Professional Documents

Culture Documents

Macroeconomic Past Paper Questions and Mark Schemes 2009 - 2011SORTED

Uploaded by

SandyKwongCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Macroeconomic Past Paper Questions and Mark Schemes 2009 - 2011SORTED

Uploaded by

SandyKwongCopyright:

Available Formats

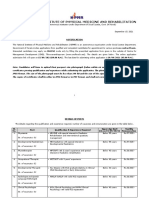

Macroeconomic Questions, 2009 - 2011

Syllabus

Level

Year ,

Paper

Question

Mark Scheme

Aggregate

Demand

SL

May 2010,

P1

2. (a) Aggregate demand consists of

consumption, investment,

government spending and net

exports (exports minus imports).

Explain two factors that may

influence investment and two

factors that may influence net

exports. [10 marks]

Aggregate

Demand

SL

May 2010,

P1

2 (b) Evaluate the effectiveness of

an increase in investment

expenditure on the performance of

an economy. [15 marks]

Answers should include:

a definition of investment

a definition of net exports

an explanation of any two factors which may influence investment such

as

the interest rate, business expectations, increased consumer demand,

cost, economic stability and efficiency of capital equipment

an explanation of any two factors which may influence net exports such

as

increases in foreign incomes increases a countrys exports, increases in a

countrys national income leads to an increase in imports, decreases in

foreign incomes results in less exports from a country, decreases in a

countrys national income results in a decrease in imports, a fall in relative

prices (if a countrys goods and services fall in price relative to those of

other countries) will result in a country selling more exports and buying

less

imports and improvements in the relative quality of a countrys goods in

comparison to other countries will result in it selling more exports and

buying less imports.

(b) Evaluate the effectiveness of an increase in investment

expenditure on the

performance of an economy. [15 marks]

Answers may include:

a definition of investment

an explanation of the performance of an economy in terms of growth,

employment, price stability and the balance of payments

consideration of an increase in investment leading to an increase in

real GDP (economic growth)

diagrams showing a movement from a point within to a point on the PPF

or

a shift of the AD to the right

the supply-side effects of increasing investment on price and real output

levels

diagram to show shift in LRAS

the possibility of demand-pull inflation, depending on where the economy

is

operating

an explanation that it could adversely affect the current account of the

balance of payments if investment expenditure is on imports

impact of different types of investment in terms of sustainable

development

a comparison with potential growth

the supply-side effects of increasing investment on price and real output

levels

short-run versus long-run effects

an overall assessment of the impact.

Syllabus

Level

Year ,

Paper

Question

Aggregate

demand

SL

May 2009,

P2

3a(ii) aggregate demand (paragraph

).

Aggregate

demand &

aggregate

supply

SL

May 2010,

P2

1(c) Using an AD/AS diagram,

explain how increased private

domestic investment and a

decreased need to import oil from

overseas are likely to contribute to

economic growth in the US economy

(paragraph ). [4 marks]

2 (b) Evaluate the possible impact on

economic performance that may

result from a government decision to

bring inflation under control. [15

marks]

Aggregate

demand &

aggregate

supply Inflation

Aggregate

demand &

aggregate

supply unemployment

Aggregate

demand &

supply

supply-side

policies

Aggregate

demand &

unemployment

May 2009,

P1

Mark Scheme

Examiners should be aware that candidates may take a different approach

which if appropriate, should be rewarded.

Effective evaluation may be to:

consider short-term versus long-term consequences

examine the impact on different stakeholders

discuss advantages and disadvantages

prioritize the arguments.

An explanation that it is the total demand for all goods and services

produced in an economy OR This comprises C+I+G+(XM) is also

sufficient.

For drawing a correctly labelled AD/AS diagram showing a shift to the

right (increase) in the AD curve and for explaining that I (private

investment) and M (imports) are components of aggregate demand

(C+ +G + XM) and an increase in spending on I and a decrease in

spending on M will increase AD. (Diagram + 1 component = [3 marks])

Answers may include: explanation of economic performance different

types of inflation according to the rate, e.g. hyperinflation importance of

the distinction between demand-pull and cost-push inflation implications of

the use of demand-side policies implications of the use of supply-side

policies impact on employment use of Phillips curve impact on balance of

payments impact on growth use of AD/AS diagrams.

Effective evaluation may be to: consider short-term versus long-term

consequences examine the impact on different stakeholders prioritize the

arguments.

For drawing a correctly labelled AD/AS diagram showing a shift to the left

(decrease) in AD and for explaining that as domestic demand falls, output

will fall contributing to unemployment in the economy.

SL

May 2010,

P2

3(b) Using an appropriate diagram,

explain how falling domestic demand

is likely to contribute to higher levels

of unemployment. [4 marks]

HL

May 2009,

P3

3(b) Using an AD/AS diagram,

explain how supply-side policies

could affect real output in the longrun. [4 marks]

For drawing a correctly labelled AD/AS diagram with a movement of the

LRAS showing an increase in real output and an explanation of how supplyside policies can increase real output in the long run such as by increasing

the quantity and/or increasing the quality of factors of production.

SL

May 2009,

P1

2 (b) Evaluate the view that the

unemployment rate can be most

effectively reduced through the use

of measures designed to increase

aggregate demand in an economy.

[15 marks]

Answers may include: explanation of measures designed to increase AD in

terms of fiscal and monetary policy use of lower interest rates to increase

AD and to combat demand deficient unemployment use of higher

government spending/lower taxation to increase AD and to combat

demand deficient unemployment illustration of demand-side policies using

AD/AS diagrams discussion of ineffectiveness of demand-side measures for

structural, real wage, frictional and seasonal unemployment discussion of

problems of demand-side measures, e.g. may lead to a rise in inflation,

financing expansionary fiscal policy, time lags associated with monetary

policy, etc. explanation of supply-side measures to deal with non-demand

Syllabus

Level

Year ,

Paper

Question

Mark Scheme

deficient unemployment discussion of problems of supply-side measures,

e.g. it may lead to the exploitation of workers, the cost and effectiveness

of government managed training, the time lags associated with the

application of supply-side policies.

Examiners should be aware that candidates may take a different approach

which if appropriate, should be rewarded.

Effective evaluation may be to: consider short-term versus long-term

consequences examine the impact on different stakeholders discuss

advantages and disadvantages prioritize the arguments.

For drawing a business cycle diagram indicating the phases of the cycle and for

explaining that Germany was in recession in 2008 as it recorded negative growth in

successive quarters. (If only recession is mentioned then [1 mark] may be awarded

for the explanation.)

Business Cycle

SL

May 2011,

P2

2 (b) Using a business cycle

diagram, explain Germanys

economic position in 2008

in relation to the business cycle. [4

marks]

Definitions

SL

May 2011,

P2

2(a) Define the following terms

indicated in bold in the text:

(i) deflation (paragraph )

(ii) savings (paragraph ).

An explanation that it is a sustained decrease in the average level of prices

(general price level) in an economy.

3(a) Define the following terms

indicated in bold in the text:

(i) unemployment rate (paragraph

)

(ii) Gross Domestic Product (GDP)

(paragraph ).

An explanation that it is the number of unemployed expressed as a

percentage of the workforce. (If this is expressed as an equation, then

full marks should be awarded if the equation is correct).

3(d) Using information from the

text/data and your knowledge of

economics, evaluate whether

demand-side policies or supply-side

policies should be used to reduce the

current level of unemployment in

Ireland. [8 marks]

Responses may include:

Evaluation of the demand-side policies:

a definition of demand-side policies

an AD/AS diagram showing a rightward shift of the AD function

a connection between the shape of the AS function and the likelihood

that

demand-side policies may or may not succeed (i.e. given the economic

slowdown in Ireland it is likely that the AD function may intersect the AS

function on a point close to its horizontal range so that an increase in AD

may result in an increase in output with negligible inflationary costs.

Otherwise, on a steeper range of AS, the demand-side policies may have a

heavy inflationary cost)

the role of increased government spending which can create additional

employment opportunities, for example, through infrastructural investment

that would stimulate the economy (paragraph )

Definitions

Demand-side

and supplyside policies

SL

SL

May 2010,

P2

May 2010,

P2

An explanation that it is any of:

income that is not spent

present consumption foregone

a withdrawal from the circular flow of income

money stored in financial institutions.

An explanation that it is the value of all goods and services produced

in an economy in a given time period.

Syllabus

Level

Year ,

Paper

Question

Mark Scheme

reduced indirect and direct taxation may successfully increase consumer

expenditure and stimulate the economy

however, if not carefully targeted, increased government spending may

leak

from the circular flow of income through increased savings and/or import

spending

the large budget deficit in Ireland may prevent further government

borrowing and reduce the scope for aggregate demand stimulation

(paragraph )

reduced interest rates may allow businesses to invest more and employ

more people

reduced interest rates may not stimulate increased investment by

businesses because of pessimistic expectations during a crisis.

Evaluation of supply-side policies:

a definition of supply-side policies

an AD/AS diagram showing a rightward shift of the LRAS function

wage restraint through reduction of union power may add flexibility to

the

labour market (paragraph )

wage restraint may be conducive to social instability (industrial action)

that

may further worsen the economic slowdown

reducing unemployment benefits

social consequences of reducing benefits (poverty, inequality)

decrease in income tax may provide incentives for workers to work more

decrease in income tax has a limited effect on highly-paid workers as

they

opt for an increase in leisure

labour market flexibility will allow market forces to set wages and lower

costs for businesses

deregulation may have severe safety or environmental consequences

interventionist policies, such as increased training/education,

encouraging

R+D, the provision of infrastructure, and improved information flows may

be high cost and involve serious opportunity costs.

Overall evaluation:

demand-side polices have a macroeconomic focus

demand-side policies may be more effective in times of cyclical

downturns

demand-side policies are flexible in timing and focus

demand-side policies are difficult to implement with limited fiscal

resources

supply-side policies have a microeconomic focus

time lags may reduce the impact of any supply-side policy in the short

term

in the long run, supply-side policies may improve efficiency and assist

international competitiveness.

Examiners should be aware that candidates may take a different approach

which if appropriate, should be rewarded.

If there is no direct reference to the text/data, then candidates may not be

Syllabus

Level

Year ,

Paper

Question

Mark Scheme

rewarded beyond level 2.

Effective evaluation may be to:

consider short-term versus long-term consequences

examine the impact on different stakeholders

discuss advantages and disadvantages

prioritize the arguments.

Fiscal policy

HL

May 2010,

P3

2(d) Using information from the

text/data and your knowledge of

economics, evaluate the role of fiscal

policy in stimulating the USA

economy. [8 marks]

Responses may include:

an explanation/definition of fiscal policy

an AD/AS diagram showing a rightward shift of AD

a reference to Keynesian policies.

Positive role that fiscal policy may have:

the effect direct investment may have on business investment (paragraph

)

the possible effect on consumer spending (paragraph )

lower production costs as a result of tax cuts in indirect taxes (paragraph

)

direct tax cuts increase disposable income (paragraph )

supply side benefits of increased government spending on infrastructure

possible increase in business confidence (paragraph )

multiplier and accelerator effects

impact on employment.

Negative role fiscal policy may have:

inflationary pressures conflicting with growth and the desire to stimulate

the economy (paragraph )

is the package powerful enough to convince investors?

inflexibility in that it cannot be changed easily and quickly

time lags for policy measures to have an effect

financing a budget deficit

crowding out effect of increased borrowing

could add to the trade deficit.

Examiners should be aware that candidates may take a different approach

which if appropriate, should be rewarded.

If there is no direct reference to the text/data, then candidates may not be

rewarded beyond level 2.

Effective evaluation may be to:

consider short-term versus long-term consequences

examine the impact on different stakeholders

discuss advantages and disadvantages

prioritize the arguments.

Fiscal Policy

SL

May 2011,

P1

2. (a) Using appropriate diagrams,

explain how an increase in

government spending could affect

both aggregate demand and

Answers should include:

a definition of government spending

a definition of aggregate demand

a definition of aggregate supply

an explanation of an increase in government spending influencing AD

Syllabus

Fiscal Policy

Level

SL

Year ,

Paper

May 2011,

P1

Question

Mark Scheme

aggregate supply in an economy. [10

marks]

use of an AD/AS diagram showing shift of AD to the right

an explanation of the possible linkage between an increase in government

spending affecting the supply-side of the economy, e.g. education and

training, government spending on infrastructure

use of an AD/AS diagram showing shift of LRAS to the right.

2(b) The lower the level of

government spending, the better.

Evaluate this view. [15 marks]

Answers may include:

Arguments in favour of lower government spending:

lower government spending and greater use of market forces to allocate

resources leading to greater economic efficiency

lower government spending leading to lower taxation

lower government spending reduces government borrowing

the importance of reduced government spending as a means of reducing

AD, to reduce inflation and a current account deficit.

Arguments against lower government spending:

the importance of government spending for the supply-side of the

economy

the importance of government spending on merit goods, public goods and

infrastructure

the importance of government spending as a means of influencing the

distribution of income through public services and state benefits

the importance of government spending as a means of regulating AD, e.g.

use of higher government spending to increase AD to encourage growth

and to reduce unemployment.

Effective evaluation may be to:

consider short-term versus long-term consequences

examine the impact on different stakeholders

discuss advantages and disadvantages

prioritize the arguments.

Fiscal Policy

SL

May 2011,

P2

2(d) Using information from the

text/data and your knowledge of

economics, evaluate the likely

effectiveness of the German

governments fiscal policies

designed to boost the economy and

reduce unemployment. [8 marks]

Responses may include:

a definition of fiscal policy

an AD/AS diagram showing an expansionary fiscal policy.

Possible strengths of the policy responses by the German government:

increased government spending should increase aggregate demand

stimulus spending should increase consumer and business confidence (paragraph

)

stimulus payments will reduce tax payments by consumers and businesses

increased social welfare spending should allow more people in Germany to maintain

an adequate standard of living

increased demand for goods and services may require more people to be employed

and reduce the level of unemployment

supply side policies leading to an increase in LRAS and a lower natural rate of

unemployment (paragraph )

cuts in personal income tax and corporate tax may produce a positive effect on AS

(paragraph ).

Possible weaknesses of the policy responses by the German government:

Syllabus

Level

Year ,

Paper

Question

Mark Scheme

the government response has been hesitant, slow and not large enough to outweigh

the impact of the global economic crisis (figures for the first stimulus package of 12

billion euros are proportionally small) (paragraphs and )

many of the measures will not have an impact until 2010 (paragraph )

increased saving by consumers may reduce the impact of increased government

spending

increased demand for goods may be satisfied by using existing stocks of produced

goods

the export sector may not be assisted by the spending

the planned deficit budgets will require increased government borrowing which will

increase public debt

the increased government spending may cause a sharp increase in inflation when

recovery begins in 2010 (paragraph ).

Effective evaluation may be to:

consider short-term versus long-term consequences

examine the impact on different stakeholders

discuss advantages and disadvantages

prioritize the arguments.

Fiscal policy multiplier

HL

November

2010, P2

4. A government decides to increase

its spending on new roads,

recognizing that there will be a

multiplier effect on national income.

Using a numerical example, explain

what may determine the size of the

multiplier.

Candidates may include the following:

a definition of the multiplier

a definition of national income

an explanation of the multiplier and its effect on national income

an identification of leakages/withdrawals and injections/additions as factors

that determine the size of the multiplier

an explanation that the size of the multiplier depends on the marginal

propensity to consume or on the marginal propensity to inject or add

income to the circular flow e.g. the higher the MPC the higher the value of

the multiplier

an explanation that the size of the multiplier depends on the marginal

propensity to save or, generally, on the marginal propensity to withdraw or

leak out of income from the circular flow, e.g. the higher the MPS the lower

the value of the multiplier

a numerical example using one of the formulae for the multiplier

an explanation of the numerical example.

Fiscal policy

and monetary

policy

HL

May 2010,

P1

2(b) Evaluate the likely effects on

the economy of relying on demandside policies to reduce the

unemployment rate. [15 marks]

Answers may include:

an explanation of the use of interest rates to reduce the unemployment

rate

an explanation of the use of increased government spending/lower

taxation levels to reduce the unemployment rate

an explanation of the linkage between lower interest rates and AD

an explanation of the crowding out effect resulting from government

borrowing to increase government spending

an explanation of the linkage between increased government spending and

lower taxation and AD

a consideration of the suitability of demand-side policies for different types

of unemployment

the impact on output, growth, inflation and the balance of payments

use of AD/AS diagrams

Syllabus

Level

Year ,

Paper

Question

Mark Scheme

AD moving to the right causes inflation on the vertical part of the AS curve

the inappropriateness of lower interest rates/higher government spending/

lower taxation in dealing with real-wage or natural unemployment

demand-side measures effective against demand-deficient unemployment

supply-side measures to deal with unemployment

the problems associated with increased government spending (running a

budget deficit)

the problem of inelastic response of consumption and investment to lower

interest rates

the problem of time lags.

Examiners should be aware that candidates may take a different approach

which if appropriate, should be rewarded.

Effective evaluation may be to:

consider short-term versus long-term consequences

examine the impact on different stakeholders

discuss advantages and disadvantages

prioritize the arguments.

Fiscal policy

and Supplyside policy

SL

November

2010, P1

2. (a) Using appropriate diagrams,

explain the difference between

demand-side and supply-side

economic policies. [10 marks]

Answers should include:

a definition of monetary policy

a definition of fiscal policy

an explanation of demand-side policies

an explanation of fiscal policy as a demand-side instrument

an explanation of monetary policy as a demand-side instrument

use of an AD/AS diagram to illustrate the likely impact on AD

an explanation of supply-side policies

an explanation of the impact of supply-side policies

use of an AD/AS diagram to illustrate the likely impact on AS

examples of supply-side policies.

Fiscal Policy

Crowding out

HL

May 2011,

P2,

3. A government decides to

introduce a major increase in its

spending programmes. Explain

how this may lead to crowding

out effects.

Candidates may include:

a definition of crowding out

an explanation of financial crowding out; i.e. that by running a budget deficit

government increases demand for loanable funds, leading to increased interest rates

and thus reduced private investment and private consumption

an explanation of physical (resource) crowding out; i.e. that increased government

spending reallocates factors of production away from the private and towards the

public sector, particularly when the economy is at or near full employment

an explanation of crowding out in terms of it being a criticism of the use of

Keynesian demand management economics by neo-classical or monetarist

economists

a diagram showing the demand for, and supply of, loanable funds with increased

demand leading to raised interest rates

an AD/AS diagram showing the impact of government spending on AD and the

subsequent decline due to crowding out

May 2009,

P2

4. Explain the possible impact on the

distribution of income of a

government shifting its main source

4. Explain the possible impact on the distribution of income of a

government shifting its main source of tax revenue from progressive direct

taxes to regressive indirect taxes.

Candidates may include any of the following: explanation of progressive

Income

inequalities

Syllabus

Income

Inequality

Level

HL

Year ,

Paper

May 2011,

P1

Question

Mark Scheme

of tax revenue from progressive

direct taxes to regressive indirect

taxes.

direct taxes explanation of regressive indirect taxes examples of direct and

indirect taxes impact of a reduction in direct taxes on the distribution of

income impact of a rise in indirect taxes on the distribution of income in

terms of equality and equity use of the Lorenz curve.

Answers should include:

a definition of income distribution, as one of the goals of macroeconomic policy.

2. (a) Explain two policies a

government might use to

redistribute income. [10 marks]

Plus any two of the following:

progressive, regressive and proportional taxation (a diagram may be used)

switching the burden of taxation between direct and indirect (more regressive) taxes

transfer payments, minimum wage

use of property or wealth taxes for redistributive purposes.

Answers may include:

a method of describing or measuring income equality or inequality such as the Lorenz

curve and/or Gini coefficient

the redistributive effects of merit goods in an economy which provides them

extensively

reference to the redistributive effects of government subsidies.

Answers should include:

a definition of income distribution, as one of the goals of macroeconomic policy.

Income

Inequality

Income

HL

HL

May 2011,

P1

May 2010,

2(b) Measures to promote greater

income equality should be a key

feature of government economic

policy. Evaluate this proposition. [15

marks]

4. With the aid of a diagram, explain

Answers may include:

a definition of income equality

reference to the difficulty and disagreement over fair distribution

consideration of benefits of greater income equality such as reduction of poverty,

increase in consumption of the poor, greater incentives for low income groups,

attainment of economic development

definitions of the four objectives of government economic policy, with an explanation

that income equality is a fifth and not always considered as important

consideration of the Laffer curve

consideration of the presumed disincentive effects of taxation

reference to the positive externalities of merit goods such as education and health

care for lower income groups

consideration of the normative nature of the statement in the question

the positive multiplier effects resulting from transferring income from sectors with high

MPS to sectors with high MPC

a reference to where the economy is in the business cycle, as an influence on

whether greater income equality would be a key feature of government economic

policy.

N.B. Some candidates may mention the balanced-budget multiplier in connection with

the last bullet point.

In attempting evaluation candidates might point to the fact that arguments for greater

or less equality coexist within economics and that notions of income equality and

fairness are not the same.

Effective evaluation may be to:

consider short-term versus long-term consequences

examine the impact on different stakeholders

discuss advantages and disadvantages

prioritize the arguments.

Candidates may include:

a definition of transfer payments

Syllabus

Year ,

Paper

Question

Mark Scheme

inequality

P2

how an increase in transfer

payments to the poorest households

in a nation is likely to affect the

Lorenz curve and the Gini coefficient

of that nation.

a definition of the Lorenz curve

a definition of the Gini coefficient

a diagram illustrating a Lorenz curve and the Gini coefficient

an explanation that an increase in transfer payments to the poorest

households can lead to an improvement in income distribution, by

increasing the incomes of lower income groups

an explanation that an improvement in income distribution will cause the

Lorenz curve to move towards the line of absolute equality

an explanation that the Gini coefficient (index) will become lower indicating

a more equitable distribution of income.

Inflation

May 2009,

P1

2. (a) Explain the possible causes of

a rise in the rate of inflation in an

economy. [10 marks]

May 2010,

P2

3. Explain how inflation can be

measured and explain three

problems associated with the

measurement of inflation.

Answers should include: definition of inflation explanation of a rise in the

rate of inflation explanation of the rise in terms of an increase in aggregate

demand (AD) explanation of the rise in terms of an increase in costs (AS).

Answers may include: explanation of the rise in terms of an increase in the

money supply (accept reference to MV = PT) use of an AD/AS diagram to

illustrate the rise in AD use of an AD/AS diagram to illustrate the rise in

costs factors which may cause AD to rise, e.g. lower taxation, higher

government spending factors which may cause AS to rise, e.g. lower

productivity, wage increases the impact of external shocks such as a rise in

oil prices reference to other relevant factors such as expectations and a

depreciating exchange rate.

Candidates may include:

a definition of inflation

measures of inflation such as a price index, retail price index, deflator,

price deflator discussion of basket of goods (regimen), weighting, base

year, regional issues (country and city).

Inflation

Level

HL

Problems associated with the measurement of inflation:

price index based on purchasing preferences of typical household

errors in the collection of data

changes in consumption habits over time

quality and types of goods and services change over time

changes in producer prices are excluded

one-off events such as seasonal variations, oil price shocks

international comparisons.

Inflation

SL

May 2009

3(d) Using information from the

text/data and your knowledge of

economics, evaluate factors that

could have caused Chinas inflation

to increase recently.

[8 marks]

Responses may include: a definition of inflation

an explanation of the difference between demand-pull and cost-push

inflation. Diagrams illustrating these two causes of inflation may be

included evaluation may be in terms of short-term and long-term impacts

on inflation.

An evaluation of factors which could have caused rising inflation such as:

rising aggregate demand (consumption, investment, government

spending, net exports) excess demand above potential growth external

shocks, such as increased oil prices increased costs of electricity, water,

broadband, gas (paragraph ) higher corn prices and the impact on the

cost of feed (paragraph ) a shortage of livestock (pigs) caused by deaths

due to disease (paragraph ) declining factors of production e.g. arable

land and water (paragraph ) rising wage costs, now exceeding

10

Syllabus

Level

Year ,

Paper

Question

Inflation cost

push

SL

November

2010, P2

Using an AD/AS diagram, explain

how wage increases create cost push

inflation (paragraph ). [4 marks]

Macroeconomic

performance

HL

May 2009,

P3

3(d) Using information from the

text/data and your knowledge of

economics, evaluate the economic

performance of Russia and Poland

since the 1990s. [8 marks]

Mark Scheme

productivity growth (paragraph ) increased government charges for the

environment and land (paragraph ).

Candidates who incorrectly label diagrams cannot be rewarded with full

marks.

Examiners must be aware that candidates may take a different approach

which if appropriate, should be rewarded.

If there is no direct reference to the data, then candidates may not be

rewarded beyond level 2.

Effective evaluation may be to: consider short-term versus long-term

consequences examine the impact on different stakeholders discuss

advantages and disadvantages prioritize the arguments.

For drawing a correctly labelled AD/AS diagram, which shows a leftward

shift of SRAS and higher price level and for explaining that wages are a

cost of production and that higher wages will lead to higher production

costs which will be passed on in the form of higher prices leading to cost

push inflation.

Responses may include:

Positives for Russia: Russia has exhibited rising growth rates throughout

the period 20022006 ranging between 5 % in 2002 to above 10 % in

20052006 unemployment in Russia is hovering around 7 % and dropping,

significantly below Polands.

Negatives for Russia: high income inequality (paragraph ) high degree of

corruption may result in less economic growth high degree of commodity

dependence (gas/oil etc.) (Russia has come to depend on a small number

of companies in the natural resource area (paragraph )) rising export

revenues from these sectors may have contributed to its growth but also

to a high current account surplus (between 8 % and 12 % of GDP) which

has exerted pressure on the ruble to appreciate and thus eroded the

competitiveness of other export oriented industries this type of growth is

not sustainable and is risky as any downturn in the world economy will

immediately lower Russian growth inflation has also been high (higher than

Polands but dropping from a high of 16 % in 2002 down to slightly less

than 12 % in 2006 which could undermine growth in the long run as nonoil investments may be hurt.

Positives for Poland: growth rates are rising to around 4 % per annum

which is satisfactory for a transition economy and may be more sustainable

than Russia strengthened property rights and monetary controls, privatized

and modernized its private sector which encouraged economic growth,

employment and income generation inflation has been kept a good levels

between 1 % and 4 % even though the drop in 2006 to less than 1 % may

warn of the risk of deflation.

Negatives for Poland: unemployment has been very high (above 12 %

throughout the period) but at least seems to be decreasing the high

unemployment may be the result of both tight policies as inflation has

been kept low but also of rigidities in the labour market (data and

(paragraph )); it may thus include both a cyclical and a large structural

component the current account deficit has ranged between 2 and 4 % of

GDP so it is not a problem.

Candidates could make a judgment on the importance of factors

contributing to the strong/weak economic performance of Russia and

11

Syllabus

Level

Year ,

Paper

Question

Monetary

Policy

HL

November

2010, P3

3 (d) Using information from the

text/data and your knowledge of

economics, evaluate the

consequences for the UK economy if

the Bank of England were

to raise interest rates from 5 % as

suggested in paragraph . [8

marks]

Monetary

policy

SL

November

2010, P2

(d) Using information from the

text/data and your knowledge of

economics, evaluate the

consequences for Icelands economy

if it maintains tight monetary

policies. [8 marks]

Mark Scheme

Poland or they could compare the two economies and make a judgment as

to which economy has performed better, justifying their judgment.

Responses may include:

Negative consequences:

may move to a recession (paragraph )

consumer confidence will fall further (paragraph )

C and I will fall, affecting AD (paragraph )

unemployment will increase further (paragraph )

household spending will fall as debt repayments increase

the exchange rate may increase, harming export competitiveness

rise in business costs, which may cause cost push inflation

negative wealth effects.

Positive consequences:

inflation may fall

an increase in the exchange rate may lead to cheaper imports of raw

materials, semi-finished goods, and finished goods, further reducing

inflation

savings may increase.

Effective evaluation may be to:

consider short-term versus long-term consequences

examine the impact on different stakeholders

discuss advantages and disadvantages

prioritize the arguments.

Responses should include:

an explanation of tight monetary policy.

Possible positive consequences include:

a reduction in the inflation rate (Figure 2)

an appreciation of the currency, making imports cheaper.

Possible negative consequences include:

a lower rate of economic growth (Figure 1)

a worsening of the current account deficit as the exchange rate increases

(Figure 3)

increased unemployment (Figure 4)

a fall in the growth rate of per capita income (paragraph )

a reduction in the rising entrepreneurship (paragraph )

changes in the distribution of income.

Effective evaluation may be to:

consider short-term versus long-term consequences

examine the impact on different stakeholders

discuss advantages and disadvantages

prioritize the arguments.

Neo-classical

HL

November

3. Using a diagram, and assuming a

Examiners should be aware that candidates may take a different approach

which if appropriate, should be rewarded.

If there is no direct reference to the text/data, then candidates

may not be rewarded beyond level 2.

Candidates may include the following:

12

Syllabus

Level

economics

Year ,

Paper

Question

Mark Scheme

2010, P2

neo-classical aggregate

demand/aggregate supply model,

explain the short-term and long-term

effects of a rise in aggregate demand

when a country is at full

employment.

a definition of aggregate demand

a definition of full employment

an explanation of neo-classical aggregate demand/aggregate supply model

a diagram showing a neo-classical LRAS with AD and SRAS intersecting at

the LRAS and a subsequent shift of AD to the right

an explanation that in the short-term there will be an increase in output

and the price level, producing an inflationary gap

an identification of the inflationary gap on the x-axis

an explanation that the higher price level means that costs of production

rise as workers negotiate higher wages to compensate for inflation

an explanation that in the long-term the SRAS curve will shift to the left

a conclusion that the long-term effect is an increase in the price level with

no change in real output.

Neo-classical

economics

SL

November

2010, P2

3(b) Using an appropriate diagram,

explain the likely effect of aggregate

demand increasing beyond potential

output (paragraph ). [4 marks]

For drawing a correctly labelled AD/AS diagram which shows AD and SRAS

intersecting to the right of LRAS and for explaining that if AD increases

beyond potential output, the effect would be inflation.

Teacher note: once the capacity of the economy is reached further

increases in aggregate demand cannot be met by increases in aggregate

supply. Consequently inflation occurs firms raise their prices across the

economy and the price level thus increases.

Supply-side

Policies

HL

May 2011,

P2

4. Explain two policies that a

government may use to attempt

to lower levels of equilibrium

unemployment.

Candidates may include:

a definition of equilibrium unemployment or unemployment

types of equilibrium unemployment or unemployment

an explanation of any two of the following supply-side policies:

education and training

reduction of trade union power

abolition of minimum wage laws

reduction of unemployment benefits

reduction of personal income taxes

any of the appropriate supply-side policies

an explanation of appropriate demand-side policies

use of a diagram to illustrate possible effects of policies

use of a diagram to illustrate equilibrium unemployment or unemployment.

Supply-side

Policies

HL

November

2010, P1

2. (a) Explain how supply-side

improvements to an economy may

be achieved through the use of taxes

and government spending. [10

marks]

Answers should include:

an explanation of supply-side improvements

use of AD/AS diagrams

an explanation of how taxes and government spending may be used to

affect AS, e.g. through:

greater government spending on healthcare, education and training

less government spending on benefits

a reduction in income tax to increase work incentives

lower corporation tax to encourage investment

lower indirect taxes to reduce business costs.

Answers may include:

distinction between SRAS and LRAS.

13

Syllabus

Level

Year ,

Paper

Question

Mark Scheme

Supply-side

Policies

HL

November

2010, P1

2(b) Evaluate the use of supply-side

policies to reduce unemployment.

[15 marks]

Answers may include:

a definition of unemployment

a definition of supply-side policies

examples of supply-side policies

the concept of a natural rate of unemployment

the importance of the different types of unemployment, e.g. demand

deficient, frictional and structural

an explanation of how supply-side policies may work to reduce

unemployment in the longer term

use of AD/AS analysis, showing LRAS shifting to the right

an assessment of the effectiveness of such measures

unemployment beyond the control of national governments, e.g. arising

from demand-side shocks or international recession

consideration of the use and effectiveness of alternative short-term

demand-side measures to reduce unemployment, i.e. fiscal and monetary

policies

an evaluation of the effectiveness of particular supply-side policies, e.g.:

tax cuts

cuts in welfare benefits

education and training/retraining

privatization/deregulation

trade union policies.

Effective evaluation may be to:

consider short-term versus long-term consequences

examine the impact on different stakeholders

discuss advantages and disadvantages

prioritize the arguments.

Supply-side

policies

SL

November

2010, P1

2 (b) Evaluate the use of supply-side

policies to improve the performance

of an economy. [15 marks]

Answers may include:

a distinction between market-oriented and interventionist supply-side

policies

advantages of supply-side policies in terms of their impact on:

productivity

economic growth

employment

inflation

current account

distribution of income

use of AD/AS diagrams to illustrate the above

Disadvantages of supply-side policies in terms of:

welfare benefits

cost of funding them

public services

exploitation of labour

time it takes them to work.

Effective evaluation may be to:

consider short-term versus long-term consequences

14

Syllabus

Level

Year ,

Paper

Question

Mark Scheme

examine the impact on different stakeholders

discuss advantages and disadvantages

prioritize the arguments.

Unemployment

HL

May 2010,

P1

2. (a) Explain why a country may

wish to reduce its unemployment

rate. [10 marks]

Answers should include:

an explanation of the unemployment rate

an explanation of the types or components of unemployment

an explanation for wishing to reduce unemployment in terms of the various

costs of unemployment. This may include the impact on:

the unemployed themselves e.g. reduced income, stress levels, selfesteem

society e.g. poverty, crime, vandalism

economy as a whole e.g. actual output is less than potential output (to

the left of the LRAS curve); or economy is at a point inside the PPC

opportunity cost of government spending on unemployment benefits,

less tax revenues available for other purposes

a government might wish to reduce unemployment in order to raise tax

revenue.

Unemployment

HL

May 2009,

P3

3(a) Define the following terms

indicated in bold in the text:

(i) structural unemployment

(paragraph )

Unemployment

SL

May 2011,

P2

2(c) Using an AD/AS diagram,

explain one type of unemployment

experienced in Germany in 2009. [4

marks]

Unemployment

SL

May 2009,

P1

Unemployment

SL

May 2009,

P2

2. (a) There are various types of

unemployment. Explain how any

three types of unemployment may

cause a rise in the unemployment

rate of an economy. [10 marks]

1a(ii) unemployment

(paragraph).

Unemployment

SL

May 2009,

P2

2 a(i) structural unemployment

(paragraph )

Any one of the following would be appropriate: long-term unemployment

that is caused as a result of a fall in the demand for a particular type of

labour unemployment that occurs as a result of the changing structure of

an economy resulting from changes in demand/supply and/or technology

and/or trade patterns unemployment that occurs when there is a mismatch

between the skills of unemployed workers and the jobs available

unemployment that exists as a result of rigidities in the labour market.

For drawing an AD/AS (or ADL/ASL) diagram showing a shift of AD (or

ADL) to the left and for explaining that unemployment is demand

deficient/cyclical because of the falling aggregate demand and the

resultant fall in the demand for workers.

Answers should include: definition of unemployment an explanation of

three of structural, frictional, seasonal, demand deficient (cyclical), real

wage unemployment (classical) explanation of the term unemployment

rate and how the three types of unemployment explained could increase

the unemployment rate.

Answers may include: diagrammatic illustration of the above.

An explanation that it is: people of working age (those in the labour force)

willing and able to work actively seeking work at the current wage rate

who are without work.

Any two of the above points would be sufficient.

Any one of the following would be appropriate: long-term unemployment

that is caused as a result of a fall in the demand for a particular type of

labour unemployment that occurs as a result of the changing structure of

an economy resulting from changes in demand/supply and/or technology

unemployment that occurs when there is a mismatch between the skills of

unemployed workers and the jobs available unemployment that exists as a

result of rigidities in the labour market.

15

16

You might also like

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Sample Programs in CDocument37 pagesSample Programs in CNoel JosephNo ratings yet

- AC2104 - Seminar 5Document3 pagesAC2104 - Seminar 5Rachel LiuNo ratings yet

- Hydrozirconation - Final 0Document11 pagesHydrozirconation - Final 0David Tritono Di BallastrossNo ratings yet

- Financial Vs Health and Safety Vs Reputation Vs Opportunity CostsDocument11 pagesFinancial Vs Health and Safety Vs Reputation Vs Opportunity Costschanlego123No ratings yet

- Pemphigus Subtypes Clinical Features Diagnosis andDocument23 pagesPemphigus Subtypes Clinical Features Diagnosis andAnonymous bdFllrgorzNo ratings yet

- Landow - The Rhetoric of HypermediaDocument26 pagesLandow - The Rhetoric of HypermediaMario RossiNo ratings yet

- World of Warcraft 5e RPG Core DocumentDocument152 pagesWorld of Warcraft 5e RPG Core DocumentHugo Moreno100% (1)

- Software Development Life CycleDocument70 pagesSoftware Development Life CycleChaitanya MalikNo ratings yet

- Long Range Plans ReligionDocument3 pagesLong Range Plans Religionapi-266403303No ratings yet

- Student Health Services - 305 Estill Street Berea, KY 40403 - Phone: (859) 985-1415Document4 pagesStudent Health Services - 305 Estill Street Berea, KY 40403 - Phone: (859) 985-1415JohnNo ratings yet

- Effective Communication Chapter11Document9 pagesEffective Communication Chapter11kamaljeet70No ratings yet

- Domestic ViolenceDocument2 pagesDomestic ViolenceIsrar AhmadNo ratings yet

- BurnsDocument80 pagesBurnsAlina IlovanNo ratings yet

- MInor To ContractsDocument28 pagesMInor To ContractsDakshita DubeyNo ratings yet

- 2018 UPlink NMAT Review Social Science LectureDocument133 pages2018 UPlink NMAT Review Social Science LectureFranchesca LugoNo ratings yet

- Software Construction - MetaphorsDocument17 pagesSoftware Construction - MetaphorsMahmoodAbdul-Rahman0% (1)

- Exam3 Buscom T F MC Problems FinalDocument23 pagesExam3 Buscom T F MC Problems FinalErico PaderesNo ratings yet

- KFC 225 Installation ManualDocument2 pagesKFC 225 Installation Manualsunarya0% (1)

- LDS Conference Report 1930 Semi AnnualDocument148 pagesLDS Conference Report 1930 Semi AnnualrjjburrowsNo ratings yet

- PSychoyos Semiotica LibreDocument68 pagesPSychoyos Semiotica Librebu1969No ratings yet

- NIPMR Notification v3Document3 pagesNIPMR Notification v3maneeshaNo ratings yet

- Foreign Laguage Teaching - Nzjournal - 15.1wiechertDocument4 pagesForeign Laguage Teaching - Nzjournal - 15.1wiechertNicole MichelNo ratings yet

- Tutorials in Complex Photonic Media SPIE Press Monograph Vol PM194 PDFDocument729 pagesTutorials in Complex Photonic Media SPIE Press Monograph Vol PM194 PDFBadunoniNo ratings yet

- Chapter 5, 6Document4 pagesChapter 5, 6anmar ahmedNo ratings yet

- Extraction of Non-Timber Forest Products in The PDFDocument18 pagesExtraction of Non-Timber Forest Products in The PDFRohit Kumar YadavNo ratings yet

- Clinical Handbook of Infectious Diseases in Farm AnimalsDocument146 pagesClinical Handbook of Infectious Diseases in Farm Animalsigorgalopp100% (1)

- A Guide To FractionsDocument18 pagesA Guide To FractionsAnnelyanne RufinoNo ratings yet

- Mehta 2021Document4 pagesMehta 2021VatokicNo ratings yet

- Securities and Exchange Commission: Non-Holding of Annual MeetingDocument2 pagesSecurities and Exchange Commission: Non-Holding of Annual MeetingBea AlonzoNo ratings yet

- PDF Certificacion 3dsmaxDocument2 pagesPDF Certificacion 3dsmaxAriel Carrasco AlmanzaNo ratings yet