Professional Documents

Culture Documents

Taganito Mining Vs CIR

Uploaded by

Patrick Ramos0 ratings0% found this document useful (0 votes)

218 views1 pagehaha

Original Title

Taganito Mining vs CIR

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documenthaha

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

218 views1 pageTaganito Mining Vs CIR

Uploaded by

Patrick Ramoshaha

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 1

Facts:

Taganito Mining Corporation (TMC) is a domestic corporation expressly granted a permit

by the government via an operating contract to explore, develop and utilize mineral deposits found

in a specified portion of a mineral reservation area located in Surigao del Norte and owned by the

government. In exchange, TMC is obliged to pay royalty to the government over and above other

taxes. During July to December 1989, TMC removed, shipped and sold substantial quantities of

Beneficiated Nickel Silicate ore and Chromite ore and paid excise taxes in the amount of

Php6,277,993.65 in compliance with Sec.151(3) of the Tax Code.

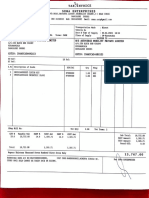

The 5% excise tax was based on the amount and weight shown in the provisional invoice issued

by TMC. The metallic minerals are then shipped abroad to Japanese buyers where the minerals were

analyzed allegedly by independent surveyors upon unloading at its port of destination. Analysis abroad

would oftentimes reveal a different value for the metallic minerals from that indicated in the

temporary/provisional invoice submitted by TMC. Variance is in the market values in the provisional

invoice and that indicated in the final calculation sheet presented by the buyers. Variances occur in the

weight of the shipment or the price of the metallic minerals per kilogram and sometimes in their metallic

content resulting in discrepancies in the total selling price. It is always the price indicated in the final

invoice that is determinative of the amount that the buyers will eventually pay TMC.

TMC contended that is entitled to a refund because the actual market value that should be

made the basis of the taxes is the amount specified in the independent surveyor abroad.

Issues:

1. Whether or not TMC is entitled to refund.

2. Whether or not the actual market value that should be used should be the market value after the

assessment abroad was conducted.

RULING:

1. NO. Tax refund partake of the nature of an exemption, and as such, tax exemption cannot

be allowed unless granted in the most explicit and categorical language. Taxes are what we pay for

civilized society. Without taxes, the government would be paralyzed for lack of the motive power to

activate and operate it.

2. NO. Use market value right after removal from the bed or mines. Sec. 151(3) of the Tax

Code1: on all metallic minerals, a tax of five percent (5%) based on the actual market value of the gross

output thereof at the time of removal, in the case of those locally extracted or produced: or the value used

by the Bureau of Customs in determining tariff and customs duties, net of excise tax and value-added tax,

in case of importation. The law refers to the actual market value of the minerals at the time these

minerals were moved away from the position it occupied, i.e. Philippine valuation and analysis

because it is in this country where these minerals were extracted, removed and eventually shipped abroad.

To reckon the actual market value at the time of removal is also consistent with the essence of an

excise tax. It is a charge upon the privilege of severing or extracting minerals from the earth, and is

due and payable upon removal of the mineral products from its bed or mines (Republic Cement vs.

Comm, 23 SCRA 967).

You might also like

- Bank StatememtDocument2 pagesBank StatememtDawn Burdette100% (3)

- Lutz v. AranetaDocument2 pagesLutz v. AranetaKyle Dionisio100% (1)

- National Development Company Vs CIRDocument7 pagesNational Development Company Vs CIRIvy ZaldarriagaNo ratings yet

- Agri Reviewer PDFDocument31 pagesAgri Reviewer PDFPatrick Ramos100% (1)

- Fast Path NavigationsDocument8 pagesFast Path Navigationsakshay sasidhar100% (1)

- TAXATION OF VAT-INPUT TAXESDocument7 pagesTAXATION OF VAT-INPUT TAXESJocelyn Verbo-AyubanNo ratings yet

- Ramoso Vs CADocument2 pagesRamoso Vs CARegine Joy MagaboNo ratings yet

- Taganito v. CIR - Barcom Case DigestDocument3 pagesTaganito v. CIR - Barcom Case DigestIon FashNo ratings yet

- Affidavit of Self Adjudication-SampleDocument2 pagesAffidavit of Self Adjudication-SampleJon Eric G. Co96% (25)

- Affidavit of Self Adjudication-SampleDocument2 pagesAffidavit of Self Adjudication-SampleJon Eric G. Co96% (25)

- PAL Vs EDU-DIGESTDocument6 pagesPAL Vs EDU-DIGESTMARRYROSE LASHERASNo ratings yet

- Roces vs. Posadas 58 Phil 108Document4 pagesRoces vs. Posadas 58 Phil 108jack fackageNo ratings yet

- Taxation of Compensation from Expropriation of Land for US Military BaseDocument3 pagesTaxation of Compensation from Expropriation of Land for US Military Basemichee coi100% (1)

- J. Carpio-Morales: Surveillance If Such Importations Are Delivered Immediately and For Use Solely Within The SubicDocument3 pagesJ. Carpio-Morales: Surveillance If Such Importations Are Delivered Immediately and For Use Solely Within The SubicTippy Dos SantosNo ratings yet

- Churchill vs. Concepcion, 34 Phil. 969Document6 pagesChurchill vs. Concepcion, 34 Phil. 969Machida AbrahamNo ratings yet

- Taganito Mining Corporation Vs Cir (Tax1)Document2 pagesTaganito Mining Corporation Vs Cir (Tax1)Ritzchalle Garcia-Oalin0% (1)

- Marcos Ii VS CaDocument2 pagesMarcos Ii VS CaEJ LomocsoNo ratings yet

- Cases For April 8Document14 pagesCases For April 8Patrick RamosNo ratings yet

- Cases For April 8Document14 pagesCases For April 8Patrick RamosNo ratings yet

- Matalin Coconut Co. vs. Municipal Council of MalabangDocument1 pageMatalin Coconut Co. vs. Municipal Council of Malabangthornapple25100% (1)

- Form COD DGT 2Document1 pageForm COD DGT 2hafiedzs sNo ratings yet

- Reyes v. AlmanzorDocument5 pagesReyes v. AlmanzorPatricia BautistaNo ratings yet

- Caballes Vs DAR Case Digest PDFDocument4 pagesCaballes Vs DAR Case Digest PDFPatrick RamosNo ratings yet

- The Mortgage Professor'S Amortization Worksheet EnterDocument16 pagesThe Mortgage Professor'S Amortization Worksheet EnterYanyan XuNo ratings yet

- Renato v. Diaz & Aurora Ma. F. TimbolDocument3 pagesRenato v. Diaz & Aurora Ma. F. TimbolBernadetteGaleraNo ratings yet

- Progressive Development v. QC - 172 SCRA 629 (1989)Document6 pagesProgressive Development v. QC - 172 SCRA 629 (1989)Nikki Estores GonzalesNo ratings yet

- Chevron Philippines Inc. V. Cir G.R. No. 210836, September 01, 2015 FactsDocument1 pageChevron Philippines Inc. V. Cir G.R. No. 210836, September 01, 2015 FactsHIGHSENBERG BERGSENHIGHNo ratings yet

- CIR V Goodyear Philippines Inc., G.R. No. 216130, August 3, 2016.Document2 pagesCIR V Goodyear Philippines Inc., G.R. No. 216130, August 3, 2016.mae ann rodolfoNo ratings yet

- Payroll in ExcelDocument9 pagesPayroll in Excelsindhu100% (1)

- Tax refund granted for erroneously paid taxesDocument2 pagesTax refund granted for erroneously paid taxesAbilene Joy Dela CruzNo ratings yet

- Jardine Davies Insurance Brokers vs. AliposaDocument2 pagesJardine Davies Insurance Brokers vs. AliposaCarlota Nicolas Villaroman100% (1)

- V:/F'Ftmaj: Upreme OurtDocument12 pagesV:/F'Ftmaj: Upreme OurtShiela BorjaNo ratings yet

- Cases For February 28Document23 pagesCases For February 28Patrick RamosNo ratings yet

- Cases For February 28Document23 pagesCases For February 28Patrick RamosNo ratings yet

- Cases For February 28Document23 pagesCases For February 28Patrick RamosNo ratings yet

- CIR Vs SM Prime Holdings IncDocument2 pagesCIR Vs SM Prime Holdings IncewnesssNo ratings yet

- Cir Vs Mega GeneralDocument2 pagesCir Vs Mega GeneralAiken Alagban LadinesNo ratings yet

- Tax Refund for Overpaid Excise TaxDocument4 pagesTax Refund for Overpaid Excise TaxHappy Dreams Philippines0% (1)

- JLN Pending, Kuching 1 30/11/22Document4 pagesJLN Pending, Kuching 1 30/11/22Jue tingsNo ratings yet

- Republic V GonzalesDocument1 pageRepublic V GonzalesmenforeverNo ratings yet

- The Comprehensive Agrarian Reform Law (Ra 6657, As Amended)Document30 pagesThe Comprehensive Agrarian Reform Law (Ra 6657, As Amended)AlyannaBesaresNo ratings yet

- Francia V Intermediate Appellate Court GR No L-67649, June 28, 1988Document1 pageFrancia V Intermediate Appellate Court GR No L-67649, June 28, 1988franzadonNo ratings yet

- PAGCOR VAT Exemption UpheldDocument2 pagesPAGCOR VAT Exemption UpheldGem S. Alegado33% (3)

- AFISCO Insurance Corp. v. CA DigestDocument3 pagesAFISCO Insurance Corp. v. CA DigestAbigayle Recio100% (1)

- Gaston vs. Republic Planters BankDocument1 pageGaston vs. Republic Planters BankIshmael SalisipNo ratings yet

- Jaime N. Soriano, Et Al. vs. Secretary of FinanceDocument1 pageJaime N. Soriano, Et Al. vs. Secretary of FinanceVel June100% (1)

- Tax 2 Case Digests Part 2 Transfer Taxes PDFDocument25 pagesTax 2 Case Digests Part 2 Transfer Taxes PDFNolaida AguirreNo ratings yet

- NTC V CA 1999Document2 pagesNTC V CA 1999Pax Yabut100% (1)

- CIR v. Mitsubishi Metal, 181 SCRA 214Document2 pagesCIR v. Mitsubishi Metal, 181 SCRA 214Homer Simpson100% (1)

- Estate Tax on Gifts Inter VivosDocument2 pagesEstate Tax on Gifts Inter Vivoscool_peach100% (1)

- Taganito Mining v. CIRDocument2 pagesTaganito Mining v. CIR8111 aaa 1118No ratings yet

- Vegetable Oil Corp. V Trinidad, G.R. No. 21475, March 26, 1924, 45 Phil. 822Document2 pagesVegetable Oil Corp. V Trinidad, G.R. No. 21475, March 26, 1924, 45 Phil. 822Maria Fiona Duran MerquitaNo ratings yet

- 01 CIR v. BPIDocument2 pages01 CIR v. BPIRem Serrano100% (1)

- Construction Contract Dispute Leads to Damages ClaimDocument34 pagesConstruction Contract Dispute Leads to Damages ClaimRosalia L. Completano LptNo ratings yet

- 01 - Alvarez Vs GuingonaDocument2 pages01 - Alvarez Vs Guingonagraciello100% (1)

- Taganito Mining Corporation Vs CirDocument2 pagesTaganito Mining Corporation Vs CirDennyTemplonuevoNo ratings yet

- Local Autonomy PowersDocument2 pagesLocal Autonomy PowersJohn Lester LantinNo ratings yet

- 17.MARK-monserrat Vs CeronDocument2 pages17.MARK-monserrat Vs CeronbowbingNo ratings yet

- Limpan Vs CIRDocument5 pagesLimpan Vs CIRBenedick LedesmaNo ratings yet

- Taxation Case Law SummaryDocument94 pagesTaxation Case Law SummaryMichael jay sarmientoNo ratings yet

- CIR v. Burmeister & Wain Scandinavian Contractor Mindanao, IncDocument4 pagesCIR v. Burmeister & Wain Scandinavian Contractor Mindanao, IncearlanthonyNo ratings yet

- Extrajudicial Settlement of EstateDocument3 pagesExtrajudicial Settlement of EstatePatrick RamosNo ratings yet

- Oceanic Wireless Network, Inc. V. Cir G.R. NO. 148380 December 9, 2005 FactsDocument2 pagesOceanic Wireless Network, Inc. V. Cir G.R. NO. 148380 December 9, 2005 FactsGyelamagne EstradaNo ratings yet

- NPC Vs Mun. of NavotasDocument2 pagesNPC Vs Mun. of NavotasClaudine Christine A. VicenteNo ratings yet

- Republic V Mambulao Lumber Company, Et Al GR No L-17725, February 28, 1962Document1 pageRepublic V Mambulao Lumber Company, Et Al GR No L-17725, February 28, 1962franzadonNo ratings yet

- 208 - Jardine v. Aliposa - de LunaDocument1 page208 - Jardine v. Aliposa - de LunaVon Lee De LunaNo ratings yet

- Baluyot Vs HolganzaDocument3 pagesBaluyot Vs HolganzaJohn Allen De TorresNo ratings yet

- Procter & Gamble V Municipality of JagnaDocument2 pagesProcter & Gamble V Municipality of JagnaJackie Canlas100% (2)

- Reaction PaperDocument3 pagesReaction PaperPatrick Ramos80% (15)

- BAR E&AMINATION 2004 TAXATIONDocument8 pagesBAR E&AMINATION 2004 TAXATIONbubblingbrookNo ratings yet

- CIR vs. BENGUET CORPORATIONDocument3 pagesCIR vs. BENGUET CORPORATIONakosiemNo ratings yet

- Apostolic Prefect of Mountain Province v. City Treasurer of Baguio CityDocument1 pageApostolic Prefect of Mountain Province v. City Treasurer of Baguio CityRiel BanggotNo ratings yet

- H.20 PP Vs Castaneda GR No. L-46881 09151988 PDFDocument5 pagesH.20 PP Vs Castaneda GR No. L-46881 09151988 PDFbabyclaire170% (1)

- Tax Evasion Case Against Spouses DismissedDocument16 pagesTax Evasion Case Against Spouses Dismissedred gynNo ratings yet

- Boco, Cedrick S PUB CORPDocument3 pagesBoco, Cedrick S PUB CORPCedrick Contado Susi BocoNo ratings yet

- Income Tax Syllabus. Rev. Jan. 2021Document13 pagesIncome Tax Syllabus. Rev. Jan. 2021Macapado HamidahNo ratings yet

- 8 RCBC Vs CIR 2007Document9 pages8 RCBC Vs CIR 2007BLNNo ratings yet

- Bertillo - Phil. Guaranty Co. Inc. Vs CIR and CTADocument2 pagesBertillo - Phil. Guaranty Co. Inc. Vs CIR and CTAStella BertilloNo ratings yet

- Tax Refund Case OverviewDocument5 pagesTax Refund Case OverviewJustine Ashley SavetNo ratings yet

- To Be Given To NocheDocument1 pageTo Be Given To NochePatrick RamosNo ratings yet

- Demand Letter - TpiDocument1 pageDemand Letter - TpiPatrick RamosNo ratings yet

- Demand Letter - TpiDocument1 pageDemand Letter - TpiPatrick RamosNo ratings yet

- Cases For April 8Document37 pagesCases For April 8Patrick RamosNo ratings yet

- "Section 1. No Person Shall Be Deprived of Life, Liberty, or PropertyDocument5 pages"Section 1. No Person Shall Be Deprived of Life, Liberty, or PropertyPatrick RamosNo ratings yet

- Cases For February 21Document24 pagesCases For February 21Patrick RamosNo ratings yet

- Case Digest of Dissenting OpinionDocument4 pagesCase Digest of Dissenting OpinionPatrick RamosNo ratings yet

- Case Digest of Dissenting OpinionDocument4 pagesCase Digest of Dissenting OpinionPatrick RamosNo ratings yet

- Dissenting Opinion by J. Puno On Request For Radio-TV CoverageDocument32 pagesDissenting Opinion by J. Puno On Request For Radio-TV CoveragePatrick RamosNo ratings yet

- Needed Book For Conflict of LawsDocument1 pageNeeded Book For Conflict of LawsPatrick RamosNo ratings yet

- Cases For March 11Document10 pagesCases For March 11Patrick RamosNo ratings yet

- Cases For March 14Document20 pagesCases For March 14Patrick RamosNo ratings yet

- Cases For March 17Document15 pagesCases For March 17Patrick RamosNo ratings yet

- Cases For February 21Document24 pagesCases For February 21Patrick RamosNo ratings yet

- Election Law Syllabus - 2016-2017Document8 pagesElection Law Syllabus - 2016-2017Patrick Ramos100% (1)

- Cases For March 7Document14 pagesCases For March 7Patrick RamosNo ratings yet

- Agrarian Law and Social Legislation SyllabusDocument20 pagesAgrarian Law and Social Legislation SyllabusPatrick Ramos0% (1)

- EPIRA LawDocument38 pagesEPIRA LawPatrick RamosNo ratings yet

- Tax Invoice Dwaraka N: Billing Period Invoice Date Amount Payable Due Date Amount After Due DateDocument2 pagesTax Invoice Dwaraka N: Billing Period Invoice Date Amount Payable Due Date Amount After Due DateDwaraka PillaiNo ratings yet

- .Apr 2022Document10 pages.Apr 2022SWAPNIL JADHAVNo ratings yet

- Inv TG B1 50939724 101360733900 September 2021Document2 pagesInv TG B1 50939724 101360733900 September 2021b kranthi kumarNo ratings yet

- TRAIN Tax Law: Primer, Guide & BIR Sample ComputationsDocument4 pagesTRAIN Tax Law: Primer, Guide & BIR Sample ComputationsSymuelly Oliva PoyosNo ratings yet

- 2551QDocument2 pages2551QCris David Moreno79% (14)

- Ace Construction CoDocument2 pagesAce Construction CoNUR FARRAH SYAKIRAH AMRANNo ratings yet

- Go AirDocument3 pagesGo AirSatyabrataNayakNo ratings yet

- My Zone Card Statement: Payment SummaryDocument2 pagesMy Zone Card Statement: Payment SummaryKunal DasNo ratings yet

- US Internal Revenue Service: p1458Document799 pagesUS Internal Revenue Service: p1458IRSNo ratings yet

- Welcome LetterDocument4 pagesWelcome LettertushilohiaNo ratings yet

- Relief Us80Document4 pagesRelief Us80Rajesh KumarNo ratings yet

- Calcutta Bill - Abhimanyug@Document2 pagesCalcutta Bill - Abhimanyug@abhimanyugirotraNo ratings yet

- Tax on NGOs, Charities and ClubsDocument5 pagesTax on NGOs, Charities and ClubsSaneej SamsudeenNo ratings yet

- Form 16: Warora Kurnool Transmission LimitedDocument10 pagesForm 16: Warora Kurnool Transmission LimitedBHASKAR pNo ratings yet

- RTI Online: Your RTI Request Filed SuccessfullyDocument1 pageRTI Online: Your RTI Request Filed SuccessfullyUtsav DwivediNo ratings yet

- TAX Chapter 5 Reviewer - Summary Principles of Business Taxation TAX Chapter 5 Reviewer - Summary Principles of Business TaxationDocument5 pagesTAX Chapter 5 Reviewer - Summary Principles of Business Taxation TAX Chapter 5 Reviewer - Summary Principles of Business TaxationMakoy BixenmanNo ratings yet

- WalmartDocument3 pagesWalmartJulie SalamonNo ratings yet

- Electronic MoneyDocument2 pagesElectronic Moneyphongvu21No ratings yet

- BBPW3203 BiDocument303 pagesBBPW3203 BiYEENo ratings yet

- Assignment 6b FabmDocument4 pagesAssignment 6b FabmKhriza Joy SalvadorNo ratings yet

- Income From Salary GuideDocument53 pagesIncome From Salary GuideBoRO TriAngLENo ratings yet

- Direct Tax MCQs on Income Tax Act 1961Document26 pagesDirect Tax MCQs on Income Tax Act 1961rkhadke1No ratings yet

- Adobe Scan 23 Jan 2024Document1 pageAdobe Scan 23 Jan 2024rajeshNo ratings yet