Professional Documents

Culture Documents

Earnings Quality

Uploaded by

viktor6Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Earnings Quality

Uploaded by

viktor6Copyright:

Available Formats

Lehman Brothers | Global Equity Strategy

Global Equity Research

31 July 2007

Quantitative Strategy

Trading on Quality:

Our trading rule for all earnings seasons

STOCK SELECTOR

We have developed a trading rule for the earnings season: we believe companies

that have high earnings quality (as defined in this report) and deliver a positive

earnings surprise, outperform companies that have a positive surprise but low

quality of earnings.

Importantly, the market appears to adjusts slowly to this information, allowing

investors to profit from such a strategy.

Rishav Dev

(91) 22 3053 2914

rdev@lehman.com

We list the companies that currently screen as high and low quality based on our

methodology in this note in advance of the bulk of reporting dates for the current

earnings season. We suggest that if stocks on this list report a positive earnings

surprise this earnings season, that investors buy and hold the stocks for two months.

Ian Scott

(44) 20 7102 2959

iscott@lehman.com

More generally, we find that earnings quality measures can be used to enhance other

factors that we regularly use as catalysts, such as earnings momentum. We show this

in practice for a global universe.

We use a definition of quality based on accruals; while not perfect, we find that it is

readily applicable to a broad group of global companies.

Inigo Fraser Jenkins

(44) 20 7102 4658

ifraserj@lehman.com

Marketing Analyst

Jane Pearce

(44) 20 7102 1662

japearce@lehman.com

Please see our website at

https://live.lehman.com/go/keyword/eqs

Lehman Brothers does and seeks to do business with companies covered in its research reports. As a result, investors should be aware that the firm may have a conflict of

interest that could affect the objectivity of this report.

Customers

of Lehman

Brothers

in do

thebusiness

United States

can receivecovered

independent,

third-party

research

the company

companies

covered

in this

at noacost

to them,

Lehman

Brothers

does and

seeks to

with companies

in its research

reports.

As a on

result,

investors or

should

be aware

that the

firmreport,

may have

conflict

of

wherethat

suchcould

research

available.

Customers

can access this independent research at www.lehmanlive.com or can call 1-800-2LEHMAN to request a copy of this

interest

affectis the

objectivity

of this report.

research.Investors should consider this report as only a single factor in making their investment decision.

Investors should consider this report as only a single factor in making their investment decision.

This research report has been prepared in whole or in part by research analysts employed by foreign affiliates of Lehman Brothers Inc. who, while qualified in their home

With

the exception

analysts based

in the

our NYSE

Taiwanorbranch,

jurisdictions,

are of

notresearch

registered/qualified

with

NASD. Lehman Brothers research analysts based outside the United States are employed by foreign affiliates

July not

2007

1

and are31

generally

qualified as research analysts by the NYSE or the NASD.

PLEASE SEE ANALYST(S) CERTIFICATION(S) AND IMPORTANT DISCLOSURES INCLUDING FOREIGN AFFILIATE DISCLOSURES BEGINNING ON PAGE 15

PLEASE SEE ANALYST(S) CERTIFICATION(S) AND IMPORTANT DISCLOSURES INCLUDING FOREIGN AFFILIATE DISCLOSURES BEGINNING ON PAGE 19

Lehman Brothers | Global Equity Strategy

1 INTRODUCTION

Are all earnings equal? And if not, are there trading opportunities as a result? These are

the two central questions that we seek to address in this paper. We think the answers are

no and yes, respectively. Importantly, the market appears to adjust slowly to the

information contained in the quality of earnings, enabling investors to profit from it.

The notion of quality of earnings has been addressed in the academic literature for

some time, and there is a growing body of work on the subject, see the seminal work by

Sloan (1996) and also Richardson, Sloan and Soliman (2001) and Chan, Chan, Jegadeesh

and Lakonishok (2001). The central question in most of this academic work has been,

how should earnings quality be measured? The focus in this note is different: can

earnings quality measures be profitably employed as trading strategies? Also, the

academic work to date has been almost exclusively US-centric, here we address a global

universe.

There is an issue of how the quality of earnings should be defined and then measured.

Following Richardson et al (2001), we use an accruals measure. The motivation for the

approach is that, broadly speaking, earnings for a company in a given year have two

components: cash flow generated that year and accruals across years. Should these two

parts of earnings be treated equally? Or more specifically, should an equal multiple be

applied to both? We show that there are indeed differences, especially relating to using

earnings momentum as a catalyst for stock returns, or earnings surprise.

We would like to be clear at the start about what we are not saying. We are not saying

that accounting does not matter. We are not free cash flow zealots who deny the

importance of earnings over and above the cash flows of a company (see section 2).

In this paper we show how an earnings quality measure can be used to augment

traditional catalyst factors such as earnings momentum. We go on to develop a trading

rule and show that in recent quarterly earnings seasons that companies that positively

surprise versus consensus that also score highly on our earnings quality measure go on to

outperform those that just have a positive earnings surprise.

31 July 2007

Lehman Brothers | Global Equity Strategy

2 ACCOUNTING MATTERS

We would like to be clear about one thing before we start on the detailed analysis of

earnings quality. We are suggesting that the accruals component of earnings can give

incremental information that is economically significant. However, we would not

subscribe to the view that is sometimes heard that cash is always better than earnings for

discriminating between stocks. The argument of the free cash flow zealots is that

earnings are prone to manipulation and that cash is a pure concept about which there

can be no dispute. The ultimate extension of this argument is that accounting does not

matter. We would strongly dispute this both in theory and with empirical evidence. True,

some accrual items that bring about differences between cash and earnings involve

assumptions or conventions that may strictly speaking reduce their accuracy. In extreme

cases it leaves some items open to manipulation by management. However, the

accounting rules are there for a good reason and accruing flows across years gives a

truer picture of the state of a company. Moreover cash flow is not exempt from

assumptions in its measurement anyway.

Even for people who do not agree with the theory on this point, we think that empirically

the results speak for themselves. Earnings strongly outperforms cash flow as a

discriminator between winners and losers. This is true at the global level, within regions

and for sectors (Figures 1-3). For example, a simple screen on P/E across a global

universe of large-cap names every quarter from 1991 to the present, rebalancing the

portfolios each quarter would have yielded a long-short return of 19.1% pa. The same

screen run on free cash flow yield would have yielded only 10.1% pa. Figure 2 shows

that this is not because of regional distortions, and Figure 3 shows that it is still true if

sectors are taken into account.

Figure 1: Performance of P/E and FCF Yield (Global Non Sector Neutral)

2500

Dec 89 = 100

2000

PE

1500

1000

FCF Yield

500

0

Dec-89

Dec-92

Dec-95

Dec-98

Dec-01

Dec-04

Chart shows the relative performance of cheap and expensive stocks screened each quarter on the measures

shown. The investment universe is the 500 largest stocks in the FTSE World index.

Source: Lehman Brothers Equity Strategy

31 July 2007

Lehman Brothers | Global Equity Strategy

Figure 2: Performance of P/E and FCF Yield (Regions, Non Sector Neutral)

800

PE Japan

Dec 89 = 100

700

600

PE Europe

500

400

PE US

FCF Yield

US

300

200

FCF Yield

Europe

100

FCF Yield Japan

0

Dec-89

Dec-92

Dec-95

Dec-98

Dec-01

Dec-04

Chart shows the relative performance of cheap and expensive stocks screened each quarter on the measures

shown within each region.

Source: Lehman Brothers Equity Strategy

Figure 3: Performance of P/E and FCF Yield, Sector Neutral (Europe)

200

Dec 91 = 100

PE

180

160

FCF Yield

140

120

100

80

Dec-91

Dec-94

Dec-97

Dec-00

Dec-03

Dec-06

Chart shows the relative performance of cheap and expensive stocks screened within each sector every quarter

on the measures shown. Universe is the 300 largest stocks in the FTSE World Europe index.

Source: Lehman Brothers Equity Strategy

31 July 2007

Lehman Brothers | Global Equity Strategy

3 OUR MEASURE OF QUALITY

The starting point for our measure of quality is to divide earnings into cash flow in the

period and accruals. What measure of cash flow should be used? We wish to focus on

the operating activity of companies rather than their financing decisions. As such, we use

a measure of free cash flow (FCF) that we define as cash flow from operations less

capex1.

Our measure of quality is therefore the proportion of earnings that comprises accruals,

i.e.

Accruals =

(netincome FCF )

netincome

Where we interpret low accruals as high quality and vice versa.

We exclude auto stocks and

Financials from this study

The definition used here is for non-Financials. Equivalent measures can be developed for

financial stocks, but we will leave that for another paper. We have also excluded auto

stocks from the analysis as the cash flows from the financing operations of some of these

companies swamps the cash flow of the core car production business within the group

accounts that we are using here.

It has been suggested that the persistence of earnings is a measure of their quality. We

have deliberately avoided such a measure here as there will be a high correlation with

whether companies are in cyclical or non-cyclical industries and the length of the cycle.

31 July 2007

Richardson et al (2001) use a broader definition of FCF. They define it as the sum of cash flow from operating

activities and cash flow from all investing activities. The main difference between that definition and the one that

we use here will be flows from the acquisitions and disposals of fixed assets. We choose to focus on capex as it

will be less quantised than these other items, and also it is the natural cash corollary of the depreciation charge

that impacts earnings.

Lehman Brothers | Global Equity Strategy

4 EARNINGS MOMENTUM AND EARNINGS QUALITY

In this note we focus not on the impact of accruals data in isolation, but rather on their

interaction with earnings momentum and earnings announcements. This is because we

think this is where the subject of earnings quality most directly affects strategies that are

implemented by investors. In this section we focus on the interaction of earnings quality

and earnings momentum, in section 5 we analyse earnings announcements.

We find that a very useful catalyst for stock performance has been earnings momentum,

which we define as the change in 12-month forward consensus forecasts between the

past two quarters. We show that the quality of earnings of these companies has a

significant impact on the efficacy of the measure. In the following sections we show the

impact when used in market-wide strategies, by region, by sector then when used as part

of an overall value + earnings momentum model.

Market-wide Earnings Momentum

Stocks that have seen a large upgrade to consensus forecasts tend to outperform those

that have had forecast cuts or increases that have not been as large. As we show here, the

size of this effect is much enhanced by using an earnings quality overlay. To do this we

used the 500 largest stocks in the FTSE World index as the starting universe. We

screened them by earnings momentum and earnings quality2 and sorted into four

quadrants as shown in Figure 4.

Figure 4: Momentum/Quality Portfolios

Earnings Momentum

High Quality

Low Momentum

Low Quality

High Momentum

Low Quality

Low Momentum

Earnings Quality

High Quality

High Momentum

Source: Lehman Brothers Equity Strategy

Portfolios were rebalanced each quarter and the common currency total return of each

group, equally weighting stocks was calculated intra quarter. The four groups have

delivered very different returns over the period since 1991. The companies that screened

as high momentum and high quality delivered the strongest performance at 12.5% pa, the

companies with low earnings momentum and low quality performed the worst at 2.9%

pa (Figure 5).

2

31 July 2007

Throughout this discussion we define earnings momentum as change in 12-month forward consensus forecasts

between the past two quarters and earnings quality as the proportion of earnings that comprises accruals (low

proportion is high quality).

Lehman Brothers | Global Equity Strategy

Figure 5: The Interaction of Earnings Momentum and Earnings Quality

700

Dec 91 = 100

High Quality

High Momentum

600

High Quality

Low Momentum

500

400

Low Quality

High Momentum

300

200

100

0

Dec-91

Low Quality

Low Momentum

Dec-94

Dec-97

Dec-00

Dec-03

Dec-06

Chart shows the performance of stocks screened on earnings quality and earnings momentum every quarter.

Universe is the 500 largest stocks in the FTSE World index. Stocks have been equally weighted and returns are on

a total return basis.

Source: Lehman Brothers Equity Strategy

What is also of interest is that within the group of companies with high momentum,

quality matters. High momentum-high quality outperformed high momentum-low

quality by 5.8% pa. In recent years, there have been two (short) sub-periods when the

outperformance was reversed: at the height of the TMT bubble in March 2000 and

September 2001-June 2003.

Figure 6: Effectiveness of Quality within High Earnings Momentum

220

Dec 91 = 100

200

180

160

140

120

100

80

60

Dec-91

Dec-94

Dec-97

Dec-00

Dec-03

Dec-06

Chart shows the relative performance of high momentum high quality and high momentum low quality stocks

screened every quarter. Universe is the 500 largest stocks in the FTSE World index. Stocks have been equally

weighted and returns are on a total return basis.

Source: Lehman Brothers Equity Strategy

31 July 2007

Lehman Brothers | Global Equity Strategy

Sectors

We applied the same technique within sectors. To do this we split the investment

universe into 10 broad non-Financial sectors and conducted the same split by these

factors within each one by ranking stocks relative to their sector peers. Even within

sectors the same result holds. Sector-neutral, high-momentum, high-quality stocks

delivered 13.0% pa, while sector-neutral, low-momentum, low-quality stocks returned

8.3% pa. There is still a spread between the returns from high-momentum, high-quality

and high-momentum, low-quality stocks; within sectors this is 1.6% pa (Figure 7).

Figure 7: The Sector-Neutral Interaction of Earnings Momentum and Earnings

Quality

700

High Quality

High Momentum

Dec 91 = 100

Low Quality

High Momentum

600

500

400

High Quality

Low Momentum

300

200

Low Quality

Low Momentum

100

0

Dec-91

Dec-94

Dec-97

Dec-00

Dec-03

Dec-06

Chart shows the performance of stocks screened within each sector on earnings quality and earnings momentum

every quarter. Universe is the 500 largest stocks in the FTSE World index. Stocks have been equally weighted and

returns are on a total return basis. Sectors have been equally weighted.

Source: Lehman Brothers Equity Strategy

31 July 2007

Lehman Brothers | Global Equity Strategy

Interaction with Value Screens

In practice, we favour an approach to stock selection in which a valuation signal is

central to the decision to over or underweight a stock, we then use mainly earnings

momentum as a catalyst factor, which we overlay on the value screen or screens. Our

favoured approach to global quantitative stock selection is to use a value and earnings

momentum within a sector-neutral framework (see Fundamental Values: A Quantitative

Approach to Stock Selection in Global Equity Markets, Lehman Quantitative Strategy

9 October 2006). There is evidence that in certain market environments, the addition of

an earnings quality measure can add value to such a process as well.

We will not go into detail on our value + momentum approach in this note. However, the

essential point is that each quarter we go long stocks that have attractive valuations and

high earnings momentum relative to their sector peers and short stocks with the opposite

characteristics. Such an approach if applied over the period 1991 to 2007 would have

yielded an annual return of 6.03% pa with an information ratio of 0.77.

Aside from this basic approach an extra constraint can be introduced that we only use the

positive earnings if the company in question has high earnings quality (i.e. has low

accrual percentage of earnings compared with other stocks in the sector). The long-short

returns from such a strategy would have been 6.73% pa with an information ratio of

0.743, Figure 8).

Figure 8: Value+Momentum and Value+Momentum+Quality Strategies Long-Short

Returns

280

Dec 91 = 100

260

240

220

200

180

160

140

120

100

80

Dec-91

Dec-94

Dec-97

Dec-00

Dec-03

Dec-06

Chart shows the performance of our favoured Global Fundamental Values long-short strategy and the same model

with an earnings quality overlay. Universe is the 500 largest stocks in the FTSE World index. Stocks have been

equally weighted and returns are on a total return basis. Sectors have been equally weighted.

Source: Lehman Brothers Equity Strategy

So the returns are not in general higher from such an approach. However, at certain

points in the cycle the addition of the earnings quality overlay does add value (and by

extension, it detracts from value at other points). In Figure 9 we show the relative return

from a value+earnings momentum+earnings quality screen relative to a value+earnings

momentum screen. This is plotted against year-on-year changes in global earnings

growth. There is a tendency for the earnings quality measure to add value in periods

when earnings growth overall is declining. This would be consistent with the hypothesis

that in periods of declining earnings growth, the market places greater value on earnings

quality.

31 July 2007

NB some of the reduction of the information ratio is because of the smaller number of stocks being selected from

the three-way sort on value, momentum and quality compared with the original value and momentum model.

Lehman Brothers | Global Equity Strategy

Figure 9: Earnings Quality Can Improve a Value + Earnings Momentum Screen in

Certain Environments

40

% (inverted)

-20

-15

30

Accruals-Adjusted Quant

Model Excess Return (RHS)

20

-10

-5

10

5

10

-10

15

-20

20

-30

-40

Jan-92

25

Global Earnings 12M Change RHS)

30

Jan-95

Jan-98

Jan-01

Jan-04

Jan-07

Chart shows the year-on-year relative performance of our favoured Global Fundamental Values long-short strategy

with an earnings quality overlay compared to the pure Global Fundamental Values approach. We also show the

year-on-year growth in earnings for the global market. Universe is the 500 largest stocks in the FTSE World index.

Stocks have been equally weighted and returns are on a total return basis. Sectors have been equally weighted.

Source: Lehman Brothers Equity Strategy

31 July 2007

10

Lehman Brothers | Global Equity Strategy

5 A TRADING RULE FOR ALL EARNINGS SEASONS

The above back tests imply that quality can be a powerful extra tool for using earnings

signals. In this section we develop this into a specific trading rule for the earnings

season.

Stocks that positively surprise on their results relative to consensus tend to outperform,

other things being equal. The problem with this is that often this is not helpful to

investors in practice as the market makes a significant part of the adjustment relatively

quickly, so unless the surprise can be forecast, it is hard to profit from the information4.

Our hypothesis is that genuine positive surprise from a company that has high-quality

earnings ought to be more valuable than surprise from a company with low-quality

earnings. Moreover, we would contend that the market is not fully aware of which

companies are high and low quality, so there ought to be a lag in the adjustment of the

stock prices to this information. If this is the case, a trading opportunity arises.

To test this we have classified stocks as high and low quality at the beginning of recent

earnings seasons. We have then split the universe of companies that subsequently

reported a positive surprise relative to the consensus into high and low quality. A strong

pattern emerges that high-quality positive surprise outperforms low-quality positive

surprise. Moreover, it is indeed the case that the excess return accrues slowly over the

months after the announcement date and is not incorporated into prices immediately.

Figure 10 shows, for a global universe, the spread of returns within the group of

companies that have delivered a positive surprise between those that were identified as

high quality before the announcement data and those that were low quality. The market

does not appear to recognise the superior quality of earnings for the group either on the

day of announcement, nor for that matter over the following week. However, one and

two months after the announcement there is a significant outperformance of 0.6% and

1.2%, respectively. Note that these numbers are not annualised and use the mean return,

though the return on the median stock is even higher.

Companies that deliver a

positive surprise relative to

consensus and also have high

earnings quality outperform

stocks that have a positive

surprise but low earnings

quality

Figure 10: Outperformance of High-Quality Positive Surprise Companies Relative to

Low-Quality Positive Surprise. US and Europe. Average of All Quarterly Reporting

Periods in 2006

1.8

1.6

Median

1.4

1.2

1.0

0.8

0.6

Mean

0.4

0.2

0.0

1 day

1 week

1 Month

2month

Chart shows the excess return of high quality positive surprise companies over low quality positive surprise

companies. We have screened stocks in the US and Europe into high and low quality based on our accruals

measure just before each earnings season, for the four quarters of 2006 earnings. Returns have been measured

from the close before the announcement date to the date shown. We have equally weighted stocks within the US

and Europe and equally weighted the two regions.

Source: Lehman Brothers Equity Strategy

31 July 2007

There is evidence that some of the surprise can be forecasted, see Zacks (1979)

11

Lehman Brothers | Global Equity Strategy

...moreover, this effect takes

place over several months

allowing a trading

opportunity.

So our trading rule is as follows. Going into an earnings season we can classify stocks as

high or low quality using reported information that is public before the announcement

date. As soon as a high-quality company announces a positive earnings surprise relative

to consensus, we would propose buying that stock and holding it for two months from

the announcement date.

The stocks that currently screen as having high earnings quality, taken from a global,

large-cap universe are shown in Figure 11. We suggest that if stocks on this list report a

positive earnings surprise, investors adopt a buy and hold strategy for two months from

the announcement date.

Exposure to regional baskets of these stocks can be gained via Lehman Brothers custom

synthetics (Bloomberg code: LBES <G0>). Please contact your sales representative or

alan.hofmeyr@lehman.com for further information on these baskets.

31 July 2007

12

Lehman Brothers | Global Equity Strategy

Figure 11: High-Quality Selection for Q2 Earnings Season with Percentage of

Earnings Accounted for by Accruals

Sectorname

CONSUMER STABLES

TELECOMS

MEDIA

CONSUMER CYCLICALS

TELECOMS

CAPITAL GOODS

CAPITAL GOODS

CONSUMER STABLES

HEALTHCARE

CAPITAL GOODS

TECHNOLOGY

CONSUMER CYCLICALS

CONSUMER STABLES

CONSUMER CYCLICALS

CONSUMER CYCLICALS

CONSUMER CYCLICALS

CONSUMER STABLES

HEALTHCARE

HEALTHCARE

HEALTHCARE

TECHNOLOGY

BASIC INDUSTRIES

CONSUMER STABLES

CONSUMER CYCLICALS

BASIC INDUSTRIES

TECHNOLOGY

CAPITAL GOODS

CONSUMER STABLES

MEDIA

MEDIA

CONSUMER CYCLICALS

HEALTHCARE

UTILITIES

ENERGY

CONSUMER CYCLICALS

CONSUMER STABLES

HEALTHCARE

MEDIA

CONSUMER CYCLICALS

CONSUMER STABLES

CONSUMER STABLES

HEALTHCARE

HEALTHCARE

HEALTHCARE

BASIC INDUSTRIES

CONSUMER STABLES

CONSUMER STABLES

HEALTHCARE

CAPITAL GOODS

ENERGY

BASIC INDUSTRIES

ENERGY

CONSUMER CYCLICALS

TECHNOLOGY

BASIC INDUSTRIES

HEALTHCARE

TECHNOLOGY

CONSUMER CYCLICALS

HEALTHCARE

Company

COLGATE-PALMOLIVE CO

AT&T INC

NEWS CORP

AUTOMATIC DATA PROCESSING

TELIASONERA AB

FANUC LTD

GENERAL DYNAMICS CORP

ANHEUSER-BUSCH COS INC

NOVARTIS AG

SCHNEIDER ELECTRIC

INTEL CORP

NIKE INC -CL B

KELLOGG CO

METRO AG

COACH INC

HENNES & MAURITZ

ALTRIA GROUP INC

ZIMMER HLDGS INC

ROCHE HLDGS AG

ROCHE HLDGS AG

YAHOO INC

MOSAIC CO

COCA-COLA CO

INDITEX

HOLCIM

NOKIA OYJ

CATERPILLAR INC

BRIT AMER TOBACCO

COMCAST CORP NEW

COMCAST CORP NEW

DEUTSCHE POST AG

MEDTRONIC INC

EDISON INTERNATIONAL

EXXON MOBIL CORP

LVMH MOET HENNESSY

L'OREAL

STRYKER CORP

DIRECTV GROUP INC

YUM BRANDS INC

KRAFT FOODS INC

HEINEKEN NV

AETNA INC

BECTON DICKINSON & CO

BRISTOL-MYERS SQUIBB CO

SHIN-ETSU CHEMICAL

SABMILLER

NESTLE SA

PFIZER INC

ITOCHU CORP

OCCIDENTAL PETROLEUM CORP

CRH

IMPERIAL OIL LTD

CANADIAN NATIONAL RAILWAY CO

SAP AG

SOUTHERN COPPER CORP

ASTELLAS PHARMA

APPLE INC

MARKS & SPENCER GP

LUXOTTICA GROUP

Accruals

0.61

0.83

1.43

2.18

2.30

3.10

3.34

3.48

3.72

3.94

4.02

4.15

4.65

5.49

6.38

6.48

7.40

7.44

7.73

7.73

9.18

9.39

10.43

10.51

10.84

11.10

11.68

12.13

12.24

12.24

13.52

14.13

14.20

14.37

15.22

16.03

16.45

16.49

16.50

16.63

17.01

17.86

17.97

18.11

18.35

18.40

18.71

19.61

19.85

19.94

20.44

20.83

20.84

20.91

21.30

21.34

21.42

21.90

21.96

Surprise Ratio (%)*

0.60

4.36

1.69

14.75

0.58

6.66

1.68

0.46

12.69

1.02

3.85

2.28

1.70

7.40

6.62

5.15

2.44

7.43

11.14

27.07

9.65

The surprise ratio shows the difference between the results published by Bloomberg News (European stocks) or

Factset (US stocks), and the median consensus expectation for either profits or income, or sales, sourced from

BloombergNews (European stocks) or IBES (US stocks), for Q2 or half-yearly results.

Companies selected from the 500 largest companies globally. Percentage accruals based on last reported

accounts. Please note that the trade ideas within this report in no way relate to the fundamental ratings applied to

stocks by Lehman Brothers equity research analysts.

Source: Lehman Brothers Equity Strategy

31 July 2007

13

Lehman Brothers | Global Equity Strategy

6 BIBLIOGRAPHY

Chan, Chan, Jegadeesh and Lakonishok (2001) Earnings Quality and Stock Returns

NBER Working Paper 2001

Ecker, Francis, Kim, Olsson and Schipper (2005) A Returns-Based Representation of

Earnings Quality, Fuqua School of Business, Duke University

Figelman, I (2007) Interaction of Stock Return Momentum with Earnings Measures,

Financial Analysts Journal 63 number 3 May/June 2007

Richardson, Sloan and Soliman (2001) Information in Accruals about the Quality of

Earnings, University of Michigan 2001

Sloan, R (1996) Do Stock Prices Fully Reflect Information in Accruals and cash Flows

about Future Earnings? The Accounting Review (July 1996)

Zacks, L (1979) EPS Forecasts Accuracy is Not Enough, Financial Analysts Journal

March/April 1979

31 July 2007

14

Lehman Brothers | Global Equity Strategy

Analyst Certification:

I, Ian Scott, hereby certify (1) that the views expressed in this research report accurately reflect my personal views about any

or all of the subject securities or issuers referred to in this report and (2) no part of my compensation was, is or will be directly

or indirectly related to the specific recommendations or views contained in this report.

FOR CURRENT IMPORTANT DISCLOSURES REGARDING COMPANIES THAT

ARE COVERED BY OUR FUNDAMENTAL ANALYSTS, PLEASE SEND A WRITTEN REQUEST TO:

LEHMAN BROTHERS CONTROL ROOM,

745 SEVENTH AVENUE, 19TH FLOOR,

NEW YORK, NY 10019

OR

REFER TO THE FIRM'S DISCLOSURE WEBSITE AT www.lehman.com/disclosures

Important Disclosures:

The analysts responsible for preparing this report have received compensation based upon various factors including the

Firm's total revenues, a portion of which is generated by investment banking activities.

Other Material Conflicts

Lehman Brothers is acting as financial advisor to AT&T in its potential acquisition of Dobson Communications.

Lehman Brothers Inc. or an affiliate is a market maker or liquidity provider in the securities of CRH Plc.

One of the analysts on the coverage team (or a member of his or her household) owns shares of the common stock of Kraft.

Guide to Lehman Brothers Equity Research Rating System

Our coverage analysts use a relative rating system in which they rate stocks as 1-Overweight, 2- Equal weight or 3Underweight (see definitions below) relative to other companies covered by the analyst or a team of analysts that are deemed

to be in the same industry sector (the sector coverage universe).

In addition to the stock rating, we provide sector views which rate the outlook for the sector coverage universe as 1-Positive,

2-Neutral or 3-Negative (see definitions below). A rating system using terms such as buy, hold and sell is not the equivalent

of our rating system. Investors should carefully read the entire research report including the definitions of all ratings and not

infer its contents from ratings alone.

Stock Rating

1-Overweight - The stock is expected to outperform the unweighted expected total return of the sector coverage universe

over a 12-month investment horizon.

2-Equal weight - The stock is expected to perform in line with the unweighted expected total return of the sector coverage

universe over a 12-month investment horizon.

3-Underweight - The stock is expected to underperform the unweighted expected total return of the sector coverage universe

over a 12-month investment horizon.

RS-Rating Suspended - The rating and target price have been suspended temporarily to comply with applicable regulations

and/or firm policies in certain circumstances including when Lehman Brothers is acting in an advisory capacity on a merger or

strategic transaction involving the company.

Sector View

1-Positive - sector coverage universe fundamentals are improving.

2-Neutral - sector coverage universe fundamentals are steady, neither improving nor deteriorating.

3-Negative - sector coverage universe fundamentals are deteriorating.

Distribution of Ratings:

Lehman Brothers Global Equity Research has 2048 companies under coverage.

41% have been assigned a 1-Overweight rating which, for purposes of mandatory regulatory disclosures, is classified as a

Buy rating. 30% of companies with this rating are investment banking clients of the Firm.

42% have been assigned a 2-Equal weight rating which, for purposes of mandatory regulatory disclosures, is classified as a

Hold rating, 40% of companies with this rating are investment banking clients of the Firm.

12% have been assigned a 3-Underweight rating which, for purposes of mandatory regulatory disclosures, is classified as a

Sell rating, 23% of companies with this rating are investment banking clients of the Firm.

31 July 2007

15

GLOBAL EQUITY RESEARCH

Lehman Brothers Inc. and its Foreign Affiliates involved in the Production of Equity Research

New York

Lehman Brothers Inc.

745 Seventh Avenue, New

York

New York 10019

1.212.526.7000

Member, NYSE and NASD

Taiwan

Lehman Brothers Inc.

Taiwan Branch

Cathay Financial Center 12F

7 Sungren Road - Shin-Yi

District

Taipei, Taiwan

Republic of China

886.2.8723.1600

London

Lehman Brothers (International)

Europe Ltd (LBIE)

25 Bank Street

London E14 5LE UK

44.20.7102.1000

Regulated by FSA

Tokyo

Lehman Brothers Japan Inc

Roppongi Hills Mori Tower

31st Floor

10-1 Roppongi 6-chome

Minato-ku, Tokyo

106-6131, Japan

813.6440.3000

Regulated by FSA

Hong Kong

Lehman Brothers Asia Limited

Hong Kong

Two International Finance

Centre

26th Floor, 8 Finance Street

Central, Hong Kong

852.2252.6000

Regulated by SFC

Seoul

Lehman Brothers (International)

Europe

Seoul Branch

Hanwha Building

12th Floor

110, Sokong-dong Chung-Ku

Seoul 100-755, Korea

82.2.317.5000

Regulated by FSC

Mumbai

Lehman Brothers Inc., India Branch

Lehman Brothers Financial Services (India) Private Limited

Winchester, Off High Street, 9th Floor

Hiranandani Business Park

Powai, Mumbai 400 076, India

91.22.3053.4626

Lehman Brothers produces a number of different types of research product including, amongst others, fundamental analysis, quantitative analysis and short term trading ideas. Recommendations contained in one

type of research product

product may

may differ

differfrom

fromrecommendations

recommendationscontained

containedininother

othertypes

typesofofresearch

researchproduct,

product,whether

whetherasasa result

a resultof ofdiffering

differing

time

time

horizons,

horizons,

methodologies,

methodologies,

or otherwise.

or otherwise.

Should

Should

you you

wishwish

to receive

to receive

any

any

research

research

product

product

of a of

type

a type

that that

you you

do not

do presently

not presently

receive,

receive,

please

please

contact

contact

youryour

Lehman

Lehman

Brothers

Brothers

salessales

representative

representative

who who

will be

willpleased

be pleased

to assist

to assist

you.you.

This material has been prepared and/or issued

issued by

by Lehman

Lehman Brothers

Brothers Inc.,

Inc., member

member SIPC, and/or one of itsits affiliates

affiliates ("Lehman

("Lehman Brothers")

Brothers") and

and has

has been

been approved by Lehman Brothers International (Europe),

authorised and regulated by the Financial Services Authority, in connection with its distribution in the European Economic Area. This material is distributed in Japan by Lehman Brothers Japan Inc., and in Hong

Kong by Lehman Brothers Asia Limited. This material is distributed in Australia by Lehman Brothers Australia Pty Limited, and in Singapore by Lehman Brothers Inc., Singapore Branch (LBIS). Where this

material is distributed by LBIS, please note that it is intended for general circulation only and the recommendations contained herein does not take into account the specific investment objectives, financial situation

or particular needs of any particular person. An investor should consult his Lehman Brothers representative regarding the suitability of the product and take into account his specific investment objectives, financial

situation or particular needs before he makes a commitment to purchase the investment product. This material is distributed in Korea by Lehman Brothers International (Europe) Seoul Branch. This document is for

information purposes only and it should not be regarded as an offer to sell or as a solicitation of an offer to buy the securities or other instruments mentioned in it. No part of this document may be reproduced in

any manner without the written permission of Lehman Brothers. With the exception of disclosures relating to Lehman Brothers, this research report is based on current public information that Lehman Brothers

considers reliable, but we make no representation that it is accurate or complete, and it should not be relied on as such. In the case of any disclosure to the effect that Lehman Brothers Inc. or its affiliates

beneficially own 1% or more of any class of common equity securities of the subject company, the computation of beneficial ownership of securities is based upon the methodology used to compute ownership

under Section 13(d) of the United States' Securities Exchange Act of 1934. In the case of any disclosure to the effect that Lehman Brothers Inc. and/or its affiliates hold a short position of at least 1% of the

outstanding share capital of a particular company, such disclosure relates solely to the ordinary share capital of the company. Accordingly, while such calculation represents Lehman Brothers holdings net of any

long position in the ordinary share capital of the company, such calculation excludes any rights or obligations that Lehman Brothers may otherwise have, or which may accrue in the future, with respect to such

ordinary share capital. Similarly such calculation does not include any shares held or owned by Lehman Brothers where such shares are held under a wider agreement or arrangement (be it with a client or a

counterparty) concerning the shares of such company (e.g. prime broking and/or stock lending activity). Any such disclosure represents the position of Lehman Brothers as of the last business day of the calendar

month preceding the date of this report.

We do not represent that this information, including any

any third

third party

party information,

information, isis accurate

accurate oror complete

complete and it should not be relied upon as such. It isis provided

provided with

with the

the understanding

understanding that Lehman Brothers is not

acting in a fiduciary capacity. Opinions expressed herein reflect the opinion of Lehman Brothers and are

are subject

subject toto change

change without

without notice.

notice. The

The products

products mentioned

mentioned inin this

this document

document may

may not be eligible for sale in

some states or countries, and they may not be suitable for all types of investors. If an investor has any doubts about product suitability, he should consult his Lehman Brothers representative. The value of and the

income produced by products may fluctuate, so that an investor may get back less than he invested. Value and income may be adversely affected by exchange rates, interest rates, or other factors. Past

performance is not necessarily indicative of future results. If a product is income producing, part of the capital invested may be used to pay that income. Lehman Brothers may, from time to time, perform

investment banking or other services for, or solicit investment banking or other business from any company mentioned in this document. 2007

2006 Lehman Brothers. All rights reserved. Additional information is

available on request. Please contact a Lehman Brothers entity in your home jurisdiction.

Lehman Brothers policy for managing conflicts of interest in connection with investment research is available at www.lehman.com/researchconflictspolicy. Ratings, earnings per share forecasts and price targets

contained in the Firm's equity research reports covering U.S. companies are available at www.lehman.com/disclosures.

Complete disclosure information on companies covered by Lehman Brothers Equity Research is available at www.lehman.com/disclosures.

www.lehman.com/disclosures.

UK07-0xxx

UK07-00xx

UK07-0402

31

July 2007

Pub Codes: 39/5068/1002

Pub Codes: 1/24/36/39/43/1002/506816

You might also like

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Commercial Real Estate and The Economy v2Document20 pagesCommercial Real Estate and The Economy v2viktor6No ratings yet

- Minutes 28.04.13Document2 pagesMinutes 28.04.13viktor6No ratings yet

- Minutes 28.04.13Document2 pagesMinutes 28.04.13viktor6No ratings yet

- Web CasesDocument54 pagesWeb CasesLucy Ngu SiNo ratings yet

- Silat Meeting 201112 NotesDocument3 pagesSilat Meeting 201112 Notesviktor6No ratings yet

- Current Priorities of GovernmentDocument1 pageCurrent Priorities of Governmentviktor6No ratings yet

- This Paper Is Not To Be Removed From The Examination HallsDocument9 pagesThis Paper Is Not To Be Removed From The Examination Hallsviktor6No ratings yet

- Anders Moden - Healed Sealed Soda PDFDocument10 pagesAnders Moden - Healed Sealed Soda PDFsqNo ratings yet

- Fund Flows Geo Focus Table - 05022016Document1 pageFund Flows Geo Focus Table - 05022016viktor6No ratings yet

- MSCI Nov15 INTSummaryDocument59 pagesMSCI Nov15 INTSummaryviktor6No ratings yet

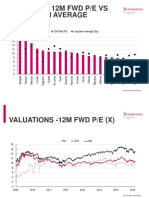

- 18 20 12M FWD P/E Long-Term Average (5yr)Document10 pages18 20 12M FWD P/E Long-Term Average (5yr)viktor6No ratings yet

- British LandDocument9 pagesBritish Landviktor6No ratings yet

- Demidovich Problems in Mathematical AnalysisDocument495 pagesDemidovich Problems in Mathematical Analysisjwcstar7985100% (5)

- Singapore Institute of Management: University of London Preliminary Exam 2015Document5 pagesSingapore Institute of Management: University of London Preliminary Exam 2015viktor6No ratings yet

- Fund Flows Geo Focus Table - 10022016Document1 pageFund Flows Geo Focus Table - 10022016viktor6No ratings yet

- EMEA pt2Document20 pagesEMEA pt2viktor6No ratings yet

- Frontier Pt1Document26 pagesFrontier Pt1viktor6No ratings yet

- Chapter SixDocument234 pagesChapter Sixviktor6No ratings yet

- Frontier Pt2Document20 pagesFrontier Pt2viktor6No ratings yet

- EMEA pt1Document20 pagesEMEA pt1viktor6No ratings yet

- Sweezy CapitalismDocument5 pagesSweezy Capitalismviktor6No ratings yet

- BeyondDocument4 pagesBeyondviktor6No ratings yet

- Turkey PakistanDocument1 pageTurkey Pakistanviktor6No ratings yet

- Investing in Canadian Stocks: The Casey Research Guide ToDocument19 pagesInvesting in Canadian Stocks: The Casey Research Guide Toviktor6No ratings yet

- HoldingsDocument4 pagesHoldingsviktor6No ratings yet

- Jeremy Silman - The Reassess Your Chess WorkbookDocument220 pagesJeremy Silman - The Reassess Your Chess Workbookalan_du2264590% (29)

- Term Structures of Credit Spreads With Incomplete Accounting InformationDocument33 pagesTerm Structures of Credit Spreads With Incomplete Accounting Informationviktor6No ratings yet

- Breastfeeding Policy Scorecard For Developed Countries-3Document1 pageBreastfeeding Policy Scorecard For Developed Countries-3viktor6No ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Updates On Open Offer (Company Update)Document80 pagesUpdates On Open Offer (Company Update)Shyam SunderNo ratings yet

- Tutorial Answer (Intangibles)Document16 pagesTutorial Answer (Intangibles)Chris TengNo ratings yet

- AMLReportDocument33 pagesAMLReportprabu2125No ratings yet

- Spontaneous Harmonization EffectsDocument20 pagesSpontaneous Harmonization EffectsMaría Victoria100% (1)

- Turkey Vision 2023Document32 pagesTurkey Vision 2023Fidel AthanasiosNo ratings yet

- The Big Idea CompilationDocument30 pagesThe Big Idea CompilationCarolyn McClendon100% (2)

- Valuable Words - Pricing Internet Domain NamesDocument19 pagesValuable Words - Pricing Internet Domain NamesEric PrenenNo ratings yet

- Cima C01 Samplequestions Mar2013Document28 pagesCima C01 Samplequestions Mar2013Abhiroop Roy100% (1)

- Introduction To Corporate Finance: Mcgraw-Hill/IrwinDocument17 pagesIntroduction To Corporate Finance: Mcgraw-Hill/IrwinMahmood KhanNo ratings yet

- Bot For Highway PDFDocument163 pagesBot For Highway PDFAbd Aziz MohamedNo ratings yet

- TW Banking Business Models of The Future 2016 UnlockedDocument8 pagesTW Banking Business Models of The Future 2016 UnlockedJc LC100% (1)

- Money in Islamic EconomicDocument12 pagesMoney in Islamic EconomicismiNo ratings yet

- TurnKey Investing With Lease-Options (Table of Contents, Intro, Chapter 1)Document35 pagesTurnKey Investing With Lease-Options (Table of Contents, Intro, Chapter 1)Matthew S. ChanNo ratings yet

- Partnerships: Termination and Liquidation: Chapter OutlineDocument51 pagesPartnerships: Termination and Liquidation: Chapter OutlineJordan Young100% (1)

- Short Term Sources of FinanceDocument17 pagesShort Term Sources of FinancePreyas JainNo ratings yet

- YTL Corporation Berhad - Annual Report 2013Document239 pagesYTL Corporation Berhad - Annual Report 2013ETDWNo ratings yet

- English Words About BankingDocument17 pagesEnglish Words About BankingAloysius KeransNo ratings yet

- Financial Inclusion PDFDocument6 pagesFinancial Inclusion PDFVamshiKrishna100% (2)

- Soal Chapter 7 Penilaian ObligasiDocument3 pagesSoal Chapter 7 Penilaian ObligasiAnonymous yMOMM9bsNo ratings yet

- Group Exercises IFRS For SMEs - 2012Document14 pagesGroup Exercises IFRS For SMEs - 2012lorenbeatulalianNo ratings yet

- Project: Book Review: Mcdonald'S Behind The Arches John F .LoveDocument13 pagesProject: Book Review: Mcdonald'S Behind The Arches John F .LoveNivedita Bhalja100% (1)

- Intermediate Accounting - Investment PropertyDocument22 pagesIntermediate Accounting - Investment PropertyNickNo ratings yet

- 1 Mark QuestionsDocument8 pages1 Mark QuestionsPhani Chintu100% (2)

- Equinix - Initiation ReportDocument27 pagesEquinix - Initiation ReportkasipetNo ratings yet

- Verma Panel FindingsDocument17 pagesVerma Panel FindingsNaga Mani MeruguNo ratings yet

- Receivables ManagementDocument8 pagesReceivables Managementramteja_hbs14No ratings yet

- AFM ForexExp QsDocument6 pagesAFM ForexExp QsJessica Marilyn VazNo ratings yet

- Social Security StrategiesDocument23 pagesSocial Security StrategiesNational Press FoundationNo ratings yet

- Private Equity Real Estate FirmsDocument13 pagesPrivate Equity Real Estate FirmsgokoliNo ratings yet

- Ar2010 pg14-15Document105 pagesAr2010 pg14-15selau642No ratings yet