Professional Documents

Culture Documents

A Study On Option Stragies

Uploaded by

Sudheer KumarCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

A Study On Option Stragies

Uploaded by

Sudheer KumarCopyright:

Available Formats

Volume 4, Number 2, April June 2015

ISSN (Print):2279-0896, (Online):2279-090X

PEZZOTTAITE JOURNALS

SJIF (2012): 2.844, SJIF (2013): 5.049, SJIF (2014): 5.81

A STUDY ON OPTION STRATEGIES

B. Sudheer Kumar12 Dr. T. Narayana Reddy13 Dr. N. Kumara Swamy 14 Y. V. Siva Krishna Reddy 15

ABSTRACT

The emergence of the market for the derivatives products, most notably forwards, futures and options, can be tracked back to

the willingness of risk-averse economic agents to guard themselves against uncertainties arising out of fluctuations in asset

prices. Derivatives are risk management instruments, which derive their value from an underlying asset. The following are the

three broad categories of participants in the derivatives market hedgers, speculators and arbitragers. Prices in an organized

derivatives market reflect the perception of market participants about the future and lead the price of underlying to the

perceived future level. In recent times the derivatives market have gained importance in terms of their vital role in the

economy. The increasing investments in stocks have attracted my interest in this area.

Numerous studies on the effects of future and options listing on the underlying cash market volatility have been done in the

developed markets. The derivative market is newly started in India and is not known by every investor, so SEBI has to take

steps to create awareness among the derivative segment. In cash market, the Profit/loss of the investor depends on the market

price of underlying asset. The investor may incur huge profit or he may incur huge loss. But in derivatives segment the

investor enjoys huge profits with limited downside.

Derivatives are mostly used for hedging purpose. In order to increase he derivatives market in India, SEBI should revise some

of their regulations like contract size, participation of FII in the derivatives market. Briefly, the study throws a light on the

derivatives market. And also the methodology is used here the existing strategies is used on empirical data for find outing the

risk and return of the strategies here the different strategies are gives different returns based on market conditions but finally

we suggest different strategies for different investors based on their perception.

KEYWORDS

Options, Futures, Derivatives etc.

INTRODUCTION

A derivative is a financial contract whose value is derived from, or depends on, the rate of some underlying asset. The

underlying asset may be bullion, index, share, bonds, currency, interest, etc., the value of derivative changes with derivative

contracts: forwards, future, swaps and options. However, because of forwards, future, swaps are very similar types of contract

many believe that there are really only two types of derivatives: options and forwards. With derivative products, it is possible to

partially or fully transfer price risks by locking in asset prices. As instruments of risk management, these generally do not

influence the fluctuations in the underlying asset prices; derivative product minimizes the impact of fluctuations in the asset

prices. Bank, security firms companies and investors to hedge risks, to gain access to cheaper money and to make profits, us

derivatives. The main reason for going derivative is low risk that here in a derivative contract the time is up to 3 to 6 months so

this maturity period is useful to the investor to protect his money. In these derivatives, futures and options are more contracts that

are tradable because those are traded at stock exchange as well OTC.

However, options are more flexible to investor to minimize the risk and maximize the profits because in this option contract the

optional buyer has a right to buy or sell or not exercise the contract because at the beginning of the contract the optional buyer

pays the premium to the seller or writer of the contract. Here we are having the two types of options those are call and put. Call

means buying of an asset and put means selling of an asset Based on the position the buyer has to exercise the contract when he

has to expect he get the profits he exercise the contract otherwise he leave the contract it means here the loss is only premium

when he cant exercise the contract. In option contract the buyer fix his risk in the form of premium.

Now a days most the investor they are enter into derivative contract for getting more profits with less risk so within a span of

time it was become a lead position. But when the investor assumes a wrong trend of market at the time the investor loss his

premium so to avoid this type of less risk form investor he prefer strategies.

12

Assistant Professor, Department of MBA, Vaagdevi Institute of Technology & Science, Andhra Pradesh, India,

bskmba06@gmail.com

13

Professor, Department of Humanities, JNTUA College of Engineering, Anantapuram, India, tnreddyjntua@gmail.com

14

Professor, Department of MBA, Vaagdevi Institute of Technology & Science, Andhra Pradesh, India,

kumaraswamy41@gmail.com

15

Student ( MBA), Vaagdevi Institute of Technology & Science, Andhra Pradesh, India, yvkrishna@gmail.com

International Journal of Applied Financial Management Perspectives Pezzottaite Journals.

1709 |P a g e

Volume 4, Number 2, April June 2015

ISSN (Print):2279-0896, (Online):2279-090X

PEZZOTTAITE JOURNALS

SJIF (2012): 2.844, SJIF (2013): 5.049, SJIF (2014): 5.81

To get optimum profits with low investment, the investor uses significant strategies in options trading. In these contracts, the

investor can create many option positions with combination of call, put, stock and bond. Generally, strategy means it is a re

planned activity to achieve a long-term goal. Normally common investor cannot create new strategies and implement strategies

without understanding return and return adjust risk in each strategy. Hence, an attempt has been made to study risk and return

relationship involved in each proposed strategy using live data of various companies options.

Introduction to Derivatives

The emergence of the market for derivative product, most notably Forwards, futures and options, can be traced back to the

willingness of risk-averse economic agents to guard themselves against uncertainties arising out of Fluctuations in asset prices. By

their very nature, the financial markets are marked by a very high degree of volatility. With derivative products, it is possible to

partially or fully transfer price risks by locking in asset prices, As Instruments of risk Management; these generally do not

influence the fluctuations in the underlying asset prices. However, by locking in asset prices, derivative products minimize the

impact of fluctuations in asset prices on the profitability and cash flow situation of risk adverse investors.

Derivative Products initially emerged as hedging devices against fluctuations in commodity prices, and commodity-Linked

derivatives remained the sole form of such products for almost three hundred years. Financial derivatives came into spotlight in

the post-1970 period due to growing instability in the financial markets. Since their emergence, these products have become very

popular and by 1990s, they accounted for about two-thirds of total transaction in derivatives products, In recent years, Market for

Financial Derivatives has grown tremendously in terms of variety of instruments available, their, complexity and also turnover. In

the class of equity derivatives the world over, futures and options on stock indices have gained more popularity than on individual

Stocks.

Derivatives in India

Trading in Derivatives of Securities commenced in June 2000 with the enactment of enabling legislation in early 2000.

Derivatives are formally defined to include: (a) a Security derived from a debt instrument, share, loan whether secured or

unsecured, risk instrument or contract for differences or any others from of Security, and (b) a contract Which derives its value

from the price, or index of prices, or underlying Securities.

Derivatives trading commenced in India in June 2000 after SEBI granted the approval to this effect in May 2000. SEBI permitted

the derivative segment of two Stock exchanges, i.e. NSE and BSE, and their clearinghouse / corporation to commerce trading and

settlement in approved derivative contracts.

To begin with, SEBI approved trading in index futures contracts based on S & P CNX Nifty Index and BSE-30 (Sensex) Index.

This was followed by approval for trading in options based on these two indices and Options on individual securities. The

derivatives trading on the NSE commenced with S&P CNX Nifty Index futures on June 12, 2000 .The trading in S&P CNX Nifty

Index Options Commenced on July 4, 2001 and trading in Options on individual securities commenced on July 2, 2001. Single

stock futures were launched on November 9, 2001. In June 2003, SEBI-RBI approved the trading on interest rate derivative

instruments.

The mini derivative future & Option contract on S&P CNX Nifty was introduced for trading on January 1, 2008 while the long

term option Contracts on S&P CNX Nifty were introduced for trading on March-3-2008.

TYPES OF DERIVATIVES

Forwards,

Futures,

Options,

Warrants,

Swaps.

NEED OF STUDY

The stock exchanges provide an organized market place for the investors to buy and sell securities freely.

In the stock exchange, there is an active bidding and a two-way auction trading takes place.

The Stock market, which is an integral part of the capital market, has a major impact on the functioning of the economy.

In the security market, the most reliable and flexible and risk free investment and abnormal profits we can gain through

derivatives which are options in that option strategies can be play a vital role in option contracts to get more profits with

low investments.

International Journal of Applied Financial Management Perspectives Pezzottaite Journals.

1710 |P a g e

Volume 4, Number 2, April June 2015

ISSN (Print):2279-0896, (Online):2279-090X

PEZZOTTAITE JOURNALS

SJIF (2012): 2.844, SJIF (2013): 5.049, SJIF (2014): 5.81

OBJECTIVES OF STUDY

To study the status of option trading in India and problems and remedies.

To study and understanding various mechanism involved in various strategies.

To test empirically the existing strategy using optional trading data.

To propose new strategies based on finding, risk and return.

REVIEW OF LITERATURE

Option

In the most technical definition, an option is the right but not the obligation to purchase or sell shares of stock at a predetermined

price, by a prearranged date. The predetermined price is known as the strike price, and is chosen by the options trader when he/she

enters a position. The prearranged date is known as the expiration date. Depending on which direction you think the underlying

stock will go in, there exist options strategies to take advantage of that stock price movement.

John Seibert

Option Strategies for a Down Market

A put option gives the buyer of that option the right to sell a stock at a pre-determined price known as the option strike price.

Buyers of put options are making bearish bets against the underlying company. The price you would pay for that put option will

be determined, among other things, by the length of time you want the option to last. The longer the time, the more you pay.

Sham Gad

Iron Butterfly Option Strategy

The iron butterfly strategy is a member of a specific group of option strategies known as wingspreads because each strategy is

named after a flying creature such as a butterfly or condor. The iron butterfly strategy is created by combining a bear call spread

with a put spread with an identical expiration date that converges at a middle strike price. A short call and put are both sold at the

middle strike price, which forms the body of the butterfly, and a call and put are purchased above and below the middle strike

price respectively to form the wings. This strategy differs from the basic butterfly spread in two respects; it is a credit spread

that pays the investor a net premium at open, whereas the basic butterfly position is a type of debit spread, and it requires four

contracts instead of three like its generic cousin.

Mark P. Cussen.

Hedging with Bear Spreads

A basic bear spread consists of buying a higher strike option (call or put - but not calls and puts in the same spread) and selling

another call or put with the same expiration but with a lower strike price. Such a spread constructed with puts is called a bear put

spread, while one constructed with calls is named a bear call spread. When you create a bear put spread, you pay a net debit of

premium since you are buying the (higher strike) higher premium put and selling the (lower strike) lower premium put. When you

create a bear call spread, you receive a net credit of premium because you are selling the (lower strike) higher premium call and

buying the (higher strike) lower premium call.

Lawrence D. Cavanagh | June 19, 2009

METHODOLOGY OF RESEARCH

Methods Adopted With Detailed Procedure: Sources of Data

Primary Data

Data observed or collected directly from first-hand Published data and the data collected in the past or other is called secondary

data. Data collected from exchange

Secondary Data

Secondary data is the data that have been already collected by and readily available from other sources. Such data are cheaper and

more quickly obtainable than the primary data and may be available when primary data cannot be obtained at all.

Data collected from internet,

Data collected from books, journals,

Data collected from websites.

International Journal of Applied Financial Management Perspectives Pezzottaite Journals.

1711 |P a g e

Volume 4, Number 2, April June 2015

ISSN (Print):2279-0896, (Online):2279-090X

PEZZOTTAITE JOURNALS

SJIF (2012): 2.844, SJIF (2013): 5.049, SJIF (2014): 5.81

Research methodology typically involves a strategy we select a strategy and implement it on company, which selected and draw a

graph table for that strategy based on strategy requirements (ITM or OTM). Then compare the strategy with the other strategy

which is gives the best return with a low return and ultimately select a best strategy which gives more return with low risk and

proposing a new strategy which gives high return based on existing strategies.

DATA ANALYSIS AND INTERPRETATIONS

a) Testing Empirically the Existing Strategy using Optional Trading Data

Long straddle = buy a cal + buy a put

Interpretation: It shows optoin premium and strke price of call and put of reliance industires int this hedging stratedy buyer loss

is limited in the form of premium and the profit is umlimited becouse if the price of the asset is incresed then autometically the

buyer get profis so he exercise the contract.

Interpretation: It shows a different market prices and different profits and only three strike prices 1150,1100,1060 it will gives

the loss those are limited losses in form of premium other wise the market is rises are fall the buyer get the profits on this strategy

at the same time the seller get losses on the same position and also at what price except those three he exercise the contract he get

profits becouse by the computating of the put and call options in this strategies.

STRATEGY2 : LONG COMBO

LONG COMBO : buy a call + sell a put

For Buying a Call Option for Tata Steel

Interpretation: Option premium and strike prices of put and call of tata steel company in this hedging strategy buyer pay the

premium in one postion and also sumultaniously he recive the premium on put option those are compensated to each other when

the price of asset is incresed he exercise the contract the above mentioned two tables are merged and to form a table called as

long combo.

For Ultimate Return on Long Combo Strategy

Interpretation: Different market prices it gives different profits buyer get profits if the market is rise or the market is fall

becouse when the market is rise his long position on tata steel is makes profits to him and when the market is fall his short

position is makes profits to him when the comparison of the both of this positions ultimately both postions are saves him. When

the market is fall 510 to 450 he gets minimum profit and when the market pirce is rise to 750 he get the high profit upto 90 this is

the total return of long combo strategy.

STRATEGY3 : CALL SPREAD

CALL SPREAD : buy a call(ITM) + sell a call (OTM)

Interpretation: Option premium and srtike price of call option of infosis company the strategist buy one call and sell one call

which one is out the money and one is in the money. in the money buying a call option profits is unlimted and loss is limited in

the form of premium in other option selling of call postion loss is unlimited due to market conditions those combinations of this

positions we framed the strategy that is call spread.

Interpretation: Different market prices it gives different profits or losses only form the above 3250 market price thebuyer will

get the profits when the market is fall he get the losses because the call positions are make proftis only when the market rising so

when the market is inceses the buyer can make more profits when the market is incresed both postions will make the profits

otherwise when the market is fall both positions will get losses so the proftis is may incresed from market fall to rise.

STRATEGY4 : LONG COMBO

LONG COMBO : Sell a put + buy a call

Interpretation: Option premium and strike price of call and put option of hundustan petolium limited company in this hedging

strategy buyer profit is unlimited and and loss is limited in form of premium in call option when the matket is rices call option

wil makes the profits and at the same time he use another position for making profits he sell the put option for making profits

when the market is fall so ultimately two tabels merged and to form a new table that is long combo.

International Journal of Applied Financial Management Perspectives Pezzottaite Journals.

1712 |P a g e

Volume 4, Number 2, April June 2015

ISSN (Print):2279-0896, (Online):2279-090X

PEZZOTTAITE JOURNALS

SJIF (2012): 2.844, SJIF (2013): 5.049, SJIF (2014): 5.81

Interpretation: Different strike prices gives different profits here the buyer only get losses at the prices 370 and 350 those are

constant losses when the market is fall here the buyer fix his risk in the from of the premium the risk will be increses only upto

the 15 otherwise when the market is inceses he get the more profits here by the using of the put and call options the buyer can get

standard returns on his investment positons when the market rise or fall the profit and losses are compensated by both of them so

the buyer will get more profits.

STRATEGY5 : LONG STRADDLE

LONG COMBO : Buy a put + buy a call

Interpretation: Option premium and strike price of call and put of tat steel compay in this hedging strategy buyer loss is limited

in the form of premium and the profit is unlimited because if the price of the asset is incresed then autometically the buyer get

profits so he exercise the cotntract. The above menteioned two tables are merged and ot form a table that is long staddle.

Interpretation: In different market pirces it gives different profits or losses only at the strike prices 570,530 and 510 he get

losses which is also limited losses those are only -5/- otherwise the market is rice or fall he will get the profits here the buyer will

take strike prices on the different prices in call and put positions and pays the premium here the loss is fixed in the form of

premium when the market is rises more and more he get the profit or when the market is fall to very loss still he also get profit so

there is no risk for investor investment.

STRATEGY6 : CALL SPREAD

CALL SPREAD : Sell a call(OTM) + buy a call(ITM)

Interpretation: Option premium and srtike price of call option of infosis company the strategist buy one call and sell one call

which one is out the money and one is in the money. in the money buying a call option profits is unlimted and loss is limited in

the form of premium in other option selling of call postion loss is unlimited due to market conditions those combinations of this

positions we framed the strategy that is call spread.

Interpretation: In different market prices it gives different profits or losses only form the above 860 market price thebuyer will

get the profits when the market is fall he get the losses because the call positions are make proftis only when the market rising so

when the market is inceses the buyer can make more profits.when the market is incresed both postions will make the profits

otherwise when the market is fall both positions will get losses so the proftis is may incresed from market fall to rise.

b) Propose New Strategies Based on Finding Risk and Return

Strategy = sell call + buy a call

Conditions:

Strike price of a selling call should be less than strike price buying call option.

Selling cal premium should be more than difference between strike prices + buying call option premium.

Interpretation: Option premium and srtike price of call option of SBI company the strategist buy one call and sell one call here

two conditions are taken for making profits those are selling strike price of a option is must be less than the buying the call option

and also the difference between the strike pices and premum payed by the longcall must be less then the short call premium.

Those combinations of this positions we framed the strategy table that is call spread.

Interpretation: In different market prices it gives different profits only form the above 2480 market price thebuyer will get the

profits 10/- when the market is fall he get the profit because the short call positions are make proftis only when the market falling

so when the market is fall the buyer can make more profits.when the market is incresed long postions will make the profits so in

this strategy the buyer never get losses because both are preotected by them when the market conditions are change.

c) Growth of Derivative Market

Interpretation: Turnover of the derivative mareket in india from 2001 to 2013. Here from 2003 to 2009 there a rapid growth in

the derivtive market which is futures and options because both contracts are have low risk and high return the highest growth of

market in 2009 after that the market is decrese because uncertinity in the software sector and financial crisis in developed

countries. After that the market is slowly pick up due to increse of software boom.

International Journal of Applied Financial Management Perspectives Pezzottaite Journals.

1713 |P a g e

Volume 4, Number 2, April June 2015

ISSN (Print):2279-0896, (Online):2279-090X

PEZZOTTAITE JOURNALS

SJIF (2012): 2.844, SJIF (2013): 5.049, SJIF (2014): 5.81

d) Growth of Options in Derivative Market with Time

Interpretation: Turnover of the option cotnract in derivative market in india with time here in this data we can observe that the

options are incresed from 2002 upto 2006 because investors are ready to inveset the money in low risk securites after it will

decrese to 2009 due to speculators and mark to market transation.after 2009 it will increses slowly due to real investors.

VARIATION OF OPTIONS AND FUTURES IN DERIVATIVE MARKET WITH TIME

Interpretation: Turnover of options and futures cotnracts in market with time here in this contracts there is a equalent percentage

of growth in both contracts but in the options more contracts are traded than futures because in the options the risk is fix in the

form of premium so the buyer has only rights but not obligations on asset so it is low risk investmet so most of the investors are

intrested to invest the money in option contract.

FINDINGS

Here the different companies and different strategies gives the different risk and returns.

The straddle strategy is a volatile strategy when the market is bullish gets the profits and when market is down get the

profits.

The long combo has no profits but by the increasing of the market the profit is decreased up to 10/-.

Call spread have the both profits and losses only when the market is bullish investor get the profits.

The new proposed strategy gives the only profits between the 30/- to 10/- it means only due to the market conditions

the profits are change.

With the comparison of the futures, options are contracts that are more tradable because options are low investment

contracts than futures.

REFERENCES

1.

www.derivativesindia.com

2.

www.indianinfoline.com

3.

www.nseindia.com

4.

www.bseindia.com

5.

www.sebi.gov.in

*****

International Journal of Applied Financial Management Perspectives Pezzottaite Journals.

1714 |P a g e

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

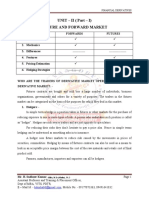

- Unit - II Future and Forward Market (Part - I)Document21 pagesUnit - II Future and Forward Market (Part - I)Sudheer KumarNo ratings yet

- Unit - Introduction To DerivativesDocument30 pagesUnit - Introduction To DerivativesSudheer KumarNo ratings yet

- A Study On Quality of Earnings in Petrochemical IndustryDocument9 pagesA Study On Quality of Earnings in Petrochemical IndustrySudheer KumarNo ratings yet

- 13 ThirteenDocument4 pages13 ThirteenSudheer KumarNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Pakistan Stock Exchange - Wikipedia PDFDocument4 pagesPakistan Stock Exchange - Wikipedia PDFanon_154643438No ratings yet

- Monthly Report: Fixed-Income ResearchDocument8 pagesMonthly Report: Fixed-Income ResearchNguyenNo ratings yet

- Custody in 2025 PDFDocument8 pagesCustody in 2025 PDFaNo ratings yet

- Derivative Securities: FINA 3204Document27 pagesDerivative Securities: FINA 3204BillyNo ratings yet

- PFRS 8-17 Conceptual Framework and Accounting StandardsDocument13 pagesPFRS 8-17 Conceptual Framework and Accounting StandardsJea Baroy50% (2)

- Accounting For Derivative Instruments and Hedging ActivitiesDocument16 pagesAccounting For Derivative Instruments and Hedging Activitiesst666asNo ratings yet

- Currency Convertibility and Its Impact On BOPDocument34 pagesCurrency Convertibility and Its Impact On BOPAditya Avasare100% (3)

- International TradeDocument2 pagesInternational TradeBianca RusuNo ratings yet

- Kantilal Chhaganlal Securities - Over 50 Years of Trusted Wealth ManagementDocument19 pagesKantilal Chhaganlal Securities - Over 50 Years of Trusted Wealth ManagementAmit MitraNo ratings yet

- Chapter 15 Test BankDocument24 pagesChapter 15 Test BankMarc GaoNo ratings yet

- Delaware 20-2705720 (State or Other Jurisdiction of (I.R.S. Employer Incorporation or Organization) Identification No.)Document183 pagesDelaware 20-2705720 (State or Other Jurisdiction of (I.R.S. Employer Incorporation or Organization) Identification No.)Makuna NatsvlishviliNo ratings yet

- Warren BuffetDocument11 pagesWarren BuffetmabhikNo ratings yet

- Indian BankDocument381 pagesIndian BankganeshNo ratings yet

- 2010 Annual ReportDocument92 pages2010 Annual ReportMotella BlogNo ratings yet

- PFRS 9 Financial InstrumentsDocument14 pagesPFRS 9 Financial InstrumentsHeheheNo ratings yet

- Bloomberg CodesDocument4 pagesBloomberg CodeskapuskondaNo ratings yet

- Agcapita Farmland Fund IV Conducts Successful Final ClosingDocument2 pagesAgcapita Farmland Fund IV Conducts Successful Final ClosingCapita1No ratings yet

- Analysis of The Cost of Capital at AmeritradeDocument1 pageAnalysis of The Cost of Capital at AmeritradeLiran HarzyNo ratings yet

- Chapter 12 - Market Microstructure and StrategiesDocument17 pagesChapter 12 - Market Microstructure and StrategiesJenniferNo ratings yet

- 2019 FRM Learning ObjectivesDocument13 pages2019 FRM Learning ObjectivesSunil ShettyNo ratings yet

- International Journal of Business and Management Invention (IJBMI)Document8 pagesInternational Journal of Business and Management Invention (IJBMI)inventionjournalsNo ratings yet

- Solution To Chapter 21Document25 pagesSolution To Chapter 21Sy Him100% (5)

- ASMAITHA Financials 02 PDFDocument58 pagesASMAITHA Financials 02 PDFthrigunNo ratings yet

- Chapter 05 - Statement of Financial Position and Statement of Cash FlowsDocument86 pagesChapter 05 - Statement of Financial Position and Statement of Cash FlowsRachel Mae Fajardo100% (2)

- Effects of PNB Scam on Indian BankingDocument22 pagesEffects of PNB Scam on Indian BankingRanglani YaShNo ratings yet

- Cordova v. Reyes Daway Lim Bernardo Lindo Rosales Law Offices (2007Document2 pagesCordova v. Reyes Daway Lim Bernardo Lindo Rosales Law Offices (2007Cherlene TanNo ratings yet

- Ponzi SchemesDocument14 pagesPonzi Schemesshah_gen89No ratings yet

- Our Valuation Methodology for Floating Rate Notes (FRNsDocument2 pagesOur Valuation Methodology for Floating Rate Notes (FRNsisasNo ratings yet

- 2654Document176 pages2654Theresa BomabebeNo ratings yet

- 2CEXAM Mock Question Licensing Examination Paper 2Document22 pages2CEXAM Mock Question Licensing Examination Paper 2Tsz Ngong Ko100% (1)