also change.

The researcher mainly focuses on the Indian economic factor and stock exchange index of India.

Furthermore, it considered the various factors like- FII, relationship with the different foreign indexes.

Objective of the Study:

The objective is:

To measure the selected factors affected on the stock exchange index.

Research Design and Methodology:

Research design& methodology is the back bone of any research study. The researcher proposes the

following research procedure for this study:

26

Dr. Rakesh Kumar, Miss Sarita Gautam

International Journal of Engineering Technology, Management and Applied Sciences

www.ijetmas.com October 2014, Volume 2 Issue 5, ISSN 2349-4476

Scope of the study: In this study, those factors which affect the stock exchange index are considered in the

scope of study. These factors are BSE Sensex, FII (Foreign Institutional Investment), Relationship among

different foreign stock exchange which are from the UK, USA and Japan.

Duration of the study: For the purpose of analyzing the data a period of 3 months (i.e. from 1 April 2014 to

30 June 2014) has been taken into consideration.

Data collection: In order to identify the factors and analyze the factors this study is based on the Secondary

data. The secondary data has been collected from Web portals i.e. data related to various stock exchange

index collected from - www.moneycontrol.com and www.bseindia.com, data on investment (FII), has been

collected from ministry of finance, dipp.nic.in, sebi.gov.in and fipbindia.com, data of global indexes has been

collected from NASDAQ, London stock exchange & NIKKEI Websites and other information collected from

other sources of secondary data will be journals, books, newspapers, magazines and news.

Statistical Tools The appropriate statistical techniques as correlation model and multivariate regression

model have been used for analyzing the data.

Analysis of Data:

Multivariate Regression- Multiple Regression Analysis calculates the effect of two or more independent

variables over one dependent variable. It finds out the nature of the relationship. A multivariable or multiple

linear regression models would take the form

y=+x11+x22++xkk

y= BSE Sensex

= intercept k= No. of items

X1= FII, 1 = slope of FII (FOREIGN INSTITUTIONAL INVESTORS)

X2= FTSE 100 return, 2 = slope of FTSE 100

X3= Nikkei 225, 3 = slope of Nikkei 225

X4= Nasdaq 100, 4 = slope of Nasdaq 100

Here, my study dependent variable is BSE Sensex Return and Independent Variables are FTSE, FII, NIKKEI,

and NASDAQ.

Output Summary -Table No. 1

Model Summary

Model

R Square

Adjusted R Square Std. Error of the Estimate

.886a

.786

.769

575.189708

a. Predictors: (Constant), NASQ, FII, FTSE, NIKK

b. Dependent Variable: BSE

There is a high degree of coefficient correlation r= .88, which shows the positive and direct correlation,

means dependent and independent variables moves in same direction. In this model we can say that BSE

Sensex and FII, FTSE, NIKKEI, NASDAQ all are moving in the same direction. R square= .78 is the

coefficient of determination which gives explained variables out of total variables, means all these

independent variables affect the dependent variable up to 78%. R2 shows the explanatory power of the model.

This shows the 78% of the variations in the BSE Sensex is explained by these four independent factors these

27

Dr. Rakesh Kumar, Miss Sarita Gautam

International Journal of Engineering Technology, Management and Applied Sciences

www.ijetmas.com October 2014, Volume 2 Issue 5, ISSN 2349-4476

are NASDAQ, FII, FTSE, and NIKKIE. Adjusted R2 shows the purified value i.e. .769.Adjusted R2 ignored

the error value in the model. Standard error indicates the extent of error in our estimation of the value of the

dependent factor i.e. BSE SENSEX. Standard Error also defines the range in the series and also predict the

accuracy in the given data series.

Table No.2

ANOVA

Model

1

Sum of Squares

df

Mean Square

Sig.

Regression

6.427E7

1.607E7

48.563

.000a

Residual

1.753E7

53

330843.201

Total

8.180E7

57

a. Predictors: (Constant), NASQ, FII, FTSE, NIKK

b. Dependent Variable: BSE

In this table it can be seen that the significance level value= .00, at 5% level of significance, So here p < 0.05

which means our regression model is valid for analysis purpose. So, this multivariate regression model is

applicable and gives reliable results. F ratio is used for the analysis of null hypothesis. In this model the F

statistics is used to test the significance of R2 as equals to 48.563 which is significant as indicated by the p

value as given in the last column.

Explained Variance

F=

UnexplainedVraiance

The value of R is significant as indicated by the p value (.000) of F statistics as given in ANOVA table. This

table also shows the two variable linear model. Explained variance is also known as variance by regression

and unexplained variance is also known as the residual variance. Degree of freedom of explained variance are

(n-1), where n is equal to the no. of total variables, so, the (n-1) is the number of independent variables. Here,

numerator is 4 and denominator is 53 in the F ratio. Based upon this test we can say that regression is

significant and the dependent variables and the independent variables are correlated.

2

Table No.3

Coefficients

Model

Standardized

Unstandardized Coefficients Coefficients

Correlations

Zeroorder

Partial

Part

1 (Constant) -40486.203

Std. Error

Beta

6268.352

Sig.

-6.459

.000

FII

-.021

.078

-.017

-.265

.792

.121

-.036

-.017

FTSE

5.417

.987

.408

5.491

.000

.661

.602

.349

NIKK

-.941

.528

-.328

-1.781

.081

.622

-.238

-.113

NASQ

9.914

2.033

.936

4.876

.000

.771

.556

.310

a. Dependent Variable: BSE

28

Dr. Rakesh Kumar, Miss Sarita Gautam

International Journal of Engineering Technology, Management and Applied Sciences

www.ijetmas.com October 2014, Volume 2 Issue 5, ISSN 2349-4476

Unstandardized coefficient B= Beta value gives the slope value of the regression model and also defined how

much the Dependent Factor (BSE Sensex) dependent upon the Independent factors. Here, intercept and slope

values are -40486.203 and -.021,5.417, -.941, 9.914. Standardized B defined the volatility in itself series. The

estimated regression equation areY= +X11+X22+X33+X44

Y= -40486.20 -.021F+5.147FT-.941N+9.914NQ

P value = (.000) (.792) (.000) (.081) (.000)

F= FII, FT= FTSE, N= NIKKEI, NQ= NASDAQ

The above estimated regression equation indicates that the FII(Foreign Institutional Investor) and NIKKEI

Japan stock Exchange is negatively related with BSE Sensex due to its negative value of coefficient (-.021&.941). Similarly, the FTSE UK Stock Exchange and NASDAQ USA Stock Exchange are positively related to

the BSE Sensex as their coefficient shows the value 5.417 & 9.914. The result indicates that if the FII goes by

one unit than BSE Sensex goes down by .021 units while keeping the other factors constant. If the FTSE goes

up by one unit than BSE Sensex also goes up by 5.417 units.If NIKKEI goes up by one unit than BSE Sensex

goes down by .941 units. Similarly, if NASDAQ goes up by one unit than BSE Sensex also goes up by 9.914

units. The results indicate that the NASDAQ USA Stock Exchange and FTSE UK Stock Exchange

significantly influence the BSE Sensex movement in positive manner. The result indicates that FII and

NIKKEI gives insignificant and negative influence on the BSESensex. This level of significance examine by

the p value of FII (.792), FTSE (.000), NIKKEI (.081), NASDAQ (.000) which should be less than or equal to

alpha or level of significance which is assumed to be .05 in the present situation. The relative importance of

the independent variables is obtained by the absolute value of the standardized beta, it shows that the

NASDAQ relatively more important than the FTSE, NIKKIE, FII. This is useful for decision making and

future planning purpose.

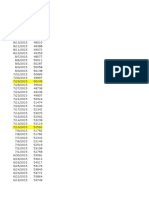

Diagrammatic Presentation:

29

Dr. Rakesh Kumar, Miss Sarita Gautam

International Journal of Engineering Technology, Management and Applied Sciences

www.ijetmas.com October 2014, Volume 2 Issue 5, ISSN 2349-4476

These graph mainly show that the trend among the variables are in increasing trend and all factors movement

goes in the same pattern.

Findings:

By analyzing various factors, researcher found that FII, NASDAQ, NIKKEI, AND FTSE have major

impact over BSE Sensex. There is an inverse relationship between Foreign Institutional Investor and

Nikkei with BSE Sensex Return. Means if FII increases than it decreases the BSE Sensex Return.

FII and BSE Sensex: Under Regression Model The B (slope value) of FII over BSE Sensex is

.021 means it creates inverse impact over BSE Sensex. Both data series are adverse in nature and

they are negatively volatile in nature. Negative Volatility is defined, standardized coefficient of

correlation. FII create impact over BSE through unstandardized coefficient which is .021.

FTSE 100 and BSE Sensex:- In the Regression model and Regression model shows that 54% data

of FTSE impacted over the BSE Sensex. 40% is volatile in nature.

NIKKEI 225 and BSE Sensex:- In the Regression model and Regression model shows that it

creates inverse effect to the BSE Sensex and 32% is volatile in nature.

30

Dr. Rakesh Kumar, Miss Sarita Gautam

International Journal of Engineering Technology, Management and Applied Sciences

www.ijetmas.com October 2014, Volume 2 Issue 5, ISSN 2349-4476

NASDAQ 100 and BSE Sensex:-In the Regression model and Regression model shows that 99%

data of NQ impacted over the BSE Sensex. 93% is volatile in nature. NASDAQ creates huge impact

over BSE Sensex.

Recommendations:

If we invest in FTSE AND NASDAQ it gives the positive return. So, we can suggest that create

more investment on BSE Sensex.

NIKKEI Japan stock exchange having the negative impact so, we can say that if we invest in BSE

Sensex so, it also gives the negative return.

FII also creates negative impact on the BSE market. Create investment on BSE Sensex when FII

gives positive impact.

Government should take the action for controlling the adverse situation.

More Indian companies should be listed on NASDAQ and FTSE stock exchange for accessing the

global capital.

Future prospects:

Here, only one Stock exchange taken as a dependent factor, for further analysis, we also add

NIFTY Stock Exchange with the BSE Sensex.

Year wise analysis of all these factors is also done for the further research.

Different stock markets are also taken as a sample for the further research or we can say that Block

wise analysis is also possible. Like- relationship with the BRICS stock exchange with the Indian

Scenario.

It is further divided in the Short term analysis basis or long term analysis basis. Like for short term

analysis daily basis FII inflow is taken and for long term yearly wise FDI data taken into

consideration.

Most of the investors must analyze these data to know the further movement of the Stock Market,

which is helpful in further investment and for getting more returns.

Through various statistical models further analysis also done, like- GARCH, ARIMA, ARMA,

ARCH and Other steps in Multiple Regression should be used for the further analysis.

Conclusion:

At last, we can say that this study examine the impact of various factors through Multivariate Regression

Analysis. This analysis defined the degree as well as relationships among the factors. Volatility of Stock

market changed very rapidly, so except these others factors should also consider for research work. FII and

Nikkei have an inverse relation whereas NASDAQ and FTSE have positive relations with the BSE SENSEX.

When investors are trading in secondary capital market in this case they should consider these studied factors

for the minimization of risk and increase the return.

References:

Saurabh Singh, L. K. Tripathi and AnupamaPardesi, FII Flow and Indian Stock Market: A Causal

Study Asian Journal of Research in Business Economics and Management Vol. 4, No. 1, (10 January

2014,) pp. 202-209. ISSN 2249-7307

Dr. Aurangzeb Factors Affecting Performance of Stock Market: Evidence from South Asian

Countries International Journal of Academic Research in Business and Social Sciences September

2012, Vol. 2, No. 9 ISSN: 2222-6990

31

Dr. Rakesh Kumar, Miss Sarita Gautam

International Journal of Engineering Technology, Management and Applied Sciences

www.ijetmas.com October 2014, Volume 2 Issue 5, ISSN 2349-4476

Pramod Kumar Saxena and KirtiKhanna Impact of Quarterly Results on Sensex and Market

Volatility - An Empirical Research Journal of Accounting & Finance, Vol. 26, No. 1, Oct 2011-Mar

2012 (ISSN 0970 -9029)

Huang, Roger D., Ronald W. Masulis, and Hans R. Stoll. Energy shocks and financial Markets

Journal of Futures Markets 16, no. 1 (1996): 1-27.

Attari, Muhammad IrfanJavaid, LuqmanSafdar, and M. B. A. Student. "The Relationship between

Macroeconomic Volatility and the Stock Market Volatility: Empirical Evidence from

Pakistan." Pakistan Journal of Commerce and Social Sciences 7.2 (2013): 309-320.

Puja Padhi STOCK MARKET VOLATILITY IN INDIA: A CASE OF SELECT SCRIPTS {Jan.

2006}- Indian Institute of Capital Markets 9th Capital Markets Conference Paper

Bibliography:

Research Methodology- Dr. Deepak Chawla and Dr. NeenaSondhi

Vikas publishing house pvt.ltd.

Statistics for business and economics- Dr. J S Chandan

Vikas publishing house pvt.ltd.

Webliography:

32

http://www.moneycontrol.com/indian-indices/s&p-bse-sensex-4.html

http://en.wikipedia.org/wiki/

http://www.bluechiplist.com/

www.trandingeconomics.com

www.hkimr.org

www.ssrn.com

http://www.investing.com

http://www.ftse.com/

http://indexes.nikkei.co.jp

www.bseindia.com

www.nasdaq100.com

Dr. Rakesh Kumar, Miss Sarita Gautam

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Ajit's Risk Tolerance and Portfolio DiversificationDocument1 pageAjit's Risk Tolerance and Portfolio DiversificationSimmi Khurana0% (2)

- Personality Traits and Risk AttitudeDocument5 pagesPersonality Traits and Risk AttitudeSimmi KhuranaNo ratings yet

- Project FormulationDocument6 pagesProject FormulationSimmi KhuranaNo ratings yet

- Behavioral FinanceDocument13 pagesBehavioral FinanceSimmi Khurana100% (1)

- Chapter 1 Behavioral Finance: An IntroductionDocument8 pagesChapter 1 Behavioral Finance: An Introductionsimmi33No ratings yet

- UNIT-3 (Managerial Economics) UPTU GBTU MTU Mba Sem1 PDFDocument16 pagesUNIT-3 (Managerial Economics) UPTU GBTU MTU Mba Sem1 PDFSimmi KhuranaNo ratings yet

- Project FinancingDocument3 pagesProject FinancingSimmi KhuranaNo ratings yet

- Case Studies of Cost and Works AccountingDocument17 pagesCase Studies of Cost and Works AccountingShalini Srivastav50% (2)

- Equity Share CapitalDocument2 pagesEquity Share CapitalSimmi KhuranaNo ratings yet

- Capital BudgetingDocument12 pagesCapital BudgetingSimmi KhuranaNo ratings yet

- BHFDocument24 pagesBHFSimmi KhuranaNo ratings yet

- Project FormulationDocument6 pagesProject FormulationSimmi KhuranaNo ratings yet

- Iup Research Paper PDFDocument14 pagesIup Research Paper PDFSimmi KhuranaNo ratings yet

- In Spite of Headwinds Faced On Account of A Slowly Global EconomyDocument2 pagesIn Spite of Headwinds Faced On Account of A Slowly Global EconomySimmi KhuranaNo ratings yet

- (B) Explain The Concept of Life Cycle CostingDocument12 pages(B) Explain The Concept of Life Cycle CostingSimmi KhuranaNo ratings yet

- BrazilDocument3 pagesBrazilSimmi KhuranaNo ratings yet

- Mutual FundDocument10 pagesMutual FundSimmi KhuranaNo ratings yet

- In Spite of Headwinds Faced On Account of A Slowly Global EconomyDocument2 pagesIn Spite of Headwinds Faced On Account of A Slowly Global EconomySimmi KhuranaNo ratings yet

- IDirect BudgetReview 2016-17Document18 pagesIDirect BudgetReview 2016-17Simmi KhuranaNo ratings yet

- Paper ReviewDocument18 pagesPaper ReviewSimmi KhuranaNo ratings yet

- Demand ForecastingDocument6 pagesDemand ForecastingSimmi KhuranaNo ratings yet

- OutDocument18 pagesOutSimmi KhuranaNo ratings yet

- Robert ShillerDocument6 pagesRobert ShillerSimmi KhuranaNo ratings yet

- 07 Vesna BucevskaDocument16 pages07 Vesna BucevskaSimmi KhuranaNo ratings yet

- Meaning of Standard Cost and Standard CostingDocument16 pagesMeaning of Standard Cost and Standard CostingSimmi KhuranaNo ratings yet

- The Butterfly Effect Holds That A Butterfly Flapping Its Wings in Some Place CanDocument2 pagesThe Butterfly Effect Holds That A Butterfly Flapping Its Wings in Some Place CanSimmi KhuranaNo ratings yet

- Behavioral FinanceDocument13 pagesBehavioral FinanceSimmi Khurana100% (1)

- Transfer PricingDocument3 pagesTransfer PricingSimmi KhuranaNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- New Democracy June-August 2017Document32 pagesNew Democracy June-August 2017Communist Party of India - Marxist Leninist - New DemocracyNo ratings yet

- Dwi Athaya Salsabila - Task 4&5Document4 pagesDwi Athaya Salsabila - Task 4&521Dwi Athaya SalsabilaNo ratings yet

- Di OutlineDocument81 pagesDi OutlineRobert E. BrannNo ratings yet

- Bhaktisiddhanta Appearance DayDocument5 pagesBhaktisiddhanta Appearance DaySanjeev NambalateNo ratings yet

- Understanding Deuteronomy On Its Own TermsDocument5 pagesUnderstanding Deuteronomy On Its Own TermsAlberto RodriguesNo ratings yet

- Module 2 - Content and Contextual Analysis of Selected Primary andDocument41 pagesModule 2 - Content and Contextual Analysis of Selected Primary andAngelica CaldeoNo ratings yet

- Chapter 10 HandoutDocument18 pagesChapter 10 HandoutChad FerninNo ratings yet

- Word Formation - ExercisesDocument4 pagesWord Formation - ExercisesAna CiocanNo ratings yet

- SDLC - Agile ModelDocument3 pagesSDLC - Agile ModelMuhammad AkramNo ratings yet

- Adjustment DisordersDocument2 pagesAdjustment DisordersIsabel CastilloNo ratings yet

- Christian Appraisal of Feminist Ideologies Among Nigerian Women 2020Document78 pagesChristian Appraisal of Feminist Ideologies Among Nigerian Women 2020Nwaozuru JOHNMAJOR ChinecheremNo ratings yet

- FunambolDocument48 pagesFunambolAmeliaNo ratings yet

- Twin-Field Quantum Key Distribution Without Optical Frequency DisseminationDocument8 pagesTwin-Field Quantum Key Distribution Without Optical Frequency DisseminationHareesh PanakkalNo ratings yet

- Speed of Sound and its Relationship with TemperatureDocument2 pagesSpeed of Sound and its Relationship with TemperatureBENNY CALLONo ratings yet

- Cash Flow StatementDocument57 pagesCash Flow StatementSurabhi GuptaNo ratings yet

- EY The Cfo Perspective at A Glance Profit or LoseDocument2 pagesEY The Cfo Perspective at A Glance Profit or LoseAayushi AroraNo ratings yet

- Science & Technology: Wireless Sensor Network and Internet of Things (Iot) Solution in AgricultureDocument10 pagesScience & Technology: Wireless Sensor Network and Internet of Things (Iot) Solution in AgricultureSivajith SNo ratings yet

- A Study On Inventory Management Towards Organizational Performance of Manufacturing Company in MelakaDocument12 pagesA Study On Inventory Management Towards Organizational Performance of Manufacturing Company in MelakaOsama MazharNo ratings yet

- Assessment Explanation of The Problem Outcomes Interventions Rationale Evaluation Sto: STO: (Goal Met)Document3 pagesAssessment Explanation of The Problem Outcomes Interventions Rationale Evaluation Sto: STO: (Goal Met)Arian May MarcosNo ratings yet

- APCHG 2019 ProceedingsDocument69 pagesAPCHG 2019 ProceedingsEnrico SocoNo ratings yet

- Prophetic Prayer Declarations - September, 2021Document5 pagesProphetic Prayer Declarations - September, 2021Jelo RichNo ratings yet

- My Perspective On Ayurveda-ArticleDocument2 pagesMy Perspective On Ayurveda-ArticleAaryan ParashuramiNo ratings yet

- Narasimha EngDocument33 pagesNarasimha EngSachin SinghNo ratings yet

- Are Moral Principles Determined by SocietyDocument2 pagesAre Moral Principles Determined by SocietyKeye HiterozaNo ratings yet

- Foundation of Special and Inclusive EducationDocument25 pagesFoundation of Special and Inclusive Educationmarjory empredoNo ratings yet

- Christian Storytelling EvaluationDocument3 pagesChristian Storytelling Evaluationerika paduaNo ratings yet

- The Islam Question - Should I Become A Muslim?Document189 pagesThe Islam Question - Should I Become A Muslim?Aorounga100% (1)

- Chap 4 eDocument22 pagesChap 4 eHira AmeenNo ratings yet

- Prayer BuddyDocument42 pagesPrayer BuddyJoribelle AranteNo ratings yet

- The Research TeamDocument4 pagesThe Research Teamapi-272078177No ratings yet