Professional Documents

Culture Documents

Our Five Top ETF Picks For 2016: CP Cuts Will Fuel Gains

Uploaded by

Brian MabenOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Our Five Top ETF Picks For 2016: CP Cuts Will Fuel Gains

Uploaded by

Brian MabenCopyright:

Available Formats

Get FREE daily updates from Pat, plus easy access to your issues and reports on TSI Network

(www.tsinetwork.ca). You can also follow Pat on Twitter! Just go to TSI Network and click on Follow TSI

Network on Twitter to get Pats latest Twitter messages (or tweets) on your computer and/or cellphone.

Your guide to safe-money investing

Published by The Successful Investor Inc.

218 Sheppard Ave. E., Toronto, ON, M2N 3A9

tel: (416) 756-0888; toll-free: 1-888-292-0296; fax: (416) 756-0397

email: service@tsinetwork.ca

Mid-February 2016 through Mid-March 2016

Vol. 19, No. 2 Pages 9 through 16

Our mission: Making you a successful investor!

Our five top ETF picks for 2016

CP cuts will fuel gains

CANADIAN PACIFIC RAILWAY

$159.03 (Toronto symbol CP; Shares

outstanding: 153.8 million; Market

cap: $25.5 billion; TSINetwork

Rating: Above Average; Yield: 0.9%;

www.cpr.ca) reported 5.9% lower

freight volumes in the latest quarter,

mainly because of falling prices for

oil, minerals and other commodities.

In the three months ended

December 31, 2015, CP earned $419

We feel that investors will profit the most by holding a million, down 8.9% from $460 million

well-balanced portfolio of high-quality stocks. However, if you don't a year earlier. However, per-share

earnings gained 1.5%, to $2.72 from

want to build a portfolio, or you want to supplement your individual

$2.68, on fewer shares outstanding.

Dear safe-money investor:

stock holdings, then ETFs can provide a great alternative.

Revenue fell 4.1%, to $1.69 billion

from

$1.76 billion. Still, revenue from

The main factors we use to evaluate ETFs are the stocks they hold,

forest

products jumped 20.4%, and

the diversification of their holdings across the five economic sectors

fertilizer shipments rose 18.0%.

and the fees (MERs) they charge.

CP is benefiting from greater

In general, investors holding mainly ETFs would want, say, 60% in efficiency, which includes speeding

up trains and cutting time spent at

Canadian ETFs and 20% to 30% in U.S. ETFs.

terminals. Its operating ratio was a

Safety-conscious investors could add some foreign ETFs, in record 59.8% in the latest quarter,

reasonable quantities: perhaps 10% to 15% (including 5% or so in the same as a year ago. (Operating

ratio is calculated by dividing regular

higher-risk funds, such as emerging-market ETFs).

operating costs by revenue. The

lower the ratio, the better.)

Here are our top five ETF picks for 2016:

ISHARES S&P/TSX 60 INDEX ETF $18.65 (Toronto symbol XIU; buy

or sell through brokers; ca.ishares.com) is a good low-fee way to buy the top

stocks on the TSX. The units are made up of stocks that represent the

S&P/TSX 60 Index, which consists of the 60 largest, most heavily

traded stocks on the exchange. The ETFs MER is just 0.18% of

assets, and the units yield 3.2%.

Job cuts are another part of CPs

improving efficiency. Since 2012, it

has reduced its workforce by 7,000

positions; it ended 2015 with 12,943

workers. Due to lower commodity

demand, CP still plans to cut 1,000

more jobs in 2016. It will also reduce

its capital spending, to $1.1 billion in

2016 from $1.5 billion in 2015.

The index mostly consists of high-quality companies. However, it

CP expects this years earnings per

must ensure that all sectors are represented, so it holds a few we share to rise at least 10%, to $11.11.

wouldnt include.

The stock trades at a moderate 14.3

times that forecast.

The indexs top holdings are Royal Bank, 8.7%; TD Bank, 8.0%;

Bank of Nova Scotia, 5.6%; CN Railway, 4.8%; BCE, 4.0%; Bank of

Montreal, 3.9%; Suncor Energy, 3.8%; (continued top of page 10)

CP Rail is a buy.

Pat McKeough

Page 10

Canadian Wealth Advisor

Valeant Pharmaceuticals, 3.5%; Enbridge Inc., 3.3%;

and Manulife Financial Corp., 3.1%.

Mid-February 2016

Trust Shares, holds stocks representing the Nasdaq

100 Index, which consists of the 100 largest

companies on the Nasdaq exchange by market cap.

iShares S&P/TSX 60 Index ETF is a top ETF

pick for 2016

The Nasdaq 100 Index contains shares of companies in a number of major industries, including

ISHARES CANADIAN SELECT DIVIDEND computer hardware and software, telecommunicaINDEX ETF $20.37 (Toronto symbol XDV; buy or sell tions, retail/wholesale trade and biotechnology. It

through brokers; ca.ishares.com) holds 30 of the highest- does not contain financial firms. The funds MER is

yielding Canadian stocks. Its selections are based on about 0.20%. It yields 1.4%.

dividend growth, yield and payout ratio. The weight

The indexs highest-weighted stocks are Apple,

of any one stock is limited to 10% of the ETFs

assets. The funds MER is 0.55%, and it yields 5.0%. 10.9%; Alphabet Inc., 10.2%; Microsoft, 8.8%;

Amazon.com, 5.4%; Facebook, 5.4%; Intel Corp.,

Its top holdings are CIBC, 9.7%; Bank of 2.9%; Comcast, 2.8%; Gilead Sciences, 2.5%; Cisco

Montreal, 7.4%; Royal Bank, 6.8%; BCE, 6.5%; Systems, 2.4%; and Qualcomm, 1.3%.

Bank of Nova Scotia, 5.6%; Rogers CommunicaPowerShares QQQ ETF is a top ETF pick for

tions, 5.2%; Laurentian Bank of Canada, 5.0%;

Manitoba Telecom, 5.0%; TD Bank, 4.7%; IGM 2016.

Financial, 4.4%; and TransCanada Corp., 4.4%.

ISHARES MSCI GERMANY FUND $24.15 (New

The ETF holds 58.6% of its assets in financial York symbol EWG; buy or sell through brokers) tracks the

stocks. The top Canadian finance stocks have sound stocks in the MSCI Germany Index.

prospects, but if you invest in this ETF, be sure to

This index aims to replicate 85% of the market

adjust the rest of your portfolio so it wont be overly

capitalization of the German stock market. The

concentrated in the financial sector.

remaining 15% is unavailable for investment, partly

iShares Canadian Select Dividend is a top ETF due to limitations on foreign ownership.

pick for 2016.

The ETFs top holdings are Bayer (diversified

SPDR S&P 500 ETF $191.30 (New York symbol SPY; chemicals), 8.9%; SAP (software), 7.6%; Siemens

buy or sell through brokers; www.spdrs.com) holds the stocks (engineering conglomerate), 7.3%; Allianz (insurin the S&P 500 Index, which consists of 500 major ance), 7.1%; Daimler (automobiles), 6.5%; BASF

U.S. companies chosen based on their market cap, (chemicals), 5.9%; Deutsche Telekom, 5.5%; Muliquidity and industry group. The funds MER is just nich Reinsurance, 3.1%; BMW AG, 2.7%; Fresenius

(health care), 2.5%; Linde AG (industrial gases),

0.10%, and it yields 2.5%.

2.4%; Deutsche Bank AG, 2.4%; and Deutsche Post

The indexs highest-weighted stocks are Apple, AG, 2.3%.

3.2%; Microsoft, 2.6%; Alphabet, 2.6%; ExxonLaunched on March 12, 1996, its expense ratio is

Mobil, 1.9%; Johnson & Johnson, 1.7%; General

Electric, 1.6%; Facebook, 1.5%; Berkshire Hathaway, 0.48%.

1.4%; Wells Fargo & Co., 1.4%; Amazon.com, 1.3%;

Weak European markets have slowed Germanys

AT&T, 1.3%; Procter & Gamble, 1.3%; and JPMorgrowth this year, while ongoing sanctions against

gan Chase, 1.3%.

Russia continue to hurt those German firms with a

The SPDR S&P 500 ETF is a top ETF pick for significant number of Russian customers. However,

the low euro remains a big plus for German exports,

2016.

and the long-term outlook for the economy is sound.

POWERSHARES QQQ ETF $101.65 (Nasdaq symbol

iShares MSCI Germany Fund is a top ETF pick

QQQ; buy or sell through brokers; www.

invescopowershares.com), formerly called Nasdaq 100 for 2016.

Published by The Successful Investor Inc. (416) 756-0888: www.TSINetwork.ca

Mid-February 2016

Canadian Wealth Advisor

Page 11

High yields from growing REITs

RIOCAN REAL ESTATE INVESTMENT

TRUST $25.02 (Toronto symbol REI.UN; Units

outstanding: 320.4 million; Market cap: $7.9 billion;

TSINetwork Rating: Average; Dividend yield: 5.6%;

www.riocan.com) is Canada's largest real estate

investment trust.

In the three months ended September 30, 2015,

RioCan's cash flow rose 5.0%, to $140.2 million

from $133.6 million a year earlier. Per-unit cash flow

gained 2.3%, to $0.44 from $0.43, on more units

outstanding.

The trust has now agreed to sell its 49 U.S. malls

for $1.2 billion (Canadian). It expects to complete the

sale in April 2016.

RioCan will put $510 million of the proceeds

toward its recent deal to buy out its joint venture with

U.S.-based Kimco Realty (New York symbol KIM).

Formed in 2000, this business owns and manages 35

malls in six provinces.

Under the deal, RioCan will acquire Kimcos 50%

stake in 22 of these properties for $715 million. The

partners then plan to sell 10 other properties. They

haven't yet made a decision about the last three,

which consist of stores vacated by Target in 2015.

The 22 properties RioCan will fully own fit well

with its plans to increase its exposure to Canada's six

largest markets: Toronto, Montreal, Ottawa, Calgary,

Edmonton and Vancouver.

RioCan trades at 14.1 times its forecast 2016 cash

flow of $1.78 a unit. Thats reasonable in light of the

REITs highly profitable properties and its 94.0%

occupancy rate. The units yield 5.6%.

RioCan is a buy.

ALLIED PROPERTIES REAL ESTATE

INVESTMENT TRUST $32.83 (Toronto symbol

AP.UN; Units outstanding: 78.3 million; Market cap:

$2.6 billion; TSINetwork Rating: Extra Risk;

Dividend yield: 4.6%; www.alliedreit.com) owns 147

office buildings, mostly in major Canadian cities.

These mainly Class I properties contain over 10.5

million square feet of leasable area.

Class I refers to 19th- and early-20th-century

industrial buildings that have been converted to retail

space. They usually feature exposed beams, interior

brick and hardwood floors.

Allied spent $400 million acquiring properties in

2012, $182.4 million in 2013 and $234.9 million in

2014. In the first three quarters of 2015, it added four

more for $164.4 million.

The new buildings helped raise the trusts revenue

by 5.6% in the quarter ended September 30, 2015, to

$90.7 million from $85.8 million a year earlier. Cash

flow rose 12.3%, to $42.9 million from $39.2

million. Cash flow per unit gained 1.9%, to $0.55

from $0.54, on more units outstanding.

The units trade at 12.6 times Allieds forecast

2016 cash flow of $2.61 a unit. They yield 4.6%.

Allied Properties REIT is a buy.

Torstar closes its printing plant

TORSTAR $2.21 (Toronto symbol TS.B; Shares

outstanding: 79.9 million; Market cap: $182.1

million; TSINetwork Rating: Average; Dividend

yield: 11.8%; www.torstar.com) will close its

money-losing printing plant in Vaughan,

Ontario, just north of Toronto, in July 2016. It

will then transfer printing of The Toronto Star

newspaper to Transcontinental Inc.

Torstar will also sell the Vaughan plant and

land. This will help offset its closing costs. It will

also give it more cash for Star Touch, the

tablet-newspaper app it launched in October.

So far, more than 200,000 users have downloaded Star Touch, which uses technology

licensed from Montreals La Presse newspaper.

The app should help Torstar attract younger

readers and sell more online ads.

Torstar is still a buy for long-term gains.

Published by The Successful Investor Inc. (416) 756-0888: www.TSINetwork.ca

Page 12

Canadian Wealth Advisor

Mid-February 2016

Two bargain buys for income and growth

GREAT-WEST LIFECO $34.22 (Toronto symbol

GWO; Shares outstanding: 993.4 million; Market

cap: $34.5 billion; TSINetwork Rating: Above

Average; Yield: 3.8%; www.greatwestlifeco.com) is

one of Canada's largest insurance firms. It also offers

mutual funds and wealth management. Power

Financial owns 67.2% of Great-West.

In the three months ended September 30, 2015,

Great-Wests earnings rose 4.3%, to $0.72 a share

from $0.69 a year earlier.

The company continues to benefit from two recent

acquisitions. In 2013, it paid $1.75 billion for Irish

Life, Ireland's largest pension manager and life

insurance provider. In 2015, it paid an undisclosed

sum for the Irish operations of Legal & General

Group plc, which provides investment and taxplanning services to wealthy individuals.

Growth by acquisition can be risky, but the

companys large size lets it take advantage of

opportunities with strong chances of success. GreatWest's expansion helped it end the latest quarter with

$1.15 trillion in assets under administration, up

12.9% from a year earlier.

The company raised its quarterly dividend by

6.0% with the March 2015 payment, to $0.326 from

$0.3075. The shares yield 3.8%. The stock trades at

just 11.7 times Great-Wests forecast 2016 earnings

of $2.93 a share.

Great-West Lifeco is still a buy.

MANULIFE FINANCIAL $18.16 (Toronto symbol

MFC; Shares outstanding: 2.0 billion; Market cap:

$37.9 billion; TSINetwork Rating: Above Average;

Dividend yield: 3.7%; www.manulife.ca) sells life

and other related forms of insurance, as well as

mutual funds and investment management services.

In the three months ended September 30, 2015,

Manulifes earnings per share, excluding one-time

items, gained 10.3%, to $0.43 from $0.39 a year

earlier. Revenue rose 16.2%, to $7.48 billion from

$6.44 billion.

The company continues to expand in growing

Asian markets. Right now, about 40% of its insurance

premiums come from that region.

Manulife ended the latest quarter with $888.0

billion of assets under management, up 34.0% from

$662.5 billion a year earlier. A large part of the

increase came from the Canadian insurance operations of U.K.-based Standard Life. Manulife bought

those assets for $4.0 billion in late 2014.

The stock trades at just 10.7 times its forecast

2016 earnings of $1.70 a share. Manulife raised its

quarterly dividend by 5.6% with the June 2015

payment, to $0.17 from $0.155. The shares yield

3.7%.

Manulife is a buy.

BNS looks to exit Thailand

BANK OF NOVA SCOTIA $55.78 (Toronto

symbol BNS; Shares outstanding: 1.2 billion;

Market cap: $67.8 billion; TSINetwork Rating:

Above Average; Dividend yield: 5.0%,

www.scotiabank.com) is considering selling all

or part of its 49% stake in Thailands Thanachart

Bank, which has a book value of $2.4 billion.

Like many Asian nations, Thailand prohibits

foreign firms from controlling domestic banks.

Economic weakness and political uncertainty

have also hurt loan demand in the country.

Bank of Nova Scotia would probably use the

proceeds from any sale to expand in Latin

America. The bank gets around 30% of its

earnings from its international operations.

In 2014, Bank of Nova Scotia acquired 51% of

the credit and consumer loan operations of

Chilean retailer Cencosud for $280 million U.S.

That made Scotiabank Chiles third-largest credit

card provider. In 2015, the bank acquired Citibanks retail banking businesses in Peru,

Panama and Costa Rica for $360 million U.S.

Bank of Nova Scotia is a buy.

Published by The Successful Investor Inc. (416) 756-0888: www.TSINetwork.ca

Mid-February 2016

Canadian Wealth Advisor

Page 13

Low oil prices could force dividend cuts

BONAVISTA ENERGY $1.83 (Toronto symbol

BNP; Shares outstanding: 211.7 million; Market cap:

$367.5 million; TSINetwork Rating: Extra Risk;

Dividend yield: 6.6%; www.bonavistaenergy.com)

explores for oil and gas in Alberta, Saskatchewan

and B.C. Its output is 75% gas and 25% oil.

In the quarter ended September 30, 2015, Bonavistas cash flow per share fell 26.7%, to $0.44 from

$0.60 a year earlier. Most of that drop came from

lower oil and gas prices; output rose 5.2%, to 78,599

barrels of oil equivalent a day from 74,720 barrels.

Like many producers, the company is cutting back

on exploration and development spending. In 2016, it

will devote $210 million to this purpose. Thats

down from the $283.4 million it spent in 2015, and

down sharply from its $639.6 million in 2014.

The lower spending will likely cut its production

in 2016 to between an average of 73,000 and 76,000

barrels per day. That reduction, along with low oil

and gas prices, will cut Bonavistas per-share cash

flow this year to an estimated $1.27, down 28.2%

from the $1.77 it will likely report for 2015. It had

cash flow of $2.69 a share in 2014.

110,794 barrels of oil equivalent per day (55% gas

and 45% oil), from 104,035 a year earlier. However,

that wasnt enough to offset sharply lower oil and

gas prices; cash flow per share fell 44.2%, to $0.58

from $1.04.

Like Bonavista, Enerplus will cut exploration

spending this year. Its outlays will now total $350.0

million, down 31.4% from $510.0 million in 2015. It

spent $811.0 million in 2014.

The lower spendingalong with Enerpluss plan

to produce less gas in the Marcellus Shale until

prices reboundwill cut its forecast 2016 production

to around 102,500 barrels of oil equivalent a day.

The company expects to generate cash flow of

$1.72 a share in 2016, based on todays low oil

prices, down from $2.67 in 2015 and $4.20 in 2014.

The stock trades at 2.5 times this years estimate. It

yields a high 8.3%, but the current dividend may not

be sustainable if energy prices remain low.

Enerplus Corp. is a hold.

ENB buys two big gas plants

The stock trades at just 1.4 times this years

forecast cash flow per share. Thats very low for a

company with strong potential to grow when oil and

gas prices recover. However, the $0.01-a-share

monthly dividend, which yields a very high 6.6%,

could be cut if oil and gas prices drop further.

Bonavista Energy is a hold.

ENERPLUS CORP. $4.34 (Toronto symbol ERF;

Shares outstanding: 206.5 million; Market cap:

$813.8 million; TSINetwork Rating: Extra Risk;

Dividend yield: 8.3%) produces oil and gas from

properties mainly in Alberta, Saskatchewan, B.C.,

North Dakota and Montana, as well as in the

Marcellus Shale, which passes through Pennsylvania,

New York, Ohio and West Virginia.

Enerplus increased its output by 6.5% in the three

months ended September 30, 2015, to an average of

ENBRIDGE INC. $47.87 (Toronto symbol ENB;

Shares outstanding: 856.7 million; Market cap:

$40.8 billion; TSINetwork Rating: Above

Average; Dividend yield: 4.4%;

www.enbridge.com) has agreed to buy two

natural gas processing plants and related

pipelines in northeastern B.C. from Murphy Oil

(New York symbol MUR).

These facilities purify raw gas from producers

in B.C.'s Montney region. They also have

long-term contracts with these clients, which

helps cut risk.

Enbridge will pay $538 million when it closes

the deal by March 31, 2016. To put that in

context, it earned $399 million, or $0.47 a

share, in its latest quarter.

Enbridge is still a hold.

Published by The Successful Investor Inc. (416) 756-0888: www.TSINetwork.ca

Page 14

Canadian Wealth Advisor

Mid-February 2016

Hold these precious metal ETFs for now

In 2011, gold shot up to a high of $1,950 U.S. an mine, refine or explore for silver. It was developed by

ounce, and silver reached a peak of $48.48.

Germany-based Structured Solutions AG.

Gold prices then fell steadily, hitting a low of

Canadian firms make up 58.0% of the funds

$1,050 in December 2015 for the first time since holdings, but it also includes miners in the U.S.

early 2010. The metal now trades at $1,143. Silver (12.3%) and Mexico (11.2%). Its MER is 0.65%.

also declined to a five-year low of $13.65 an ounce

in December 2015. It now trades at $14.68.

The ETFs top holdings are Fresnillo plc at 13.4%;

Tahoe Resources Inc., 12.9%; Silver Wheaton,

Longer term, gold and silver could well regain 12.7%; Industrias Penoles, 9.7%; Polymetal, 5.6%;

their 2011 highs. This would simply reflect the vast Pan American Silver, 4.8%; Primero Silver, 4.6%;

inflationary expansion in the U.S. money supply since First Majestic Silver, 4.5%; MAG Silver, 4.5%; Hecla

the 2008 financial crisis.

Mining, 4.5%; Alamos Gold, 4.4%; and Fortuna

Silver Mines, 3.8%.

Meanwhile, growth-promoting policies that gained

a following in the 2014 U.S. mid-term elections may

Global X Silver Miners ETF is a hold.

continue no matter which party wins this years

presidential race. This could increase tax collections

Uncertain outlook for copper

and cut the deficit. If that happens, gold and silver

could stay low.

GLOBAL X COPPER MINERS ETF $10.06

Still, if you want to hold gold or silver stocks,

these two ETFs offer top-quality global miners and

low fees.

ISHARES S&P/TSX GLOBAL GOLD INDEX

FUND $9.38 (Toronto symbol XGD; buy or sell through

brokers; ca.ishares.com) aims to mirror the performance

of the S&P/TSX Global Gold Index, which is made

up of 35 gold stocks from Canada and around the

world. The ETF began trading on March 23, 2001. Its

MER is 0.61%.

The funds top holdings are Barrick Gold at

14.3%; Newmont Mining, 13.1%; Goldcorp, 11.7%;

Franco-Nevada, 8.6%; Randgold Resources (ADR),

8.1%; Agnico-Eagle Mines, 8.0%; AngloGold Ashanti (ADR), 4.2%; and Gold Fields (ADR), 2.9%.

iShares S&P/TSX Global Gold Index is a hold.

GLOBAL X SILVER MINERS ETF $19.09 (New

York symbol SIL; buy or sell through brokers;

www.globalxfunds.com) tracks the Solactive Global Silver

Miners Index.

(New York symbol COPX; buy or sell through brokers;

www.globalxfunds.com) tracks the Solactive Global

Copper Miners Index, which includes 20 to 40

international companies that mine, refine or

explore for copper. Germany-based Structured

Solutions AG created this index.

Canadian firms make up 38.8% of the ETFs

holdings. It also includes companies based in

Australia (15.6%), Mexico (5.5%), Peru (5.4%)

and Poland (5.0%). The funds MER is 0.65%.

Its top holdings are Southern Copper at 6.9%;

Oz Minerals, 6.8%; CST Mining Group, 6.4%;

Kaz Minerals plc, 5.9%; Sandfire Resources,

5.9%; Grupo Mexico, 5.7%; Glencore plc, 5.4%;

Turquoise Hill, 5.4%; Lundin Mining, 5.4%;

Jiangxi Copper, 5.4%; Copper Mountain Mining,

5.3%; and Antofagasta plc, 4.6%.

Copper prices have fallen from over $4.50

U.S. a pound at the start of 2011 to just $2.11

today. Over the longer term, improving global

economies and uncertain supply should push

copper higher. In the near term, though, the

metals outlook is uncertain.

Global X Copper Miners ETF is a hold.

That index includes 25 international firms that

Published by The Successful Investor Inc. (416) 756-0888: www.TSINetwork.ca

Mid-February 2016

Canadian Wealth Advisor

Page 15

Updates on our safety-conscious stocks

MANITOBA TELECOM SERVICES INC. $30.95

(Toronto symbol MBT; Shares outstanding: 79.3

million; Market cap: $2.4 billion; TSINetwork

Rating: Average; Dividend yield: 4.2%; www.mts.ca)

has completed the sale of its Allstream division to

U.S.-based Zayo Group (New York symbol ZAYO).

The company received $420.0 million, net of

transaction costs. It will probably put the proceeds

toward its long-term debt, which was $677.1 million

as of September 30, 2015. Thats equal to 29% of its

$2.4-billion market cap.

4.6%; www.bce.ca) has formed a new partnership

with U.S.-based iHeartRadio, which streams live

radio stations and other audio broadcasts over the

Internet. iHeartRadio has more than 75 million users

in the U.S., Australia and New Zealand.

BCE plans to use iHeartRadios technology to

launch a free-to-use, advertising-supported streaming

service in Canada in mid-2016. This service will also

feature BCEs 106 radio stations, as well as other

content from its TV channels.

BCE is a buy.

Manitoba Telecom is still a hold.

TRANSCANADA CORP. $48.05 (Toronto symbol

TRP; Shares outstanding: 709.0 million; Market cap:

$34.0 billion; TSINetwork Rating: Above Average;

Dividend yield: 4.3%; www.transcanada.com) has

launched two legal challenges to the U.S.

governments recent decision to block its proposed

Keystone XL pipeline, which would have pumped

crude oil from Alberta to the U.S. Gulf Coast.

The company spent $4.3 billion on Keystone XL

and now expects to write off between $2.5 billion

and $2.9 billion of this total.

TransCanada plans to appeal the U.S. decision

under the North American Free Trade Agreement and

will ask for $15 billion U.S. in damages. In a

separate case, it will challenge the U.S. president's

authority to deny a construction permit.

These trials will take several years to settle, and

theres no guarantee TransCanada will win. Even so,

by 2020, the company plans to complete $46 billion

worth of other pipelines and power plants. Cash flow

from these projects will let TransCanada raise its

dividend by 8% to 10% annually over the next five

years.

TransCanada is a buy.

BCE INC. $56.74 (Toronto symbol BCE; Shares

outstanding: 849.3 million; Market cap: $48.8 billion;

TSINetwork Rating: Above Average; Dividend yield:

IBMs cloud shift will pay off

IBM $124.72 (New York symbol IBM; Shares

outstanding: 970.1 million; Market cap: $137.4

billion; TSINetwork Rating: Above Average;

Dividend yield: 4.2%; www.ibm.com) reported

better-than-expected results in its latest quarter.

In the quarter ended December 31, 2015,

revenue fell 8.5%, to $22.06 billion from $24.11

billion a year earlier. However, that beat the

consensus of $22.04 billion. IBM gets 60% of its

revenue from outside the U.S., and the higher

U.S. dollar hurts the value of these sales.

The company continues to expand in fastergrowing areas like cloud computing and analytics software. In the latest quarter, IBMs cloud

and analytics businesses increased their revenue by 16%. That revenue now accounts for

35% of the company's total. It also helps offset

weaker demand for IBMs consulting services

and mainframe computers.

The companys earnings fell 18.6%, to $4.7

billion, or $4.84 a share, from $5.8 billion, or

$5.81 The latest earnings beat the consensus

estimate of $4.81 a share.

IBM will probably earn $14.98 a share in

2016, and the stock trades at just 8.3 times that

forecast. The shares yield 4.2%.

IBM is a buy for long-term gains.

Published by The Successful Investor Inc. (416) 756-0888: www.TSINetwork.ca

Page 16

Canadian Wealth Advisor

Mid-February 2016

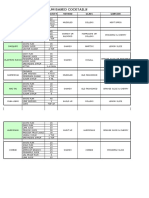

Heres our CWA REIT & Trust Portfolio

The federal governments tax on income-trust distributions took effect on January 1, 2011. Most trusts

have since converted to corporations.

Real estate investment trusts (REITs) were exempted from the income-trust tax. As a result,

high-quality REITs should remain attractive to income-seeking investors.

Name

Price

$

Symbol**

Dist. Yield

$

35.72

BEP.UN

1.66u 6.2

Industry

Sector

Current

p/e

Canadian Wealth Advisor

Rating

Advice

Utilities

117.2

Extra Risk

Buy

Mfg.

Mfg.

Mfg.

Mfg.

8.7

16.2

10.1

16.6

Extra Risk

Extra Risk

Extra Risk

Average

Buy

Buy

Buy

Best Buy

Extra Risk

Extra Risk

Average

Extra Risk

Extra Risk

Extra Risk

Extra Risk

Average

Average

Average

Extra Risk

Average

Buy

Buy

Tendered

Hold

Buy

Hold

Buy

Buy

Buy

Hold

Buy

Buy

Income trusts

Brookfield

Real estate investment trusts (REITs)

Allied REIT

Canadian REIT

H&R REIT

RioCan REIT

32.83

40.96

18.72

25.02

AP.UN

REF.UN

HR.UN

REI.UN

1.50

1.80

1.35

1.41

4.6

4.4

7.2

5.6

& Ind.

& Ind.

& Ind.

& Ind.

Former income trusts that have converted to conventional corporations*

Algonquin Pwr. 11.87

ARC Resources 18.10

Bell Aliant

31.11

Bonavista

1.83

Crescent Point 14.77

Enerplus

4.34

Innergex Power 11.82

Pembina Pipeline 31.46

Pengrowth

1.08

Penn West

1.06

Peyto Energy

30.06

Veresen&

7.74

AQN

ARX

BA

BNP

CPG

ERF

INE

PPL

PGF

PWT

PEY

VSN

0.39u. 4.7

1.20 6.6

1.90 6.2

0.12 6.6

1.20 8.1

0.36 8.3

0.62 5.3

1.83 5.8

0.04 3.7

0.04 3.8

1.32 4.4

1.00 12.9

Utilities

Resources

Utilities

Resources

Resources

Resources

Utilities

Utilities

Resources

Resources

Resources

Utilities

28.7

d.

24.9

d.

d.

d.

d.

33.1

d.

d.

28.7

23.6

**Toronto Exchange unless otherwise noted. *Converted from income trust to corporation, .un suffix dropped from trading

symbol. Current p/e: current unit price divided by latest 12-month earnings.

Yield: distribution divided by unit price. d. loss.

& Name changed from Fort Chicago Energy Partners L.P.

Next Month: The CWA ETF Portfolio

2016 THE SUCCESSFUL INVESTOR INC. 218 Sheppard Ave. E., Toronto, ON, M2N 3A9. Tel: (416) 756-0888; Fax: (416)

756-0397; email: service@tsinetwork.ca. Published monthly. Annual subscription rate is $119 plus GST or HST for 12 monthly issues.

Canadian Wealth Advisor aims to provide investors with unbiased, independent, money-making advice on ETFs and other

safe-money investments, plus financial planning and taxes. However, all investments involve some risk.

The Successful Investor Inc. is affiliated by common ownership with Successful Investor Wealth Management Inc., which provides

fee-based portfolio management services and pooled funds. Contact The Successful Investor Inc. for information. Successful Investor

Wealth Management clients may hold securities recommended or discussed here and in other Successful Investor Inc. publications.

NOTE TO READERS: We may make our mailing list available to organizations offering products or services that might interest you. If you

prefer NOT to receive these offers, please send our mailing envelope to us with Do Not Rent Name written on it. Thank you.

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Best of Laxman - Volume IV by R.K.laxmanDocument208 pagesThe Best of Laxman - Volume IV by R.K.laxmannot here 2make friends sorry100% (2)

- Retail FormulaDocument5 pagesRetail FormulavipinvermaseptNo ratings yet

- Principles of Marketing - Customer RelationshipDocument5 pagesPrinciples of Marketing - Customer RelationshipRosette Anne Fortun MorenoNo ratings yet

- Walmart Enhances Supply Chain ManageDocument10 pagesWalmart Enhances Supply Chain Managecons theNo ratings yet

- Problems On Cash Flow StatementsDocument12 pagesProblems On Cash Flow Statementsdevvratrajgopal73% (11)

- Project Report on IPO in IndiaDocument7 pagesProject Report on IPO in IndianeetliNo ratings yet

- EPIC Consulting GroupDocument13 pagesEPIC Consulting GroupMuhammad Moazam Shahbaz100% (1)

- 7250 Dallas Parkway, Suite 1000 Plano, TX 75024 1-800-879-8000Document13 pages7250 Dallas Parkway, Suite 1000 Plano, TX 75024 1-800-879-8000Brian MabenNo ratings yet

- Facades Guide 11 - 2020Document53 pagesFacades Guide 11 - 2020Brian MabenNo ratings yet

- IGU Quality Standard Reference DocumentDocument33 pagesIGU Quality Standard Reference DocumentBrian MabenNo ratings yet

- Features Brochure: Raymond Trucks and Tow TractorsDocument20 pagesFeatures Brochure: Raymond Trucks and Tow TractorsKhan MuniruzzamaNo ratings yet

- hft2100 Manual en 4474882Document11 pageshft2100 Manual en 4474882Brian MabenNo ratings yet

- Rum Based Cocktails: Name Ingredients Quantity Method Glass GarnishDocument2 pagesRum Based Cocktails: Name Ingredients Quantity Method Glass GarnishArnieNo ratings yet

- Canadian English Smart Grade 4Document116 pagesCanadian English Smart Grade 4Brian Maben89% (9)

- Pia Policy ProjectDocument118 pagesPia Policy ProjectRude RanaNo ratings yet

- Leverage Capital Structure and Dividend Policy Practices in Indian CorporateDocument12 pagesLeverage Capital Structure and Dividend Policy Practices in Indian CorporateDevikaNo ratings yet

- Fashion Marketing of Luxury Brands Recen PDFDocument4 pagesFashion Marketing of Luxury Brands Recen PDFCosmin RadulescuNo ratings yet

- SMA - Role ProfileDocument5 pagesSMA - Role ProfilePrakriti GuptaNo ratings yet

- Measure C Voter Guide March 2024 ElectionDocument7 pagesMeasure C Voter Guide March 2024 ElectionKristin LamNo ratings yet

- Law Review 5Document88 pagesLaw Review 5Bilguun Ganzorig75% (4)

- Returns Discounts and Sales TaxDocument1 pageReturns Discounts and Sales TaxSwapnaKarma BhaktiNo ratings yet

- PWC Emerging Logistics Trends 2030Document64 pagesPWC Emerging Logistics Trends 2030Jeffrey NsambaNo ratings yet

- Role Play MpuDocument2 pagesRole Play MpukebayanmenawanNo ratings yet

- Active Vs PassiveDocument6 pagesActive Vs PassiveYingying SheNo ratings yet

- For The Families of Some Debtors, Death Offers No RespiteDocument5 pagesFor The Families of Some Debtors, Death Offers No RespiteSimply Debt SolutionsNo ratings yet

- Customer Satisfaction Towards Honda Two Wheeler: Presented By: Somil Modi (20152002) BBA-MBA 2015Document9 pagesCustomer Satisfaction Towards Honda Two Wheeler: Presented By: Somil Modi (20152002) BBA-MBA 2015Inayat BaktooNo ratings yet

- The Funding Cost of Chinese Local Government DebtDocument48 pagesThe Funding Cost of Chinese Local Government Debt袁浩森No ratings yet

- Volume 1Document50 pagesVolume 1rivaldo10jNo ratings yet

- Chapter 13Document5 pagesChapter 13Marvin StrongNo ratings yet

- Chapter 2 The New Products ProcessDocument7 pagesChapter 2 The New Products ProcessmanoNo ratings yet

- Roborobo Co., LTDDocument26 pagesRoborobo Co., LTDUnitronik RoboticaNo ratings yet

- Mobile Services: Your Account Summary This Month'S ChargesDocument8 pagesMobile Services: Your Account Summary This Month'S ChargesVenkatram PailaNo ratings yet

- PatanjaliDocument52 pagesPatanjaliShilpi KumariNo ratings yet

- PT. Unilever Indonesia TBK.: Head OfficeDocument1 pagePT. Unilever Indonesia TBK.: Head OfficeLinaNo ratings yet

- SEC CasesDocument18 pagesSEC CasesRainidah Mangotara Ismael-DericoNo ratings yet

- Project Report On TCS Courier ServicesDocument8 pagesProject Report On TCS Courier ServicesMehwish ZahoorNo ratings yet

- Bangladesh Business Structure ReportDocument32 pagesBangladesh Business Structure ReportMd. Tareq AzizNo ratings yet

- Bandai Namco Holdings Financial ReportDocument1 pageBandai Namco Holdings Financial ReportHans Surya Candra DiwiryaNo ratings yet