Professional Documents

Culture Documents

Apply for a Personal Loan in 4 Easy Steps

Uploaded by

Ronald TemajoOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Apply for a Personal Loan in 4 Easy Steps

Uploaded by

Ronald TemajoCopyright:

Available Formats

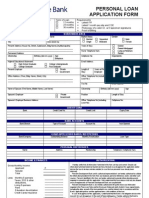

Apply for your

Security Bank Personal Loan

in 4 simple steps:

View our checklist to see what documents you

need to apply.

Print and fill out the application form on the

following page - dont forget to sign it!

Take a picture (you can use your phone) or

scan your application form, proof of

identification, and a proof of income.

Email the scan or picture of your application

form, and required documents to

plonlineapp@securitybank.com.ph

Prefer to apply in person? You can also

bring your completed application to any

Security Bank branch - search for the branch

nearest you at www.securitybank.com/map

Sourcing Data:

PERSONAL REFERENCES

SPOUSE INFORMATION

Channel Source:

Source Code: _____________________________________________

Referror / Account Officer / DSA: ______________________________________________________________

APPLICATIONS WITH INCOMPLETE DOCUMENTS AND INFORMATION WILL NOT BE PROCESSED.

Mr.

Spouse:

Name:

First

Mrs.

Date of Birth (mm/dd/yyyy):

PERSONAL LOAN DETAILS

With previous or existing Security Bank Personal Loan?

Desired Loan Amount

Yes

12

Loan Purpose:

Appliance

18

Tuition Fees

24

36

Relationship

Telephone No.

2.

Educational Attainment:

High School

Vocational

College

Others: __________________

Business / Employer:

Payment term (Months)

Address

Last

Post Graduate

No

PHP

Name

1.

Middle

Position:

CREDIT CARD DETAILS

Business / Employer Address (Floor, Street, Brgy./Village, Subdivision, City/Municipality, Province):

Zip Code:

Credit Card

1.

Credit Limit

Card No.

Expiry Date

Personal Consumption

Others: ____________________________

2.

Mode of Loan Release:

Via Manager s Check

Credit to my Security Bank Account:

Office Phone No.:

Branch: _____________________________

Number of Dependents:

Children:

Account Type: ____________________________

Others:

(Relationship:________________)

MY WORK AND FINANCES

Acct. No.

Employment Type:

Position:

PERSONAL INFORMATION

Title:

Name:

First

Mr.

Mrs.

Rank and File

Government

Private

Junior Officer

Ms.

Gender:

Middle

Bank / Company

1.

Self-Employed

Supervisor

Assistant Manager / Senior Assistant Manager

Manager / Senior Manager

Permanent:

Y

N

Assistant Vice President / Senior Assistant Vice President

Last

Civil Status:

Educational Attainment:

Car Ownership:

Home Ownership:

Single

Legally Separated

Married

Annulled

Date of Birth (mm/dd/yyyy):

Citizenship:

High School

Vocational

Others: __________________

College

Personal, monthly amortization (PHP ____________)

Company Provided

Both

None

Owned

Living with relatives

Rented, PHP______________/mo.

Mortgage

Length of Stay: __________ years

Company-Owned

Present Home Address (No., Street, Brgy./Village, Subdivision, City/Municipality, Province)*:

Date of Hire:

Length of Service:

TIN:

SSS/GSIS/UNIFIED ID Number:

Business / Employer:

Business / Employer Address (Floor, Street, Brgy./Village, Subdivision, City/Municipality, Province):

Fax No.:

Best Time / Day to Call:

Mobile Phone No.:

Zip Code:

Zip Code:

Office Phone No.:

Home Phone No.:

Gross Monthly Income:

Telephone No.:

E-mail Address:

Immediate Supervisor / HR Contact Person:

Permanent Home Address (No., Street, Brgy./Village, Subdivision, City/Municipality, Province)*:

Type of Loan

Monthly Payment

2.

UNDERTAKING

Nature of Business:

Widow/Widower

Place of Birth:

Post Graduate

Outstanding Balance

Vice President / First Vice President / Senior Vice President / Executive Vice President

President / Chief Executive Officer / Director / Chairman

Mother s Maiden Name

OTHER LOAN ACCOUNTS

Zip Code:

I hereby certify that all information herein are true and correct based on my own knowledge and further authorize

the Bank to obtain information as it may require concerning my loan application and agree that it shall remain the

Banks property whether my loan is approved or not. Any information given by me or other persons I authorized

which is not true or accurate, will automatically cause the Bank to reject my loan or cancel its approval.

I hereby willingly, voluntarily, and with full knowledge of my right under the law, waive the right to confidentiality

of information and authorize the Bank to disclose, divulge and reveal any such information relating to the account of

the Borrower/Mortgagor, including events of default, for the purpose of, among others, client evaluation, credit

reporting or verification and recovery of the obligation due and payable to the Bank under the terms and conditions

of this agreement.

In view of the foregoing, the Bank may disclose, divulge and reveal the aforementioned information to third

parties, including but not limited to my employer, the Banks affiliates, subsidiaries, agents or services providers, the

Bankers Association of the Philippines Credit Bureau (BAP CB) or to any similar central monitoring entity or

recipients as provided for by law and required by competent authority.

I further authorize the Bank, as my Attorney-in-Fact, to conduct random verification with the Bureau of Internal

Revenue (the "BIR") in order to establish the authenticity of my Tax Statements (the "ITR) and the accompanying

financial statements/documents submitted to the Bank in accordance with banking regulatory requirements.

I hold the Bank free and harmless from any and all liabilities, claims and demands of whatever kind or nature in

connection with or arising from the aforementioned disclosure or reporting.

I hereby acknowledge that the Personal Loan or any part(s) thereof shall be deemed to have been availed on

the date when the funds are transferred to my bank account maintained with the Bank, or upon receipt of the

Managers Check, reflecting the amount of the loan less the applicable fees, charges and taxes.

I further authorize the Bank to deduct from my Loan proceeds all fees including, but not limited to, processing

fees, documentary stamp tax, notarial fees and interest accruals should the first due date be over 30 days from the

release of my loan and other related charges.

I likewise authorize the Bank to provide me with a consumer loan or additional bank product/s (such as but not

limited to auto, housing, credit card and other products suited to my situation) at the Banks sole discretion. My

acceptance of the credit card or the proceeds of any loan released pursuant thereto shall be conclusive proof of my

acknowledgement of my additional obligations and/or indebtedness to the Bank under the Terms and Conditions set

forth by the Bank and prevailing at the time the credit card is issued or the additional loan is approved.

I hereby agree that the Bank has the right to approve a lower amount than my desired loan amount as indicated

in this application and shall render the Bank free and harmless from any liability arising thereof.

I hereby agree that should my application be denied, the Bank has no obligation to furnish the reason for such

rejection or to return my application and other submitted documents.

I also legally bind myself to the Terms and Conditions of the Loan Program Promissory Note, Disclosure

Statement and other relevant documents that I shall execute in favor of the Bank.

Name of Previous Employer:

Previous Home Address (No., Street, Brgy./Village, Subdivision, City/Municipality, Province)*:

Borrower's Signature Above Printed Name

Zip Code:

FOR BANKS USE ONLY

Length of Service:

Preferred Billing / Mailing Address:

Home

Business / Employer

Total Years at Work / in Business:

Date

You might also like

- Personal Loan Application FormDocument1 pagePersonal Loan Application FormMikky Garcia Dela CruzNo ratings yet

- Spouse information for personal loan applicationDocument2 pagesSpouse information for personal loan applicationDemp Almiranez75% (4)

- Security Bank Sample Loan App FormDocument1 pageSecurity Bank Sample Loan App FormJennifer DeleonNo ratings yet

- Sterling Bank Sample Loan App FormDocument2 pagesSterling Bank Sample Loan App FormJennifer DeleonNo ratings yet

- HSBC Add-On Credit Card Application: Primary Credit Cardholder DetailsDocument2 pagesHSBC Add-On Credit Card Application: Primary Credit Cardholder DetailsPrabudh BansalNo ratings yet

- Hong Leong Bank Wise Credit Card Application (Malaysia) 2014Document5 pagesHong Leong Bank Wise Credit Card Application (Malaysia) 2014kamarulxNo ratings yet

- China Bank Credit Card Application FormDocument2 pagesChina Bank Credit Card Application FormLan TracinNo ratings yet

- Credit Card Application: Please State Your Relative's Name and Relation If YESDocument2 pagesCredit Card Application: Please State Your Relative's Name and Relation If YESMha AnnNo ratings yet

- Personal Loan FormDocument3 pagesPersonal Loan FormWilsfun100% (2)

- Info Update Form Aug2016Document3 pagesInfo Update Form Aug2016Kate PotinganNo ratings yet

- SuperCard Online ConsentDocument3 pagesSuperCard Online ConsentVinoth KumarNo ratings yet

- Hyderabad Hemanth Kumar Myla 9493767162 ApplicationDocument2 pagesHyderabad Hemanth Kumar Myla 9493767162 ApplicationHemanth KumarNo ratings yet

- Formulario de Banco BankasiDocument11 pagesFormulario de Banco BankasiRodilHuanca100% (1)

- SLF002 CalamityLoanApplication V05-2Document2 pagesSLF002 CalamityLoanApplication V05-2LouiseNo ratings yet

- E Doc 51043016122200031Document8 pagesE Doc 51043016122200031Danao ErickNo ratings yet

- DBS Varying Terms of MortgageDocument1 pageDBS Varying Terms of Mortgagericky_sporeNo ratings yet

- Cardmember DeclarationDocument2 pagesCardmember Declarationsharrath mNo ratings yet

- HBL PersonalLoan - Terms and ConditionsDocument2 pagesHBL PersonalLoan - Terms and ConditionsHisham KhalidNo ratings yet

- Pag-IBIG Fund Multi Purpose Loan Application SLF001 V03Document2 pagesPag-IBIG Fund Multi Purpose Loan Application SLF001 V03Jazz Adaza67% (3)

- Credit Card Member Declaration PDFDocument2 pagesCredit Card Member Declaration PDFTiwari AnuragNo ratings yet

- Loan Validation and Audit RequestDocument6 pagesLoan Validation and Audit RequestDshane101100% (2)

- State Bank Guide to Opening AccountsDocument8 pagesState Bank Guide to Opening Accountsrafi617No ratings yet

- Personal Loan Application FormDocument1 pagePersonal Loan Application FormDomingo RamilNo ratings yet

- Credit Card Application EncryptedDocument10 pagesCredit Card Application EncryptedUtkarsh TripathiNo ratings yet

- Calamity HMDFDocument3 pagesCalamity HMDFchennieNo ratings yet

- Customer Declaration FormDocument1 pageCustomer Declaration FormMayank mangukiyaNo ratings yet

- RESPA Qualified Written Request (QWR), Complaint, Dispute and Validation of Debt, TILA RequestDocument19 pagesRESPA Qualified Written Request (QWR), Complaint, Dispute and Validation of Debt, TILA RequestCasey Serin100% (7)

- Axis Savings Account T&CsDocument2 pagesAxis Savings Account T&Csrohan1234567No ratings yet

- Habib Bank Limited Personal LoanDocument2 pagesHabib Bank Limited Personal LoanKhawar A BalochNo ratings yet

- Savings Accounts TNCDocument8 pagesSavings Accounts TNCShivi ChauhanNo ratings yet

- Credit Card Application EncryptedDocument9 pagesCredit Card Application EncryptedSOUMYA PAULNo ratings yet

- DOA Template LCDocument10 pagesDOA Template LCYash Mit100% (1)

- Calamity Loan Application Form (CLAF, HQP-SLF-066) (Applicable To Imus Branch Members Only)Document2 pagesCalamity Loan Application Form (CLAF, HQP-SLF-066) (Applicable To Imus Branch Members Only)egabad78% (9)

- Opening & Operation of Bank AccountDocument21 pagesOpening & Operation of Bank AccountNazmul H. PalashNo ratings yet

- Sample Qualified Written Request 1Document8 pagesSample Qualified Written Request 1winstons2311No ratings yet

- Application FormDocument8 pagesApplication FormAustine ObasuyiNo ratings yet

- CASH BACK Credit Card Application - EncryptedDocument6 pagesCASH BACK Credit Card Application - EncryptedanshNo ratings yet

- Uob Credit Card FormDocument2 pagesUob Credit Card FormadrianjongNo ratings yet

- Corporate Account Application FormDocument6 pagesCorporate Account Application FormNavin KRNo ratings yet

- General Terms and Conditions 2022Document7 pagesGeneral Terms and Conditions 2022seetameNo ratings yet

- Change Bank Details FormDocument2 pagesChange Bank Details FormMustafa Bapai100% (1)

- Schneider Sent First American A RESPA Qualified Written Request, Complaint, and Dispute of Debt and Validation of Debt LetterDocument9 pagesSchneider Sent First American A RESPA Qualified Written Request, Complaint, and Dispute of Debt and Validation of Debt Letterlarry-612445No ratings yet

- NRI Royale Application Form Front Back Offline 2Document5 pagesNRI Royale Application Form Front Back Offline 2Anantha PadmanabhanNo ratings yet

- Physical Statement Suppression FormDocument2 pagesPhysical Statement Suppression Formramya53919No ratings yet

- CitiBank ApplicationDocument15 pagesCitiBank ApplicationJordan P HunterNo ratings yet

- Fannie Mae Hardship AffidavitDocument2 pagesFannie Mae Hardship AffidavitkwillsonNo ratings yet

- MITC RevisedDocument1 pageMITC RevisedthilakgottipatiNo ratings yet

- 2.application Form PDFDocument4 pages2.application Form PDFfirdyadtNo ratings yet

- E Statement Registration v1 0Document1 pageE Statement Registration v1 0u4rishiNo ratings yet

- Direct Deposit FormDocument2 pagesDirect Deposit FormCamiloNo ratings yet

- Indian Bank Global Credit Card Usage GuideDocument14 pagesIndian Bank Global Credit Card Usage GuideJijithpillaiNo ratings yet

- Bank Appeal LetterDocument2 pagesBank Appeal LetterCorvette Vittorio Vendetto50% (4)

- COB DeclarationDocument2 pagesCOB DeclarationParul KumarNo ratings yet

- Pag-IBIG MPL Application FormDocument2 pagesPag-IBIG MPL Application Formhailglee192580% (5)

- SPL Application Form PDFDocument9 pagesSPL Application Form PDFAdnan MunirNo ratings yet

- AMERICAN EXPRESS CREDIT CARD APPLICATIONDocument8 pagesAMERICAN EXPRESS CREDIT CARD APPLICATIONAkash HimuNo ratings yet

- CCM FormDocument6 pagesCCM FormKs KarthikeyanNo ratings yet

- How to Make Your Credit Card Rights Work for You: Save MoneyFrom EverandHow to Make Your Credit Card Rights Work for You: Save MoneyNo ratings yet

- Cape Unit 1 Biology Past Paper AnswersDocument5 pagesCape Unit 1 Biology Past Paper AnswersDamon HelthNo ratings yet

- Castration Procedure in Farm AnimalsDocument70 pagesCastration Procedure in Farm AnimalsIgor GaloskiNo ratings yet

- QPDocument3 pagesQPgood buddyNo ratings yet

- Routes of Europeanisation and Constraints On EU in UenceDocument22 pagesRoutes of Europeanisation and Constraints On EU in UenceElena IliutaNo ratings yet

- Bhimrao Ramji Ambedkar (: (Bimrawramdi Ambe KƏR) ʑ Ɽ ʱ Anthropologist OratorDocument1 pageBhimrao Ramji Ambedkar (: (Bimrawramdi Ambe KƏR) ʑ Ɽ ʱ Anthropologist OratorDevashish ChakrabartyNo ratings yet

- Evolution of the armed conflict on the Moro frontDocument17 pagesEvolution of the armed conflict on the Moro frontAnonymous WAhU6vhsYNo ratings yet

- Coffee Day BeveragesDocument4 pagesCoffee Day BeveragesankitNo ratings yet

- Role of Artificial Intelligence (AI) in Marketing: August 2021Document14 pagesRole of Artificial Intelligence (AI) in Marketing: August 2021Ankita SinghNo ratings yet

- Court upholds conviction for illegal possession of narra lumberDocument2 pagesCourt upholds conviction for illegal possession of narra lumberJANE MARIE DOROMALNo ratings yet

- Sample Graphic Design Proposal TemplateDocument49 pagesSample Graphic Design Proposal TemplateCj CjNo ratings yet

- A Poetics of Unnatural NarrativeDocument255 pagesA Poetics of Unnatural NarrativeConrad Aquilina100% (5)

- BRM Flex Hone Catalog 2011Document64 pagesBRM Flex Hone Catalog 2011altexsteveNo ratings yet

- The Zen of Nutrition Simplified for Weight LossDocument8 pagesThe Zen of Nutrition Simplified for Weight LossitsovtNo ratings yet

- Bridge Scoping Cost Estimate WorksheetDocument1 pageBridge Scoping Cost Estimate WorksheetPhil MarceloNo ratings yet

- Cotizacion de Productos: 1.-Impresora HP Laserjet Pro P1102W WifiDocument5 pagesCotizacion de Productos: 1.-Impresora HP Laserjet Pro P1102W WifidiegoNo ratings yet

- Post: Assistant Director (General) : Bangladesh BankDocument1 pagePost: Assistant Director (General) : Bangladesh BankEqbal HossanNo ratings yet

- Ibm Business Analytics Case Study 1 22 13 PDFDocument10 pagesIbm Business Analytics Case Study 1 22 13 PDFjheikkunNo ratings yet

- Flowsheet WWT IKPPDocument5 pagesFlowsheet WWT IKPPDiffa achmadNo ratings yet

- Icici PrudentialDocument141 pagesIcici PrudentialBura NareshNo ratings yet

- Full Download Ebook PDF Perrines Literature Structure Sound and Sense 13th Edition PDFDocument29 pagesFull Download Ebook PDF Perrines Literature Structure Sound and Sense 13th Edition PDFjames.sepulveda805100% (27)

- Virtualization Software and Linux Installation GuideDocument82 pagesVirtualization Software and Linux Installation GuideshanvijayrNo ratings yet

- Ar. Bernard TschumiDocument50 pagesAr. Bernard TschumiLabeedAbdulrehmanNo ratings yet

- Essential Elements of a Valid ContractDocument3 pagesEssential Elements of a Valid ContractPrithvi NathNo ratings yet

- TurunanDocument39 pagesTurunansadfjdsaNo ratings yet

- Possessive Pronoun FlashcardDocument1 pagePossessive Pronoun FlashcardCelynn ClaireNo ratings yet

- Opinion Essay - Unit 7 - Group 11Document3 pagesOpinion Essay - Unit 7 - Group 11NGUYEN THI THANH THAONo ratings yet

- TN Haj Committee - List of Qurrah Provisional CoversDocument25 pagesTN Haj Committee - List of Qurrah Provisional CoverskayalonthewebNo ratings yet

- PIM2 - 21 Connection Data: XDM-100 Installation and Maintenance Manual Connector Pin AssignmentsDocument4 pagesPIM2 - 21 Connection Data: XDM-100 Installation and Maintenance Manual Connector Pin AssignmentsArfan TulifNo ratings yet

- Youth Entrepreneurship ProgramDocument6 pagesYouth Entrepreneurship ProgramAdrimar AquinoNo ratings yet

- Aw Educational ResumeDocument1 pageAw Educational Resumeapi-628146149No ratings yet