Professional Documents

Culture Documents

AGR 2015 Annual Survey - FINAL

Uploaded by

Legal CheekOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

AGR 2015 Annual Survey - FINAL

Uploaded by

Legal CheekCopyright:

Available Formats

Graduate

Recruitment

2015

The AGR

Annual Survey

Produced for AGR by

The AGR Annual Survey 2015

Annual Survey 2015

Association of Graduate Recruiters

6 Bath Place

Rivington Street

London

EC2A 3JE

Survey produced for AGR by

CFE Research

Phoenix Yard

Upper Brown Street

Leicester LE1 5TE

For more information please contact Sarah Neat on 0116 229 3300 or Sarah.neat@cfe.org.uk

Website: www.cfe.org.uk

All information contained in this report is believed to be correct and unbiased, but the publisher does not accept

responsibility for any loss arising from decisions made upon this information.

CFE Research and the Association of Graduate Recruiters

All rights reserved. No part of this publication may be reproduced, stored in a retrieval system or transmitted in

any form or by any means, electronic, mechanical, photocopying or otherwise, without prior permission of the

publisher.

Annual Survey 2015

Contents

Foreword ................................................................................................................................... 7

Executive summary .................................................................................................................... 9

Introduction ............................................................................................................................ 12

Graduate vacancies.................................................................................................................. 14

Graduate vacancies in 2013-2014 and 2014-2015 ....................................................................................................... 14

Vacancy changes by sector from 2013-2014 to 2014 to 2015 ..................................................................................... 15

Vacancies in 2013-2014 and 2014-2015 by size of firm ............................................................................................... 16

Vacancies in 2014-2015 by geographical area .............................................................................................................. 17

Vacancies in 2014-2015 by career area ........................................................................................................................ 18

Diversity of graduate recruits in 2013-2014 ................................................................................................................. 19

Monitoring and improving the diversity of graduate recruits ...................................................................................... 20

Graduate salaries ..................................................................................................................... 23

Graduate salaries in 2014-2015 .................................................................................................................................... 23

Graduate salaries in 2014-2015 by geographical area ................................................................................................. 24

Salaries for retained graduates..................................................................................................................................... 24

Student placements and internships ........................................................................................ 26

Provision of placement and internship programmes in 2013-2014 ............................................................................. 26

Salaries for placement students and interns ................................................................................................................ 27

Applications and selection ....................................................................................................... 30

Cost per hire estimates recruitment .......................................................................................................................... 30

Graduate applications in 2014-2015 ............................................................................................................................ 32

Time to offer in 2014-2015 ........................................................................................................................................... 33

Offers and acceptances 2014-2015 .............................................................................................................................. 34

Selection criteria ........................................................................................................................................................... 35

Selection methods ........................................................................................................................................................ 36

Monitoring the selection process ................................................................................................................................. 38

Graduate development and retention ...................................................................................... 41

Cost per hire estimates development ....................................................................................................................... 41

Graduate employment contracts in 2014-2015 ........................................................................................................... 42

Ownership of headcount and funding .......................................................................................................................... 43

Graduate development programmes in 2014-2015 ..................................................................................................... 44

Financial support for graduate development ............................................................................................................... 46

Assessment of graduates and development programmes ........................................................................................... 47

Graduate retention ....................................................................................................................................................... 48

Annual Survey 2015

Appendix 1 .............................................................................................................................. 50

Methodology and respondent profile.......................................................................................................................... 51

Annual Survey 2015

Foreword

Our employer members graduate vacancies have risen by 13.2% compared to 2014, meaning that total

vacancies have reached the highest ever level on our records and exceeding the predictions made at the

start of the season. Median graduate salaries have risen by 3.7% and the average salary paid to an intern is

now 317 per week.

Yet despite this buoyant graduate market the number of female graduates joining AGR employer

programmes averages only 41.6%, even though 58.7% of graduates are women. So diversity in our

graduate workforce remains a challenge. Whats more, the overall share of females has not improved in the

last five years despite 62.8% of firms currently having a strategy to improve their gender balance. This is an

issue which requires more of our attention.

This year, AGR is also pleased to be able to share the first industry-wide benchmarks of how much

graduates cost to recruit and develop. By using your total recruitment and development budgets and

dividing these by the number of your graduate vacancies, we can state that graduates cost an average of

3,396 to recruit and 2,693 to develop. The average for law firms is much higher and so is listed

separately. These figures once again reflect the level of investment that our industry is making to attract

and nurture graduate talent.

Employers are also retaining their graduates. Despite a commentary that all graduates are job-hoppers,

graduates stay with our employer members for a median period of 5 years. Whats more, only 5% leave in

their first year on the job and just 12% leave before the end of two years. We have gathered a wealth of

insight into the financing and support in graduate development programmes and we encourage you to

delve into the report to find out more.

Our findings also highlight some gaps in data that are holding improvements. For example, 86.4% of

employers dont know the socio-economic background of their hires, 72.2% dont know their 5-year

retention rates, and 40.4% dont calculate the value that graduates bring to their business. Making better

use of data will be essential to help us to best manage our talent in future.

To help you make good use of these benchmarks in your work, you can interact with our data once again

on AGRs website. Be sure to log into our Data Dashboard and explore the numbers most relevant to you.

Our research also continues to evolve and we value your feedback. Enjoy the report and we look forward to

your continued engagement with AGR and our analysis.

Stephen Isherwood

Chief Executive, AGR

Samuel Gordon

Research Analyst, AGR

Annual Survey 2015

Annual Survey 2015

Executive summary

Graduate vacancies

Employers are offering 13.2% more graduate vacancies than last year with a predicted 24,126 vacancies for

the 2014-15 season. The sectors with the largest number of vacancies are Accounting and professional

services (23.0%), the Public sector (14.6%), and Engineering and industrial firms (12.1%). 54.1% of vacancies

are outside London, with the top two regions being the West Midlands (7.7%) and the South East (6.9%).

Four in five employers (78.4%) have at least one targeted strategy to improve diversity. The most common

focus is on gender diversity, with 62.8% of firms working to increase their share of female hires. However,

the average share of female hires is currently 41.6%, compared to 58.7% of university graduates. The

average share of Black Asian Minority Ethnic (BAME) hires is 15.6%, compared to 18.6% of university

graduates. Only 25.8% of employers monitor the socio-economic background of their hires.

Graduates cost an estimated 3,396 to recruit on average, excluding the legal sector where the average

cost per hire is 12,682. These costs also exhibit economies of scale, with firms employing less than 25

graduates averaging 5,632 to recruit each hire and those employing more than 250 graduates only

averaging 2,0891.

Graduate salaries

Median graduate salaries have risen. Starting salaries now stand at 28,000, up 3.7% from 27,000 a year

ago. Median salaries at 1, 3 and 5 years are 28,000, 35,000 and 45,000 respectively. These changes

reflect the increasing competitiveness of the market.

Student placements and internships

Employers are investing more in their interns. 72.6% of respondents offered internships in 2013-14, with

7,195 places offered and the typical length of an internship being 11 weeks. On average, employers are

converting 44.5% of their interns into graduate hires. The median salary for interns in 2013-14 was 317

per week, up 3.3% from the year before.

56.3% of employers offered sandwich/industrial placement years in 2013-14. The median salary for these

opportunities has also risen by 1.6% to 326 per week.

These figures exclude Law firms.

Annual Survey 2015

Graduate applications and selection

Applications per vacancy continue to drop and now stand at 65 compared to 69 in 2013-14. Employers are

planning to make 10.9% more offers than vacancies available and the average time between a graduate

applying for and receiving an offer is 11 weeks. 8.2% of offers are reneged upon.

Selection methods remain largely static compared to last year. 77.0% of employers use a 2:1 degree entry

standards (74.2% last year), 33.3% use UCAS tariffs (38.2% last year), and only 29.1% have entry cut-offs

based on specific subjects (30.3% last year). However, use of video interviewing continues to rise, with

29.8% of employers now using this technology versus 21.2% last year and just 6.3% using it three years ago.

Employers are also taking steps to measure whether their selection process is working. 72.8% of employers

monitor candidate feedback on the selection process. Two thirds of employers (66.3%) use the on-the-job

performance of graduates to check whether their selection process is bringing in the best performers.

Graduate development and retention

Graduate development programmes are typically 24 months long as well as being centrally funded and with

a centrally held headcount. 76.0% of graduates are employed on permanent contracts, although this

proportion varies by the size of firm. Graduates on these programmes receive an average of 12.6 days of

technical training and 7.8 days of soft skills training, both off-the-job.

The support offered by these programmes varies significantly. While 99.3% include an induction at the

start, just 60.0% include an event to mark the end. Half of employers (50.8%) pay travel expenses to help

graduates relocate during rotations, and three quarters (76.7%) of employers pay all of the fees for

professional qualifications. Around a third of employers (35.6%) also run compulsory training for their

managers on how to manage graduates. The best structure seems to be very specific to the firm.

Employers investment in graduate development seems to be paying off. The average length of time that

graduates stay with one employer is 5 years. On average, just 6% of graduates leave their employer in their

first year on the job, with just 11% leaving their employer before the end of their second year. The 1, 2 and

3 year retention rates are 93.8%, 88.6% and 79.2% respectively.

Graduates cost an estimated 2,963 to develop over the course of a graduate development programme2.

This cost exhibits economies of scale, with firms employing less than 25 graduates investing 4,246 per

hire, while firms that hire more than 250 graduates just 736. Despite this level of investment in graduate

hires, just 40.9% of employers know what methods are used to calculate the value that graduates bring to

their business and 40.4% do not calculate the value graduates add.

This figure excludes Law firms.

10

Annual Survey 2015

Introduction

11

Annual Survey 2015

Introduction

Welcome to the AGR Annual Survey 2015.

The AGR Annual Survey is the definitive study of AGR employer members and their recruitment and

development practices. It provides the latest insights on conditions and trends in the graduate recruitment

and development market, as well as regular benchmarking of key market indicators including vacancy and

salary levels.

As the leading survey of graduate recruitment practices, spanning the longest continuous series of

recruitment seasons, the survey previously referred to as the Summer Survey is the primary source of

information on graduate recruitment levels, methods and practices amongst AGR members. It is an

invaluable tool for assessing, organising and optimising graduate recruitment and development activities.

Undertaken on behalf of AGR by CFE Research, this Annual Survey explores:

Chapter 1: Predicted graduate vacancy levels for the 2014-2015 recruitment season split by

business sector, geographical area and career area, and changes observed since 2013-2014.

Chapter 2: Predicted graduate starting salaries in 2013-2014 by business sector, geographical area

and career area.

Chapter 3: The use of placement and internship programmes amongst AGR employers and their

role and contribution to graduate recruitment.

Chapter 4: The volume of applications submitted to AGR members for positions on graduate

programmes and selection methods as well as the new calculation of the total cost to recruit a

graduate.

Chapter 5: The extent and cost per hire of graduate development programmes amongst AGR

members and the features of the programmes, and levels of retention and progression amongst

graduate recruits.

12

Annual Survey 2015

Chapter 1

Graduate vacancies

13

Annual Survey 2015

Graduate vacancies

This chapter presents AGR members graduate vacancy levels for the 2014-2015 recruitment season by

business sector, size and geographical area, and compares these to the year-end graduate vacancy levels

observed for 2013-2014.

Graduate vacancies in 2013-2014 and 2014-2015

AGR members are offering 13.2%3 more graduate vacancies in the 2014-15 season. Figure 1.1 presents

year-on-year changes in vacancies since 2000 and shows that the market is now in a period of sustained

growth. Employer members offered 24,126 graduate vacancies in 2014-15 overall.

2000

14.7%

2001

14.6%

2002

-6.5%

2003

-3.4%

2004

15.5%

2005

5.1%

2006

5.1%

2007

12.7%

2008

2009

0.6%

-8.9%

2010

8.9%

2011

2012

1.7%

-8.2%

2013

4.3%

2014

4.3%

2015 (predicted)

13.2%

Figure 1.1:

Graduate vacancy changes at AGR employers from 1999-2000 to 2014-2015 Percentage increase or decrease on

previous year - Varying bases

This is based on predictions as of July 2015.

14

Annual Survey 2015

Vacancy changes by sector from 2013-2014 to 2014 to 2015

Vacancies have increased in almost all sectors. Consulting and business services firms had the largest

increase in vacancies since 2013-14, at 47.8%, although the largest growth by volume is in Accountancy and

professional services and the Public sector. The changing dynamics of the market are represented in Table

1.2 below4.

Overall, employers in the Accountancy or professional services firms sector continue to offer the highest

proportion of vacancies at 23.0%. The Public sector offers the second highest proportion at 14.6% followed

by Engineering or industrial companies (12.1%).

Three sectors have experienced a decrease in the number of vacancies. Energy, water or utility firms had a

9.5% drop in vacancies compared to 2013-14, and transport and logistics companies this year experienced a

15.1% reduction in their already small numbers. Vacancies at Law firms dropped slightly (1.1%), compared

to last years 3.3% increase as captured in the AGR 2015 Winter Review.

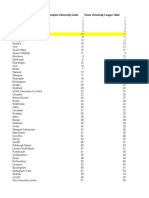

Table 1.2: Vacancies in 2014-2015 by sector

Change in total vacancies

% of 24,126 vacancies

2013-14 2014-15

Accountancy or professional service firm

23.0%

18.4%

Public sector

14.6%

17.1%

Engineering or industrial company

12.1%

5.9%

Retail

10.1%

12.7%

Banking or financial services

9.6%

7.3%

IT & Telecommunications

9.1%

16.4%

Construction company or consultancy

5.4%

19.8%

Law firm

5.1%

-1.1%

Consulting or business service firm

4.5%

47.8%

FMCG company

1.9%

7.3%

Energy, water or utility company

1.0%

-9.5%

Insurance company

0.5%

21.5%

Transport or logistics company

0.5%

-15.1%

Other

0.6%

24.6%

The following sectors are not reported in our analysis as the small number of respondents may jeopardise their

anonymity: chemical or pharmaceutical companies, investment bank or fund managers, motor manufacturing and oil

companies.

15

Annual Survey 2015

Vacancies in 2013-2014 and 2014-2015 by size of firm

Figure 1.3 shows that the proportion of graduates in firms of different sizes is broadly the same as last year,

indicating that vacancies are growing across the board. Firms with more than 5,000 employees account for

60.9% of vacancies in 2014-15.

31.3%

20,000 employees or more

32.3%

29.6%

5,000-19,999 employees

28.0%

15.8%

2,500-4,999 employees

17.1%

10.8%

1,000-2,499 employees

10.5%

10.9%

250-999 employees

10.8%

1-249 employees

1.7%

1.2%

2014-2015

2013-2014

Figure 1.3:

Graduate vacancies for AGR employers in 2013-14 and 2014-2015 (predicted) by size of firm Base = 197

16

Annual Survey 2015

Vacancies in 2014-2015 by geographical area

Table 1.4 summarises the proportion of 2014-15 vacancies by region. Not surprisingly, London continues to

attract large numbers of candidates with 45.9% of vacancies. The next largest regions are West Midlands

(7.7%) and the South East (6.9%). The share of vacancies in the South East appear to have dropped when

compared to the 8.9% reported for 2013-14 in the AGR 2015 Winter Review.

Table 1.4: Vacancies in 2014-2015 by geographical area

% of 18,930 vacancies

London

45.9%

West Midlands

7.7%

South East

6.9%

South West

6.2%

North West

6.2%

Yorkshire and Humberside

5.6%

Scotland

5.1%

East Midlands

3.9%

North East

3.8%

East of England

3.0%

Wales

2.3%

Northern Ireland

1.6%

EMEA

1.1%

Americas

0.3%

Rest of World

0.4%

*The base appears 18,930 instead of 24,126 because some responding organisations

failed to provide information about the geographical areas in which they recruit. Please

note recruiters may be offering vacancies in more than one geographical area

simultaneously.

17

Annual Survey 2015

Vacancies in 2014-2015 by career area

Table 1.5 shows the proportion of graduate vacancies by career area. Excluding the Other category which

accounted for 16.6% of total predicted vacancies, Accountancy continues to attract the highest proportion

of vacancies at 16.1%. Consulting and IT were the second most popular career areas at 12.1%, mirroring the

findings from the Winter 2015 Review.

Table 1.5: Vacancies in 2014-2015 by career area

% of 20,343 vacancies

Accountancy

16.1%

Consulting

12.1%

IT

12.1%

Legal

5.4%

Retail management

5.2%

General management

4.8%

Financial management

4.4%

Civil engineering

3.9%

Mechanical engineering

3.5%

Sales

2.8%

Investment

2.7%

Electrical/ electronic engineering

2.2%

Actuarial

1.5%

HR

1.3%

Marketing

1.2%

Science

1.2%

Purchasing

0.9%

Manufacturing

0.8%

Research

0.8%

Logistics

0.6%

All other career areas

16.6%

*The vacancies base appears 20,343 instead of 24,126 because some responding

organisations failed to provide information about the career areas in which they recruit.

Recruiters may be offering vacancies in more than one career area simultaneously.

18

Annual Survey 2015

Diversity of graduate recruits in 2013-2014

The proportion of female hires averaged 41.6% per employer in 2013-14. This is relatively low. According to

the UKs Higher Education Statistics Agency, 58.7% of all university graduates are female, representing a

mismatch of more than 15%. While the reasons for this mismatch are still unclear, it appears that more

could be done to attract female candidates to graduate recruitment programmes.

This gender balance varies by sector. For example, females made up the largest share of graduate recruits

in the Public (59.4%) and Retail sectors (56.8%) in 2013-14. Both of these sectors have overtaken Law firms,

which had held the largest proportion of female graduates in 2009-2010 (54.6%). The lowest share of

female hires is in Engineering and Industrial companies (23.8%) and Construction companies/consultancies

(27.5%).

Campaigns to attract more female candidates do seem to be having an effect. Over the last five years, the

largest increases in females joining appear to have been in the Public sector (9.8%) and Engineering and

industrial companies (8.0%), reflecting their sustained focus on diversity. Most of the increases and changes

in other sectors have been small suggesting a need for industry-wide attention to address the gender gap.

39.0%

41.6%

All respondents

54.6%

53.8%

Law firm

53.5%

56.8%

Retail

50.0%

53.2%

FMCG company

49.6%

Public sector

59.4%

38.3%

40.0%

Accountancy or professional services firm

35.2%

Banking or financial services

40.9%

34.7%

30.3%

Energy, water or utility company

28.4%

IT/Telecommunications company

34.8%

26.7%

27.5%

Construction company or consultancy

Engineering or industrial company

15.8%

23.8%

2009-2010

2013-2014

Figure 1.6:

Average proportion of female graduates AGR employers recruited in 2009-2010 compared to 2013-2014 by sector

5

Varying bases

5

Please note that the outliers in the 2013-2014 have been removed, but a similar methodology was not adopted in

2009-2010. In addition the AGR membership base per sector between the two periods examined may have changed

which could account for some of the changes witnessed.

19

Annual Survey 2015

The proportion of Black Asian and Minority Ethnic (BAME) hires averaged 15.6% per employer in 20132014. This proportion compares well with the graduate talent pool: according to HESA data, 18.6% of

university graduates are BAME. In other words, fewer BAME candidates are joining the graduate

programmes of AGR members than leaving university, but the gap is small.

The share of BAME hires per employer also varies by sector. Figure 1.7 indicates that Banking or financial

services firms (20.1%) and Public sector firms (19.1%) have a higher proportion of BAME hires than in the

graduate talent pool, whilst BAME graduates are least likely to join FMCG (9.7%) and Retail firms (11.5%) .

All respondents

15.6%

Banking or financial services

20.1%

Public sector

19.1%

Law firm

18.1%

Energy, water or utility company

18.0%

Engineering or industrial company

12.8%

Construction company or consultancy

12.4%

Retail

FMCG company

Other

11.5%

9.7%

8.0%

Figure 1.7:

Average proportion of Black Asian and Minority Ethnic graduates AGR employers recruited in 2013-2014 by sector

Base = 91

Monitoring and improving the diversity of graduate recruits

Employers are capturing a range of diversity data about their graduates and to different extents. For

example, while 91.2% knew the proportion of females they had hired in 2013-14, only 60.6% knew their

proportion of BAME hires. Employers were least likely to know the share of 2013-14 graduates who were

from low socio-economic backgrounds or who were lesbian, gay, bisexual or transgender (LGBT). 91.6% of

employers and 81.7% did not know these figures respectively.

The overwhelming majority of AGR members (88.7%) monitored at least one aspect of diversity in 2014-15.

Gender is the most likely characteristic to be monitored (88.1%), followed by ethnicity (68.6%) and

disability (47.2%). The share monitoring socio-economic diversity is also up slightly and now at 25.8%

compared to 24.3%.

Nearly four-fifths of employers (78.4%) also have a strategy to improve diversity amongst their graduate

recruits. Just over three-fifths of AGR employers (62.8%) have targeted strategies to improve their gender

balance, with strategies to improve ethnicity being the next most common (43.9%).

Encouragingly, 36.5% of employers have a strategy to improve socio-economic diversity, slightly up from

the 34.1% recorded last year in the 2014 AGR Summer Review. Intriguingly, more employers are trying to

20

Annual Survey 2015

improve social mobility than are monitoring it. As more employers start initiatives to address social

mobility, monitoring is going to be increasingly important in order to evaluate their success.

88.1%

Gender

62.8%

68.6%

Ethnicity

43.9%

47.2%

Disability

29.1%

31.4%

Sexuality

23.0%

25.8%

Socio-economic background

Other

None

36.5%

3.8%

1.4%

Monitor (n=159)

11.3%

Strategy to address (n=148)

21.6%

Figure 1.8:

Comparison of proportion of AGR employers who monitor versus have targeted strategies to improve diversity in

2014-2015

Employers use more than one metric to capture socio-economic background. The most widely-used metric

is whether an applicant is a first generation graduate (95.0%), followed by their type of schooling (82.5%)

and whether they had been in receipt of free school meals (62.5%). This varying use of metrics means that

progress on social mobility is more complicated to track than the progress on gender or ethnicity.

First generation graduate

95.0%

State or private schooling

82.5%

Whether they claimed Free Meals at school

Parent's occupation

Other

62.5%

10.0%

5.0%

Figure 1.9:

Type of socio-economic data collected by AGR employers in 2014-2015 Base = 40, multiple responses possible (this

question is answered only by those who collect data)

21

Annual Survey 2015

Chapter 2

Graduate salaries

22

Annual Survey 2015

Graduate salaries

This chapter looks at predicted starting salaries for the 2014-2015 recruitment season by business sector

and geographical area.

Graduate salaries in 2014-2015

The median starting salary for graduates in 2014-2015 is 28,000. This represents a 3.7% increase from the

27,000 reported for 2013-14 in the AGR 2014 Summer Review and a continuation of the steady increase

from 25,000 in 2010-2011, 26,000 in 2011-2012 and 26,500 in 2012-2013.

Table 2.1 indicates that the median starting salary for graduates recruited in 2014-2015 varies across

sector6. Law firms offered the highest starting salaries at a median of 37,0007. Banking or financial services

firms continue to occupy second place but at a slightly lower starting salary of 31,250 (down from the

33,000 predicted in 2013-2014). Consulting or business services, FMCG companies and IT &

Telecommunications companies are the next highest with median starting salaries of 28,500.

Table 2.1: Median graduate starting salary by sector in 2014-2015

Median

Law firm

37,000

Banking or financial services

31,250

Consulting or business services

28,500

FMCG company

28,500

IT & Telecommunication

28,500

Accountancy or professional service firm

28,000

Energy, water or utility company

26,750

Engineering or industrial company

25,750

Construction company or consultancy

25,500

Public sector

23,750

Retail

21,500

Other

22,000

The following sectors are not reported in our analysis as the small number of respondents within the sector may jeopardise their

anonymity: chemical or pharmaceutical companies, insurance companies, investment bank or fund managers, oil companies and

transport or logistics companies.

7

The highest starting salaries have historically been offered to investment bank or fund managers however due to low bases

cannot be reported in this review.

23

Annual Survey 2015

Graduate salaries in 2014-2015 by geographical area

Table 2.2 shows the median expected starting salary by region. Graduate vacancies in London continue to

attract the highest starting salaries in the UK at 28,500, followed by the South East at 25,500. Both of

these values are slightly lower than last year, with the 2014 Summer Review listing 29,250 and 26,000

respectively. However, this is more reflective of the lower number of survey respondents from the

investment banking sector than an industry-scale change.

Table 2.2: Median graduate starting salaries by region in 2014-2015

London

28,500

South East

25,500

South West

25,000

East of England

25,000

East Midlands

25,000

West Midlands

25,000

North West

25,000

Yorkshire and Humberside

25,000

Scotland

25,000

North East

24,750

Wales

24,500

Northern Ireland

23,000

EMEA

28,000

Americas

25,000

Salaries for retained graduates

Table 2.3 compares the salary progression of retained graduates. Those recruited one year ago had a

median salary of 28,000, matching that currently expected for new graduates. After three years the

median salary had increased to 35,000, a 4.5% increase on the 33,500 reported last year. After five years

in a job the median salary is 45,000 although rates of progression will vary between sectors.

Table 2.3: Median salary of those previously recruited

Those recruited one year ago

28,000

Those recruited three years ago

35,000

Those recruited five years ago

45,000

24

Annual Survey 2015

Chapter 3

Student placements and

internships

25

Annual Survey 2015

Student placements and

internships

This chapter examines placement and internship programmes that AGR members provide for

undergraduates and graduates. Figures reported in this chapter represent actual year-end figures for the

2013-2014 recruitment season.

Provision of placement and internship programmes in 2013-2014

72.6% of employers offered internships to students in 2013-14 with 7,195 internship opportunities in total.

Over half of employers (56.3%) offered one or more sandwich/industrial placements with employers

reporting a total of 2,676 opportunities. The average length of an internship was nearly 11 weeks (10.9

weeks), while the average length of a sandwich placement was around one year (50.1 weeks).

An average of 44.5% of interns were converted into graduate hires for 2014-15, while only 36.8% of

previous placement students were converted into graduates. Amongst those employers who offered

internships and placement opportunites, the average number of internships offered was 52 and the

average number of placements was 28.

Table 3.1:Internship, placement and

graduate vacancies in 2013-2014 by

sector

Internships

Graduate

% of 7,195

% of 21,3568

Law firm

20.8%

5.8%

Accountancy or professional services firm

18.8%

21.9%

Banking or financial services

16.2%

10.1%

Engineering or industrial company

14.5%

12.9%

Public sector

6.1%

14.1%

Construction company or consultancy

3.3%

5.1%

FMCG company

3.1%

2.0%

Energy, water or utility company

2.9%

1.3%

Retail

2.5%

10.4%

IT & Telecommunications

1.8%

8.8%

Only those sectors which are also represented for internships are included here.

26

Annual Survey 2015

Table 3.1 represents the spread of internship, placement and graduate vacancies by sector. One-fifth of

internship places were in Law firms (20.8%), which is not surprising given these vacation schemes can be as

short as 1-2 weeks and are heavily relied upon as a source of future hires. The sectors with the next highest

number of interns are Accountancy or professional services firms (18.8%) and Banking and financial

services (16.2%).

Use of Sandwich or industrial placements also varies by sector. The largest share of placement vacancies is

in Engineering or industrial companies (19.8%), Retail companies (12.9%), and Banking and financial

services firms (11.0%)9. Employers reported offering 2,676 placement opportunities in 2013-14.

More than half (62.1%) of employers with internships made them available to graduates as well as

students. On average, 90.6% of the internship places were open to graduates. Almost three-quarters of all

employers (70.9%) also recruited graduates and interns using the same selection instruments (Figure 3.2).

This shows that employers are standardising their approach to these two forms of entry-level talent.

Yes

70.9%

No

Don't know

21.8%

7.3%

Figure 3.2:

Whether selection instruments used for placement/intern programmes mirror those for recruiting graduates 20142015 Base= 179

Salaries for placement students and interns

All employers paid their placement students and only 1.8% of employers did not pay their interns. The

average weekly salary for interns rose by 3.3% to 317, up from 307 in 2012-13. The average weekly salary

for a sandwich/placement student rose 1.6% to 326, up from 321 in 2012-13.

Figure 3.3 shows the variation in the salaries offered. Half of interns (50.0%) were paid more than 300 a

week. A higher share of sandwich or industrial placements students (57.2%) were paid more than 300 a

week, reflecting the higher level of investment from employers to fill these opportunities. However, this

may be influenced by a higher proportion of employers who were unable to state the average weekly salary

paid to sandwich or industrial placement students.

The following sectors are not reported in our analysis as the small number of respondents may jeopardise their anonymity:

chemical or pharmaceutical companies, consulting or business services firms, insurance companies, investment bank or fund

managers, motor manufacturing, oil companies, and transport or logistics companies.

27

Annual Survey 2015

Up to 250

7.0%

2.4%

30.7%

251-300

20.2%

23.7%

301-350

39.3%

11.4%

13.1%

351-400

401 or more

Prefer not to say

14.9%

4.8%

4.4%

4.8%

6.1%

Don't know

15.5%

Interns (114)

Didn't pay them

1.8%

0.0%

Sandwich placements (84)

Figure 3.3:

Average weekly salary paid to interns and sandwich placements at AGR employers in 2012-2013 (these questions

are answered only by those who offer internships and sandwich placements)

28

Annual Survey 2015

Chapter 4

Applications and selection

29

Annual Survey 2015

Applications and selection

This section examines AGR members financial investment in recruiting graduates. It goes on to explore the

volume of applications received by AGR employers and the methods as well as criteria they use to select

graduates.

Cost per hire estimates recruitment

This year marks a new milestone for the AGR. For the first time, we have calculated the total cost to recruit

a graduate. This average was calculated by taking total graduate recruitment budgets in the last financial

year and dividing these by the predicted number of hires in 2014-15. Using this method, the average cost to

recruit a graduate is 4,859 including Law firms and 3,396 without. The average budget for graduate

recruitment was 327,00010.

There are some caveats with these estimates and they should be used with care. Different firms include

different activities in their budget: for example, Figure 4.1 shows that while almost all employers (98.1%)

include marketing costs, only around half include outsourced activities (51.9%), and a third include the

internal salary costs of the recruitment team as well. This means that the costs in different sectors are not

directly comparable. However, the estimates provide a holistic benchmark that can be used to secure

resources internally and to drive debate.

Attraction e.g. marketing

98.1%

Selection e.g. assessments, interviews

92.6%

Outsourced services

51.9%

Graduate recruitment team salary costs

Other

33.3%

18.5%

Figure 4.1:

Activities included in AGR employers recruitment budgets Base = 162, multiple responses possible

The average cost to recruit a graduates varies by sector. Figure 4.2 indicates that Law firms have the

highest cost per hire (12,682) followed by Energy, water or utility companies (8,085). Retail firms have

the lowest cost per hire at just 1,252.

10

Trimmed mean used

30

Annual Survey 2015

All respondents (excluding Law firms)

3,396

Energy, water or utility company

8,085

FMCG company

6,144

Public sector

3,324

IT & Telecommunications

2,985

Engineering or industrial company

Construction company or consultancy

Accountancy or professional services firm

Retail

2,573

2,281

2,000

1,252

Law firm

12,682

Figure 4.2:

Recruitment cost per hire of AGR employers by sector - Varying bases

These costs are also influenced by economies of scale. Employers planning to recruit only 1-25 graduates

have the highest recruitment cost per hire (5,632) whilst firms expecting to recruit more than 250

graduates have the lowest cost per hire at 2,08911.

1-25 graduates

5,632

26-50 graduates

4,117

51-100 graduates

101-250 graduates

251 or more

4,910

2,220

2,089

Figure 4.3:

Recruitment cost per hire of AGR employers (excluding Law firms) by size of intake Base = 96

11

This recruitment cost per hire analysis by size of intake excludes Law firms.

31

Annual Survey 2015

Graduate applications in 2014-2015

Employers received an average of 65 applications per graduate vacancy in 2014-15. This represents a drop

on previous years, as shown in Figure 4.412, although it is also worth pointing out that previous surveys

have been captured at a slightly earlier point in the year (May/June rather than July). Employers received

an average of 4,522 applications in 2014-15, compared to 4,690 in the last season. The drop in applications

reflects the increasingly buoyant market.

1999-2000

35

2000-2001

39

2001-2002

38

2002-2003

42

2003-2004

38

2004-2005

2005-2006

2006-2007

2007-2008

2008-2009

33

28

29

31

49

2009-2010

69

2010-2011

83

2011-2012

73

2012-2013

85

2013-2014

2014-2015*

69

65

Figure 4.4:

Number of applications per vacancy received by AGR employers between 1999 and 2015 Varying bases

Figure 4.5 shows the averages for 2014-15 split out by sector. FMCG firms have the highest number of

applications per vacancy at 109. The only sectors to record an increase in applications per vacancy

compared to 2013-14 were the Energy, water or utility sector (from 51 applications per vacancy to 99) and

Retailers (from 68 applications per vacancy to 76), although the two numbers are not directly comparable

as the 2014 Summer Survey was carried out earlier in the year.

12

The 2014-2015 predicted results were captured at a slightly later point in the year (June/July) than previous AGR

Reviews (May/June).

32

Annual Survey 2015

All respondents

65

FMCG company

109

Energy, water or utility company

99

Banking or financial services

78

Retail

76

IT & Telecommunications

72

Engineering or industrial company

46

Public sector

44

Law firm

42

Construction company or consultancy

Accountancy or professional services firm

35

22

Other

82

Figure 4.5:

Average number of applications per vacancy to date 2014-15 by sector Varying bases

Figure 4.5 also shows that the number of applications per vacancy appears to reduce as the size of graduate

intake increases. Firms with an intake of 1-25 graduates have received 94 applications per vacancy to date

compared to just 20 for those employers recruiting more than 500 graduates.

1-25 graduates

94

26-50 graduates

76

51-75 graduates

76-100 graduates

55

22

101-250 graduates

38

251-500 graduates

501 or more graduates

32

20

Figure 4.5:

Average number of applicants to date per predicted vacancy 2014-15 By size of graduate intake 2014-2015

Varying bases

Time to offer in 2014-2015

The average time between an applicant applying for a graduate position and receiving an offer is 11 weeks.

Figure 4.6 shows that on average the Public sector has the longest time to offer (15.5 weeks) whilst the IT &

Telecommunications sector has the shortest (6.8 weeks). Some sectors are more efficient than others

although the length of the process will also be affected by application volumes.

33

Annual Survey 2015

All respondents

11.0

Public sector

15.5

Accountancy or professional services firm

14.0

Law firm

12.3

Construction company or consultancy

12.3

FMCG company

11.3

Energy, water or utility company

11.2

Banking or financial services

9.8

Retail

IT & Telecommunications

8.1

6.8

Other

11.6

Figure 4.6:

Average time to offer for graduate places by sector Varying bases

Offers and acceptances 2014-2015

Employers plan to over-offer this year to account for offers being declined. On average, they plan to make

111 offers for every 100 vacancies available13. At the time of gathering these results in July 2015 employers

had made an average of 79.1% of the offers they planned to make and 89.6% of these offers had already

been accepted. 8.2% of offers had been reneged upon i.e. accepted and subsequently declined.

Figure 4.7 and Figure 4.8 show the trends by sector. Engineering or industrial companies make the highest

proportion of over-offers, with 118 for every 100 vacancies.

All respondents

110.9%

Engineering or industrial company

118.3%

Public sector

115.0%

Construction company or consultancy

113.8%

Law firm

112.4%

Energy, water or utility company

111.6%

Accountancy or professional services firm

IT & Telecommunications

Banking or financial services

Retail

111.0%

106.9%

105.9%

105.1%

FMCG company

104.0%

Other

104.0%

Figure 4.7:

Proportion of offers employers plan to make to vacancies in 2014-2015 by sector - Varying bases

13

This over-offer calculation and the analysis by sectors in Figure 4.7 are based on the proportion of offers employers

plan to make compared to the exact number of graduates they plan to recruit in 2014-2015. However, where the

number of offers made to date exceeds those which they planned to make, the latter figure has been updated with

the former higher number to calculate the proportion of over-offers.

34

Annual Survey 2015

The challenge of reneged offers varies considerably by sector. Accountancy or professional services firms

and Banking or financial services face the biggest challenges, with 12.9% and 12.8% of reneged offers

respectively. This challenge is much smaller for Law firms, with only 1.3% of offers reneged upon.

All respondents

8.2%

Accountancy or professional services firm

12.9%

Banking or financial services

12.8%

Energy, water or utility company

12.2%

IT & Telecommunications

11.8%

Public sector

9.8%

Construction company or consultancy

6.7%

Retail

6.5%

Engineering or industrial company

5.8%

FMCG company

Law firm

4.0%

1.3%

Other

4.3%

Figure 4.8:

Offers accepted then declined as a proportion of offers made by AGR employers in 2014-15 to date by sector

Varying bases

Selection criteria

Employers use many approaches to their selection process. Nine out of ten employers (91.9%) include a

competency-based approach, with one-third of firms (33.7%) relying solely on a competency-based

approach. Around one in four firms (26.7%) used both competency and technical approaches, with only one

in six firms (15.1%) using a combination of competency, strengths and technical approaches.

Competency only

33.7%

Competency and technical

26.7%

Competency, strength and technical

Competency and strength

Other combination

15.1%

13.4%

11.0%

Figure 4.9:

AGR employers approaches to graduate selection Base = 172

The most common entry cut-off is a 2:1 degree, with 77.0% of AGR employers using this as an entry criteria

for their selection process and one-fifth (20.0%) require a minimum of a 2.2 degree classification. The

second-most popular entry criteria was use of UCAS tariffs (33.3%), with 306 UCAS points being the average

35

Annual Survey 2015

number of points used. The use of UCAS tariffs has decreased slightly from 38.2% in 2013-201414. Only

21.2% of employers use work experience as minimum selection criteria, down from 29.2% in 2012-13.

Minimum 2.1 degree classification

77.0%

UCAS tariff

33.3%

Specific degree subjects

29.1%

Relevant work experience

21.2%

Minimum 2.2 degree classifiaction

Tier 2 Visa

GPA (grad point average) scores

20.0%

5.5%

3.0%

Minimum 1st degree classification

1.8%

Applications only from specific universities

1.8%

Other

7.3%

Figure 4.10:

Minimum entry standards at AGR employers in 2014-2015 Base = 165, multiple responses possible

Selection methods

AGR members are employing a range of selection instruments to recruit graduates in the 2014-2015

season15. Figure 4.11 shows that assessment centre or group selection events (91.8%) are the most

popular, followed by face-to-face interviews (74.3%). Almost one in three (29.8%) AGR employers now use

video interviewing compared to 21.2% in 2013-2014.

Assessment centre/group selection event

91.8%

Face-to-face interviews

74.3%

Psychometric testing (including online)

71.3%

Telephone interviews

42.7%

Online selection/deselection excercises

32.2%

Video interviews

Other

29.8%

2.9%

Figure 4.11:

Graduate selection instruments at AGR employers in 2014-2015 Base = 171, multiple responses possible

14

Please note, the response options included in this survey question altered slightly from the AGR Summer Survey

2014.

15

Please note, the response options included in this survey question altered slightly from the AGR Summer Survey

2014.

36

Annual Survey 2015

Figure 4.12 shows that for those employers who use psychometric tests in their selection process, numeric

reasoning tests remain the most popular (77.9%) with verbal reasoning tests as the second most popular

(68.9%). The proportion of firms using verbal reasoning tests has decreased slighty from 75.6% (in 20132014) to 68.9%. Conversely, situational judgement tests are more common in 2014-2015 than the previous

recruitment season (37.7% compared to 30.1%).

Numeric reasoning tests

77.9%

Verbal reasoning tests

68.9%

Situational Judgement test

37.7%

Personality and interest tests/questionnaires

31.1%

Abstract/Spatial reasoning tests

Other

22.1%

10.7%

Figure 4.12:

Types of psychometric testing used or plan to use by AGR employers in 2014-2015 Base =122, multiple responses

possible (this question is answered only by those who use psychometric testing)

Nine out of ten (90.8%) employers cover at least one form of expense incurred by applicants related to

assessment centres or group selection events. As Figure 4.13 shows, the most common expenses covered

are travel and accommodation, both at a capped amount (63.8% and 40.8% respectively).

Travel - capped maximum

63.8%

Accommodation - capped maximum

40.8%

Travel - all

24.3%

Food - all

24.3%

Accommodation - all

Food - capped maximum

Don't cover any expenses

23.0%

13.8%

9.2%

Figure 4.13:

Type of expenses paid by AGR employers for candidates to attend assessment events Base=152, multiple

responses possible

37

Annual Survey 2015

Monitoring the selection process

Three-quarters (72.8%) of employers monitored their selection process using candidate feedback. They are

most likely to monitor feedback from successful candidates (66.5%), although more than half (51.4%)

monitor feedback from assessors as well (Figure 4.14).

Yes - from successful candidates

66.5%

Yes - from unsuccessful candidates

56.1%

Yes - from assessors

No

51.4%

27.2%

Figure 4.14:

AGR employers that monitor feedback on the candidate experience during selection process Base=173, multiple

responses possible

Some sectors are much more likely to capture candidate feedback than others, as in Figure 4.15. 100% of

Accountancy or professional services firms monitored this, with Public sector and IT & Telecommunications

companies the next most likely sectors to monitor feedback (84.6% and 83.3% respectively). Retail firms

were the least likely to capture candidate feedback on their selection process (58.3% of employers).

All respondents

66.5%

Accountancy or professional services firm

100.0%

Public sector

84.6%

IT & Telecommunications

83.3%

Transport and logistic

80.0%

Consulting or business

80.0%

FMCG company

Construction company or consultancy

Banking or financial services

Energy, water or utility company

Retail

72.7%

66.7%

64.3%

62.5%

58.3%

Figure 4.15:

AGR employers that monitor feedback from successful candidates about their experience during selection process

by sector Varying bases

38

Annual Survey 2015

Two-thirds of AGR members (66.3%) also benchmark the on-the-job-performance of graduates to check

whether their selection process is bringing in high performers. As shown in Figure 4.16, more than fourfifths of Law, Retail and FMCG companies do this (84.6%, 83.3% and 81.8% respectively), whist Engineering

or industrial companies are least likely to do this type of benchmarking (39.1%).

All respondents

66.3%

Law firm

84.6%

Retail

83.3%

FMCG company

81.8%

Banking or financial services

78.6%

Public sector

76.9%

Energy, water or utility company

75.0%

Construction company or consultancy

72.7%

Accountancy or professional services firm

57.1%

IT & Telecommunications

45.5%

Insurance company

40.0%

Engineering or industrial company

39.1%

Other

16.7%

Figure 4.16:

AGR employers who do benchmark on-the-job performance of recruited graduates to check if the selection process

is working by sector - Varying bases

39

Annual Survey 2015

Chapter 5

Graduate development and

retention

40

Annual Survey 2015

Graduate development and

retention

This chapter looks at the processes AGR members put in place to facilitate the professional development of

graduate recruits. It investigates graduate contracts, development and induction programmes and reports

on financial support available to the new graduate hires. It reports on who holds responsibility for the new

hires and how companies evaluate the impact of their new graduates and the graduate development

programmes. Graduate retention rates are explored.

Cost per hire estimates development

This year we have also calculated the first industry-wide benchmarks of the average cost to develop a

graduate. These cost per hire estimates were calculated by taking total graduate development budgets in

the last financial year, and dividing these by the total number of graduate hires in 2013-14.

The average cost to develop one graduate across a development programme is 2,963. Given that most

graduate programmes are two years long (see later in the report), this equates to 1,482 per year. Law

firms, with their high spending on professional qualifications, have a much higher cost at 16,975.

There are caveats with these benchmarks and they should be used with care. The budgets for each

employer includes the money spent on all graduate development programmes and all forms of support but

exclude the cost of supporting professional qualifications (except in the case of Law) and also excludes the

cost of staff time. In cases where employers were not able to supply an exact budget, the midpoint of a

banded range e.g. 25,000 to 50,000 was also used in the calculations. However, the estimates provide a

holistic benchmark that can be used to secure resources internally and to drive debate.

The cost to develop a graduate varies by sector and also exhibits economies of scale. Ignoring Law firms,

Figure 5.1 shows that Public sector employers invest the most in development (3,139) whilst Retail firms

invest the least (1,054). Figure 5.2 shows that this cost per hires ranges from 4,246 for an intake of 1-25

graduates to 736 for graduate intakes of more than 25016.

Law firms spend far more than other sectors to develop their trainees, with an average cost to develop one

graduate at 16,975. The main reason for this difference is the inclusion of fees for professional

qualifications: Legal Practice Courses (LPCs) and Graduate Diplomas in Law (GDL) as well as maintenance

grants. This effect is also made larger by the relatively small volume of hires that Law firms take on.

16

This development cost per hire analysis by size of intake excludes Law firms.

41

Annual Survey 2015

All respondents (excluding Law firms)

2,963

Public sector

3,139

FMCG company

2,924

Banking or financial services

2,861

Construction company or consultancy

2,544

IT & Telecommunications

2,367

Engineering or industrial company

2,262

Retail

1,054

Law firm

16,975

Figure 5.1:

AGR employers average (trimmed mean) development cost per graduate - by sector - Varying bases

1-25 graduates

4,246

26-50 graduates

2,884

51-100 graduates

2,687

101-250 graduates

251 or more

3,454

736

Figure 5.2:

AGR employers average (trimmed mean) development cost per hire (excluding Law firms) - by size of graduate

intake Varying bases

Graduate employment contracts in 2014-2015

Three quarters of employers (76.0%)17 are appointing graduates on permanent contracts in 2014-15. A

further quarter (26.9%) are offering fixed-term contracts. Both of these figures are broadly consistent with

last years Summer 2014 Review (76.6% and 26.6% respectively). Figure 5.3 reveals that a higher proportion

of large firms rely on permanent contracts when compared to smaller firms.

17

Based on 171 responses

42

Annual Survey 2015

1-249 employees

250-999 employees

40.0%

38.5%

1,000-2,499 employees

63.0%

2,500-4,999 employees

87.1%

5,000-19,999 employees

87.2%

20,000 employees or more

100.0%

Figure 5.3:

Proportion of graduates on permanent contracts by size of employer - Varying bases

Ownership of headcount and funding

The most common organisational support for graduate development programme is that graduate

headcount is held centrally and the source of funding comes from a central budget. However, a

departmental headcount with a central budget is the next most common and is used in around a fifth of

cases (18.4%). This suggests that devolution of responsibility is common.

Central headcount with central budget

28.2%

Departmental headcount with

department budget

18.4%

Departmental headcount with mixture

of central & department budgets

Departmental headcount with central

budget

Mixture of central & department

headcount with mixture of central &

department budgets

17.8%

10.4%

9.2%

Figure 5.4:

Top 5 combinations amongst AGR members for where headcount responsibility and source of graduate

development programme funding sits within their organisation Base = 163

Table 5.5 shows how the use of a centrally held headcount varies by the size of firm. Smaller firms are much

more likely rely on a central headcount than larger firms. The responses showed no clear trend in terms of

the share of employers that chose a mixture of central and departmental headcount versus those who

opted for headcount to only be held in departments.

43

Annual Survey 2015

Table 5.5: Departments who own

the headcount of graduate hires

Central

headcount

All respondents

36.0%

1-249 employees

63.6%

250-999 employees

58.3%

1,000-2,499 employees

44.4%

2,500-4,999 employees

23.3%

5,000-19,999 employees

24.4%

20,000 employees or more

29.0%

Base

164

Graduate development programmes in 2014-2015

Graduate development programmes in 2014-15 are typically two years long. 67.9% of employers have a

programme of this length. Firms with larger intakes are also more likely to have longer programmes, with

companies that hire more than 500 graduates having 29 month programmes on average.

The number of programmes appears to increase with the size of graduate intakes. Employers recruiting 125 graduates have the lowest number of programmes (2.2) while employers recruiting more than 500

graduates have the most (8.3). Individual employers ran an average of 4.2 structured programmes in 201415.

Support for graduates varies widely by programme (Figure 5.6). 99.3% have a formal induction, which is

typically followed by off-the-job soft skill training (92.7%), peer coaching/buddying (87.3%) and off-the-job

technical training (86.7%). Assigning a senior mentor to new starters was also common (78.7%). Over threequarters of respondents also offered financial support for professional qualifications (76.0%).

Induction

99.3%

Soft skills training - off-the-job

92.7%

Graduates assigned a peer coach/buddy

87.3%

Technical training - off-the-job

86.7%

Rotation Placement

81.3%

Graduate assigned a senior mentor

78.7%

Financial support for professional qualifications

76.0%

End-of-programme events

Other

60.0%

8.7%

Figure 5.6:

Type of development activities offered to graduates by AGR employers in 2014-2015 Base = 150, multiple

responses possible

44

Annual Survey 2015

The least commonly used form of support were end-of-programme events (60.0%) although with nearly

two thirds of employers offering these it is still a common form of development (Figure 5.7). End-ofprogramme events were most common in Engineering and industrial companies (72.2%) and least common

in Accountancy and professional services firms (37.5%).

All respondents

60.0%

Engineering or industrial company

72.2%

Energy, water or utility company

71.4%

FMCG company

70.0%

Construction company or consultancy

66.7%

Law firm

55.6%

IT & Telecommunications

54.5%

Banking or financial services

53.8%

Public sector

50.0%

Retail

50.0%

Accountancy or professional services firm

37.5%

Figure 5.7:

End of programme events run by AGR employers in 2014-2015 by sector - Varying bases

Graduates typically received 20.3 days of off-the-job training, with averages of 12.6 days of technical

training and 7.8 days of soft skills training respectively. As shown in Figure 5.8 two in five firms (44.2%)

offered optional training for their managers on how to manage graduates, with over a third of companies

offering compulsory training (35.6%). This share of employers training their managers is surprisingly low

given that manager engagement is a hot topic amongst graduate employers.

Optional training for managers of graduates

44.2%

Complulsory training for managers of graduates

Other

Don't know

35.6%

9.2%

14.7%

Figure 5.8:

Percentage of managers of graduates receiving training in 2014-2015-Base=163

45

Annual Survey 2015

Financial support for graduate development

Where employers offered financial support, 94.5% of employers offer some form of financial support for

professional qualifications, with over three quarters (76.7%) of employers paying all of the fees. One-fifth

(19.9%) of employers cover other expenses, a small percentage of companies also placed a cap on the

maximum amount that could be claimed for fees (13.7%) and other expenses (17.8%). Over half (54.1%) of

AGR employers provide paid study leave and a minority 5.5% offered no financial support at all (Figure 5.9).

Course fees - all

76.7%

Paid study leave

54.1%

Other expenses - all

19.9%

Other expenses-capped maximum amount

17.8%

Course fees-capped maximum amount

13.7%

Other

No financial support offered

11.0%

5.5%

Figure 5.9:

Types of financial support AGR employers provide for graduates studying for a professional qualification -Base=146,

multiple responses possible

84.6% of employers offer financial support for graduates who relocate offices during their graduate

development programmes. The most commonly covered cost is travel, with around half (50.8%) of

employers covering the travel costs of relocation and only 16.2% covering the travel costs of the daily

commute. One-quarter (27.7%) of employers cover the cost of accommodation albeit capped at a

maximum amount (Figure 5.10).

Travel costs - for relocation only

50.8%

Accommodation costs - capped maximum amount

27.7%

Accommodation costs - all

20.0%

Paid training courses

20.0%

Travel costs - for daily commute

16.2%

Other

16.9%

Don't know

None

11.5%

15.4%

Figure 5.10:

Types of financial support AGR employers provide for graduates who relocate Base=130, multiple responses

possible

46

Annual Survey 2015

Assessment of graduates and development programmes

Employers who calculate this monetary value of their graduates do so using a variety of metrics. The most

common metrics were the hours billed to clients (21.7%), assessing the indirect cost savings of growing

their own talent (19.9%) and the costs of training (13.3%). Using sales or revenue generated by the

graduate either directly (7.2%) or indirectly (2.4%) were much less common, which could reflect a low

number of graduates in sales roles. Two-fifths (40.4%) of employers do not calculate the monetary value

that graduates bring to their business, which is somewhat surprising given the level of investment made in

graduates. Of those employers who assess the monetary value that graduates add to their business, on

average they use just over two methods of measurement (Figure 5.11).

Hours billed to clients

21.7%

Indirect cost savings

19.9%

Training costs

13.3%

Salary

12.7%

Time to return the cost invested

10.2%

Sales/revenue generated directly the graduate

7.2%

Direct cost savings

Sales/revenue generated indirectly

Other

6.6%

2.4%

1.2%

Don't know

18.7%

N/A - We don't calculate the value they add

40.4%

Figure 5.11:

Methods used by AGR employers to assess the monetary value that graduates add to the business Base = 166,

multiple responses possible

93.5% of employers intend to assess the performance of their graduate development programmes. Almost

all review performance ratings (92.8%) and around two thirds (67.3%) look at levels of retention. Two-fifths

(39.9%) review the time to promotion. Less common methods include comparing graduate performance

relative to direct hire peers (15.7%) and school leaver peers (1.3%) (Figure 5.12).

Performance ratings

92.8%

Retention

67.3%

Time to promotion

39.9%

Performance relative to direct hire peers

Performance relative to school leavers peers

Other

15.7%

1.3%

2.6%

Figure 5.12:

18

Methods used by AGR employers to assess the performance of graduates in 2014-2015 Base = 153 , multiple

responses possible

18

Multiple responses were possible and this question was answered only by those who assess their graduate

development programmes.

47

Annual Survey 2015

Some sectors are also more likely to assess graduate retention than others (Figure 5.13). Assessing

retention was most common in the three sectors of Construction companies/consultancies (88.9%),

Banking and financial services (84.6%), and Retail (81.8%).

All respondents

67.3%

Construction company or consultancy

88.9%

Banking or financial services

84.6%

Retail

81.8%

Insurance company

80.0%

Transport or logistics company

80.0%

IT & Telecommunications

72.7%

Law firm

71.4%

Public sector

66.7%

FMCG company

60.0%

Energy, water or utility company

57.1%

Accountancy or professional services firm

55.6%

Engineering or industrial company

Other

52.9%

33.3%

Figure 5.13:

AGR employers who assess graduate retention - by sector Base = 153

Graduate retention

Less than half of employers (40.5%) were able to report on the average number of years that graduates

stay within their organisation. Of those who did know, the average length of stay was 4.9 years. Smaller

firms have the lowest retention rates (3.9 years) when compared to the overall average (Table 5.14).

Table 5.14: Average length of stay by size of

employer

Mean years

1-249 employees

3.9

250-999 employees

5.4

1,000-2,499 employees

4.6

2,500-4,999 employees

4.6

5,000-19,999 employees

5.2

20,000 employees or more

5.5

48

Annual Survey 2015

Employers are also retaining their graduate hires. Almost all graduates (93.8%) were still in post within a

year of joining. This drops to 88.6% for those recruited 1 to 2 years ago and to three quarters (79.2%) for

those recruited 2 to 3 years ago. These findings mirror those of the Summer 2014 Review where the

average retention rate for graduates recruited one year ago was 94.8%; after three years this had dropped

to 79.0%. This suggests that overall retention rates appear to be stable.

Joined less than one year ago (113)

93.8%

Joined one to two years ago (103)

Joined two to three years ago (80)

88.6%

79.2%

Figure 5.15:

Average proportion of graduates recruited by AGR members still working for their organisations after particular

lengths of time

Overall, employers are not keeping good records of the share of graduates they retain. One-third (31.5%) of

respondents did not know the retention rate for graduates who joined less than one year ago and almost

three-quarters (72.2%) did not know the retention rates for those who joined 4-5 years ago. Given the

significant investment made to attract and develop great candidates, this lack of good records is an issue

worth further attention.

49

Annual Survey 2015

Appendix 1

Methodology and

respondent profile

50

Annual Survey 2015

Methodology and respondent profile

Method

Information was captured through an online survey that was hosted on the CFE Research website for four

weeks in June and July 201519. The link to the survey was sent to the total population of AGR members

(n=310) via email.

Analysis

Statistical software was used to generate a variety of statistics including frequencies, means and medians20.

For each chart or table featuring in the Summer 2015 Review, we report the number of organisations

whose responses inform the findings as the base. Bases vary throughout the report as not all participants

responded to the same questions due to the routing applied. If bases are too low to ensure the reliability of

the findings or to maintain the anonymity of respondents, figures are not reported.

The 2015 Annual Survey includes comparisons between the 2013-2014 and 2014-2015 recruitment

seasons. Data for the 2013-2014 recruitment season relates to members year-end figures whilst figures for

2014-2015 refer to AGR members predictions as of June-July 2015 and so reflect a forecast, albeit a figure

which will be very close to the year-end figures. Comparisons between recruitment seasons are reported as

percentage increases or decreases. It is also important to understand that the graduate recruitment

practices of AGR members vary widely from sector to sector. Law firms provide a case in point

recruitment lead times of two years are standard as graduates are often sponsored to complete postgraduate law courses prior to the commencement of their Training Contract. The vacancy levels reported

for the 2014-2015 recruitment season, therefore, relate to vacancies for which law firms are recruiting,

although graduates will not typically commence employment until 2016-2017.

19

Please note that previous AGR Summer Surveys have been conducted slightly earlier between May and June.

A frequency reports the proportion of respondents giving a specific answer. A mean (average) is calculated by

adding together all of our results and then dividing it by the total number of respondents. A median is the number we

obtain by placing all of the responses to a given question together in order of their value and selecting the middle

value. Where there is no single middle value, the two middle values are added together and divided by two.

20

51

Annual Survey 2015

Profile of respondents

A total of 205 AGR employers took part in the survey which represents a 66% response rate. It is estimated

that in 2014-2015 responding AGR members expect to offer a total of 24,126 graduate vacancies.

Two-thirds (69.1%) of AGR employers report recruiting just one intake of graduates per year; 16.7% of AGR

employers recruit more than one intake and one-tenth (10.3%) having a rolling programme of recruitment.

A small minority of AGR members (1.5%) recruit graduates on an ad hoc basis (Figure 6.1).

Rolling programme

of recruitment,

10.3%

Ad hoc recruitment,

1.5%

Other, 2.5%

More than one

intake of graduates

per year, 16.7%

One intake of

graduates per year ,

69.1%

Figure 6.1: