Professional Documents

Culture Documents

APMA 2005 Policy Paper

Uploaded by

Sania AliOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

APMA 2005 Policy Paper

Uploaded by

Sania AliCopyright:

Available Formats

APMA

THE VOICE OF THE AUTOMOTIVE

ORIGINAL EQUIPMENT SUPPLIERS IN CANADA

DRIVING CANADAS ENGINE OF GROWTH

Automotive Parts Manufacturers Association

Policy Paper 2005

Automotive Parts Manufacturers Association (APMA)

2005 Policy Paper

Driving Canadas Engine of Growth

TABLE OF CONTENTS

PAGE

FOREWORD

A.

CUSTOMERS, MARKET SHARE CHANGES AND STRATEGIC POSITIONING

B.

INFRASTRUCTURE

ENERGY

DECREASING DELIVERY TIME BETWEEN CANADA AND UNITED STATES

CUSTOMERS

ENVIRONMENT

12

FINANCIAL AND POLITICAL INFRASTRUCTURE

12

C.

INNOVATION AND TECHNOLOGY FOR ECONOMIC PROSPERITY

15

D.

GOVERNMENT SUPPORT FOR THE AUTOMOTIVE SECTOR

18

GLOBALIZATION, ATTRACTING NEW INVESTMENT AND RETAINING EXISTING

18

INVESTMENT

CANADIAN AUTOMOTIVE PARTNERSHIP COUNCIL (CAPC)

E.

HUMAN RESOURCES: MANAGING HUMAN CAPITAL

19

22

DEVELOPING INNOVATORS

22

APPRENTICESHIP TRAINING PROGRAMMES AND TAX CREDITS

24

IMPORTING INNOVATORS

25

LABOUR LEGISLATION

26

CAREER DEVELOPMENT AND LIFELONG LEARNING

26

2005 APMA Policy Paper November 2005

Page 2

DRIVING CANADAS ENGINE OF GROWTH

FOREWORD

Why Support the Auto Sector?

The auto industry is Canadas largest manufacturing industry by far. In fact, the original equipment supply

industry by itself is Canadas largest manufacturing industry. The multiplier effect for the auto industry is

currently being debated but the minimum multiplier for each assembly plant employee is 7 and there are

economic models as high as 10. To put this into perspective, the new Toyota plant announcement in

Woodstock which will employ 1,300 people translates to between 9,100 and 13,000 people that will have

employment as a result of this plant commencing production. Not all of that additional employment will be

in Canada, but the majority of it will be.

Government can afford to invest substantial sums to attract assembly plants to Canada because of the

taxes (income, GST and provincial) they collect from their employees. Lets do a conservative estimate of

the impact a hypothetical new assembly plant will have.

Initial Employment

Estimated Average Salary (Industry Canada Statistic)

Average Income Tax Paid

Average Purchases (made by those employees)

Average GST @7% (paid on those purchases)

Average PST @ 8% (paid on those purchases)

Average Total Federal and Provincial Taxes per

Employee

Total Taxes per Year (from 1,000 employees)

Hypothetical Government Investment

Payback Time $100,000,000 $22,800,000 =

1,000

$72,000

$18,000

$32,000

$2,240

$2,560

$22,800

$22,800,000

$100,000,000

4.38 yrs.

Presuming the plant is open for 20 years, net government revenues for 15.62 years

(after payback) @$22,800,000 per year is $356,136,000 or a net return of $256,136,000

back to governments.

This example is only for the assembly plant employees and does not include any corporate taxes. Add the

supply base to the equation and the net return for government would easily be over a billion dollars.

The above hypothetical example clearly illustrates why government investment in the auto industry is a

strategic investment for the long term health of Canadas economy and a substantial net benefit to all

Canadians.

Automotive Parts Manufacturers Association

www.apma.ca

info@apma.ca

416.620.4220

2005 APMA Policy Paper November 2005

Page 3

It is critical that the Canadian and Provincial governments continue their investment strategies. We should

continue to strive to produce 15% of all the light vehicles sold in North America and increase our parts

shipment by $20 billion. We need a Team Auto Canada approach to achieve these lofty goals. They are a

stretch, but they are attainable.

The last few years have been difficult for the original equipment supply industry. The Canadian dollar went

from 64 US in 2003 to over 85 US by September, 2005. Steel increased 200%, resin increased 100%,

aluminum increased 60%, all at the same time as the assemblers have been demanding price decreases.

(The average selling price for parts declined over 20 per cent from 2000 to 2004 and it is still declining).

The Canadian industry has faired better than the US industry with only one significant insolvency

originating in Canada versus seven major ones, a dozen minor ones, and the bailout of Visteon in the US

over the last year. At a recent conference in Michigan, Craig Fitzgerald of Platt & Morin forecast that up to

30% of the US supply base could be insolvent within six months. The Canadian industry is better off due to

our higher productivity, lower average wages and lower health care costs, but is not far behind and faces

formidable obstacles to remain profitable. Vehicles continue to be produced so there is an opportunity to

expand our market share and move up the value chain. What we know for certain is that the status quo is

not an option. If we do not change as an industry, our global competitors will have us for lunch.

APMAs strategic vision on how to accomplish this is set out in this document. We have consulted all the

industry stakeholders to create a comprehensive plan to expand and prosper. The five main challenges

facing our industry are highlighted in detail as are the opportunities that are before us. The industry has

been through tough times before and emerged stronger. We need to again work smart and retool to be

more efficient and continue to be the Engine of Growth for Canadas future for our future.

www.apma.ca

Automotive Parts Manufacturers Association

info@apma.ca

416.620.4220

2005 APMA Policy Paper November 2005

A.

Page 4

CUSTOMERS, MARKET SHARE CHANGES AND STRATEGIC

POSITIONING

Within the context of international trade, there are three significant trading blocks: North America, the

European Union and Asia (primarily Japan, China, India and Thailand). Focusing on North America, for our

trading region to be globally competitive, we must ensure that our trading block has a suitably equipped

infrastructure to facilitate the flow of commercial goods within the North American trading block between

Canada, the United States and Mexico. Failure to have infrastructure and policies to ensure the rapid flow

of commercial goods within the NAFTA region could be the Achilles Heel of the NAFTA regions success in

the global context.

The automotive industry, the most globalized and integrated industry worldwide, is both challenging and

rewarding. The industry maintains its integration by utilizing strategically placed suppliers throughout the

global supply chain network. Globally, suppliers are under constant scrutiny, challenged to be the worlds

best in their sector. The very nature of the industry and its manufacturing processes places unique

pressures on the industry and its suppliers both regionally and globally.

Relating specifically to the supply base, much of the business opportunities are determined by the success

or failure of customers throughout the supply chain and ultimately the success or failure of the vehicle

assemblers, which are constantly challenged to produce attractive, reliable, durable vehicles with

innovative designs and state of the art technologies. The consumer is demanding more and better vehicles

without a willingness to pay more for the product.

The failure of vehicle manufacturers to succeed in the foregoing, results in loss of vehicle sales and

consequently, loss of market share which directly impacts the supply chain.

Over the last several years, General Motors, Ford and the Chrysler side of DaimlerChrysler, traditionally

known as the Big 3, have lost market share to the New North American Manufacturers (NNAMs), primarily,

the Japanese manufacturers (Toyota, Honda and Nissan), as well as BMW, Hyundai and the Mercedes

side of DaimlerChrysler.

In response, all vehicle manufacturers have become much more conscious of managing their costs and

vehicle selling prices to maintain sales volumes. The traditional Big 3 have been particularly aggressive in

their price reduction initiatives. As a result, the supply base has been forced to absorb arbitrary cost

reduction targets that through the years have marginalized many suppliers resulting in many becoming debt

laden and insolvent - only to be rescued by their customers to ensure there were no disruptions in the

supply chain.

As development and design functions are being pushed down the supply chain, suppliers are responsible

for more research, technology and innovation functions in their products than ever before, often without

financial support from the vehicle assemblers, again led by the traditional Big 3. As a result, studies1

indicate that the NNAMs have risen to be the preferred customers of choice over the Big 3 because they

are perceived as promoting better supplier/customer relationships. They do this by rewarding research,

development and innovation and use collaborative methods to set and achieve cost reduction targets rather

than an adversarial approach of imposed price reductions without consultation.

1

Planning Perspectives, Inc., May 2005

www.apma.ca

Automotive Parts Manufacturers Association

info@apma.ca

416.620.4220

2005 APMA Policy Paper November 2005

Page 5

This year the Big 3 have all announced plans to use a collaborative approach to their supplier relationships.

The APMA applauds their change in approach but we know that it will take dedicated management skills to

successfully adopt this business model.

In addition, with globalization of the industry and the entry of emerging economies in Asia (China, India and

Thailand) and Eastern Europe (Slovakia, Hungary, Poland and the Czech Republic), competition has

intensified for all participants. These emerging economies pose threats and opportunities for North

American companies. Global sourcing of components has become the norm and as such, North American

suppliers must compete with companies in other jurisdictions that do not necessarily have the same cost

base or legacy costs.

Opportunities are also present as a result of these emerging economies. Their growth provides North

American companies new market opportunities if they develop systems to harness the lower input costs in

those countries for some of their products currently manufactured in more expensive jurisdictions.

Consequently, the traditional business model and its dynamics have significantly changed for OE suppliers

and they must quickly adapt to the changes or risk their very existence.

APMA actively pursues programmes and initiatives through its networks to provide knowledge and market

specific information to its members and provide opportunities through its events, trade and procurement

missions and committee activities to allow its members to explore the opportunities available because of

the changing market, globally and in North America.

APMA PROPOSES:

Collaboration: The whole automotive manufacturing industry, led by the vehicle assemblers

themselves and the large Tier 0.5 suppliers down to other levels, work diligently together to

successfully implement the collaborative approach to purchasing and cost reduction. If the

collaborative model is adopted as the industry standard waste will be removed from the system

resulting in cost savings, price reductions and fewer supplier bankruptcies. To be successful all

companies must carefully review their compensation practices to ensure that the collaborative

approach is appropriately rewarded.

Strategic Focus and Innovation: Companies within the entire supply chain closely examine their

business processes and develop long term strategies on how to deal with globally competitive threats

and opportunities. Part of this strategy must include cultivating a culture of innovation which leads to

more forward thinking strategies and solutions.

Diversification Strategies: APMA member companies aggressively pursue diversification strategies

to balance their current customer base to match the changing market share of their customers. For

most members this means gaining business with the NNAMs.

Sourcing Decisions: Vehicle manufacturers and Tier 0.5 suppliers collectively rationalize their

sourcing decisions based on innovation, value, quality and cost. Lowest price is not necessarily the

best value, but traditionally, purchasing executive compensation focuses almost entirely on price

reduction. Compensation and especially bonuses must be realigned to fairly reward purchasing

personnel for achieving results in all areas of innovation, value, quality and cost reduction.

Cost Reduction Targets: All vehicle manufacturers and key suppliers set cost reduction targets at

practical and realistic levels in collaboration with their suppliers. This should reduce the number of

insolvencies in the supply chain.

Reward Research, Development and Technology: Vehicle assemblers must reward research,

development and technology brought forward by suppliers in order to encourage more innovative

www.apma.ca

Automotive Parts Manufacturers Association

info@apma.ca

416.620.4220

2005 APMA Policy Paper November 2005

Page 6

products. This will cultivate suppliers to become more and more innovative, ultimately leading to better

vehicles and increased vehicle sales.

North American Sourcing: That New North American Manufacturers (NNAMs) continue to grow their

sourcing within North America to strengthen the supply industry where their customers are located.

Support for Industry: That the NNAMs encourage their suppliers to support the industry associations

in North America in order to help strengthen the supply base as a whole.

That Governments Expand and Develop Support Programmes to assist companies to become

globally focused. This includes strengthening programmes to support JV, partnerships, and licensing

in combination with outsourcing, innovation and technology.

That Member Companies take Advantage of APMA Services which provide key information and

opportunities in a cost effective manner, designed to allow SMEs the ability to learn more and

participate in initiatives internationally focused.

www.apma.ca

Automotive Parts Manufacturers Association

info@apma.ca

416.620.4220

2005 APMA Policy Paper November 2005

B.

Page 7

INFRASTRUCTURE

ENERGY

While energy costs are determined by competitive market forces, there are a number of variables that

influence these prices and need to be controlled.

The supply and cost of reliable energy will become an ever increasing issue in the coming years. As

production of natural gas peaks in North America, supply decreases and demand increases, costs will rise

to levels never before seen in North America. The problems with an old and antiquated North America

power grid will be further multiplied in Ontario as electricity generation stations that use coal are taken

offline or switched to natural gas.

ELECTRICITY

In 2004, Ontario announced that it would be closing all of its coal-fired generating stations by 2007. It did,

in fact, close Lakeview Generating Station this year.

At one time the cost of electricity was a competitive advantage for Ontario - no longer. The cost of

electricity has increased on average over 50% since 2000. In a comparison to twenty jurisdictions that

Ontario competes with Ontario had the highest electricity costs. This summer, the cost of electricity peaked

at 55.3 per kilowatt hour - a horrendous rate. In a recent Energy Probe report, the Ontario Coal-fired

generating stations ranked among the cleanest out of 403 coal generation units in North America. Units 3

and 4 at the Lambton generating station ranked in the top ten. This summer when Ontario had to buy

power from dirty coal-fired US plants to meet demand, Ontario caused more emissions to be released into

the atmosphere than if Ontario had kept Lakeview open. This never should have happened. This is proof

that Lakeview Generating Station was closed prematurely. It may be too late to restart it but closure of any

more coal-fired generating stations needs to be suspended until the availability of reasonably priced

replacement power is guaranteed even in a worst case scenario.

APMA applauds the recent announcement by the Ontario government to refurbish Bruce A by 2009. The

key is to ensure there are no cost overruns and keeping to the construction schedule.

As important as is cost, a reliable supply is even more important. This summer there were brown outs or

decreased voltage and some short service interruptions. A service interruption as short as two seconds

causes robots and other automated equipment to malfunction. They need to be reset and this takes about

one and a half hours. This is obviously very expensive as an average assembly plant has hundreds of

robots. The availability of reliable electricity could become the limiting factor in determining where new

automotive investment dollars will be spent. Adding 1000 jobs to Ontarios automotive industry will

increase daily electricity peak demand in the province by one million watts. This problem will continue to be

a concern in both the short and long term for the future of the automotive original equipment supply industry

in Ontario, unless new generation capacity is developed now. Issues related to supply and demand must

be addressed to ensure that supply exceeds demand in order to keep prices competitive with other

jurisdictions competing for automotive investments. This needs to be solved in order for Ontario to remain

an automotive manufacturing powerhouse.

www.apma.ca

Automotive Parts Manufacturers Association

info@apma.ca

416.620.4220

2005 APMA Policy Paper November 2005

Page 8

APMA believes that new generation capacity be developed that is environmentally friendly; that will allow

Canada to meet its Kyoto commitments promoting advanced technologies developed and manufactured in

Canada. Atomic Energy of Canada Limited (AECL) has developed a second generation nuclear reactor that

is safe, efficient and uses relatively abundant uranium for fuel. There has also been important

technological innovation in the burning of coal that approaches the cleanliness and CO2 emissions of

natural gas.

APMA PROPOSES:

Refurbish Ontarios Nuclear Operations: Ontarios existing nuclear operation capacity be

refurbished where feasible and brought on line as soon as possible.

Second Generation CANDU Nuclear Reactors: Where not feasible to refurbish existing nuclear

generating plants, second generation CANDU nuclear reactors be built to replace their power output

using the same locations to take advantage of the existing transmission infrastructure.

New Generation Capacity: New generation capacity to be built in Ontario be as environmentally

friendly as is feasible, i.e. Fuel Cells Stations, Wind Turbines, Solar, Biomass and Hydro. This will

require government subsidies in the beginning but be self-sustaining in the long term. Tax credits are

probably the most efficient.

Reopen Market to Competition: The Ontario Electricity Generation market be reopened to

competition only after all refurbished nuclear generation capacity within the province of Ontario comes

back online.

Coal-fired Electrical Generating Stations stay on line until there is new capacity in place to replace

them. It is imperative that there is always more supply than demand.

Use of clean coal technology thoroughly investigated: Rather than eliminating coal-fired

generating stations per se just because they burn coal, set emission performance standards for all

types of generating stations. It may be that new technology coal-fired generators will meet the

standards.

Fuel Cell Technology: All levels of government support the development of fuel cell technology that

uses hydrogen produced from electrolysis of water.

NATURAL GAS

The price and shortages in supply of natural gas will put more pressure on an already troubled industry, to

the point where the Canadian industry will not be competitive with off-shore countries that are not required

under Kyoto to reduce CO2 emissions. The cost pressures will be multiplied in Ontario if the province

switches from burning coal to natural gas to produce electricity. In 1999, the benchmark price of natural

gas was $2.32 US per million British thermal units. In 2005 that price has increased to $9.81/MBtu (Nymex

Henry Hub, August 24, 2005). This cost increase will have a multiplier effect on the Canadian automotive

original equipment supply industry. The cost to produce primary materials such as steel and chemicals will

increase and, at the same time, the cost to take these primary materials and form them into finished

automotive parts will increase. This cost increase could affect jobs within the automotive original

equipment supply industry.

APMA PROPOSES:

Natural Gas Exploration and Transportation: Exploration for natural gas resources take place now

and that greater gas transportation and storage capacity be built.

www.apma.ca

Automotive Parts Manufacturers Association

info@apma.ca

416.620.4220

2005 APMA Policy Paper November 2005

Page 9

Alternatives: Alternatives such as liquefied natural gas or coal bed methane be developed.

Converting Coal-fired Electrical Generating Capacity: Before considering converting coal-fired

electrical generating capacity to natural gas, the natural gas market in Ontario be thoroughly studied

and conversion only be undertaken if natural gas availability and price is not significantly affected.

OIL

The price of oil has sky rocketed over the last year. This has added to the many other cost increases the

auto supply industry has faced. This increase in the price of oil affects direct energy costs for processing

and transportation and the cost of raw materials derived from petroleum. Due to the taxing structure of

gasoline the federal government has reaped a windfall of increased tax revenue that has increased the

federal surplus considerably.

APMA PROPOSES:

Utilize Government Surpluses: The federal government utilize part of its budget surplus to

encourage manufacturing companies to save energy and raise productivity as a means of dealing with

higher energy costs.

DECREASING DELIVERY TIME BETWEEN CANADA AND UNITED STATES CUSTOMERS

Canadas automotive original equipment supply industry is the preeminent user of the Just in Time (JIT)

delivery process as an integral part of the manufacturing process. The automotive industry is Canadas

largest importer and exporter of products which have exponentially increased through the years; firstly, due

to the Auto Pact (1965), then the Free Trade Agreement (1984) and finally NAFTA (1987), making our

industry the most integrated in North America. Within the existing infrastructure, the Windsor/Detroit border

area is the most critical to the automotive sector. More than $140 billion per year in exports and imports

pass through Windsor, most of which is automotive. Access to and from Ports of Entry from the East and

West coasts of Canada are equally important with the growing market presence of shipments to and from

the Asia Pacific Region.

The Windsor border crossing is Canadas busiest and is using infrastructure that is ancient. Last year the

Ambassador Bridge celebrated its 75th birthday, the Windsor-Detroit vehicle tunnel was finished in 1929

and the railway tunnel is over 100 years old.

In other parts of Ontario the cross border infrastructure is also at, or near capacity, due to various approach

bottlenecks or in the case of Fort Erie/Buffalo, inadequate bridge capacity.

Current improvements at the Customs Plazas and increased staffing levels at some border crossings have

relieved some of the bottlenecks. These improvements are viewed as temporary and projections indicate

that in the very near future, utilization will once again exceed infrastructure capacities as trade flow

increases. A number of Intelligent Technology Systems (ITS) are also being implemented in the short term

to help manage traffic flows on highways approaching border crossings. While the foregoing remedies may

address some of the needs in the short term, for the longer term, more infrastructure is the only answer.

Time is money and all these delays add to the cost of manufacturing by increasing inventory required for

just in case (instead of what should be, just in time), lost productivity, additional warehousing and,

www.apma.ca

Automotive Parts Manufacturers Association

info@apma.ca

416.620.4220

2005 APMA Policy Paper November 2005

Page 10

transportation costs. There is also the additional pollution and greenhouse gas emissions generated by

trucks going nowhere stuck in traffic or engines not operating in their most efficient range.

At the present time, customs and immigration inspections occur after people or goods transit the structure.

Currently there is no inspection of vehicles before they traverse the structure leaving it vulnerable to

terrorist attack while creating inspection bottlenecks at the incoming inspection facility on the far side of the

structure.

A number of automated pre-clearance systems have been implemented to expedite passage of low risk

goods and people, allowing customs and immigration personnel to concentrate on high risk goods and

people. Being low risk is only beneficial if adequate capacity exists at the customs and immigrations plazas

to separate low risk from high risk traffic - so that the low risk traffic is not caught in line behind the high risk

traffic. In particular, what is required are dedicated lanes approaching and transiting the border crossing so

that low risk traffic can be separated from the high risk traffic early on and processed independently of the

high risk traffic.

APMA PROPOSES:

Border Customs Plazas:

Continue to aggressively pursue and implement infrastructure

improvements and staffing levels at existing Customs Plazas and provide dedicated access lanes for

low risk commercial goods shipments. Highway #405 upgrades are prime examples of what should

occur at all border crossing approaches.

East and West Coast Ports of Entry: Enhance access infrastructure points to and from the Ports of

Entry on the East and West Coasts of Canada which are more relevant today with the growing market

presences of shipments to and from the Asia Pacific region.

Accelerate the Installation of a Fully Automated, Electronic, Secure Clearing System for

Commercial Vehicles that is Fully Compatible with United States Customs and Security

Agencies. From a commercial viewpoint, it is imperative that United States customers not perceive

Canadian suppliers as unreliable because of potential border crossing delays. We must make the

border crossing a seamless, reliable and prompt process for low risk commerce. Commercial

programmes such as FAST, CSA, C-TPAT and PAPS work well and need to be promoted and

expanded. For low risk goods and travelers, all customs and immigration information must be

paperless and information instantaneously transferable between Canada and United States Customs

and Security agencies. The vision we have is that when a FAST shipment leaves an automotive parts

supplier, the manifest is electronically and instantaneously sent to US or Canadian Customs and

Security. They then have all the information required and can make quick decisions on whether or not

to inspect.

Accelerate the integration of a fully automated electronic-secure individual crossing for low risk

individuals that is fully compatible with all Canadian and United States immigration and security

agencies. The NEXUS pass system is a great start with its fingerprint scanning and photo ID system.

NEXUS AIR is now starting up as well. It is imperative that NEXUS and NEXUS AIR use the same

card and that Can Pass be integrated into NEXUS. All these programmes should, in fact, be one

integrated programme.

Intelligent Technology Systems (ITS): That Governments at all levels immediately implement

Intelligent Technology Systems (ITS) to provide maximum traffic controls and advance notification to

minimize congestion and traffic choke points as an immediate short term solution. This would include

incorporating low risk commercial goods traffic management programmes such as FAST.

www.apma.ca

Automotive Parts Manufacturers Association

info@apma.ca

416.620.4220

2005 APMA Policy Paper November 2005

Page 11

Provide dedicated fast track lanes for vehicles, individuals and goods that qualify for low risk

passage so that those shipments and travelers are not caught in line behind others that have not so

qualified. There is sufficient space to partially implement this now but to be truly effective, plaza

reconstruction and additional lanes are essential at Windsor and Sarnia crossings.

Expedite the Implementation of Customs Pre-Clearance at Buffalo/Fort Erie. The planned

programme of pre-clearance at Buffalo/Fort Erie has the advantage of early separation of low risk from

high risk traffic speeding up the crossing time for low risk traffic. It also allows for pre-crossing

inspection increasing security for the structure itself. This is a vast improvement and the pilot project

should be up and running as soon as possible. Once the kinks are ironed out, this could become the

model for other crossings for speeding up border crossing time and decreasing the cost of border

crossing delays.

WINDSOR/DETROIT BORDER CROSSING INFRASTRUCTURE

The debate on the adequacy of the Windsor/Detroit infrastructure started in 1999, two years before 9/11,

when it was apparent that from increased traffic alone another structure would be required. The Detroit

River International Crossing Project (DRIC) has confirmed that additional capacity is required no later

than 2015. The DRIC is also predicting a new crossing will be built by 2013 while others are suggesting

2019. If the new crossing is delayed our industry will shrink due to our inability to competitively service our

customers in the United States. Some interest groups have also suggested that another crossing is not

necessary. If we delay building a new border crossing this could become a self-fulfilling prophecy due to

lost business. We cannot allow that to happen.

Over the last year there has been the Lets Get Windsor-Essex Moving strategy, the Schwartz Report and

the release by DRIC of 15 potential crossings (now reduced to nine and soon to be three). We now need to

move forward as quickly as possible to improve cross border flow in the short term through more efficient

processing methods and vigilance in ensuring adequate staffing at all times. Concurrently, we must

expedite the process of deciding on and building another crossing structure.

APMA PROPOSES:

Plan for and Expedite Infrastructure Improvements to remove congestion at the Windsor/Detroit

border and immediately increase the size of the customs and immigration plazas at the Ambassador

Bridge. The expansion of the plaza is underway with the US with direct access to I-75, I-96 - expected

to open 2006. The Canadian plaza expansion is also underway with completion of 3 new booths for the

east side of the plaza scheduled for December 31, 2005.

Upgrade the Link from Highway 401 to the Ambassador Bridge to relieve congestion and improve

accessibility for Windsor residents. There must be expressway access from Highway 401 to the

Ambassador Bridge. This will shorten border crossing time and remove trucks from Windsor streets

while reducing air pollution in Windsor from idling trucks stopping for the 16 stoplights on Huron Church

Road. In four years, all that has been built is a pedestrian overpass. We need to do much more and do

it now!

Accelerate the DRIC Project when and where possible. The final crossing recommendation is due at

the end of 2007. If more resources are given to the panel the process could be accelerated and a final

crossing built before 2013. To accomplish this we need, as the Canadian Senate report stated in June

2005, war time urgency. A new crossing in Windsor is a provincial and national priority and the health

of our industry and the Canadian economy is dependent on it.

www.apma.ca

Automotive Parts Manufacturers Association

info@apma.ca

416.620.4220

2005 APMA Policy Paper November 2005

Page 12

ONTARIO INFRASTRUCTURE

Gridlock on Ontarios highways is now a common occurrence. There are constant accidents and

congestion slowdowns from Windsor to past Oshawa and from Fort Erie to Barrie on the 400 series

Highways and the QEW. The worst area of all is the Greater Toronto Area (GTA). With eight assembly

plants and hundreds of supplier plants throughout the GTA or on the periphery and having to traverse the

GTA, the delays are costing billions of dollars and contributing to significant increases in pollution from

idling trucks.

APMA PROPOSES:

Continue to expand 400 Series Highways, QEW and create the mid Niagara Highway. This is

another capacity problem that will take time to remedy so immediate commencement is required.

Make Highway 401 six lanes from Toronto to Windsor, extend the 407 to Hwy 135, complete the 427 to

past Barrie, widen the 400 to eight lanes to past Barrie and start building the mid Niagara Highway. In

addition, where feasible within the GTA, add grade separations where arterial roads cross to reduce

congestion and pollution. This should be funded by the Federal and Ontario governments as

infrastructure improvements are for the benefit of the whole Canadian economy.

ENVIRONMENT

The Canadian automotive original equipment supply industry has been proactive in the areas of

environmental matters for over a decade. In 1993, APMA and its members entered into a voluntary

agreement with Environment Canada and the Ontario Ministry of Environment. This Agreement was

renewed in 1998. The result of the two agreements was the prevention of over 1 million kilograms of

pollution. In 2002 APMA signed an Environmental Performance Agreement with Environment Canada and

Industry Canada. The goal of this agreement is to achieve verifiable reductions in the use, generation and

release of specified priority substances in the automotive parts sector. APMA also signed a separate

agreement with the Ontario Ministry of Environment in 2003.

APMA PROPOSES:

Additional Incentives to Reduce Emissions: The federal and provincial agreements must provide

additional incentives for companies that reduce emissions below legislative levels.

Harmonization of Environmental Performance Agreements: The federal and Ontario governments

and APMA harmonize both agreements so that companies can comply with both by completing one set

of documents. This should result in increased participation.

FINANCIAL AND POLITICAL INFRASTRUCTURE

The automotive industry, a global industry, has no boundaries. Decisions made elsewhere impact the

industry in Canada just as decisions made in Canada impact the industry elsewhere. The decisions are

greatly influenced by changing macro variables. The variables may impact decisions relating to

investment, sourcing and vehicles produced in specific markets. Further, these variables are numerous

making it difficult for companies to plan for their impact which ultimately may affect their profitability.

Companies who can best prepare to manage change will be the most successful and prosper.

www.apma.ca

Automotive Parts Manufacturers Association

info@apma.ca

416.620.4220

2005 APMA Policy Paper November 2005

Page 13

In the past few years, some of the key financial and political variables that have had an influence in the

automotive industry in Canada include:

The Canadian government has signed the Kyoto Accord but has not yet released details on how to

achieve the greenhouse gas reductions required by it.

The value of the Canadian dollar relative to the United States dollar. While the higher dollar may

benefit import based industries in Canada, it negatively affects the automotive sector in Canada.

The velocity of the change is another problem as companies cannot adjust their operations quickly

enough to offset the effect of the increased dollar value on their profitability.

Commodity price increases resulting from increased world demand or lack of supply. Steel, resins,

precious metals have all risen in price from 50% to 100% affecting the input costs for automotive

original equipment suppliers.

The undervalued Chinese currency allows Chinese products to be artificially lower priced than

those from other jurisdictions.

Wage rate differences between Canada and other emerging economies such as China, India,

Mexico and Eastern Europe countries.

Levels of unionization in Canada versus other jurisdictions.

Lack of enforceable laws to control intellectual property rights infringements emanating primarily

from China.

The emergence of the European Union and Asian markets as two significant Trading Zones.

North America must strengthen and develop the North American Trading Zone to ensure we can

compete with the other two Trading Zones.

The emergence of the Security and Prosperity Partnership of North America (SPP) signed by the

United States, Canada and Mexico to harmonize regulations, standards and border regulations.

Free Trade Agreements have become popular with emerging countries.

APMA PROPOSES:

Global Sourcing Strategies: Companies develop strategies to use global sourcing considerations as

a method to acquire more business in North America (via low cost emerging economies such as China,

India and Eastern Europe). These strategies should focus on the opportunities, versus threats that

these emerging economies present.

Canadian Dollar Stability: While the Canadian dollar does fluctuate, the Canadian government,

through the Bank of Canada, must continue to maintain a stable Canadian dollar. The dollar had been

relatively stable at $0.80 to $0.84 for a year but is now at $0.85. Interest rates should be adjusted to

keep the Canadian dollar below $0.85.

Labour: Unions must consider their impact and role within companies as they try to compete globally.

Strictly on a labour cost perspective, Canadian labour rates are much higher than in many other

www.apma.ca

Automotive Parts Manufacturers Association

info@apma.ca

416.620.4220

2005 APMA Policy Paper November 2005

Page 14

jurisdictions. For this to continue, significant productivity improvements must be included in the

collective bargaining outcomes.

Security and Prosperity Partnership of North America (SPP): APMA wholeheartedly endorses the

Security and Prosperity Partnership of North America (SPP). The SPP will work towards synchronizing

regulations for trade within the North American trading block by removing trade obstacles between the

NAFTA countries for low risk commercial trade. This includes product standards, customs regulations,

security regulations, and electronic data interchange for seamless border crossings.

Free Trade Agreements: Government needs to carefully review and scrutinize potential Free Trade

Agreements to ensure that Canadian companies are fairly represented and receive equal and barrier

free access to those foreign markets.

WTO Rules and Regulations: The Canadian government monitor WTO Rules and Regulations and

their application and infringements by low cost countries such as China.

The Canadian governments work with other governments to pressure the Chinese government to

allow the Yuan to float freely.

Government Programmes: Government continue to develop and strengthen programmes that

support industry initiatives in joint ventures, partnerships, licensing initiatives and exports which include

trade and procurement missions. These programmes should also be designed to help companies

develop strategies to compete globally and take into account taxation rate targets and interest rates.

Kyoto: The Canadian Government must release the plan for Kyoto NOW. Any increases in cost for

OEMs as a result of Kyoto must be worked into contracts sooner rather than later.

Voluntary Partnerships: The Canadian Government must continue to work in a voluntary manner to

achieve desired VOC reductions in the OEM sector.

www.apma.ca

Automotive Parts Manufacturers Association

info@apma.ca

416.620.4220

2005 APMA Policy Paper November 2005

C.

Page 15

INNOVATION AND TECHNOLOGY FOR ECONOMIC PROSPERITY

In the globally competitive automotive industry, Canadas labour rates are higher than in many emerging

jurisdictions. As such, Canadian companies are not competitive in labour intensive products and

processes. However, because Canada has a very mature automotive sector, Canadas competitive

advantages will come from our advanced use of manufacturing and management techniques and

innovation that will allow Canadian manufacturers to move to higher levels in the value chain or produce

products or supply services at high levels of productivity that can negate the competitive advantage of low

labour rates in other jurisdictions.

Innovation and the use of advanced technologies and methods will be Canadas competitive advantage in

the global marketplace. Utilizing virtual and rapid prototyping technologies can render significant benefits in

bringing new products to market more rapidly at lower cost. Virtual prototyping is now so sophisticated that

entire vehicles and factories to produce them can be created on the computer prior to any physical

prototypes being built. Different design alternatives and scenarios can be investigated to ensure that the

optimum solution has been developed and previously unanticipated problems can be analyzed and solved,

all in a virtual world on the computer. This is a huge advance over building the factory and then spending

months taking the bugs out. It increases efficiency, quality, speed to market and lowers construction and

machinery costs all at the same time.

Canada has historically been very strong in research and development with a solid infrastructure already in

place made up of government agencies and well established universities and colleges. The disconnect has

been that much of the research done has tended to be curiosity driven and not aimed at a particular

outcome or solving a real world unknown. The challenge then is to better integrate these research

organizations to more effectively assist companies to not only conduct research and development, but also

to innovate and bring that research to commercial success as products or processes within a reasonable

period of time at the lowest possible cost.

Only through collaboration and better integration will synergies be created that will lead to more advanced

research and development, innovations and ultimately, commercialization which will provide Canadian

automotive parts suppliers with more business opportunities locally and around the globe.

The AUTO21 Network of Centres of Excellence (NCE) positions Canada as a leader in automotive

research and development, by helping to fund research projects that include consumer education in the use

of safety devices, advanced polymer foam processes, vehicle telematics, and advanced fuels and

powertrains research.

The Canadian Lightweight Materials Research Initiative (CLiMRI) co-ordinates research & development

activities on the implementation of lightweight & high strength materials into transportation applications.

Materials and Manufacturing Ontario (MMO) is an Ontario Centre of Excellence committed to making

connections between the best university research and the needs of Ontario industry. MMO supports

university research in materials and manufacturing, develops partnerships, trains qualified graduate

students with an industrial orientation, and transfers knowledge and technology to industry.

The role of the Natural Sciences and Engineering Research Council of Canada (NSERC) is to make

investments in people, discovery and innovation for the benefit of Canadians by funding more than 9,600

www.apma.ca

Automotive Parts Manufacturers Association

info@apma.ca

416.620.4220

2005 APMA Policy Paper November 2005

Page 16

university professors every year and encouraging more than 500 Canadian companies to invest in

university research.

These are just four of many research funding organizations in Canada. Please note that the only one that

is dedicated to the auto sector is AUTO21.

Vehicle manufacturers are now requiring original equipment suppliers to take on more and more design

responsibility creating a more technologically sophisticated level of employment in the automotive original

equipment supply industry than Canada has ever had. These new demands require designers, engineers,

artists, mould designers, process designers, etc. This out-sourcing of design and engineering is an

opportunity for Canadian automotive original equipment suppliers to make innovation and design our

competitive advantage. However, one of the key problems is the ability to assemble the necessary team

and afford to keep the team in place from proposal, to concept, to design, to prototype, to production. This

process may take several years and there is no guarantee at the proposal stage. Affordability is an issue

for all manufacturers. Government support should be available to all companies, perhaps, scalable, based

on company size to provide more benefit for smaller companies who have lesser resources.

The current Scientific Research and Experimental Development tax credit system (SR & ED) has been

substantially improved but there are still difficulties in obtaining advanced approvals and defining when in

the prototyping process, development ends. It also needs changes to accommodate the new opportunities

created by the downloading of R & D to the supply base and expanded to include the new technology of

virtual prototyping.

The Government of Ontario recently announced funding enhancements to the Ontario Research

Commercialization Programme and Ontario Commercialization Investment Fund to assist in the

commercialization of promising technology. We need to ensure that it is administered with a user friendly

approach so that industry can take full advantage of it.

The Ontario government has also established a new Ministry of Research and Innovation headed by

Premier McGuinty himself.

A grant/loan system that bases repayment on cash flow from the innovative product or process would

greatly increase the research and development (R & D) investment climate in the automotive industry in

Canada.

In order for suppliers to become more innovative they need to create a culture of innovation within their

organizations. Larger organizations generally have the resources to create this culture but small and

medium enterprises (SMEs) do not. SMEs need assistance in developing a culture of innovation.

There are a number of opportunities awaiting Canadian companies that could propel companies to the

forefront. While the gasoline internal combustion engine will not be replaced any time soon, it, may,

eventually be replaced or, at the least supply only a portion of the motive power for vehicles in the future.

Accordingly, automotive suppliers must consider their positioning and product mix for future advancements

in hybrid and fuel cell technologies, diesel, bio diesels and other game changing technologies.

APMAs Innovation and Technology Committee evaluates and assesses innovation initiatives in concert

with the Canadian Automotive Partnership Councils (CAPC) Innovation and Technology Working Group for

the benefit of the entire automotive industry. An early outcome that is currently being assessed is the

Automotive Parts Manufacturers Association

www.apma.ca

info@apma.ca

416.620.4220

2005 APMA Policy Paper November 2005

Page 17

merits of an automotive Web Portal for the industry in Canada. The portal will contain all pertinent

information in one central source to facilitate information exchanges for research, development and

innovation, most helpful for Canadas SMEs and researchers.

APMA PROPOSES:

Support of Innovation: Government and industry expand support for innovation initiatives and

collaboration models. We believe these are the areas where the automotive industry in Canada can

best excel and prosper. An example is the Automotive Web Portal.

Innovation in Ontario: The government of Ontario should consult with the automotive industry on

how to best organize the new Research and Innovation Ministry to make it as efficient and effective as

possible in assisting innovation in Ontario to bring true economic benefit to the province.

Productivity and Innovation: Governments at all levels must aggressively pursue a productivity and

innovation strategy. Among other items, this strategy must continue to support and fund Made-inCanada innovation initiatives and foster a culture of innovation. By developing an atmosphere of

innovation, companies will become more productive.

Made-in-Canada Innovation Centre: Government, industry and educational institutions develop a

Made-in-Canada Innovation Centre to help companies create a culture of innovation, assist in

innovation and provide best practices and benchmark data.

Technology Partnership Canada Programme now becoming the Transformative Technologies

Programme: Government expand and enhance the new Transformative Technologies Programme so

that it is more easily accessed by the automotive industry. Navistar was the first automotive use of the

Technology Partnership Canada Programme, but there are many more companies that could qualify for

the new Transformative Technologies Programme if it was enhanced to take into account the realities

of the automotive industry.

Taxation and Credits: Given substantial government surpluses, the Government of Canada and

Provincial Governments aggressively enhance Investment Tax Credits and credits for capital

acquisition which immediately offsets costs, helps to improve competitiveness and, in the long run,

increases government revenue. In addition, the capital cost allowance rate for equipment used in R &

D should be increased significantly.

Canadas Innovation and Research Organizations: Governments at all levels continue to

aggressively fund the most effective of Canadas innovation and research organizations in an effort to

subsidize administrative costs and allow more funds to be used for direct project related expenses;

specifically, double AUTO21 funding.

Organizational Collaboration: Canadas leading innovation organizations significantly increase their

collaboration to increase efficiencies and strengthen effectiveness by developing synergies and cost

share administrative costs.

Corporate strategies: Companies challenge themselves to develop a culture of innovation,

concentrate on innovative solutions to existing problems in the marketplace and identify problem

products/processes and dedicate resources to resolving those problems. This may serve as an

effective strategy to develop new business opportunities with the NNAMs.

www.apma.ca

Automotive Parts Manufacturers Association

info@apma.ca

416.620.4220

2005 APMA Policy Paper November 2005

D.

Page 18

GOVERNMENT SUPPORT FOR THE AUTOMOTIVE SECTOR

The automotive industry in Canada has been quite successful and profitable through the years. However,

in the active competitive environment of other states offering lucrative incentives to invest in their

jurisdictions, there is an ongoing need for governments to remain active in providing support mechanisms

to the sector to attract and retain companies in Canada. We require a Made-in-Canada Automotive

Strategy. The truth is that the substantial sums offered by other jurisdictions tilt site selection in those

other jurisdictions favour. Our governments investments are required to re-level the playing field.

GLOBALIZATION, ATTRACTING NEW INVESTMENT AND RETAINING EXISTING INVESTMENT

After several years of assembly plant closures, Canada has turned the corner. Although Canadian light

weight vehicle production has dropped from 3 million units in 1999 to 2.6 million units in 2004, we now see

a trend of increasing production over the next few years.

Some significant factors influencing investment decisions include the move to lower cost component

producers in emerging economies and the shifting of market share away from the traditional Big 3 to the

NNAMs. As the market share shifts for new vehicles, the OE supply base is impacted as well because in

many cases, the NNAMs have their own preferred suppliers. This affects the ability for traditional Big 3

suppliers to gain new business to offset order reductions from the traditional Big 3.

While the Canadian automotive industry is currently strong, through global sourcing initiatives of the vehicle

assemblers, the traditional methods of conducting business have changed.

In the past, the low value of the Canadian dollar gave Canadian suppliers a competitive advantage and

significant increases in export sales (primarily to the United States) were achieved. However, more

recently, with the increasing value of the Canadian dollar relative to the U.S dollar and other currencies and

global sourcing from emerging countries, government must re-examine its trade policies.

With appropriate government policies Canada can remain a net exporter, but government must

acknowledge and support other trade initiatives to assist companies to participate in the world trade arena.

Joint ventures, global partnerships and licensing agreements with foreign-owned companies are more

commonplace today. Government policies must reflect these different methods of doing business, which is

very different from an exporting based strategy.

The Federal Government and Government of Ontario have each committed $500 million in public

investments to the automotive sector in Canada. While the Province of Ontarios qualifying criteria is fairly

well documented, the Federal criterion is not. Notwithstanding, through government commitments, to date,

the automotive sector has been able to secure four investments including one new assembly facility.

These investments are the Navistar diesel centre in Chatham, the Ford of Canada flexible manufacturing

plant for Oakville and elsewhere in Ontario, the General Motors of Canada Beacon Project and the Toyota

Motor Manufacturing Canada new assembly plant for Woodstock, Ontario. APMA would like to applaud all

participants on these new investments.

It is extremely important to note that the government investments are not government handouts, but rather

investments in the sector tied to research, development, innovation, human resource development and

training and modernization of facilities. Examining the specifics in more detail is quite revealing. With

www.apma.ca

Automotive Parts Manufacturers Association

info@apma.ca

416.620.4220

2005 APMA Policy Paper November 2005

Page 19

commitments of less than $1 Billion from combined public funds, the four companies mentioned above

have committed $4 Billion in direct investment to Ontario. Please note that this $4 Billion does not include

spin off investments and government revenues associated with continued or expanded manufacturing at

these plant locations, nor does it factor in the growth of the automotive parts supply segment which will be

realized as a result of supplying those operations.

While Canada has been successful in securing investments from DaimlerChrysler, Ford, GM, Honda and

Toyota, government should also aim at attracting investment from Nissan, Volkswagen, BMW, Hyundai and

Peugeot-Citroen as they increase market share to further diversify our industry in Canada. In setting out

criteria for advancing funds, the government should do as China does and include local content

requirements. This will increase the multiplier effect and create more employment in Canada.

Canadas objective should strive to retain light vehicle production targets of 15% of NAFTA sales and

increase parts production by $20 Billion by 2015.

APMA wishes to congratulate the federal government for creating the new Automotive and Industrial

Materials Branch. The industrial materials include chemicals, plastics, steel, aluminum, composites, other

advanced industrial materials and nanotechnologies. The automotive industry consumes 37% of Canadas

steel, 17% of rubber and 14% of aluminum etc. so that this realigned Branch can focus on automotive and

the related industrial materials. This realignment has been a long standing request of the APMA and we

believe a more efficient use of government resources.

APMA PROPOSES:

Canadian Automotive Policy: The Federal Government consult with industry to develop and

publish a strategically focused Automotive Policy to encourage new assembly and supplier

manufacturing in Canada and increased purchases by OEMs from Canadian suppliers. Once the

policy is developed, government and industry should work together to implement it.

Investment Initiatives: Government continue to use investment initiatives to encourage existing

vehicle manufacturers to build more capacity in Canada while seeking to attract new investment. If the

opportunity arises, the investment needs to be made even if the original allocation of funds has been

exceeded.

Productivity Programmes:

Government provide incentives to companies for productivity

improvement programmes allowing companies to embrace lean manufacturing techniques as a way of

increasing industry productivity levels to be globally competitive.

Canadas Brand: Government continue to enhance a strong Marketing of Canada branding

programme to market Canadas in foreign jurisdictions.

CANADIAN AUTOMOTIVE PARTNERSHIP COUNCIL (CAPC)

Formed in 2002, CAPC has 16 members consisting of the Ministers of Industry for Canada, Ontario and

Quebec, the 5 OEM CEOs, four CEOs appointed by APMA for three year terms, CAW, an academic rep, a

dealer rep, and an aftermarket rep. Each of these is supported by an alternate representative. This

powerful group, formed to unite the automotive industry and address the common issues affecting the

Canadian industry, has set up working groups to address the various areas as follows:

www.apma.ca

Automotive Parts Manufacturers Association

info@apma.ca

416.620.4220

2005 APMA Policy Paper November 2005

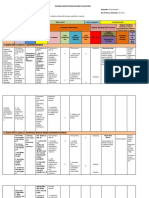

Initiative

CAPC

Strategic Vision Working Group

Fiscal / Investment

Trade Infrastructure

Innovation

Regulatory Harmonization

Human Resources Development

Sustainability

International Trade Policy

Page 20

Chair

Michael Grimaldi/Don Walker

Ray Tanguay

Michael Grimaldi

Steven Landry

Ross Paul

William Osborne

Bob Magee

Gerry Fedchun

Jim Stanford/Gerry Fedchun (Interim)

CAPCs working groups have provided industry stakeholder participants excellent opportunities to dialogue,

evaluate and address difficult issues. APMA and its members are well represented on each of the Working

Groups and on the CAPC Panel and our concerns are being carried forward as a result. In fact, many of

the initiatives APMA has pursued through the years have either been funded or initiated. In particular,

APMA, has been an advocate of human resource development since 1997 and had devoted considerable

resources to this issue. We are pleased that through CAPC, a number of initiatives have commenced.

Some of which are: the Council for Automotive Human Resources has been created and is actively

pursuing its objectives with federal funding; the Federal and Government of Ontario have committed

significant funds towards attracting automotive investments and infrastructure improvements; preliminary

funding has been received for a study on the merits of a Web Portal for the automotive sector focused on

research, development and innovation and there is a just released analysis of apprenticeship training in the

automotive industry.

Within CAPC, it is anticipated that some of the initiatives will be finite and the working groups will conclude

their work and disband, while others will be longer term.

In some instances, progress at CAPC has been slowed at government levels. It is APMAs opinion that

such delays are detrimental to the purposes for which CAPC was formed. Our industry continues to be in a

state of flux, and in a globally competitive industry, it cannot afford to lose valuable time on bureaucratic

approvals or delays in programme implementation.

APMA will support CAPC and its initiatives with APMAs voice being carried forward by APMAs

representatives and alternates. APMA staff continues to actively represent its members and interests as

they serve on almost all the working groups and provide valuable input. It is APMAs intention that over the

long term a majority of APMAs representatives to CAPC be APMA Board members.

APMA continues to support CAPC and the entire automotive industry in Canada by including keynote

presentations from CAPC at its Annual Conference and Exhibition. APMAs Annual Conference provides

CAPC an excellent avenue to communicate to the entire industry and, through media coverage, the

Canadian public on CAPCs initiatives and scorecard report which summarizes the status of each initiative.

APMA PROPOSES:

Support for CAPC: That the Federal and Provincial Governments continue to support and actively

participate in the CAPC process from the highest levels.

www.apma.ca

Automotive Parts Manufacturers Association

info@apma.ca

416.620.4220

2005 APMA Policy Paper November 2005

Page 21

Expedite Evaluation Processes: That the Federal and Provincial Governments have an expedited

process to evaluate CAPC recommendations and be prepared to act on them quickly and, where

appropriate, fund them.

Automotive Strategy: CAPC pursue its receipt of a clear and concise Automotive Strategy from the

Federal Government. This was anticipated for December 2004, but is yet to appear.

APMA and CAPC: APMA remain, through direct member representation or APMA staff, intimately

involved in the CAPC process and its Working Groups.

Communication to Industry: APMA continue to be a strong communication medium for CAPC by

providing a platform and network for CAPC to communicate to the broader automotive industry in

Canada.

www.apma.ca

Automotive Parts Manufacturers Association

info@apma.ca

416.620.4220

2005 APMA Policy Paper November 2005

E.

Page 22

HUMAN RESOURCES: MANAGING HUMAN CAPITAL

Executives often talk about employees being their most important asset; but those words will soon ring true

as never before. By 2010, except for immigration, there will be zero growth in the Ontario labour force. By

2020, the Canadian labour market is expected to face a shortage of a million workers. Even today,

companies are already encountering significant challenges in hiring technical or skilled employees, and

retaining key talent. According to the 2002 APMA Autoshift report, the automotive components industry is

not just facing an impending shortage of skilled workers, it is facing a shortage of the right people with the

right attributes and complimentary skills and the right talents. In addition, companies will need people who

are motivated to learn, unlearn and relearn.

What is key to the success of an organization in managing its human resources is developing a strategic

plan and creating an environment and culture within their organization that is rewarding, innovative,

engaging and truly committed to the growth and success of its workforce. Human resource-related issues

will have a big impact on business strategies. With labour and talent in short supply, companies will need

to carefully plot their long term strategies and ensure that their company is viewed as a preferred employer.

The important human resource issues are:

The skill level of supplier industry employees, including soft skills, literacy, numeracy and problem

solving;

Ensuring employee satisfaction and engagement (maintaining morale and motivation);

Effective leadership (upgrading the skills of all levels of management);

Attracting, developing and retaining top talent and innovators including skilled trades;

Succession planning;

Compliance with legal requirements (e.g. Duty to Accommodate, Human Rights, Employment

Standards Act, Ontario Labour Relations Act).

Ultimately, it is the companys approach to human resources that will result in its success in the recruitment

and retention of workers. Each organization needs to create a culture that identifies its employees as value

added strategic partners, assisting in the growth and development of the firm.

DEVELOPING INNOVATORS:

PROGRAMMES

SECONDARY

SCHOOL

TECHNOLOGICAL

EDUCATION

Each student in elementary and secondary school should be technically literate in order to be a

contributor to society, whatever career path they decide on. In order for our society to be more innovative,

we must all realize the potential of technology and find new ways to harness technology to be successful.

We must also comprehend that technology does not solely mean computers. Technology has many

diverse applications and has a substantial impact on our quality of life.

Not every student is academically inclined, nor should they all be encouraged to enter the learn by

research stream. Technological education programmes in our high schools address the 50% of students

who learn by doing, promote the integration of critical thinking with collaborative working strategies and

provide students with the essential skills to enter the workplace, apprenticeship, college or university. In

our high schools, a mandatory course credit in technology education is essential to building skills and, more

importantly, awareness of careers related to technology.

www.apma.ca

Automotive Parts Manufacturers Association

info@apma.ca

416.620.4220

2005 APMA Policy Paper November 2005

Page 23

There are many students who would find a career in technology a rewarding lifetime pursuit but never enter

it because they have never been exposed to technology and do not understand what careers are available

or what they would be doing in those careers.

On May 17, 2005, the Ontario McGuinty government announced new investments to create new

opportunities for young people. Ontario high schools received $45 million in one-time funding to support

student success in technological education programmes. The new funding can be allocated to new

equipment, equipment repair and facility enhancements. Schools that receive the new funding are

engaged in multi-year plans, success measurements and community partnerships in order to create strong

and sustainable programmes. APMA applauds the Ontario government for their commitment to

technological education programmes.

APMA PROPOSES:

All high school students be required to take at least one technology course credit prior to

graduation in order to expose them to opportunities that are currently not visible to them. This will also

help to increase enrolment in apprenticeships and college and university technology programmes, as

students become more aware of the post secondary programmes available to them.

All engineering programmes have a technology course as a mandatory requirement. This will

increase the prestige of these courses and result in entering students having some hands-on

experience.

Ministries of Education should include technological education programmes in yearly budget

announcements and reward schools with best practices and successful partnerships. In the

past, technological education programmes have been subject to significant budget reductions so that

educational institutions now lack the required equipment and qualified instructors to properly support

these programmes. Continuous funding is required in order to maintain technology facilities and keep

them from becoming the victim of cost cutting as they are more costly per student than most academic

courses.

The Federal Government provide funding for innovative programmes that promote careers in

technology. Community not-for-profit organizations such as Skills Canada, the Yves Landry

Foundation and Industry/Education Councils are instrumental in reaching students, parents and

teachers. Funding should be equitable and based on the successes achieved by these organizations.

DEVELOPING INNOVATORS: POST SECONDARY EDUCATION

Innovation can only occur if there are highly qualified people capable of both innovating and taking

innovation to commercial success. All these qualities are not usually found in one person so that

innovation in the automotive industry is a collaborative effort by a team of scientists, engineers,

technologists and skilled workers working together to take an idea from creative thought to a commercial

product or process.

APMAs Annual Human Resources Survey informs us that there is still a lack of technologically qualified

people. The worst shortage is in the skilled trades. Furthermore, demographics are working against us. By

2010 over 33% of our skilled trades can retire and 50% by 2015. This comes just at a time when the OEMs

are requesting their suppliers take on more technologically challenging work. To do this, a larger pool of

www.apma.ca

Automotive Parts Manufacturers Association

info@apma.ca

416.620.4220

2005 APMA Policy Paper November 2005

Page 24

technologically qualified people is required. If the absolute size of the labour force in Canada is not

increasing, there are only three sources from which to increase the technologically skilled workforce.

They are:

(i) convince a higher percentage of young people to immerse themselves in technology programmes;

(ii) retrain people from other occupations (both existing employees and employees from other industries)

and

(iii) import talent from other parts of the world through immigration.

Over the past several years, APMA has been partnering with colleges, universities and other training

providers to develop innovative programmes that meet industry needs and attract qualified applicants. The

Centre for Automotive Parts Expertise (CAPE) at Georgian College is one such collaboration, as is the Ford

Centre for Excellence in Manufacturing (FCEM) at St. Clair College. Industry/education partnerships can

inspire innovation programmes that will enhance learning and skills development, and attract quality

applicants. Canada is very good at graduating sufficient and qualified people in the arts and social

sciences; our deficiency is in science and technology graduates. Industry demands more and better

technology programmes that reflect the realities of todays industry.

APMA PROPOSES:

The Ontario Government expand funding for innovative training programmes that meet industry

needs. As technology changes, Ontarios post-secondary school system must continue to be up to

date to provide relevant skills to the future workforce.

The Ontario Government play an active role in fostering the relationship between colleges and

secondary schools. The challenge with many post secondary programmes is that students are not

aware of the entrance requirements and potential career opportunities. Enrolment in many college

technology programmes are low and at risk of being cancelled because of the lack of students coming

from the secondary schools. This is at the same time that 70%of high school graduates do not pursue

post secondary training. Colleges and school boards need to work more collaboratively to increase

student enrolment at the secondary school level. This will require funding to staff the collaborative

initiative.

The Federal Government increase its funding for technology programmes. Technology

programmes, by their nature of requiring equipment and laboratories are more expensive and need to

be funded accordingly.

APPRENTICESHIP TRAINING PROGRAMMES AND TAX CREDITS

Having a competitive workforce means having people who know how to apply the latest technology to the

tasks at hand. This includes investing in on-the-job training to enhance skill levels. Enhancing the skill

level of people is a benefit to society as a whole so society should participate in its cost. The advantage

of on-the-job training is that it is very efficient because a person receives training that is put to immediate

use. In a typical academic setting, less than 5% of what is learned is ever used in any given job. This is

normal because when taking academic courses, one does not know which 5% will be needed after

graduation.

We need to instill a training culture in Canada and assist those companies that are innovative and proactive

in training their human resources. Training incentives and tax credits are needed now in order to train the

workforce of the future. In Europe, up to $5,000 per employee is available from government for training

www.apma.ca

Automotive Parts Manufacturers Association

info@apma.ca

416.620.4220

2005 APMA Policy Paper November 2005

Page 25

and in the southern United States there is even more. This is an issue of both developing human capital

and competitiveness.

Currently, the Ontario government offers employers an Apprenticeship Training Tax Credit at $5,000 per

year for up to three years for a total of $15,000 for apprentices enrolled between May 2004 and January 1,

2008. This is a step in the right direction; however the tax credit is taxed as income to the employer so the

net benefit can be substantially less. Employers need to realize the full $5,000 benefit per apprentice,

rather than having tax collected on the credit. This also needs to be a long term programme to develop a

culture of continuous training.

The Federal Government also needs to be involved in the training of apprentices. A Federal Tax Credit

and Income Support for apprentices, issued directly from the Employment Insurance Fund, is needed to

help employers and apprentices with the cost of apprenticeship training. Apprenticeship training is an

essential partnership of employers, apprentices, government and training institutions. With the increased

mobility of labour, training costs need to be shared amongst industry and government in order to ensure a