Professional Documents

Culture Documents

Highlights: World Estimates

Uploaded by

Khrystyna MatsopaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Highlights: World Estimates

Uploaded by

Khrystyna MatsopaCopyright:

Available Formats

WORLD ESTIMATES

HIGHLIGHTS

The projection for world total grains (wheat and coarse grains)

production in 2015/16 is 3m t lower m/m (month-on-month), at

1,996m, about 2% below last seasons record. Nearly all the m/m

decrease is for maize (corn), with a higher estimate in the US offset

by drought-related reductions in Ethiopia, South Africa and China.

Consumption is expected to show a fractional y/y (year-on-year) gain

to 1,992m t, mainly on a sustained rise in food demand. The feed use

figure is slightly lower than before owing to likely reduced uptake of

imported sorghum in China. The anticipated cut in sorghum

shipments to that country is reflected in a downward revision to total

grains trade, to 314m t. With US exports of sorghum likely to be

curtailed, more is expected to be used locally in place of maize,

including for ethanol and feed. The global grains stocks forecast is

unchanged m/m, at a 29-year high of 454m t.

The projection of world soyabean production in 2015/16 is lifted by

2m t, to 321m, matching last years all-time peak. However, reflecting

a reduced figure for opening stocks, coupled with an upward revision

to total use, the forecast of aggregate carryovers is down slightly from

October, with most of the adjustment due to the major exporters.

Nevertheless, at 46.7m t, inventories would still be up by 4% y/y at a

fresh high. The outlook for trade is upgraded to about 129m t, with

Chinas needs accounting for the modest y/y rise. Brazil is seen as

the largest exporter in 2015/16, its shipments significantly exceeding

those by the US.

Global rice output in 2015/16 is forecast broadly unchanged from

October, at around 474m t, a marginal fall from the previous years

record. Owing to smaller opening stocks and with consumption likely

to expand to a new peak, global end-season reserves are anticipated

to tighten markedly, by 12%, to 94m t mostly on steep declines in

the major exporters. Projected trade is maintained at 41.5m t, down

fractionally y/y, but well above average on firm demand from buyers

in Asia in particular.

Bearish fundamentals pressured export values in November, with the

IGC Grains and Oilseeds Index (GOI) weakening by 3%.

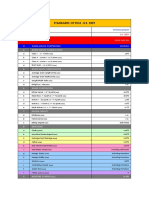

12/13

million tons

TOTAL GRAINS

13/14

14/15

est.

a)

Production

15/16

f'cast

29.10

19.11

1797

2006

2030

1999

271

310

322

315

314

1820

1932

1989

1991

1992

Carryover stocks

336

409

450

454

454

year/year change

-23

74

40

98

120

145

142

149

Production

655

714

723

726

726

Trade

142

156

153

150

151

Consumption

677

696

710

718

720

Carryover stocks

170

188

201

209

208

year/year change

-21

18

14

Trade

Consumption

Major exporters

b)

1996

WHEAT

Major exporters

b)

50

54

63

67

69

Production

869

997

1013

970

967

Trade

100

122

125

125

125

Consumption

866

947

987

974

974

Carryover stocks

132

181

207

200

200

year/year change

50

26

MAIZE (CORN)

Major exporters

c)

-7

33

51

63

59

60

272

285

321

319

321

99

113

127

126

129

266

281

308

317

319

Carryover stocks

28

32

45

49

47

year/year change

13

SOYABEANS

Production

Trade

Consumption

Major exporters

d)

11

12/13

14

13/14

est.

25

14/15

f'cast

million tons (milled basis)

33

30

15/16

proj.

29.10

19.11

RICE

Production

473

478

478

474

38

43

42

42

42

Consumption

469

479

483

487

486

Carryover stocks

113

112

107

94

year/year change

-2

-5

40

38

31

Trade

Major exporters

e)

474

94

-13

21

21

Figures may not add due to rounding

a)

Wheat and coarse grains

b)

Argentina, Australia, Canada, EU, Kazakhstan, Russia, Ukraine, US

c)

Argentina, Brazil, Ukraine, US

d)

Argentina, Brazil, US

e)

India, Pakistan, Thailand, US, Vietnam

IGC GRAINS & OILSEEDS INDEX (GOI)

350

Jan 2000 = 100

300

250

200

2015

2014

2010-14 range

150

Jan

Feb

Mar

Apr

May

Jun

Jul

Aug

See: http://www.igc.int/grainsupdate/igc_goi.xlsb

O V E RV I E W

Sep

Nov

Dec

harvested area is projected at 221.8m ha, down almost 1% y/y.

Grains production in 2015/16 to be down 2% y/y, mainly

on lower maize output.

Despite strong demand, a further rise in stocks is

forecast, to their highest in 29 years, but with an

increased share in China.

World wheat harvested area in 2016/17 seen falling by

less than 1%.

Global soyabean output is projected to match the

previous years record, with end-season stocks likely

to edge higher, to a fresh peak.

Rice trade to remain historically high in 2016 on sales

to key buyers in Asia.

Total grains: Supply and demand summary

mt

12/13

13/14

14/15

15/16

y/y

336

(est.)

409

(f'cast)

450

change

359

Production

Total supply

1,797

2,156

2,006

2,342

2,030

2,439

1,996

2,446

Total use

of which: Food

Feed

Industrial

Closing stocks

1,820

637

772

299

336

1,932

651

840

316

409

1,989

660

879

323

450

1,992

666

877

327

454

+ 0.2%

a)

98

271

120

310

145

322

149

314

+ 3.2%

- 2.3%

Opening stocks

major exporters

Trade (Jul/Jun)

+ 9.9%

- 1.7%

+ 0.3%

+ 1.0%

Against the backdrop of tentative prospects for a marginal

expansion of harvested area, together with above-average

yields, global soyabean production in 2015/16 could match

last seasons peak. While growing demand for soyabean

products is expected to contribute to a 3% rise in consumption,

end-season inventories are still seen edging up to a new high

as accumulation in the major exporters compensates for

declines elsewhere, primarily in China. A modest increase in

deliveries to that market is likely to boost trade to a record of

129m t. Soyameal import demand could reach a high of 63m t

on heavy sales to feed users in the EU and Far East Asia.

World rice output in 2015/16 is seen 1% lower than the

previous years peak as disappointing crops in some

producers including India and Thailand are only partly

offset by improved harvests elsewhere in Asia. With food

demand expected to underpin record consumption, aggregate

end-season inventories are set to contract markedly almost

entirely tied to a drop of one-third in the major exporters. Trade

is anticipated to remain historically high in calendar 2016 on

shipments to a number of Asian markets, including Indonesia

and the Philippines, amid state efforts to ensure ample

domestic supplies. Thailand is seen as the biggest exporter for

the first time since 2011.

- 0.2%

+ 1.2%

M A R K E T S U M M A RY

+ 0.9%

a) Argentina, Australia, Canada, EU, Kazakhstan, Russia, Ukraine, US

World total grains (wheat and coarse grains) production in

2015/16 is expected to be down only slightly y/y. Bumper

outturns of wheat, barley and sorghum were outweighed by a

fall for maize, although output of that crop could still be the

third largest ever.

Total consumption is placed marginally higher y/y, at 1,992m t.

Food use is forecast to expand by 1%, broadly matching

population growth. Strong demand for livestock products will

underpin feeding, while industrial use is seen climbing by 1%,

led by uptake for starch. Global end-2015/16 stocks (aggregate

of respective local marketing years) are projected to expand by

4m t, to 454m, the most since the mid-1980s, including a

further rise in the major exporters. However, Chinas share of

the world total could be the biggest in 15 years, with

inventories there largely inaccessible to the global grains

economy. A 7m t fall in world trade is forecast, to 314m, mainly

because of smaller wheat and barley imports in Near East Asia

and North Africa.

Northern hemisphere 2016/17 winter wheat sowing is almost

finished. Conditions are mostly good, but concerns persist

about dryness in some parts, especially in Ukraine.

Incorporating assumptions for spring wheat plantings and the

next southern hemisphere crops, world

After gains in the previous two months, most grains and

oilseeds export prices have eased since the last GMR. While

markets were occasionally underpinned by unfavourable

weather, including in parts of the Black Sea region, the

Americas and Asia, prices gradually turned lower on a

renewed focus on bearish supply and demand fundamentals.

The IGC GOI dropped by 3% from late October and is down by

19% y/y.

Losses in barley markets were particularly pronounced, with

average export prices falling by 4% on currency movements,

reduced buying by China and seasonal harvest pressure in

Australia. The wheat and soyabean indices both declined by

3%.

IGC Grains & Oilseeds Prices Index (GOI)*

GMR 461

Change**

y/y

change

IGC GOI

183

- 2.6%

- 18.9%

Wheat sub-Index

Maize sub-Index

Barley sub-Index

Rice sub-Index

Soyabeans sub-Index

169

177

181

152

175

- 3.3%

- 0.2%

- 3.8%

- 0.2%

- 3.3%

- 24.1%

- 8.3%

- 17.9%

- 12.8%

- 21.5%

*Jan 2000=100, **Change vs. GMR 460

White and parboiled rice export prices were narrowly

mixed amid few fresh developments. Earlier large

purchases by Asian buyers through diplomatic channels

mildly underpinned, as did diminishing crop prospects

due to the impact of El Nio. However, with some export

values weighed by currency movements, the IGC GOI

sub-Index was broadly unchanged.

Wheat: GOI sub-Index

Jan 2000 = 100

360

320

280

Soyabeans: GOI sub-Index

240

Jan 2000 = 100

360

200

320

160

2015

2014

2010-14 range

280

120

Jan

Feb

Mar

Apr

May

Jun

Jul

Aug

Sep

Nov

Dec

240

World wheat quotations mostly weakened, pressured by

large spot availabilities and with exporters competing for

limited business. With worries about poor crop weather

in some areas also subsiding slightly, the IGC GOI subIndex dropped by 3% from the last report, down 24% y/y.

200

160

2015

2014

2010-14 range

120

Jan

Feb

Mar

Apr

May

Jun

Jul

Aug

Sep

Nov

Dec

Maize: GOI sub-Index

World soyabean markets were weaker since the last

GMR, the IGC GOI sub-Index falling by around 3%.

Despite mild support from firm export demand and

technical features, pressure stemmed from prospects for

ample global supplies, with better than expected harvest

results in the US and an improvement in planting

conditions in South America.

Jan 2000 = 100

360

320

280

240

More detailed analysis, including US dollar fob export

prices and commentary on other grains and oilseeds

markets is included within the report.

200

160

2015

2014

2010-14 range

120

Jan

Feb

Mar

Apr

May

Jun

Jul

Aug

Sep

Nov

Dec

With mixed trends across the main origins, the IGC GOI

maize sub-Index was broadly unchanged compared to

late October. However, US prices have recently

declined, resulting in narrower spreads between the

leading exporters.

Rice: GOI sub-Index

Jan 2000 = 100

240

220

200

180

160

140

2015

2014

2010-14 range

120

Jan

Feb

Mar

Apr

May

Jun

Jul

Aug

Sep

Nov

Dec

SUPPLY & DEMAND: TOTAL GRAINS#

Million tons

Opening Production Imports

stocks

Total

supply

Use

Food Industrial Feed

Total a)

Exports Closing

stocks

TOTAL GRAINS

Argentina **

2013/14

2014/15 est.

2015/16 f'cast

3.1

6.3

9.8

51.0

54.3

44.5

0.0

0.0

0.0

(45.0)

Australia **

2013/14

2014/15 est.

2015/16 f'cast

5.8

5.6

5.3

37.6

35.6

36.3

54.1

60.7

54.3

4.6

5.0

4.9

2.4

2.8

2.9

(54.8)

0.0

0.0

0.0

43.4

41.2

41.6

14.3

14.9

12.5

23.1

24.6

21.5

24.6

26.3

25.9

6.3

9.8

6.9

(12.4)

(21.4)

(26.9)

(6.5)

2.2

2.2

2.3

0.8

0.8

0.8

7.6

6.7

7.6

11.6

10.8

11.7

26.1

25.2

25.2

5.6

5.3

4.8

3.2

2.9

2.8

6.1

6.3

6.4

19.5

18.2

18.6

30.1

28.8

29.3

30.2

29.1

24.6

14.9

10.3

7.2

(41.7)

Canada

2013/14

2014/15 est.

2015/16 f'cast

8.1

14.9

10.3

66.2

51.4

49.4

0.8

2.0

1.3

(10.1)

EU*

2013/14

2014/15 est.

2015/16 f'cast

Kazakhstan

2013/14

2014/15 est.

2015/16 f'cast

Russia

Ukraine

USA

2013/14

2014/15 est.

2015/16 f'cast

2013/14

2014/15 est.

2015/16 f'cast

2013/14

2014/15 est.

2015/16 f'cast

21.8

25.4

29.5

(60.9)

(7.0)

301.3

326.4

308.0

20.4

16.1

18.6

343.6

367.9

356.1

(307.8)

(18.7)

(356.0)

2.6

2.3

3.0

17.5

16.6

17.3

0.0

0.4

0.2

20.0

19.3

20.5

2.5

2.5

2.5

8.7

7.9

10.0

88.7

100.5

100.1

1.2

0.5

0.7

98.6

108.9

110.8

15.9

16.3

16.4

(11.0)

(100.6)

63.6

63.5

63.9

5.3

7.3

9.1

62.4

64.5

61.0

(7.9)

(59.0)

43.1

50.4

67.6

425.6

432.7

424.2

35.0

35.9

36.4

161.0

171.6

165.7

273.7

284.8

279.8

44.5

53.6

45.1

25.4

29.5

31.2

(165.6)

(279.7)

(45.3)

(31.1)

0.2

0.2

0.2

4.0

4.5

4.2

9.0

10.0

9.2

8.8

6.4

6.9

2.3

3.0

4.4

4.6

4.6

4.5

32.0

35.1

36.1

66.0

68.4

69.0

24.8

30.5

31.8

7.9

10.0

10.0

(31.7)

(11.6)

(112.3)

0.1

0.0

0.0

67.8

71.8

70.1

7.3

7.1

7.1

0.9

0.9

0.9

15.4

15.6

15.8

28.3

27.8

28.0

32.2

34.8

33.3

7.3

9.1

8.9

(15.6)

(27.8)

(31.9)

(7.3)

164.5

164.8

166.5

140.0

143.1

145.7

339.5

343.2

347.6

87.0

80.4

75.2

50.4

67.6

75.9

(166.7)

(144.1)

(346.2)

(78.5)

(69.0)

214.4

216.4

218.5

393.8

409.6

406.2

781.3

798.3

796.1

278.2

286.3

268.0

120.0

144.6

149.2

(218.7)

(404.2)

(794.2)

(270.9)

(141.5)

58.7

62.5

64.8

165.1

177.3

181.7

340.8

356.1

362.2

1.0

0.9

1.2

147.9

166.8

180.8

(183.7)

(365.2)

15.0

17.0

16.7

131.6

133.4

135.6

10.4

5.1

2.4

20.5

20.0

12.7

(16.5)

(135.4)

(67.0)

8.2

8.1

6.9

(419.1)

MAJOR EXPORTERS b)

2013/14

2014/15 est.

2015/16 f'cast

75.2

68.3

61.1

476.9

491.1

498.7

32.2

32.2

32.6

(493.6)

98.5

120.0

144.6

1,050.3

1,082.0

1,040.8

30.8

27.2

27.8

(144.2)

(1034.6)

123.0

147.9

166.8

348.1

349.8

357.4

18.5

26.2

20.0

489.6

523.9

544.2

(160.9)

(364.4)

(22.0)

(547.3)

25.7

20.5

20.0

136.6

137.8

130.0

0.1

0.3

0.6

162.4

158.6

150.7

1,179.6

1,229.2

1,213.2

131.4

131.7

132.4

(1206.6)

China

2013/14

2014/15 est.

2015/16 f'cast

96.6

96.4

95.8

India

2013/14

2014/15 est.

2015/16 f'cast

(20.3)

WORLD TOTAL

2013/14

2014/15 est.

2015/16 f'cast

99.9

101.8

103.9

4.4

4.8

5.1

(150.9)

c)

(13.1)

c)

335.9

409.4

449.9

2,006.0

2,029.6

1,996.1

310.1

321.7

314.4

2,341.9

2,439.1

2,446.0

650.7

659.6

666.4

316.3

322.8

326.8

840.1

878.9

876.9

1,932.5

1,989.2

1,992.2

310.1

321.7

314.4

409.4

449.9

453.8

(447.0)

(1998.8)

(314.9)

(2445.8)

(663.4)

(327.1)

(878.0)

(1991.4)

(314.9)

(454.4)

SUPPLY & DEMAND: ALL WHEAT#

Million tons

Opening Production

stocks

Imports

d)

Total

supply

Use

Food Industrial Feed

Exports Closing

d)

stocks

Total a)

WHEAT

Argentina (Dec/Nov)

2013/14

2014/15 est.

2015/16 f'cast

0.2

1.7

4.5

9.2

13.9

10.4

0.0

0.0

0.0

9.4

15.6

14.9

4.2

4.5

4.5

0.1

0.1

0.1

0.4

0.4

0.4

5.2

5.7

5.7

2.5

5.4

5.5

1.7

4.5

3.7

Australia (Oct/Sep)

2013/14

2014/15 est.

2015/16 f'cast

4.7

4.9

4.8

25.3

23.7

24.0

0.0

0.0

0.0

30.1

28.6

28.8

1.9

1.9

2.0

0.5

0.5

0.5

3.5

4.0

3.7

6.6

7.1

6.8

18.6

16.8

17.8

4.9

4.8

4.2

Canada (Aug/Jul)

2013/14

2014/15 est.

2015/16 f'cast

5.1

10.4

7.1

37.5

29.4

26.1

0.1

0.1

0.1

42.6

39.8

33.2

2.8

2.6

2.6

0.8

0.9

0.9

4.1

4.4

4.3

8.8

8.9

8.8

23.5

23.9

20.2

10.4

7.1

4.2

EU* (Jul/Jun)

2013/14

2014/15 est.

2015/16 f'cast

8.8

9.5

12.0

143.2

156.1

157.7

4.1

6.2

5.6

156.1

171.8

175.3

54.3

54.5

54.7

10.3

10.8

10.8

43.0

52.2

56.0

113.8

123.6

127.8

32.8

36.3

31.6

9.5

12.0

15.8

(5.7)

(175.4)

135.0

148.5

149.3

2.2

3.4

3.8

146.0

161.0

164.3

(149.7)

(3.9)

(164.8)

(31.8)

of which common wheat

2013/14

2014/15 est.

2015/16 f'cast

8.7

9.1

11.2

47.3

47.3

47.5

10.3

10.8

10.8

43.0

52.2

56.0

106.1

115.8

120.0

30.7

34.0

29.4

9.1

11.2

14.9

(29.7)

(15.1)

Kazakhstan (Jul/Jun)

2013/14

2014/15 est.

2015/16 f'cast

2.1

1.7

2.4

13.9

13.0

14.0

0.0

0.4

0.2

16.1

15.1

16.6

2.2

2.2

2.2

0.0

0.0

0.0

1.7

2.0

2.0

6.0

6.8

6.4

8.4

5.9

6.5

1.7

2.4

3.8

Russia (Jul/Jun)

2013/14

2014/15 est.

2015/16 f'cast

7.3

6.1

6.9

52.1

59.1

60.6

1.0

0.4

0.4

60.4

65.6

67.9

12.9

12.9

13.0

1.5

1.5

1.5

12.4

14.0

14.5

35.8

36.6

37.0

18.5

22.2

23.7

6.1

6.9

7.1

(7.5)

Ukraine (Jul/Jun)

2013/14

2014/15 est.

2015/16 f'cast

USA (Jun/May)

2013/14

2014/15 est.

2015/16 f'cast

MAJOR EXPORTERS b)

2013/14

2014/15 est.

2015/16 f'cast

(68.5)

3.0

3.9

5.5

22.3

24.7

27.5

(4.7)

(26.0)

19.5

16.1

20.5

58.1

55.1

55.8

50.8

54.2

63.5

361.6

375.1

376.1

0.0

0.0

0.0

25.3

28.6

33.0

(23.6)

5.8

5.7

5.8

0.2

0.2

0.2

(30.7)

4.6

4.1

3.4

9.8

11.2

9.7

(9.8)

82.3

75.3

79.7

422.2

440.5

449.3

25.5

25.6

25.7

109.6

109.9

110.4

0.6

0.5

0.5

13.9

14.4

14.4

(447.7)

3.5

4.0

4.7

11.9

12.0

12.9

(4.5)

(12.7)

6.2

3.3

4.9

34.2

31.6

33.1

(5.0)

(33.2)

74.8

84.4

90.5

9.5

11.2

14.6

(14.0)

32.0

23.2

21.8

(7.8)

3.9

5.5

5.5

(4.0)

16.1

20.5

24.8

(22.6)

(23.9)

222.3

232.2

238.5

145.7

144.8

141.8

54.2

63.5

69.1

(90.4)

(238.4)

(142.0)

(67.3)

(63.3)

(374.6)

China (Jul/Jun)

2013/14

2014/15 est.

2015/16 f'cast

53.7

58.7

64.9

121.9

126.2

129.0

6.7

2.1

2.0

182.4

187.1

195.9

88.0

87.5

87.1

3.2

3.2

3.2

23.0

22.0

22.0

123.3

121.9

121.6

0.3

0.2

0.4

58.7

64.9

73.9

India (Apr/Mar)

2013/14

2014/15 est.

2015/16 f'cast

24.2

18.0

17.2

93.5

95.9

88.9

0.0

0.3

0.6

117.7

114.1

106.8

78.5

80.7

82.5

0.2

0.2

0.2

5.0

5.0

5.0

93.7

93.5

95.3

6.0

3.4

0.5

18.0

17.2

10.9

WORLD TOTAL

2013/14

2014/15 est.

2015/16 f'cast

170.0

187.7

201.3

713.8

723.1

726.2

156.3

153.1

150.8

883.9

910.8

927.4

471.9

477.6

483.5

21.6

22.0

22.1

132.9

140.1

146.4

696.2

709.5

719.6

156.3

153.1

150.8

187.7

201.3

207.8

(200.8)

(725.9)

(149.9)

(926.7)

(145.9)

(718.2)

(149.9)

(208.5)

e)

e)

SUPPLY & DEMAND: MAIZE#

Million tons

Opening Production Imports

stocks

Total

supply

Use

Food Industrial Feed

Exports Closing

stocks

Total a)

MAIZE

Argentina (Mar/Feb)

2013/14

2014/15 est.

2015/16 f'cast

2016/17 f'cast

0.5

1.8

3.0

3.8

32.1

33.1

33.8

26.0

0.0

0.0

0.0

1.0

32.6

34.9

36.8

30.8

0.3

0.3

0.3

0.3

1.8

2.0

2.2

2.3

9.3

11.5

12.0

9.4

12.2

14.8

15.5

12.4

18.6

17.1

17.5

16.0

1.8

3.0

3.8

2.5

Brazil (Mar/Feb)

2013/14

2014/15 est.

2015/16 f'cast

2016/17 f'cast

5.1

8.5

13.9

12.8

81.5

80.1

84.7

81.4

0.6

0.8

0.4

0.5

87.2

89.4

98.9

94.8

4.0

4.1

4.1

4.1

1.7

1.9

2.2

2.2

44.9

45.6

47.0

49.1

53.7

54.6

56.1

58.1

24.9

21.0

30.0

26.0

8.5

13.9

12.8

10.7

(25.0)

(15.3)

(16.5)

(98.4)

EU* (Oct/Sep)

2013/14

2014/15 est.

2015/16 f'cast

5.2

6.6

7.3

64.2

76.2

57.6

15.8

9.4

12.5

85.2

92.2

77.4

4.2

4.2

4.2

13.8

14.1

14.5

56.2

60.0

49.5

76.3

80.9

70.6

2.3

4.0

1.7

6.6

7.3

5.1

South Africa (May/Apr)

2013/14

2014/15 est.

2015/16 f'cast

2016/17 f'cast

1.5

0.9

2.4

1.9

12.4

15.0

10.6

11.5

0.1

0.0

0.7

0.4

14.0

15.8

13.7

13.8

5.5

5.6

5.6

5.6

0.1

0.1

0.1

0.1

5.0

5.2

5.0

5.3

11.1

11.4

11.2

11.6

2.1

2.0

0.6

0.8

0.9

2.4

1.9

1.4

(1.2)

(1.3)

9.8

9.9

8.6

19.9

18.9

15.5

2.5

2.3

1.2

(1.6)

(12.5)

(0.0)

(14.1)

Ukraine (Oct/Sep)

2013/14

2014/15 est.

2015/16 f'cast

1.3

2.5

2.3

30.9

28.5

23.0

0.0

0.0

0.0

32.2

31.0

25.3

0.5

0.5

0.5

0.3

0.3

0.3

7.7

8.0

7.0

USA (Sep/Aug)

2013/14

2014/15 est.

2015/16 f'cast

20.9

31.3

44.0

351.3

361.1

346.8

0.9

0.8

0.8

373.0

393.2

391.6

5.1

5.1

5.2

159.3

161.1

160.8

128.0

135.1

134.5

292.9

301.9

301.1

48.8

47.3

44.0

31.3

44.0

46.5

(162.7)

(133.0)

(301.5)

(45.0)

(40.6)

49.0

53.0

55.0

135.8

138.0

145.0

202.4

208.6

217.6

0.2

0.2

0.2

86.1

98.4

103.7

0.0

0.0

0.0

0.8

0.5

0.5

f)

(342.3)

China (Oct/Sep)

2013/14

2014/15 est.

2015/16 f'cast

Japan (Oct/Sep)

2013/14

2014/15 est.

2015/16 f'cast

WORLD TOTAL

2013/14

2014/15 est.

2015/16 f'cast

#

66.9

86.1

98.4

218.5

215.6

220.0

(92.5)

(227.0)

0.5

0.8

0.5

0.0

0.0

0.0

(387.1)

3.3

5.5

3.0

288.7

307.2

321.4

7.3

7.6

7.6

(322.5)

15.4

14.3

14.7

15.9

15.1

15.2

(14.8)

(15.3)

(218.6)

1.1

1.1

1.1

3.4

3.4

3.2

10.4

9.7

10.1

15.2

14.5

14.7

(10.2)

(14.8)

g)

g)

131.5

181.1

207.3

996.7

1,013.0

967.3

121.7

124.8

125.3

1,128.3

1,194.1

1,174.6

109.6

111.1

110.7

256.8

263.7

265.5

545.6

574.0

563.4

947.1

986.8

974.1

121.7

124.8

125.3

181.1

207.3

200.5

(204.7)

(969.7)

(124.9)

(1174.5)

(107.8)

(267.4)

(562.7)

(974.4)

(124.9)

(200.0)

IGC estimates. May differ from official estimates shown elsewhere in this report.

Years shown for southern hemisphere countries include following marketing years for maize and sorghum. For example, for Argentina, the

"2013/14" year includes the 2013/14 (Dec/Nov) local marketing year for wheat and the 2014/15 (Mar/Feb) marketing year for maize.

a) Including seed and waste.

f) Includes residual.

b) Argentina, Australia, Canada, EU, Kazakhstan,

g) IGC July/June trade

Russia, Ukraine, United States

h) Excludes trade in malt

c) Includes trade in malt.

Totals may not sum due to rounding.

d) Including estimated trade in secondary products

Figures in brackets represent the previous estimate.

e) IGC July/June trade: excluding trade in secondary products

SUPPLY & DEMAND: ALL RICE#

Million tons (milled basis)

Opening

Production

Imports

stocks

Total

Total

supply

use a)

Exports

Closing

stocks

India (Oct/Sep)

2013/14 est.

2014/15 f'cast

2015/16 proj.

23.4

22.0

16.7

106.7

104.8

103.6

0.0

0.1

0.1

130.1

126.9

120.4

97.5

98.7

100.0

10.5

11.6

9.2

22.0

16.7

11.2

Pakistan (Nov/Oct)

2013/14 est.

2014/15 f'cast

2015/16 proj.

0.6

0.8

1.1

6.8

6.9

6.8

0.1

0.1

0.1

7.5

7.8

7.9

2.8

2.8

2.9

3.9

3.9

3.9

0.8

1.1

1.1

13.2

11.8

9.9

20.3

18.7

16.6

0.3

0.2

0.2

33.7

30.7

26.6

11.0

11.3

11.2

10.9

9.5

10.0

11.8

9.9

5.4

1.2

1.0

1.6

6.1

7.1

6.1

0.7

0.8

0.8

8.0

8.9

8.4

4.0

4.1

4.0

3.0

3.2

3.1

1.0

1.6

1.3

Thailand (Jan/Dec)

2013/14 est.

2014/15 f'cast

2015/16 proj.

USA (Aug/Jul)

2013/14 est.

2014/15 f'cast

2015/16 proj.

(6.0)

(8.3)

Vietnam (Jan/Dec)

2013/14 est.

2014/15 f'cast

2015/16 proj.

1.4

1.9

2.2

28.0

28.1

27.9

0.2

0.3

0.2

29.5

30.3

30.3

21.3

21.8

21.9

6.4

6.3

6.5

1.9

2.2

2.0

39.7

37.6

31.4

167.9

165.6

161.0

1.3

1.4

1.3

208.8

204.5

193.7

136.6

138.7

140.0

34.7

34.5

32.7

37.6

31.4

21.0

(193.6)

(139.9)

(32.6)

36.0

36.2

36.3

34.9

35.2

35.3

0.0

0.0

0.0

(36.8)

(35.5)

Total 5 leading exporters b)

2013/14 est.

2014/15 f'cast

2015/16 proj.

(160.9)

Bangladesh (Jul/Jun)

2013/14 est.

2014/15 f'cast

2015/16 proj.

0.6

1.1

1.0

34.4

34.5

34.6

(35.0)

1.1

0.6

0.7

(0.8)

1.1

1.0

1.0

(1.3)

China (Jan/Dec)

2013/14 est.

2014/15 f'cast

2015/16 proj.

49.6

50.7

51.7

142.5

144.6

145.3

3.7

4.4

4.6

195.9

199.6

201.5

144.8

147.5

149.2

0.4

0.4

0.4

50.7

51.7

51.9

Indonesia (Jan/Dec)

2013/14 est.

2014/15 f'cast

2015/16 proj.

3.9

2.5

1.5

36.3

36.3

36.6

1.1

1.3

1.7

41.3

40.1

39.8

38.8

38.6

38.3

0.0

0.0

0.0

2.5

1.5

1.5

(40.4)

(38.9)

15.3

15.7

15.9

13.2

13.1

13.5

0.0

0.0

0.0

2.1

2.6

2.4

(37.5)

(1.5)

Philippines (Jul/Jun)

2013/14 est.

2014/15 f'cast

2015/16 proj.

1.8

2.1

2.6

11.9

11.9

11.5

1.7

1.7

1.8

(1.6)

WORLD TOTAL

2013/14 est.

2014/15 f'cast

2015/16 proj.

113.3

111.6

106.6

477.7

478.3

473.6

(106.5)

(474.1)

43.2

42.1

41.5

(15.7)

591.0

589.9

580.2

479.5

483.4

486.3

(580.7)

(486.7)

IGC estimates. May differ from official estimates shown elsewhere in the report.

a) Including seed and waste.

b) India, Pakistan, Thailand, United States, Vietnam.

Totals may not sum due to rounding.

(2.2)

Figures in brackets represent the previous estimate.

43.2

42.1

41.5

111.6

106.6

94.0

SUPPLY & DEMAND: SOYABEANS#

Million tons

Opening

Production

Imports

stocks

Total

supply

Use

Food

Feed

Exports

Crush

Total a)

Closing

stocks

SOYABEANS

Argentina (Apr/Mar)

2014/15

2015/16 est.

2016/17 f'cast

5.0

9.0

17.4

53.4

61.4

57.0

0.0

0.0

0.0

(17.8)

Brazil (Feb/Jan)

2014/15

2015/16 est.

2016/17 f'cast

USA (Sep/Aug)

2013/14

2014/15 est.

2015/16 f'cast

Canada (Sep/Aug)

2013/14

2014/15 est.

2015/16 f'cast

Ukraine (Sep/Aug)

2013/14

2014/15 est.

2015/16 f'cast

1.7

2.2

2.0

86.1

96.2

99.5

(3.9)

(99.0)

3.8

2.5

5.2

91.4

106.9

108.4

10.5

13.7

24.5

230.9

264.5

264.9

(26.8)

(261.8)

0.2

0.2

0.4

5.4

6.0

5.9

0.1

0.3

0.2

0.6

0.1

0.1

2.0

0.9

0.8

1.9

1.7

2.0

40.0

40.4

43.5

42.0

42.6

46.1

2.9

3.9

3.7

2.6

1.0

0.9

0.3

0.4

0.3

0.0

0.0

0.0

7.4

10.5

11.5

9.0

17.4

16.8

(10.0)

(18.7)

88.4

98.5

101.6

0.0

0.1

0.1

2.6

2.9

3.3

37.8

40.8

42.4

40.5

44.0

46.0

45.7

52.5

54.7

2.2

2.0

0.9

(102.9)

(0.2)

(3.6)

(42.1)

(46.2)

(54.5)

(2.3)

97.2

110.3

114.3

0.0

0.0

0.0

2.2

3.7

3.4

47.9

50.9

51.5

50.1

54.6

55.0

44.6

50.5

46.7

2.5

5.2

12.7

(51.1)

(54.6)

(45.6)

(11.6)

(111.8)

(3.8)

244.1

279.2

290.3

0.0

0.1

0.1

6.7

8.3

8.7

125.7

132.0

137.4

132.6

141.1

147.0

97.8

113.5

112.9

13.7

24.5

30.4

(289.5)

(0.2)

(9.0)

(136.7)

(146.8)

(110.1)

(32.5)

5.8

6.6

6.5

0.0

0.0

0.0

0.3

0.3

0.4

2.0

1.8

1.8

2.4

2.3

2.2

3.2

3.9

4.0

0.2

0.4

0.3

(1.9)

(2.3)

(3.9)

1.4

1.3

1.5

1.5

1.5

1.6

1.3

2.4

2.2

(1.6)

(1.7)

3.0

4.1

4.0

0.0

0.0

0.0

0.1

0.2

0.1

(4.1)

0.3

0.2

0.1

(0.2)

Paraguay (Mar/Feb)

2013/14

2014/15 est.

2015/16 f'cast

0.7

0.4

0.3

8.3

8.5

8.8

0.0

0.0

0.0

9.0

9.0

9.1

0.0

0.0

0.0

0.1

0.2

0.2

3.6

3.8

3.9

3.7

4.1

4.2

4.9

4.6

4.6

0.4

0.3

0.3

China (Oct/Sep)

2013/14

2014/15 est.

2015/16 f'cast

11.8

12.0

13.0

12.0

12.2

11.0

70.8

79.0

81.0

94.5

103.1

105.0

10.7

10.5

11.1

1.6

2.6

2.3

69.5

76.4

79.9

82.4

90.0

93.8

0.2

0.2

0.2

12.0

13.0

11.0

(80.0)

(104.0)

(78.9)

(92.8)

1.2

1.9

2.1

13.6

13.8

14.0

15.3

16.7

17.4

13.3

14.3

15.0

14.3

15.2

16.0

0.1

0.1

0.1

1.0

1.4

1.3

(2.0)

(13.9)

(17.2)

(14.8)

(15.9)

EU* (Oct/Sep)

2013/14

2014/15 est.

2015/16 f'cast

0.5

1.0

1.4

0.1

0.1

0.2

0.8

0.8

0.9

India (Oct/Sep)

2013/14

2014/15 est.

2015/16 f'cast

0.7

0.7

0.4

11.9

10.5

10.5

0.0

0.0

0.0

12.5

11.2

10.9

0.4

0.3

0.3

0.9

0.7

0.6

10.4

9.7

9.6

11.7

10.6

10.5

0.2

0.2

0.2

0.7

0.4

0.2

Japan (Oct/Sep)

2013/14

2014/15 est.

2015/16 f'cast

0.3

0.2

0.2

0.2

0.2

0.2

3.0

3.1

3.1

3.4

3.5

3.6

0.8

0.8

0.8

0.2

0.2

0.2

2.2

2.3

2.3

3.2

3.3

3.3

0.0

0.0

0.0

0.2

0.2

0.2

(3.0)

(3.4)

(2.2)

(3.2)

WORLD TOTAL

2013/14

2014/15 est.

2015/16 f'cast

#

0.0

0.0

0.0

(74.8)

(105.8)

Total 3 major exporters b)

2013/14

2014/15 est.

2015/16 f'cast

58.4

70.4

74.4

28.4

32.0

44.8

284.8

321.1

321.0

c)

113.1

126.6

128.8

313.2

353.1

365.8

16.4

16.6

17.6

13.8

16.8

16.9

249.8

273.2

283.1

281.2

308.3

319.1

c)

113.1

126.6

128.8

32.0

44.8

46.7

(47.2)

(319.1)

(125.9)

(366.2)

(17.4)

(17.2)

(280.8)

(317.1)

(125.9)

(49.1)

IGC estimates. May differ from official estimates shown elsewhere in the report.

a)

Including seed and waste.

b)

Argentina, Brazil, USA

c)

IGC October/September trade

Totals may not sum due to rounding

Figures in brackets represent the previous estimate

You might also like

- Market: International Grains CouncilDocument9 pagesMarket: International Grains CouncilZerohedgeNo ratings yet

- Food Outlook: Biannual Report on Global Food Markets. October 2016From EverandFood Outlook: Biannual Report on Global Food Markets. October 2016No ratings yet

- Commodities - MARKETS OUTLOOKDocument8 pagesCommodities - MARKETS OUTLOOKMilling and Grain magazineNo ratings yet

- Commodities - MARKETS OUTLOOK 1504Document6 pagesCommodities - MARKETS OUTLOOK 1504Milling and Grain magazineNo ratings yet

- Global Feed Markets: November - December 2014Document9 pagesGlobal Feed Markets: November - December 2014Milling and Grain magazineNo ratings yet

- Global Feed Markets: November - December 2013Document8 pagesGlobal Feed Markets: November - December 2013Milling and Grain magazineNo ratings yet

- World Agricultural Supply and Demand EstimatesDocument40 pagesWorld Agricultural Supply and Demand EstimatesBrittany EtheridgeNo ratings yet

- World Agricultural Supply and Demand EstimatesDocument40 pagesWorld Agricultural Supply and Demand EstimatesBrittany EtheridgeNo ratings yet

- Commodities - MARKETS OUTLOOK 1506Document6 pagesCommodities - MARKETS OUTLOOK 1506Milling and Grain magazineNo ratings yet

- World Agricultural Supply and Demand EstimatesDocument40 pagesWorld Agricultural Supply and Demand EstimatesMayankNo ratings yet

- Global Feed Markets: January - Febrauary 2014Document8 pagesGlobal Feed Markets: January - Febrauary 2014Milling and Grain magazineNo ratings yet

- USDA Agricultural Demands ReportDocument40 pagesUSDA Agricultural Demands ReportAustin DeneanNo ratings yet

- Food Outlook: Biannual Report on Global Food Markets: November 2019From EverandFood Outlook: Biannual Report on Global Food Markets: November 2019No ratings yet

- Commodities - MARKETS OUTLOOKDocument6 pagesCommodities - MARKETS OUTLOOKMilling and Grain magazineNo ratings yet

- LatestDocument40 pagesLatestPetrus Slamet Putra WijayaNo ratings yet

- Commodities - MARKETS OUTLOOKDocument6 pagesCommodities - MARKETS OUTLOOKMilling and Grain magazineNo ratings yet

- Food Outlook: Biannual Report on Global Food Markets July 2018From EverandFood Outlook: Biannual Report on Global Food Markets July 2018No ratings yet

- Latest 2018-4-10 PDFDocument40 pagesLatest 2018-4-10 PDFd_stepien43098No ratings yet

- USDA WASDE Nov 2022Document40 pagesUSDA WASDE Nov 2022Vamsi Krishna KonaNo ratings yet

- Wasde Report 1220Document40 pagesWasde Report 1220Roni ChittoniNo ratings yet

- World Agricultural Supply and Demand EstimatesDocument40 pagesWorld Agricultural Supply and Demand EstimatesBrittany EtheridgeNo ratings yet

- Global Feed Markets: November - December 2011Document6 pagesGlobal Feed Markets: November - December 2011Milling and Grain magazineNo ratings yet

- World Agricultural Supply and Demand EstimatesDocument40 pagesWorld Agricultural Supply and Demand EstimatesBrittany EtheridgeNo ratings yet

- US Wheat Associates Road Trip 2015Document2 pagesUS Wheat Associates Road Trip 2015Milling and Grain magazineNo ratings yet

- Global Feed Markets: November - December 2012Document10 pagesGlobal Feed Markets: November - December 2012Milling and Grain magazineNo ratings yet

- GmrsummeDocument7 pagesGmrsummesofaki1No ratings yet

- Food Outlook: Biannual Report on Global Food Markets: November 2018From EverandFood Outlook: Biannual Report on Global Food Markets: November 2018No ratings yet

- Commodities - MARKETS OUTLOOK 1508Document6 pagesCommodities - MARKETS OUTLOOK 1508Milling and Grain magazineNo ratings yet

- World Agricultural Supply and Demand Estimates: United States Department of AgricultureDocument40 pagesWorld Agricultural Supply and Demand Estimates: United States Department of AgricultureFranc LuisNo ratings yet

- MarketingDocument2 pagesMarketingDikuba.K.Alicia Ashley AshleyNo ratings yet

- Grain World Markets and TradeDocument61 pagesGrain World Markets and TradeGad HellscreamNo ratings yet

- Wheat and Barley June 2015Document4 pagesWheat and Barley June 2015Priyanka PrasadNo ratings yet

- Production PDFDocument34 pagesProduction PDFJaskaran Pal SinghNo ratings yet

- Soybean and Oilseed Meal Import Prospects Higher As Severe Weather Damages EU CropsDocument39 pagesSoybean and Oilseed Meal Import Prospects Higher As Severe Weather Damages EU Cropssilver lauNo ratings yet

- Milling and Grain Magazine - September 2016 - FULL EDITIONDocument116 pagesMilling and Grain Magazine - September 2016 - FULL EDITIONMilling and Grain magazineNo ratings yet

- Commodities - MARKETS OUTLOOKDocument6 pagesCommodities - MARKETS OUTLOOKMilling and Grain magazineNo ratings yet

- Food Outlook: Biannual Report on Global Food Markets. November 2017From EverandFood Outlook: Biannual Report on Global Food Markets. November 2017No ratings yet

- Oil Crops OutlookDocument13 pagesOil Crops OutlookGrowing AmericaNo ratings yet

- World Agricultural Supply and Demand EstimatesDocument40 pagesWorld Agricultural Supply and Demand EstimatesCharlie 'Sharif' BastaNo ratings yet

- World Agricultural Supply and Demand Estimates: United States Department of AgricultureDocument40 pagesWorld Agricultural Supply and Demand Estimates: United States Department of AgricultureAnkit AgarwalNo ratings yet

- WASDE Jan 2008Document40 pagesWASDE Jan 2008kcolombiniNo ratings yet

- World Agricultural Supply and Demand Estimates: United States Department of AgricultureDocument40 pagesWorld Agricultural Supply and Demand Estimates: United States Department of Agricultureapi-51572145No ratings yet

- Wasde 0423Document59 pagesWasde 0423Alondra AlvarezNo ratings yet

- Oilseeds and Products Annual Tokyo Japan 4-7-2016Document20 pagesOilseeds and Products Annual Tokyo Japan 4-7-2016Dane SpaceyNo ratings yet

- World Agricultural Supply and Demand Estimates: United States Department of AgricultureDocument40 pagesWorld Agricultural Supply and Demand Estimates: United States Department of AgricultureB6D4N0No ratings yet

- Focus v16 n7 FNLDocument10 pagesFocus v16 n7 FNLrichardck61No ratings yet

- Agricultura DemandaDocument36 pagesAgricultura DemandaAdolf MarNo ratings yet

- Round Up: July 2015Document37 pagesRound Up: July 2015Vicente NguyenNo ratings yet

- Oilseeds MundialDocument35 pagesOilseeds MundialingjoselaraNo ratings yet

- Yield: Harvest Lbs/ac Begin Stocks Imports Seed & ResidualDocument1 pageYield: Harvest Lbs/ac Begin Stocks Imports Seed & ResidualBrittany EtheridgeNo ratings yet

- El Niño and Cereal Production Shortfalls: Policies For Resilience and Food Security in 2016 and BeyondDocument6 pagesEl Niño and Cereal Production Shortfalls: Policies For Resilience and Food Security in 2016 and BeyondIFPRINo ratings yet

- چاول خبریں ۴ جولائ ۲۰۲۰Document40 pagesچاول خبریں ۴ جولائ ۲۰۲۰Mujahid AliNo ratings yet

- PEANUT MARKETING NEWS - August 17, 2020 - Tyron Spearman, EditorDocument1 pagePEANUT MARKETING NEWS - August 17, 2020 - Tyron Spearman, EditorBrittany EtheridgeNo ratings yet

- Fresh Deciduous Fruit (Apples, Grapes, & Pears) : World Markets and TradeDocument23 pagesFresh Deciduous Fruit (Apples, Grapes, & Pears) : World Markets and TradeKarthik RamdossNo ratings yet

- Focus v16 n8 FNLDocument6 pagesFocus v16 n8 FNLrichardck61No ratings yet

- Grain and Feed Annual - Bangkok - Thailand - 3-18-2016Document12 pagesGrain and Feed Annual - Bangkok - Thailand - 3-18-2016touch daraNo ratings yet

- FAO FodOutlookDocument119 pagesFAO FodOutlookVinay Hr LaambaNo ratings yet

- 20th March, 2015 Daily Exclusive ORYZA Rice E-Newsletter by Riceplus MagazineDocument16 pages20th March, 2015 Daily Exclusive ORYZA Rice E-Newsletter by Riceplus MagazineMujahid AliNo ratings yet

- Grain and Feed Update - Ankara - Turkey - 10-13-2017Document6 pagesGrain and Feed Update - Ankara - Turkey - 10-13-2017Amir SaifNo ratings yet

- Oilseeds 2015Document37 pagesOilseeds 2015marianaNo ratings yet

- Japan USADocument14 pagesJapan USAKhrystyna MatsopaNo ratings yet

- Tea PDFDocument35 pagesTea PDFKhrystyna MatsopaNo ratings yet

- Investment Plan For EuropeDocument8 pagesInvestment Plan For EuropeKhrystyna MatsopaNo ratings yet

- MarketingDocument2 pagesMarketingKhrystyna MatsopaNo ratings yet

- Remuneration Establishing Rewards and Pay PlansDocument31 pagesRemuneration Establishing Rewards and Pay PlansKhrystyna MatsopaNo ratings yet

- International StaffingDocument1 pageInternational StaffingKhrystyna MatsopaNo ratings yet

- EconometricsDocument10 pagesEconometricsKhrystyna MatsopaNo ratings yet

- Model Business in FranceDocument5 pagesModel Business in FranceKhrystyna MatsopaNo ratings yet

- Organizing Function of ManagementDocument6 pagesOrganizing Function of ManagementKhrystyna MatsopaNo ratings yet

- Choco BoxDocument3 pagesChoco BoxKhrystyna MatsopaNo ratings yet

- A Characteristic Trait of UkraineDocument5 pagesA Characteristic Trait of UkraineKhrystyna MatsopaNo ratings yet

- GlobalizationDocument14 pagesGlobalizationKhrystyna MatsopaNo ratings yet

- An Economic System Is A System of Production and Exchange of Goods and Services As Well As Allocation of Resources in A SocietyDocument2 pagesAn Economic System Is A System of Production and Exchange of Goods and Services As Well As Allocation of Resources in A SocietyKhrystyna MatsopaNo ratings yet

- Developing Pricing Strategies and Programs: Marketing Management, 13 EdDocument19 pagesDeveloping Pricing Strategies and Programs: Marketing Management, 13 EdKhrystyna MatsopaNo ratings yet

- Questions For Exam FinanceDocument2 pagesQuestions For Exam FinanceKhrystyna MatsopaNo ratings yet

- Company To Company Third Ed BOLJA KopDocument68 pagesCompany To Company Third Ed BOLJA KopPušik UracNo ratings yet

- CH 10Document46 pagesCH 10Khrystyna MatsopaNo ratings yet

- CH 10Document46 pagesCH 10Khrystyna MatsopaNo ratings yet

- Organizing Function of ManagementDocument13 pagesOrganizing Function of ManagementKhrystyna Matsopa100% (1)

- Teacher Book (Old Edition)Document162 pagesTeacher Book (Old Edition)Khrystyna MatsopaNo ratings yet

- микроDocument2 pagesмикроKhrystyna Matsopa100% (1)

- Whole Wheat Vs Enriched FlourDocument1 pageWhole Wheat Vs Enriched FlourterrysticklerNo ratings yet

- The Little Red HenDocument3 pagesThe Little Red HenANNA HENDRIKA GIDHA DARINo ratings yet

- GST Rate Schedule For GoodsDocument213 pagesGST Rate Schedule For GoodsNnaabyendu SahaNo ratings yet

- Wheat and Millets: Structures, Types and ProcessingDocument30 pagesWheat and Millets: Structures, Types and ProcessingFaiza NoorNo ratings yet

- Millets HarvestDocument50 pagesMillets HarvestJanardhan BejumainaNo ratings yet

- SPECS - Thailand White Rice 05%Document1 pageSPECS - Thailand White Rice 05%Abdul Razak AbdullahNo ratings yet

- FACTSHEET Guidelines For Increasing Fibre IntakeDocument4 pagesFACTSHEET Guidelines For Increasing Fibre Intakehp1903100% (1)

- Flow Process Wheat Flour Production PDFDocument1 pageFlow Process Wheat Flour Production PDFescanor lion prideNo ratings yet

- Session # 7: Lilac Flour Mills: Joint Product and By-Product CostingDocument8 pagesSession # 7: Lilac Flour Mills: Joint Product and By-Product CostingPRITEENo ratings yet

- Chicken Feed FormulaDocument6 pagesChicken Feed FormulareinpolyNo ratings yet

- Ingredients in BakingDocument18 pagesIngredients in Bakingarnold kent namocatcatNo ratings yet

- Rice Krispies HistoryDocument2 pagesRice Krispies HistoryAnna MuižnieceNo ratings yet

- Ramesha Mugalodi - Rice Hybrids Suitable For Dry Direct Seeding in IndiaDocument19 pagesRamesha Mugalodi - Rice Hybrids Suitable For Dry Direct Seeding in IndiaAmaresh ChandelNo ratings yet

- MATERI 6 393 763 1 SM DikonversiDocument5 pagesMATERI 6 393 763 1 SM DikonversiReno MarwanNo ratings yet

- Maths STD 4 Annual Revisio Worksheet 2023 PDFDocument8 pagesMaths STD 4 Annual Revisio Worksheet 2023 PDFSanjeev PatelNo ratings yet

- Baking With Wholewheat Flour 101Document1 pageBaking With Wholewheat Flour 101Mohamed RayNo ratings yet

- Disclosure To Promote The Right To InformationDocument10 pagesDisclosure To Promote The Right To InformationsffdsdfeefefsfeseesfNo ratings yet

- Millet Leaf Product CatalogueDocument6 pagesMillet Leaf Product CatalogueAmudha priyaNo ratings yet

- Lablab Bean: Lablab Purpureus (Syn Dolichos Lablab, Lablab Niger)Document1 pageLablab Bean: Lablab Purpureus (Syn Dolichos Lablab, Lablab Niger)Akash RambhiaNo ratings yet

- The Processing and Storage of Guinea Corn (Sorghum) in Donga Local Government Area of Taraba State.Document29 pagesThe Processing and Storage of Guinea Corn (Sorghum) in Donga Local Government Area of Taraba State.Joshua Bature Sambo100% (3)

- Vietop Feed Cost January 2019Document13 pagesVietop Feed Cost January 2019Ivy Joyce Bueno FerreriaNo ratings yet

- Grain Lovibond and Gravity Readings PDFDocument5 pagesGrain Lovibond and Gravity Readings PDFGaston CassaroNo ratings yet

- Ethiopian Food Composition TableDocument58 pagesEthiopian Food Composition TableMENGISTU TAYE100% (1)

- 07032003212942CPE131 p1Document174 pages07032003212942CPE131 p1Sophia Fellah OuhhabiNo ratings yet

- Principles and Methods of Rice MillingDocument12 pagesPrinciples and Methods of Rice MillingMary - Ann Andal100% (1)

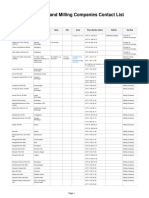

- 4.6 Nepal Storage and Milling Companies Contact ListDocument3 pages4.6 Nepal Storage and Milling Companies Contact ListPankaj MandalNo ratings yet

- Crex Inventario Control de StockDocument42 pagesCrex Inventario Control de StockHarold Onni Arispe CarreñoNo ratings yet

- History of BakingDocument3 pagesHistory of BakingPepep Batukol100% (1)

- Pengaruh Umur Panen Terhadap Karakteristik Tepung Jagung Pulut PUTIH (Zea Mays Var. Ceratina)Document10 pagesPengaruh Umur Panen Terhadap Karakteristik Tepung Jagung Pulut PUTIH (Zea Mays Var. Ceratina)MasYoga TcsNo ratings yet

- Vermicelli Prduct ListDocument2 pagesVermicelli Prduct ListAmarjit PattnaikNo ratings yet