Professional Documents

Culture Documents

Who Determines The Rupee Value! - Business Recorder

Uploaded by

MoinOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Who Determines The Rupee Value! - Business Recorder

Uploaded by

MoinCopyright:

Available Formats

11/16/2015

Who determines the rupee value! | Business Recorder

Who determines the rupee value!

November 16, 2015

ANJUM IBRAHIM

0 Comments

This week's article focuses on structural and deliberate policy impediments to allow the

rupee value to be set by market conditions; next week's article would focus on the

November 2015 rupee decline and factors responsible for it.

The responsibility for ensuring a balanced exchange rate rests with the government as

well as the central bank. However, the instruments to ensure the balance are available

with the central bank though the political government does, even in some countries

where the central bank is independent, indicate what rate it perceives to constitute the balance.

An independent central bank has a number of instruments to deal with exchange rate imbalance which include (i) open market

operations for example through sale of dollars to strengthen a weakening currency with the objective of making exports

competitive - the assumption being that the central bank can out-purchase the private sector including speculators; (ii) note

printing which ideally must be at tandem with the growth of productivity and not as a means to fund the government's current

expenditure, (iii) manipulating interest rates to encourage or dampen borrowing with implications on inflation, (iv) setting

reserve requirements or how much each financial institution must hold in reserve which impacts on money supply; and (v)

disallow the government to use the central bank as a lender of first resort instead of last resort - a policy that would impact on

the exchange rate.

Four factors can negatively impact on the independence of a central bank to undertake its responsibilities efficiently and

effectively. First, legal independence of the central bank; in this context it is evident that the PML-N government has proceeded

with the necessary legislation to grant legal independence to the State Bank of Pakistan (SBP) in response to the International

Monetary Fund (IMF) condition under the 6.64 billion dollar Extended Fund Facility (EFF). However, no one is convinced that this

would be implemented in spirit. The penchant to retain control by the Finance Minister is however not unique to Ishaq Dar.

Lorenzo Bini Smaghi, member of the executive board of the European Central Bank, in his speech delivered at the conference

`Good Governance and Effective Partnership' in the Hungarian National Assembly on 19 April 2007 stated that "safeguarding

central bank independence takes more than a series of legal provisions, as the experience of the past eight years has shown.

It requires, above all, a wide degree of acceptance of the principle of independence within the underlying political and economic

culture of the society. This requires a leading role by governments and politicians.... in understanding and explaining the

fundamental reasons behind the choice to delegate powers to an independent monetary authority for the welfare of present and

future generations. Central bank independence, like any other law, needs to be continuously protected and implemented over

time. This is the responsibility of the political institutions". Pakistani politicians remain unconcerned with SBP independence

partly because the PML-N government has at present the strength in parliament to push any finance bill through and partly

because their focus and expertise remains on matters political as opposed to economic.

Secondly, goal independence is required where the central bank has the right to set its own policy goals, be it to set inflation

targets, control money supply, or allow the market to set the real effective exchange rate. However, here too there is

considerable interference from the Dar-led Finance Ministry evident from his announcements of key SBP decisions, including a

change in the discount rate, prior to the official announcements by the SBP.

Thirdly, operational independence and here the SBP does have considerable independence. However, the Dar-led Finance

Ministry initially did compel the SBP to become the lender of first as opposed to last resort though in recent months this practice

has been abandoned due to IMF pressure under the EFF.

http://www.brecorder.com/top-stories/0/1247004/?tmpl=component&print=1&layout=default&page=

1/2

11/16/2015

Who determines the rupee value! | Business Recorder

And, finally, management independence; research indicates that "if a government is in the habit of appointing and replacing the

governor frequently, it clearly has the capacity to micro-manage the central bank through its choice of governors". It is relevant to

note the appointment of three governors during the five- year tenure of the PPP-led coalition government; and the resignation of

Yaseen Anwar before the end of his three-year constitutional term (he was in the job for 2 years and 104 days) considered to be

an outcome of what his supporters claim was hounding by Dar and the appointment of a pliant replacement on 29 April 2014.

A very few, in Dar's defence, may try to lay the blame on Prime Minister Nawaz Sharif given that he has emerged as a firm

proponent of a strong rupee as an indication of the strength of the economy but they would not find a receptive audience as the

primary responsibility of the finance ministry is to properly advise and guide the prime minister on matters that he may not be

proficient in. There is however overwhelming evidence since Ishaq Dar took over the finance portfolio that he places

considerable emphasis on a strong rupee as a means to understate the heavy reliance on external borrowing that has been

the hallmark of the Ministry since he took over the finance portfolio.

Dar made a disturbing admission in the Senate on Friday while urging the opposition not to mislead the public on account of

external loans by contending that total external debt would be 65 and not 68 billion dollars as contended by Senator Sherry

Rehman in an adjournment motion. Four observations are in order: (i) the Economic Survey 2014-15 notes that total external

debt and liabilities stock was 62.6 billion dollars end March 2015 which implies that total external debt incurred in just seven

months (between 1 April and at present) is a whopping 2.4 billion dollars; (ii) according to budget documents for 2015-16,

external debt was estimated at 662 billion rupees for last year which at the exchange rate of a little over 98 rupees to the dollar

(an exchange rate not applicable during Dar's tenure) gives a total of 65 billion dollars external debt; (iii) in the current year Dar

has budgeted 728 billion rupees external debt (minus 23.9 billion dollar grants) which at the current rate of exchange of 105

rupees to the dollar would imply total indebtedness of nearly 69 billion dollars by the end of the year; and (iv) all external debt is

not at concessional rate and includes very high interest bearing issuance of two billion dollars of Eurobonds in 2013-14,

another half a billion dollars issued last year and one billion dollars budgeted for the current year as inexplicably "other aid".

To conclude, the rate of exchange would determine the county's external indebtedness and next week's article would highlight

the reasons for the recent rupee depreciation.

Copyright Business Recorder, 2015

Share

Like

Tw eet

http://www.brecorder.com/top-stories/0/1247004/?tmpl=component&print=1&layout=default&page=

2/2

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Traders World Magazine - Issue #51 - "NakedSwan Trading" by EfremHoffmanDocument12 pagesTraders World Magazine - Issue #51 - "NakedSwan Trading" by EfremHoffmanNaked Swan Trading ( Efrem Hoffman )25% (4)

- Taxation Reviewer - SAN BEDADocument128 pagesTaxation Reviewer - SAN BEDAMark Lawrence Guzman93% (28)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Maruti WagonR Owners Manual - Petrol PDFDocument108 pagesMaruti WagonR Owners Manual - Petrol PDFAjinkyaSalgaonkarNo ratings yet

- TSPIC v. Employees Union rules on salary increase creditingDocument8 pagesTSPIC v. Employees Union rules on salary increase creditingJohn Lloyd MacuñatNo ratings yet

- Auto Finance Industry AnalysisDocument15 pagesAuto Finance Industry AnalysisMitul SuranaNo ratings yet

- Open Banking: How To Design For Financial Inclusion: Ariadne Plaitakis and Stefan StaschenDocument46 pagesOpen Banking: How To Design For Financial Inclusion: Ariadne Plaitakis and Stefan StaschenOmar Bairan100% (1)

- UntitledDocument986 pagesUntitledJindalNo ratings yet

- Vaccines With Diluents How To Use ThemDocument1 pageVaccines With Diluents How To Use ThemMoinNo ratings yet

- Otter ModeDocument1 pageOtter ModeMoinNo ratings yet

- List of National HighwaysDocument2 pagesList of National HighwaysMoinNo ratings yet

- Owners EquityDocument8 pagesOwners Equityumer sheikhNo ratings yet

- HDFC Life Guaranteed Wealth Plus BrochureDocument23 pagesHDFC Life Guaranteed Wealth Plus BrochureMichael GloverNo ratings yet

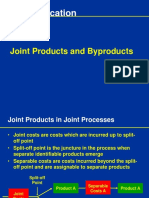

- Costing By-Product and Joint ProductsDocument36 pagesCosting By-Product and Joint ProductseltantiNo ratings yet

- Business Environment AnalysisDocument9 pagesBusiness Environment AnalysisHtoo Wai Lin AungNo ratings yet

- Exercise 2 - CVP Analysis Part 1Document5 pagesExercise 2 - CVP Analysis Part 1Vincent PanisalesNo ratings yet

- HDFC Standard Life Insurance Company-Recruitment and SelectionDocument74 pagesHDFC Standard Life Insurance Company-Recruitment and Selectionindia2000050% (2)

- King Abdul Aziz University: IE 255 Engineering EconomyDocument11 pagesKing Abdul Aziz University: IE 255 Engineering EconomyJomana JomanaNo ratings yet

- NusukDocument2 pagesNusukJib RanNo ratings yet

- Test Bank For Contemporary Labor Economics 9th Edition Campbell Mcconnell Full DownloadDocument9 pagesTest Bank For Contemporary Labor Economics 9th Edition Campbell Mcconnell Full Downloadkarenparrishsioqzcfndw100% (32)

- Forex Extra QuestionsDocument9 pagesForex Extra QuestionsJuhi vohraNo ratings yet

- Cash Receipt Cycle: Step Business Activity Embedded Control Forms Risk InformationDocument10 pagesCash Receipt Cycle: Step Business Activity Embedded Control Forms Risk InformationJudy Ann EstradaNo ratings yet

- Joint Cost Allocation Methods for Multiple ProductsDocument17 pagesJoint Cost Allocation Methods for Multiple ProductsATLASNo ratings yet

- A Transaction Cost DOuglas NorthDocument9 pagesA Transaction Cost DOuglas NorthSala AlfredNo ratings yet

- PPCFDocument4 pagesPPCFAbdulkerim kedirNo ratings yet

- Banking License ApplicationDocument22 pagesBanking License ApplicationFrancNo ratings yet

- Pacific Oxygen Vs Central BankDocument3 pagesPacific Oxygen Vs Central BankAmmie AsturiasNo ratings yet

- Role of Public Financial Management in Risk Management For Developing Country GovernmentsDocument31 pagesRole of Public Financial Management in Risk Management For Developing Country GovernmentsFreeBalanceGRPNo ratings yet

- New England Compounding Center (NECC) Case Study.Document7 pagesNew England Compounding Center (NECC) Case Study.onesmusnzomo20No ratings yet

- Indian Economy 1950-1990 - Question BankDocument5 pagesIndian Economy 1950-1990 - Question BankHari prakarsh NimiNo ratings yet

- Etr Template ExampleDocument56 pagesEtr Template ExampleNur Fadhlin SakinaNo ratings yet

- Portfoli o Management: A Project OnDocument48 pagesPortfoli o Management: A Project OnChinmoy DasNo ratings yet

- AutoDocument11 pagesAutorocky700inrNo ratings yet

- Motivation Letter MoibDocument2 pagesMotivation Letter MoibMeheret AshenafiNo ratings yet

- Dataformatics IAPO - 81-76366 - 20191122 - 131616Document2 pagesDataformatics IAPO - 81-76366 - 20191122 - 131616Aseem TamboliNo ratings yet