Professional Documents

Culture Documents

Attest services, independence, and audit risk

Uploaded by

Christian De Leon0 ratings0% found this document useful (0 votes)

78 views5 pagesAttest services involve auditors providing an independent opinion on the reliability of a client's financial statements. Auditors must maintain independence and follow standards of field work, which include adequately planning the audit, understanding internal controls, and obtaining sufficient evidence. The audit process assesses audit risk, which is the risk of an unqualified opinion being issued on materially misstated financial statements. Audit risk has three components - inherent, control, and detection risk.

Original Description:

CIS

Original Title

Chapter 1 - CIS

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentAttest services involve auditors providing an independent opinion on the reliability of a client's financial statements. Auditors must maintain independence and follow standards of field work, which include adequately planning the audit, understanding internal controls, and obtaining sufficient evidence. The audit process assesses audit risk, which is the risk of an unqualified opinion being issued on materially misstated financial statements. Audit risk has three components - inherent, control, and detection risk.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

78 views5 pagesAttest services, independence, and audit risk

Uploaded by

Christian De LeonAttest services involve auditors providing an independent opinion on the reliability of a client's financial statements. Auditors must maintain independence and follow standards of field work, which include adequately planning the audit, understanding internal controls, and obtaining sufficient evidence. The audit process assesses audit risk, which is the risk of an unqualified opinion being issued on materially misstated financial statements. Audit risk has three components - inherent, control, and detection risk.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 5

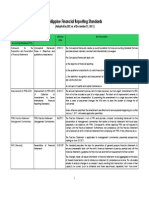

Chapter 1

Attest service, is performed by Certified Public Accountants

(CPA) who work for public accounting firms that are independent

of the client organization being audited.

- an engagement in which a practitioner is engaged to

issue, or does issue, a written communication that

expresses a conclusion about the reliability of a written

assertion that is the responsibility of another party.

Independence - Throughout the audit process, the auditor must

maintain independence from the client organization.

Public confidence in the reliability of the companys internally

produced financial statements rests directly on an evaluation of

them by an independent auditor.

Sarbanes-Oxley [SOX] Act of 2002

Advisory services are professional services offered by public

accounting firms to improve their client organizations operational

efficiency and effectiveness.

Internal auditing as an independent appraisal function

established within an organization to examine and evaluate its

activities as a service to the organization.

First SAS (SAS 1) was issued by the AICPA in 1972.

General Standards

1. The auditor must have adequate technical training and

proficiency.

2. The auditor must have independence of mental attitude.

3. The auditor must exercise due professional care in the

performance of the audit and the preparation of the report.

Standards of Field Work

1. Audit work must be adequately planned.

2. The auditor must gain a sufficient understanding of the internal

control structure.

3. The auditor must obtain sufficient, competent evidence.

Reporting Standards

1. The auditor must state in the report whether financial

statements were prepared in accordance with generally accepted

accounting principles.

2. The report must identify those circumstances in which

generally accepted accounting principles were not applied.

3. The report must identify any items that do not have adequate

informative disclosures.

4. The report shall contain an expression of the auditors opinion

on the financial statements as a whole.

Management Assertions

1. The existence or occurrence assertion affirms that all assets

and equities contained in the balance sheet exist and that all

transactions in the income statement actually occurred.

2. The completeness assertion declares that no material assets,

equities, or transactions have been omitted from the financial

statements.

3. The rights and obligations assertion maintains that assets

appearing on the balance sheet are owned by the entity and that

the liabilities reported are obligations.

4. The valuation or allocation assertion states that assets and

equities are valued in accordance with GAAP and that allocated

amounts such as depreciation expense are calculated on a

systematic and rational basis.

5. The presentation and disclosure assertion alleges that

financial statement items are correctly classified (e.g., long-term

liabilities will not mature within one year) and that footnote

disclosures are adequate to avoid misleading the users of

financial statements.

Audit risk is the probability that the auditor will render an

unqualified (clean) opinion on financial statements that are, in

fact, materially misstated.

Audit Risk Components

These are inherent risk, control risk, and detection risk.

Inherent risk is associated with the unique characteristics of the

business or industry of the client.

Control risk is the likelihood that the control structure is flawed

because controls are either absent or inadequate to prevent or

detect errors in the accounts.

Detection risk is the risk that auditors are willing to take that

errors not detected or prevented by the control structure will also

not be detected by the auditor.

The Structure of an IT Audit

Audit Planning

Tests of Controls - The objective of the tests of controls phase is

to determine whether adequate internal controls are in place and

functioning properly.

Substantive Testing - This phase involves a detailed investigation

of specific account balances and transactions

INTERNAL CONTROL OBJECTIVES

1. To safeguard assets of the firm.

2. To ensure the accuracy and reliability of accounting records

and information.

3. To promote efficiency in the firms operations.

4. To measure compliance with managements prescribed policies

and procedures

INTERNAL CONTROL PRINCIPLES

Management Responsibility

Methods of Data Processing

Limitations

(1)

the possibility of error

(2)

circumvention

(3)

management override

(4)

changing conditions

Reasonable Assurance - This reasonableness means that the cost

of achieving improved control should not outweigh its benefits.

PDC Control Model

Preventive Controls - passive techniques designed to reduce the

frequency of occurrence of undesirable

events.

Detective Controls - devices, techniques, and procedures

designed to identify and expose undesirable events that elude

preventive controls.

Corrective Controls - fix the problem

Coso Internal Control Framework

Five components: the control environment, risk assessment,

information and communication, monitoring, and control

activities.

The Control Environment

Control environment is the foundation for the other four control

components. The control environment sets the tone for the

organization and influences the control awareness of its

management and employees.

Risk Assessment

Organizations must perform a risk assessment to identify,

analyze, and manage risks relevant to financial reporting.

Information and Communication

The accounting information system consists of the records and

methods used to initiate, identify, analyze, classify, and record

the organizations transactions and to account for the related

assets and liabilities. The quality of information that the

accounting information system generates impacts managements

ability to take actions and make decisions in connection with the

organizations operations and to prepare reliable financial

statements.

Monitoring

Monitoring

The process by which the quality of internal control design and

operation can be assessed.

Control Activities

Policies and procedures used to ensure that appropriate actions

are taken to deal with the organizations identified risks. Control

activities can be grouped into two distinct categories: physical

controls and information technology (IT) controls.

Physical Controls - This class of controls relates primarily to

the human activities employed in accounting systems. These

activities may be purely manual, such as the physical custody of

assets, or they may involve the physical use of computers to

record transactions or update accounts. Six categories of physical

control activities: transaction authorization, segregation of duties,

supervision, accounting records, access control, and independent

verification.

Transaction Authorization

The purpose of transaction authorization is to ensure that all

material transactions processed by the information system are

valid and in accordance with managements objectives.

Segregation of Duties

Objective 1. The segregation of duties should be such that the

authorization for a transaction is separate from the processing of

the transaction.

Objective 2. Responsibility for asset custody should be separate

from the recordkeeping responsibility.

Objective 3. The organization should be structured so that a

successful fraud requires collusion between two or more

individuals with incompatible responsibilities.

Supervision

Accounting Records

The accounting records of an organization consist of source

documents, journals, and ledgers.

Access Control

The purpose of access controls is to ensure that only authorized

personnel have access to the firms assets.

Independent Verification

Verification procedures are independent checks of the

accounting system to identify errors and misrepresentations.

You might also like

- Auditing in Cis Environment - Chapter 1Document4 pagesAuditing in Cis Environment - Chapter 1Giyah UsiNo ratings yet

- 1001 It Environments - Stand-Alone Personal ComputersDocument4 pages1001 It Environments - Stand-Alone Personal ComputersiamnumberfourNo ratings yet

- Partnership DissolutionDocument15 pagesPartnership DissolutionAbc xyzNo ratings yet

- Acctg301 PartnershipDissolutionDocument16 pagesAcctg301 PartnershipDissolutionTiu Voughn ImmanuelNo ratings yet

- Fundamentals of PartnershipsDocument6 pagesFundamentals of PartnershipsJobelle Candace Flores AbreraNo ratings yet

- Unit I and 2Document6 pagesUnit I and 2harlene_luNo ratings yet

- CFAS ReviewerDocument6 pagesCFAS ReviewerAziNo ratings yet

- 25 Stock Market Quiz QuestionsDocument5 pages25 Stock Market Quiz QuestionsPrateik MeshramNo ratings yet

- Approved CAE BSA ACP 311 PetalcorinDocument132 pagesApproved CAE BSA ACP 311 PetalcorinFRAULIEN GLINKA FANUGAONo ratings yet

- Exam Financial ManagementDocument5 pagesExam Financial ManagementMaha MansoorNo ratings yet

- 2 - Partnership OperationsDocument6 pages2 - Partnership OperationsAangela Del Rosario CorpuzNo ratings yet

- Partnership DissolutionDocument7 pagesPartnership DissolutionAngel Frolen B. RacinezNo ratings yet

- Philippine Financial Reporting Standards: (Adopted by SEC As of December 31, 2011)Document27 pagesPhilippine Financial Reporting Standards: (Adopted by SEC As of December 31, 2011)Ana Liza MendozaNo ratings yet

- Auditing in Cis Environment Lesson 2Document38 pagesAuditing in Cis Environment Lesson 2Leny Joy DupoNo ratings yet

- Application Controls and General ControlsDocument65 pagesApplication Controls and General ControlsCillian ReevesNo ratings yet

- Expenditure Cycle Part IDocument8 pagesExpenditure Cycle Part ISecret LangNo ratings yet

- Cpa Review School of The Philippines Manila Financial Accounting and Reporting 6725 Accounting ProcessDocument5 pagesCpa Review School of The Philippines Manila Financial Accounting and Reporting 6725 Accounting ProcessJane ValenciaNo ratings yet

- ACC 211 - Review 2 (Chapters 5, 6, & 7)Document4 pagesACC 211 - Review 2 (Chapters 5, 6, & 7)Brennan Patrick WynnNo ratings yet

- IS Auditing Quizzer 2020 Version PDFDocument13 pagesIS Auditing Quizzer 2020 Version PDFPhoeza Espinosa VillanuevaNo ratings yet

- Legal Environment of Philippine Business and Management - Midterm ExaminationsDocument2 pagesLegal Environment of Philippine Business and Management - Midterm ExaminationsMaanParrenoVillarNo ratings yet

- General and Application ControlsDocument8 pagesGeneral and Application ControlsAnamir Bello CarilloNo ratings yet

- Pas 36 - Impairment of AssetsDocument20 pagesPas 36 - Impairment of AssetsMa. Franceska Loiz T. RiveraNo ratings yet

- Chapter 2 Audit of CashDocument11 pagesChapter 2 Audit of Cashadinew abeyNo ratings yet

- Questionnaire: Act112 - Intermediate Accounting IDocument20 pagesQuestionnaire: Act112 - Intermediate Accounting IMichaelNo ratings yet

- Module IV: MUS Sampling - Factory Equipment Additions: RequirementsDocument2 pagesModule IV: MUS Sampling - Factory Equipment Additions: RequirementsMukh UbaidillahNo ratings yet

- Quiz 1 BWFF2033Document2 pagesQuiz 1 BWFF2033otaku himeNo ratings yet

- Jadzo Customs Automotive Center Reservation System: A Project PaperDocument55 pagesJadzo Customs Automotive Center Reservation System: A Project Paperkriz anthony zuniegaNo ratings yet

- ReceivablesDocument16 pagesReceivablesJanela Venice SantosNo ratings yet

- Module 06 - PPE, Government Grants and Borrowing CostsDocument24 pagesModule 06 - PPE, Government Grants and Borrowing Costspaula manaloNo ratings yet

- Audit in CIS QuizDocument3 pagesAudit in CIS QuizctcasipleNo ratings yet

- Ae 123 Management ScienceDocument7 pagesAe 123 Management ScienceMa MaNo ratings yet

- Study Notes 4 PAPS 1013Document6 pagesStudy Notes 4 PAPS 1013Francis Ysabella BalagtasNo ratings yet

- Partnership LiquidationDocument9 pagesPartnership LiquidationJeasa LapizNo ratings yet

- Fundamentals of Assurance ServicesDocument32 pagesFundamentals of Assurance ServicesDavid alfonsoNo ratings yet

- APC 403 PFRS For SEs (Section 1-2)Document3 pagesAPC 403 PFRS For SEs (Section 1-2)AnnSareineMamadesNo ratings yet

- Auditing Theory1 1Document14 pagesAuditing Theory1 1JPIA MSU-IITNo ratings yet

- Chapter 6Document3 pagesChapter 6Kristine TiuNo ratings yet

- 2021 2022 1st Sem Prelim ExamDocument2 pages2021 2022 1st Sem Prelim ExamPHILLIT CLASSNo ratings yet

- Chapter 6 Accounting Information SystemDocument11 pagesChapter 6 Accounting Information SystemRica de guzmanNo ratings yet

- Toa Conceptual FrameworkDocument6 pagesToa Conceptual FrameworkDarwin Lopez100% (1)

- Accntg4 Non-Current Assets Held For Sale and Discontinued Operations NewDocument32 pagesAccntg4 Non-Current Assets Held For Sale and Discontinued Operations NewALYSSA MAE ABAAGNo ratings yet

- Income Tax - CorpDocument27 pagesIncome Tax - CorpAlyssa Joie PalerNo ratings yet

- Payback Period Method For Capital Budgeting DecisionsDocument5 pagesPayback Period Method For Capital Budgeting DecisionsAmit Kainth100% (1)

- Seatwork 02 InvestmentsDocument2 pagesSeatwork 02 InvestmentsJella Mae YcalinaNo ratings yet

- Information Technology Auditing 3rd Edition James HallDocument9 pagesInformation Technology Auditing 3rd Edition James HallHiraya ManawariNo ratings yet

- Financial Accounting Volume 2 by Valix Soluti 1Document3 pagesFinancial Accounting Volume 2 by Valix Soluti 1Fatima JahaddinNo ratings yet

- Discontinued Operation: Intermediate Accounting 3Document21 pagesDiscontinued Operation: Intermediate Accounting 3Trisha Mae AlburoNo ratings yet

- Income Based ValuationDocument25 pagesIncome Based ValuationApril Joy ObedozaNo ratings yet

- Midterm Exam Problem Submissions: 420, 000andshareholder Equityof SDocument3 pagesMidterm Exam Problem Submissions: 420, 000andshareholder Equityof SkvelezNo ratings yet

- ACP311 Special Transaction LecturesDocument33 pagesACP311 Special Transaction LecturesJohn Stephen PendonNo ratings yet

- (201001 - 201020) Afar - Partnership Formation (PPT Version)Document41 pages(201001 - 201020) Afar - Partnership Formation (PPT Version)Mau Dela CruzNo ratings yet

- Fundamentals of Accounting I: Conceptual Framework (ACCT 1A&BDocument12 pagesFundamentals of Accounting I: Conceptual Framework (ACCT 1A&BericacadagoNo ratings yet

- Optical Clinic Financial RecordsDocument3 pagesOptical Clinic Financial RecordsJadon MejiaNo ratings yet

- Multiple Choice Questions Conceptual FameworkDocument4 pagesMultiple Choice Questions Conceptual FameworkUy Uy Choice100% (1)

- p1 Review With AnsDocument7 pagesp1 Review With AnsJiezelEstebeNo ratings yet

- AC 3102 Statistics Activity 3Document11 pagesAC 3102 Statistics Activity 3Jireh RiveraNo ratings yet

- Pas 26. GalangDocument1 pagePas 26. GalangKarlie Pangilinan GalangNo ratings yet

- Philippine Deposit Insurance Corporation (PDIC) ExplainedDocument4 pagesPhilippine Deposit Insurance Corporation (PDIC) ExplainedRia Evita RevitaNo ratings yet

- Internal Control PSA315Document8 pagesInternal Control PSA315John Lexter Macalber100% (1)

- Internal ControlDocument21 pagesInternal ControlkwekwkNo ratings yet

- Ch07 Sarbanes-Oxley, Internal Control, & CashDocument43 pagesCh07 Sarbanes-Oxley, Internal Control, & CashChristian De LeonNo ratings yet

- Day 11 Chap 6 Rev. FI5 Ex PRDocument8 pagesDay 11 Chap 6 Rev. FI5 Ex PRChristian De Leon0% (2)

- Managerial Accounting Quiz 3 - 1Document8 pagesManagerial Accounting Quiz 3 - 1Christian De LeonNo ratings yet

- Chapter 2 - CISDocument5 pagesChapter 2 - CISChristian De LeonNo ratings yet

- Financial Reporting DevelopmentsDocument139 pagesFinancial Reporting DevelopmentsgligorjanNo ratings yet

- Management Advisory Services - PreboardDocument13 pagesManagement Advisory Services - PreboardAngelica Estrada100% (4)

- CSRDocument1 pageCSRChristian De LeonNo ratings yet

- Fall 2010 Quiz 2 CH 5Document6 pagesFall 2010 Quiz 2 CH 5Christian De LeonNo ratings yet

- Tax Rates (Percentage Tax)Document2 pagesTax Rates (Percentage Tax)Christian De LeonNo ratings yet

- Tax Rates (Percentage Tax)Document2 pagesTax Rates (Percentage Tax)Christian De LeonNo ratings yet

- 65716RR No 12-2012 PDFDocument2 pages65716RR No 12-2012 PDFGale Calaycay LaenoNo ratings yet

- 3 ThingsDocument1 page3 ThingsChristian De LeonNo ratings yet

- Intermediate AccountingDocument12 pagesIntermediate AccountingLeah BakerNo ratings yet

- Chapter 1 Accounting Information Systems: An OverviewDocument28 pagesChapter 1 Accounting Information Systems: An OverviewChristian De LeonNo ratings yet

- AMIS 525 Pop Quiz – Chapter 3 Break-Even Analysis and Contribution Margin ConceptsDocument5 pagesAMIS 525 Pop Quiz – Chapter 3 Break-Even Analysis and Contribution Margin ConceptsChristian De LeonNo ratings yet

- BLT PRTC Pre-BoardDocument12 pagesBLT PRTC Pre-BoardJohanna CatahanNo ratings yet

- Time Series and Forecasting: Learning ObjectivesDocument33 pagesTime Series and Forecasting: Learning ObjectivesAkhlaq Ul HassanNo ratings yet

- Ac 2012 Ar Appendix A Ex5Document42 pagesAc 2012 Ar Appendix A Ex5Christian De LeonNo ratings yet

- Chapter 2 Why People CommiDocument18 pagesChapter 2 Why People CommiChristian De Leon100% (1)

- Day 11 Chap 6 Rev. FI5 Ex PRDocument8 pagesDay 11 Chap 6 Rev. FI5 Ex PRChristian De Leon0% (2)

- Managerial Accounting Quiz 3 - 1Document8 pagesManagerial Accounting Quiz 3 - 1Christian De LeonNo ratings yet

- GMOB9eCh18 CultureDocument21 pagesGMOB9eCh18 CultureChristian De LeonNo ratings yet

- Sales Reviewer PDFDocument25 pagesSales Reviewer PDFShaireen Prisco Rojas100% (2)

- Law On Negotiable Instruments (Memory Aid)Document24 pagesLaw On Negotiable Instruments (Memory Aid)Christian De Leon100% (1)

- Final Project Taxation Law IDocument28 pagesFinal Project Taxation Law IKhushil ShahNo ratings yet

- Conflict Resolution SkillsDocument51 pagesConflict Resolution SkillsZahirul HaqNo ratings yet

- Altar Server GuideDocument10 pagesAltar Server GuideRichard ArozaNo ratings yet

- The Slave Woman and The Free - The Role of Hagar and Sarah in PaulDocument44 pagesThe Slave Woman and The Free - The Role of Hagar and Sarah in PaulAntonio Marcos SantosNo ratings yet

- STP Analysis of ICICI BANK vs SBI for Savings AccountsDocument28 pagesSTP Analysis of ICICI BANK vs SBI for Savings AccountsUmang Jain0% (1)

- Taiping's History as Malaysia's "City of Everlasting PeaceDocument6 pagesTaiping's History as Malaysia's "City of Everlasting PeaceIzeliwani Haji IsmailNo ratings yet

- Managing The Law The Legal Aspects of Doing Business 3rd Edition Mcinnes Test BankDocument19 pagesManaging The Law The Legal Aspects of Doing Business 3rd Edition Mcinnes Test Banksoutacheayen9ljj100% (22)

- Accounting Time Allowed - 2 Hours Total Marks - 100: You Are Required To Calculate TheDocument3 pagesAccounting Time Allowed - 2 Hours Total Marks - 100: You Are Required To Calculate TheNew IdNo ratings yet

- 2016 BPP Passcard F1 PDFDocument209 pages2016 BPP Passcard F1 PDFSyed Haider Hussain NaqviNo ratings yet

- Financial Analysis Premier Cement Mills LimitedDocument19 pagesFinancial Analysis Premier Cement Mills LimitedMd. Harunur Rashid 152-11-4677No ratings yet

- ThesisDocument310 pagesThesisricobana dimaraNo ratings yet

- Rhetorical AnalysisDocument4 pagesRhetorical Analysisapi-495296714No ratings yet

- 2003 Patriot Act Certification For Bank of AmericaDocument10 pages2003 Patriot Act Certification For Bank of AmericaTim BryantNo ratings yet

- Electrical Energy Audit and SafetyDocument13 pagesElectrical Energy Audit and SafetyRam Kapur100% (1)

- Gonzaga vs. CA DigestDocument1 pageGonzaga vs. CA DigestStephanie Reyes GoNo ratings yet

- Symptomatic-Asymptomatic - MedlinePlus Medical EncyclopediaDocument4 pagesSymptomatic-Asymptomatic - MedlinePlus Medical EncyclopediaNISAR_786No ratings yet

- Simic 2015 BR 2 PDFDocument23 pagesSimic 2015 BR 2 PDFkarimesmailNo ratings yet

- The Adams Corporation CaseDocument5 pagesThe Adams Corporation CaseNoomen AlimiNo ratings yet

- GST English6 2021 2022Document13 pagesGST English6 2021 2022Mariz Bernal HumarangNo ratings yet

- Pennycook Plagiarims PresentationDocument15 pagesPennycook Plagiarims Presentationtsara90No ratings yet

- Smartrac DogboneDocument2 pagesSmartrac DogboneLesther GarciaNo ratings yet

- Baker Jennifer. - Vault Guide To Education CareersDocument156 pagesBaker Jennifer. - Vault Guide To Education Careersdaddy baraNo ratings yet

- Attestation Process ChecklistDocument2 pagesAttestation Process Checklistkim edwinNo ratings yet

- 50Document3 pages50sv03No ratings yet

- English JAMB Questions and Answers 2023Document5 pagesEnglish JAMB Questions and Answers 2023Samuel BlessNo ratings yet

- Key Ideas of The Modernism in LiteratureDocument3 pagesKey Ideas of The Modernism in Literaturequlb abbasNo ratings yet

- Civil Air Patrol News - Mar 2007Document60 pagesCivil Air Patrol News - Mar 2007CAP History LibraryNo ratings yet

- Lord Subrahmanya Bhujangam StotramDocument31 pagesLord Subrahmanya Bhujangam StotramDhruv Giri100% (1)

- B001 Postal Manual PDFDocument282 pagesB001 Postal Manual PDFlyndengeorge100% (1)

- Risk Management in Banking SectorDocument7 pagesRisk Management in Banking SectorrohitNo ratings yet