Professional Documents

Culture Documents

Finance Revision Questions & Summary

Uploaded by

knoxbusiness0 ratings0% found this document useful (0 votes)

126 views2 pagesList at least four characteristics of useful information. List at least five users of financial information. Suggest a reason for each of them to be using the information. Name and describe the purpose of four accounting rations. At the end of this unit you should be able to: the role of the finance function in an organisation including: a) payment of wages b) payment of accounts c) maintenance of financial records.

Original Description:

Original Title

HBM Finance Revision Qs and Summary

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

DOC, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentList at least four characteristics of useful information. List at least five users of financial information. Suggest a reason for each of them to be using the information. Name and describe the purpose of four accounting rations. At the end of this unit you should be able to: the role of the finance function in an organisation including: a) payment of wages b) payment of accounts c) maintenance of financial records.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

126 views2 pagesFinance Revision Questions & Summary

Uploaded by

knoxbusinessList at least four characteristics of useful information. List at least five users of financial information. Suggest a reason for each of them to be using the information. Name and describe the purpose of four accounting rations. At the end of this unit you should be able to: the role of the finance function in an organisation including: a) payment of wages b) payment of accounts c) maintenance of financial records.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

You are on page 1of 2

Finance Revision Questions & Summary

1 What four main areas does financial information cover?

2 List some of the factors which may be taken into account when one

business deciding whether or not to provide a line of credit.

3 For what purpose might a manager use financial information?

4 List at least four characteristics of useful information.

5 List at least five users of financial information.

6 Using the users of financial information that you have just listed, suggest a

reason for each of them to be using the information.

7 Why might an organisation be interested in calculating accounting rations?

8 Name and describe the purpose of four accounting rations.

At the end of this unit you should be able to:

The role of the finance function in an organisation including:

a) payment of wages

b) payment of accounts

c) maintenance of financial records

the purpose and use of:

a) profit and loss account

b) balance sheet

c) cashflow statement

the main uses of financial information

the main users of financial information and the reasons for use

ratio analysis

budgets are statements showing future expenditure; a management tool;

useful for monitoring and controlling business operations

they are also useful for gaining information, setting targets and

delegating authority

a cash budget is a good example of a budget

budgets are most easily used when created using a piece of appropriate

computer software

accounting ratios can be calculated for any business that produces

financial reports

Higher Grade Business Management Knox Academy

ratios are normally calculated to highlight the areas of profitability,

liquidity and efficiency

the use of accounting ratios has limitations

the main profitability ratios are:

a) gross profit as a percentage of sales

b) gross profit as a percentage of cost of goods sold

c) net profit as a percentage of sales

the main liquidity ratios are:

a) current ratio

b) acid test ratio

the main efficiency ratio is:

a) return on capital employed

calculation of ratios is not enough; analysis must also take place

analysis of ratios may include comparisons over a number of years or

comparisons with other businesses in the same sector

useful financial information should cover the areas of profitability,

liquidity, efficiency and capital structure

financial information becomes more useful when it is used as a

comparator

useful financial information has certain characteristics

the users of financial information are a varied group

users of financial information have many reasons for showing an interest

in a company’s financial statements

Keep studying for your NAB and final exam.

Remember to practise past paper questions and ask for help in difficult

areas.

Higher Grade Business Management Knox Academy

You might also like

- The Balanced Scorecard: Turn your data into a roadmap to successFrom EverandThe Balanced Scorecard: Turn your data into a roadmap to successRating: 3.5 out of 5 stars3.5/5 (4)

- SCM-Accountant's Role (Pedrera, Marc)Document4 pagesSCM-Accountant's Role (Pedrera, Marc)Marc ChristianNo ratings yet

- Group 2Document97 pagesGroup 2SXCEcon PostGrad 2021-23100% (1)

- Financial Statement Analysis: Business Strategy & Competitive AdvantageFrom EverandFinancial Statement Analysis: Business Strategy & Competitive AdvantageRating: 5 out of 5 stars5/5 (1)

- 2E Studies (Sun - 29-10-2023) - Final Mid-TermDocument22 pages2E Studies (Sun - 29-10-2023) - Final Mid-TermahmedNo ratings yet

- Cost Accounting BookDocument197 pagesCost Accounting Booktanifor100% (3)

- Chapter 1Document3 pagesChapter 1Andrea QuetzalNo ratings yet

- Introduction To Management Accounting: Learning ObjectivesDocument7 pagesIntroduction To Management Accounting: Learning ObjectivesMumbaiNo ratings yet

- MBA Managerial Accounting SummaryDocument31 pagesMBA Managerial Accounting Summarycamirpo100% (1)

- Management Reports Control Reports Performance Evaluation and ManagementDocument43 pagesManagement Reports Control Reports Performance Evaluation and ManagementTricia Marie TumandaNo ratings yet

- QuizDocument5 pagesQuizrinajean catapangNo ratings yet

- Lecture Eight Analysis and Interpretation of Financial StatementDocument19 pagesLecture Eight Analysis and Interpretation of Financial StatementSoledad PerezNo ratings yet

- DAIBB Management ACC-1 PDFDocument24 pagesDAIBB Management ACC-1 PDFAshik100% (1)

- Chapter 1 StudentsDocument7 pagesChapter 1 StudentsArah Opalec0% (1)

- Dwnload Full Horngrens Cost Accounting A Managerial Emphasis Global 16th Edition Datar Solutions Manual PDFDocument36 pagesDwnload Full Horngrens Cost Accounting A Managerial Emphasis Global 16th Edition Datar Solutions Manual PDFaffluencevillanzn0qkr100% (7)

- Chapter 1 SolutionsDocument14 pagesChapter 1 SolutionschloeNo ratings yet

- Chapter 1 Solutions Horngren Cost AccountingDocument14 pagesChapter 1 Solutions Horngren Cost AccountingAnik Kumar MallickNo ratings yet

- BusFinTopic 4Document9 pagesBusFinTopic 4Nadjmeah AbdillahNo ratings yet

- NCERT Class 12 Accountancy Accounting RatiosDocument47 pagesNCERT Class 12 Accountancy Accounting RatiosKrish Pagani100% (1)

- CH - 5 Accounting RatiosDocument47 pagesCH - 5 Accounting RatiosAaditi V100% (1)

- Instructor'S Manual: Financial Statement AnalysisDocument3 pagesInstructor'S Manual: Financial Statement Analysisjoebloggs1888No ratings yet

- Financial AnalysisDocument15 pagesFinancial AnalysisPeter Jhon TrugilloNo ratings yet

- NNDC - Ican Kaduna Study Centre: Practice Questions On Introduction To Management Accounting A. Multiple Choice QuestionsDocument8 pagesNNDC - Ican Kaduna Study Centre: Practice Questions On Introduction To Management Accounting A. Multiple Choice QuestionsAbdulkadir KayodeNo ratings yet

- Literature Review On Cost Accounting SystemDocument7 pagesLiterature Review On Cost Accounting Systemafmabbpoksbfdp100% (1)

- Performance Management and Reporting Master of Accounting Siska Tifany K, 2001904992Document4 pagesPerformance Management and Reporting Master of Accounting Siska Tifany K, 2001904992siska tifanyNo ratings yet

- Chapter 01 - AnswerDocument18 pagesChapter 01 - AnswerTJ NgNo ratings yet

- DocxDocument7 pagesDocxRavinesh PrasadNo ratings yet

- Chapter 01 - AnswerDocument19 pagesChapter 01 - AnswerOscar Antonio100% (2)

- Financial Statement Analysis Study Resource for CIMA & ACCA Students: CIMA Study ResourcesFrom EverandFinancial Statement Analysis Study Resource for CIMA & ACCA Students: CIMA Study ResourcesNo ratings yet

- BSBFIM601 Manage FinancesDocument5 pagesBSBFIM601 Manage FinancesCindy Huang0% (2)

- 1... FMA Assignment 2Document7 pages1... FMA Assignment 2kibur amahaNo ratings yet

- Ais Assignment 1 Q1. The Annual Report Is Considered by Some To Be The Single Most Important Printed Document ThatDocument2 pagesAis Assignment 1 Q1. The Annual Report Is Considered by Some To Be The Single Most Important Printed Document ThatNinnette BediakoNo ratings yet

- Dwnload Full Horngrens Cost Accounting A Managerial Emphasis Canadian 8th Edition Datar Solutions Manual PDFDocument18 pagesDwnload Full Horngrens Cost Accounting A Managerial Emphasis Canadian 8th Edition Datar Solutions Manual PDFaffluencevillanzn0qkr100% (8)

- MODULE 3 FinanceDocument15 pagesMODULE 3 FinanceJohanna Cabrera MendozaNo ratings yet

- Give 4 Examples of Firms You Think Would Be Significant Users of Cost Management Information and Explain Why?Document2 pagesGive 4 Examples of Firms You Think Would Be Significant Users of Cost Management Information and Explain Why?Vernn92% (13)

- Conceptual Framework For Financial Accounting and ReportingDocument19 pagesConceptual Framework For Financial Accounting and ReportingShaheen MahmudNo ratings yet

- Solutions Lecture 1Document7 pagesSolutions Lecture 1jojoinnit100% (2)

- Introduction To Corporate Finance 4Th Edition Booth Test Bank Full Chapter PDFDocument36 pagesIntroduction To Corporate Finance 4Th Edition Booth Test Bank Full Chapter PDFbarbara.wilkerson397100% (13)

- Scope of Management AccountingDocument3 pagesScope of Management AccountingMuhammad Akmal HossainNo ratings yet

- Introduction To Corporate Finance 4th Edition Booth Test Bank 1Document49 pagesIntroduction To Corporate Finance 4th Edition Booth Test Bank 1glen100% (48)

- Leac 205Document47 pagesLeac 205Jyoti SinghNo ratings yet

- Accounting Ratios: Inancial Statements Aim at Providing FDocument53 pagesAccounting Ratios: Inancial Statements Aim at Providing FPathan Kausar100% (1)

- Leac 205Document47 pagesLeac 205Harish Singh NegiNo ratings yet

- Ch01 MQ SolutionsDocument10 pagesCh01 MQ SolutionsozcanozkanNo ratings yet

- Intro in Management AccountingDocument10 pagesIntro in Management AccountingGilvi Anne MaghopoyNo ratings yet

- Tips For The Emerson Electric CaseDocument3 pagesTips For The Emerson Electric CaseCahyo Priyatno0% (1)

- Research QuestionsDocument43 pagesResearch QuestionsammarhassanNo ratings yet

- Report AmmarDocument43 pagesReport AmmarammarhassanNo ratings yet

- Assignment 1 Conceptual Frame WorkDocument5 pagesAssignment 1 Conceptual Frame Workpoli nikNo ratings yet

- FMA - Assignment - 2018-2019 PDFDocument3 pagesFMA - Assignment - 2018-2019 PDFJulian David TellezNo ratings yet

- Financial Management-2Document5 pagesFinancial Management-2Shameer Babu Thonnan ThodiNo ratings yet

- Wiley CMAexcel Learning System Exam Review 2017: Part 2, Financial Decision Making (1-year access)From EverandWiley CMAexcel Learning System Exam Review 2017: Part 2, Financial Decision Making (1-year access)No ratings yet

- Strategic Cost Management PrelimDocument6 pagesStrategic Cost Management Prelimailel isagaNo ratings yet

- Managerial Accounting Course OutlineDocument4 pagesManagerial Accounting Course OutlineASMARA HABIB100% (1)

- Cariquitan Assignmentba429Document2 pagesCariquitan Assignmentba429justineNo ratings yet

- Essentials of Financial Statement AnalysisDocument87 pagesEssentials of Financial Statement AnalysisouzheshiNo ratings yet

- Finance for Nonfinancial Managers: A Guide to Finance and Accounting Principles for Nonfinancial ManagersFrom EverandFinance for Nonfinancial Managers: A Guide to Finance and Accounting Principles for Nonfinancial ManagersNo ratings yet

- 2012v1 FTT Chapter TwoDocument18 pages2012v1 FTT Chapter TwoAvinash DasNo ratings yet

- Operations PresentationDocument32 pagesOperations PresentationknoxbusinessNo ratings yet

- SGBM 8-12 Revision HomeworkDocument7 pagesSGBM 8-12 Revision HomeworkknoxbusinessNo ratings yet

- SGBM Revision Homework Unit 6 GCDocument4 pagesSGBM Revision Homework Unit 6 GCknoxbusinessNo ratings yet

- Homework: Standard Grade Business Management Units 2 and 3 - RevisionDocument1 pageHomework: Standard Grade Business Management Units 2 and 3 - RevisionknoxbusinessNo ratings yet

- SGBM Revision Homework Units 2-3 Additional PPQsDocument7 pagesSGBM Revision Homework Units 2-3 Additional PPQsknoxbusinessNo ratings yet

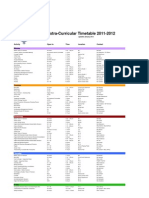

- Extra-Curricular Jan 2012 UpdateDocument1 pageExtra-Curricular Jan 2012 UpdateknoxacademyNo ratings yet

- AHBM 2010 Q7a Example SolDocument2 pagesAHBM 2010 Q7a Example SolknoxbusinessNo ratings yet

- SGBM Revision Homework Unit 5 GCDocument4 pagesSGBM Revision Homework Unit 5 GCknoxbusinessNo ratings yet

- SGBM Marketing Homework GCDocument2 pagesSGBM Marketing Homework GCknoxbusinessNo ratings yet

- SGBM Finance Revision Homework FGCDocument4 pagesSGBM Finance Revision Homework FGCknoxbusinessNo ratings yet

- SGBM Revision Homework Unit 5 FGDocument5 pagesSGBM Revision Homework Unit 5 FGknoxbusinessNo ratings yet

- SGBM Finance Revision Homework GC QsDocument3 pagesSGBM Finance Revision Homework GC QsknoxbusinessNo ratings yet

- SGBM Revision Homework Unit 1Document4 pagesSGBM Revision Homework Unit 1knoxbusinessNo ratings yet

- Unit 3 NotesDocument10 pagesUnit 3 NotesknoxbusinessNo ratings yet

- SGAD Unit 1aDocument37 pagesSGAD Unit 1aknoxbusinessNo ratings yet

- AHBM Mindmap No. 1 Conor BowlesDocument1 pageAHBM Mindmap No. 1 Conor BowlesknoxbusinessNo ratings yet

- Manual/Paper-Based Document Storage: Standard Grade Administration Unit 3bDocument34 pagesManual/Paper-Based Document Storage: Standard Grade Administration Unit 3bknoxbusiness100% (1)

- Features of Good Filing Systems: Standard Grade Administration Unit 3aDocument9 pagesFeatures of Good Filing Systems: Standard Grade Administration Unit 3aknoxbusinessNo ratings yet

- Knox Unit 2c Reception NotesDocument10 pagesKnox Unit 2c Reception NotesknoxbusinessNo ratings yet

- Security of Information: Standard Grade Administration Unit 3cDocument11 pagesSecurity of Information: Standard Grade Administration Unit 3cknoxbusinessNo ratings yet

- SGAD Unit 2aDocument52 pagesSGAD Unit 2aknoxbusinessNo ratings yet

- Knox Unit 4 Re Pro GraphicsDocument8 pagesKnox Unit 4 Re Pro GraphicsknoxbusinessNo ratings yet

- SGAD Unit 1bDocument25 pagesSGAD Unit 1bknoxbusinessNo ratings yet

- Knox Unit 2d Mail Handling NotesDocument9 pagesKnox Unit 2d Mail Handling NotesknoxbusinessNo ratings yet

- SGAD Unit 1b - Pupil NotesDocument14 pagesSGAD Unit 1b - Pupil NotesknoxbusinessNo ratings yet

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- Standard Grade Administration: Unit 2BDocument16 pagesStandard Grade Administration: Unit 2BknoxbusinessNo ratings yet

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- Unit 8 - Growth OutlineDocument1 pageUnit 8 - Growth OutlineknoxbusinessNo ratings yet

- Cfdcir 04Document3 pagesCfdcir 04subodhmallyaNo ratings yet

- IET Educational (Xiao-Ping Zhang)Document17 pagesIET Educational (Xiao-Ping Zhang)Mayita ContrerasNo ratings yet

- Kultura NG TsinaDocument5 pagesKultura NG TsinaJeaniel amponNo ratings yet

- Manila City - Ordinance No. 8330 s.2013Document5 pagesManila City - Ordinance No. 8330 s.2013Franco SenaNo ratings yet

- Air Asia CompleteDocument18 pagesAir Asia CompleteAmy CharmaineNo ratings yet

- Invoice: House No 211-R, Sector 15-B, Afer Zon North Nazima Bad Town, KarachiDocument3 pagesInvoice: House No 211-R, Sector 15-B, Afer Zon North Nazima Bad Town, KarachijeogilaniNo ratings yet

- Portfolio Management ASSIGN..Document23 pagesPortfolio Management ASSIGN..Farah Farah Essam Abbas HamisaNo ratings yet

- SCHOOLDocument18 pagesSCHOOLStephani Cris Vallejos Bonite100% (1)

- ECO 303 PQsDocument21 pagesECO 303 PQsoyekanolalekan028284No ratings yet

- Complete Data About Swiss Grid PDFDocument7 pagesComplete Data About Swiss Grid PDFManpreet SinghNo ratings yet

- Sabc Directory2014-2015Document48 pagesSabc Directory2014-2015api-307927988No ratings yet

- Congo Report Carter Center Nov 2017Document108 pagesCongo Report Carter Center Nov 2017jeuneafriqueNo ratings yet

- What Is Public Choice Theory PDFDocument8 pagesWhat Is Public Choice Theory PDFSita SivalingamNo ratings yet

- Exemption Certificate PDFDocument33 pagesExemption Certificate PDFChaudhary Hassan ArainNo ratings yet

- Solution Manual For Database Systems Design Implementation and Management 10th EditionDocument13 pagesSolution Manual For Database Systems Design Implementation and Management 10th EditionChris Harris0% (1)

- Assignment 2-3 ContempDocument2 pagesAssignment 2-3 ContempMARK JAMES BAUTISTANo ratings yet

- MyNotesOnCNBCSoFar 2016Document38 pagesMyNotesOnCNBCSoFar 2016Tony C.No ratings yet

- MNCDocument25 pagesMNCPiyush SoniNo ratings yet

- CV Siti Nur Najihah BT Nasir 1Document1 pageCV Siti Nur Najihah BT Nasir 1sitinurnajihah458No ratings yet

- Process Planning and Cost EstimationDocument13 pagesProcess Planning and Cost EstimationsanthoshjoysNo ratings yet

- MKTG 361 Phase 2Document10 pagesMKTG 361 Phase 2api-486202971No ratings yet

- Competition ActDocument25 pagesCompetition ActAnjali Mishra100% (1)

- Butler Lumber Company: An Analysis On Estimating Funds RequirementsDocument17 pagesButler Lumber Company: An Analysis On Estimating Funds Requirementssi ranNo ratings yet

- Money, Banking, and Monetary Policy: ObjectivesDocument9 pagesMoney, Banking, and Monetary Policy: ObjectivesKamalpreetNo ratings yet

- L03 ECO220 PrintDocument15 pagesL03 ECO220 PrintAli SioNo ratings yet

- Methods To Initiate Ventures: Leoncio, Ma. Aira Grabrielle R. Mamigo, Princess Nicole B. G12-AB126Document21 pagesMethods To Initiate Ventures: Leoncio, Ma. Aira Grabrielle R. Mamigo, Princess Nicole B. G12-AB126Precious MamigoNo ratings yet

- Seedling Trays Developed by Kal-KarDocument2 pagesSeedling Trays Developed by Kal-KarIsrael ExporterNo ratings yet

- Wind & Storm Proof UmbrellaDocument17 pagesWind & Storm Proof UmbrellaIbrahim KhanNo ratings yet

- New Microsoft Word DocumentDocument6 pagesNew Microsoft Word DocumentmanojjoshipalanpurNo ratings yet