Professional Documents

Culture Documents

Start Accumulating Quality Midcaps

Uploaded by

HareshOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Start Accumulating Quality Midcaps

Uploaded by

HareshCopyright:

Available Formats

Fund of the Month

January 11, 2016

Start accumulating quality portfolio

With markets having corrected more than 16% from the

highs, the risk-reward ratio for investment is favourable. It

is difficult to build a portfolio at precise market bottoms.

However, with a favourable reward to risk ratio, we

believe this is an opportune time for portfolio construction

from a long term perspective

Indian equity markets have witnessed selling pressure over the last few

months on the back of weak global markets. Indian markets have

corrected more than 16% from the all time high levels achieved in March

2015. The flight of capital from emerging markets on the back of concern

of further rate hikes from the US Federal Reserve on one hand and global

slowdown concern leading by slowdown in China have led to weakening

of market sentiments. We believe that the breather in 2015 forms part of

the larger bull market which began since mid 2013 and provides an

attractive incremental buying opportunity for long term investors.

The broader markets have consistently outperformed the benchmarks on

relative as well as absolute terms since the outcome of General Election in

May 2014. During structural downtrends, the broader markets are

generally hammered down and tend to underperform the benchmarks

owing to low risk appetite. However, strength in broader markets during

last 10 month corrective phase suggests strong appetite among

participants to own stocks even as benchmarks are undergoing a

corrective phase

Although the market sentiment may remain weak, stock specific

investment opportunities persist across the market segment irrespective of

the market capitalization. As earnings visibility exists in selected broader

market stocks, investors should focus on funds with quality stocks which

have higher growth potential. So, one has to be selective while investing,

thereby focusing on visibility of revenues, balance sheet strength, cash

flow profile and management quality

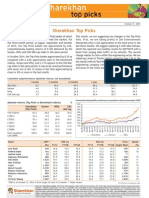

Exhibit 1: Forward PE ratio gap declines as we discount future

earnings

Exhibit 2: as earnings growth in midcap likely to be better for many of

the midcap stocks

Trend in one year forward P/Es

Earnings CAGR over FY15-FY18E of BSE Sensex vs. BSE Midcap

24.8

18.4

20.0

25

16.9

16.1

14.0

12.9 11.9

20

(x)

(x)

30

30

25

20

15

10

5

0

15

10

24.4

15.7

5

FY15

FY16E

Midcap P/E

FY17E

FY18E

0

Sensex

Sensex P/E

BSE Midcap Index

Source: Bloomberg, ICICIdirect.com Research

Source: Bloomberg, ICICIdirect.com Research

Indian economy poised for upturn

Research Analyst

Sachin Jain

sachin.jain@icicisecurities.com

Isha Bansal

isha.bansal@icicisecurities.com

Amid the earnings hiccups the macro indicators show that the economy is

poised for a cyclical upturn. The Chinese slowdown and the resultant

falling commodity prices (especially crude) have provided a huge cushion

to the government to maintain a balance between growth and fiscal

consolidation.

Furthermore, with falling inflation, the rate cut cycle (125 bps repo rate cut

in CY15) has begun, which is expected to be a huge boost for a revival of

the capex cycle as well as relief on working capital strains. The

governments improving gross tax collection (21.7% YoY in H1FY16) is

ICICI Securities Ltd | Retail Mutual Fund Research

also expected to provide a lever for higher allocation towards

infrastructure spending.

The government has initiated a number of structural policy reforms like

power reforms, road sector reforms, implementation of DBT in centrally

funded welfare schemes, increasing FDI in many sectors, thrust on

manufacturing in sectors like defence, focus on ease of doing business,

taxation reforms, etc. The GST bill proposed to be discussed in Rajya

Sabha in the ongoing winter session is a crucial development which

investors will be watching. Any positive development on this front will

boost investor sentiments. Structurally, the outlook for Indian equity

markets remains good on the back of a steep correction in commodities,

especially crude oil & industrial metals, 125 bps repo rate cut and

subsequent transmission of the same to corporate balance sheets along

with relatively stable exchange rates

Exhibit 3: Declining trend of CRB index indicates fall in commodity

prices since June 2014

Exhibit 4: Crude prices have declined by 70% from $114/bl in June14

120

340

90

$/bl

290

240

60

190

30

Jan-14

Feb-14

Mar-14

Apr-14

May-14

Jun-14

Jul-14

Aug-14

Sep-14

Oct-14

Nov-14

Dec-14

Jan-15

Feb-15

Mar-15

Apr-15

May-15

Jun-15

Jul-15

Aug-15

Sep-15

Oct-15

Nov-15

Dec-15

Jan-14

Feb-14

Mar-14

Apr-14

May-14

Jun-14

Jul-14

Aug-14

Sep-14

Oct-14

Nov-14

Dec-14

Jan-15

Feb-15

Mar-15

Apr-15

May-15

Jun-15

Jul-15

Aug-15

Sep-15

Oct-15

Nov-15

Dec-15

Jan-16

140

CRB Index

Brent Crude

Source: Bloomberg

Source: Bloomberg

Any intermediate throwbacks from here on should be utilised to buy in a

staggered manner from a medium-term perspective to ride the larger

uptrend

Preferred midcap funds:

Recommended funds

SBI Magnum Global Fund

HDFC Midcap Opportunities Fund

SBI Magnum Global Fund

Franklin India Smaller Companies Fund

HDFC Midcap Opportunities Fund

Franklin India Smaller Companies Fund

(Refer to attached fund cards for scheme details)

ICICI Securities Ltd | Retail Mutual Fund Research

Page 2

SBI Magnum Global Fund - 1994

Fund Objective

To provide the investors maximum growth opportunity through well researched investments in Indian equities, PCDs and FCDs from selected

industries with high growth potential and Bonds.

Standard Deviation (%)

Beta

Sharpe ratio

R Squared

Alpha (%)

Large

Mid

Small

Risk Parameters

Market Capitalisation (%)

Data as on January 05,2016 ;Portfolio details as on Nov-2015

Source: ACEMF

ICICIdirect.com

Mutual Fund Research

18.2

7.6

24.4

15.2

5.9

5.9

2.8

-1

31-Dec-12

31-Dec-13

9.71

-5.73

500

600

546.2

1000

459.7

1500

1064.9

1

1562.4

SIP Performance (Value if invested | 5000 per month (in'000))

2000

300

%

9.4

7.9

6.6

4.7

4.2

4.2

4.1

4.0

3.6

3.1

Asset Type

Domestic Equities

Domestic Equities

Domestic Equities

Domestic Equities

Domestic Equities

Domestic Equities

Domestic Equities

Domestic Equities

Domestic Equities

Domestic Equities

Last Three Years Performance

31-Dec-14

31-Dec-13

31-Dec-15

31-Dec-14

7.92

66.56

SBI Magnum Global Fund 7.43

54.69

Benchmark

263.3

Top 10 Sectors

Finance - NBFC

Chemicals

Bearings

Textile

Finance - Housing

Household & Personal Products

Batteries

Leather

Consumer Food

Tyres & Allied

5 Year

Benchmark

249.6

%

8.9

4.2

3.8

3.6

36

3.5

3.1

3.0

3.0

2.9

2.8

3 Year

Fund Name

180

Top 10 Holdings

Asset Type

CBLO

Cash & Cash Equivalents

Procter & Gamble Hygiene & Health Care Ltd Domestic Equities

Solar Industries (India) Ltd.

Domestic Equities

Britannia

Ltd.

Domestic

Equities

Bi

i IIndustries

d

i L

d

D

i E

ii

Cholamandalam Investment & Finance Com Domestic Equities

MRF Ltd.

Domestic Equities

Sundaram Finance Ltd.

Domestic Equities

Grindwell Norton Ltd.

Domestic Equities

Shriram City Union Finance Ltd.

Domestic Equities

Kajaria Ceramics Ltd.

Domestic Equities

1 Year

Fund

59.9

2011

78.2

-14.2

-34.2

899

6 Month

61.9

Calendar Year-wise Performance

2015

2014

2013

2012

NAV as on Dec 31 (|)

209.7

194.4

116.7

106.4

Return (%)

7.9

66.6

9.7

36.0

Benchmark (%)

7.4

54.7

-5.7

38.5

Net Assets (| Cr)

2378

1738

910

959

30

20

10

0

-10

60

SIP

Expense Ratio (%)

Exit Load

Benchmark

Last declared Quarterly AAUM(| cr)

Performance vs. Benchmark

133.5

September 30, 1994

R. Srinivasan

5000

1000

1.95

1% on or before 12M, Nil after 12M

S&P BSE Mid-Cap

2378

Return%

Key Information

NAV as on January 05, 2016 (|)

Inception Date

Fund Manager

Minimum Investment (|)

Lumpsum

0

1Yr

3Yrs

Total Investment

5Yrs

Fund Value

Benchmark Value

Whats In

Whats out

Kennametal India Ltd.

%

0.3

13.22

0.62

0.00

0.74

11.96

Total Stocks

Top 10 Holdings (%)

Fund P/E Ratio

Benchmark P/E Ratio

Fund P/BV Ratio

14.8

56.1

20.4

Equity

Debt

Cash

10Yrs

Portfolio Attributes

Asset Allocation

38.0

38.8

41.7

-10.0

91.3

0.0

8.7

Performance of all the schemes managed by the fund manager

31-Dec-14 31-Dec-13 31-Dec-12

Fund Name

31-Dec-15 31-Dec-14 31-Dec-13

SBI Small & Midcap Fund-Reg(G)

20.56

110.66

7.85

S&P BSE Small-Cap

6.76

69.24

-11.23

SBI Magnum Global Fund 94-Reg(D)

7.92

66.55

9.69

S&P BSE Mid-Cap

7.43

54.69

-5.73

SBI Magnum Balanced Fund-Reg(D)

7.36

43.23

11.85

Crisil Balanced Fund Index

0.48

25.34

6.05

SBI Emerging Businesses Fund-Reg(G)

4.33

58.01

-7.87

S&P BSE 500

-0.82

36.96

3.25

SBI Magnum Equity Fund-Reg(D)

2.43

42.65

5.54

NIFTY 50

-4.06

31.39

6.76

SBI Contra Fund-Reg(D)

-0.09

47.65

-1.75

S&P BSE 100

-3.25

32.28

5.87

Dividend History

Date

Oct-30-2015

Jun-06-2014

May-31-2011

Mar-12-2010

Mar-26-2007

Jul-01-2005

Value of investment of | 10000 invested since

inception

SBI Magnum Global fund

Benchmark

Additional Benchmark

Fund name

Product Label

This product is suitable for investors seeking*:

Long term growth opportunity

Investments in Indian equities, PCDs and FCDs

from selected industries with high growth

potential to provide investors maximum growth

opportunities

Data as on January 05,2016 ;Portfolio details as on Nov-2015

Source: ACEMF

ICICIdirect.com

Mutual Fund Research

Dividend (%)

51

57

50

50

50

42.5

|

NA

N/A

N/A

HDFC Mid-Cap Opportunities Fund

Fund Objective

The aim of the fund is to generate long-term capital appreciation from a portfolio that is substantially constituted of equity and equity related

securities of small and mid-cap companies.

Top 10 Sectors

Pharmaceuticals & Drugs

Bank - Private

IT - Software

Bank - Public

Finance - NBFC

Pesticides & Agrochemicals

Printing And Publishing

Air Conditioners

Tyres & Allied

Bearings

Standard Deviation (%)

Beta

Sharpe ratio

R Squared

Alpha (%)

Large

Mid

Small

Risk Parameters

Market Capitalisation (%)

Source: ACEMF

Mutual Fund Research

18.5

25.9

15.7

6.6

0.6

Fund

3 Year

5 Year

Benchmark

Last Three Years Performance

31-Dec-14

31-Dec-13

31-Dec-15

31-Dec-14

5.81

76.63

HDFC Mid-Cap Opportunities

6.46

55.91

Benchmark

Fund Name

31-Dec-12

31-Dec-13

9.64

-5.10

1Yr

3Yrs

Total Investment

5Yrs

Fund Value

%

0.3

0.2

Whats out

Total Stocks

Top 10 Holdings (%)

Fund P/E Ratio

Benchmark P/E Ratio

Fund P/BV Ratio

29.7

46.9

18.0

Equity

Debt

Cash

Portfolio Attributes

Asset Allocation

10Yrs

Benchmark Value

Whats In

Petronet LNG Ltd.

Interglobe Aviation Ltd.

15.03

0.76

-0.01

0.86

10.04

465.9

557.8

SIP Performance (Value if invested | 5000 per month (in'000))

600

500

00

400

300

200

100

0

300

%

10.6

7.4

7.2

6.8

4.7

4.4

3.8

3.8

3.2

2.9

1 Year

27

71

Asset Type

Domestic Equities

Domestic Equities

Domestic Equities

Domestic Equities

Domestic Equities

Domestic Equities

Domestic Equities

Domestic Equities

Domestic Equities

Domestic Equities

6 Month

249

9.4

%

3.0

2.9

2.3

2.3

23

2.3

2.3

2.3

2.3

2.1

2.0

180

Asset Type

Domestic Equities

Cash & Cash Equivalents

Domestic Equities

mestic

Funds

Un

i Mutual

M

lF

d U

Domestic Equities

Domestic Equities

Domestic Equities

Domestic Equities

Domestic Equities

Domestic Equities

Data as on January 05,2016 ;Portfolio details as on Nov-2015

ICICIdirect.com

2011

13.4

-18.3

-31.0

1593

10

61.7

Top 10 Holdings

Bajaj Finance Ltd.

CBLO

Aurobindo Pharma Ltd.

HDFC Li

Liquid

Fund(G)-Direct

Plan

id F

d(G) Di

Pl

Hindustan Petroleum Corporation Ltd.

Divis Laboratories Ltd.

Torrent Pharmaceuticals Ltd.

Voltas Ltd.

NIIT Technologies Ltd.

Ipca Laboratories Ltd.

2012

18.6

39.6

39.2

2756

20

60.7

Calendar Year-wise Performance

2015

2014

2013

NAV as on Dec 31 (|)

38.2

36.1

20.4

Return (%)

5.8

76.6

9.6

Benchmark (%)

6.5

55.9

-5.1

Net Assets (| Cr)

10763

9161

3049

30

60

SIP

Expense Ratio (%)

Exit Load

Benchmark

Last declared Quarterly AAUM(| cr)

Performance vs. Benchmark

37.9

June 25, 2007

Chirag Setalvad

5000

0

1.75

1% on or before 1Y, NIL after1Y

NIFTY MIDCAP 100

10763

Return%

Key Information

NAV as on January 05, 2016 (|)

Inception Date

Fund Manager

Minimum Investment (|)

Lumpsum

74.0

23.6

26.1

25.5

4.4

94.6

0.0

5.4

Performance of all the schemes managed by the fund manager

31-Dec-14 31-Dec-13 31-Dec-12

Fund Name

31-Dec-15 31-Dec-14 31-Dec-13

HDFC Small and Mid Cap Fund-Reg(G)

6.42

51.48

7.52

NIFTY SMALL 100

7.21

54.95

-8.28

HDFC Mid-Cap Opportunities Fund(G)

5.81

76.63

9.64

NIFTY MIDCAP 100

6.46

55.91

-5.10

HDFC Multiple Yield Fund 2005(G)

4.67

20.43

6.65

Crisil MIP Blended Index

6.79

16.83

4.41

HDFC Long Term Adv Fund(G)

-2.40

44.68

10.96

S&P BSE SENSEX

-5.03

29.89

8.98

Dividend History

Date

Mar-25-2015

Feb-28-2014

Feb-28-2013

Feb-23-2012

Value of investment of | 10000 invested since inception

HDFC Mid cap Opportunities fund

Benchmark

Additional Benchmark

Product Label

Fund name

This product is suitable for investors seeking*:

Long term capital appreciation

Investment predominantly in equity and equity

related instruments of Small and Mid Cap

companies

Data as on January 05,2016 ;Portfolio details as on Nov-2015

Source: ACEMF

ICICIdirect.com

Mutual Fund Research

Dividend (%)

20

17.5

11.5

15

|

NA

N/A

N/A

Franklin India Smaller Companies Fund

Fund Objective

An open end diversified equity fund that seeks to provide long term capital appreciation by investing in mid and small cap companies.

Top 10 Sectors

Bank - Private

Bearings

Air Conditioners

IT - Software

Cable

Chemicals

Cement & Construction Materials

Construction - Real Estate

Printing And Publishing

BPO/ITeS

Standard Deviation (%)

Beta

Sharpe ratio

R Squared

Alpha (%)

Large

Mid

Small

Risk Parameters

Market Capitalisation (%)

Data as on January 05,2016 ;Portfolio details as on Nov-2015

Source: ACEMF

ICICIdirect.com

Mutual Fund Research

21.6

15.7

7.9

6.6

642.3

SIP Performance (Value if invested | 5000 per month (in'000))

800

600

400

200

465.9

%

12.7

6.7

4.6

3.5

3.5

3.3

3.2

3.2

3.1

3.0

31-Dec-12

31-Dec-13

13.22

-5.10

300

0

Asset Type

Domestic Equities

Domestic Equities

Domestic Equities

Domestic Equities

Domestic Equities

Domestic Equities

Domestic Equities

Domestic Equities

Domestic Equities

Domestic Equities

Last Three Years Performance

31-Dec-14

31-Dec-13

31-Dec-14

31-Dec-15

9.56

89.92

Franklin India Smaller Comp

6.46

55.91

Benchmark

295

%

9.5

3.5

3.0

2.8

28

2.8

2.4

2.4

2.3

2.2

2.1

5 Year

Benchmark

4

249.4

Asset Type

Cash & Cash Equivalents

Domestic Equities

Domestic Equities

Domestic

Equities

D

i E

ii

Domestic Equities

Rights

Domestic Equities

Domestic Equities

Domestic Equities

Domestic Equities

3 Year

Fund Name

180

Top 10 Holdings

Call Money

Finolex Cables Ltd.

eClerx Services Ltd.

FAG Bearings

India

B i

I di Ltd.

Ld

Yes Bank Ltd.

Tata Motors - DVR Ordinary

Voltas Ltd.

Repco Home Finance Ltd.

Atul Ltd.

HDFC Bank Ltd.

2011

11.3

-25.9

-31.0

307

1 Year

Fund

61.7

2012

17.1

51.7

39.2

344

6 Month

62

Calendar Year-wise Performance

2015

2014

2013

NAV as on Dec 31 (|)

40.2

36.7

19.3

Return (%)

9.6

89.9

13.2

Benchmark (%)

6.5

55.9

-5.1

Net Assets (| Cr)

2651

1774

369

SIP

40

30

20

10

0

60

Expense Ratio (%)

Exit Load

Benchmark

Last declared Quarterly AAUM(| cr)

31.9

Performance vs. Benchmark

40.0

January 13, 2006

R. Janakiraman

5000

0

2.35

1% on or before 1Y

NIFTY MIDCAP 100

2651

Return%

Key Information

NAV as on January 05, 2016 (|)

Inception Date

Fund Manager

Minimum Investment (|)

Lumpsum

0

1Yr

3Yrs

Total Investment

5Yrs

Fund Value

Benchmark Value

Whats In

Whats out

AIA Engineering Ltd.

%

0.7

14.47

0.73

0.01

0.80

12.42

Total Stocks

Top 10 Holdings (%)

Fund P/E Ratio

Benchmark P/E Ratio

Fund P/BV Ratio

12.5

29.0

49.1

Equity

Debt

Cash

10Yrs

Portfolio Attributes

Asset Allocation

70.0

32.8

26.7

25.5

4.5

88.2

0.0

11.8

Performance of all the schemes managed by the fund manager

31-Dec-14 31-Dec-13 31-Dec-12

Fund Name

31-Dec-15 31-Dec-14 31-Dec-13

Franklin India Smaller Cos Fund(G)

9.56

89.92

13.22

NIFTY MIDCAP 100

6.46

55.91

-5.10

Franklin India Feeder - Franklin U.S. Opport

8.76

8.37

55.24

----Franklin India Prima Fund(G)

6.81

78.14

7.40

NIFTY 500

-0.72

37.82

3.61

Franklin India Opportunities Fund(G)

2.30

58.58

2.14

S&P BSE 200

-1.48

35.47

4.38

Franklin India Flexi Cap Fund(G)

1.96

55.90

7.07

NIFTY 500

-0.72

37.82

3.61

Franklin India High Growth Cos Fund(G)

1.49

79.58

9.22

NIFTY 500

-0.72

37.82

3.61

Franklin Asian Equity Fund(G)

-4.59

9.18

12.36

-----

Dividend History

Date

Feb-23-2015

Feb-17-2014

Feb-25-2013

Aug-09-2007

Value of investment of | 10000 invested since

inception

Franklin India Smaller companies

Benchmark

Additional Benchmark

Product Label

This product is suitable for investors seeking*:

Long term capital appreciation

A fund that invests primarily in small and mid

cap companies

Data as on January 05,2016 ;Portfolio details as on Nov-2015

Source: ACEMF

ICICIdirect.com

Mutual Fund Research

Dividend (%)

20

15

25

9

|

570000

871370

736745

Pankaj Pandey

Head Research

pankaj.pandey@icicisecurities.com

ICICIdirect.com Research Desk,

ICICI Securities Limited,

1st Floor, Akruti Trade Centre,

Road No. 7, MIDC,

Andheri (East)

Mumbai 400 093

research@icicidirect.com

Disclaimer

ANALYST CERTIFICATION

We Sachin Jain, CA and Isha Bansal, MBA (Fin) Research Analysts, authors and the names subscribed to this report, hereby certify that all of the views

expressed in this research report accurately reflect our views about the subject issuer(s) or Funds. We also certify that no part of our compensation

was, is, or will be directly or indirectly related to the specific recommendation(s) or view(s) in this report.

Terms & conditions and other disclosures:

ICICI Securities Limited (ICICI Securities) AMFI Regn. No.: ARN-0845. Registered office of I-Sec is at ICICI Securities Ltd. - ICICI Centre, H. T. Parekh

Marg, Churchgate, Mumbai - 400020, India. ICICI Securities Limited is a Sebi registered Research Analyst having registration no. INH000000990. ICICI

Securities is a full-service, integrated investment banking and is, inter alia, engaged in the business of stock broking and distribution of financial

products. ICICI Securities is a wholly-owned subsidiary of ICICI Bank which is Indias largest private sector bank and has its various subsidiaries

engaged in businesses of housing finance, asset management, life insurance, general insurance, venture capital fund management, distribution of

financial products etc. (associates), the details in respect of which are available on www.icicibank.com.

ICICI Securities is one of the leading distributors of Mutual Funds and participate in distribution of Mutual Fund Schemes of almost all AMCs in India.

The selection of the Mutual Funds for the purpose of including in the indicative portfolio does not in any way constitute any recommendation by ICICI

Securities Limited (hereinafter referred to as ICICI Securities) with respect to the prospects or performance of these Mutual Funds. The investor has the

discretion to buy all or any of the Mutual Fund units forming part of any of the indicative portfolios on icicidirect.com. Before placing an order to buy

the funds forming part of the indicative portfolio, the investor has the discretion to deselect any of the units, which he does not wish to buy. Nothing in

the indicative portfolio constitutes investment, legal, accounting and tax advice or a representation that any investment or strategy is suitable or

appropriate to the investor's specific circumstances.

The details included in the indicative portfolio are based on information obtained from public sources and sources believed to be reliable, but no

independent verification has been made nor is its accuracy or completeness guaranteed. The funds included in the indicative portfolio may not be

suitable for all investors, who must make their own investment decisions, based on their own investment objectives, financial positions and needs.

This may not be taken in substitution for the exercise of independent judgement by any investor. The investor should independently evaluate the

investment risks. ICICI Securities and affiliates accept no liabilities for any loss or damage of any kind arising out of the use of this indicative portfolio.

Past performance is not necessarily a guide to future performance. Actual results may differ materially from those set forth in projections. ICICI

Securities may be holding all or any of the units included in the indicative portfolio from time to time as part of our treasury management. ICICI

Securities Limited is not providing the service of Portfolio Management Services (Discretionary or Non Discretionary) to its clients.

Mutual fund investments are subject to market risks, read all scheme related documents carefully.

Kindly note that such research recommended funds in indicative portfolio are not based on individual risk profile of each customer unless a customer

has opted for a paid Investment Advisory Service offered by I-Sec. Investors should consult their financial advisers if in doubt about whether the

product is suitable for them.

The information contained herein is strictly confidential and meant solely for the selected recipient and may not be altered in any way, transmitted to,

copied or distributed, in part or in whole, to any other person or to the media or reproduced in any form, without prior written consent of ICICI

Securities Limited. The contents of this mail are solely for informational purpose and may not be used or considered as an offer document or

solicitation of offer to buy or sell or subscribe for securities or other financial instruments or any other product. While due care has been taken in

preparing this mail, I-Sec and affiliates accept no liabilities for any loss or damage of any kind arising out of any inaccurate, delayed or incomplete

information nor for any actions taken in reliance thereon. This mail/report is not directed or intended for distribution to, or use by, any person or entity

who is a citizen or resident of or located in any locality, state, country or other jurisdiction, where such distribution, publication, availability or use

would be contrary to law, regulation or which would subject I-Sec and affiliates to any registration or licensing requirement within such jurisdiction.

ICICI Securities and/or its associates receive compensation/ commission for distribution of Mutual Funds from various Asset Management Companies

(AMCs). ICICI Securities host the details of the commission rates earned by ICICI Securities from Mutual Fund houses on our website

www.icicidirect.com. Hence, ICICI Securities or its associates may have received compensation from AMCs whose funds are mentioned in the report

during the period preceding twelve months from the date of this report for distribution of Mutual Funds or for providing marketing advertising support

to these AMCs. ICICI Securities also provides stock broking services to institutional clients including AMCs. Hence, ICICI Securities may have received

brokerage for security transactions done by any of the above AMCs during the period preceding twelve months from the date of this report

ICICI Securities Ltd | Retail Mutual Fund Research

Page 3

You might also like

- Understanding Natural Gas and LNG OptionsDocument248 pagesUnderstanding Natural Gas and LNG OptionsTivani MphiniNo ratings yet

- Clearance Procedures for ImportsDocument36 pagesClearance Procedures for ImportsNina Bianca Espino100% (1)

- John L Person- Forex Conquered Pivot Point Analysis NotesDocument2 pagesJohn L Person- Forex Conquered Pivot Point Analysis Notescalibertrader100% (1)

- This Study Resource Was: Case: San Miguel in The New MillenniumDocument2 pagesThis Study Resource Was: Case: San Miguel in The New MillenniumBaby BabeNo ratings yet

- EQUITY SECURITIES With Answer For Uploading PDFDocument10 pagesEQUITY SECURITIES With Answer For Uploading PDFMaricon Berja100% (1)

- Oil and Gas Service Contracts: A Review of 8 Countries' StrategiesDocument21 pagesOil and Gas Service Contracts: A Review of 8 Countries' StrategiesRicardo IbarraNo ratings yet

- Weekly Market Commentary 04132015Document4 pagesWeekly Market Commentary 04132015dpbasicNo ratings yet

- Sam Strother and Shawna Tibbs Are Vice Presidents of MutualDocument2 pagesSam Strother and Shawna Tibbs Are Vice Presidents of MutualAmit PandeyNo ratings yet

- H1 2014 - Market InsightsDocument50 pagesH1 2014 - Market Insightsshaj VarmaNo ratings yet

- Stock Investment Tips Recommendation - Buy Stocks of Shree Cement With Target Price Rs.4791Document20 pagesStock Investment Tips Recommendation - Buy Stocks of Shree Cement With Target Price Rs.4791Narnolia Securities LimitedNo ratings yet

- Sharekhan Top Picks: Absolute Returns (Top Picks Vs Benchmark Indices) % Sharekhan Sensex Nifty CNX (Top Picks) Mid-CapDocument7 pagesSharekhan Top Picks: Absolute Returns (Top Picks Vs Benchmark Indices) % Sharekhan Sensex Nifty CNX (Top Picks) Mid-CapJignesh RampariyaNo ratings yet

- Equity Market Review Jan-11Document23 pagesEquity Market Review Jan-11Shailendra GaurNo ratings yet

- Recovery FundDocument31 pagesRecovery FundRohitOberoiNo ratings yet

- 46 - India - BARDocument21 pages46 - India - BARgirishrajsNo ratings yet

- India Inc. A Look AheadDocument20 pagesIndia Inc. A Look AheadsebbatasNo ratings yet

- India: Financial Services: Still Amid Choppy Waters Stocks Not Yet Ready For UpturnDocument25 pagesIndia: Financial Services: Still Amid Choppy Waters Stocks Not Yet Ready For UpturnPranjayNo ratings yet

- Diwali-Picks Microsec 311013 PDFDocument14 pagesDiwali-Picks Microsec 311013 PDFZacharia VincentNo ratings yet

- Straight from the Fund Manager - Insights on Indian Markets, Economy and SectorsDocument1 pageStraight from the Fund Manager - Insights on Indian Markets, Economy and SectorsAditya BahlNo ratings yet

- ELSS Invest Long Term HorizonDocument8 pagesELSS Invest Long Term HorizonTamil KannanNo ratings yet

- J Street Volume 282Document10 pagesJ Street Volume 282JhaveritradeNo ratings yet

- Stock Market Today Tips - Book Profit On The Stock CMCDocument21 pagesStock Market Today Tips - Book Profit On The Stock CMCNarnolia Securities LimitedNo ratings yet

- Sip 06 May 201010Document5 pagesSip 06 May 201010Sneha SharmaNo ratings yet

- Sharekhan Top Picks: Absolute Returns (Top Picks Vs Benchmark Indices) % Sharekhan Sensex Nifty CNX (Top Picks) Mid-CapDocument7 pagesSharekhan Top Picks: Absolute Returns (Top Picks Vs Benchmark Indices) % Sharekhan Sensex Nifty CNX (Top Picks) Mid-CapRajesh KarriNo ratings yet

- Top Pick SMFDocument5 pagesTop Pick SMFDebjit DasNo ratings yet

- KRBL ReportDocument28 pagesKRBL ReportHardeep Singh SohiNo ratings yet

- Mutual Fund Review: Equity Markets UpdateDocument31 pagesMutual Fund Review: Equity Markets Updatemaitre6669No ratings yet

- LPL 2014 Mid-Year OutlookDocument15 pagesLPL 2014 Mid-Year Outlookkbusch32No ratings yet

- Sharekhan Top Picks: CMP As On September 01, 2014 Under ReviewDocument7 pagesSharekhan Top Picks: CMP As On September 01, 2014 Under Reviewrohitkhanna1180No ratings yet

- Corporate GovernanceDocument182 pagesCorporate GovernanceBabu RaoNo ratings yet

- Which Sensex Stocks Should You Bet On - The Economic Times On MobileDocument22 pagesWhich Sensex Stocks Should You Bet On - The Economic Times On MobileKirti NagdaNo ratings yet

- Ashiana Crisil PDFDocument22 pagesAshiana Crisil PDFJaimin ShahNo ratings yet

- Britannia Q1 FY15-16 Results & OutlookDocument29 pagesBritannia Q1 FY15-16 Results & OutlookDaniel ChngNo ratings yet

- Reliance Mutual Fund Reliance Small Cap Fund: PresentsDocument33 pagesReliance Mutual Fund Reliance Small Cap Fund: PresentsVishnu KumarNo ratings yet

- Sharekhan Top Picks Analysis and Stock RecommendationsDocument7 pagesSharekhan Top Picks Analysis and Stock RecommendationsAnonymous W7lVR9qs25No ratings yet

- HDFC Prudence Fund PDFDocument21 pagesHDFC Prudence Fund PDFaadhil1992No ratings yet

- Mirae Asset Funds Speak April 2014Document15 pagesMirae Asset Funds Speak April 2014Prasad JadhavNo ratings yet

- Ipru Value Discovery FundDocument4 pagesIpru Value Discovery FundJ.K. GarnayakNo ratings yet

- JSTREET Volume 325Document10 pagesJSTREET Volume 325JhaveritradeNo ratings yet

- Top Picks For 2015Document14 pagesTop Picks For 2015Dhawan SandeepNo ratings yet

- Crisil Yearbook On The Indian Debt Market 2015.unlockedDocument114 pagesCrisil Yearbook On The Indian Debt Market 2015.unlockedPRATIK JAINNo ratings yet

- 4QFY14E Results Preview: Institutional ResearchDocument22 pages4QFY14E Results Preview: Institutional ResearchGunjan ShethNo ratings yet

- J Street Volume 262Document8 pagesJ Street Volume 262JhaveritradeNo ratings yet

- Indian Equity Market Capitalization Today - Buy Stocks of Emami LTD With Target Price Rs 635.Document21 pagesIndian Equity Market Capitalization Today - Buy Stocks of Emami LTD With Target Price Rs 635.Narnolia Securities LimitedNo ratings yet

- PC Jeweller LTD IER InitiationReport 2Document28 pagesPC Jeweller LTD IER InitiationReport 2Himanshu JainNo ratings yet

- Dewan Housing 2QFY15 Results Update Maintains Strong GrowthDocument6 pagesDewan Housing 2QFY15 Results Update Maintains Strong GrowthSUKHSAGAR1969No ratings yet

- Investor 2015Document61 pagesInvestor 2015rajasekarkalaNo ratings yet

- Weekly Market Commentary 03302015Document5 pagesWeekly Market Commentary 03302015dpbasicNo ratings yet

- Stock Advisory For Today - But Stock of Coal India LTD and Cipla LimitedDocument24 pagesStock Advisory For Today - But Stock of Coal India LTD and Cipla LimitedNarnolia Securities LimitedNo ratings yet

- India Equity Analytics: HCLTECH: "Retain Confidence"Document27 pagesIndia Equity Analytics: HCLTECH: "Retain Confidence"Narnolia Securities LimitedNo ratings yet

- The Money Navigator April 2016Document36 pagesThe Money Navigator April 2016JhaveritradeNo ratings yet

- Information Bite 15mar8Document4 pagesInformation Bite 15mar8information.biteNo ratings yet

- Investment Funds Advisory Today - Buy Stock of Escorts LTD and Neutral View On Hindustan UnileverDocument26 pagesInvestment Funds Advisory Today - Buy Stock of Escorts LTD and Neutral View On Hindustan UnileverNarnolia Securities LimitedNo ratings yet

- Weekly Equity NewsletterDocument4 pagesWeekly Equity Newsletterapi-221305449No ratings yet

- How To Calculate Returns From A Mutual Fund - Economic TimesDocument2 pagesHow To Calculate Returns From A Mutual Fund - Economic TimesManishKaloniaNo ratings yet

- RBI Policy Review Oct 2011 Highlights and RecommendationDocument7 pagesRBI Policy Review Oct 2011 Highlights and RecommendationKirthan Ψ PurechaNo ratings yet

- Investment Banking Industry Analysis Report PDFDocument46 pagesInvestment Banking Industry Analysis Report PDFricky franklinNo ratings yet

- Sharekhan Top Picks for February 2013Document7 pagesSharekhan Top Picks for February 2013nit111No ratings yet

- Market Watch Daily 20.01.2014Document1 pageMarket Watch Daily 20.01.2014Randora LkNo ratings yet

- Time Not TimingDocument1 pageTime Not TimingtpsuryaNo ratings yet

- Dhanuka Agritech - Detailed Report - CRISIL - July 2013Document27 pagesDhanuka Agritech - Detailed Report - CRISIL - July 2013aparmarinNo ratings yet

- Mid-Year Outlook 2014 Abridged: Investor's Almanac Field NotesDocument4 pagesMid-Year Outlook 2014 Abridged: Investor's Almanac Field NotesJanet BarrNo ratings yet

- India Financials SU 09 April 2015Document64 pagesIndia Financials SU 09 April 2015leorbalaguruNo ratings yet

- Centrum Broking Limited: Institutional EquitiesDocument53 pagesCentrum Broking Limited: Institutional EquitiesgirishrajsNo ratings yet

- Market Watch Daily 25.02.2014Document1 pageMarket Watch Daily 25.02.2014Randora LkNo ratings yet

- Market Outlook 16th March 2012Document4 pagesMarket Outlook 16th March 2012Angel BrokingNo ratings yet

- Top SIP fund picks for disciplined long-term investingDocument4 pagesTop SIP fund picks for disciplined long-term investingLaharii MerugumallaNo ratings yet

- Government of Andhra Pradesh Backward Classes Welfare DepartmentDocument3 pagesGovernment of Andhra Pradesh Backward Classes Welfare DepartmentDjazz RohanNo ratings yet

- ADocument6 pagesAJuan Gabriel Garcia LunaNo ratings yet

- Written Math Solutions and Word ProblemsDocument1 pageWritten Math Solutions and Word ProblemsShakir AhmadNo ratings yet

- CH 7 Stocks Book QuestionsDocument9 pagesCH 7 Stocks Book QuestionsSavy DhillonNo ratings yet

- Annual Report 2016-2017 PDFDocument138 pagesAnnual Report 2016-2017 PDFPunita PandeyNo ratings yet

- Spanish Town High Entrepreneurship Unit 2 Multiple Choice QuestionsDocument4 pagesSpanish Town High Entrepreneurship Unit 2 Multiple Choice Questionspat samNo ratings yet

- The Last Four Digits of The Debtor's Federal Tax Identification Number Are 3507Document5 pagesThe Last Four Digits of The Debtor's Federal Tax Identification Number Are 3507Chapter 11 DocketsNo ratings yet

- Special Intake For 2022 Elite Lite Activity Bonus W.E.F. 1 Oct 2022Document5 pagesSpecial Intake For 2022 Elite Lite Activity Bonus W.E.F. 1 Oct 2022Kanaka DhasheneNo ratings yet

- CPT Mock QuestionDocument41 pagesCPT Mock QuestionVijay Teja Reddy100% (1)

- What Are The Features of The IstisnaDocument4 pagesWhat Are The Features of The IstisnaanassaleemNo ratings yet

- 3732 8292 1 PBDocument15 pages3732 8292 1 PBRasly 28No ratings yet

- Commercial Real Estate Manager in Los Angeles CA Resume Robert HarrisDocument2 pagesCommercial Real Estate Manager in Los Angeles CA Resume Robert HarrisRobertHarrisNo ratings yet

- Homework 6Document6 pagesHomework 6LiamNo ratings yet

- Sample Audit ReportsDocument3 pagesSample Audit Reportsvivek1119100% (1)

- Haldiram Foods International LTD 2005Document10 pagesHaldiram Foods International LTD 2005Saurabh PatilNo ratings yet

- Cortazar Schwartz Naranjo 2007Document17 pagesCortazar Schwartz Naranjo 2007carreragerardoNo ratings yet

- Model By-Laws For The Regulated Non-Withdrawable Deposit Taking Non-Wdt Sacco Societies in KenyaDocument59 pagesModel By-Laws For The Regulated Non-Withdrawable Deposit Taking Non-Wdt Sacco Societies in KenyaAmos NjeruNo ratings yet

- Business Cae - Cameron LNGDocument12 pagesBusiness Cae - Cameron LNGDavidNo ratings yet

- Statement of Financial PositionDocument2 pagesStatement of Financial PositionAnnabeth BrionNo ratings yet

- 1 Partnership FormationDocument7 pages1 Partnership FormationJ MahinayNo ratings yet

- REPORT ON Bank Performance Analysis: A Comparative Study of Premier Bank and One BankDocument36 pagesREPORT ON Bank Performance Analysis: A Comparative Study of Premier Bank and One BankTakia KhanNo ratings yet

- Adjusting Accounts and Preparing Financial StatementsDocument48 pagesAdjusting Accounts and Preparing Financial Statementsjoeltan111100% (1)

- Commercial Utility of BailmentDocument6 pagesCommercial Utility of BailmentEditor IJTSRDNo ratings yet