Professional Documents

Culture Documents

2015 Capital Gains Tax Rates

Uploaded by

MRT10Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

2015 Capital Gains Tax Rates

Uploaded by

MRT10Copyright:

Available Formats

(/?trk=nw_gn_2.

0)

"

Credit Cards

Banking

Investing

Mortgages

2015 Capital Gains Tax Rates

ARIELLE O'SHEA

(HTTPS://WWW.NERDWALLET.COM/BLOG/AUTHOR/AOSHEA/)

You can trust that we maintain strict editorial integrity (/blog/nerdwallet-editorial-guidelines/) in our

writing and assessments; however, we receive compensation when you click on links to products from our

partners and get approved. Here's how we make money (/blog/how-we-make-money/).

When it comes to investing whether in the markets or in a material

item like a home you want the value of what you bought to go up. But

that uptick in value also comes with a downside: capital gains taxes.

Capital gains taxes are levied on the difference between what you paid

for an asset (also known as your basis) and what you sell the asset for,

and theyre divided into short-term and long-term gains based on the

amount of time you owned the asset. Short-term capital gains tax rates

are equal to your ordinary income tax. Tax rates on long-term capital

gains generally assessed on investments youve held for longer than a

year are much more generous; many taxpayers qualify for a 0% tax

rate.

Heres a brief overview of the rates in effect for this year, and the

income levels that put you into each tax bracket:

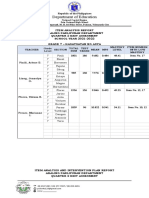

2015 Capital Gains Tax Rates

Single

Married

Filing

Jointly

Married

Filing

Separately

Head of

Household

Tax

Bracket

ShortTerm

Capital

Gains

Rate

LongTerm

Capital

Gains

Rate

Up to

Up to

Up to

Up to

10%

10%

0%

$9,225

$18,450

$9,225

$13,150

$9,225

to

$37,450

$18,451

to

$74,900

$9,226 to

$37,450

$13,151 to

$50,200

15%

15%

0%

$37,450

$74,900

$37,451

to

$90,750

$74,901

to

$151,200

$37,451 to

$75,600

$50,201

to

$129,600

25%

25%

15%

$90,751

$151,201

$75,601 to

$129,601

28%

28%

15%

to

$189,300

to

$230,450

$115,225

to

$209,850

$189,301

to

$230,451

to

$115,226

to

$209,851

to

33%

33%

15%

$411,500

$411,500

$205,750

$411,500

$411,501

to

$413,200

$411,501

to

$464,850

$205,751

to

$232,425

$411,501

to

$439,000

35%

35%

15%

$413,201

and over

$464,851

and over

$232,426

and over

$439,001

and over

39.6%

39.6%

20%

As you can see, you can be in highest ordinary income tax bracket

39.6% and still pay no more than 20% in long-term capital gains taxes.

Those in the 10% and 15% brackets pay no tax on long-term capital gains.

Some investors may also be liable for the Net Investment Income Tax, an

additional 3.8% that applies to whichever is smaller: your net investment

income, or the amount by which your modified adjusted gross income

exceeds the threshold amounts listed below. For more on this, check out

the IRSs explanation (http://www.irs.gov/Individuals/Net-InvestmentIncome-Tax) and this Q&A (http://www.irs.gov/uac/Newsroom/NetInvestment-Income-Tax-FAQs). Here are the income thresholds that

might make investors subject to this additional tax:

Single or head of household: $200,000

Married filing jointly: $250,000

Married filing separately: $125,000

How capital gains are calculated

Capital gains taxes can apply on everything from investments, such as

stocks or bonds, to real estate (though usually not your home), cars,

boats and other tangible items. To put it simply, the money you make on

the sale of any of these items is your capital gain. Money you lose is a

capital loss. Investment capital losses can be used to offset gains. For

example, if you sold one stock for a $10,000 profit this year and sold

another at a $4,000 loss, youll only be taxed on capital gains of $6,000.

The difference between your capital gains and your capital losses is

called your net capital gain. If your losses exceed your gains, you can

actually deduct the difference on your tax return, up to a limit of $3,000

per year ($1,500 for those married filing separately).

Finally, it should be noted that the chart of capital gains tax rates above

applies to most assets, but there are some noteworthy exceptions.

Long-term capital gains on so-called collectible assets are generally

taxed at 28%; these are things like coins, precious metals, antiques, and

fine art. Short-term gains on such assets are still taxed at the ordinary

income tax rate.

How to minimize capital gains taxes

Its clear that whenever possible, you want to hold an asset for a year or

longer so you can qualify for the long-term capital gains tax rate, since it

is significantly lower for most assets. But there are several other steps

you can take to lower your tax burden:

EXCLUDE HOME SALES

The IRS has a provision that can help homeowners avoid capital gains on

home sales, since this is one of the biggest investments most people

make. To qualify, you must have owned the home for at least two years

in the five year period leading up to the sale, and used the home as your

primary residence for two years in that same five-year period. You also

must not have excluded another home from capital gains in the two-year

period before the home sale. If you meet those rules, you can exclude up

to $250,000 in gains from a home sale if youre single, and up to

$500,000 if youre married filing jointly.

REBALANCE WITH DIVIDENDS

Dividends

(http://www.irs.gov/publications/p550/ch01.html#en_US_2014_publink100010066)

are payments you receive for owning stocks or similar investments. They

may be taxed similar to capital gains, depending on whether they are

qualified or nonqualified. (Whats the difference? Qualified dividends are

from investments held for a certain amount of time and are taxed like

long-term capital gains; nonqualified dividends are taxed like short-term

capital gains at the investors ordinary income tax rate.)

One way to minimize taxes: Rather than reinvest dividends in the

investment that paid them, rebalance

(http://www.nerdwallet.com/blog/investing/2013/how-to-rebalance401k-portfolio/) by putting that money into your underperforming

investments. (Typically, you would rebalance by selling securities that

are doing well and putting that money into those that are

underperforming. But using dividends to invest in underperforming

assets will allow you avoid selling strong performers and thus avoid

any capital gains that would come from the sale.)

USE TAX-ADVANTAGED ACCOUNTS

These include 401(k) plans, IRAs and 529 accounts, in which the

investments grow tax-free or tax-deferred. That means you dont have

to pay capital gains if you sell investments within these accounts. Roth

IRAs and 529s in particular have big tax advantages: Qualified

distributions from those are tax-free; in other words, you dont pay any

taxes on investment earnings. With traditional IRAs and 401(k)s, youll

pay taxes when you take distributions from the accounts in retirement. If

youre interested in opening an IRA, check out NerdWallets list of best

account providers (http://www.nerdwallet.com/blog/investing/best-iraaccount-providers/).

CARRY LOSSES OVER

If your net capital loss exceeds the limit you can deduct for the year, the

IRS allows you to carry the excess into the next year, deducting it on

that years return.

CONSIDER A ROBO-ADVISOR

Robo-advisors (http://www.nerdwallet.com/blog/investing/best-roboadvisors/) are online services that manage your investments for you

automatically. They often include tax strategy, including tax-loss

harvesting, which involves selling losing investments to offset the gains

from winners.

The bottom line

Capital gains taxes can add a considerable amount to your tax bill, even

if they are from long-term gains. If you think youll be subject to them,

its wise to consult an accountant or tax advisor when filing taxes, as he

or she can give you tailored advice and information about minimizing

the burden.

More from NerdWallet:

Best Online Brokers (https://www.nerdwallet.com/investing/bestonline-broker/)

Best Robo-Advisors

(http://www.nerdwallet.com/blog/investing/best-robo-advisors/)

Investing in ETFs and Index Funds

(http://www.nerdwallet.com/blog/investing/etf-index-funds-vsmutual-funds/)

Arielle OShea is a staff writer at NerdWallet, a personal finance website.

Email: aoshea@nerdwallet.com (mailto:aoshea@nerdwallet.com). Twitter:

@arioshea (https://twitter.com/arioshea).

Image via iStock.

You might also like

- 5 Intimate Sex Positions To Improve Your Bond With Your PartnerDocument3 pages5 Intimate Sex Positions To Improve Your Bond With Your PartnerMRT10No ratings yet

- Energy Advice For Older HomesDocument32 pagesEnergy Advice For Older HomesMRT10No ratings yet

- Family Handyman 4:2014 PDFDocument96 pagesFamily Handyman 4:2014 PDFMRT10100% (1)

- Earnings Before InterestDocument2 pagesEarnings Before InterestKumarNo ratings yet

- Top 10 Myths About IslamDocument3 pagesTop 10 Myths About IslamMRT10No ratings yet

- Invest Four More White PaperDocument10 pagesInvest Four More White PaperciccioNo ratings yet

- Patrick Wolff - The Complete Idiot's Guide To Chess (2nd Edition)Document383 pagesPatrick Wolff - The Complete Idiot's Guide To Chess (2nd Edition)Jeias Silvestre100% (9)

- ExamineDocument78 pagesExamineMRT100% (1)

- Fereydoon Batmanghelidj - Your Bodys Many Cries For Water EngDocument72 pagesFereydoon Batmanghelidj - Your Bodys Many Cries For Water EngFreddy Jr Perez100% (2)

- Creatine in Type 2 DiabeticsDocument16 pagesCreatine in Type 2 DiabeticsMRT10No ratings yet

- Investor's Guide To The Business CycleDocument3 pagesInvestor's Guide To The Business CycleMRT10No ratings yet

- 12 Companies Paying Reliable Monthly DividendsDocument10 pages12 Companies Paying Reliable Monthly DividendsMRT10No ratings yet

- Debt:Equity RatioDocument2 pagesDebt:Equity RatioMRT10No ratings yet

- Top 10 Myths About IslamDocument3 pagesTop 10 Myths About IslamMRT10No ratings yet

- 2016: List of 50 Tax Write-OffsDocument19 pages2016: List of 50 Tax Write-OffsMRT10No ratings yet

- How To Be Special and MysteriousDocument11 pagesHow To Be Special and MysteriousMRT10No ratings yet

- Investor's Guide To The Business CycleDocument3 pagesInvestor's Guide To The Business CycleMRT10No ratings yet

- 12 Companies Paying Reliable Monthly DividendsDocument10 pages12 Companies Paying Reliable Monthly DividendsMRT10No ratings yet

- 2016 An Awesome Year To Invest in REITsDocument6 pages2016 An Awesome Year To Invest in REITsMRT10No ratings yet

- 2016 An Awesome Year To Invest in REITsDocument6 pages2016 An Awesome Year To Invest in REITsMRT10No ratings yet

- Investor's Guide To The Business CycleDocument3 pagesInvestor's Guide To The Business CycleMRT10No ratings yet

- Financial Ratio'sDocument2 pagesFinancial Ratio'sMRT10No ratings yet

- How To Remove Yourself From People Search WebsitesDocument14 pagesHow To Remove Yourself From People Search WebsitesMRT10No ratings yet

- Debt: Equity RatioDocument2 pagesDebt: Equity RatioMRT10No ratings yet

- The Market Value Versus Book ValueDocument3 pagesThe Market Value Versus Book ValueMRT10No ratings yet

- Guide To Attract WomenDocument10 pagesGuide To Attract WomenMRT10No ratings yet

- Why Are Stocks Tanking, & What Should I DoDocument4 pagesWhy Are Stocks Tanking, & What Should I DoMRT10No ratings yet

- Prophethood & Making of Islamic Historical IdentityDocument30 pagesProphethood & Making of Islamic Historical IdentityMRT10No ratings yet

- How Much Home Can I AffordDocument2 pagesHow Much Home Can I AffordMRT10No ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5784)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Comprehension and Essay Writing Junior Judicial Assistant Delhi High Court 2012Document2 pagesComprehension and Essay Writing Junior Judicial Assistant Delhi High Court 2012varaki786No ratings yet

- CB 4 Letter To Gov. Cuomo Re Congestion PricingDocument3 pagesCB 4 Letter To Gov. Cuomo Re Congestion PricingGersh KuntzmanNo ratings yet

- MOCK EXAMS FINALSDocument3 pagesMOCK EXAMS FINALSDANICA FLORESNo ratings yet

- Barangay Hearing NoticeDocument2 pagesBarangay Hearing NoticeSto Niño PagadianNo ratings yet

- Bihar High Court Relaxation Tet Case JudgementDocument4 pagesBihar High Court Relaxation Tet Case JudgementVIJAY KUMAR HEERNo ratings yet

- Ethics in Organizational Communication: Muhammad Alfikri, S.Sos, M.SiDocument6 pagesEthics in Organizational Communication: Muhammad Alfikri, S.Sos, M.SixrivaldyxNo ratings yet

- Order Dated - 18-08-2020Document5 pagesOrder Dated - 18-08-2020Gaurav LavaniaNo ratings yet

- WEEK 5 ACCT444 Group Project 14-34Document6 pagesWEEK 5 ACCT444 Group Project 14-34Spencer Nath100% (2)

- Retirement PlanningDocument2 pagesRetirement PlanningXuanyi ZhongNo ratings yet

- LatestEffective Specs HIIDocument390 pagesLatestEffective Specs HIIGeorge0% (1)

- Canadian Administrative Law MapDocument15 pagesCanadian Administrative Law MapLeegalease100% (1)

- Emery Landlord Dispute 2015Document2 pagesEmery Landlord Dispute 2015Alex GeliNo ratings yet

- The Elite and EugenicsDocument16 pagesThe Elite and EugenicsTheDetailerNo ratings yet

- Dr. M. Kochar vs. Ispita SealDocument2 pagesDr. M. Kochar vs. Ispita SealSipun SahooNo ratings yet

- LR Procedure Hook ReleaseDocument4 pagesLR Procedure Hook Releasefredy2212No ratings yet

- 6th Semester SyllabusDocument5 pages6th Semester Syllabusz0nej.a.sanibirdsNo ratings yet

- Pdic 2Document6 pagesPdic 2jeams vidalNo ratings yet

- Divine Law Theory & Natural Law TheoryDocument20 pagesDivine Law Theory & Natural Law TheoryMaica LectanaNo ratings yet

- New Key Figures For BPMon & Analytics - New Controlling & SAP TM Content & Changes Key Figures - SAP BlogsDocument8 pagesNew Key Figures For BPMon & Analytics - New Controlling & SAP TM Content & Changes Key Figures - SAP BlogsSrinivas MsrNo ratings yet

- FABM2 - Lesson 1Document27 pagesFABM2 - Lesson 1wendell john mediana100% (1)

- Black SupremacistDocument7 pagesBlack SupremacistJoMarie13No ratings yet

- Mila Exam LegalDocument2 pagesMila Exam LegalSarmila ShanmugamNo ratings yet

- History of Agrarian ReformDocument3 pagesHistory of Agrarian ReformMaria Ferlin Andrin MoralesNo ratings yet

- Item Analysis Repost Sy2022Document4 pagesItem Analysis Repost Sy2022mjeduriaNo ratings yet

- 4IS1 - 01 - Que - 20210504 QP 2021Document28 pages4IS1 - 01 - Que - 20210504 QP 2021fmunazza146No ratings yet

- Patrice Jean - Communism Unmasked PDFDocument280 pagesPatrice Jean - Communism Unmasked PDFPablo100% (1)

- Activity 1 Home and Branch Office AccountingDocument2 pagesActivity 1 Home and Branch Office AccountingMitos Cielo NavajaNo ratings yet

- Kerala rules on dangerous and offensive trade licensesDocument3 pagesKerala rules on dangerous and offensive trade licensesPranav Narayan GovindNo ratings yet

- Hacienda LuisitaDocument94 pagesHacienda LuisitanathNo ratings yet

- But I Was Never There!: Feel As Though You Left EgyptDocument4 pagesBut I Was Never There!: Feel As Though You Left Egyptoutdash2No ratings yet