Professional Documents

Culture Documents

Client Questionnaire (For A Shareholders Agreement)

Uploaded by

Azmul HaqueOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Client Questionnaire (For A Shareholders Agreement)

Uploaded by

Azmul HaqueCopyright:

Available Formats

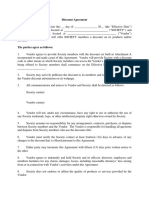

QUESTIONNAIRE FOR [FOUNDERS] SHAREHOLDERS AGREEMENT

[OR INCORPORATED JOINT VENTURE]

IDENTITY OF THE INVESTORS

Please provide names, residential addresses and Passport numbers

of all individual founders and shareholders for purposes of

identification.

CAPITAL AND FUNDING1

How many initial shares will be issued? Will they be fully or partly

paid?

What will be the proportions of equity to be held by each of the

shareholders and the amount of initial investment by each party?

Will there be different classes of shares established to reflect

different interests or contributions of the shareholders?

Will there be any obligations on shareholders to make additional

finance available to the Company? Will there be any limit to that

obligation?

Will new shares be offered to shareholders in proportion to existing

shareholdings (any pre-emption rights)?

Will any default or dilution provisions apply if financial commitments

are not met by the shareholders?

Will the shareholders be required to give any guarantees to support

Company borrowing?

Will there be provision for ensuring that any liability under such

guarantees is borne in agreed equity proportions between the

shareholders?

BUSINESS OF THE COMPANY

What will be the nature of the activities carried on by the Company?

Will there be any geographical limitations placed on the joint

ventures operations?

Will there be a business plan and/or budget?

BOARD OF DIRECTORS

What rights will each party have to appoint directors?

1|Page

Will the other shareholders have the right to be consulted on the

proposed appointment of any new directors/will there be any

minimum qualification requirements for any new directors?

Will particular voting arrangements apply to matters specifically

reserved to the board and/or to any other matters?

Who will determine the appointment of any managing director or

any other executive directors?

SHAREHOLDER MEETINGS

What will the quorum and notice requirements for shareholder

meetings be?

Will any special voting rights attach to any of the shares?

MATTERS REQUIRING UNANIMITY OR A SPECIAL MAJORITY

Are there any specified matters that will require unanimity or a

special majority at board level?

Are there any specified matters to be reserved for decision by the

shareholders at shareholder level?

PROFIT DISTRIBUTION

What will be the dividend policy of the Company?

Should there be a minimum level of profits to be distributed or

retained each year?

How can the dividend policy be changed?

RESTRICTIONS ON SHAREHOLDERS AND COMPETITION

Will the shareholders be prohibited from competing with the

Company? If so, what territorial or other limitations should apply?

Will there be any exceptions for any existing activities of a party

that are not being contributed to the Company?

Will the shareholders have obligations to refer business to the

Company?

How long will the restrictions apply for - whilst a shareholder/after a

party ceases to be a shareholder in the Company and/or the

termination of the joint venture agreement?

Will

there

be

a

restriction

on

employees/customers of the Company?

What competition approvals are likely to be required for the

formation and operation of the Company (if any)?

any

party

poaching

2|Page

TRANSFER OF SHARES

Should the shareholders be permitted to sell their shares or should

the Company be wound up if any party wishes to sell out?

If transfers will be permitted, should the other shareholders have

pre-emptive rights before any sale to a third party takes place?

Should partial transfers be allowed - to connected persons or

generally?

Should any transfers be permitted free of pre-emption rights (eg

intra-group transfers or transfers to family trusts)?

Should there be any minimum period during which no sales to third

parties are permitted?2

How will shares be valued for the purposes of the transfer

provisions?

Should a tag along right (eg transferor must require the third party

purchaser to offer to buy the other shareholders interests at the

same price per share) or drag along right (eg transferor can oblige

the other shareholders to transfer their shares to the same

purchaser) be included?

SERVICES AND EMPLOYEES

Will any of the shareholders be providing services to the Company

and if so will a fee be paid?

Will any services be documented by way of separate agreement?

Will the Company have its own employees?

Are service contracts required and are there particular individuals

with key roles in the joint venture calling for special treatment?

DEADLOCK

What will constitute a deadlock issue?

What mechanisms will be included to assist the shareholders in

resolving any deadlock issues - reference to chairman/chief

executives of each party/mediation/arbitration/ expert?

TERMINATION

Is the joint venture for a fixed term or indefinite duration?

Are there any circumstances in which the joint venture will

automatically terminate (eg loss of a regulatory approval, the

transfer of any partys shares)?

3|Page

Can a party give notice of termination (leading to liquidation unless

otherwise agreed) after a minimum period or is exit solely by

transfer of shares?

4|Page

The parties will need to consider what the desired ratio of equity to debt for the balance sheet of the Company

should be. There may be advantages in debt financing, on the other hand it may be necessary to demonstrate a

stronger balance sheet for the purposes of market perception or the ability to raise outside finance. A commercial

decision will also be necessary, in the case of debt finance, as to how much should be raised by outside loans and

how much (if practical) from the shareholders themselves. Where the rate of interest on an outside loan is less than

the return which the Company can generate on those funds, there may be attraction in allowing the Company to

gear up with outside loans.

This will be particularly appropriate in the case of a new business.

You might also like

- Key Elements of Shareholder AgreementDocument5 pagesKey Elements of Shareholder AgreementPurva TambeNo ratings yet

- AJKRSP Conflict of Interest PolicyDocument4 pagesAJKRSP Conflict of Interest PolicyM Jehanzeb IshaqNo ratings yet

- Oint Enture Contract ChecklistDocument3 pagesOint Enture Contract ChecklistZulaine GuerraNo ratings yet

- Spot Option Software AgreementDocument17 pagesSpot Option Software AgreementFadi RonaldoNo ratings yet

- Independent Director Appointment LetterDocument5 pagesIndependent Director Appointment Letterpallab duttaNo ratings yet

- Shareholders AgreementDocument18 pagesShareholders AgreementmoiramcfNo ratings yet

- Drafting Shareholders' Agreements ChecklistDocument6 pagesDrafting Shareholders' Agreements ChecklistMarius Angara100% (1)

- Protect proprietary information and business opportunities with a joint NDADocument2 pagesProtect proprietary information and business opportunities with a joint NDAgernsby935100% (1)

- Business Growth Action Plan and Strategies For Development ExampleDocument16 pagesBusiness Growth Action Plan and Strategies For Development ExampledanielNo ratings yet

- Stripe Atlas Confidential Information and Invention Assignment Agreement For Indiv Consultant (CA) - FORMDocument20 pagesStripe Atlas Confidential Information and Invention Assignment Agreement For Indiv Consultant (CA) - FORMStefanoFallahaNo ratings yet

- Checklist For Distributor AgreementDocument4 pagesChecklist For Distributor AgreementAnonymous 2evaoXKKdNo ratings yet

- Lease Deed for Life Sciences Company SpaceDocument12 pagesLease Deed for Life Sciences Company SpaceBharath Athi RatnaNo ratings yet

- Commercial Agency AgreementDocument12 pagesCommercial Agency AgreementA. El MahdiNo ratings yet

- Appointment Letter Independent DirectorDocument11 pagesAppointment Letter Independent DirectorrajNo ratings yet

- 001P DIFC Governor Scam Falsified MOU 200312Document6 pages001P DIFC Governor Scam Falsified MOU 200312Muhammad AffendiNo ratings yet

- Sample Affinity Partner ContractDocument3 pagesSample Affinity Partner Contractconcon_hernandezNo ratings yet

- Board Resolution Approving Loan of FundsDocument1 pageBoard Resolution Approving Loan of FundsGryswolf0% (1)

- Effectively Managing Distributor Dealer and Sales Representative RelationshipsDocument9 pagesEffectively Managing Distributor Dealer and Sales Representative RelationshipsTe NgNo ratings yet

- Reducing Legal Risks Through ContractsDocument44 pagesReducing Legal Risks Through ContractsLawQuestNo ratings yet

- Renaissance Community Coop Bylaws (Unapproved)Document6 pagesRenaissance Community Coop Bylaws (Unapproved)Fund for Democratic CommunitiesNo ratings yet

- CO-BROKER AGREEMENT - CocoaDocument7 pagesCO-BROKER AGREEMENT - CocoaNoah CyrusNo ratings yet

- Agency ContractDocument7 pagesAgency ContractSaubhagya100% (1)

- Founders Agreement TemplateDocument13 pagesFounders Agreement TemplateDarrell SaricNo ratings yet

- Formulir Siup3aDocument9 pagesFormulir Siup3aEKO PARTOWONo ratings yet

- Sample Legal Sevices AgreementDocument5 pagesSample Legal Sevices AgreementMalia JordanNo ratings yet

- Company Secretaries: Their Duties and PowersDocument8 pagesCompany Secretaries: Their Duties and PowersBarbraNo ratings yet

- C & F Agreement - OldDocument4 pagesC & F Agreement - Oldsapnaa11No ratings yet

- Nondisclosure Agreement for Potential InvestorsDocument3 pagesNondisclosure Agreement for Potential InvestorsAnthony K. HenryNo ratings yet

- 10.3 Term Sheet For Equity InvestmentDocument12 pages10.3 Term Sheet For Equity InvestmentMarius AngaraNo ratings yet

- Memorandum of Understanding: 1. Reciprocal Fee Sharing ArrangementDocument3 pagesMemorandum of Understanding: 1. Reciprocal Fee Sharing ArrangementAshoka100% (1)

- CEO VP In-House Legal Counsel in Los Angeles CA Resume Stuart WebsterDocument4 pagesCEO VP In-House Legal Counsel in Los Angeles CA Resume Stuart WebsterStuartWebsterNo ratings yet

- Value Added Reseller AgreementDocument10 pagesValue Added Reseller AgreementEngelbertNo ratings yet

- Transfer of SharesDocument9 pagesTransfer of SharesamitkmeenaNo ratings yet

- Angel Guidebook - Term Sheet 1Document13 pagesAngel Guidebook - Term Sheet 1Anupjyoti DekaNo ratings yet

- SLA - Due DiligenceDocument2 pagesSLA - Due DiligenceSamhitha KumbhajadalaNo ratings yet

- RevenueRegulations1 68Document4 pagesRevenueRegulations1 68lorkan19No ratings yet

- Due Diligence ChecklistDocument13 pagesDue Diligence ChecklistanandNo ratings yet

- BBAA - Shareholders AgreementDocument43 pagesBBAA - Shareholders AgreementArvel DomingoNo ratings yet

- Sample Generic Confidentiality AgreementDocument1 pageSample Generic Confidentiality AgreementAditya LakhaniNo ratings yet

- Amendments To Bahrain Labour LawDocument11 pagesAmendments To Bahrain Labour LawRatheeshkumar P Thankappan MenonNo ratings yet

- Guarantee - CorporateDocument2 pagesGuarantee - Corporatedilarn167% (6)

- 2 A Non Circumvention Non DisclosureDocument5 pages2 A Non Circumvention Non DisclosurekhuramNo ratings yet

- Auction: SampleDocument6 pagesAuction: SampleOctavian CiceuNo ratings yet

- Marketing Agreement Template SignaturelyDocument4 pagesMarketing Agreement Template SignaturelyAndrea De CastroNo ratings yet

- Partnership DeedDocument4 pagesPartnership DeedPavan KumarNo ratings yet

- Fortis Merchant Referral Agreement TEMPLATE (Updated 6.16.21)Document4 pagesFortis Merchant Referral Agreement TEMPLATE (Updated 6.16.21)Vinay ParkerNo ratings yet

- Founder Advisor Standard Template v26Document5 pagesFounder Advisor Standard Template v26Yan BaglieriNo ratings yet

- Writing The Grievance Arbitration BriefDocument19 pagesWriting The Grievance Arbitration BriefSmochi50% (2)

- Stock Option Agreement (Shareholder To Optionee)Document2 pagesStock Option Agreement (Shareholder To Optionee)Legal Forms100% (1)

- Software Warranty AssignmentDocument4 pagesSoftware Warranty AssignmentTosha BrownNo ratings yet

- Sample CADocument3 pagesSample CAVita DepanteNo ratings yet

- Pre Negotiation AgreementDocument7 pagesPre Negotiation AgreementMaria VangelosNo ratings yet

- Shares Sale AgreementDocument14 pagesShares Sale AgreementIan Ling100% (1)

- Terms of Use ShortexDocument14 pagesTerms of Use ShortexSvyat ZadorozhnyyNo ratings yet

- AGENT AGREEMENT FOR STUDENT RECRUITMENTDocument3 pagesAGENT AGREEMENT FOR STUDENT RECRUITMENTOzzirisNo ratings yet

- Referral AgreementDocument4 pagesReferral AgreementSergeNo ratings yet

- SecurView Channel Partner AgreementDocument11 pagesSecurView Channel Partner AgreementMike FrankelNo ratings yet

- State Bank of IndiaDocument1 pageState Bank of IndiaBala SundarNo ratings yet

- Chapter 18 - Technical AnalysisDocument5 pagesChapter 18 - Technical AnalysisPeterGomes100% (1)

- Annualreport2019 PDFDocument422 pagesAnnualreport2019 PDFZain Wahab GmNo ratings yet

- API NY - GDP.PCAP - CD DS2 en Excel v2 3469429Document74 pagesAPI NY - GDP.PCAP - CD DS2 en Excel v2 3469429shahnawaz G 27No ratings yet

- Homework 1 - Version BDocument3 pagesHomework 1 - Version BІлияс Махатбек0% (1)

- FIN 300 Chapter 3 Homework Solutions Spring 18Document2 pagesFIN 300 Chapter 3 Homework Solutions Spring 18Janet TramNo ratings yet

- A Ijara Home FinanceDocument13 pagesA Ijara Home FinanceIndranil RoyNo ratings yet

- ABM Strand Is One of The 4 Major Strands in The Academic Track of The Senior High SchoolDocument3 pagesABM Strand Is One of The 4 Major Strands in The Academic Track of The Senior High SchoolMulong CabrillasNo ratings yet

- Starting a Chocolate Company Business PlanDocument26 pagesStarting a Chocolate Company Business PlanYummy Choc83% (6)

- 01 Us v. DrescherDocument6 pages01 Us v. DrescherAminor VillaroelNo ratings yet

- CPEM 2014 - TOC - PracticeAids Audit File DocumentationDocument6 pagesCPEM 2014 - TOC - PracticeAids Audit File DocumentationranibarNo ratings yet

- Notice To Employee: WWW - Irs.gov/efileDocument2 pagesNotice To Employee: WWW - Irs.gov/efileRODRIGO GRIJALBA CABREJOSNo ratings yet

- Problems SAPMDocument4 pagesProblems SAPMSneha Swamy100% (1)

- Chapter 12 in Class ProblemsDocument2 pagesChapter 12 in Class Problemsamu_scribdNo ratings yet

- Tutorial 03 - International Convergence of Financial ReportingDocument2 pagesTutorial 03 - International Convergence of Financial ReportingMueen MajidNo ratings yet

- Chapter 2 Forensic Auditing and Fraud InvestigationDocument92 pagesChapter 2 Forensic Auditing and Fraud Investigationabel habtamuNo ratings yet

- Chapter 5 Accounting For Revenue and Other ReceiptsDocument49 pagesChapter 5 Accounting For Revenue and Other ReceiptsKapoy-eeh LazanNo ratings yet

- Wagners Hypothesis With Public ExpendituresDocument3 pagesWagners Hypothesis With Public ExpendituresSamad Raza KhanNo ratings yet

- Assignment 3: Notes ReceivableDocument2 pagesAssignment 3: Notes ReceivableRodlyn LajonNo ratings yet

- Transfer and Business Taxation by Ballada Solution ManualDocument5 pagesTransfer and Business Taxation by Ballada Solution ManualAnonymous aU6BvWTIV20% (1)

- PGDM II FINANCE ElectivesDocument21 pagesPGDM II FINANCE ElectivesSonia BhagwatNo ratings yet

- Penny Stock Promo ReviewDocument1 pagePenny Stock Promo ReviewJ_BechampOmpregaNo ratings yet

- ATS - Daily Trading Plan 27agustus2018Document1 pageATS - Daily Trading Plan 27agustus2018wahidNo ratings yet

- Loan AgreementDocument4 pagesLoan AgreementJoey YanNo ratings yet

- Axiata Dialog 3Q09 ResultDocument6 pagesAxiata Dialog 3Q09 ResultseanreportsNo ratings yet

- R41 Valuation of Contingent Claims IFT Notes PDFDocument28 pagesR41 Valuation of Contingent Claims IFT Notes PDFZidane Khan100% (1)

- HW On Receivables B PDFDocument12 pagesHW On Receivables B PDFJessica Mikah Lim AgbayaniNo ratings yet

- The Cheat Sheet WelcomeDocument1 pageThe Cheat Sheet WelcomeDan ButuzaNo ratings yet

- BS Delhi English 22-10-2022Document26 pagesBS Delhi English 22-10-2022Relaxing MusicNo ratings yet

- SBI Mutual Funds: Financial ServicesDocument9 pagesSBI Mutual Funds: Financial ServicesShivam MutkuleNo ratings yet