Professional Documents

Culture Documents

Details of Acquisition of External IT Business of Volvo IT AB (Company Update)

Uploaded by

Shyam Sunder0 ratings0% found this document useful (0 votes)

17 views3 pagesHCL is acquiring the external it business of Volvo IT AB ('Volvo IT'), a subsidiary of AB Volvo, the top holding company of the Volvo group. The acquisition does not fall within the definition of related party transaction(s) and whether the promoter / promoter group / transaction is at "arms length" Industry to which the entity being acquired belongs it Infrastructure and Application Operations. Transaction is expected to close by end of March 2016.

Original Description:

Original Title

Details of acquisition of external IT business of Volvo IT AB [Company Update]

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentHCL is acquiring the external it business of Volvo IT AB ('Volvo IT'), a subsidiary of AB Volvo, the top holding company of the Volvo group. The acquisition does not fall within the definition of related party transaction(s) and whether the promoter / promoter group / transaction is at "arms length" Industry to which the entity being acquired belongs it Infrastructure and Application Operations. Transaction is expected to close by end of March 2016.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

17 views3 pagesDetails of Acquisition of External IT Business of Volvo IT AB (Company Update)

Uploaded by

Shyam SunderHCL is acquiring the external it business of Volvo IT AB ('Volvo IT'), a subsidiary of AB Volvo, the top holding company of the Volvo group. The acquisition does not fall within the definition of related party transaction(s) and whether the promoter / promoter group / transaction is at "arms length" Industry to which the entity being acquired belongs it Infrastructure and Application Operations. Transaction is expected to close by end of March 2016.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 3

February 16, 2016

Mr. Girish Joshi

Mr. Avinash Kharkar

BSE Limited

Phiroze Jeejeebhoy Towers

Dalal Street

Mumbai 400 001

National Stock Exchange of India Limited

Exchange Plaza, 5th Floor, Plot No. C/1, G Block

Bandra Kurla Complex, Bandra (East)

Mumbai 400 051

Sub: Disclosure under Regulation 30 (4) of the SEBI (Listing Obligations and

Disclosures Requirements) Regulations 2015

In terms of Regulation 30 (4) of the SEBI (Listing Obligations and Disclosures

Requirements) Regulations 2015, enclosed are the details of the external IT business of

Volvo IT AB being acquired by the Company.

This is for your information and records.

Thanking you,

Yours faithfully,

For HCL Technologies Limited

Manish Anand

Company Secretary

Encl:a/a

Details of acquisition of external IT business of Volvo IT AB

Name of the target entity (details in brief such as size,

turnover etc.)

The Company is acquiring the external IT business of Volvo IT AB

('Volvo IT'), a subsidiary of AB Volvo, the top holding company of

the Volvo Group.

Whether the acquisition would fall within related party

The acquisition does not fall within the definition of related party

transaction(s) and whether the promoter/ promoter group/ transaction.

group companies have any interest in the entity being

acquired? If yes, nature of interest and details thereof and

whether the same is done at arms length

Industry to which the entity being acquired belongs

IT Infrastructure and Application Operations.

Objects and effects of acquisition (including but not limited

to, disclosure of reasons for acquisition of target entity, if

its business is outside the main line of business of the

listed entity)

This transaction enables the Company to create a market leading

position in the Nordics and France, gives it a differentiated offering

in Mainframe services and provides it with significant domian

capabilities to serve the Company's global automotive and

manufacturing customers.

Brief details of any governmental or regulatory approvals

required for the acquisition

The approval of European Union has been obtained for this

transaction. No other Regulatory approvals are required.

Indicative time period for completion of the acquisition

The transaction is expected to close by end of March 2016.

Nature of consideration - whether cash consideration or

share swap and details of the same

This transaction is for all-cash consideration.

Cost of acquisition or the price at which the shares are

acquired

The total cash consideration for this transaction is 1,130 million SEK

Percentage of shareholding / control acquired and / or

number of shares acquired

The Company is only acquring entire external IT business of Volvo

IT AB. No shareholding stake in this entity is being acquired by the

Company.

Brief background about the entity acquired in terms of

products/line of business acquired, date of incorporation,

history of last 3 years turnover, country in which the

acquired entity has presence and any other significant

information (in brief)

Volvo IT is part of Volvo Group delivering IT services to the Volvo

Group as well as non-Volvo Group customers in Europe. Vovo IT

has been engaged since 1970 as a internal provider to Volvo cars

and Volvo trucks and since 1999 to external customers in the

business that is being acquired. About 2500 highly skilled people

are engaged in serving both the internal IT needs and the external

customers. The Revenue pertaining to the external IT business

being acquired has been SEK 1,537 M in FY13, SEK 1,558 M in

FY14 and SEK 1,687 M in FY15 (FY ending December).

You might also like

- VC Financing Guide: Stages & ProcessDocument19 pagesVC Financing Guide: Stages & ProcessVishnu NairNo ratings yet

- Ebook FB AdsDocument86 pagesEbook FB AdsPMK100% (2)

- Market Potential and Customer Satisfaction of Adidas ShoesDocument85 pagesMarket Potential and Customer Satisfaction of Adidas ShoesPurnendraNo ratings yet

- Due DiligenceDocument23 pagesDue DiligenceSudhir Kochhar Fema AuthorNo ratings yet

- RAP Honda and ToyotaDocument32 pagesRAP Honda and Toyotascrewyou0980% (1)

- Mutual Fund Holdings in DHFLDocument7 pagesMutual Fund Holdings in DHFLShyam SunderNo ratings yet

- STP Scheme: Is It Mandatory To Get The Company Registered in India ?Document5 pagesSTP Scheme: Is It Mandatory To Get The Company Registered in India ?RAMESHBABUNo ratings yet

- STPI Ready Reckoner 2007Document17 pagesSTPI Ready Reckoner 2007NirajNo ratings yet

- Ready Reckoner for STP RegistrationDocument8 pagesReady Reckoner for STP RegistrationgsrtravelsNo ratings yet

- Fiat Annual Report 2010Document402 pagesFiat Annual Report 2010ssachanNo ratings yet

- Board of InvestmentDocument34 pagesBoard of InvestmentarmanwarsiNo ratings yet

- Akanksha Finvest Limited 2011Document10 pagesAkanksha Finvest Limited 2011JobyThomasIssacNo ratings yet

- Updates (Company Update)Document2 pagesUpdates (Company Update)Shyam SunderNo ratings yet

- Grindwell Norton AR2011Document78 pagesGrindwell Norton AR2011absmsNo ratings yet

- Dipp - Nic.in English Faqs FaqsDocument18 pagesDipp - Nic.in English Faqs FaqsDon WolfNo ratings yet

- Intimation of Establishment of A Subsidiary Company in China (Company Update)Document1 pageIntimation of Establishment of A Subsidiary Company in China (Company Update)Shyam SunderNo ratings yet

- Special Economic Zones (SEZ) - IntroductionDocument23 pagesSpecial Economic Zones (SEZ) - IntroductionR. SainiNo ratings yet

- AIRTEL1PPTDocument19 pagesAIRTEL1PPTpoojagkhandelwalNo ratings yet

- Existing Company. The Demerger Transaction Would Be Subject To, Inter Alia, The Preparation of ADocument8 pagesExisting Company. The Demerger Transaction Would Be Subject To, Inter Alia, The Preparation of AAnushree GoyalNo ratings yet

- Ready ReckonerDocument12 pagesReady Reckonerniranjan bhagatNo ratings yet

- Infosys Statement On Announcement Made by Royal Bank of Scotland On Williams & Glyn (Company Update)Document2 pagesInfosys Statement On Announcement Made by Royal Bank of Scotland On Williams & Glyn (Company Update)Shyam SunderNo ratings yet

- Complete Guide To Setup A Software Export HouseDocument7 pagesComplete Guide To Setup A Software Export HouseSantosh KodereNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- 1.business Process Outsourcing (BPO) Company Registration in IndiaDocument11 pages1.business Process Outsourcing (BPO) Company Registration in IndiavinothNo ratings yet

- 1.business Process Outsourcing (BPO) Company Registration in IndiaDocument11 pages1.business Process Outsourcing (BPO) Company Registration in IndiavinothNo ratings yet

- BPO Registration Guide: How to Start a BPO Business in IndiaDocument11 pagesBPO Registration Guide: How to Start a BPO Business in IndiavinothNo ratings yet

- Bid Notice-IFRSDocument5 pagesBid Notice-IFRSProNo ratings yet

- Business Process Outsourcing (BPO) Company Registration in IndiaDocument15 pagesBusiness Process Outsourcing (BPO) Company Registration in IndiavinothNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document4 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Company Update)Document5 pagesFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Company Update)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- About IIFL: IIFL/India Infoline Refer To India Infoline LTD and Its Subsidiaries/ Group CompaniesDocument52 pagesAbout IIFL: IIFL/India Infoline Refer To India Infoline LTD and Its Subsidiaries/ Group CompaniesHarika AnkamNo ratings yet

- STP Scheme benefits of Software Technology Parks of India in BangaloreDocument25 pagesSTP Scheme benefits of Software Technology Parks of India in BangaloreJhilik PradhanNo ratings yet

- Intralot's Diversity and Range of 400+ Games Provides a Competitive AdvantageDocument6 pagesIntralot's Diversity and Range of 400+ Games Provides a Competitive AdvantageEric BoroianNo ratings yet

- Infosys Annual Report 2016 Available Online For ADS Holders (Company Update)Document200 pagesInfosys Annual Report 2016 Available Online For ADS Holders (Company Update)Shyam SunderNo ratings yet

- Suprajit Engineering Limited - Annual Report 2010-11Document72 pagesSuprajit Engineering Limited - Annual Report 2010-11red cornerNo ratings yet

- Kohinoor Energy Limited: I... .U "Elam..Document20 pagesKohinoor Energy Limited: I... .U "Elam..Momeena IslamNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Ioi Corporation RealDocument24 pagesIoi Corporation RealKomrad M AzminNo ratings yet

- AditiDocument7 pagesAditiakshali raneNo ratings yet

- Investor Presentation May 2016 (Company Update)Document29 pagesInvestor Presentation May 2016 (Company Update)Shyam SunderNo ratings yet

- Auto LineDocument256 pagesAuto LineVedha SathishNo ratings yet

- How to enter direct selling in IndiaDocument4 pagesHow to enter direct selling in IndiaPallavi RNo ratings yet

- How To Do Business in IndiaDocument4 pagesHow To Do Business in IndiaDeepa AshNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Infinera Corporation Reports Third Quarter 2010 Financial ResultsDocument8 pagesInfinera Corporation Reports Third Quarter 2010 Financial ResultssharishsNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document7 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Disclosure No. 376 2014 Annual Report For Fiscal Year Ended December 31 2013 SEC FORM 17 ADocument380 pagesDisclosure No. 376 2014 Annual Report For Fiscal Year Ended December 31 2013 SEC FORM 17 ARanShibasakiNo ratings yet

- Update - Acquisition of A Stake in Carat Lane Trading Private Limited (Company Update)Document2 pagesUpdate - Acquisition of A Stake in Carat Lane Trading Private Limited (Company Update)Shyam SunderNo ratings yet

- IFB Industries LTDDocument10 pagesIFB Industries LTDSourabh KumarNo ratings yet

- Globe Telecom SEC Form 17-A for Fiscal Year 2017Document296 pagesGlobe Telecom SEC Form 17-A for Fiscal Year 2017Rexer AnthonyNo ratings yet

- Investor Presentation Q2FY17 (Company Update)Document30 pagesInvestor Presentation Q2FY17 (Company Update)Shyam SunderNo ratings yet

- Worldcall 2010 FinalDocument126 pagesWorldcall 2010 FinalRafael BeckhamNo ratings yet

- WNSDocument3 pagesWNSAnonymous f3AnDlikNo ratings yet

- It SezDocument1 pageIt Sezsumeet_scirbdNo ratings yet

- Sona Koyo Steering Systems LimitedDocument21 pagesSona Koyo Steering Systems LimitedTyagi Munda AnkushNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Manufacturing SectorDocument5 pagesManufacturing SectorNur KameliaNo ratings yet

- Foreign InvestmentDocument12 pagesForeign InvestmentMahmudur RahmanNo ratings yet

- Hindustan Times Ltd-10Document55 pagesHindustan Times Ltd-10comradeajayNo ratings yet

- ROKKO Holdings 2010 Annual ReportDocument103 pagesROKKO Holdings 2010 Annual ReportWeR1 Consultants Pte LtdNo ratings yet

- Updates (Company Update)Document4 pagesUpdates (Company Update)Shyam SunderNo ratings yet

- Imm Work Final 2013Document67 pagesImm Work Final 2013Keyur BhojakNo ratings yet

- General Warehousing & Storage Revenues World Summary: Market Values & Financials by CountryFrom EverandGeneral Warehousing & Storage Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- HINDUNILVR: Hindustan Unilever LimitedDocument1 pageHINDUNILVR: Hindustan Unilever LimitedShyam SunderNo ratings yet

- Financial Results For Dec 31, 2013 (Result)Document4 pagesFinancial Results For Dec 31, 2013 (Result)Shyam Sunder0% (1)

- JUSTDIAL Mutual Fund HoldingsDocument2 pagesJUSTDIAL Mutual Fund HoldingsShyam SunderNo ratings yet

- Financial Results For September 30, 2013 (Result)Document2 pagesFinancial Results For September 30, 2013 (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document4 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Settlement Order in Respect of Bikaner Wooltex Pvt. Limited in The Matter of Sangam Advisors LimitedDocument2 pagesSettlement Order in Respect of Bikaner Wooltex Pvt. Limited in The Matter of Sangam Advisors LimitedShyam SunderNo ratings yet

- Order of Hon'ble Supreme Court in The Matter of The SaharasDocument6 pagesOrder of Hon'ble Supreme Court in The Matter of The SaharasShyam SunderNo ratings yet

- PR - Exit Order in Respect of Spice & Oilseeds Exchange Limited (Soel)Document1 pagePR - Exit Order in Respect of Spice & Oilseeds Exchange Limited (Soel)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Settlement Order in Respect of R.R. Corporate Securities LimitedDocument2 pagesSettlement Order in Respect of R.R. Corporate Securities LimitedShyam SunderNo ratings yet

- Financial Results For June 30, 2013 (Audited) (Result)Document2 pagesFinancial Results For June 30, 2013 (Audited) (Result)Shyam SunderNo ratings yet

- Exit Order in Respect of The Spice and Oilseeds Exchange Limited, SangliDocument5 pagesExit Order in Respect of The Spice and Oilseeds Exchange Limited, SangliShyam SunderNo ratings yet

- Standalone Financial Results, Auditors Report For March 31, 2016 (Result)Document5 pagesStandalone Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results For June 30, 2014 (Audited) (Result)Document3 pagesFinancial Results For June 30, 2014 (Audited) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results For March 31, 2016 (Result)Document11 pagesStandalone Financial Results For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results For Mar 31, 2014 (Result)Document2 pagesFinancial Results For Mar 31, 2014 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results For September 30, 2016 (Result)Document3 pagesStandalone Financial Results For September 30, 2016 (Result)Shyam SunderNo ratings yet

- PDF Processed With Cutepdf Evaluation EditionDocument3 pagesPDF Processed With Cutepdf Evaluation EditionShyam SunderNo ratings yet

- Standalone Financial Results For June 30, 2016 (Result)Document2 pagesStandalone Financial Results For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Investor Presentation For December 31, 2016 (Company Update)Document27 pagesInvestor Presentation For December 31, 2016 (Company Update)Shyam SunderNo ratings yet

- Transcript of The Investors / Analysts Con Call (Company Update)Document15 pagesTranscript of The Investors / Analysts Con Call (Company Update)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- J H: A E M C S F M: Umping Edges N Xamination of Ovements in Opper Pot and Utures ArketsDocument21 pagesJ H: A E M C S F M: Umping Edges N Xamination of Ovements in Opper Pot and Utures ArketsKumaran SanthoshNo ratings yet

- Invoice: Telecom Equipment Pte LTDDocument1 pageInvoice: Telecom Equipment Pte LTDRiff MarshalNo ratings yet

- QSB InformationDocument4 pagesQSB InformationAtul KasarNo ratings yet

- Presentacion Evolucion Excelencia Operacional - Paul Brackett - ABBDocument40 pagesPresentacion Evolucion Excelencia Operacional - Paul Brackett - ABBHERMAN JR.No ratings yet

- MTAP Saturday Math Grade 4Document2 pagesMTAP Saturday Math Grade 4Luis SalengaNo ratings yet

- MM ZC441-L2Document60 pagesMM ZC441-L2Jayashree MaheshNo ratings yet

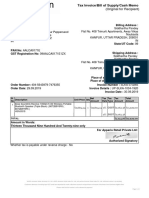

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Satyam SinghNo ratings yet

- Formato Casa de La Calidad (QFD)Document11 pagesFormato Casa de La Calidad (QFD)Diego OrtizNo ratings yet

- MASSEY ENERGY CO 8-K (Events or Changes Between Quarterly Reports) 2009-02-23Document10 pagesMASSEY ENERGY CO 8-K (Events or Changes Between Quarterly Reports) 2009-02-23http://secwatch.comNo ratings yet

- Organization Development and Change: Chapter Twenty: Organization TransformationDocument16 pagesOrganization Development and Change: Chapter Twenty: Organization TransformationGiovanna SuralimNo ratings yet

- Telesales Tips From A - ZDocument20 pagesTelesales Tips From A - ZKing Solomon CatralNo ratings yet

- CH 02 Project Life Cycle and Organization: A Guide To The Project Management Body of Knowledge Third EditionDocument15 pagesCH 02 Project Life Cycle and Organization: A Guide To The Project Management Body of Knowledge Third Editionapi-3699912No ratings yet

- COA 018 Audit Checklist For Coal Operation Health and Safety Management Systems Field Audit2Document42 pagesCOA 018 Audit Checklist For Coal Operation Health and Safety Management Systems Field Audit2sjarvis5No ratings yet

- Township Solicitor Chosen at Meeting: Running For A CauseDocument15 pagesTownship Solicitor Chosen at Meeting: Running For A CauseelauwitNo ratings yet

- Sarah Williams CVDocument2 pagesSarah Williams CVsarahcwilliamsNo ratings yet

- A Review of Journal/Article Title: Introducing The Hoshin Kanri Strategic Management System in Manufacturing Sme'SDocument2 pagesA Review of Journal/Article Title: Introducing The Hoshin Kanri Strategic Management System in Manufacturing Sme'SAlmas Pratama IndrastiNo ratings yet

- Factors - Influencing Implementation of A Dry Port PDFDocument17 pagesFactors - Influencing Implementation of A Dry Port PDFIwan Puja RiyadiNo ratings yet

- Murphy Et Al v. Kohlberg Kravis Roberts & Company Et Al - Document No. 16Document15 pagesMurphy Et Al v. Kohlberg Kravis Roberts & Company Et Al - Document No. 16Justia.comNo ratings yet

- You Exec - Sales Process FreeDocument13 pagesYou Exec - Sales Process FreeMariana Dominguez AlvesNo ratings yet

- BLGF Opinion March 17 2011Document7 pagesBLGF Opinion March 17 2011mynet_peterNo ratings yet

- Advertising and Consumerism in The Food IndustryDocument42 pagesAdvertising and Consumerism in The Food IndustryIoana GoiceaNo ratings yet

- Dwnload Full Retailing 8th Edition Dunne Test Bank PDFDocument35 pagesDwnload Full Retailing 8th Edition Dunne Test Bank PDFjayden4r4xarnold100% (14)

- Mail Merge in ExcelDocument20 pagesMail Merge in ExcelNarayan ChhetryNo ratings yet

- TTK Report - 2011 and 2012Document2 pagesTTK Report - 2011 and 2012sgNo ratings yet

- Hill and Jones Chapter 4 SlidesDocument32 pagesHill and Jones Chapter 4 Slidesshameless101No ratings yet

- PSP Study Guide 224 Q & A Revision Answers OlnyDocument214 pagesPSP Study Guide 224 Q & A Revision Answers OlnyMohyuddin A Maroof100% (1)

- RFI Vs eRFIDocument6 pagesRFI Vs eRFITrade InterchangeNo ratings yet