Professional Documents

Culture Documents

Budget 2015 - A Step Further Towards Financial Inclusion and Social Security MUDRA Bank To Turn Youth From Being Job-Seekers, To Job-Creators

Uploaded by

TarunKumarSinghOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Budget 2015 - A Step Further Towards Financial Inclusion and Social Security MUDRA Bank To Turn Youth From Being Job-Seekers, To Job-Creators

Uploaded by

TarunKumarSinghCopyright:

Available Formats

Budget 2015: A step further towards financial inclusion and social Secu...

1 of 3

http://pib.nic.in/newsite/PrintRelease.aspx

Press Information Bureau

Government of India

Special Service and Features

17-March-2015 16:08 IST

Budget 2015: A step further towards financial inclusion and social Security MUDRA Bank to turn youth from being

job-seekers, to job-creators

Feature

Budget 2015

*Dr. H.R. Keshavamurthy

India is one of the youngest nations in the world with more than 54% of the total population below 25 years of age.

Our young people have to be both educated and employable for the jobs of the 21st Century. Yet less than 5% of our

potential workforce gets formal skill training to be employable and stay employable. With rural population still forming

close to 70% of Indias population, enhancing the employability of rural youth is the key to unlocking Indias demographic

dividend.

The year 2022 will be the Amrut Mahotsav, the 75th year, of Indias independence. The vision of what the Prime

Minister has called Team India, led by the States and guided by the Central Government, includes among other objectives,

educating and skilling our youth to enable them to get employment; The Skill India and the Make in India programmes are

aimed at doing this and we also have to encourage and grow the spirit of entrepreneurship in India and support new

start-ups. Thus only can our youth turn from being job-seekers, to job-creators.

Though corporate and business entities have a role to play; this has to be complemented by informal sector

enterprises which generate maximum employment. There are some 5.77 crore small business units, mostly individual

proprietorship, which run small manufacturing, trading or service businesses. 62% of these are owned by SC/ST/OBC.

This bottom-of-the-pyramid, hard-working entrepreneurs find it difficult, if not impossible, to access formal systems of

credit. Towards this direction a major initiative has been announced in the recent budget in the name MUDRA Bank.

Micro Units Development Refinance Agency (MUDRA) Bank, with a corpus of Rs.20,000 crore and credit

guarantee corpus of Rs 3,000 crore has been announced in the Budget 2015. MUDRA Bank will refinance Micro-Finance

Institutions through a Pradhan Mantri Mudra Yojana. In lending, priority will be given to SC/ST enterprises. These

measures will greatly increase the confidence of young, educated or skilled workers who would now be able to aspire to

become first generation entrepreneurs; existing small businesses, too, will be able to expand their activities.

The Union Finance Minister, Shri Arun Jaitley in his Budget Speech for 2015-16 said Our government firmly

believes that development has to generate inclusive growth. While large corporate and business entities have a role to play,

this has to be complemented by informal sector enterprises which generate maximum employment. There are some 5.77

crore small business units, mostly individual proprietorship, which run small manufacturing, trading or service businesses.

62% of these are owned by SC/ST/OBC. These bottom-of-the-pyramid, hard-working entrepreneurs find it difficult, if not

impossible, to access formal systems of credit. I, therefore, propose to create a Micro Units Development Refinance Agency

(MUDRA) Bank, with a corpus of Rs. 20,000 crore, and credit guarantee corpus of Rs. 3,000 crore. MUDRA Bank will

refinance Micro-Finance Institutions through a Pradhan Mantri Mudra Yojana. In lending, priority will be given to SC/ST

enterprises. These measures will greatly increase the confidence of young, educated or skilled workers who would now be

able to aspire to become first generation entrepreneurs; existing small businesses, too, will be able to expand their activities.

Just as we are banking the un-banked, we are also funding the un-funded.

The government proposes to set up a Micro Units Development and Refinance Agency (MUDRA) Bank through a

statutory enactment. This Bank would be responsible for regulating and refinancing all Micro-finance Institutions (MFI)

which are in the business of lending to micro/small business entities engaged in manufacturing, trading and services

activities. The Bank would partner with state level/regional level co-ordinators to provide finance to Last Mile Financer of

small/micro business enterprises.

27-07-2015 03:19

Budget 2015: A step further towards financial inclusion and social Secu...

2 of 3

http://pib.nic.in/newsite/PrintRelease.aspx

The MUDRA Bank would primarily be responsible for

1)

Laying down policy guidelines for micro/small enterprise financing business

2)

Registration of MFI entities

3)

Regulation of MFI entities

4)

Accreditation /rating of MFI entities

5)

Laying down responsible financing practices to ward off indebtedness and ensure

protection principles and methods of recovery.

6)

Development of standardized set of covenants governing last mile lending to micro/small

7)

Promoting right technology solutions for the last mile

8)

Formulating and running a Credit Guarantee scheme for providing guarantees to the

extended to micro enterprises

9)

Creating a good architecture of Last Mile Credit Delivery to micro businesses under the

Mantri Mudra Yojana.

proper client

enterprises

loans which are being

scheme of Pradhan

The above measures would not only help in increasing access of finance to the unbanked but also bring down the

cost of finance from the last Mile Financers to the micro/small enterprises, most of which are in the informal sector.

Just as PMDJY is banking the un-banked, we are also funding the un-funded, the creation of a bank to refinance

micro-finance institutions, with priority to dalits and tribal enterprises, leads the way in the budget's leg-up for "social

justice". Most of the skilled labourers in the industry are from dalit communities. They have the potential to start their own

micro units, in case they can get easy loans. Though most of them are highly skilled in their jobs and understand technical

nuances of their work, with very little or no property they don't have access to financing facilities. When education is

already increasing among SC students, the refinance facility of micro units can be encouraging for them to turn

entrepreneurs.

The Governments proposal to create a Micro Units Development Refinance Agency (MUDRA) Bank as a single

regulator for all types of entities in the microfinance space is a positive for the sector. It is likely to bring in uniform

regulation and a code of conduct for these entities. This would facilitate the adoption of responsible finance principles by all

lenders and in-turn help prevent issues of overleveraging of borrowers. It could become a prominent source of funding and

liquidity to Non Banking Finance Companies- Microfinance Institutions (NBFC-MFIs) and other players in the sector.

NBFC-MFIs cost of funds could come down significantly. The Rs. 3000 crore credit guarantee corpus could give a boost to

the Micro, Small and Medium Enterprise sector that many a time struggles to provide collateral while availing of loans.The

MSME sector has hailed the establishment of Micro Units Development Refinance Agency (MUDRA) Bank.

Representatives of the MSME sector feel that if implemented properly, the initiatives of the NDA Government will help

achieve double- digit GDP growth, surpassing China.

Financial Inclusion through Jan Dhan to Jan Suraksha

The Financial Inclusion is one of the top most priorities of the government as exclusion of a large number of people

from any access to financial services inhibits the growth of our country. The Pradhan Mantri Jan Dhan Yojana (PMJDY), the

biggest financial inclusion initiative in the world, has surpassed original target of opening bank accounts for 7.5 crore

uncovered households in the country by 26th January, 2015, with banks already opening 11.50 Crore accounts by 17th

January 2015. Out of the accounts opened, 60% are in rural areas and 40% are in urban areas. Share of female account

holders is about 51%.The Rupay cards have been issued to more than 10 crore beneficiaries who will get a benefit of

personal accidental insurance of Rs. 1.00 Lac under the Yojana. In addition there is a life insurance cover of Rs.30, 000 for

eligible beneficiaries.

Further, taking into account that large proportion of Indias population is without insurance of any kind - health,

accidental or life, encouraged by the success of the Pradhan Mantri Jan Dhan Yojana, Government is creating a universal

social security system for all Indians, specially the poor and the under-privileged. The soon-to-be-launched Pradhan

Mantri Suraksha Bima Yojna will cover accidental death risk of Rs.2 lakh for a premium of just Rs.12 per year. Similarly,

the Atal Pension Yojana, will provide a defined pension, depending on the contribution, and its period. To encourage

people to join this scheme, the Government will contribute 50% of the beneficiaries premium limited to Rs 1,000 each year,

for five years, in the new accounts opened before 31st December, 2015. The third Social Security Scheme is the Pradhan

Mantri Jeevan Jyoti Bima Yojana which covers both natural and accidental death risk of Rs.2 lakhs. The premium will be

Rs.330 per year, or less than one rupee per day, for the age group 18-50.

Also it has been proposed in the Budget 2015, creation of a Senior Citizen Welfare Fund by appropriation of

unclaimed deposits of about Rs.3,000 crore in the PPF and approximately Rs. 6,000 crore in the EPF corpus, which will be

27-07-2015 03:19

Budget 2015: A step further towards financial inclusion and social Secu...

3 of 3

http://pib.nic.in/newsite/PrintRelease.aspx

used to subsidize the premiums of vulnerable groups such as old age pensioners, BPL card-holders, small and marginal

farmers and others.

To address the needs of senior citizens in the country which is now approximately 10.5 crore, out of which over one

crore are above the age of 80 years with 70% from rural areas and a large number in the BPL category, a new scheme for

providing Physical Aids and Assisted Living Devices for senior citizens, living below the poverty line is in the pipeline.

To summarise, these social security schemes reflect Governments commitment to utilize the Jan Dhan platform, to

ensure that no Indian citizen will have to worry about illness, accidents, or penury in old age. Being sensitive to the needs of

the poor, under-privileged and the disadvantaged, Government also remains committed to the ongoing welfare schemes for

the

SCs,

STs

and

Women.

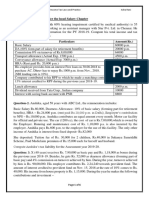

The Sukanya Samruddhi Yojana will provide support for marriage and education of young women. Despite serious

constraints on Union finances, allocations made this year are as follows:

SC

` 30,851 crore

ST

` 19,980 crore

Women

` 79,258 crore

An integrated education and livelihood scheme called Nai Manzil will be launched this year to enable Minority

Youth who do not have a formal school-leaving certificate to obtain one and find better employment. Further, to show-case

civilization and culture of the Parsis, the Government will support, in 2015-16, an exhibition, The Everlasting Flame.

To conclude, as the Prime Minister referred to the ancient Sanskrit verse: Sukhasya Moolam Dharma, Dharmasya

Moolam Artha, Arthasya Moolam Rajyam which puts the onus on the state to involve people in economic activity.

*Dr. H. R. Keshavamurthy is the Director( M & C),PIB,Kolkata

(With inputs from ministry of Finance)

(PIB Features)

Email: - featuresunit@gmail.com

himalaya@nic.in

SS-300/SF-300/ 17.03.2015

YSK/ Uma

27-07-2015 03:19

You might also like

- HRDDocument56 pagesHRDTarunKumarSinghNo ratings yet

- 1311 - (Ethics) Suspension - Meaning, Features, Reasons Death, Resignation, Promotion During Suspension & Case Studies - MrunalDocument26 pages1311 - (Ethics) Suspension - Meaning, Features, Reasons Death, Resignation, Promotion During Suspension & Case Studies - MrunalTarunKumarSinghNo ratings yet

- Economic Survey Ch13 P3 Human Resources - Minorities SC ST PH Elderly USTAAD Van Bandhu Hamari DharohaDocument12 pagesEconomic Survey Ch13 P3 Human Resources - Minorities SC ST PH Elderly USTAAD Van Bandhu Hamari DharohaTarunKumarSinghNo ratings yet

- 1311 - (Ethics) Conduct Rules - Meaning, Implication, Examples, Misconduct VsDocument33 pages1311 - (Ethics) Conduct Rules - Meaning, Implication, Examples, Misconduct VsTarunKumarSinghNo ratings yet

- Diplomacy BIMSTEC Third Summit at Nay Pyi Taw Outcomes Obstacles Trans Border Connectivity BCIM CorriDocument8 pagesDiplomacy BIMSTEC Third Summit at Nay Pyi Taw Outcomes Obstacles Trans Border Connectivity BCIM CorriTarunKumarSinghNo ratings yet

- Diplomacy Middle East Iran-US Nuclear Dead Amp Operation Raahat To Rescue Indians From YemenDocument5 pagesDiplomacy Middle East Iran-US Nuclear Dead Amp Operation Raahat To Rescue Indians From YemenTarunKumarSinghNo ratings yet

- Diplomacy Durand Line Baluchistan Gwadar Port IndiaPakistanAfghanistanIranian InterestsDocument6 pagesDiplomacy Durand Line Baluchistan Gwadar Port IndiaPakistanAfghanistanIranian InterestsTarunKumarSinghNo ratings yet

- Diplomacy 11th Pravasi Bharatiya Divas 2013 Highlights Issues AwardsDocument8 pagesDiplomacy 11th Pravasi Bharatiya Divas 2013 Highlights Issues AwardsTarunKumarSinghNo ratings yet

- Diplomacy AIIB Asian Infrastructure Investment Bank - Purpose Structure Indias Interests - Pro Anti ArDocument6 pagesDiplomacy AIIB Asian Infrastructure Investment Bank - Purpose Structure Indias Interests - Pro Anti ArTarunKumarSinghNo ratings yet

- HRD Government Intervention For Skill Development Issues From Design Amp Implementation For GS Mains2Document4 pagesHRD Government Intervention For Skill Development Issues From Design Amp Implementation For GS Mains2TarunKumarSinghNo ratings yet

- Diplomacy Al-Qaeda Threat To India US Report On Indias Counter-Terrorism Measures Border Security ManDocument4 pagesDiplomacy Al-Qaeda Threat To India US Report On Indias Counter-Terrorism Measures Border Security ManTarunKumarSinghNo ratings yet

- Diplomacy 11th Pravasi Bharatiya Divas 2013 Highlights Issues AwardsDocument8 pagesDiplomacy 11th Pravasi Bharatiya Divas 2013 Highlights Issues AwardsTarunKumarSinghNo ratings yet

- Diplomacy Delaram Zaranj Highway Chabahar Port India-Iran-Afghanistan Trade RelationsDocument3 pagesDiplomacy Delaram Zaranj Highway Chabahar Port India-Iran-Afghanistan Trade RelationsTarunKumarSinghNo ratings yet

- Soil Health Card' - An Innovation in Agriculture SectorDocument2 pagesSoil Health Card' - An Innovation in Agriculture SectorTarunKumarSinghNo ratings yet

- Avoid Indiscriminate Use of UreaDocument2 pagesAvoid Indiscriminate Use of UreaTarunKumarSinghNo ratings yet

- Railway Budget 2015 A Step Forward To Seek Resource Mobilization For Higher InvestmentDocument2 pagesRailway Budget 2015 A Step Forward To Seek Resource Mobilization For Higher InvestmentTarunKumarSinghNo ratings yet

- Salute to Womanhood Across IndiaDocument2 pagesSalute to Womanhood Across IndiaTarunKumarSinghNo ratings yet

- Diplomacy 11th Pravasi Bharatiya Divas 2013 Highlights Issues AwardsDocument8 pagesDiplomacy 11th Pravasi Bharatiya Divas 2013 Highlights Issues AwardsTarunKumarSinghNo ratings yet

- Insurance Reform - A Game ChangerDocument3 pagesInsurance Reform - A Game ChangerTarunKumarSinghNo ratings yet

- Equality, Empowerment of Women, Women's Full Enjoyment of Human Rights Are Basic Ingredients of Development PDFDocument3 pagesEquality, Empowerment of Women, Women's Full Enjoyment of Human Rights Are Basic Ingredients of Development PDFTarunKumarSinghNo ratings yet

- Agricultural Research - Technology InclusionDocument2 pagesAgricultural Research - Technology InclusionTarunKumarSinghNo ratings yet

- India's Agricultural Extension ProgrammesDocument2 pagesIndia's Agricultural Extension ProgrammesTarunKumarSinghNo ratings yet

- A Leap Towards Hassle-Free ProceduresDocument2 pagesA Leap Towards Hassle-Free ProceduresTarunKumarSinghNo ratings yet

- Inflation Falls, GDP Surges as Economy Looks UpDocument2 pagesInflation Falls, GDP Surges as Economy Looks UpTarunKumarSinghNo ratings yet

- Avoid Indiscriminate Use of UreaDocument2 pagesAvoid Indiscriminate Use of UreaTarunKumarSinghNo ratings yet

- Achieving The Objective of "Swachh and Swastha Bharat"Document3 pagesAchieving The Objective of "Swachh and Swastha Bharat"TarunKumarSinghNo ratings yet

- Environment Stewardship Programme of NPCIDocument2 pagesEnvironment Stewardship Programme of NPCITarunKumarSinghNo ratings yet

- A Big Push in Budget For Infrastructure To Lift Indian EconomyDocument2 pagesA Big Push in Budget For Infrastructure To Lift Indian EconomyTarunKumarSinghNo ratings yet

- "Swavlamban" - The Mantra For Inclusion of Persons With DisabilitiesDocument3 pages"Swavlamban" - The Mantra For Inclusion of Persons With DisabilitiesTarunKumarSinghNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Pension ProposalsDocument12 pagesPension ProposalsprastacharNo ratings yet

- IAS - Cadre RulesDocument27 pagesIAS - Cadre RulesindianeconomistNo ratings yet

- 2023-08 The ConnexionDocument64 pages2023-08 The ConnexionleporeNo ratings yet

- Project My Life - Creating A Strong FoundationDocument8 pagesProject My Life - Creating A Strong Foundationsigal ardan100% (1)

- Problems On Taxable Salary Income Additional PDFDocument24 pagesProblems On Taxable Salary Income Additional PDFNALIN MEHTA 1713068No ratings yet

- The Mathematics of FinanceDocument30 pagesThe Mathematics of FinancezahidacaNo ratings yet

- A-1690 XTH Labour & Indutrial Law IIDocument18 pagesA-1690 XTH Labour & Indutrial Law IIRaqesh MalviyaNo ratings yet

- Certified Trust and Financial Advisor: ABA CTFA Dumps Available Here atDocument4 pagesCertified Trust and Financial Advisor: ABA CTFA Dumps Available Here atBhagyashree kawaleNo ratings yet

- Exit KitDocument27 pagesExit Kitjinxed0% (1)

- BU 12 Tentative MOU Legislative Transmittal PackageDocument7 pagesBU 12 Tentative MOU Legislative Transmittal PackageJon OrtizNo ratings yet

- Marcelo Steel Corporation Tax Exemption CaseDocument2 pagesMarcelo Steel Corporation Tax Exemption CasesakuraNo ratings yet

- Update BFP pensioner detailsDocument1 pageUpdate BFP pensioner detailsJENET JAENANo ratings yet

- EY Tax Immigration Issues PDFDocument15 pagesEY Tax Immigration Issues PDFEugene FrancoNo ratings yet

- Hotel Berry Application FormDocument6 pagesHotel Berry Application Formmelissacorker100% (1)

- RSabha QA Given by Govt On 18.03.2021Document2 pagesRSabha QA Given by Govt On 18.03.2021Project Manager IIT Kanpur CPWDNo ratings yet

- Maxwell ScandalDocument4 pagesMaxwell ScandalShoaib SharifNo ratings yet

- Chris Abele ExpulsionDocument4 pagesChris Abele ExpulsionChris LiebenthalNo ratings yet

- Separation Agreement Checklist MASSDocument4 pagesSeparation Agreement Checklist MASSbanker135No ratings yet

- Application for GratuityDocument2 pagesApplication for GratuityRanjan KumarNo ratings yet

- Intermediate Accounting 15Th Edition Kieso Solutions Manual Full Chapter PDFDocument67 pagesIntermediate Accounting 15Th Edition Kieso Solutions Manual Full Chapter PDFprise.attone.itur100% (10)

- Pension FundsDocument24 pagesPension FundsRonica MahajanNo ratings yet

- Bajaj Allianz ReportDocument112 pagesBajaj Allianz ReportSamartha_2567% (3)

- SBN-1451: Military and Uniformed Personnel Insurance FundDocument5 pagesSBN-1451: Military and Uniformed Personnel Insurance FundRalph RectoNo ratings yet

- Proposal For Brgy'sDocument9 pagesProposal For Brgy'sKcaisse EssaickNo ratings yet

- IFS QuestionDocument6 pagesIFS QuestionHdkakaksjsbNo ratings yet

- Caso Gerber AdministraciónDocument22 pagesCaso Gerber AdministraciónJuan Carlos VallesNo ratings yet

- BajajDocument4 pagesBajajraheja_ashishNo ratings yet

- The Furnished Room - My Future WifeDocument2 pagesThe Furnished Room - My Future Wifemiky feristenNo ratings yet

- Rule8 and 9 of CCS Pension Rules 1972Document10 pagesRule8 and 9 of CCS Pension Rules 1972rakbab486No ratings yet

- Scheme de Pensie ParlamentarăDocument15 pagesScheme de Pensie ParlamentarăRaduZlatiNo ratings yet