Professional Documents

Culture Documents

Best Buy Case Analysis

Uploaded by

Hifzaan 'Raph' MastanOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Best Buy Case Analysis

Uploaded by

Hifzaan 'Raph' MastanCopyright:

Available Formats

Title: - MGT6950 Strategic Management of Business Policy (BEST BUY CO.

)

Author: - Hifzaan Mastan

Madonna University User ID: - 210410

Specialization: - Cost Management

Course: - Masters in Business Administration - Madonna University, Michigan State, U.S.A

Instructor : Prof Dr. Kaup Mohammed

Submitting to: - Prof. Dr. Stuart Arends

STRATEGIC MANAGEMENT 210410

ACKNOWLEDGEMENT

I would like to express my special thanks of gratitude to our professor Dr. Stuart Arends and Dr.

Kaup Mohammed who gave me the opportunity to do this Case Study in Strategic Management,

which also helped me in doing a lot of Research and I came to know about so many new things. I

am really thankful to him.

I would also like to thank my parents and friends who helped me a lot in finishing this project

within the limited time.

I am making this project not only for marks but to also increase my knowledge.

STRATEGIC MANAGEMENT 210410

CONTENT

1. Introductionpg.1

2. Historypg.1

3. Mission, Vision and Valuespg.2

4. SWOT Analysis..pg.4

5. Corporate objectives and Strategiespg.7

6. Competitive Analysis..pg.12

7. External matrixpg.17

8.

Internal matrixpg.18

9.

Space matrix, BCG matrix & CPM matrixpg.19-21

10. Financial Analysis..pg.23

11. Income statements...pg.26

12. Recommendationspg.27

13. Conclusion...pg.31

14. Bibliographypg.32

STRATEGIC MANAGEMENT 210410

INTRODUCTION

Best Buy Co., Inc. (NASDAQ: BBY) together with its subsidiaries is one of the worlds leading

companies that operates as a retailer of consumer electronics, home office products,

entertainment software, appliances and related services in the United States, Canada, China,

Europe and Mexico. It controls retail stores and websites under 11 brand names: Best Buy, Five

Star Appliances, Future Shop, Geek Squad, Magnolia Audio Video, The Carphone Warehouse,

Best Buy Mobile, Audiovisions, Napster, Pacific Sales and Speakeasy. Best Buy currently has

about 165,000 employees worldwide.

The company preliminarily recorded revenues of $45 billion during the fiscal year ended

February 28, 2009, a 12.5% increase over 2008. The operating profit during the FY09 was $1.76

billion, an 18.6% decrease over 2008. The net income during the same period was $1 billion, a

28.7% decrease from 2008. (Reuters, 2009)

HISTORY

Best Buy was originally founded as Sound of Music, Inc. by Richard Schulze and another

partner in 1969. It operated as a single home and car audio specialty store in St. Paul, Minnesota.

In 1971, he bought out his partner and began to expand the chain. By early 1980s, Schulze

broadened the product line to include appliances and VCRs to target older and more affluent

customers. Schulze would continue to expand the product line to suit the needs of his customers.

After almost 20 years of operations, Sound of Music officially changes its name to Best Buy and

1

STRATEGIC MANAGEMENT 210410

launches its first superstore in 1983. Best Buy grew quickly somewhere around 1984 and 1987; it

extended from eight stores to 24 and its sales bounced from $29 million to $240 million. (Best

Buy, 2014) In 1985, the organization effectively brought $8 million up in an IPO on NASDAQ.

To separate Best Buy from its rivals, Schulze presented the distribution center like store

arrangement in 1989 and took sales staff off commission. The quantity of workers per store was

lessened by around a third, bringing about significant cost savings. This idea was critical to Best

Buy's climb to end up as the second biggest consumer electronics retailer in the U.S. by 1993.

Best Buy kept on growing fiercely in the next years and ended up in a lot of debt in 1995. In

1997, income dove and the organization acknowledged it had overextended itself with its

development. (Best Buy, 2014) The organization started a huge makeover, downsized operations

and controlled stock all the more firmly. From that point forward, Best Buy has flourished once

again under superior management. The organization actualized creative ideas in its stores,

extended locally and globally, and rapidly turned into the world's driving consumer electronics

retailer. As of February 28, 2009, Best Buy is the biggest consumer electronics retailer in the

U.S. with a domestic market share of 22%.

MISSION, VISION AND VALUES OF THE COMPANY

To make technology deliver on its promises.

"Our formula is simple: were a growth company focused on better solving the unmet needs of

our customersand we rely on our employees to solve those puzzles. Thanks for stopping."

Best Buy mission is to bring technology and consumers together in a retail environment that

focuses on educating consumers on the features and benefits of technology and entertainment

products.

STRATEGIC MANAGEMENT 210410

Best Buy's vision is to make life fun and easy for consumers.

Companys Values:

Have fun while being the best.

Learn from challenge and change.

Show respect, humility and integrity.

Unleash the power of our people.

Revised Mission

Best Buys mission is to bring technology and consumers together in a retail environment. We

strive to meet and exceed out customers expectations and preserve our public image as the

leading low-cost specialty retailer. We are dedicated to providing the best quality electronics and

home office equipment in the North American retail industry. As leading technology provider we

strive to incorporate the best, most reliable technology into our everyday operation to ensure

efficiency and maximize revenues. Best Buy as a whole feels that success is not only dependent

on our growth and profitability, but also the well being of our employees and the satisfaction of

our customers.

Revised Vision

At Best Buy, our vision is to become the leading electronics specialty retailer that focuses on

customers and their needs.

STRATEGIC MANAGEMENT 210410

SWOT ANALYSIS

STRENGTHS

Best Buy has constantly recorded solid development. The organization's revenue grew at a

CAGR of 9.90% amid FY05-08, from $27 billion to $40 billion. Operating profit grew massively

at a CAGR of 10.64% amid FY05-08 from $1.4 billion to $2.1 billion. Likewise net income

expanded by a CAGR of 9.35% amid the same period, from $980 million to $1.4 billion. The

increment in net earnings was driven by revenue growth and a decrease in selling, general and

administrative expense rate, offset by a decrease in gross profit rate and a higher effective

income tax rate. With the colossal increment in its operating and net profits throughout the years,

the organization fortified its monetary position in the business sector. Trustworthy Brand Name

Best Buy is perceived as one of the best organizations on the planet on account of its sound

administration. In 1993, the organization turned into the second biggest consumer electronics

retailer and in 2000, Fortune magazine named it one of the top 10 performing stocks. Best Buy

was named organization of the Year by Forbes magazine in 2004, Specialty Retailer of the

Decade by Discount Store News in 2001, positioned one among the Top 10 America's Most

Generous Corporations by Forbes magazine and made Fortune Magazine's List of Most Admired

Companies in 2006. Extensive Store Coverage Over the years, Best Buy has assembled a name

for itself through offering a wide determination of items and excellent services. This has allowed

Best Buy to open many stores both domestically and internationally in the past several years. At

the end of FY09, the company was operating approximately 1,100 domestic retail stores. On the

STRATEGIC MANAGEMENT 210410

international front, the company operated approximately 3,000 stores. Going forward, the

company plans to open more stores in new countries such as Turkey and Mexico.

WEAKNESSES

Dependence on United States market

Although Best Buy has international operations in China, Europe and Canada, the company

mainly derives its revenues from the U.S. market. About 83% of the companys total revenue

comes from the U.S. Furthermore, the company relies heavily on the sales of consumer

electronic products. Therefore, this high market concentration in the U.S. can result as a big

disadvantage for the company in the long-run as consumer electronic products decrease from

42% in 2007 to 41% in 2008 in the revenue mix. It could significantly affect the revenues of the

company and also its expansion opportunities if it continues to focus only in the U.S. market.

Best Buy needs to further diversify its revenue generating sources.

Dependence on select number of vendors for its merchandise

Best Buy mainly depends on a handful of vendors for the supply of their products. Best Buys 20

largest suppliers account for just over 60% of the merchandise it purchases. If any of key

vendors fails to supply products or if there is any disruption and loss from any vendors the

company may not be able to meet the demands of the customers which can result in the decline

of revenues.

OPPORTUNITIES

New ventures

STRATEGIC MANAGEMENT 210410

The recent joint venture between Best Buy and The Carphone Warehouse is an exciting

opportunity for the company to expand into new geographic locations in Europe. The consumer

electronics market has been one of the fastest-growing industries in the European market over

the past five years.22 The management will have to be careful in this expansion and try not to

overextend its resources. Bankruptcies Best Buys largest competitor, Circuit City, filed for

bankruptcy at the end of 2008 and is closing 155 stores. This will prove to be tremendous

opportunity for Best Buy to gain market share as competitors scramble to fill the void left by

Circuit City. Many other consumer electronic stores have also filed for bankruptcy. Tweeter, a

high-end rival, shut down in December 2008, and Sharper Images stores, which sold more

exotic electronics, have liquidated. CompUSA closed most of its stores in 2007. As the weaker

players in this market are weeded out, Best Buy must be actively seeking to gain those market

shares.

Threats

Deteriorating Economic Conditions Best Buy sells products and services that consumers tend to

view as luxury goods rather than necessities. Therefore, the company is more sensitive to

changes in general economic conditions that impact consumer spending. Future economic

conditions and other factors including consumer confidence, employment levels, interest rates,

tax rates, consumer debt levels, fuel and energy costs and the availability of consumer credit

could reduce consumer spending or change consumer purchasing habits. A further deterioration

of the U.S. economy or the global economy could adversely affect consumer spending habits and

thus Best Buys earnings.

Highly Competitive Market

STRATEGIC MANAGEMENT 210410

The retail business is highly competitive. Best Buy faces competition regarding its customers,

employees, locations, products and other important aspects of business with many other local,

regional, national and international retailers. Furthermore, there are numerous internet retailers

that sell similar products that Best Buy does. These internet competitors may have a smaller

market presence and financial resources, but their prices are substantially lower because of lower

overhead. This competition could force Best Buy to reduce its products prices or increase costs

of doing its business. As a result of this competition, the company may experience lower revenue

and higher operating costs. Best Buy will have to do its best to differentiate itself from these

internet competitors. Flat panel TVs saturation Despite what is now believed to be nearly a 50%

penetration rate in digital TVs, it seems that the market will soon hit its saturation point.23 This

could potentially be a problem for Best Buy since it derives most of its revenues from TV sales.

To add to the problem, discretionary spending is clearly slowing and higher ticket OLED TVs

appear to be at least a couple of years away before being widely available in large screen sizes.

In the meantime the recent introduction of 240 Hz LCD TVs (second derivative of the 120 Hz

LCD TVs), will create excitement for the consumer.

CORPORATE OBJECTIVES

Best Buys current business strategy has two primary goals: offering customers the widest range

of products at the lowest prices and expanding into new international markets. The companys

recent acquisitions and new business ventures have been in these two directions. The

management is positive that these two strategies will allow Best Buy to be in a favorable position

to grow domestically and internationally.

Customer Centricity Operating Model -

STRATEGIC MANAGEMENT 210410

Best Buys success thus far is a testament to its commitment to treat customer as unique

individuals [and] meeting their needs with end-to-end solutions. Since 1989, Best Buy prides

itself as one of the earliest retailers to adopt the strategy of non-commissioned employees to give

customers more control during the purchasing experience. In 2004, Best Buy began

implementing an innovative strategy it calls customer-centricity in its stores. Through these

strategies, Best Buy has differentiated itself as a store that provides mid- to high-end electronics

and entertainment systems and excellent customer service. The customer-centricity operating

model views Best Buy as a portfolio of customers rather than products. It forces the company to

understand its customer base at a deeper level and better target its needs. In 2004, Best Buy

tracked its customers behaviors and identified five initial customer segments that represented

significant new growth opportunities. The segments were each given a name :

1. Jill, the busy suburban mom who wants to enrich her childrens lives with technology and

entertainment.

2. Buzz, the focused, active, younger male customer who wants the latest technology and

entertainment.

3. Ray, the family man who wants technology that improves his life the practical adopter of

technology and entertainment.

4. Barry, the affluent professional who wants the best technology and entertainment experience

and who demands excellent service.

5. BB4B (Best Buy for Business), the small business customer who can use Best Buys product

solutions and services to enhance the profitability of his or her business. Best Buy tested out

these segments at 32 U.S. stores by training and empowering employees to better meet these

8

STRATEGIC MANAGEMENT 210410

customer segments needs. It allowed employees large discretion in making the store more

appealing to their particular customer segment. The results were astounding. The lab stores sales

were an average of 7% higher than other U.S. Best Buy stores. Close rates (the percentage of

shoppers who make a purchase) also rose by approximately 6%.8 SG&A for the stores were

expectedly higher, but the model helped lower employee turnover from 81% in 2005 to 69% in

2006. The company decided to adopt this strategy with all of their stores and the transition was

fully completed in 2007. To this day, Best Buy continually revises the customer segments in

order to capture new growth opportunities.

Cross Industry Expansion

Since 2000, Best Buy has acquired entire or majority stakes in nine companies that complement

its existing products, services and culture. These acquisitions, over $3 billion in combined value,

expanded the companys operations into Canada, China and Europe. Additionally, they added a

wide range of products such as kitchen and bath appliances, broadband technology, and repair

services to Best Buys existing portfolio. Beginning in 2008, Best Buy has been focused on

strengthening its market position by expanding into the cellular phone sales to compete with its

rivals. Best Buy entered into a joint venture with U.K.s largest cellular phone retailer, The

Carphone Warehouse to open new Best Buy Mobile stores in the U.S. Furthermore, its

acquisition of Napster launched Best Buy into an entirely different market of digital media

distribution. To help drive Best Buy Mobiles expansion, the management intends to enhance

service plans with Napsters distribution platform and mobile capabilities. Best Buy hopes to

increase the companys share of the 160 million handset market in the U.S. to 10% in under five

years from about 4% currently. Aggressive Store Growth The expansion of retail stores for Best

Buy plays a significant role in its revenue growth and success. For FY09, Best Buy operated just

9

STRATEGIC MANAGEMENT 210410

shy of 4,000 retail stores worldwide. Over the past decade, Best Buy has almost doubled the

number of stores domestically every five years. Majority of international store growth comes

from the acquisitions of The Carphone Warehouse and Five Star Appliances. Additionally, the

company opened a Best Buy store in Shanghai and a pilot store in Mexico. Figure 1 shows the

addition of new stores domestically and internationally over the last five fiscal years. Table

below shows the breakdown of stores.

Best Buy Global stores breakdown as of (February 28, 2009)

Distribution

The distribution system is crucial to Best Buys operations in order to meet its customer needs.

Generally, U.S. Best Buy stores merchandise, except for major appliances and largescreen

televisions, is shipped directly from manufacturers to the distribution centers located in

10

STRATEGIC MANAGEMENT 210410

California, Georgia, Indiana, Minnesota, New York, Ohio, Oklahoma and Virginia. Major

appliances and large-screen televisions are shipped to satellite warehouses in each major market.

The distribution system in the international segment operates similarly. The Canada stores

merchandise is shipped directly from the suppliers to the distribution centers in British Columbia

and Ontario. Five Star Appliances stores merchandise are received and warehoused at more than

50 distribution centers and warehouses. The China Best Buy stores merchandise is shipped

directly from the suppliers to the distribution center in Shanghai. In order to meet release dates

for selected products and to improve inventory management, certain merchandise is shipped

directly to the stores from manufacturers and distributors.

Suppliers

In fiscal year ended March 2008, the 20 largest suppliers accounted for just over 60% of the

merchandise purchased, with five suppliers Sony, Hewlett-Packard, Samsung, Apple, and

Toshiba representing just over one-third of total merchandise purchased.14 Best Buy

generally does not have long-term written contracts with the major suppliers. The company,

however, has not experienced significant difficulty in maintaining satisfactory levels of supply.

Best Buy operates global sourcing offices in China in order to purchase products directly from

manufacturers in Asia. These offices have improved the product sourcing efficiency and

provided the company with the capability to offer private-label products that complement the

existing product line. In the future, the company expects purchases from the global sourcing

offices to increase as a percentage of total purchases.

11

STRATEGIC MANAGEMENT 210410

COMPETITIVE ANALYSIS

Force

Strategic Significance

Internal Rivalry

Internal rivalry is the most significant force of Porters Five Forces and is very high in the

consumer electronics retail industry. According to Yahoo Finance, there are approximately 7

major companies that are traded publically and sell predominately electronic products. There are

also numerous privately-held retailers that serve specific niche markets. With a market

capitalization of over $16 billion, Best Buy is the dominant player in this industry. Competition,

however, comes from companies outside of this industry. Discount retailers such as Wal-Mart,

Target and Costco occupy a significant part of the consumer electronics market. Wal-Mart, for

example, booked $378 billion in sales in FY08 and its $92.2 million in gross profit more than

double Best Buys $40 billion in revenue during the same period.20 Wal-Mart does not

breakdown its sales into different product categories, so it is not possible to directly compare the

two businesses. However, even if consumer electronics was merely 1% of Wal-Marts $378

billion operation, it would still be very significant to Best Buy. Competition is high primarily

because there is little to no switching costs if a buyer chooses to shop elsewhere. Furthermore,

12

STRATEGIC MANAGEMENT 210410

the products are not differentiated: buyers can get similar products at almost all of the different

electronic stores. As a result, companies compete on prices and non-tangibles, such as customer

service and goodwill.

An important observation of the market is its net profit margin (NPM). The NPM shows how

much profit a company makes after taxes for every dollar it generates in revenue. According to

Yahoo Finance, the NPM of the consumer electronics retail market is low(3.80%). This implies

that competition is quite fierce, and profitability and survival is depended on inventory turnover.

Circuit City had to liquidate its assets because it was not able drive sales as effectively as other

competitors over the past several years. Combine the level of competition with the current

economic conditions, many companies in the industry must find it more difficult to continue

operations as they did in the past several years.

Threat of New Entrants

The threat of potential new entrants into the consumer electronics retail industry is relatively

low. The market capital of the industry, according to Yahoo Finance, is currently at $23.2 billion.

This figure is substantially lower than other industries such as Apparel Stores ($37.2 billion),

Home Improvement Stores ($53.0 billion) or Discount Variety Stores ($240.4 billion). The low

market capitalization implies that it would not be difficult to enter the industry based solely on

the capital required. However, a potential entrant would have to overcome the superior brand

reputation that Best Buy has established. Best Buy has built a reputation for selling mid- to highend product and excellent customer service. It would be difficult for an entrant to challenge the

13

STRATEGIC MANAGEMENT 210410

company. Furthermore, it would be difficult to undercut incumbent firms who have already

established relationships with suppliers to purchase merchandize at the lowest prices. Although

the threat of entry is low, the potential pool of entrant is actually quite large as it consists of

numerous online electronics retailers. These online retailers are the most likely candidate to enter

the consumer electronics retail market because they already have large existing inventories and

extensive experience dealing with customers two key factors that give them a potential edge.

The fact that they are currently only online retailers suggests that acquiring real estate is a

significant entry barrier. However, once an online retailer is able to establish a strong reputation

with customers, it is likely to enter the industry to captures additional sales through non-web

customers. As mentioned, the NPM of the industry is low (3.80%). This means that a key

component to be successful in this industry is to drive sales and have high inventory turnover.

High inventory turnover implies that large inventories are required in warehouses. Together,

these two factors make a very significant barrier to entry for potential entrants. (Kwok, 2009)

Threat of Substitute Products

The substitute products that may take a portion of the market share away from the consumer

electronics retail industry do no pose a huge or direct threat. Todays society and culture places a

lot of emphasis on technology and is highly dependent on electronics. As a result, there are few

substitutes for electronics that will directly take their place, such as books, magazines and other

non-electronic hobbies to occupy peoples time. Some of the main retailers of books are Barnes

and Noble, Borders and the online retailer Amazon.com. Bargaining Power of Buyers The

bargaining power of buyers for electronic products is extremely low because the buyers

primarily consist of a weak and fragmented group of individuals. There are several reasons for

this:

14

STRATEGIC MANAGEMENT 210410

1. The purchase volume is very low. Most people do not go to Best Buy and purchase 10 HD

TVs or 10 DVD players, for example. The typical individual will purchase one item of a specific

product. So the buyers often do have any influence on prices.

2. The cost of buying electronic products is not a huge percent of a buyers budget, unlike

purchasing a house or car. Also, there is no intense competition between buyers for any one

brand (i.e. Sony, Panasonic, Samsung, and etc.).

3. Because electronic products are often a luxury than a necessity, buyers do not generally have a

say in what products get produced and at what price.

4. Most importantly, buyers do not have the ability to integrate backwards because it is not

feasible for individuals to build their own electronic products or establish their own retail shops.

As a result, the buyers in the consumer electronics retail market do not have any substantial

bargaining power over the companies in the market and do not have any substantial influence on

the products or prices.

Bargaining Power of Suppliers

The suppliers for companies in the market have relatively high bargaining power mainly due to

the fact that there are only a number of suppliers that the market demands from. Among the pool

of suppliers include major manufacturers such as Sony, Samsung, LG, Panasonic and Toshiba.

These suppliers provide the latest state-of-the-art technology and companies like Best Buy must

purchase from them in order to keep its inventory fresh and satisfy its customers. There is no

way around purchasing these products; for example, backward integration is difficult and

requires a lot of capital and technological expertise. This suggests that suppliers have a

15

STRATEGIC MANAGEMENT 210410

substantial influence on the products that they manufacture and their pricing. Furthermore, the

high bargaining power of the suppliers is also due to the sheer number of stores that they are in.

Therefore, consumer electronics retailers must purchase them to stay competitive in the industry.

On the other hand, there are several factors that lower the bargaining power of the suppliers.

While most of all the suppliers have their own online stores to drive sales, they rely almost

entirely upon retailers to bring in revenue. Suppliers want their products on the shelves for

people to see and test them. They also rely on the sales teams within retail stores to help drive

sales. Therefore, a company can partially mitigate the bargaining power of a supplier if it is

especially effective in bringing sales. Best Buy, as the industry leader, therefore has more

bargaining power than other retailers. Additionally, while there might not be intense competition

between buyers for any one brand, there is intense competition among the suppliers. For

example, the most recent Blu-ray and HD-DVD rivalry between Sony and Toshiba caused less

bargaining power for these suppliers.(Best Buy 2014)

16

STRATEGIC MANAGEMENT 210410

EXTERNAL AND INTERNAL MATRIX

Source (perleybrook.umfk.maine.edu)

17

STRATEGIC MANAGEMENT 210410

Source (perleybrook.umfk.maine.edu)

18

STRATEGIC MANAGEMENT 210410

Space Matrix

Source (perleybrook.umfk.maine.edu)

As we can see through this space matrix that Best Buy employs an aggressive strategy.

With its strong financials and competitive age there is scope for further growth for Best

Buy. It has great market share with the number of new entrants being very little.

19

STRATEGIC MANAGEMENT 210410

Source (perleybrook.umfk.maine.edu)

The strategy that Best Buy employs is rather Aggressive and it did not opt for Conservative,

Competetive or Defensive strategy.

20

STRATEGIC MANAGEMENT 210410

Competetive Profile Matrix

Source (perleybrook.umfk.maine.edu)

CompUSA and Circuit City, were forced to close their doors in recent years as a result of the

strength of the Five Forces. Both were large competitors in the industry. In 2008 Circuit Citys

annual revenues were $11.7 billion, and in 2006, CompUSAs revenues topped $4 billion.

According to a 2010 report by Gap Intelligence, approximately 55% of Circuit City shoppers

were planning to transition to Best Buy7. This statistic correlates to the 1.7% same store sales

growth for Best Buy in 2010, the only year in which same store sales growth was positive

from2008 through 2012. However, Amazons revenues from consumer electronics grew by 74%

from2009 to 2010. Best Buys financial statements provide insights on the industry. Best Buy is

by far the largest firm in the big box electronic retail industry in terms of sales and market cap.

As of March 2013, Best Buys market cap of $6.8 billion was greater than the combined value of

21

STRATEGIC MANAGEMENT 210410

the next four largest public competitors at $4.8 billion according to March 2013 Yahoo! Finance

data. From 2005 to 2007, Best Buys annual revenue growth was between 11.8% and

16.5%.Same store sales in 2006 and 2007 were 4.9 and 4.1% respectively. (Gupta, 2013)

22

STRATEGIC MANAGEMENT 210410

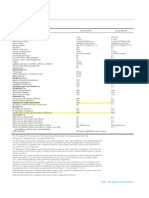

FINANCIAL ANALYSIS

23

STRATEGIC MANAGEMENT 210410

Source: (http://financials.morningstar.com/ratios/r.html?t=BBY®ion=usa&culture=en-US)

A few years ago, most people expected Best Buy to go down the same lane as its competitor

Circuit City, which after years of losses, went bankrupt. Even RadioShack went down a similar

path earlier this year as online giants like Amazon took away sales from brick-and-mortar stores.

But, Best Buy has been a completely different story, thanks to the companys turnaround

strategy, Renew Blue.

Best Buys return on equity, which is a widely used indicator of a companys profitability, stood

at a negative 8% at the end of 2011. While other similar companies went bankrupt, Best Buy

took its online rivals head-on and turned around its operations. By matching competitors on price

and focusing on providing a superior customer experience, they were able to prevent a

24

STRATEGIC MANAGEMENT 210410

significant fall in sales. While price competition would have hit margins significantly, the

company averted this by cutting down costs significantly. They streamlined their operations,

established an online presence, shut down low-performing stores and used all other stores as

distribution centers for online sales. By the end of 2014, the company managed to generate an

ROE of a positive 8%. (Forbes, 2014)

Encouraged by the success of its turnaround strategy, Best Buy plans to continue its cost cutting

efforts in FY 2016 to battle industry and economic pressures. The company has set itself a target

of approximately $400 million in cost reductions and gross profit optimization, over the next

three years. It will utilize these incremental savings for investments in delivery and cost control

and other growth initiatives, which are expected to amount to approximately $100 million to

$120 million.

25

STRATEGIC MANAGEMENT 210410

INCOME STATEMENT

26

STRATEGIC MANAGEMENT 210410

As we can see from the above income statement there has been a steady decline in the Revenue

but to offset the decline in revenues there has also been a decline in cost of good sold leading to a

fairly good gross profit. Yet as we analyze further we see that the operating expenses are fairly

high which is really sapping the profits. The net income is still at a normal rate which is a good

sign for Best Buy. The EBITDA has also increased from the previous year adding to the strong

financials displayed by Best Buy.

RECOMMENDATIONS

Offer on site, in-store and online training.

Companies such as General Assembly (GA) have created successful networks of digital training

centers. Best Buy can bring in GA or other providers and use part of their big box stores as

training centers. This will bring in high-profit streams of revenue while engaging the customer in

a much deeper way than selling them a commoditized flat screen. Best Buy could also arrange

for on site training at corporate campuses. Companies are struggling to keep up with the latest

technologies and would welcome a brand-name, national training provider to teach their

employees on site.

Best Buy can partner with Microsoft, Cisco, Salesforce.com and others to deliver online and on

site training modules. It can also work with Udacity, Coursera and other online course providers

to offer a common space for video conferencing and study sessions for their classes.

Slash the number of SKUs by 50% in every store.(Forbes)

27

STRATEGIC MANAGEMENT 210410

Instead of every location in a dense region trying to be all things to all customers, have each

store in a few tech sectors specialize. The Best Buy in Union Square in NYC, for example,

boasts an extensive music technology section complete with a 20-foot high wall of digital guitars

a feature not replicated many other NYC Best Buy shops. Best Buy should also expand

beyond commodity products and begin focusing on innovative categories, for example, personal

health monitoring and quantification. Everything from weight scales that are connected to Wi-Fi

networks to pulse monitoring watches will be increasingly popular as consumers use technology

to manage their health and lifestyle. Designated Best Buys could become health tech centers with

partners including GE , Nike and others. This approach will drastically decrease the amount of

working capital dedicated to holding inventory. By slicing inventory down to the key products

that consumers wish to buy, Best Buy frees up capital to deliver a top-flight training and service

platform. A focus on revenue growth when all that revenue only brings more losses is misguided.

Best Buy should clearly seek to replace commoditized revenue with higher-margin revenue that

engages key customer bases. (Vela, 2013)

Expansion of Service Offerings

Best Buy should offer Installation, Warrantees, Delivery, Maintenance, Technical

Support/Service etc. Many of their other competitors in the appliance and electronics industries,

such as Sears and Lowes are already doing these types of things for their customers. If Best Buy

wants to retain their market share in the electronics industry and/or grow their low market share

in the appliance industry, they could take advantage of this. This is an example of related

diversification. Approximated Costs: $50,000,000

28

STRATEGIC MANAGEMENT 210410

Turn 20% of every store into a tech incubator for startups.

Incubators have blossomed in the past few years in urban centers including San Francisco, New

York, LA and Washington, DC. Since Best Buy has a big footprint in suburban locations, it can

host incubators that will attract startups that cannot be or do not wish to be in urban settings.

Incubators will bring several benefits to Best Buy: Best Buy can showcase the cutting-edge tech

from the startups. While a customer may not be able to purchase the technology it will attract

back the tech-oriented base that Best Buy has lost. This is similar to how car enthusiasts attend

auto shows even though one cannot purchase a car at those events.

Startups create community. Just offering lots of stuff in a big box is a losing formula in the world

of electronics unless you create a compelling reason for people to show up and purchase there.

Best Buy can create its own community network by hosting hackathons and other tech gatherings

centered on their in-house incubator which will attract hundreds of potential customers for each

event.

Start a media content download service on their website

More and more people are using the web nowadays to download and listen/watch media

(music, videos, movies, etc). Best Buy is a leading retailer in the music and movie industry. It

could start (or team up with a service such as Rhapsody) to offer a subscription-based download

service where users can download albums from the latest artists or the latest DVD movies.

Companies and services such as Rhapsody, NetFlix, and iTunes have found this to be a great

way to make money. Given the rapid growth of the web, and the use of it, this could give

BestBuy a chance to make money from customers they might never have seen in their stores.

Approximated costs: About $5,000,000

29

STRATEGIC MANAGEMENT 210410

Through this strategy, Best Buy can transform itself from a white elephant chain to a nimble

leader catalyzing adoption of new technologies. Instead of waiting for tech companies to come

up with hardware that it then tries to sell at zero margins, Best Buy can shift to help SMBs as

well as consumers use these new technologies and host the brainpower of future innovation. Best

Buy will not only dramatically increase in value, but it will create a sticky, loyal community of

customers who will now have a reason to visit the locations and purchase services and good from

Best Buy and recommend Best Buy to their networks. (Vela, 2013)

FINANCING STRATEGY

As one can see, debt financing seems like a great route to take here, with the highest EPS out of

any other method. Also, one strategy that can have a big effect on cash is the buyback or

repurchase of Common stock. When this stock is eliminated, the value per share can rise.

STRATEGY EVALUATION

Yearly performance evaluations for each store/department should be carried out. Things should

be measured simply using sales, revenue, and profits for each store. If each store is performing as

30

STRATEGIC MANAGEMENT 210410

well as the other existing stores, leave it as-is. If some stores are lacking, use a growth metric

(store must see an increase in revenues and/or profits by a certain percentage each year). Watch

the popularity of the downloading service do the revenues outweigh the costs? Watch

appliance/major electronics sales from year to year are sales rising because Best Buy is

offering installation, support, and service? If not on a steady increase over a 5 year period,

they can decide what to do from there. Is customer satisfaction on the rise? Give out a customer

survey with questions relating to the new services offered.

CONCLUSION

As internet retailing becomes more accessible to even those who are not technologically savvy,

Best Buy will become all but obsolete. Furthermore, internet retailing will almost always be less

expensive for customers because of lower overhead costs. In order to survive this paradigm shift,

Best Buy must reshape the look and feel of its advertisements and stores. More importantly it

needs to sell a shopping experience that cannot be imitated online. Therefore, the management

should try to abandon the warehouse superstore format to a showroom or exhibit format. One

possibility is for the products to be laid out in different types of showrooms for customers to

interact with. The concept is similar to an Apple store, but at a much larger scale and

incorporating a wider range of products. The existing customer-centricity model would still exist,

but the emphasis would be shifted to selling a lifestyle rather than a profile. Another possibility

is to add coffee shops, game rooms, music rooms and etc. that all utilize products that are sold by

Best Buy. The advantage of doing this is to increase the customers duration in the store and thus

increase the chances of closing a sale. I believe rethinking the retail experience to make it more

personable and physically interactive is a viable way to compete with internet retailing.

31

STRATEGIC MANAGEMENT 210410

Bibliography

Best Buy. (2014). Retrieved from Best Buy: Bestbuy.com

Forbes. (2014). Retrieved from Forbes.

Gupta, T. (2013). Best Buy.

Kwok, I. (2009). Strategic report for Best Buy.

Reuters. (2009). Retrieved from Reuters: www.reuters.com

Vela, M. (2013, January 3). Retrieved from Fortune.

(perleybrook.umfk.maine.edu) (2009)

Morningstar. (2015) Retrieved from:

(http://financials.morningstar.com/ratios/r.html?t=BBY®ion=usa&culture=en-US)

32

You might also like

- Best Buy Case StudyDocument17 pagesBest Buy Case Studyyan86% (7)

- Best Buy Business AnalysisDocument11 pagesBest Buy Business Analysisraheem34No ratings yet

- Best BuyDocument36 pagesBest BuySuperman2182100% (1)

- Best Buy Final PaperDocument13 pagesBest Buy Final Paperdavid_levereNo ratings yet

- BEST BuyDocument16 pagesBEST BuyPurna WayanNo ratings yet

- Best Buy Strategic Management AnalysisDocument12 pagesBest Buy Strategic Management Analysissolaf2010100% (1)

- Best Buy Strategy Report - FinalDocument26 pagesBest Buy Strategy Report - FinalcuryaismaraNo ratings yet

- Best Buy Case Study Strategy FormulationDocument73 pagesBest Buy Case Study Strategy FormulationChan Ka Yan100% (1)

- Best Buy Case Report #2Document3 pagesBest Buy Case Report #2МенчеВучковаNo ratings yet

- MGMT590 Best Buy Strategy Report - FinalDocument26 pagesMGMT590 Best Buy Strategy Report - FinalJasmine Abd El Karim100% (1)

- BestBuyCaseStudy 1 2 FinalDocument16 pagesBestBuyCaseStudy 1 2 FinalRahila SaeedNo ratings yet

- Strategic Management-Best BuyDocument9 pagesStrategic Management-Best BuyAmit PrakashNo ratings yet

- Final ProjectDocument52 pagesFinal ProjectKaki Ethridge100% (2)

- Best Buy Co. IncDocument13 pagesBest Buy Co. IncNazish Sohail100% (2)

- Best Buy Case Study AnalysisDocument5 pagesBest Buy Case Study AnalysisNate Lindstrom0% (1)

- Best Buy Co., Inc. Customer-CentricityDocument8 pagesBest Buy Co., Inc. Customer-CentricityjddykesNo ratings yet

- Best Buy Marketing Case Study - Robert Paul EllentuckDocument33 pagesBest Buy Marketing Case Study - Robert Paul EllentuckRobert Paul EllentuckNo ratings yet

- BestBuy Strategic Analysis.Document6 pagesBestBuy Strategic Analysis.Jackie S LaymanNo ratings yet

- Best Buy Analysts PresentationDocument55 pagesBest Buy Analysts PresentationMinnesota Public Radio100% (4)

- Filene'S Basement: Case SynopsisDocument3 pagesFilene'S Basement: Case SynopsisDeepikaNo ratings yet

- Best Buy CaseDocument7 pagesBest Buy CaselatrellvisNo ratings yet

- Best BuyDocument16 pagesBest BuyPallavi GhaiNo ratings yet

- Day 2 - Case Study - Best BuyDocument18 pagesDay 2 - Case Study - Best BuyMarcus GaleniusNo ratings yet

- Marketing: Best Buy's Segmentation, Targeting, and Positioning ImplementationDocument17 pagesMarketing: Best Buy's Segmentation, Targeting, and Positioning ImplementationSiare Antone100% (1)

- Showrooming at Best Buy: Case AnalysisDocument4 pagesShowrooming at Best Buy: Case AnalysisAnubhavChauhanNo ratings yet

- Indian Institute of Management Indore: Business To Business MarketingDocument5 pagesIndian Institute of Management Indore: Business To Business MarketingVishal BharaniNo ratings yet

- Case Analysis TIVODocument8 pagesCase Analysis TIVOMuhammad Nasir0% (1)

- Showrooming-Best Buy Case FINAL EngDocument3 pagesShowrooming-Best Buy Case FINAL EngMislav MatijevićNo ratings yet

- Telenor: Revolutionizing: Syed Ali ImamDocument7 pagesTelenor: Revolutionizing: Syed Ali Imammaheen100% (1)

- Assignment 7: Digital Marketing - Case Study "Telenor: Revolutionizing Retail Banking in Serbia: Digital Transformation of The Customer Experience".Document2 pagesAssignment 7: Digital Marketing - Case Study "Telenor: Revolutionizing Retail Banking in Serbia: Digital Transformation of The Customer Experience".Manisha Scrichand100% (2)

- Tale of Two Companies, Case SummaryDocument3 pagesTale of Two Companies, Case Summaryshershah hassan0% (1)

- AddonsDocument11 pagesAddonsShreyas Marulkar100% (1)

- Tgs Kelompok Best BuyDocument10 pagesTgs Kelompok Best BuyLiana ReginaNo ratings yet

- Best Buy Marketing Case Study Robert Paul EllentuckDocument33 pagesBest Buy Marketing Case Study Robert Paul EllentuckAbhishek NagarajNo ratings yet

- Designs by Kate AnalysisDocument2 pagesDesigns by Kate Analysissukumar sukuNo ratings yet

- Netflix Case PaperDocument8 pagesNetflix Case PaperM Sul100% (1)

- The Fashion Channel: Case Analysis IDocument11 pagesThe Fashion Channel: Case Analysis IMeli161283No ratings yet

- Case1 - TelenorDocument4 pagesCase1 - TelenorMine Sayrac67% (3)

- Filenes BasementDocument3 pagesFilenes BasementAhsan KhanNo ratings yet

- Designs by Kate - The Power of Direct Sales CaseDocument18 pagesDesigns by Kate - The Power of Direct Sales CasekananguptaNo ratings yet

- Fashion Case StudyDocument4 pagesFashion Case StudySneha Daswani100% (1)

- B 1 Peak Sealing Technologies Product Line Extension DilemmaDocument3 pagesB 1 Peak Sealing Technologies Product Line Extension DilemmaNirmal Kumar RoyNo ratings yet

- Showrooming at BestBuyDocument7 pagesShowrooming at BestBuyAJITH INo ratings yet

- Accessories Under One Roof Providing International Shopping ExperienceDocument9 pagesAccessories Under One Roof Providing International Shopping ExperienceBarsha1100% (1)

- Filene's BasementDocument5 pagesFilene's BasementsingarajusarathNo ratings yet

- Acctg352 - Promotion Push Strategy Human Resource ManagementDocument10 pagesAcctg352 - Promotion Push Strategy Human Resource ManagementAnn Marie GabayNo ratings yet

- TiVo in 2002Document11 pagesTiVo in 2002ssluiswNo ratings yet

- Best Buy Co-Case AnalysisDocument1 pageBest Buy Co-Case Analysisgane009No ratings yet

- Case Study - J.C. PenneyDocument5 pagesCase Study - J.C. PenneyVasili RabshtynaNo ratings yet

- Best BuyDocument32 pagesBest BuyHashani Anuttara AbeygunasekaraNo ratings yet

- Best Buy AnalysisDocument5 pagesBest Buy Analysisraetohjr100% (1)

- Cisco SystemsDocument10 pagesCisco Systemssudha2040100% (1)

- 5 C Analysis: Company Customers Competitors Collaborators ContextDocument6 pages5 C Analysis: Company Customers Competitors Collaborators ContextMahesh KalithNo ratings yet

- Time Warner, Inc., Is Playing Games With Stockholders.Document12 pagesTime Warner, Inc., Is Playing Games With Stockholders.WolfManNo ratings yet

- Unique Online Furniture (SV)Document4 pagesUnique Online Furniture (SV)Hằng NguyễnNo ratings yet

- Swot Analysis of ABS CBNDocument1 pageSwot Analysis of ABS CBNJeger JbTattoo Baguio50% (2)

- Gathering Data: Advertisem EntDocument7 pagesGathering Data: Advertisem EntLilitNo ratings yet

- Convenience Store Business Plan SampleDocument44 pagesConvenience Store Business Plan Sampleairborne506100% (2)

- Best Buy Co., Inc.: Strategic Report ForDocument55 pagesBest Buy Co., Inc.: Strategic Report ForasmshihabNo ratings yet

- Imprtant Final For Next PLC AIC Case StudyDocument6 pagesImprtant Final For Next PLC AIC Case StudyBhavin MehtaNo ratings yet

- Marketing To WomenDocument3 pagesMarketing To WomenPratyoosh DwivediNo ratings yet

- A Study On Shoplifting and Security Measures in Big BazaarDocument5 pagesA Study On Shoplifting and Security Measures in Big BazaarGODsml0% (1)

- B2 First Unit 7 Test: Section 1: VocabularyDocument2 pagesB2 First Unit 7 Test: Section 1: VocabularyNatalia KhaletskaNo ratings yet

- Operations and Service ManagementDocument9 pagesOperations and Service ManagementMuntaha JunaidNo ratings yet

- Consumer Perceived Risk in Online Shopping EnvironDocument6 pagesConsumer Perceived Risk in Online Shopping EnvironKajol NigamNo ratings yet

- Presentation On Brand Valuation of Malls: Group MembersDocument18 pagesPresentation On Brand Valuation of Malls: Group Memberssovan12100% (1)

- Wegman Case StudyDocument2 pagesWegman Case StudyBetheemae R. MatarloNo ratings yet

- Go-To-Market Strategy For Murtle - in "How Do We Get Our Products Sold"Document2 pagesGo-To-Market Strategy For Murtle - in "How Do We Get Our Products Sold"Rahul PrithamNo ratings yet

- How ComeDocument24 pagesHow ComeGreenNo ratings yet

- A Project Report: "Sales Promotion Activities"Document67 pagesA Project Report: "Sales Promotion Activities"NotmenowNo ratings yet

- NFPA 101 2009 - Occupant Load FactorDocument1 pageNFPA 101 2009 - Occupant Load FactorMarius Carlo Manahan ValenzuelaNo ratings yet

- Possible Questions For The Oral Exam TEENS 4Document4 pagesPossible Questions For The Oral Exam TEENS 4lopezludmi242No ratings yet

- MM MerDocument483 pagesMM Meraanchal gargNo ratings yet

- Expenditure of Youth To Kpop Autosaved AutosavedDocument35 pagesExpenditure of Youth To Kpop Autosaved AutosavedMaricar GuanNo ratings yet

- Nike Live Store EssayDocument1 pageNike Live Store Essaysidrah tonseNo ratings yet

- Geography - Impact of OOT Shopping CentresDocument4 pagesGeography - Impact of OOT Shopping CentresevosxNo ratings yet

- Lean Six Sigma Improving Efficiency Retail Store Operations 0215 1Document14 pagesLean Six Sigma Improving Efficiency Retail Store Operations 0215 1Aishwarya HotaNo ratings yet

- Consumers' Percppt-Wps OfficeDocument16 pagesConsumers' Percppt-Wps OfficechiesamongNo ratings yet

- Ar 42152: Urban Design StudioDocument14 pagesAr 42152: Urban Design Studiosaurav kumarNo ratings yet

- The Poorest Rich Man Novel Chapter 1 - 2 PoetryDocument2 pagesThe Poorest Rich Man Novel Chapter 1 - 2 PoetryGuzman BraulioNo ratings yet

- Walmart Case StudyDocument14 pagesWalmart Case StudySugandha GhadiNo ratings yet

- Book Case Study 1: Salt Lake City Centre, KolkataDocument1 pageBook Case Study 1: Salt Lake City Centre, KolkataCharu OswalNo ratings yet

- Answer SheetDocument4 pagesAnswer SheetKotak ChannelNo ratings yet

- PDF File PDFDocument118 pagesPDF File PDFAman HansdaNo ratings yet

- Ch5 Notes With Answers 1Document16 pagesCh5 Notes With Answers 1Zaira Ronquillo AuxteroNo ratings yet

- Unit 7 Lesson1 Is There A Bookstore Near Here - Part1Document4 pagesUnit 7 Lesson1 Is There A Bookstore Near Here - Part1Ei LeeNo ratings yet

- Coupons 141-148Document2 pagesCoupons 141-148Jeevan SwainNo ratings yet

- Miracle On 34th StreetDocument2 pagesMiracle On 34th StreetPaul CanalettiNo ratings yet

- Shade Band Subm-WPS OfficeDocument2 pagesShade Band Subm-WPS OfficeMd MasumNo ratings yet

- LCH1006 Test Notes Sample Questions (2021-2022) Updated 21 March 2022Document9 pagesLCH1006 Test Notes Sample Questions (2021-2022) Updated 21 March 2022celesteheiiNo ratings yet

- The Compound Effect by Darren Hardy - Book Summary: Jumpstart Your Income, Your Life, Your SuccessFrom EverandThe Compound Effect by Darren Hardy - Book Summary: Jumpstart Your Income, Your Life, Your SuccessRating: 5 out of 5 stars5/5 (456)

- Summary: Atomic Habits by James Clear: An Easy & Proven Way to Build Good Habits & Break Bad OnesFrom EverandSummary: Atomic Habits by James Clear: An Easy & Proven Way to Build Good Habits & Break Bad OnesRating: 5 out of 5 stars5/5 (1635)

- Can't Hurt Me by David Goggins - Book Summary: Master Your Mind and Defy the OddsFrom EverandCan't Hurt Me by David Goggins - Book Summary: Master Your Mind and Defy the OddsRating: 4.5 out of 5 stars4.5/5 (383)

- Summary of 12 Rules for Life: An Antidote to ChaosFrom EverandSummary of 12 Rules for Life: An Antidote to ChaosRating: 4.5 out of 5 stars4.5/5 (294)

- Summary of The Anxious Generation by Jonathan Haidt: How the Great Rewiring of Childhood Is Causing an Epidemic of Mental IllnessFrom EverandSummary of The Anxious Generation by Jonathan Haidt: How the Great Rewiring of Childhood Is Causing an Epidemic of Mental IllnessNo ratings yet

- Make It Stick by Peter C. Brown, Henry L. Roediger III, Mark A. McDaniel - Book Summary: The Science of Successful LearningFrom EverandMake It Stick by Peter C. Brown, Henry L. Roediger III, Mark A. McDaniel - Book Summary: The Science of Successful LearningRating: 4.5 out of 5 stars4.5/5 (55)

- We Were the Lucky Ones: by Georgia Hunter | Conversation StartersFrom EverandWe Were the Lucky Ones: by Georgia Hunter | Conversation StartersNo ratings yet

- Mindset by Carol S. Dweck - Book Summary: The New Psychology of SuccessFrom EverandMindset by Carol S. Dweck - Book Summary: The New Psychology of SuccessRating: 4.5 out of 5 stars4.5/5 (328)

- The War of Art by Steven Pressfield - Book Summary: Break Through The Blocks And Win Your Inner Creative BattlesFrom EverandThe War of Art by Steven Pressfield - Book Summary: Break Through The Blocks And Win Your Inner Creative BattlesRating: 4.5 out of 5 stars4.5/5 (274)

- Summary of The Algebra of Wealth by Scott Galloway: A Simple Formula for Financial SecurityFrom EverandSummary of The Algebra of Wealth by Scott Galloway: A Simple Formula for Financial SecurityNo ratings yet

- The Body Keeps the Score by Bessel Van der Kolk, M.D. - Book Summary: Brain, Mind, and Body in the Healing of TraumaFrom EverandThe Body Keeps the Score by Bessel Van der Kolk, M.D. - Book Summary: Brain, Mind, and Body in the Healing of TraumaRating: 4.5 out of 5 stars4.5/5 (266)

- How To Win Friends and Influence People by Dale Carnegie - Book SummaryFrom EverandHow To Win Friends and Influence People by Dale Carnegie - Book SummaryRating: 5 out of 5 stars5/5 (556)

- The One Thing: The Surprisingly Simple Truth Behind Extraordinary ResultsFrom EverandThe One Thing: The Surprisingly Simple Truth Behind Extraordinary ResultsRating: 4.5 out of 5 stars4.5/5 (709)

- The Whole-Brain Child by Daniel J. Siegel, M.D., and Tina Payne Bryson, PhD. - Book Summary: 12 Revolutionary Strategies to Nurture Your Child’s Developing MindFrom EverandThe Whole-Brain Child by Daniel J. Siegel, M.D., and Tina Payne Bryson, PhD. - Book Summary: 12 Revolutionary Strategies to Nurture Your Child’s Developing MindRating: 4.5 out of 5 stars4.5/5 (57)

- Summary of The Galveston Diet by Mary Claire Haver MD: The Doctor-Developed, Patient-Proven Plan to Burn Fat and Tame Your Hormonal SymptomsFrom EverandSummary of The Galveston Diet by Mary Claire Haver MD: The Doctor-Developed, Patient-Proven Plan to Burn Fat and Tame Your Hormonal SymptomsNo ratings yet

- Summary of Atomic Habits by James ClearFrom EverandSummary of Atomic Habits by James ClearRating: 5 out of 5 stars5/5 (169)

- The 5 Second Rule by Mel Robbins - Book Summary: Transform Your Life, Work, and Confidence with Everyday CourageFrom EverandThe 5 Second Rule by Mel Robbins - Book Summary: Transform Your Life, Work, and Confidence with Everyday CourageRating: 4.5 out of 5 stars4.5/5 (329)

- Sell or Be Sold by Grant Cardone - Book Summary: How to Get Your Way in Business and in LifeFrom EverandSell or Be Sold by Grant Cardone - Book Summary: How to Get Your Way in Business and in LifeRating: 4.5 out of 5 stars4.5/5 (86)

- Blink by Malcolm Gladwell - Book Summary: The Power of Thinking Without ThinkingFrom EverandBlink by Malcolm Gladwell - Book Summary: The Power of Thinking Without ThinkingRating: 4.5 out of 5 stars4.5/5 (114)

- Steal Like an Artist by Austin Kleon - Book Summary: 10 Things Nobody Told You About Being CreativeFrom EverandSteal Like an Artist by Austin Kleon - Book Summary: 10 Things Nobody Told You About Being CreativeRating: 4.5 out of 5 stars4.5/5 (128)

- How Not to Die by Michael Greger MD, Gene Stone - Book Summary: Discover the Foods Scientifically Proven to Prevent and Reverse DiseaseFrom EverandHow Not to Die by Michael Greger MD, Gene Stone - Book Summary: Discover the Foods Scientifically Proven to Prevent and Reverse DiseaseRating: 4.5 out of 5 stars4.5/5 (84)

- SUMMARY: So Good They Can't Ignore You (UNOFFICIAL SUMMARY: Lesson from Cal Newport)From EverandSUMMARY: So Good They Can't Ignore You (UNOFFICIAL SUMMARY: Lesson from Cal Newport)Rating: 4.5 out of 5 stars4.5/5 (14)

- Summary of The New Menopause by Mary Claire Haver MD: Navigating Your Path Through Hormonal Change with Purpose, Power, and FactsFrom EverandSummary of The New Menopause by Mary Claire Haver MD: Navigating Your Path Through Hormonal Change with Purpose, Power, and FactsNo ratings yet

- Summary, Analysis, and Review of Daniel Kahneman's Thinking, Fast and SlowFrom EverandSummary, Analysis, and Review of Daniel Kahneman's Thinking, Fast and SlowRating: 3.5 out of 5 stars3.5/5 (2)

- Book Summary of Ego Is The Enemy by Ryan HolidayFrom EverandBook Summary of Ego Is The Enemy by Ryan HolidayRating: 4.5 out of 5 stars4.5/5 (387)

- Designing Your Life by Bill Burnett, Dave Evans - Book Summary: How to Build a Well-Lived, Joyful LifeFrom EverandDesigning Your Life by Bill Burnett, Dave Evans - Book Summary: How to Build a Well-Lived, Joyful LifeRating: 4.5 out of 5 stars4.5/5 (62)

- Essentialism by Greg McKeown - Book Summary: The Disciplined Pursuit of LessFrom EverandEssentialism by Greg McKeown - Book Summary: The Disciplined Pursuit of LessRating: 4.5 out of 5 stars4.5/5 (187)

- Summary of When Things Fall Apart: Heart Advice for Difficult Times by Pema ChödrönFrom EverandSummary of When Things Fall Apart: Heart Advice for Difficult Times by Pema ChödrönRating: 4.5 out of 5 stars4.5/5 (22)