Professional Documents

Culture Documents

Impact of Information Technology-620

Uploaded by

shirinCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Impact of Information Technology-620

Uploaded by

shirinCopyright:

Available Formats

International Journal of Management and Commerce Innovations ISSN 2348-7585 (Online)

Vol. 2, Issue 1, pp: (311-314), Month: April 2014 - September 2014, Available at: www.researchpublish.com

Impact of Information Technology on the

Profitability of Banking Sector in India

Mrs. S.Gnana Sugirtham

(M.com., M. Phil.), Assistant Professor, Department of Commerce, Sri Krishna Arts and Science College,

Coimbatore 641 008, India

Abstract: Development in the contemporary context is a process whereby minimum progress at the socio-economic,

political and technological level is ensured to fulfill the basic needs of human beings. Economic development,

includes the development of agriculture, industry, trade, transport, means of irrigation, power resource etc. It thus

indicates a process of development. This sectoral improvement is the part of the process of development, which

refers to the economic development. The present study has made a comprehensive research regarding the impact

of information technology on the profitability of banking sector in India. A sample of 23 banks from various

groups has been selected. The profitability parameters were applied and the result was analyzed.

Keywords: socio-economic, political and technological level, development of agriculture, industry, trade, transport,

means of irrigation.

I.

INTRODUCTION

Development in the contemporary context is a process whereby minimum progress at the socio-economic, political and

technological level is ensured to fulfill the basic needs of human beings. It is also a relative phenomenon based on the

comparison between the advanced and the underdeveloped countries.

The key to National prosperity and development lies, in the effective combination of three factors technology, raw

material and capital, of which technology is perhaps the most important, since the creation and adoption of new scientific

techniques can, in fact, make up for deficiency in natural resources and reduce the demands of capital.

Role of commercial Banks in Economic Development:

Banking is an important segment of the service providing sector and acts as a backbone of economic progress1. The banks

render vital services to the masses belonging to the various sectors of the economy like agriculture, industry whether

small scale or large scale2.

The banking system is one of the few institutions that impinge on the economy and affect its performances for better or

worse. They act as a development agency and are the source of hope and aspirations of the masses 3.

As an economic institution, banks are supposed to be more directly and positively related to the performance of the

economy than most non-economic institutions are. Schumpeter, the first modern economist, regarded the banking system

as one of the two key agents (the other being entrepreneurship) in the whole process of economic development. 4

Statement of the Problem

At a time when the world over was undergoing a radical transformation due to the all pervasive influence of information

technology one sector that has undergoing fundamental changes as a consequence of the application of it has been

banking. The present study has made a comprehensive research regarding the impact of information technology on the

profitability of banking sector in India.

Objectives of the Study

To assess the profitability of commercial banks before and after the implementation of information technology enabled

services.

Page | 311

Research Publish Journals

International Journal of Management and Commerce Innovations ISSN 2348-7585 (Online)

Vol. 2, Issue 1, pp: (311-314), Month: April 2014 - September 2014, Available at: www.researchpublish.com

II.

RESEARCH METHODOLOGY

The performance of a bank can be measured by a number of indicators. For measuring the performance of Indian banking

industry, various parameters were selected to analyse the profitability and a comparative study is done between partially

computerized era and IT enabled era.

Profitability Parameters

For measuring the profitability of commercial banks the study employs the following ratios:

a.

b.

c.

d.

e.

f.

g.

Interest earned ratio

Interest paid ratio

Non-interest income ratio

Non-interest expenses ratio

Spread ratio

Burden ratio.

Profitability ratio.

III.

SAMPLE DESIGN FOR DIAGONISTIC STUDY

The universe of the present study is the Scheduled commercial banks of India. The Indian Banking sector has been

divided into five groups and a representative sample of 30% has been selected from each group based on its profitability.

i) Nationalized bank Group:

a.

b.

c.

d.

e.

f.

Punjab National Bank (PNB),

Canara Bank (CB),

Bank of India (BOI),

Bank of Baroda (BOB)

Indian Overseas Bank (IOB )

Oriental Bank of Commerce (OBC).

ii) SBI & its Associates bank Group:

a.

b.

State Bank of India (SBI)

State Bank of Indore (SBID).

iii) Old private sector bank Group:

a.

b.

c.

d.

e.

Federal Bank Ltd (FB)

Jammu and Kashmir Bank Ltd (J&KB)

Karnataka Bank ltd (KB)

South Indian Bank (SIB)

Tamil Nadu Mercantile Bank Ltd., (TMB).

iv) New private sector bank Group:

a.

b.

ICICI Bank ltd (ICICI)

HDFC Bank Ltd (HDFC).

v) Foreign banks:

a.

b.

c.

d.

e.

f.

Standard Chartered Bank (SCB)

Citibank NA (CIB)

HSBC Ltd (HSBC)

ABN Ambro Bank NV (ABNB)

Deutsche Bank AG (DB)

Bank of America (BOA)

g.

h.

JP Morgan Chase Bank (JPMCB)

Barclays Bank PLC (BB)

Page | 312

Research Publish Journals

International Journal of Management and Commerce Innovations ISSN 2348-7585 (Online)

Vol. 2, Issue 1, pp: (311-314), Month: April 2014 - September 2014, Available at: www.researchpublish.com

Period of Study

The period under study is divided into two parts. The first period is called as partially computerized era which includes

the period from 1998-1999 to 2003-2004. This period is considered to be representative enough to indicate the broad

trends of the performance of the banks in the period of partial computerization of Banks in India. The second period is

called the Information Technology enabled era which included the period from 2004-2005 to 2009-2010.

Sources of Data

The present study is based upon secondary data. Secondary information have been collected from various relevant issued

of statistical Tabled Relating to Banks, Report on currency and Finance, published by the Reserve Bank of India and

Database on Indian Banking published by Indian Banking Association. In addition to it, some information is also

collected from the different relevant issues of Economic survey published by the Government of India and other books

and journals.

IV.

FINDINGS OF DIAGNOSTIC ANALYSIS

The findings of diagnostic analysis on Impact of Information Technology on the profitability of banking sector in India

have been listed under different headings as follows:

1.

Thus it was concluded from the ratio analysis of the indicator interest earned ratio that of nationalized bank group

(Group 1) the Bank of India had the highest growth rate of 47, in the SBI and its Associates bank group (Group 2) the

state Bank of India and the State Bank of Indore had a growth rate of 38 and 33 respectively. In the old private sector

Bank group (Group 3), the Tamilnadu Mercantile Bank had a growth rate of 42, in the new private sector Bank group

(Group 4), the HDFC Bank had a growth rate of 100, in the foreign Bank group (Group 5) as well, the Bank of

America had a growth rate of 100. The correlation analysis revealed that the foreign bank group (Group 5) had the

highest positive correlation of, 991 of all the bank groups under study. The paired t test analysis with regard to the

indicator interest earned ratio revealed that the old private sector bank group (Group 3) had the highest significant t

value of 1.452.

2.

The ratio analysis with regard to interest paid ratio concluded that In the Nationalized bank group (Group 1) the

Indian Overseas Bank had the highest CGR of 4.71%. In the SBI & its Associates bank group (Group 2), the State

Bank Of Indore had a CGR of 44.54% in the IT enabled era, in the old private sector bank group (Group 3), the

Karnataka Bank had the Maximum CGR of 7.15%, in the New Private Sector Bank group (Group 4) the ICICI had a

positive growth rate of 7 and a CGR of 7.15%, in the foreign bank group (Group 5) , the JP Morgan chase Bank

registered the highest positive CGR of 12.20%. The correlation analysis of the indicator interest paid ratio revealed

that the Foreign bank group (Group 5) had the highest correlation co efficient of .894. An analysis of paired t test

proved that the nationalized bank group (Group 1) had a significant t value of 1.807.

3.

Thus it could be concluded that with regard to the indicator non interest expenses ratio, Thus in the Nationalized

bank group (Group 1) almost all banks in its group revealed negative growth rate In the SBI & its Associates Bank

group (Group2) the State Bank of India and the State Bank of Indore had negative growth rates of -33 and -59

respectively. In the old private sector Bank group (Group 3) the Jammu & Kashmir Bank had a CGR of 2.09 %, in

the new private sector bank group (Group 4) the HDFC Bank exhibited a growth rate of 43%, in the foreign bank

group, and the JP Morgan chase Bank had a negative growth rate of 92. The results of correlation analysis revealed

that the Nationalized bank group (Group 1), had the highest positive correlation of .878. The paired t test at 5%

level of significance (Table 4.39) proved that the old private sector bank group (Group 3) had a significant t value

3.416.

4.

Thus it was concluded from the ratio analysis of the indicator spread ratio that in the nationalized bank group (Group

1), the Bank of Baroda had a growth rate of 200 and a CGR of 14.81%, in the SBI & its Associates bank group

(group 2), the State Bank of India and the State bank of Indore revealed negative growth rate of -101 and -84

respectively. In the Old private sector bank group (Group 3), the Federal Bank revealed a growth rate of 28, in the

new private sector bank group (Group 4), the ICICI bank had the highest growth rate of 2,800,in the foreign bank

group (Group 5), the Bank of Nova Scotia registered the highest CGR of 28.82%. A correlation analysis of the

indicator spread ratio revealed that the SBI & its Associates Bank group (Group 2) and Foreign Bank group (Group

Page | 313

Research Publish Journals

International Journal of Management and Commerce Innovations ISSN 2348-7585 (Online)

Vol. 2, Issue 1, pp: (311-314), Month: April 2014 - September 2014, Available at: www.researchpublish.com

5) had the highest correlation values of .954 and .950respectively. The paired t test analysis revealed that the old

private sector bank group (Group 3) had a significant t value of 3.627.

5.

It was concluded from the ratio analysis of burden ratio that in the nationalized bank group (Group 1), the Bank of

India and the Bank of Baroda exhibited negative growth rate of -125 and -60 , in the SBI & its Associates bank group

(Group2),the State Bank of India (-43) and the State Bank of Indore (-50)revealed negative growth rates, in the old

private sector banks (Group 3) the analysis revealed that the Jammu & Kashmir Bank had the highest negative

growth rate of -400 in its group, in the new private sector bank group (Group 4), the HDFC bank registered a growth

rate of 250 in the foreign bank group (Group 5), Standard Chartered Bank had the highest negative growth rate of 225. The correlation analysis revealed that the Nationalized bank group (Group 1) had the highest correlation coefficient of .954. The paired t test analysis for the indicator burden ratio revealed that the old private sector bank

group (Group 3) had a significantt value of 2.845.

6.

Thus it was concluded that in the nationalized bank group (Group 1), the Bank of India and the Bank of Baroda

exhibited negative growth rate of -125 and -60 , in the SBI & its Associates bank group (Group2),the State Bank of

India (-43) and the State Bank of Indore (-50)revealed negative growth rates, in the old private sector banks (Group

3) the analysis revealed that the Jammu & Kashmir Bank had the highest negative growth rate of -400 in its group, in

the new private sector bank group (Group 4), the HDFC bank registered a growth rate of 250 in the foreign bank

group (Group 5), Standard Chartered Bank had the highest negative growth rate of -225. The correlation analysis

revealed that the Nationalized bank group (Group 1) had the highest correlation co- efficient of .954. The paired t

test analysis for the indicator burden ratio revealed that the old private sector bank group (Group 3) had a significant

t value of 2.845.

7.

Thus it could be concluded from the ratio analysis of the indicator profitability ratio that in the Nationalized Bank

group (Group 1), the Bank of Baroda had a growth rate of 100 and a CGR of 25.89%, in the SBI & its Associates

banks (Group 2), the State Bank of India had a growth rate of -101. In the old private sector Bank group (Group 3),

the Federal Bank registered the highest growth rate of 11 and with a CGR of 20.22%. In new private sector Bank

group (Group 4) the ICICI bank revealed the highest growth rate of 175 and a CGR of 25.89%.In the foreign bank

group (Group 5), the Bank of America registered the highest growth rate of 133 in its group. The correlation analysis

of the indicator, the profitability ratio proved that foreign bank group (Group 5) had the highest positive correlation

of .999. The results of the paired t test revealed that the old private sector bank group (Group 3) had significant t

value of 3.464.

REFERENCES

[1]

Sachdeva, S.K, (1972): Oxford Encyclopedia illustrated Dictionary New Standard Publication, Delhi-7, p.47.

[2]

Jha, Probodh Kumar, (1985): Banking And Economic Growth , N.K. Subrahmanya (ed), Modern banking of

India, Deep Publications, New Delhi, p.54.

[3]

Vashist, Avatat Krishna, (1991): Public Sector Banks in India , H.K. Publishers and Distributors, New Delhi,p.3

[4]

Sooden,Meenakshi,(1992):Regional Disparities of Commercial Banking in India, Kanishka Publishing House ,

Delhi p.17.

[5]

Ahmad, Taha Khaled, "The Efficiency of the Banking System in Jordan, 1990- 1996", Ph.D.Thesis, Colorado State

University, 2000

[6]

All, Hashem Mohammed, the Utilization of Selected Managerial Accounting Concepts and Techniques in Branch

Bank Management Ph.D. Thesis, The University of Arizona, 1972.

[7]

Qureshi T.M., Zafar M.K. and Khan M.B. (2008). Customer Acceptance of Online Banking in Developing

Economies. Journal of Internet Banking and Commerce. 13(1). April. Accessed on 20th January, 2010 on

http://www.arraydev.com/commerce/jibc/.

[8]

Uppal R.K. (2010), Emerging Issues and Strategies to Enhance M-Banking Services, African Journal of

Marketing, February, pp. 29-36, available online http://www.academicjournals.org/ajmm.

Page | 314

Research Publish Journals

You might also like

- Project Planning SchedulingDocument85 pagesProject Planning SchedulingAmit KumarNo ratings yet

- Entrepreneurs (2014) : 1. The Bansals - Sachin Bansal, Binny Bansal, Mukesh Bansal - of FlipkartDocument3 pagesEntrepreneurs (2014) : 1. The Bansals - Sachin Bansal, Binny Bansal, Mukesh Bansal - of FlipkartshirinNo ratings yet

- Sapm AssignmentDocument12 pagesSapm AssignmentshirinNo ratings yet

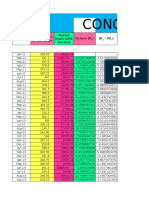

- Concor: Date Market Price of The Share Market Index (BSE Sensex) Return (R) (R - Ar)Document6 pagesConcor: Date Market Price of The Share Market Index (BSE Sensex) Return (R) (R - Ar)shirinNo ratings yet

- Sapm AssignmentDocument12 pagesSapm AssignmentshirinNo ratings yet

- CHAPTER III Findings and AnalysisDocument28 pagesCHAPTER III Findings and AnalysisshirinNo ratings yet

- Sapm AssignmentDocument12 pagesSapm AssignmentshirinNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- CM TreasuryDocument12 pagesCM TreasuryChinh Le DinhNo ratings yet

- Marketing Audit of Mauritius Commercial BankDocument2 pagesMarketing Audit of Mauritius Commercial BankRumeysha rujubNo ratings yet

- Bank loan allowance provisionsDocument3 pagesBank loan allowance provisionsJudith CastroNo ratings yet

- Financial Benchmarks India PVT LTD: Reference RatesDocument1 pageFinancial Benchmarks India PVT LTD: Reference RateskritiNo ratings yet

- Micro Finance PPT FinalDocument37 pagesMicro Finance PPT FinalVaibhav Alawa100% (2)

- Aishwarya Precision Works GECLSDocument7 pagesAishwarya Precision Works GECLSchandan bhatiNo ratings yet

- Banking Awareness PDF For All Banking Exams - 2141Document26 pagesBanking Awareness PDF For All Banking Exams - 2141AnuuNo ratings yet

- Credit Crisis of 1772Document1 pageCredit Crisis of 1772Aflia SabrinaNo ratings yet

- 第四章 PDFDocument21 pages第四章 PDFMelva CynthiaNo ratings yet

- Topic 7: Cash Management and Control, Preparation Bank Reconciliations and Maintaining A Petty Cash System Solutions To Tutorial QuestionsDocument3 pagesTopic 7: Cash Management and Control, Preparation Bank Reconciliations and Maintaining A Petty Cash System Solutions To Tutorial QuestionsMitchell BylartNo ratings yet

- Q418 Results PresentationDocument69 pagesQ418 Results PresentationMe lahNo ratings yet

- Invoice-Template-Excel-2003Document1 pageInvoice-Template-Excel-2003Bang IpulNo ratings yet

- New Balance $798.07 Minimum Payment Due $40.00 Payment Due Date 07/17/22Document7 pagesNew Balance $798.07 Minimum Payment Due $40.00 Payment Due Date 07/17/22Aravind NandaNo ratings yet

- Branch Code:04789 Branch Name:: To Whomsoever It May Concern Provisional Home Loan Interest CertificateDocument1 pageBranch Code:04789 Branch Name:: To Whomsoever It May Concern Provisional Home Loan Interest CertificatekabuldasNo ratings yet

- Comparative Study Between Public and Private BankDocument40 pagesComparative Study Between Public and Private BankRashmi ShuklaNo ratings yet

- Activity No. 1Document2 pagesActivity No. 1Justine MaravillaNo ratings yet

- Credit Default SwapDocument10 pagesCredit Default SwapDalmia Finance 2018-20No ratings yet

- Working Capital Management at Indusind BankDocument18 pagesWorking Capital Management at Indusind BankSanchit Mehrotra100% (2)

- Act Roi WebsitepayDocument2 pagesAct Roi Websitepaynagendra reddy panyamNo ratings yet

- FX Past PapersDocument80 pagesFX Past PapersShan Ali ShahNo ratings yet

- Facilities With Tally 1Document5 pagesFacilities With Tally 1s_balvantNo ratings yet

- Capital Adequacy Framework for Indian BanksDocument326 pagesCapital Adequacy Framework for Indian BanksucoNo ratings yet

- Credit Card Statement For The Period: MR RH Van Rensburg 13 Oval North Beacon Valley Mitchells Plain 7785Document4 pagesCredit Card Statement For The Period: MR RH Van Rensburg 13 Oval North Beacon Valley Mitchells Plain 7785RyanNo ratings yet

- Lao Law On Payment System 2017 PDFDocument18 pagesLao Law On Payment System 2017 PDFfandieconomistNo ratings yet

- MBL Internship ReportDocument34 pagesMBL Internship ReportAyman Ahmed Cheema0% (1)

- Proforma Invoice To Poland PDFDocument1 pageProforma Invoice To Poland PDFTommy DwijayaNo ratings yet

- DBG Y9 WT4 GHW4 G LHiDocument5 pagesDBG Y9 WT4 GHW4 G LHiamit06sarkarNo ratings yet

- Revision of Service Charges - DepositDocument10 pagesRevision of Service Charges - DepositThe QuintNo ratings yet

- NC 079-80-264 Interest RatesDocument3 pagesNC 079-80-264 Interest RatesSaddam AliNo ratings yet

- Project: Customer Relationship ManagementDocument65 pagesProject: Customer Relationship ManagementAbhishek GuptaNo ratings yet