Professional Documents

Culture Documents

Presentation On Introduction To Amalgamtion PDF

Uploaded by

DeepOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Presentation On Introduction To Amalgamtion PDF

Uploaded by

DeepCopyright:

Available Formats

Introduction to Mergers & Amalgamations

Amrish Shah

ICAI WIRC Seminar

February 2013

Content

Modes of M&A in India

Amalgamation and Merger Basic concept

Type of mergers

Key driver for mergers

Domestic mergers

Cross border mergers

Key regulations governing mergers

Case studies

Page 2

Introduction to Amalgamations

Modes of M&A in India

Overview - Modes of M&A in India

M&A

Internal

Restructuring

Acquisitions

Business

Purchase

Share

Purchase

Buyback

Merger / Demerger

Capital

Reduction

Amalgamation

Financial

restructuring/

Enhancing

stake/repatriation

Consolidation of

businesses /

entities

Demerger

Slump Sale /

Itemised Sale

Focus on core

business /sell off

non core

business

Page 4

Focus on

inorganic growth

/strategic or non

strategic

investments

Enhancing

stake/repatriation

Introduction to Amalgamations

Focus on core

business /hiveoff of non core

business

/monetize

Merger / Amalgamation - Basic concept

What do you mean by merger / amalgamation?

Merger refers to consolidation of two or more entities

Involves transfer of assets and liabilities from one or more transferor companies to a transferee

company

In consideration, typically the transferee company issues shares to the shareholders of transferor

company

Consideration could be in any form However, considering tax neutrality conditions the same is discharged by

way of issue of shares

Key difference between Merger and Amalgamation in India

Merger combination of two or more enterprises whereby the assets and liabilities of one are vested

in the other, with the effect that the former enterprise loses its identity

Amalgamation combination of two corporate entities where the assets and liabilities of both are

vested in a third entity, with the effect that both former entities lose their identities to form a new entity

Terms merger and amalgamation appear synonymous, there is a difference between two All

amalgamations are necessarily merger, but all mergers may not necessarily be amalgamation

Page 6

Introduction to Amalgamations

Types of Merger / Amalgamation

Cogeneric mergers

Mergers takes place between companies operating in same industry

Further classified into:

Horizontal merger Merger take place between companies engaged in same business activities

Vertical merger Merger take place between companies which are engaged in different functions within

same business activities

Conglomerate mergers

Merger takes place between companies operating in different industry

Other type of mergers

Up-stream merger Subsidiary company is merged with its Parent company

Down-stream merger Parent company is merged with its Subsidiary company

Reverse merger Sound financial company is merged with loss making company or unlisted

company is merged with listed company to get automatic listing

Page 7

Introduction to Amalgamations

Merger / Amalgamation Key drivers

Acquisitions

Tax savings

Consolidation of operations

to exploit synergy

Fund constraint

Eliminate multiple layers of

holding

Eliminate no. of companies

in group

Balance sheet right sizing

Automatic listing of Co

Reverse Merger

SEBI TOC compliance

Develop focused brand

image/ stronger market

standing through single

flagship entity

Takeover of sick company

Consolidation of Promoter

holdings

Page 8

Rationale for business

consolidation

Introduction to Amalgamations

Domestic merger / amalgamation situations

Consideration in the form of shares of Company C

Consideration in the form

of shares of Company B

Shareholders

Shareholders

Shareholders

Shareholders

Merger

Company A

Merger

Company B

Merger of Company A with Company B

Company B

Company A

Company C

Merger of Companies A & B with Company C

Shareholders

No shares to be issued

by HOLD Co

HOLD Co

Consideration in the

form of shares of

SUB Co

100%

HOLD Co

100%

SUB Co

SUB Co

Merger of SUB Co with HOLD Co

Page 9

Introduction to Amalgamations

Merger of HOLD Co with SUB Co

Cross border merger situations

Merger of F CO 1 (holding I CO) with F CO 2

Merger of F CO with I CO

Shareholders

Shareholders

Consideration in the form

of shares of F CO 2

F CO 1

Consideration in the

form of shares of I

CO

F CO

F CO 2

Merger

OUTSIDE INDIA

OUTSIDE INDIA

INDIA

INDIA

I CO

I CO

Merger of I CO with F CO

Consideration in the

form of shares of

F CO

F CO

OUTSIDE INDIA

Extant company law

provisions do not allow this

form of merger *

INDIA

Shareholders

Page 10

I CO

Introduction to Amalgamations

*However Companies Bill 2012 proposes

to allow such mergers subject to certain

approvals

Key regulatory reactions on mergers

Income tax

Companies Act

Stamp duty

Tax neutrality

High Court approval

Valuation of shares

Availability of tax exemptions

Transfer of tax credits

Approval of shareholders and

creditors

Indian Stamp Act vs. State

Stamp Act

Step up in tax basis

Post implementation procedures

Valuation of immovable property

Set-off of stamp duty

SEBI & Stock exchange

Listing of shares / New Co

Stock exchange approvals

Take over code implications

Filing compliances

Exchange control

Key regulations

Cross border

Host jurisdiction compliances

Tax implications in host

juridiction

Page 11

Issue of shares to non resident

on merger

FDI / RBI Approval / automatic

route

Accounting

Method of accounting

Other regulations

Competition Act

Pooling of interest

Indirect tax

Purchase method

Accounting

Industry specific law

Expense accouting

Cancellation of investment

Introduction to Amalgamations

Glossary

Glossary

AIM

Alternative Investment Market

Co

Company

DDT

Dividend Distribution Tax

FDI

Foreign Direct Investment

LSE

London Stock Exchange

M&A

Merger & Amalgamation

NBFC

Non Banking Financial Company

PE

Private Equity

RBI

Reserve Bank of India

SEBI

Securities and Exchange Board of India

TOC

Takeover Code

Page 13

Introduction to Amalgamations

Thank You

For further information / clarifications, please contact:

Amrish Shah

Partner & Transaction Tax Leader

Email : amrish.shah@in.ey.com

Phone : +91 22 6192 0680

Disclaimer

This presentation contains information in summary form and is therefore

intended for general guidance only. It is not expected to be a substitute for

detailed research or the exercise of professional judgment. Accordingly,

this presentation should neither be regarded as comprehensive nor

sufficient for the purposes of decision-making. Neither Ernst & Young

Private Limited nor any of its affiliates can accept any responsibility for loss

occasioned to any person acting or refraining from action as a result of any

material in this presentation. The information provided is not, nor is it

intended to be an advice on any matter and should not be relied on as such.

Professional advice should be sought before taking action on any of the

information contained in it. Without prior permission of Ernst & Young, this

document may not be quoted in whole or in part or otherwise referred to in

any documents.

You might also like

- Current Affairs Q&A PDF Free - January 2020 by AffairsCloud PDFDocument32 pagesCurrent Affairs Q&A PDF Free - January 2020 by AffairsCloud PDFamreen khanNo ratings yet

- Current Affairs August Question & Answer 2016 PDF by AffairsCloudDocument33 pagesCurrent Affairs August Question & Answer 2016 PDF by AffairsCloudl8o8r8d8s8i8v8No ratings yet

- Prestigious Approvals: Techno India UniversityDocument24 pagesPrestigious Approvals: Techno India UniversityDeepNo ratings yet

- SSC Mock Test - Solution - 158Document12 pagesSSC Mock Test - Solution - 158DeepNo ratings yet

- SSC Mock Test Paper - 158Document22 pagesSSC Mock Test Paper - 158DeepNo ratings yet

- GDS West Bengal Recruitment NotificationDocument204 pagesGDS West Bengal Recruitment NotificationKabya Srivastava100% (2)

- General Knowledge Objective Type Questions and Answers - SSC CGL 2016Document4 pagesGeneral Knowledge Objective Type Questions and Answers - SSC CGL 2016DeepNo ratings yet

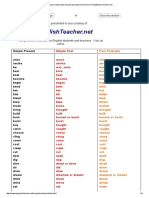

- Irregular Simple Past and Past Participle Verb Forms FromDocument4 pagesIrregular Simple Past and Past Participle Verb Forms FromDeepNo ratings yet

- India Post Recruitment 2016Document29 pagesIndia Post Recruitment 2016Govind kaleNo ratings yet

- Mcqs On Economics (WWW - Qmaths.in)Document43 pagesMcqs On Economics (WWW - Qmaths.in)Sundara BabuNo ratings yet

- RatioDocument76 pagesRatioRamesh RahemNo ratings yet

- Rural FinanceDocument92 pagesRural FinanceDeepNo ratings yet

- Project Report On Financial Statement Analysis of Kajaria Ceramics Ltd.Document121 pagesProject Report On Financial Statement Analysis of Kajaria Ceramics Ltd.Syed Mohd Ziya86% (83)

- Project Report On Financial Statement Analysis of Kajaria Ceramics Ltd.Document121 pagesProject Report On Financial Statement Analysis of Kajaria Ceramics Ltd.Syed Mohd Ziya86% (83)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5784)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Paragon Offshore Report Sept 2014 Dichotomy CapitalDocument10 pagesParagon Offshore Report Sept 2014 Dichotomy CapitalIan ClarkNo ratings yet

- DividendDocument5 pagesDividendAkash79No ratings yet

- SGX-Listed TT International Announces Financial Commitment of S$92.0 Million by Prima BB and Utraco Investment To Develop Big Box Retail Project in Singapore's WestDocument3 pagesSGX-Listed TT International Announces Financial Commitment of S$92.0 Million by Prima BB and Utraco Investment To Develop Big Box Retail Project in Singapore's WestWeR1 Consultants Pte LtdNo ratings yet

- Glencore Announces Significant Reserves Increase at Kazzinc MinesDocument4 pagesGlencore Announces Significant Reserves Increase at Kazzinc Mines2fercepolNo ratings yet

- Acclaw On CorporationDocument5 pagesAcclaw On CorporationJeayan CasonaNo ratings yet

- TTC Group, IncDocument13 pagesTTC Group, IncBob RGNo ratings yet

- President Uhuru Kenyatta's Speech On The Rebranding of Kaskazi Beach Hotel & Ultra-Modern Dr. Charles Gekunda Otara Conference CentreDocument2 pagesPresident Uhuru Kenyatta's Speech On The Rebranding of Kaskazi Beach Hotel & Ultra-Modern Dr. Charles Gekunda Otara Conference CentreState House Kenya100% (2)

- AFCABLDocument95 pagesAFCABLsoyeb60No ratings yet

- Trust Declaration, StocksDocument3 pagesTrust Declaration, StocksVochariNo ratings yet

- Additional Case-Lets For Practice-April 17-RaoDocument13 pagesAdditional Case-Lets For Practice-April 17-RaoSankalp BhagatNo ratings yet

- Issue of Shares and DebenturesDocument3 pagesIssue of Shares and DebenturesAarya KhedekarNo ratings yet

- 1 RethinkingDocument12 pages1 Rethinkingananth999No ratings yet

- Notice: Premerger Notification Waiting Periods Early TerminationsDocument4 pagesNotice: Premerger Notification Waiting Periods Early TerminationsJustia.comNo ratings yet

- Bata Shoe Company Bangladesh OperationsDocument17 pagesBata Shoe Company Bangladesh OperationsRummanBinAhsanNo ratings yet

- Sec Form 12-1 Registration Statement With Prospectus PDFDocument53 pagesSec Form 12-1 Registration Statement With Prospectus PDFIrwin Ariel D. MielNo ratings yet

- Key Financial Ratios How To Calculate Them and What They MeanDocument3 pagesKey Financial Ratios How To Calculate Them and What They MeanGilang Anwar HakimNo ratings yet

- Yukos Annual Report 2002Document57 pagesYukos Annual Report 2002ed_nycNo ratings yet

- Adopting IFRS in India for Global CompetitivenessDocument2 pagesAdopting IFRS in India for Global CompetitivenessSahana ShivakumarNo ratings yet

- OTCEIDocument17 pagesOTCEIMani Sankar100% (1)

- Business Policy and StrategyDocument9 pagesBusiness Policy and StrategyRamesh Arivalan100% (7)

- Kellogg's Financial Statement Case StudyDocument10 pagesKellogg's Financial Statement Case StudyKhoa Huynh67% (6)

- Investment in Equity Securities - Problem 16-5 and 16-7Document4 pagesInvestment in Equity Securities - Problem 16-5 and 16-7Jessie Dela CruzNo ratings yet

- Topic 2 Incorporation Legal PersonalityDocument4 pagesTopic 2 Incorporation Legal PersonalityVasugi SugiNo ratings yet

- Ra 7652Document4 pagesRa 7652des_0212No ratings yet

- Annual Reports JMAS 2020Document222 pagesAnnual Reports JMAS 2020Yoga Sahputra UlungNo ratings yet

- P&G Cost of Capital AnalysisDocument64 pagesP&G Cost of Capital Analysiskuch bhi75% (4)

- Chapter 8 Stock ValuationDocument14 pagesChapter 8 Stock ValuationLuu Quang TungNo ratings yet

- Confirmatory Order in The Matter of Kailash Auto Finance LimitedDocument8 pagesConfirmatory Order in The Matter of Kailash Auto Finance LimitedShyam SunderNo ratings yet

- Hindustan Construction Co LTDDocument39 pagesHindustan Construction Co LTDLubdh PandaNo ratings yet

- Company Law NotesDocument178 pagesCompany Law Notessiewhong93100% (6)