Professional Documents

Culture Documents

Compusoft, 3 (6), 961-966 PDF

Uploaded by

Ijact EditorOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Compusoft, 3 (6), 961-966 PDF

Uploaded by

Ijact EditorCopyright:

Available Formats

COMPUSOFT, An international journal of advanced computer technology, 3 (6), June-2014 (Volume-III, Issue-VI)

ISSN:2320-0790

Role of Data mining in Insurance Industry

K. Umamaheswari1 , Dr. S. Janakiraman2

1

Research scholar, Dept of Co mputer Science Bharathiar university, Coimbatore, Tamilnadu, India

2

Assistant Professor, Dept of Ban king technology, Pondicherry university, Pondicherry, India

Abstract: In the global era, Insurance systems rapidly a lot of tremendous development in our society. Due to the

increased stress in day-to-day life, the growth of demand of insurance increased. Data mining help s insurance firms

to discovery useful patterns from the customer database. The purpose of the paper aims to present how data mining

is useful in the insurance industry, how its techniques produce good results in insurance sector and how data mining

enhance in decision making using insurance data. The conceptual paper is written based on secondary study,

observation fro m various journals, magazines and reports.

Keywords : Applicat ions, benefits, CRM , Data mining, Insurance industry,

I. INTRODUCTION

The key objectives of the IRDA include promotion of

Data mining is an interdisciplinary field of

competition so as to enhance customer satisfaction

astronomy, business, and computer science,

and ensure the financial security of the insurance

economic and other to discover new patterns from

market. Various types of insurance such as Life

large datasets. Data mining technology can help the

insurance, Property insurance, health insurance,

insurance firms for taking crucial business decisions.

vehicle insurance and other insurance (Travel,

The insurance sector is primarily dependent on

Liability, Credit insurance) used the data min ing

customers base. The most scenario of any insurance

technique depends upon their requirements. Today,

firm, effect ive management of customer data is

insurance sector may gain valuable informat ion that

essential one. With the help of data min ing

helps to other profitable policies to the customer

techniques, the customer data handled effectively.

community.

Data mining is to help the market specialists for

decision making process. Companies in the insurance

B. Data Mining

industry collected huge amounts of data about their

Data mining refers to extracting or mining

customers. Due to their protective regulations,

knowledge fro m large amount of data. Data min ing

extracting informat ion fro m the database caused a lot

as a synonym for another popularly used term,

of time. In that situation, Data mining very helpful to

knowledge discovery from data or KDD The goal

the firm for access the data easily.

of this technique is to find pattern that was previously

unknown data [1].

A. Insurance sector

The steps of knowledge discovery process as

The insurance broadly divided into life, health and

discussed as follows,

non-life insurance. The insurance companies have

Selection: Selecting data relevant to the analysis task

vital role in insurance provides which meet the

fro m the database.

requirements of the customers at the same time are

Preprocessing: Removing noise and inconsistent

affordable. Insurance is the equitable transfer of the

data, combin ing multip le data sources.

risk of a loss, from one entity to another in exchange

Transformati on: Transforming data into appropriate

for payment. It against the risk of a contingent,

forms to perform data mining

uncertain loss. Growing interest towards insurance

Data mining

: Choosing a data mining algorith m

among people, innovative products and distribution

which is appropriate to pattern in the data, ext racting

channels are sustaining the growth of the insurance

data patterns.

sector

Interpretation/ Evaluation: Interpret ing the patterns

The Insurance Regulatory and Development

into knowledge by removing redundant or irrelevant

Authority (IRDA) were constituted as an autonomous

patterns. Translating the useful patterns into terms

body to regulate and develop the insurance industry.

that human understandable.

961

COMPUSOFT, An international journal of advanced computer technology, 3 (6), June-2014 (Volume-III, Issue-VI)

This paper is organized as follows, first summarized

about the background of the study. Secondly,

describes about the data mining and its tasks. Third,

how data min ing techniques used for insurance

industry are summarized, finally the conclusion of

the study is described.

predicting fraudulent claims & medical coverage and

predicting the customers pattern which customer

will buy new policies. Data mining is applied in

insurance industry, but tremendous competitive

advantages the companies who have implemented it

successfully.

Some of the areas data mining can be applied to

Insurance industry are

Identify risk factors that predict profits,

claims and losses.

Customer level Analysis

Marketing and sales analysis

Developing new product lines

Reinsurance

Financial analysis

Estimating outstanding claims provision

Detecting fraud

II. RELATED WORK

Literature survey is an essential for any study. This

section described the background work of the data

mining techniques in the insurance domain. Lijia Guo

et al., [3] focused on property/casual insurance and

described the data mining techniques which used for

the process of property insurance. T. L. Oshini

Goonetilleke et al., [14 ] summarized the analysis of

customer analysis when min ing a life insurance data.

He focused on the customer retention and

implemented the techniques for customer attrition.

That recommended that problem of attrition analysis

of life insurance domain was successfully removed

with the implementation of data mining techniques.

Katharina Morik et al., [4] discussed the customer

churn management using insurance dataset. He

focused on customer churn how to minimize the

churn in the insurance industry. A. B. Devale et

al.,[6] listed about the application of data min ing

techniques in life insurance, he explains how the data

mining methodologies useful for the insurance firms .

With rapid changes taking place in the field of

insurance industry, decision support system plays an

important role. Data mining used to support the

controlling of policies, the administrative and

management tasks, efficient management of

organization and financial data.

A. Data Mi ning Techni ques

Data min ing techniques have applied to various

insurance domains to improve decision making. Data

mining

use

predictive

modeling,

market

segmentation, market basket analysis to answer

business questions with greater accuracy. Various

data mining techniques used for the insurance

industry development are Classificat ion, Clustering,

Regression and Association rules, summarizat ion

used for knowledge discovery fro m database. [25]

Classification

It is one of the most commonly used techniques, to

develop models that can population records at large.

The classifier t rain ing algorith m uses this technique

used for business development. Various classifiers

used for the classification algorithms such as

Decision tree, Bayesian classifier, neural network,

Support vector machine etc. Customer database can

be

segmented

into

homogeneous

groups,

classification maps data into predefined group into

segments.

The application of data min ing

classification algorithms are applied on insurance

benchmark dataset. Types of classification are

Supervised classification

Unsupervised classification

Clustering

It used for identificat ion of similar classes of objects.

Its used for grouping based on the customers

behavior. It is applicable for customer segmentation

and targeted market ing. Types of Clustering are

Partit ioning methods

Nanthawadee Sucharittham et al., [16] summarized

the survey of application of data mining techniques

of life insurance domain. Rekha Bhowmik et al., [17]

detected the auto insurance fraud using the various

fraud anomaly detection technique. And focused to

identify the behavior of customer and analyzed the

profitable customers for the insurance company. S.

Balaji et al., [7] su mmarized the classification

techniques used for the prediction of data over life

insurance customer data. He analyzed the various

classifier algorithms (Nave Bayes, Bayesian

Network classifier etc). H. Lookman Sithic et al.,

[11] analy zed the various review for the fraud

detection. He listed the number of research paper

related to insurance fraud activities. Jayanthi Ranjan

[20] summarized the applications of customer

relationship management in insurance company. She

done the case study with insurance data

III. ROLE OF DATA MINIING IN

INS URANCE INDUS TRY

Data mining is a powerful new technology with great

potential to help insurance firms focus on the most

important informat ion in the data they have collected

about the behavior of their customers and potential

customers. Data mining assist insurance sector in

962

COMPUSOFT, An international journal of advanced computer technology, 3 (6), June-2014 (Volume-III, Issue-VI)

Hierarchical agglo merative methods

Density based methods

Grid based methods

Model based methods

Regression

It can be used for prediction. Regression

analysis used to model the relationship between one

or mo re independent and dependent variables. In

insurance firm, mo re co mplex techniques needed to

predict future values. Types of regression includes

Linear regression

Non-linear regression

Multi-variate linear regression

Multi-variate non linear regression

Association

Predicting insurance product

behavior and attitude

Predicting the performance

progress of segments throughout

the performance period

Prediction to find what factors will

attract new avenues in Insurance

sector

Classify trends of movements

through the organization for

successful/unsuccessful customer

historical records

Insurance companies faced a lot of problems

on customer retention. Association used for this task,

because it finds all the association where customers

bought a frequent item set. Association helps

business firms to make certain decisions. Market

basket analysis and cross selling programs are typical

examples for wh ich association modeling is usually

adopted.

Multi-variate association rule

Multi-dimensional association rule

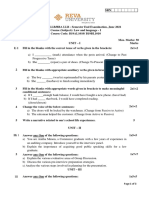

Table 1 shows how a how data mining techni ques

will add value to insurance data.

Data mining

techni ques

Patterns

Clustering

customer having similar

characteristics

Analysis of customer attrition in

insurance sector

Policy most likely to be used, most

unlikely to be used

Segments related to policy

Classification

& Prediction

Predicting consumer behavior

discovery of such association that

promotes business technique

Summarization

provides summary informat ion

Various mult idimensional

summary reports

Statistical summary info rmation

Summarizati on:

This technique which used for report generation

provides better decision making for large volume of

customer database with the help of visualizat ion

tools. It will p rovide more functionality in business

decision making. For solving the business problems

and making decision, this data min ing techniques can

be help to the organization but selecting the

appropriate techniques can important for the

organization.

B. Data mining tasks

Data mining is becoming common in both the

insurance sectors like private and public. Data of the

customer are one of the most valuable assets of any

firm. The traditional methods, which were used for

handling huge amounts of data generated by

insurance transactions, are too complex. For

transferring huge amount of data for decision

making, data mining makes the methodology.

Insurance firms use the data min ing methodologies to

enhance research and increase sales among the

customers.The data mining used for various tasks in

the insurance sector as follo ws.

Acquiring new customers:

When the customers want to insure some policy then

this technique helps us finding the associations

between different items. Types of Association rules

are

Association

Acquisition of new customer is most important

scenario of any firm. Tradit ionally, the insurance

companies used the services of brokers to acquire the

customers, but today a lot of ways helps to acquire

the new customers [8]. Insurance firm focused of

both acquiring new customer & retaining existing

ones.

Predicting the likelihood of success

of policies

Classifying the historical customer

records

Prediction of what type of policy

most likely to be retained, most

likely to be left

963

COMPUSOFT, An international journal of advanced computer technology, 3 (6), June-2014 (Volume-III, Issue-VI)

Cluster Analysis used in the private sector to identify

target group of customers. It involves targeting the

population who are most likely to become customers

or most profitable to the company.

Underwriting and Policy management

Data mining can be used in this application to

optimize the function of the insurance value chain

(Premiu m Analysis and Loss analysis)

Customer level analysis

Analysis of customer purchase patterns and behavior.

Using associated discovery technique, most insurance

firms accurately select which policies and services to

offer which customers [8]. According [21], it used

data mining technology for insurance settlement and

analyzed the customer records and also developed

function structure model for customer analysis using

data mining method.

Risk management

One of the main stages in the process of risk

management is risk financing is, of course, insurance.

Insurance industry is keen in identifying the risks

pertaining to their business.

Risk management contains the six phases are risk

identification, risk analysis, risk priorit ization and

risk mon itoring [19].

Reinsurance:

Reinsurance comes under in the fields of risk

management. The reinsurer may be either a specialist

reinsurance company, which only undertakes

reinsurance business, or another insurance company.

Data min ing tools can develop predictive models to

arrive at the reinsurance level for the book of

business based on the historical claims data. These

predictive models can be identified suitable policies

for reinsurance based on the loss experience of

similar policies in past.

Customer Segmentation

Segment based products for targeting the customers.

Data mining can be used for customer segmentation,

for promoting the cross-selling of services, and in

increasing customer retention.

Customers are

assigned to lifestyle segment based on their purchase

history. Market segmentation is the key issue for the

development of loyal relationships among the

customers [22]

Policy designing and policy selection

The insurance firm made the investigation whether

people tend to purchase policy for the reason and the

policy designed. In that case, to compete successful

in the market , insurance companies used data min ing

technologies.

Fraud detection

Detecting fraud claims is important in the insurance

firm. Data min ing isolates the factors that lead to

fraud waste and abuse. To identify which t ransactions

are most likely to be fraudulent. This is called as

Fraud anomaly detection. In medical insurance,

various medical insurance agencies suffered due to

fraud claim in the health insurance; here he

developed a model with three steps for the health

insurance fraud detection. And he discussed the

characteristics of fraud detection are high claims

payment data is incorrect, suspicious data analysis,

problem of hospital or physician [12]. The types of

fraud and how much of fraud activit ies in the

insurance firm discussed and he developed a claim

sorting algorithm for the claim p rocessing systems

[13].

Predicti on

Data mining used for variety of applications such as

predicting and classifying customers and clustering

customer characteristics for achievement of

profitability. Fro m the customer point of view,

predictive analytics provides some benefits such as

simp lified claim handling process, reduced policy

premiu m for lo w risk customers, faster and

automated claim settlement.[26] . Data min ing tools

predict behaviors and future trends, allowing

businesses to make proactive, knowledge-driven

decisions. It performs inference on the current data

(insurance dataset) order to make pred ictions [7]

Trend analysis

Trend analysis often refers to the science of studying

changes in social patterns, including fashion,

technology, and consumer behavior. In insurance, to

reveal difference between the typical customer this

month and last [23]. Data mining used in the different

service industry especially in insurance firms the

most frequently used applications for customer

segmentation, customer retention, risk assessment

and fraud detection and Policy approval process.

Insurance firms have a lot of improved changes in

Information technology. Insurance industry has

Clai ms management

It is one of the most function is the insurance; data

mining handled the claims management function

such as claim analysis and fraud analysis.

Devel oping new product lines

To develop the new product/plan depends on the

customer needs. Insurance firms utilized all of their

available information to better develop new product

and marketing campaigns [8].

964

COMPUSOFT, An international journal of advanced computer technology, 3 (6), June-2014 (Volume-III, Issue-VI)

historically been a growing industry. It plays an

important role in insuring the economic well being

one country. Many insurers use data min ing

techniques to identify the new customers and other

are applying this technique to reduce portfolio risk,

and to identify policies that were based on fraudulent

informat ion

organization. The future of the insurance lies in the

increasing the product plans and improving service

levels using advanced data mining techniques.

V. REFERENC ES

[1] Han and Kamber, Data Mining: Concepts and

Techniques,Second Morgan Kaufman Publisher,

2006,

C. Challenges

In insurance organizations, processing large

quantities of data during data mining has some of the

challenges. Data mining system faces a lot of

problems and pitfalls when handling customers data

such as

Noisy data

High volu me and high complexity for

different kinds of data.

Hybrid one or mo re techniques

Corrupted values

Missing attribute values

One of the biggest challenges that insurance

faces is improve the customer retention and higher

revenue.

[2] Micheal J. A .Berry and Gordon S.linoff. EBook

Data Mining Technique for market ing Sales and

CRM, Wiley Publishing, Inc., Indianapolis. Indiana,

2004.

[3] Lijia Guo. Applying Data mining Techniques in

Property/Casualty Insurance, Casualty Actuarial

Society Foru m Casualty Actuarial Society Arlington, Virg inia W inter 2003.

[4] Katharina Morik and Hanna Kopcke. Analyzing

Customer Churn in Insurance Data. Lecture Notes in

Co mputer Science, vol. 3202, 2004, pp. 325-336 .

[5] Keyvan Vahidy Rodpysh,, Amir Aghai and

Meysam Majdi , Applying data mining techniques

for

Customer

Relationship

management,

International Journal of Information Technology,

Control and Automation Vo l.2, No.3, July 2012

[6] A. B. Devale

and Dr. R. V. Kulkarn i,

Application of data mining techniques in life

insurance, International journal of Data min ing and

Knowledge management Process, Vol.2, No.12,.pp.

31-40. July 2012

[7] S. Balaji and Dr. K. Srinivasta, Nave Bayes

Classification Approach for Mining Life Insurance

Databases for Effect ive Pred iction of Customer

Preferences over Life Insurance Products ,

International journal of Co mputer Applications,

vol.51, No.3, pp.22-26. August 2012

[8] Kanwal garg, Dharminder ku mar and m.c.garg,

,Data min ing techniques for identifying the

customer behavior of investment in life insurance

sector in india, International journal of informat ion

technology and knowledge management, Vo l.1,

pp.51-56.

D. Future Trends

Due to technology increased, future application areas

also creates new challenges and opportunities for data

mining. Advanced data mining techniques can be

developed and used by the insurance firm that helps

business development to ensure the growth and

development of insurance companies.

Future data min ing technologies involves [25]

Standardization of data min ing language

Predictive analysis

Advanced Text min ing

Semantic and Image min ing

IV. CONCLUS ION

Data mining takes a vital role in the entire

applications domain especially in insurance sector.It

highlighted the importance and role of data min ing

techniques are useful in insurance sector for

managing the customer data and gain business

advantage. It can enhance an insurance business

process. For business decision making, data min ing

techniques are implemented in this domain. This

paper discusses how insurance firms can benefit by

data min ing methodologies and thereby reduce costs,

increase profits, acquire new customers, retain

current customers and develop new products. We can

conclude that Insurance sector is having increasing

growth rate and adopted with various data min ing

techniques. Insurance firms use the proper data

mining techniques prove to be a boon for the

[9] Cheng C.H. and Chen Y.S. (2009), Classifying

the segmentation of customer value via RFM model

and RS theory, Expert Systems with Applications,

Vo l.36, pp. 4176-4184.

[10] Gu lshan Vohra and Dr. Bhart Bhushan Data

mining techniques for analyzing the investment

behavior of customers in life insurance sector,

International Journal of Research in Engineering &

Applied Sciences, Vo 2, Issue 1 January 2012.

965

COMPUSOFT, An international journal of advanced computer technology, 3 (6), June-2014 (Volume-III, Issue-VI)

[11] H.Lookman Sithic, T.Balasubramanian, Survey

of Insurance Fraud Detection Using Data Mining

Techniques, International Journal of Innovative

Technology and Exp loring Engineering, Vol-2, Issue3, February 2013.

[12] Kuo-Chung Lin , Ch ing-Long Yeh, Use of

Data Mining Techniques to Detect Medical Fraud in

Health Insurance, International Journal of

Engineering and Technology Innovation, vol. 2, no.

2, pp. 126-137, 2012

[22] M iguis V.L., Camanho A.S., Joo Falco e

Cunha (2012), Customer data min ing for lifestyle

segmentation,

Expert

Systems

with

Applications,Vo l.39, pp. 9359-9366.

[23] M. Ven katesh A Study Of Trend Analysis In

Insurance Sector In India ,International Journal Of

Engineering And Science (IJES) ,Vo lu me 2 ,Issue

6,pp 01-05, June 2013.

[24] Mrs.Bharat i M. Ramageri, Data min ing

techniques and Applications, Indian journal of

computer science & engineering, Vol1, No .4, pp.301305.

[25] Jayanthi Ran jan Data min ing in pharma sector

: benefits, IJHCQA, Vo l. 22 No. 1, 2009, pp. 82-92.

[13] Derrig R. A., "Insurance fraud," Journal of Risk

and Insurance, vol. 69.3, pp. 271-287, 2002.

[14] T. L. Oshini Goonetilleke and H. A. Caldera ,

Mining Life Insurance Data for Customer Attrit ion

Analysis ,Journal of Industrial and Intelligent

Information Vo l. 1, No. 1, March 2013

[15] Gabor Melli , Osmar R. Zaane ,Brendan Kitts,

Introduction to the Special Issue on Successful RealWorld Data M ining Applications , SIGKDD

Exp lorat ions Vo l 8, Issue 1.

[16]

Nanthawadee

Sucharittham,

,Thanaruk

heeramunkong Choochart Haruechaiyasak, Bao Tu

Ho, Dam Hieu Ch i, Data Mining fo r Life Insurance

Knowledge Ext raction: A Survey.

[26] Ashok Goudar, Predictive Analytics in

insurance Servies, MPHASIS, Hp co mpany.

[27]. Insurance Industry, challenges reforms and

allignement, Confederat ion of Indian Industry.

[17]. Rekha Bhowmik, Detecting Auto Insurance

Fraud by Data Mining Techniques, Journal of

Emerging Trends in Co mputing and Informat ion

Sciences , Vo lu me 2 No.4, Aprill 2011

[18] Abdhesh Gupta Anwiti,Life Insurance

Reco mmender System Based on Association Rule

Mining and Dual Clustering Method for Solving Cold

start problem ,International Journal of Advanced

Research in

Co mputer Science and Software

Engineering , Vol 3, Issue 10, October 2013.

[19] Dilbag singh,Pradeep Kumar, Conceptual

Mapping of Insurance Risk Management to Data

Mining, International Journal of Co mputer

Applications, Vo l. 39, No.2, pp.13-18 2012.

[20] Jayanthi Ran jan, Raghuvir Singh, Analytical

customer relationship management in insurance

industry using data min ing: a case study of Indian

insurance company, International Journal of

Networking and Virtual Organisations,Vo l. 9, No. 4,

pp. 331-366 .2011.

[21] Xu Zhikun1, Wang Yanwen2 and Liu Zhaohui,

Optional Insurance Co mpensation Rate Selection

and Evaluation in Financial Institutions ,

International Journal of u - and e- Service, Science

and Technology,Vo l.7, No.1 , pp.233-242 ,2014

966

You might also like

- Data Mining HealthcareDocument9 pagesData Mining HealthcareKhaled Omar El KafafyNo ratings yet

- A Single SignOn Guide For SAP S4HANA Cloud, Private EditionDocument15 pagesA Single SignOn Guide For SAP S4HANA Cloud, Private EditionmutyalapatiNo ratings yet

- The Application of Big Data in The Insurance Industry-With Potential Risks and Possible SolutionsDocument6 pagesThe Application of Big Data in The Insurance Industry-With Potential Risks and Possible SolutionsMiguelNo ratings yet

- Value Proposition of Analytics in P&C InsuranceDocument39 pagesValue Proposition of Analytics in P&C InsuranceGregg BarrettNo ratings yet

- Stackiq Insuranceind WPP FDocument18 pagesStackiq Insuranceind WPP Fsmitanair143No ratings yet

- Ronkes New SeminarDocument28 pagesRonkes New Seminarwillyshow84No ratings yet

- AI in InsuranceDocument8 pagesAI in InsuranceAjay BaviskarNo ratings yet

- LMS 9Document11 pagesLMS 9prabakar1No ratings yet

- Retrieve 2Document44 pagesRetrieve 2jilaoshi.aNo ratings yet

- Role of It in Insurance SectorDocument118 pagesRole of It in Insurance SectorNandini JaganNo ratings yet

- SSRN Id3382125Document14 pagesSSRN Id3382125Ramona-Elena POPESCUNo ratings yet

- Insuretech 2Document8 pagesInsuretech 2Anusha.RNo ratings yet

- Deep Learning Powers Finance InnovationTITLEDocument5 pagesDeep Learning Powers Finance InnovationTITLEtoNo ratings yet

- Application of Data ScienceDocument8 pagesApplication of Data SciencepallaB ghoshNo ratings yet

- Insurance Ai Paper CIA 3Document7 pagesInsurance Ai Paper CIA 3Khushal MittalNo ratings yet

- Data Mining in Automotive CustomerManagementDocument4 pagesData Mining in Automotive CustomerManagementIIR indiaNo ratings yet

- Case Study: Digital Transformation at New India Assurance Co. LTDDocument6 pagesCase Study: Digital Transformation at New India Assurance Co. LTDkggurujiNo ratings yet

- Case Study: Digital Transformation at New India Assurance Co. LTDDocument6 pagesCase Study: Digital Transformation at New India Assurance Co. LTDkggurujiNo ratings yet

- Assignment 1A Final Draft Research ProposalDocument11 pagesAssignment 1A Final Draft Research ProposalAnil KumarNo ratings yet

- B Predictive Modeling For InsurersDocument8 pagesB Predictive Modeling For InsurersMikhail FrancisNo ratings yet

- Alternate Data Sources V1.3-FinalDocument35 pagesAlternate Data Sources V1.3-FinalVijay BalajiNo ratings yet

- Technincal ReportDocument10 pagesTechnincal ReportUtkarsh RajNo ratings yet

- User Segmentation of EcommerceDocument8 pagesUser Segmentation of EcommerceIJRASETPublicationsNo ratings yet

- Machine Learning and Data Analytics for CybersecurityDocument10 pagesMachine Learning and Data Analytics for CybersecurityKabir WestNo ratings yet

- 4 XI November 2016Document6 pages4 XI November 2016Vardhan SinghNo ratings yet

- 5 (T) InsurTech Examining The Role of Technology in Insurance SectorDocument17 pages5 (T) InsurTech Examining The Role of Technology in Insurance SectorKanika MaheshwariNo ratings yet

- WK9 Data MiningDocument7 pagesWK9 Data MiningErvin Phillip FranklinNo ratings yet

- A Study On Customer Profiling of Shriram Life Insurance CustomersDocument6 pagesA Study On Customer Profiling of Shriram Life Insurance Customersprashant.sharma2467No ratings yet

- Claims Fraud Predictive ModelDocument14 pagesClaims Fraud Predictive ModelChirisa VanleeNo ratings yet

- Mining Techniques in Health Care: A Survey of ImmunizationDocument6 pagesMining Techniques in Health Care: A Survey of ImmunizationseventhsensegroupNo ratings yet

- Case Study 3Document2 pagesCase Study 3Tushar NepaleNo ratings yet

- Big DataDocument6 pagesBig Dataalexandre lessagahNo ratings yet

- How Machine Learning Can Be Used To Improve Predictive AnalyticsDocument7 pagesHow Machine Learning Can Be Used To Improve Predictive AnalyticsIJRASETPublicationsNo ratings yet

- Data Mining Techniques in Finance Industry ReviewDocument17 pagesData Mining Techniques in Finance Industry ReviewFunnyVideo1 TubeNo ratings yet

- JPNR 2022 S03 053Document5 pagesJPNR 2022 S03 053asma.saadiNo ratings yet

- How Data Analytics Is Transforming The Finance IndustryDocument17 pagesHow Data Analytics Is Transforming The Finance IndustrySandaNo ratings yet

- Is Insurance Tech Demand Tied to Production CostsDocument16 pagesIs Insurance Tech Demand Tied to Production CostsMarkNo ratings yet

- A Data Mining Approach To Predict Prospective Business Sectors For Lending in Retail Banking Using Decision TreeDocument10 pagesA Data Mining Approach To Predict Prospective Business Sectors For Lending in Retail Banking Using Decision TreeLewis TorresNo ratings yet

- An Analytical Approach For Customer Retention Through Business IntelligenceDocument11 pagesAn Analytical Approach For Customer Retention Through Business Intelligenceshreeram iyengarNo ratings yet

- Insurance BI Case Study: Current Apps & Future TrendsDocument2 pagesInsurance BI Case Study: Current Apps & Future TrendsprinceNo ratings yet

- 2017 CustomerChurnDocument6 pages2017 CustomerChurnNitya BalakrishnanNo ratings yet

- Thesis Insurance CompanyDocument6 pagesThesis Insurance Companypuzinasymyf3100% (1)

- Why this worksDocument13 pagesWhy this worksMonnu montoNo ratings yet

- Artikel - 2019 - 3 - Insurtech - Micro-Trends - To - WatchDocument4 pagesArtikel - 2019 - 3 - Insurtech - Micro-Trends - To - WatchMario Vittoria FilhoNo ratings yet

- Amira Hassan, Computational Intelligence Models For Insurance Fraud Detection - A Review of A Decade of ResearchDocument7 pagesAmira Hassan, Computational Intelligence Models For Insurance Fraud Detection - A Review of A Decade of ResearchNuno GarciaNo ratings yet

- Case Critique 7 PDFDocument4 pagesCase Critique 7 PDFKarl LumandoNo ratings yet

- Role of Data Mining Technique A Boon To SocietyDocument6 pagesRole of Data Mining Technique A Boon To SocietyIJRASETPublicationsNo ratings yet

- Mark Henry DAta MiningDocument3 pagesMark Henry DAta MiningJoshua FetalverNo ratings yet

- How Could The Application of Big Data Impact Enterprise Performance?Document15 pagesHow Could The Application of Big Data Impact Enterprise Performance?DEBARGHA KARKUNNo ratings yet

- Analysis of Vehicle Insurance Data To deDocument8 pagesAnalysis of Vehicle Insurance Data To deericgyan319No ratings yet

- Asea DaniDocument11 pagesAsea Daniqualityassurance.masstechNo ratings yet

- A Hybrid Neuro-Fuzzy Network For Underwriting of Life InsuranceDocument6 pagesA Hybrid Neuro-Fuzzy Network For Underwriting of Life Insurancegovardhan50No ratings yet

- Review On Latest Trends and Techniques in Predictive AnalyticsDocument6 pagesReview On Latest Trends and Techniques in Predictive AnalyticsIJRASETPublicationsNo ratings yet

- Claims Classification of Insurance PoliciesDocument3 pagesClaims Classification of Insurance PoliciesHema Latha Krishna NairNo ratings yet

- Introduction to Data Mining Techniques and ApplicationsDocument14 pagesIntroduction to Data Mining Techniques and ApplicationsuttamraoNo ratings yet

- Digital fluency NotesDocument10 pagesDigital fluency Notesanushatanga7No ratings yet

- Insurance Innovation Report 2016Document21 pagesInsurance Innovation Report 2016Rishita GuptaNo ratings yet

- Role of Data and Information Within The FinancialDocument12 pagesRole of Data and Information Within The Financialcollins makokhaNo ratings yet

- Accepted Manuscript: Computers & SecurityDocument39 pagesAccepted Manuscript: Computers & SecurityBehnamNo ratings yet

- Data-Driven Business Strategies: Understanding and Harnessing the Power of Big DataFrom EverandData-Driven Business Strategies: Understanding and Harnessing the Power of Big DataNo ratings yet

- Recent Advances in Risk Analysis and Management (RAM)Document5 pagesRecent Advances in Risk Analysis and Management (RAM)Ijact EditorNo ratings yet

- Compusoft, 1 (1), 8-12Document5 pagesCompusoft, 1 (1), 8-12Ijact EditorNo ratings yet

- Implementation of Digital Watermarking Using MATLAB SoftwareDocument7 pagesImplementation of Digital Watermarking Using MATLAB SoftwareIjact EditorNo ratings yet

- Adaptive Firefly Optimization On Reducing High Dimensional Weighted Word Affinity GraphDocument5 pagesAdaptive Firefly Optimization On Reducing High Dimensional Weighted Word Affinity GraphIjact EditorNo ratings yet

- Information Technology in Human Resource Management: A Practical EvaluationDocument6 pagesInformation Technology in Human Resource Management: A Practical EvaluationIjact EditorNo ratings yet

- Compusoft, 2 (5), 114-120 PDFDocument7 pagesCompusoft, 2 (5), 114-120 PDFIjact EditorNo ratings yet

- Compusoft, 2 (5), 127-129 PDFDocument3 pagesCompusoft, 2 (5), 127-129 PDFIjact EditorNo ratings yet

- Compusoft, 2 (5), 121-126 PDFDocument6 pagesCompusoft, 2 (5), 121-126 PDFIjact EditorNo ratings yet

- A New Cryptographic Scheme With Modified Diffusion For Digital ImagesDocument6 pagesA New Cryptographic Scheme With Modified Diffusion For Digital ImagesIjact EditorNo ratings yet

- Graphical Password Authentication Scheme Using CloudDocument3 pagesGraphical Password Authentication Scheme Using CloudIjact EditorNo ratings yet

- Measurement, Analysis and Data Collection in The Programming LabVIEWDocument5 pagesMeasurement, Analysis and Data Collection in The Programming LabVIEWIjact EditorNo ratings yet

- Compusoft, 2 (5), 108-113 PDFDocument6 pagesCompusoft, 2 (5), 108-113 PDFIjact EditorNo ratings yet

- Role of Information Technology in Supply Chain ManagementDocument3 pagesRole of Information Technology in Supply Chain ManagementIjact EditorNo ratings yet

- Attacks Analysis and Countermeasures in Routing Protocols of Mobile Ad Hoc NetworksDocument6 pagesAttacks Analysis and Countermeasures in Routing Protocols of Mobile Ad Hoc NetworksIjact EditorNo ratings yet

- Audit Planning For Investigating Cyber CrimesDocument4 pagesAudit Planning For Investigating Cyber CrimesIjact EditorNo ratings yet

- Compusoft, 3 (12), 1374-1376 PDFDocument3 pagesCompusoft, 3 (12), 1374-1376 PDFIjact EditorNo ratings yet

- Impact of E-Governance and Its Challenges in Context To IndiaDocument4 pagesImpact of E-Governance and Its Challenges in Context To IndiaIjact Editor100% (1)

- Compusoft, 3 (12), 1364-1368 PDFDocument5 pagesCompusoft, 3 (12), 1364-1368 PDFIjact EditorNo ratings yet

- Compusoft, 3 (12), 1369-1373 PDFDocument5 pagesCompusoft, 3 (12), 1369-1373 PDFIjact EditorNo ratings yet

- Compusoft, 3 (12), 1386-1396 PDFDocument11 pagesCompusoft, 3 (12), 1386-1396 PDFIjact EditorNo ratings yet

- Archiving Data From The Operating System AndroidDocument5 pagesArchiving Data From The Operating System AndroidIjact EditorNo ratings yet

- Compusoft, 3 (12), 1377-1385 PDFDocument9 pagesCompusoft, 3 (12), 1377-1385 PDFIjact EditorNo ratings yet

- Compusoft, 3 (12), 1360-1363 PDFDocument4 pagesCompusoft, 3 (12), 1360-1363 PDFIjact EditorNo ratings yet

- Compusoft, 3 (12), 1350-1353 PDFDocument4 pagesCompusoft, 3 (12), 1350-1353 PDFIjact EditorNo ratings yet

- Compusoft, 3 (12), 1354-1359 PDFDocument6 pagesCompusoft, 3 (12), 1354-1359 PDFIjact EditorNo ratings yet

- Compusoft, 3 (11), 1343-1349 PDFDocument8 pagesCompusoft, 3 (11), 1343-1349 PDFIjact EditorNo ratings yet

- Compusoft, 3 (11), 1327-1336 PDFDocument10 pagesCompusoft, 3 (11), 1327-1336 PDFIjact EditorNo ratings yet

- Compusoft, 3 (11), 1337-1342 PDFDocument6 pagesCompusoft, 3 (11), 1337-1342 PDFIjact EditorNo ratings yet

- Compusoft, 3 (11), 1317-1326 PDFDocument10 pagesCompusoft, 3 (11), 1317-1326 PDFIjact EditorNo ratings yet

- Configuration Management and ConnectorsDocument51 pagesConfiguration Management and ConnectorsJORGE ENRIQUE CRUZ BASABENo ratings yet

- Basic Prediction Techniques in Modern Video Coding Standards PDFDocument90 pagesBasic Prediction Techniques in Modern Video Coding Standards PDFAndrijaNo ratings yet

- Ge - SR 489Document8 pagesGe - SR 489Geovanny Andres Cabezas SandovalNo ratings yet

- Effective Use of Instagram For BusinessDocument10 pagesEffective Use of Instagram For BusinessDemand MetricNo ratings yet

- DQx8-24V 6ES75221BF000AB0 - Datasheet - enDocument3 pagesDQx8-24V 6ES75221BF000AB0 - Datasheet - enCarlosNo ratings yet

- Air Bubble DetectionDocument7 pagesAir Bubble DetectionAditya Shinde100% (1)

- AIS Chapter 4 Revenue CycleDocument6 pagesAIS Chapter 4 Revenue CycleKate Alvarez100% (1)

- AccessGateway AG v630Document82 pagesAccessGateway AG v630sunny shahNo ratings yet

- Cyber Security Analyst ResumeDocument5 pagesCyber Security Analyst Resumeafiwgbuua100% (2)

- The Life of PiDocument30 pagesThe Life of PiΧΡΗΣΤΟΣ ΠΑΝΤΣΙΔΗΣ100% (1)

- Acer Ferrari 3200 3400 1 Quanta ZI5 - Rev1ADocument32 pagesAcer Ferrari 3200 3400 1 Quanta ZI5 - Rev1AdanielNo ratings yet

- nAS 400 PDFDocument4 pagesnAS 400 PDFMatt TravisNo ratings yet

- Christmas Light Extravaganza Contest RulesDocument3 pagesChristmas Light Extravaganza Contest RulesExcelsiorApparelNo ratings yet

- Cable Protection Systems LatviaDocument30 pagesCable Protection Systems LatviaÖmer Faruk GÜLNo ratings yet

- Hands-On With GEL Scripting, Xog and The Rest ApiDocument166 pagesHands-On With GEL Scripting, Xog and The Rest ApiVicente RJNo ratings yet

- DS52 N FA410Document2 pagesDS52 N FA410Kelvin NgNo ratings yet

- COMP 211 Introduction To Software EngineeringDocument18 pagesCOMP 211 Introduction To Software EngineeringsirmadamstudentNo ratings yet

- Humalyzer Primus: Semi-Automatic Microprocessor Controlled PhotometerDocument2 pagesHumalyzer Primus: Semi-Automatic Microprocessor Controlled PhotometerHussein N. Farhat100% (1)

- Section 7 Quiz Exception HandlingDocument6 pagesSection 7 Quiz Exception Handlingsyahndra100% (1)

- DC SwitchgearDocument10 pagesDC SwitchgearpjchauhanNo ratings yet

- ESL Independent Study Lab - ReadingDocument5 pagesESL Independent Study Lab - ReadingHo TenNo ratings yet

- Propositional logic rules and operationsDocument157 pagesPropositional logic rules and operationsAbu HurairaNo ratings yet

- User Guide GC 075 XXX FI Verze 1.00 EN - 2Document20 pagesUser Guide GC 075 XXX FI Verze 1.00 EN - 2michaelmangaa0% (1)

- 4-QUESTION PAPER MAT1014 - DMGT - Model QPsDocument7 pages4-QUESTION PAPER MAT1014 - DMGT - Model QPsVenkat Venkat100% (1)

- QP 5Document129 pagesQP 5Kaushal Suresh SanabaNo ratings yet

- Outsourced ProcessDocument3 pagesOutsourced ProcessJohn RajeshNo ratings yet

- Implementing HRD Programs: Learning & Development 2011 1Document39 pagesImplementing HRD Programs: Learning & Development 2011 1PreciousGirlDdNo ratings yet

- The Bootcampers Guide To Web AccessibilityDocument137 pagesThe Bootcampers Guide To Web AccessibilityNguyen Duy HaiNo ratings yet

- Os Lab Manual PDFDocument81 pagesOs Lab Manual PDFSRIHITHA YELISETTINo ratings yet